News

28 Jan 2021 - Webinar | Collins St Asset Management

|

This webinar from Collins St Asset Management was recorded on 9 December 2020. During this half hour webinar Michael Goldberg (Managing Director & Portfolio Manager) and Rob Hay (Head of Distribution & Investor Relations) will share: - Their contrarian insights into the Australian economy for CY2021; - Why backing the infrastructure thematic requires a flexible and 'non-consensus' mindset; and - Their top 3 stock picks for playing in the infrastructure space over the next 12 - 18 months. |

27 Jan 2021 - AIM Global High Conviction Fund: 2020 Annual Letter

27 Jan 2021 - Regulation, Rates and Inflation - Risks to Watch in 2021?

|

Regulation, Rates and Inflation - Risks to Watch in 2021? Andrew Clifford, Chief Investment Officer, Platinum Asset Management 5 January 2021 While stock markets continued their strong run over the last quarter, from early November it was notable that many companies with economically sensitive (cyclical) businesses experienced strong stock price performance. Similarly, there were strong price moves across a broad range of commodities (particularly iron ore and copper) over this same period. These moves in markets are consistent with investors pricing in continuing improvement in the global economic outlook for the year ahead. The commencement of these stock and commodity price moves aligned with the US election and the announcement of successful COVID-19 vaccine trials. While the high-flying growth stocks continued to perform well, the continued economic recovery potentially poses a threat via higher inflation and interest rates. Similarly, the 'anti-monopoly' movement is gaining momentum, not only in the US and Europe, but also in China, which represents a potential risk to the business models of many of the popular growth names. It is certainly too early to make such bold predictions about either interest rates or changes in regulatory regimes, but the unfolding of events over recent weeks lead us to restate our conclusion from last quarter that: We believe extreme caution is warranted in regards to the market's current 'high flyers', while opportunities abound elsewhere. The election of Joe Biden as the next US President is likely to reduce the uncertainty around the US-China relationship generally and trade and tariffs in particular. While the complaints around China's behaviour on various fronts, from the South China Sea to unfair trade practices, had strong bipartisan support in Washington and within the US government, it appeals to us that President-elect Biden is a far more conventional politician than his predecessor. As such, we would expect a more traditional negotiated approach to the various issues rather than random decrees issued via Twitter. Such a considered approach is likely to recognise the deep interdependence of the US and China economies, especially in industries such as semiconductors and electronics, where neither side can operate without the other in the medium term. From a political point of view, we acknowledge that it would be difficult for President-elect Biden to outright reverse the bans on Huawei or lift recent sanctions on Chinese companies linked to the People's Liberation Army (PLA), potentially these measures can be quietly diluted over time. However, even if they stand, a more reasoned approach to trade and tariffs is likely. The importance of this, is the certainty that it brings both to businesses in making long-term investment decisions and for investors in assessing the long-term potential of companies. At the time of writing, the Georgia Senate run-off elections were about to take place. Success in both seats would result in Democrats having effective control of the Senate and the potential for Biden's policies on infrastructure spending (including green initiatives), expansion of the Affordable Care Act (designed to provide affordable health insurance coverage for all Americans), funded by a reversal of some of Trump's tax cuts, to be put into place. Whether this result unfolds (the polls and betting markets suggest a very tight race), it is highly likely that substantial ongoing fiscal stimulus will occur. In the final days of 2020, the US Congress passed a stimulus bill valued at US$900 billion, or 4.4% of GDP. By any standard this is a significant fiscal spend, particularly when considered in light of the previous US$2 trillion of stimulus that is still flowing through the system and an economy that by all measures is recovering very quickly.1 The news of successful COVID-19 vaccine trials and subsequent regulatory approvals reduces uncertainty on the pathway out of the pandemic. The day-to-day news regarding new COVID-related lockdowns in Europe (as well as locally), together with rising infections in the US make for sombre reading. However, the beginning of vaccination programs in the US and Europe offer a very clear light at the end of the tunnel. While there remain unanswered questions around the longevity of the immune response, new variants of the virus are developing, and there are significant logistical issues in dealing with the vast numbers involved, it is highly likely that substantial portions of the US and European populations will be immunised by the end of 2021. China has also approved a locally developed vaccine for use in the general population, which is likely to be used broadly in the developing world. It should also be noted that there are numerous other vaccines in late stages of development and through time, individual vaccines will be refined in response to outcomes of current programs. While we have been of the view that the development of an effective vaccine was highly likely (as discussed by our portfolio manager and resident virologist, Dr Bianca Ogden in the article "COVID-19: Demystifying this Frightening Disease"), the start of the vaccination programs significantly reduces the risk of shutdowns and travel restrictions continuing beyond the end of 2021. Again, this reduces the long-term uncertainty faced by businesses, particularly those impacted directly, such as travel-related industries. Of course, the year ahead remains difficult, but in the context of the stock market, the value of companies is determined by at least a decade of future profits, not just the next six to 12 months. The 'anti-monopoly' movement has also continued to gain momentum not only in the US but also China. In the US, the Federal Trade Commission and 48 states filed two antitrust lawsuits against Facebook, focused on acquisitions and the impact on competition. The Department of Justice filed a case against Google claiming they used anti-competitive tactics to protect its monopoly over search. These cases join various actions in the European Union and Australia's move to make the likes of Facebook and Google pay other media outlets for the use of their content. In China, regulators outlined restrictions on how consumer data can be used in relation to anti-competitive practices. Investigations have also commenced into suspected anti-competitive practices at Alibaba, financial regulators having earlier suspended the initial public offering (IPO) of their financial arm, Ant Group. The dominant e-commerce and technology giants have amassed huge user numbers over the last decade, providing them with enormous market power and highly profitable business models. Indeed, social media platforms have been seen as responsible for swaying elections and enabling uprisings. Our key point is that governments the world over will attempt to rein in this power, and as such there is a genuine risk of additional regulation for dominant players in e-commerce, payments and social media.

One interesting development has been shortages in a range of commodity products from steel to electronic components and silicon wafers, despite the global economy remaining at pre-COVID levels. The explanation behind these shortages is likely multifaceted. The demand for goods (electronics, autos, home furnishings and renovations) has been strong while services (travel, eating out and entertainment) has been weak. Thus, there has been a short-term boost in demand while suppliers of inputs potentially cut output on initial expectations of reduced demand or COVID-enforced closures. Potentially, these shortages and the associated higher prices may be relatively short-lived, however, a lack of significant investment in new capacity for a period of time in many of these industries may see longer-term shortages developing. This has all occurred before any economic benefit that may accrue from the continued post-pandemic opening or improving business optimism following the US election. With governments around the world likely to continue spending to accelerate the economic recovery, this could potentially exacerbate the shortages over the course of 2021. While there is no evidence of a rise in inflation in goods and services in the major economies yet, it is easy to see an inflation scare unfolding as the year progresses. The stock market bull run has continued, though the better performance of economically sensitive stocks is an interesting development. In most respects, the stock price recovery of these 'real world' businesses is hardly surprising. Economic activity continues to recover and vaccinations provide a pathway to full recovery over the course of 2021. The potential for better trade relations between the US and China under a Biden presidency point to less risk of the world slipping back into tariff-inspired manufacturing recessions, as experienced in 2018-19. Governments continue to promise more spending, focused on real world activities, such as infrastructure and 'decarbonising' projects (i.e. renewable energy and electric vehicles). Additionally, valuations were generally deeply depressed, as investors avoided companies facing any uncertainty in their future earnings. On the other hand, the speculative mania in growth stocks has continued to a large extent unabated. The market for new listings has remained excitable with many stocks continuing to debut at prices of 50% or more above their issue price. Issuance of special purpose acquisition companies (SPACs)2 continue, as have elevated levels of retail participation in the market. Valuations have moved from extraordinary to even higher. The one area that has slowed somewhat are the 'megacap' FAANG stocks (Facebook, Amazon, Apple, Netflix and Google owner Alphabet), perhaps in response to the various antitrust initiatives, or possibly reflecting the beginnings of a loss of momentum for growth stocks more generally. As we have stated in previous reports, manias tend to end abruptly. The significant bull markets of the last 40 years have come to an end when monetary conditions tighten. While it is hard to imagine a traditional central bank tightening cycle currently, potentially a slowing of the printing presses may be enough. Alternatively, an inflation scare could push long-term interest rates higher with ramifications for stocks whose valuations are based on the premise of near-zero interest rates. When a collapse in the stock prices of growth stocks comes, it too should not come as a surprise. When companies are valued on multiples of sales (not profits) of 20 times or more, the probability that their business will meet investor expectations on growth rates and profitability, to justify the valuation, is simply remote. A select few may achieve what is needed to provide investors with a reasonable return, but in aggregate one should ultimately expect substantial losses on the holding of a portfolio of such stocks. 2020 was certainly a most unusual year and perhaps doubly so in the stock market. However, the two bedrocks of our investment approach remain. Firstly, investors' cognitive biases will cause them to overemphasise recent events and news. This means the best investment opportunities can often be found in areas the crowd is avoiding; while those investments the crowd is embracing are best avoided. There is nothing to suggest that 2020 has changed basic human psychology. Indeed, the evidence shows quite the contrary, with significant returns achieved in unpopular areas, such as semiconductors and commodities. Our second fundamental investment principle is that the price you pay for an asset will determine your return. While you may buy overvalued stocks that move higher, over time this approach is unlikely to yield good returns, as ultimately the stock price will reflect assessments of future profits and cashflows from the business. Of course, we know that speculative bull markets can run for a long time, but the pain for those investors who don't exit the party in time can be significant. 1 Source: Congressional Budget Office, EY. 2 SPACs raise funds from investors and use those funds to acquire existing, privately held companies with the intention of taking them public via an IPO. DISCLAIMER: This article has been prepared by Platinum Investment Management Limited ABN 25 063 565 006, AFSL 221935, trading as Platinum Asset Management ("Platinum"). This information is general in nature and does not take into account your specific needs or circumstances. You should consider your own financial position, objectives and requirements and seek professional financial advice before making any financial decisions. You should also read the relevant product disclosure statement before making any decision to acquire units in any of our funds, copies are available at www.platinum.com.au. The commentary reflects Platinum's views and beliefs at the time of preparation, which are subject to change without notice. No representations or warranties are made by Platinum as to their accuracy or reliability. To the extent permitted by law, no liability is accepted by Platinum for any loss or damage as a result of any reliance on this information.

|

22 Jan 2021 - Managers Insights | Collins St Asset Management

|

Damen Purcell, COO of Australian Fund Monitors, speaks with Rob Hay, Head of Distribution & Investor Relations at Collins St. Since inception the fund has performed strongly returning 17.29% per annum. However the volatility of the past 2 years has provided Collins St with strong opportunities and the fund has outperformed the ASX 200 Total Return Index by 8.99% per annum since January 2019. Listen to this interview as a podcast |

13 Jan 2021 - Webinar | Paragon Australian Long Short Fund Performance Update & Outlook

|

In this webinar, John Deniz provides an update of the Fund's performance for 2020 along with Paragon's current market outlook and the Fund's positioning. |

12 Jan 2021 - President Biden and the Share Market

11 Jan 2021 - Equities: I can't live with you, I can't live without you

10 Jan 2021 - 3 market myths that threaten to derail investors' long-term wealth

|

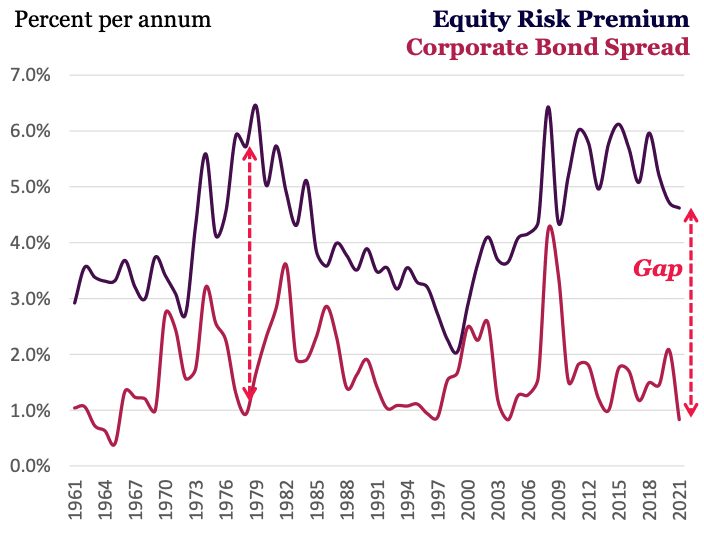

3 market myths that threaten to derail investors' long-term wealth Montaka Global Investments 10 January 2021 The US stock market recently hit fresh all-time highs. But then we learnt that US inflation in the month of October was 6.2%, the highest annual rate in 31 years. Many investors are naturally now fearing three 'facts' have emerged from the current situation: equities as an asset class are stretched and this is 'as good as it gets'; that likely interest rate rises will crunch stocks; and finally, that there are no undervalued stocks providing buying opportunities in the market today. But for strong, though perhaps counterintuitive, financial and economic reasons, these three fears are likely myths. We believe that equities continue to represent attractive, long-term value; structural deflationary forces will keep rates relatively low; and there are great companies available today at cheap prices. There is a danger that if investors fall for these myths they will bail out of equities and miss out on their long-term wealth-building potential. Myth 1: Equities are overvaluedWhile investors fear that equities are overvalued, the fact is that equities are better value than other asset classes. Investors are being paid unusually high returns for taking on equity risk compared with the likes of bonds. A good measure of the value of equities is the 'gap' between the equity risk premium (ERP) and the bond spread (how much corporate bonds yield above government bonds). The ERP is the extra return investors get for owning stocks, rather than risk-free government bonds. Historically, the gap between the ERP and bond spread has averaged around 2%. The gap has been as wide as 5% percent when equities were relatively cheap. It has also fallen close to zero when equities were expensive, such as during the 1999 tech bubble. (During this 20-year period of the gap closing, equities compounded at 18 percent per annum!) The 'Gap' between ERP and Corporate bond spread

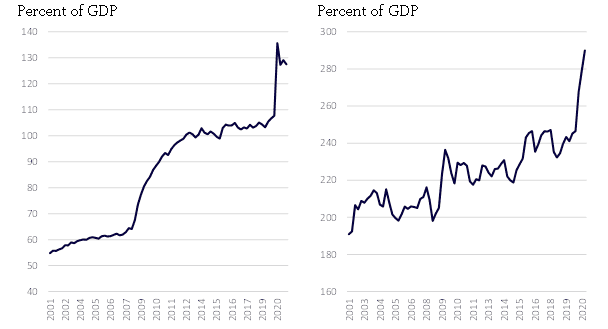

Source: NYU Stern (Damodaran); Bloomberg; Montaka Global The gap today is around 4%, so well above average. As equity prices have soared since the depths of the pandemic, the ERP has reduced. But spreads in other asset classes, such as bonds, have also reduced. On a relative basis, therefore, equities remain just as attractive as they did in 2019 when the S&P 500 was lower by one-third. Myth 2: We have entered a structural inflationary cycleThe second fear is that interest rates will keep rising and slam the breaks on equities. But equity prices are actually more likely to keep rising in the long term. For the gap between the equity and bond spread to normalise from 4% today to the long-term average of 2%, equities must perform better than bonds going forward. Despite the current inflation worries, equity prices are more likely to rise because higher bond yields (resulting lower bond prices) are unsustainable, in our view. Strong, long-term, structural disinflationary forces will continue to pressure interest rates to much lower levels than we've observed historically. For a start, populations are aging across the world. The working-age cohort in major economies, such as China and Europe, are shrinking as more people retire, which will logically reduce economic growth over time. Governments will also have to ramp up spending on pensions and healthcare. That lower economic growth will push down interest rates. The soaring power of compute and big data is also creating of an increasing array of intelligent applications which require few, if any, humans to operate. Less demand for labour over time is disinflationary. US Federal public debt Global, non-financial corporate debt

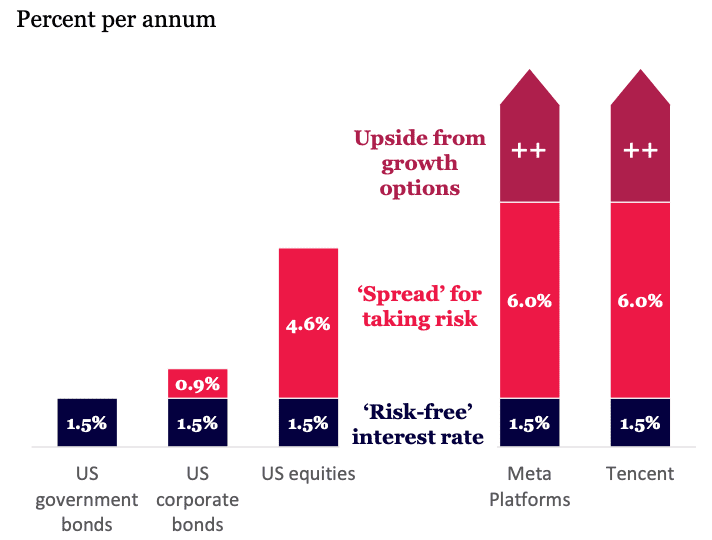

Source: Bank of International Settlements; Federal Reserve Bank of St. Louis And the huge debt loads of governments and corporates, which has surged post-pandemic, means interest rates cannot increase materially and sustainably. If rates do rise, consumers, corporates and governments will spend less - all at the same time - to meet higher interest costs, which in turn cuts economic growth and forces interest rates back down. So, notwithstanding short periods of slightly higher bond yields to reflect the economic cycle, a long-term regime of historically low interest rates appears likely. And if that is so, then the longer-term prospects for equities remain attractive. Myth 3: It feels like most stocks are overvalued todayDespite the positive outlook for equities, some investors will still argue that many stocks are overvalued. But while that is true, a subset of stocks are materially undervalued, including Meta Platforms (formerly Facebook) and China's Tencent. Even if you only considered their existing core businesses, both Meta and Tencent are cheap. Based on 2022 earnings, the earnings yield of both Meta and Tencent's core business is around 4.5%. If you subtract a risk-free rate of, say, 1.5% you get a spread of 3.0%. Not so attractive, you might suggest. But by 2025, that same spread has increased to more than 6.0% due to earnings growing organically over this time. Compensation for taking risk - comparison

Source: Bloomberg; Montaka Global estimates What's more, both Meta and Tencent have large, high-probability growth options tied to the 'metaverse', e-commerce, artificial intelligence and cloud computing. As these growth options are monetised, the 'spread' of the shares of these companies increases even further. On this basis, Meta and Tencent appear to be highly attractive investment opportunities. Hold the line on equitiesThe message to investors is to remain selective based on clear-minded, fact-based analysis. We continue to believe that equities offer materially better value than bonds, in general today. And this belief is based on detailed, 'first-principles' analysis. Of course, not all equity investments are created equal. Many stocks are overvalued today - but some are materially undervalued. If investors can patiently accumulate and own these undervalued businesses, it will steadily drive their compounding higher. And over the long-term, compounding in equities at rates of return well above those in cash or bonds, will lead to dramatically outsized wealth accumulation. Maintaining high exposure to equities is the key element to building wealth through investments. Don't fall for these 3 myths and give up on the remarkable long-term wealth building power of equities. Note: Montaka is invested in Meta & Tencent. Written By Lachlan Mackay Funds operated by this manager: |

8 Jan 2021 - ESG INSIGHT: Banks are putting the squeeze on fossil fuels

5 Jan 2021 - Webinar | Premium China Funds Management: Emerging Markets & Fixed Income Update December 2020

|

Jonathan Wu, Executive Director & Chief Investment Specialist at Premium China Funds Management, gives an update on the Premium Asia Income Fund. |