No events currently listed.

Find a Fund

Peer Group Analysis View All»

| Index Selector Links | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

5.68% |

5.85% |

6.21% |

|

71.86% |

11.11% |

54.94% |

|

11.64% |

1.39% |

4.43% |

|

15.82% |

4.95% |

7.42% |

|

14.85% |

5.50% |

8.56% |

|

16.37% |

2.49% |

7.13% |

|

18.61% |

6.42% |

8.49% |

|

21.13% |

5.30% |

10.27% |

|

19.59% |

1.71% |

8.80% |

|

18.22% |

0.93% |

8.21% |

|

7.85% |

1.25% |

1.59% |

|

10.32% |

4.07% |

4.46% |

|

9.33% |

6.73% |

6.21% |

|

10.18% |

7.03% |

6.28% |

|

17.48% |

7.31% |

5.13% |

|

11.75% |

4.02% |

6.20% |

|

10.31% |

-1.43% |

1.54% |

Hedge Clippings

18 Oct 2024 - Hedge Clippings | 18 October 2024

|

|

|

|

Hedge Clippings | 18 October 2024 Most economists are now convinced that yesterday's monthly labour force numbers released by the ABS have ruled out any chance of a rate cut this side of Christmas. For the record, for the past six months the unemployment rate has stayed steady around 4.1%, with 64,000 people joining the workforce in September, and the number of unemployed falling by 9,000. As the ABS pointed out, employment has risen by 3.1% in the past year, faster than the civilian population growth of 2.5%, taking the employment-to-population ratio to a new historical high of 64.4%. Even so, there are now 616,000 unemployed people, 90,000 more than there were in September last year, although that number is 93,000 fewer than there were pre-Covid when unemployment was at 5.2%. If those numbers sound confusing to you, join the club, but the ABS seemed to be able to make sense of them, as we suppose real economists do, which is what matters. Of course, behind the numbers were more details which caused a slanging match between the Treasurer Jim Chalmers and the opposition employment spokes-person, Michaelia Cash, who pointed to the fact that the majority of jobs growth in the past year - around 70% - has been in the government or "non-market" sectors of health, education and public service, leading to claims that the government was simply increasing the size of the bureaucracy to create jobs. Drilling down further, about 90% of the increase in hours worked was also in the non-market, and presumably lower-paid, sector. If you're one of those who are now employed the argument is academic (like so much of what goes down in Canberra) - a job is a job, and wages are wages - but it does emphasise another aspect of the current two speed nature of the economy. Private sector jobs are more likely to be higher paid, and one would think they in turn lead to additional flow on economic (jobs) growth. Meanwhile, back to the RBA, who had forecast that unemployment would be rising to 4.3% by the end of the year, which barring any unforeseen surprises, now seems unlikely. Hence the view from economists that the RBA will lag their overseas counterparts who have already started to cut rates in line with easing inflation. A speech this week from Sarah Hunter, RBA Assistant Governor (Economic) was entitled "Inflation Expectations - Why They Matter and How They Are Formed" and gave an inkling into the RBA's thought process. We're neither going to try to summarise it here (you can follow the link yourself if you'd like to) - nor claim to fully understand it all, but possibly the old saying that "perception is reality" sums it up: If everyone's perception is that inflation is high (and the media and one side or other of politics would suggest that it is) then that is the reality. As a result, it affects people's and businesses' economic decisions. However, Hunter finished her speech with the conclusion (amongst others) that it's a good news story with respect to expectations: Short-term expectations appear to be converging towards long-term ones, and recently they have been working to bring price expectations down faster. So maybe the RBA will deliver the experts (and borrowers) a surprise before Christmas after all? News & Insights New Funds on FundMonitors.com Manager Insights | Seed Funds Management Market Commentary - September | Glenmore Asset Management September 2024 Performance News Bennelong Concentrated Australian Equities Fund Glenmore Australian Equities Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

23 Oct 2024 - Performance Report: Bennelong Twenty20 Australian Equities Fund

[Current Manager Report if available]

23 Oct 2024 - Investment Perspectives: 10 charts that recently caught our eye

22 Oct 2024 - Performance Report: ECCM Systematic Trend Fund

[Current Manager Report if available]

22 Oct 2024 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

22 Oct 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Dimensional Global Real Estate Trust Unhedged Class | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Dimensional Global Small Company Trust - Active ETF | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Dimensional Global Sustainability Trust AUD Hedged Class | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Dimensional Global Sustainability Trust Unhedged Class | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Dimensional Global Value Trust - Active ETF | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Realm Short Term Income Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 850 others |

21 Oct 2024 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

21 Oct 2024 - Performance Report: Bennelong Emerging Companies Fund

[Current Manager Report if available]

21 Oct 2024 - Manager Insights | Seed Funds Management

|

Chris Gosselin, CEO of Australian Fund Monitors, speaks to Nichols Chaplin, Director and Portfolio Manager at Seed Funds Management. Nicholas shares insights on APRA's plan to phase out additional tier one bonds, which could destabilise the banking sector and impact retail investors. The Seed Funds Management Hybrid Income Fund has a track record of 9 years and has outperformed the Solactive Australian Hybrid Securities (Net) benchmark since inception in October 2015, providing investors with an annualised return of 6.39% compared with the benchmark's return of 4.86% over the same period.

|

18 Oct 2024 - Performance Report: Cyan C3G Fund

[Current Manager Report if available]

18 Oct 2024 - Global Investment Committee's outlook: low risk no longer

|

Global Investment Committee's outlook: low risk no longer Nikko Asset Management October 2024 As the Global Investment Committee (GIC) convened on 26 September, our Q2 outlook for resilient though somewhat softer US growth had materialised. However, our US EPS growth estimates (consistent with strong but softer GDP growth) remained slightly more conservative than market estimates. Going forward, we perceive heightened risk to both growth (two-way) and inflation (upside) compared to our Q2 guidance. Nevertheless, our central near-term scenario remains for slowing but positive growth in the US, alongside slowly moderating prices. Key takeaways are as follows:

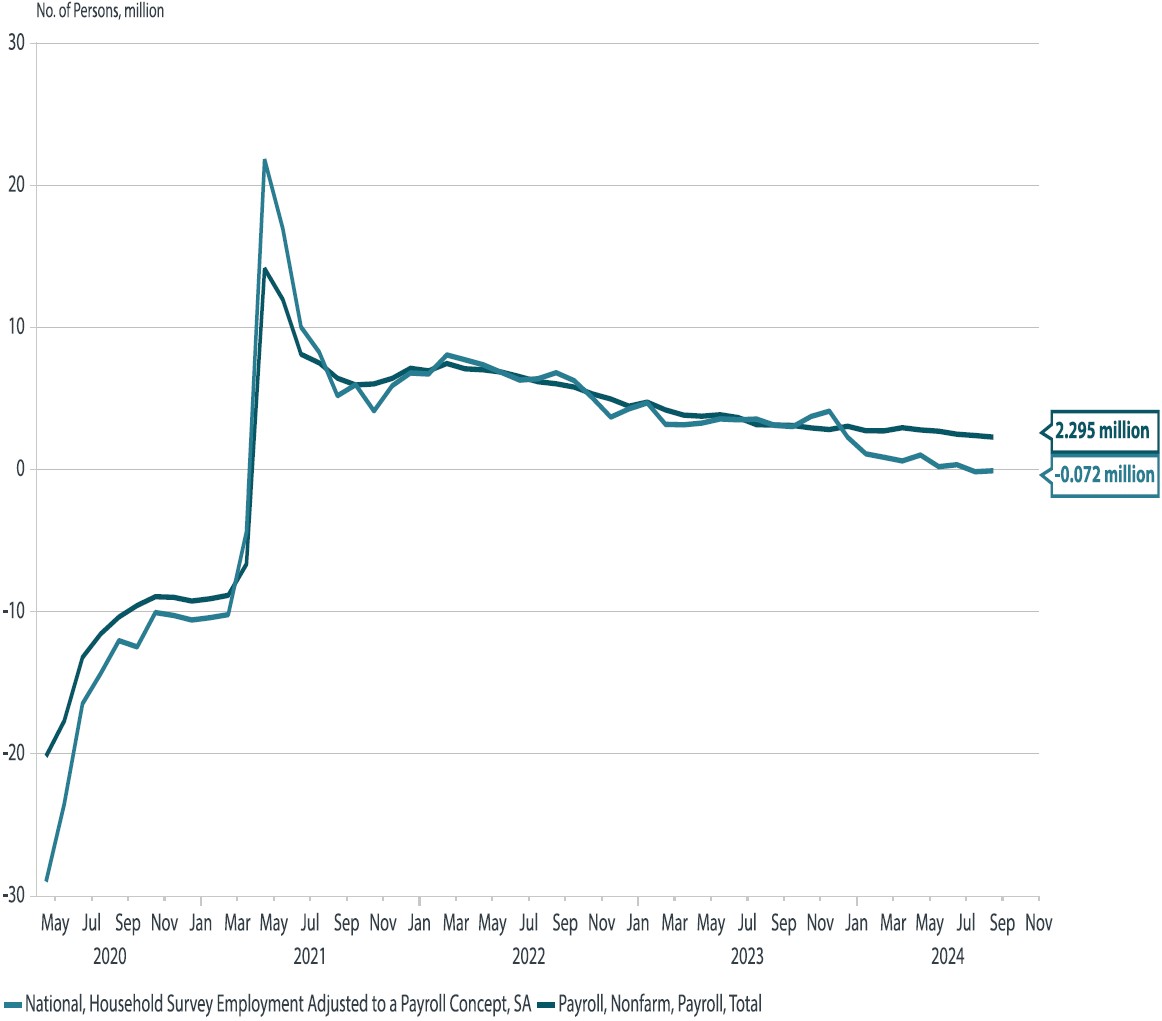

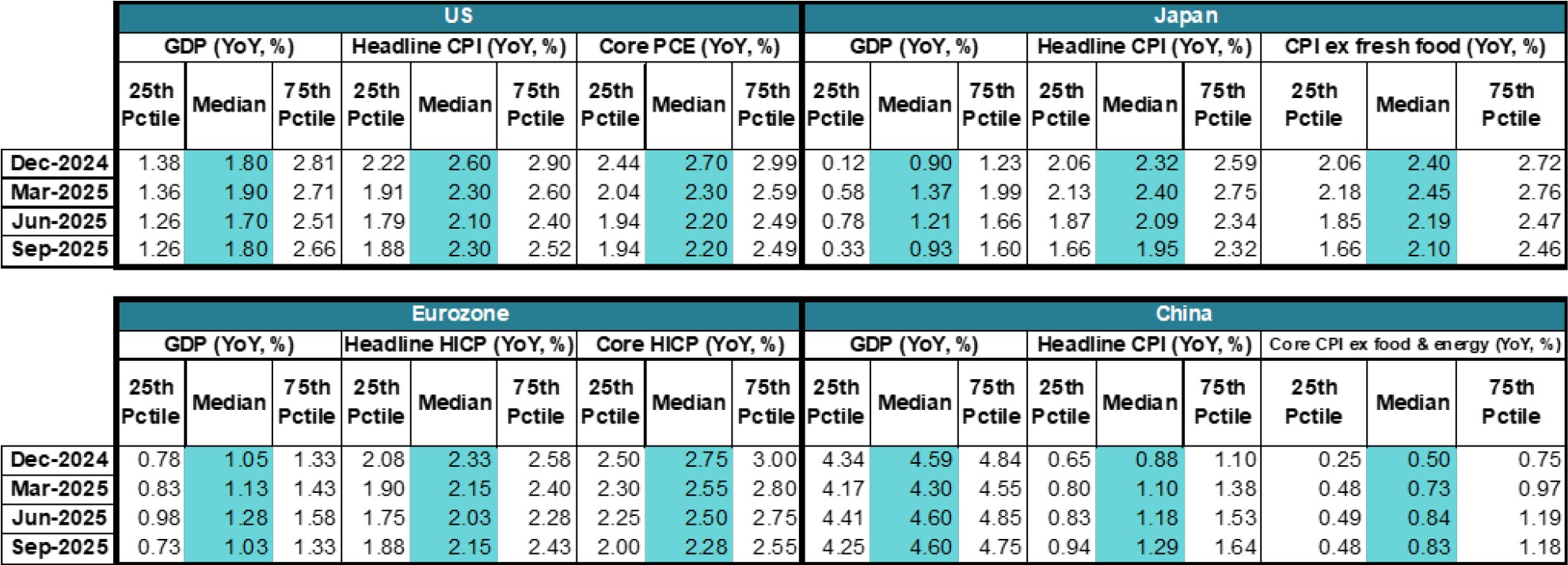

Q3 2024 in review: the "great dispersion" in stocks and bondsOver the course of Q3, the market experienced a change of course on several factors. Following a surprise rate hike from the Bank of Japan (BOJ) in July (the central bank took overnight rates to 25 bps), a downside surprise in US non-farm payroll data triggered speculation of imminent Fed rate cuts. This, in turn, led to the unwinding of speculative yen-funded "carry trades", triggering both a sudden drop in dollar-yen as well as unexpected volatility in Japanese equities--the target investments of short-term overseas investors utilising borrowed yen. Markets recovered quickly from the volatility, although dollar-yen appears to have corrected decisively lower from highs above 160. Domestic investors went bargain hunting as Japanese indices sold off and Japanese corporates used their large cash balances to buy back their shares at lower prices. Underweight institutional investors accumulated domestic equities to rebalance their portfolios while households, unfazed by speculative selling, continued to exercise the tax advantages that accrued to them under the New NISA. We convened an Extraordinary GIC at the time and shifted our guidance, primarily to allow for greater volatility. Aware that volatility tends to cluster and that markets may be at the threshold of a new volatility regime, we widened our ranges for both US GDP and the FOMC to admit downside risks. We also implemented new ranges for valuation (P/E) alongside existing earnings ranges for Japanese indices. Meanwhile, on the eve of the GIC on 26 September, markets had received news of surprise stimulus from China, on the heels of a larger-than-expected 50 bp rate cut from the FOMC on 19 September which had prompted bond markets to price in a succession of significant US rate cuts. Equity markets subsequently broke to new highs, even as bonds priced in a sombre macroeconomic scenario, though they barely reacted to the Fed's move on 19 September as the market had already priced in multiple 50 bp interest rate cuts. Meanwhile, toward the end of Q3, both Japanese stock markets and dollar-yen were influenced by speculation that Japan's ruling Liberal Democratic Party (LDP) would elect a new Abenomics-inspired leader (and thus prime minister). However, the LDP leadership vote on 27 September resulted in disappointment for the markets, which had to lower their expectations for the BOJ to end or indefinitely postpone its interest rate hike cycle. The LDP elected Shigeru Ishiba as its new leader and prime minister, who subsequently called a snap election for 27 October. However, as we noted in our insight, "Less may be more in Japan's LDP leadership contest", the situation is very different now than at the start of the Abenomics era when inflation struggled to turn positive. In Q3, we not only saw Japanese Q2 corporate earnings remain consistently strong but we also witnessed incipient signals of stronger consumption demand, backed by the advent of positive year-on-year (YoY) real wage growth. Global macro: growth risks persist, inflation tamer vs. Q2 on surfaceUS: From a macroeconomic standpoint, there is not enough clear motivation from underlying economic indicators to price in an imminent US recession, even despite softening data. Although the GIC foresees US GDP growth dipping below the 2% level, our outlook is for YoY growth to remain above 1.5% in the year to September 2025. The US consumer has remained resilient, even despite a softer job market, with consumption among higher-income households assisted by the "wealth effect" of gains in US stocks. While much slower than in early 2024, the US continues to add over two million jobs to non-farm payrolls YoY (see "What the Fed's rate cut tells us about current financial conditions"), which is stronger than job growth typically tends to be immediately prior to a US recession. That said, the unemployment rate has triggered the Sahm rule (typically a forward indicator of recession), due in part due to the widening disparity between the household survey (which shows YoY job growth already in contraction), and based on which the unemployment rate is calculated and the establishment survey, which tabulates non-farm payrolls. Chart 1: Employment conditions in the US

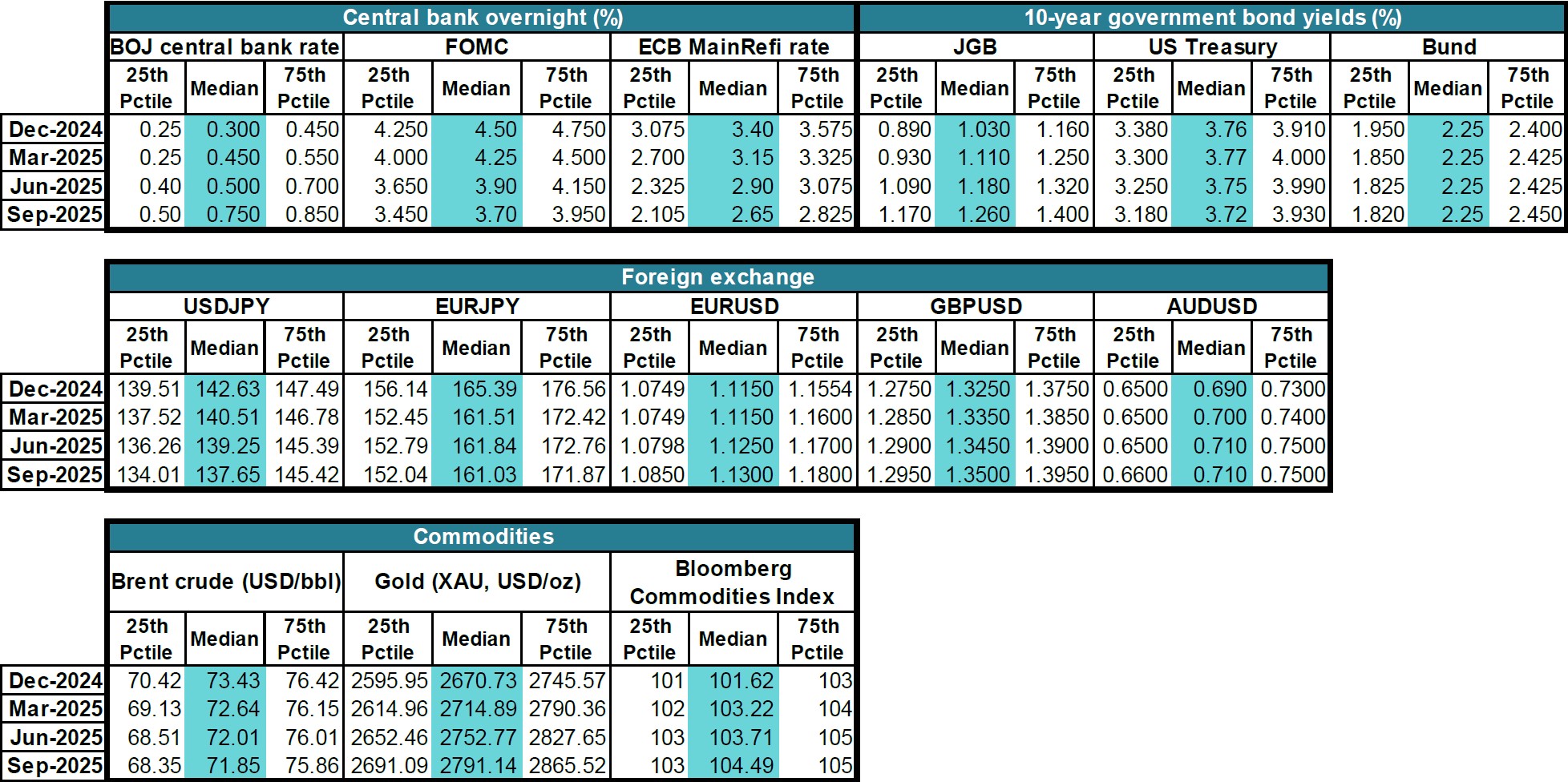

Source: Nikko AM, BLS Motivating the divide in part are disperse conditions between higher income households (where both job conditions and investment income are more supportive) and lower-income households, which are a higher proportion of the household survey than the establishment survey. Meanwhile, we see inflation as likely to stay on a gradual downward trajectory, although our median US core PCE outlook is for prices to show above 2% YoY growth over the course of the year to September 2025. Meanwhile, our voter survey shows a less dispersed central tendency for both headline and US inflation compared to Q2 as inflation subsides gradually. Notwithstanding, several members cite heightened inflationary tail risks. Many of the risks cited by voters have the potential to extend beyond the one-year outlook horizon. Macro vs. forward-looking financial market indicators: We are carefully observing the "great dispersion" of scenarios priced into financial markets, particularly in equities and bonds. We are unconvinced that the circular logic of aggressively lower rates could justify ever-higher equity valuations. This is particularly so given the messaging from the Fed. Although the FOMC did comply with market expectations for a "jumbo" cut in July, Fed Chair Jerome Powell continues to warn against assuming this would be the "new pace" of monetary easing in the absence of clear deterioration of economic conditions. Meanwhile, should economic conditions deteriorate (which is the bond market's signal) we are doubtful that the optimistic scenarios priced into the equity markets would indeed come to pass. Japan: Despite financial volatility in August, Japanese GDP appears to be on a trajectory to continue growing above-trend (potential GDP has been estimated at around 0.6% by the BOJ). Nonetheless, the median GIC voter offers more conservative estimates of Japanese GDP growth than in Q2 (no longer above 2% YoY) thanks in part to slower--albeit positive--growth in the US and other export markets. Meanwhile although headline CPI is foreseen dipping below 2% as early as the September quarter of 2025 with imported price inflation allayed by a slowly strengthening yen, our median GIC outlook is for ex-food inflation to remain above 2% over the year to September 2025. Euro area: The median GIC voter meanwhile foresees Eurozone GDP growth as likely to break above 1% YoY and remain at these levels over the year to September 2025, although both headline and core inflation are likely to remain stubbornly in excess of the European Central Bank (ECB)'s 2% medium-term target. However, immediate upside inflationary risks have been somewhat downgraded since the Q2 GIC, when much greater upside dispersion was seen among voters' estimates of future European inflation in both headline and core HICP. China: were it not for China's recent fiscal and monetary stimulus packages, GIC voters would have likely downgraded their GDP growth outlook, which they expect to still remain in the upper 4% range (but under 5%) over the year to September 2025. According to GIC voters, compared to the beginning of Q3, when stimulus was not priced in, moves by the Fed and the People's Bank of China (PBOC) have shifted the growth outlook. At the beginning of Q3, growth was perceived to come from abroad while now there is much more focus on domestic recovery. Meanwhile, communication between the PBOC and the government, which had previously been much more compartmentalised, now demonstrates greater coordination and a tone of shared urgency among Chinese officials. Their aim extends beyond simply stemming the decline in the housing market, focusing instead on stimulating domestic demand growth. Voters note that Chinese stimulus has been delivered at a time when markets are particularly sensitive to easing, though the size is half of what was delivered in 2009 (CNY 4 trillion vs. CNY 2 trillion in debt-funded fiscal easing in 2024) when the economy was one-third the size it is now. GDP growth is now less likely to falter near the 4% level (compared to the 5% target), particularly in the near-term--specifically, in the fourth quarter of 2024 and the first quarter of 2025. That the package also includes consumption coupons issued by an administration that once eschewed what it deemed "welfarism" underscores the priority for China to keep social unrest at bay given its sluggish domestic economy. Nonetheless, the outlook for headline CPI remains on the 1% handle, with core CPI still foreseen below 1% YoY over the year to September 2025. This is because voters perceive difficulties for China in lifting prices successfully; rather, attempts to date to allay weakness in the much greater consumer economy with investment in industry and export could potentially mean some degree of exportation of deflationary price pressures on exported Chinese goods. However, the impact of such pressures on trade partners could be limited in comparison to the early 2000s given today's higher relative price levels, reduced global trade openness and rise in trade barriers. That said, exported deflationary pressures are not always persistent. Though many Chinese firms do compete on price to gain market share, once gained, price increases often follow in an attempt to expand margins. Interest rates: the power of financial markets, a double-edged swordFOMC: In line with our relatively softer growth and inflation guidance over the year to September 2025, we have also downgraded our FOMC outlook relative to Q2. As mentioned in the "macro" section, softer indicators--particularly pertaining to US jobs--reinforce the need for further rate normalisation, as also apparent in the FOMC's own downgraded "dot plots" for growth, inflation and rates. The median GIC voter took the Fed's own forecast at face value to bring rates another 50 bp lower by the end of 2024. This is less dovish than the outlook currently priced into the bond market, which foresees potential for up to 75 bps in cuts by the end of 2024. Subsequently, the GIC foresees roughly 25 bps of easing per quarter, with a median outlook of 3.7% and an interquartile range between 3.45% and 3.95% by the end of September 2025. BOJ overnight rates: In Q2, we had priced in a partial but not a full probability of a July rate hike, which we saw as a modest surprise. However, following our August review, we saw little risk of the BOJ following up its surprise July hike with immediate additional tightening prior to gauging the impact of its move in Q3. Moreover, the BOJ called out both financial markets volatility as well as uncertainty abroad (e.g. in US growth) as one reason to remain on hold in September. Much like the influence that the markets appear to have had on the Fed's "pre-emptive" 50 bp cut, we see the BOJ's stance as being much more market-conscious than it was prior to the volatility experienced in early August. We do foresee potential for another rate hike before year-end, but such a move would most likely come after the October inflation data is published. According to the media, consumers will face price hikes on 2,900 food and drink items in the month of October (the broadest price increase in 2024 so far), as firms pass along higher raw material costs to consumers. GIC voters are therefore pricing in prospects of another hike prior to year-end (with the median guidance at 0.3%). There remains the risk that if financial market volatility resurges, the BOJ may remain on hold--all else being equal--at any point over the coming year. Conversely, if inflation surprises to the upside, there is also the risk that the BOJ could deliver a larger hike; our voters attribute a 25% or less chance that rates may rise to 0.45% before the year-end. Subsequently, the median GIC voter foresees rates as likely to rise to 50 bp by June 2025, and to 75 bps by September 2025. ECB: After the Q2 median guidance of 3.65% for the September-end refinancing rate came in close to the actual outcome, the GIC modestly downgraded its ECB outlook for the coming year. The Fed's larger-than-expected rate cut in September may have opened the door for more aggressive easing by the ECB. The median GIC voter predicts that it is somewhat likely for the ECB to reduce overnight rates before the year-end, with the interquartile range by the end of December 2025 at 3.075% to 3.575%). Nonetheless, given persistent services inflation, especially in Europe, the rate cut outlook is more conservative compared to the FOMC. Our median voter foresees a further 75 bps of cuts as likely in 2025. This compares to the FOMC's 80 bps foreseen for 2025, in addition to the 50 bps of cuts in Q4 2024. 10-year interest rates: Despite the uncomfortable positive correlation between equities and 10-year bond prices (with long-term bonds affording insufficient diversification from market risk), it is hard for participants in the bond market to "fight the Fed" given the apparently strong influence financial markets have on policy. This may paradoxically dilute the power of financial market indicators, including term structures of interest rates, as forward indicators of economic activity. Moreover, the positive correlation across geographies in longer-term bond markets is also apparent, even despite disparate policy trajectories. For example, in spite of improved prospects for near-term BOJ hikes since Q2 as priced into the short end of the JGB yield curve, the term structure of Japanese yields has flattened modestly since July, possibly influenced by Fed easing. Meanwhile, long-term US Treasury yields have declined even though the inversion between the 2- and 10-year benchmark Treasury yield has corrected. GIC voters foresee limited movement in 10 year Treasury yields from their current levels, even despite additional FOMC cuts, due to many of the cuts already being priced into the bond curve. Likewise, voters' central scenario is for little movement in 10-year Bunds over the coming year. One significant caveat--though not a central scenario among voters that inflation will disrupt the Fed's rate cut trajectory-- inflationary surprises and fiscal risk have registered higher than in Q2 in both probability and impact among voters' tail risks (see "Risks to Our Outlook* below). Foreign exchange: gradual yen appreciationFollowing volatility in August, we adjusted our outlook on the Japanese yen to allow for greater appreciation by the currency, as did the market as a whole. Partly responsible for this outlook adjustment was the prospect for narrowing yield differentials as the Fed eased and the BOJ tightened. Also, after observing one round of carry-trade unwinding and observing that market volatility tends to cluster, we upgraded the potential for volatile moves; volatility tends to come alongside yen appreciation. Meanwhile, the dollar's prospects have been downgraded modestly across currencies. The downgrade is less pronounced against the euro, pound and Australian dollar compared to the yen. Noting that the September 2024 BOJ Tankan survey released on 1 October references a fiscal year-end dollar-yen rate of 144.31, which is reasonably close to the spot rate at the time of writing, additional appreciation may impact exporters' overseas revenues, which we cover in the Japanese equities section. Mild upside to commodities, dispersed view on gold and oilIn line with the downward adjustment in oil prices thanks to supply and demand factors, the GIC downgraded its Q2 assumptions on Brent crude, foreseeing oil to remain below USD 80 per barrel for the year to September 2025. Any upside surprise, meanwhile, may result in an upgrade to inflation expectations. While this is not our central scenario, we do see rising tail risks connected to geopolitics, including violence in the Middle East. As its central scenario the GIC foresees mild upside to commodity prices over the coming year. Meanwhile, we expect the quest for diversification away from market risk, along with the inconvenient positive correlation between equities and US Treasuries (a traditional risk haven) will prove very supportive for gold in the coming year. Although the market prices a correction to near USD 2,500 per ounce over the next year, the GIC median voter sees potential for gold to rise above USD 2,700, with a 25% chance of the precious metal climbing to USD 2,800 or higher over the year to September 2025. Earnings growth and equity valuation: making way for higher asset volatilityOver the immediate horizon, the Fed's pre-emptive rate cut has had positive effects. Ongoing stimulus may continue to offer potential for resilient earnings growth from US stocks over the year to September 2025. We foresee double-digit YoY earnings growth still remaining intact over the year to September 2025. However, we also flag risks associated with ongoing market concentration (see "Risks to Our Outlook" below). Although our earnings outlook remains roughly in line with consensus, we foresee the potential for valuations to overshoot near-term due to Fed stimulus, and then gradually moderate over the course of the year to September 2025. We also anticipate potential for rebounds in lower-valued indices, such as the STOXX and Hang Seng. We believe that the latter can capitalise on its recent trough as Chinese stimulus takes effect and earnings growth recovers. But we expect valuations to remain on a downtrend for the STOXX, while we see earnings recovering over the course of the year to September 2025. Japan equities: low valuation + earnings growth + volatility = opportunityAlthough we foresee a rising trend in Japanese earnings and some adjustments in valuation over time, we expect volatility and dips in price creating significant opportunities for new purchases among longer-term investors. Notwithstanding the volatility, we see potential for broad-based Japanese corporate earnings growth, plus significant ability for the index to regain ground after sharp dips. This is due not only to comparatively reasonable valuation relative to US stocks, whose P/E ratios are well above their historical 20-year range, but also Japan's strong structural growth backdrop. This is evidenced by the gathering momentum of domestic consumption and investment alongside improving governance among corporates. We also note the presence of structural buyers in the form of domestic corporates buying back their own shares, institutions topping up domestic shareholdings to meet allocations and households exercising the tax advantages inherent in the new NISA. However, we do not discount the potential for interim negative surprises, particularly among large exporters, given the smaller buffer that current yen rates provide to exporters in terms of overseas revenues and investment income windfalls. Broader price ranges reflecting reactions to earnings surprises and valuation shifts: In August, we had introduced ranges not only for EPS growth but also for P/E ratios. We calculate price ranges taking into account the combined maximum and minimum impacts of earnings growth and valuation shifts. The highs within the price range represent our anticipated upper end of index fluctuations due both to earnings surprises and valuations, which we believe will experience bouts of interim volatility so long as market trading remains dominated by foreign investors (who on aggregate trade more frequently than domestic investors) even though many classes of domestic investors are likelier to buy and hold. Chart 2: Percentage of total TSE trading volume by foreigners

Source: Nikko AM, Tokyo Stock Exchange Risks to our outlook: harbingers of inflationDespite the generally benign outlook to global growth and inflation, our voters cited the following heightened risks that were biased toward the inflationary upside:

Investment strategy conclusion: stay invested, insure against inflationOur anticipated economic outlook remains benign. Although we anticipate a slowdown in US growth, we do not foresee recession as imminent, with the Fed's pre-emptive rate cut already contributing to accommodative financial conditions due to its anticipatory impact on financial markets. Accommodative financial conditions remain supportive near-term. Meanwhile, though it remains difficult to anticipate the timing of market-related corrections, we also signal heightened tail risks associated with policy uncertainty surrounding elections in the US as well as the potential for even small disappointments in economic data and policy to exercise a greater impact on asset markets and therefore growth in the future. We see the risks as biased toward the inflationary, and also foresee the disparity in outlooks priced in by the US bond and stock markets as ultimately unsustainable. In the event of upside risks to inflation, holding stocks (however volatile) may help protect the future purchasing power of investors, while upside may be limited for bonds, even if central banks do deliver easing as anticipated. For this reason, we continue to see demand for assets that are typically resilient to inflation that may also provide diversification hedges against US market risk. We favour gold and increasing exposure to Japanese domestic demand, which is showing signs of sustainable structural recovery and is less correlated with US growth and stimulus than export-oriented firms. The GIC's guidance ranges may be found in Appendix 1 of this document. A note on changes to the Global Investment Committee Process: In June 2024, we made changes to the Global Investment Committee, as to align our quarterly Outlook more closely with the views underlying our portfolio investments. In lieu of forecasts, we have chosen to provide guidance ranges for indicators and indices that we feel most closely relate to the asset classes we manage. In place of forecasts the Global Investment Committee now provide aggregate guidance at the median for our central outlook, and at the 25th and 75th percentiles. The asset classes represented in our Outlook can change over time, depending on what is most representative of our active investment views. In the event full ranges are not available, this may be interpreted as to mean that the asset class is not a central focal point for our highest conviction investment views. Appendix 1: GIC Outlook guidanceGlobal macro indicators

Central bank rates, forex, fixed income and commodities

Equities

Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information Please note that much of the content which appears on this page is intended for the use of professional investors only. |

21 Oct 2024 - Manager Insights | Seed Funds Management

|

Chris Gosselin, CEO of Australian Fund Monitors, speaks to Nichols Chaplin, Director and Portfolio Manager at Seed Funds Management. Nicholas shares insights on APRA's plan to phase out additional tier one bonds, which could destabilise the banking sector and impact retail investors. The Seed Funds Management Hybrid Income Fund has a track record of 9 years and has outperformed the Solactive Australian Hybrid Securities (Net) benchmark since inception in October 2015, providing investors with an annualised return of 6.39% compared with the benchmark's return of 4.86% over the same period.

|

14 Oct 2024 - Manager Insights | Altor Capital

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Benjamin Harrison, Chief Investment Officer at Altor Capital. The Altor AltFi Income Fund has a track record of 6 years and 5 months and has outperformed the RBA Cash Rate + 5% benchmark since inception in April 2018, providing investors with an annualised return of 11.68% compared with the benchmark's return of 6.67% over the same period.

Disclaimer This video presentation (the "Content") has been prepared by Australian Fund Monitors Pty Ltd, "AFM" (AFSL 324476) and has been prepared without taking into account the investment objectives of the viewer or recipient. The Content is intended for information purposes only, and recipients should conduct full research and take appropriate advice prior to making any investment decisions. The Content is believed to be accurate at the time of publication, but past performance is not guaranteed. Copyright, Australian Fund Monitors Pty Ltd. October 2024. |

20 Sep 2024 - Global Webcast: Reflecting on a volatile month & 2Q24 results season

|

Global Webcast: Reflecting on a volatile month & 2Q24 results season Alphinity Investment Management August 2024 |

|

Elfreda Jonker and Jonas Palmqvist reflect on what has been happening in markets over the previous month and review key themes from the second quarter of 2024. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Global Sustainable Equity Fund, Alphinity Sustainable Share Fund |

16 Sep 2024 - Manager Insights | Seed Funds Management

|

Paul Sanger, Head of Sequoia Direct, speaks to Nicholas Chaplin, Director and Portfolio Manager at Seed Funds Management. Nicholas Chaplin, Director & Portfolio Manager of Seed Funds Management, critiqued APRA's proposal to phase out Additional Tier 1 (AT1) bonds, highlighting concerns about the potential risks to banking stability and retail investors. He discussed the current challenges with AT1 instruments in the Australian market, the transition timeline, and the differing impacts on large and small banks. Nicholas also explored alternative solutions and gauged the market's reaction to the proposed changes. The Seed Funds Management Hybrid Income Fund has a track record of 8 years and 11 months and has outperformed the Solactive Australian Hybrid Securities (Net) benchmark since inception in October 2015, providing investors with an annualised return of 6.37% compared with the benchmark's return of 4.79% over the same period.

|

26 Aug 2024 - Manager Insights | Seed Funds Management

|

Chris Gosselin, CEO of Australian Fund Monitors, speaks to Nicholas Chaplin, Director and Portfolio Manager at Seed Funds Management. The Seed Funds Management Hybrid Income Fund has a track record of 8 years and 10 months and has outperformed the Solactive Australian Hybrid Securities (Net) benchmark since inception in October 2015, providing investors with a return of 8.41% over the past 12 months and an annualised return of 6.4% since inception compared with the benchmark's return of 4.84% over the same period.

|

8 Aug 2024 - The RBA's August decision: Insights from Nick Chaplin of Seed Funds Management

|

Chris Gosselin, CEO of Australian Fund Monitors, speaks to Nichols Chaplin, Director and Portfolio Manager at Seed Funds Management. Topics covered include: interest rates and inflation; US markets; volatility in equity markets; and bonds and hybrids.

|

||

5 Aug 2024 - Manager Insights | Argonaut

|

Chris Gosselin, CEO of FundMonitors.com, speaks with David Franklyn, Executive Director & Head of Funds Management at Argonaut. The Argonaut Natural Resources Fund has a track record of 4 years and 6 months. The fund has outperformed the S&P/ASX 300 Resources TR benchmark since inception in January 2020, providing investors with an annualised return of 27.27% compared with the benchmark's return of 8.73% over the same period.

|

17 Jun 2024 - Manager Insights | East Coast Capital Management

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Richard Brennan, Strategy Ambassador at East Coast Capital Management. The ECCM Systematic Trend Fund has a track record of 4 years and 4 months. The fund has outperformed the Barclay Hedge Global Macro benchmark since inception in January 2020, providing investors with an annualised return of 17.34% compared with the benchmark's return of 7.75% over the same period.

|

11 Jun 2024 - Manager Insights | Digital Asset Funds Management

|

Chris Gosselin, CEO of FundMonitors.com, interviews Dan Nicolaides on how Digital Asset Funds Management uses crypto market volatility for stable returns and risk management.

|

4 Jun 2024 - Innovations shaping the global healthcare universe

|

Innovations shaping the global healthcare universe Magellan Asset Management May 2024 |

|

The healthcare sector is in a state of constant evolution, and with the COVID-19 pandemic behind us and an upcoming US election, what impacts could we see in the sector? Investment Analyst, Wilson Nghe sheds light on the dynamics that could play out from the US elections, how the healthcare system has transformed since the pandemic and highlights the opportunities and challenges that investors need to watch out for. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund, Magellan Core ESG Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

Online Applicatons

Free, simple and secure

Olivia123 - the fast simple and secure online alternative to completing paper based application forms.