News

29 Jun 2023 - Navigating ESG in the apparel trade

28 Jun 2023 - Channel Capital Cayman: Embracing Sustainability - Unveiling the Power of ESG Investing

|

Channel Capital Cayman: Embracing Sustainability - Unveiling the Power of ESG Investing Channel Capital May 2023 ESG Investing is the consideration of environmental, social and governance (ESG) factors in the investment decision making process. It is estimated that between a quarter and a third of the current global assets under management are in some way influenced by ESG considerations in varying capacities.* The environmental component of ESG analysis centers on assessing a company's impact on the environment including factors such as energy use or pollution output. The social component evaluates the company's relationship with people and society, encompassing areas such as diversity and inclusion, human rights, health and safety. Finally, the governance component examines how the company is governed, taking into account transparency and reporting, ethical standards, compliance, and board composition. The origins of ESG investing can be traced back to the 1960s, when it emerged as 'socially responsible investing'. Initially, investors focused on excluding stocks or entire industries from their portfolios based on objectionable business activities such as tobacco production, gambling or weapons. In its present form, ESG investing seeks to better align investors' interests with societal needs and has been evolving over the years incorporating a wide and complex set of issues, primarily driven by consumer preferences, the influence of younger generations and overall investor demand for more socially engaged and purposeful corporations. DECODING ESG FOCUSED FUNDSAn ESG Investment Fund is a broad term used to describe any investment fund for which the fund manager uses ESG criteria to determine its portfolio composition and allocation strategy. The fund's prospectus should provide clear disclosure regarding its approach to incorporating ESG factors and the methodology used to weigh and assess these factors. ESG fund managers have the flexibility to use or combine various ESG strategies, including:

Today, more than 5,000 investors (including asset managers, pension funds, insurers, sovereign wealth funds, endowments and foundations) representing a staggering US$121 trillion of assets under management have become signatories to the UN Principles for Responsible Investment (PRI). These principles are built on six core pillars, mainly focused on committing to integrating ESG issues into their practices and advocating for adequate disclosures from the entities in which they invest.

UNVEILING THE LANDSCAPE OF ESG INVESTING - ASSET CLASSES AND PERFORMANCEESG investing exhibits distinct characteristics that vary depending on the type of asset class. Listed Equities have the longest track record, exhibit a higher level of sophistication, and offer a wealth of available data. The integration of ESG factors into listed equity analysis is becoming more common among asset managers. Additionally, exclusions and engagement strategies are primarily employed when it comes to this particular asset class. As Private Equity becomes a major force in the global economy, it is also becoming a powerful change agent for driving progress on ESG, climate and sustainability and there is an increasing trend of ESG integration and conviction, with Private Equity firms having the ability to consistently influence their portfolio companies on relevant ESG matters. The long-term horizon of Private Equity investments also facilitates a focus on ESG. When it comes to debt instruments, more innovative ESG related products such as Green Bonds and Social Impact Bonds have hit the market and are becoming more popular. Traditional fixed income initially lagged behind but recently there has been an increased focus in areas such as the sustainability of government debt issuers and the view that the governance factor ("G") can play a material role when it comes to financial performance of government and corporate bonds. Current trends suggest that incorporating ESG into fixed income investing should be part of the overall credit risk analysis and should contribute to more stable financial returns. Due to its nature, responsible investing is more challenging for commodity related investments. Excluding certain types of commodities is a possibility, as well as investing in commodity related companies with good ESG practices. When analyzing commodity related investments from an ESG lens, it is crucial to prioritize several key factors. These include evaluating the sourcing risks associated with the physical origin and location, supply chain related ESG risks, usage in products and services and carbon foot printing over the life cycle of the commodity. A natural question around ESG investing is whether there is a downside to it, from a risk or performance perspective. According to a study that measured how ESG funds performed relative to funds in the same Morningstar category over a 10 year period**, the overall conclusion appears to be that ESG funds have tended to perform very similarly and with very similar levels of risk to non-ESG focused funds. Therefore, there is not yet convincing evidence that ESG funds may be reliably better than non-ESG funds or that choosing ESG funds would put investors at any kind of disadvantage in terms of risk or performance. ESG REGULATORY AND REPORTING FRAMEWORKEurope is at the forefront of the ESG regulatory framework. The Corporate Sustainability Reporting Directive (CSRD) entered into force in 2023 (with reporting requirements starting in 2024) and has expanded the requirements of the previous Non-Financial Reporting Directive (NFRD) and will require nearly 50,000 companies to enhance their reporting around sustainability. Companies will have to publish information related to matters such as environmental protections, greenhouse gas emissions targets, social responsibility and treatment of employees, respect for human rights, anti-corruption and bribery, diversity on company boards and due diligence processes in relation to sustainability. In addition, the EU Disclosures Regulation applies to all financial market participants, including AIFMs, and requires them to publish their policies on integration and impact of sustainability risks into their investment program. ESG specific products (known as "article 9") require even further additional disclosures. In March 2022, the SEC proposed climate-risk disclosure requirements for public companies and SEC filings will be required to discuss financially material, climate-related risks and the company's climate risk management processes. In recent years, the Securities and Exchange Commission (SEC) has penalized certain investment advisors for making material ESG related misstatements, where the advisors were not able to prove that some investments had undergone an ESG quality review as previously disclosed to investors. The SEC has advised that they are examining registrants for consistency and adequacy of disclosures concerning ESG investment strategies, and is also closely monitoring voting practices, internal controls and compliance programs. In the Cayman Islands, an ESG framework for Cayman Islands Investment Funds has been proposed that will mostly target greenwashing (more on this later in the article) in the investment funds industry. The initial focus will be on the name of the fund, its marketing, failure to adhere to sustainable development goals, lack of disclosure and possible misleading claims. In terms of global reporting, numerous international institutions such as the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI) and the Task Force on Climate-related Financial Disclosure (TCFD) have been working to form standards and define materiality to facilitate the incorporation of ESG factors into the investment process. ESG AND FUND GOVERNANCEAs part of their oversight role, fund directors need to be aware of the efforts by fund managers to withstand ESG scrutiny by investors, the public and regulators. Fund Directors must gain comfort as to how the programs and processes of fund managers and advisers can address and manage ESG investment risks. As part of their ongoing fiduciary duties, fund directors need to make sure that the Fund disclosures accurately reflect and not overstate the fund's ESG investing activities and that it has appropriate controls, policies and procedures in place around ESG investing. Naturally, the expected level of oversight intensifies for investment funds marketed as ESG Funds or those with prominent ESG elements in their marketing materials, in contrast to Funds with minimal or no ESG components. Fund directors should focus on how ESG is defined, operationalized and monitored by a Fund that uses ESG factors as part of its investment process, and make sure the Fund builds ESG into the due diligence for investments. They should also receive adequate and regular information and reporting on the Fund's ESG strategy, performance and proxy-voting record. If the fund manager engages sub-advisers, fund directors need to understand how sub-advisers use ESG factors and if they have a compliance program in place. The metrics used to measure a holding's ESG factors must be applied consistently across investment products. Fund directors should discuss with fund managers if investment professionals are using an appropriate level of judgement and healthy skepticism when using ESG data from third parties. Fund directors also need to understand and regularly discuss how the fund manager considers the interplay between ESG investing and performance for investors. Fund directors must be aware that as their funds vote their shares as fiduciaries on a growing set of issues, there is an increase in reputational risk if the proxy issues are not supported by a deliberate and transparent voting policy that aligns with the Fund's broader ESG policies. As part of their fiduciary duty to a fund, fund directors must oversee the fund's compliance function, proxy voting disclosures, investment performance and risk management and be familiar with the fund's ESG related investments, disclosures and practices. With the ESG regulatory landscape evolving every year, Fund directors must receive frequent updates on regulatory trends and changes and confirm with fund managers that the Fund's practices remain in compliance with the latest applicable laws and regulations. ESG IMPLEMENTATION AND ITS CHALLENGES AND CONTROVERSIESESG implementation does not come without a number of challenges and controversies. The following are key hot topics surrounding ESG investing:

The surge of an anti-ESG movement has been noted in many locations, particularly in the United States where governors from 19 US states have pledged to resist ESG investing over antitrust consumer protection and discrimination concerns (dropping some of the largest fund managers who promote ESG and penalize the US fossil fuel industry from pension and state-owned investment funds).

CONCLUSIONESG Investing is still evolving and, despite the challenges noted above, a significant number of pension funds, sophisticated and institutional investors will continue to expect investments to follow and comply with certain ESG criteria. Unsurprisingly, greater attention and efforts are needed to improve transparency, international consistency and comparability. According to the study we noted above, an ESG investing approach does not necessarily mean lower returns or a higher level of risk. It is also important to note that ESG and sustainable investing is applied differently depending on the asset class and that the level and intensity of ESG analysis may also vary for each portfolio company depending on the sector and the nature of its activities. From a fund governance perspective, fund directors need to stay up to date on ESG matters and the applicable regulatory framework and pay particular attention to ESG fund disclosures and the fund's actual ESG procedures to ensure consistency and no gaps or misstatements between the disclosures and the final product offered to investors. A proxy voting policy aligned with the Fund's ESG framework is also important. Fund directors should engage in regular discussions regarding the fund managers' long term ESG strategy to retain and attract investors. These discussions are crucial to instilling confidence that an effective strategy is in place to maintain competitiveness and visibility in the market. To this end, it is important that fund managers define their corporate ESG and sustainability framework and articulate how it aligns with their overall business strategy and purpose. AUTHOR: Martin Laufer |

|

Sources: *The ESG potential - how mutual fund boards can manage risks and seize opportunities, E&Y, January 2021.** How Well Has Environmental, Social, and Governance Investing Performed? Michael Iachini, September 2021. |

27 Jun 2023 - Banks, interest rates and opportunities in the finance sector

|

Banks, interest rates and opportunities in the finance sector Magellan Asset Management June 2023 |

|

Alan Pullen, Portfolio Manager, discussed the recent bank defaults, the impact of interest rates on banks in general and where he sees opportunities in the financial sector. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

26 Jun 2023 - Risk-adjusting small-cap upside

|

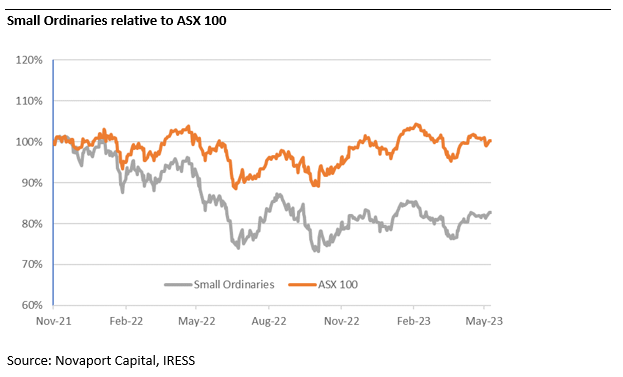

Risk-adjusting small-cap upside PURE Asset Management June 2023 Those investing in smaller companies will appreciate the difficulties faced by this market segment since early 2022. Central banks have raised interest rates in unison, with liquidity and confidence evaporating as a result. The unfortunate outcome is that share price appreciation has been a mirage for most emerging businesses. When compared to large cap peers, the chart below illustrates the degree of such underperformance. Since January 2022, small cap equities have experienced their own 'GFC'. A key adage we live by at PURE is that share prices are not always reflective of underlying operational performance. Market sentiment and liquidity can savagely impact small cap valuations, and while painful for existing equity holders, create phenomenal opportunities for astute new investors. The risk is that equity prices remain under pressure for longer than an equity investor can stomach, resulting in further losses. Our key takeaway from the above chart, it that strong outperformance has always followed underperformance. When small cap share prices appreciate, they do so quickly. The unknown here is timing. While no investors have certainty on timing, hybrid investing is a unique way to 'risk-adjust' this variable. Hybrid investments involve entering a transaction via a credit instrument, yet retaining exposure to equity returns via a conversion mechanism. The outcome being sought is to remove downside equity volatility, yet retain exposure to upside equity volatility. This entails swapping some equity upside for capital structure protection, security, and a consistent interest income stream. Getting 'paid to wait' in the form of interest income ensures a cash yield is received as each investment thesis materialises. Today's conditions are extremely attractive to deploy capital via hybrid structures. Many borrowers are unable to access debt markets, with most dissatisfied with their cost of equity. The result is a strong negotiating position for deal originators, as value drivers (interest rates / conversion premiums) are being agreed from a position of power. If capital preservation can be achieved as a secured creditor, upside potential from this cycle low should be self-evident. While an attractive way to invest, hybrid deals are are difficult for investors to source as they involve a direct negotiation with the Borrower. PURE's funds were established as a vehicle to provide exposure to this form of investing, a strategy which remains unique to this day. Have you considered hybrid investments as a way to risk-adjust your exposure to emerging companies? Funds operated by this manager: |

22 Jun 2023 - Japan - Back in Vogue

|

Japan - Back in Vogue Redwheel (Channel Capital) June 2023 For the first time in my 20-year career, I feel like the cool kid in town. Suddenly, almost everyone wants to know what I think about Japan; about the new Bank of Japan Governor, the Yen, the Tokyo Stock Exchange's (TSE) focus on low valuation stocks, about what companies I think Warren Buffett will buy next and whether I think Japan is really changing "this time". Apart from a brief period of Abenomics-induced euphoria a decade ago, Japan is the hottest I can remember, and yes, "this time" it is with good reason. Having experienced and (just about) survived Japan's "lost decades", though, I would be remiss if I didn't suggest this exuberance was balanced with caution. But first, let's talk about why Japan is enjoying the spotlight. Japan is cheap , flush with cash, and in the midst of sweeping corporate governance reform. It is the third largest economy in the world, with nearly 4,000 listed companies, yet despite eight straight weeks of net buying , foreign ownership is at multi-year lows . This underweight exposure by the investment community is despite Japanese companies booking low double-digit returns over 10 years, driven by dividends and higher EPS growth than the S&P . Impressively, these returns have come through despite the market de-rating, meaning a negative contribution from valuation compression. Now, GDP growth is widely forecasted to be the highest among developed nations in 2023, and the outlook for earnings growth is strong . The country is potentially set to benefit from its relatively recent re-opening to foreign travel (October 2022) and in particular, to its largest trading partner, China. Geopolitical friction and re-shoring efforts globally are drawing attention from regional investors to a politically and socially stable, deep and liquid alternative market that has been hiding in plain sight. Japan is viewed as a key destination for capital seeking innovative and vibrant firms, geopolitically aligned with the west. Amidst the global angst surrounding inflation, Japan remains relatively buffered and has counter-inflationary traits in the large cash positions of both corporates and households. Uniquely, Japan welcomes some of the inflationary pressures, which are almost exclusively imported through higher energy and food pricing. With those cost-pressures looking to ease later this year, real wage growth is predicted to turn positive in the 2H , which could help drive domestic demand. The near monopoly of political power held by the Liberal Democratic Party since the 1950s means that Japanese politics lack the soap-opera dramatics seen elsewhere. The finely choreographed cooperation between the Government, the central bank, financial institutions and regulators is a rare strength of Japan and provides a reassuringly consistent platform from which to determine and accomplish long-term goals - the most important of which in recent years, were arguably the Abe administration's corporate governance reforms, given teeth by the Tokyo Stock Exchange's recent announcements. Many market watchers will remember there was similar excitement amongst foreign investors about Japan when the late PM Abe announced his 3rd Arrow of Corporate Governance reform through Abenomics, followed by frustration that changes were not happening fast enough, which was fair! Changing deeply entrenched corporate cultures and values takes time and takes an element of herd mentality in Japan. We have now passed that point of critical mass. 18 years ago when the Redwheel Nissay Stewardship strategy began, stewardship and engagement were relatively new and alien concepts in corporate Japan. Finding corporate management teams who were willing to embrace change and see shareholders as partners with whom they could work towards a common goal, was often a long and grueling process. Now, stewardship is an established concept and engagement is a recognized instrument of responsible investing (when wielded correctly). This means that sectors and industries which were historically more difficult, or near-impossible, to engage with have started to open up to shareholders and their opinions. There are clear signs of change throughout corporate Japan in areas ranging from gender diversity to shareholder return, and although the pace is accelerating, the seeds of change were planted many years ago. What then, has happened recently to finally bring foreign investor focus back to Japan? Last year the TSE restructured their listing categories and requirements (into TSE Prime, Standard and Growth), giving an indefinite grace period for companies to meet the new criteria. At the beginning of this year however, they announced the end to the grace period was March 2026, and expectations are that companies which don't meet requirements by then will be downgraded or de-listed. At this point, there aren't any hard and fast enforcement measures from the TSE, but the language they have used is more powerful than it has ever been. Companies are expected to demonstrate financial literacy, including assessment, explanation and defence of their share price and capital efficiency . There is a particular focus on companies with a PriceBookRatio (PBR) of less than 1, who are "encouraged" by the TSE to disclose their plans for improvement. The simplest way to improve metrics for many of these companies are to lighten balance sheets by selling off assets, unwinding cross-shareholdings and returning excess cash to shareholders. Many of us have heard this all before, but these new measures from the TSE and the resolve behind them imply firm determination from the top. The master stroke of marketing for Japan was delivered from the very unlikely location of Omaha. Buffet's highly publicised recent visit to Tokyo was followed shortly after by his comment that "we're not done in Japan" at Berkshire Hathaway's annual meeting, and value investors globally set about trying to figure out where Buffett would strike next. Now, the pinch of wasabi: The warning from the TSE aimed at companies trading below liquidation value, refers to more than 40% of stocks in the index, or around 2000 names, including corporate behemoths like Toyota Motor and Mitsubishi UFJ group. It is therefore very tempting for investors to buy a large swathe of the Topix and hope for the best. However, I believe that although huge strides have been made across the market, the majority of these companies will not change, even with pressure from the TSE or from activists. As recently as last month, companies from global retailer Seven & I Holdings to the country's third largest oil refiner Cosmo Energy, have taken steps to bat away activist investors (Value Act and Murakami, respectively). Smaller, more domestic, companies which make up the majority of the <1PBR cohort may be even harder to convince, with or without activist pressure. They key point is that Japan has always been a stock-pickers' market, and crucially for engagement or activist funds, it is a management-pickers' market. Identifying corporate managers with the will to change will be key. It is all very well identifying companies which have challenges that we can help address, but what of the quality and receptiveness of the management themselves? Engagement is highly inefficient and ineffective when met with a firmly closed door. Part of a teams' expertise should be focussed on assessing whether the door towards constructive dialogue is open, or even, just slightly ajar. Through Redwheel's joint venture with Nissay Asset Management, we have one of the longest-running dedicated engagement strategy in Japan, supported by a 22-person sector analyst team based in Tokyo. Company analysis is based on over 3,000 in-person meetings with Japanese corporates per year, and their knowledge is an invaluable resource to discover management with "engageability". Having on-the-ground resources and the ability to identify companies that are changing will be more important than ever to navigate and benefit from the stars potentially aligning for Japan. One can't overstate the over-riding importance and impact of corporate reform in a market which is home to truly excellent companies who are leaders in their global fields. After a slow start, corporate governance reform has gained momentum and is now self-sustaining, while at the same time, some companies have fallen victim to market style-shifts and tumbled despite solid earnings and steady reform. We believe we have a rare opportunity to invest in excellent companies at severely undervalued levels, in an environment which has never been more supportive of determined and active engagement. |

|

Funds operated by this manager: CC Redwheel Global Emerging Markets Fund, CC Redwheel China Equity Fund Sources: [1] MSCI World and Developed World, Citi Research, MSCI, Factset, March 2023 [2] Mizuho Securities research, 30.05.2023 [3] Goldman Sachs Research, 30.05.2023 [4] Bloomberg data [5] Market reports JPMorgan, Schroders, Citi Wealth, SocGen, Deutsche Asset Management, Invesco, AXA, T Rowe Price, January 2023. [6] NLI Research Institute, May 2023 [7] JPX January 30, 2023 Key information: No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor's investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only. |

21 Jun 2023 - Thinking small to win big

|

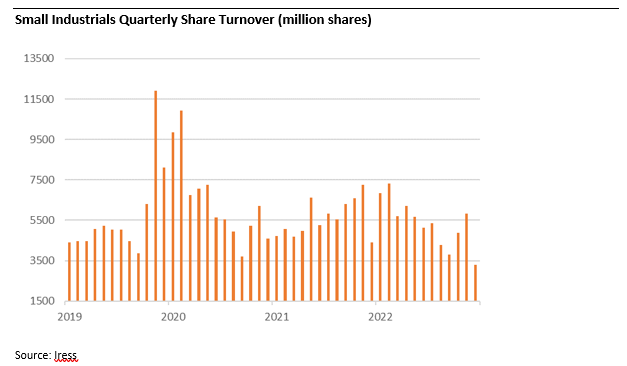

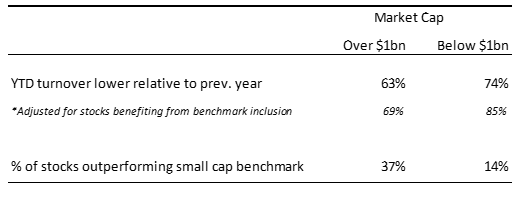

Thinking small to win big Novaport Capital May 2023 Conventional wisdom suggests that 'time in the market' is a less risky strategy than 'timing the market'. Boom and gloom provide attractive entry and exit points but only if the timing is right. Accurately identifying market peaks and troughs is notoriously difficult. In our experience, gradually allocating more to markets during times of market distress and less when 'everything is awesome' is a preferable approach. Small caps, and in particular, industrials, present an opportunity for investors at current levels. The Small Ordinaries benchmark has underperformed the ASX100 since November 2021. Notably, industrials have underperformed resources, which have been supported by thematics such as energy security, battery materials, and gold. In addition, adjusting to tighter monetary policy has weighed on small industrials. The recent underperformance presents a chance for investors to incrementally allocate to the sector. Falling liquidity signals capitulation Investors' willingness to trade reveals their confidence, or lack thereof, in the market. Rising liquidity can create a virtuous circle during a bull market, when abundant liquidity entices more capital into markets (attracted by lower trading costs). Yet when liquidity falls and markets are falling, the cycle works in reverse. Capital ceases to flow to (or exits) the market due to illiquidity concerns. Since November 2021, liquidity in the small industrials sector has dropped meaningfully. Thus far in 2023, the daily average value of turnover for small industrials has been $704m, down a third (from $1,070m) during the same period in 2021. The decline in liquidity indicates that a lower amount of new money is being put to work in Small Caps. Contrarian investors have a better chance of picking up a bargain now, relative to last year. Microcaps have been hit harder Not surprisingly the decline in liquidity has been most pronounced for the smallest of small caps. 74% of the smaller small industrials (with a market capitalisation of less than $1 billion) had lower turnover in the last 12 months relative to the previous year. Adjusting for stocks which benefited from index inclusion, 85% of companies saw turnover decline. The impact on liquidity has been lower for the larger small companies, 63% had lower turnover (or 69% adjusting for index changes). Unsurprisingly, 37% of 'larger' small caps (market cap >$1bn) outperformed the benchmark relative to a mere 14% of the 'smallest' companies. One of our holdings Quantum Intellectual Property Ltd, provides a case study of the current dynamic in microcaps. Quantum has a meaningful and growing share of the Australian Patent, Trade Mark and IP Legal Services market. Over the last year their share price has fallen by 19%, materially under-performing the small cap benchmark. On our estimates, the company trades on an attractive discount to earnings and yield metrics relative to the broader market, however its share turnover is 23% lower than the previous year. In a recent market update, the company reaffirmed expectations for organic growth, improving margins and further consolidation opportunities. The decline in liquidity merely reflects that the stock has fallen off the market's radar in our view, creating an investment opportunity. Quantum is just one example of similar opportunities arising in the current market environment. Different exposures than large caps The Australian stock market is heavily weighted towards highly profitable bank and resources stocks. The smaller end of the market has a wider range of exposures, from resource exploration stocks and retailers to fast growing technology businesses. The composition of the small caps benchmark evolves over time. Furthermore, industrial companies are less risky than three years ago. We estimate that loss making companies are now only 5% of the small industrials' universe, down from over 30% before the pandemic. The current small cap market has a lower exposure to risky, early stage or loss-making companies. Following the recent underperformance of small caps, we see attractively priced opportunities relative to the large cap universe. For example, Domain Holdings offers faster growth than REA Group (as it increases market penetration), yet it trades at a discount. At the same time, small cap building materials companies in markets with high barriers to entry, trade at through cycle earnings multiples in the mid-teens, despite having more favourable industry structures relative to than their historical averages. Smaller Companies have traditionally been more volatile and sensitive to the economic environment, which is expected to be challenging. There are valid reasons to be cautious. However, the small industrials benchmark is comprised of more robust businesses post the 2022 market correction. Their underperformance relative to large caps and the withdrawal of liquidity suggests the market is already fearful. This presents us with an opportunity to increase our exposure to quality, but overlooked, businesses. Author: Sinclair Currie, Principal and Co-Portfolio Manager Funds operated by this manager: NovaPort Microcap Fund, NovaPort Wholesale Smaller Companies Fund This material has been prepared by NovaPort Capital Pty Limited (ABN 88 140 833 656 AFSL 385 329) (NovaPort), the investment manager of the NovaPort Smaller Companies Fund and the NovaPort Microcap Fund (Funds). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante) is a member of the Challenger Limited group of companies (Challenger Group) and is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable to your circumstances. The Fund's Target Market Determination and Product Disclosure Statement (PDS) available at www.fidante.com should be considered before making a decision about whether to buy or hold units in the Funds. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. NovaPort and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, NovaPort and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties. Fidante is not an authorised deposit-taking institution (ADI) for the purpose of the Banking Act 1959 (Cth), and its obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante. Investments in the Fund(s) are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group. |

20 Jun 2023 - Australian Secure Capital Fund - Market Update May

|

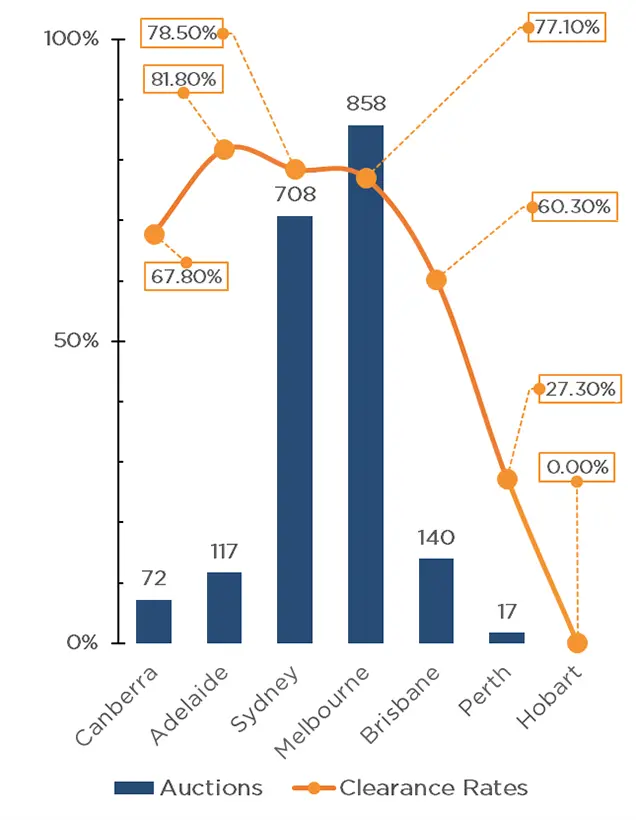

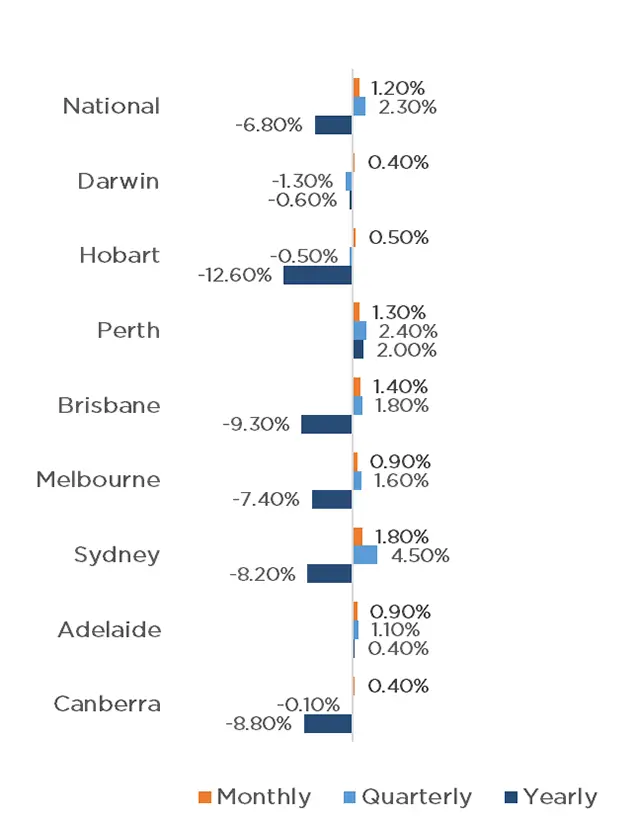

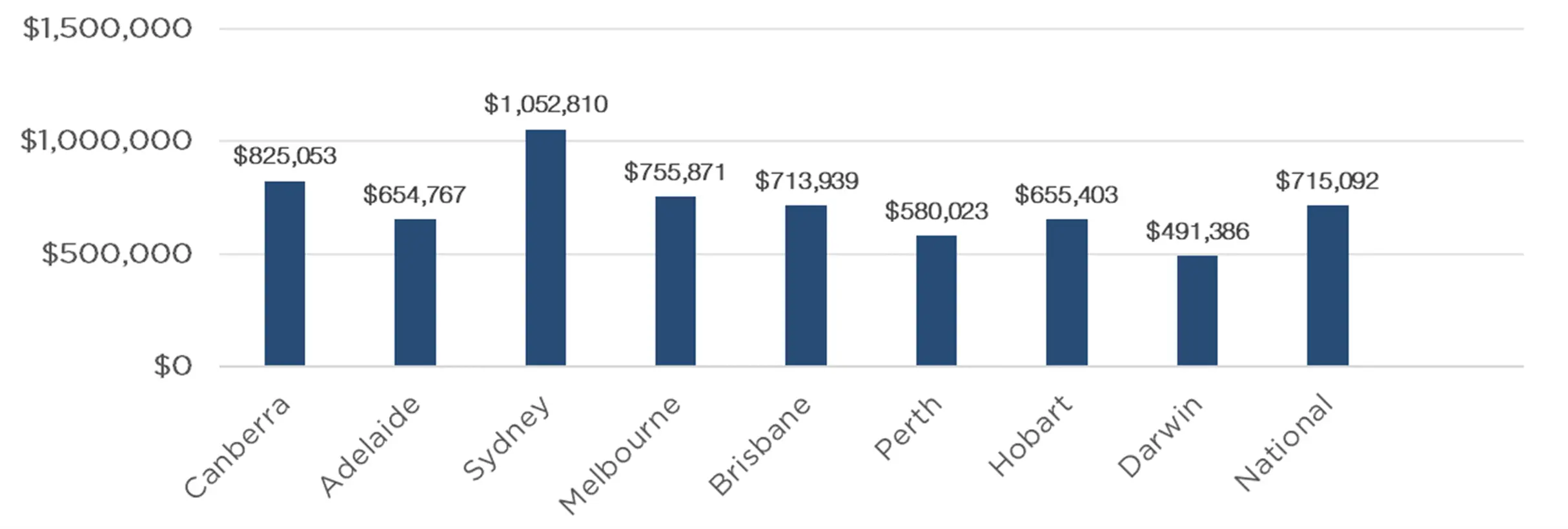

Australian Secure Capital Fund - Market Update May Australian Secure Capital Fund June 2023 The Australian housing market continues to bounce back despite further interest rate rises, with CoreLogic's national Home Value Index rising by 1.2% in May. The capitals and the regions both performed strongly, with all capital cities recording a month-on-month increase, and only regional Victoria decreasing. Once again, the capital cities performed well with Sydney leading the way with a 1.8% increase, followed by Brisbane (1.4%), Perth (1.3%), Melbourne (0.9%), Adelaide (0.9%), Tasmania (0.5%), Darwin (0.4%) and Canberra (0.4%). Performance across regional areas was also largely positive, with only Victoria experiencing a reduction in values (-0.5%). The Northern Territory and ACT, maintained values, whilst New South Wales (0.5%), Western Australia (0.5%), Tasmania (0.7%), Queensland (0.8%) and South Australia (0.9%) all experienced growth. The property market continues to experience a lack of supply, with the last weekend of May holding just 1912 auctions, well below the 3226 that occurred on the same weekend in 2022. This lack of supply is likely the factor propping up property prices. Melbourne (858) and Sydney (708) led the way with significantly more auctions taking place than the rest of the country with Brisbane (140), Adelaide (117), Canberra (72) and Perth (17) all well below previous year figures. Whilst the total auctions were down considerably, clearance rates were exceptionally high, with a weighted average of 75.9% across the capital cities, well above the 59.3% last year. Adelaide had the highest clearance rate across the country, with 81.8% (up from 73.6% last year). Sydney and Melbourne also performed strongly with 78.5% and 77.1% respectively, well above the 56.4% and 60.4% last year. Canberra recorded 67.8% (64.4% last year) with Brisbane also outperforming last year, with 60.3% (51.2% last year). Perth was the weakest performance of the cities, with only a 27.3% clearance rate, down from 42.1% last year. Clearance Rates & Auctions 22nd - 25th of May 2023

|

16 Jun 2023 - Glenmore Asset Management - Market Commentary

|

Market Commentary - May Glenmore Asset Management May 2023 Equity markets were mixed in May. In the US, the S&P 500 rose +0.3%, the Nasdaq rebounded sharply +5.8%, whilst in the UK, the FTSE 100 declined by -5.4%. In Australia, the All Ordinaries Accumulation index fell -2.6%, driven by ongoing investor caution around the impact of interest rate hikes by the Reserve Bank of Australia. The technology sector was the top performing sector, as investor sentiment continues to recover after materially underperforming in 2022. Consumer discretionary was the worst performer, with multiple ASX listed stocks flagging consumer spending is weakening due to rising interest rates and cost of living pressures. Gold stocks also underperformed in the month. Small cap stocks significantly underperformed as investor funds moved to the perceived safety of larger cap stocks. As an example, on the ASX, the Emerging Companies index fell -6.4%, whilst the Small Ordinaries Accumulation index declined -3.3%. In bond markets, the US 10 year bond yield rose +20bp to close at 3.66%, whilst the Australian 10 year bond rate increased +26bp to 3.60%. Both movements were due to increased inflation expectations. In currency markets, the A$/US$ declined -2% to close at US$0.65. Commodities were broadly weaker in May. Brent crude oil declined -8.6%, copper -6.5%, iron ore -5.0%, whilst gold -1.2%. Thermal coal fell sharply, down -27.3%. The numerous interest rate hikes implemented by the Reserve Bank over the past 12 months are clearly having an impact on consumer spending, as evidenced by multiple ASX listed retailers announcing profit downgrades in recent weeks. Whilst some components of the CPI basket are declining (eg. Commodities), other parts such as power prices and wages are still rising (eg. Recent 5.75% award wage increase which commences on 1 July). Services inflation in particular, continues to be too high, as businesses across the board increase prices. With regards to interest rates, given inflation is proving more difficult to reduce to the Reserve Bank's targeted band of 2%-3%, it now appears likely that the RBA will need to lift rates 2-3 more times in this cycle. One theme that continues to impact the fund's relative performance versus benchmark is the underperformance of small/mid cap stocks on the ASX, noting the fund has a strong skew to this part of the market. Whilst this has been negative for the performance of the fund in recent months, we strongly believe this focus will produce some outstanding buying opportunities for longer term focussed investors over the next 6-12 months. The Fund continues to see numerous attractively valued stocks across a wide range of sectors and is well capitalised to take advantage of this current short term investor bearishness. Funds operated by this manager: |

15 Jun 2023 - The Rate Debate - Ep39 - Monetary policy changing the goalposts

|

The Rate Debate - Ep39 Monetary policy changing the goalposts Yarra Capital Management June 2023 Australia has been delivered another rate hike in an attempt to "quash" inflation. This month Darren debates with special guest Tim Toohey, Head of Macro and Strategy, the risks posed by rising wages and weak productivity growth, and why the RBA continue to change its goalposts to drive down inflation.

|

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

14 Jun 2023 - Demographics: how population changes will reshape global growth

|

Demographics: how population changes will reshape global growth abrdn June 2023 Low fertility is a problem for countries. Many developed markets (DMs) are starting to struggle with ageing populations and their associated social and economic issues. Meanwhile, it could be a problem even for emerging markets (EMs), which face a slowdown in the growth of their 'working-age' populations over the next 30 years. Last year, we published two papers - Emerging market demographics 'in focus' - implications for growth and the rise of the global middle class and Emerging market demographics 'in focus' - implications for equilibrium real interest rates - that examined the issues in developing economies. Our latest on the topic, Towards the peak: How the rise and fall of populations affects economic growth, seeks to advance the discussion by looking at things from a global perspective and asking what this may mean for investors. Population divergenceThe world's population is expected to grow by a further 1.7 billion people to reach 9.7 billion by 2050, according to the latest United Nations data. However, these numbers hide big differences between and within EMs and DMs. For example, the US' population is expected to increase by some 37 million by 2050, while Germany's could fall by some 4 million over the same period. Lower fertility in some European countries could be partially alleviated by immigration. Meanwhile, the number of people in developing economies is expected to continue growing, driven mainly by countries in Africa and developing Asia. That said, the population of the largest emerging market, China, began shrinking in 2022. Its impact on growth...EMs will drive global economic growth - accounting for some 75% -- in the coming decades. China and developing Asia alone will be responsible for some 60% of that. Despite their own demographic challenges, EMs will likely grow between two and 2.5 times faster than DMs (see Chart 1). Chart 1: Global GDP increasingly driven by Asia Source: Haver, abrdn, as at February 2023 India and Indonesia are set to join China among the world's top seven largest economies by 2050. What's more, Nigeria will be just outside the top ten (No. 11), while the Philippines, Pakistan and Vietnam will occupy places within the top 25. India and Indonesia are set to join China among the world's top seven largest economies by 2050 On the other hand, big oil producers - Russia, Saudi Arabia and Norway - will slip down the rankings as the world transitions to low-carbon energy sources. We found in our two previous papers that, while the percentage of 15-64-year-olds in EMs (often used as a proxy for the working-age population) is shrinking, the impact on growth isn't as bad as feared because social changes mean that people start and stop work later. What's more, there's a lot of scope for human capital - the economic value of a worker's skills and experience - to grow in EMs as more people attain higher education levels. That said, the next three decades will see labour playing a less important role in potential growth, as demographics hold back capital-stock growth. This means potential growth could fall close to zero in the Eurozone and Japan by 2050. But China's ability to improve the quality of its workforce could help offset the effects of its ageing population. ...and impact on productivityProductivity has been in gentle decline for many economies since the 2007/08 global financial crisis and we don't see much hope for a return to the boom years of the 2000s. Commodity-exporting countries have experienced productivity decline for years, while institutional weakness and political instability pose risks in EMs. The potential for demographics to create negative feedback loops, including for productivity, could result in additional risks. Ageing populations can strain the sustainability of social welfare models and public debt, which could reduce public spending in other areas and spur emigration. These risks are greatest in the ageing societies of China, Thailand and developed Asia. Other at-risk regions include Latin America (excluding Argentina, Mexico and Peru), central and eastern Europe, Japan and the Eurozone area. Only a few markets could see productivity improve if a feedback loop operates between demographics and growth. Pakistan, the Philippines, Israel, Nigeria and South Africa are among these as they benefit from improving dependency ratios - due to relatively youthful populations and falling birth rates. What this means for investorsHere are five things for investors to consider:

Author: Robert Gilhooly, Senior Emerging Markets Research Economist and Michael Langham, Emerging Markets Analyst |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund |

.jpg)