News

9 Nov 2021 - 'Reaching for yield' into corporate debt takes on a risky hue

|

'Reaching for yield' into corporate debt takes on a risky hue Magellan Asset Management October 2021 William White, a Canadian, became the top economist at the Bank for International Settlements (BIS) over a 14-year career to 2008 at the bank owned by central banks. Among those who heard of him, White became known as "the man no one wanted to hear".[1] From 2003, in an era when central banks prioritised inflation targeting (and yet the response to every crisis by the 'maestro' Federal Reserve chairman Alan Greenspan was to slash the US cash rate), White and his team studied the data the BIS gathered on banks worldwide. They judged that low interest rates meant too much money was sloshing around. They observed a bubble developing in US housing. They noted the obscure way mortgages were being securitised. They spotted the stellar ratings on dodgy mortgage-backed securities. They observed the increase in risky loans. White ensured that BIS publications were sprinkled with warnings that bubbles lead to financial upheavals.[2] On top of that, White aired his concerns through speeches and papers. Two of White's efforts stood out. The first was in 2003 at Jackson Hole in the US at the annual gathering of central bankers that included Greenspan, who then publicly snubbed White for his remarks.[3] What upset Greenspan was that White warned that, even though inflation was docile, liberalised financial markets allowing investors to take too much risk meant that "financial imbalances could build up ... possibly resulting in financial instability" so damaging that "central banks may need to push policy rates to zero".[4] White's other warning of note was a 2006 paper titled Is price stability enough? In it, White concluded that "one hopes that it will not require a disorderly unwinding of current excesses to prove convincingly that we have indeed been on a dangerous path" by targeting inflation only.[5] The US subprime crisis of 2007 that morphed into the global financial crisis of 2008 was, of course, that chaotic unravelling. While no household name, White is acknowledged as the economist who foresaw the calamity, and the BIS is regarded as among the foremost voices on financial risks. That is the context in which to view a paper the BIS released in March this year that warns about the "bankruptcy gap". This term refers to the difference between expected and actual - "very low" - global bankruptcies since the pandemic began, even fewer insolvencies in some countries.[6] The BIS said ample credit from banks and the corporate-debt market means lockdown-hit companies in "airline, hotel, restaurant and leisure sectors" in particular are surviving on debt, not economic viability. "The more worrying scenario is the combination of higher debt levels and depressed earnings for credit-dependent firms", the BIS said, essentially warning that a spate of defaults could threaten financial stability. The concerns are centred on the lower-rated - or 'junk' - segments of the corporate debt market - where the US$11 trillion US market (of which about US$3 trillion is junk debt), as the world's benchmark, gets outsized attention. So too does China's US$17 trillion corporate-debt market, where recent defaults and property giant Evergrande's woes pushed the average yield on Chinese high-yield bonds issued offshore from 9.56% on June 30 to 15.45% at the end of September.[7] The risky form of finance that gained in global popularity from the 1980s has turned more hazardous due to ultra-loose monetary policies and the decision by key central banks to backstop their corporate bond markets - most notably, the Fed's historic decision in March last year to buy US investment-grade corporate bonds.[8] The combination prompted investors to pile into risky company debt to earn their required returns. This 'reach for yield' means that junk bonds are priced at little premium over investment-grade corporate debt and government bonds. In the US on September 30, for instance, the ICE BofA US High Yield Index Option Adjusted Spread of junk to government bonds had plunged from a record of 11.38% just before the Fed began buying corporate bonds on March 23 last year to only 4.21% on September 30, not far above the 3.94% set on September 15, its lowest since just before the subprime crisis of 2007.[9] Given that companies have used record low interest rates to lengthen the maturity of their debt holdings - and default risk rises over time - the barometer is at a de facto historic low. The rating companies are sounding similar concerns to the BIS (as, less directly, is the OECD).[10] Moody's and S&P Global Ratings told the Financial Times in August that a borrowing frenzy amounting to a record US$786 billion[11] in "speculative-grade" (the junkiest) debt so far in 2021 amid "clear signs of risk taking" meant "the current easy access to corporate financing might be laying the foundation for a future debt crisis" from "elevated levels of defaults".[12] The frenzy this year comes after a record US$1 trillion was invested in corporate debt. The wider concern is the systemic threat. Even if any corporate-bond crisis fails to inflict such damage, higher company debt loads foreshadow a downturn because higher repayments would force businesses to shed staff and refrain from investing as they prioritised reducing their debts (a 'balance sheet' recession, in the jargon). The risks around speculative-grade corporate debt raise the broader question of whether or not prolonged central-bank asset buying, by forcing investors to take excessive risk, could prove counterproductive. The verdict on the worth of quantitative easing will be obvious if junk bonds are at the centre of the next crisis. Let's acknowledge that bond investors helped many viable companies survive an emergency. Let's note too that the BIS is not pushing the warnings about the bankruptcy gap with the same urgency with which White voiced his concerns. Many forecasts obviously prove inaccurate, including those of the BIS, which is prone to alarm. If higher inflation proves transitory as officials expect, low interest rates could persist for a while yet and the reach for yield might prove innocuous. But benign investment markets might only prompt more investors to seek higher and riskier debt-based returns and that might presage a delayed, but bigger, blow-up. A crisis could start in many of the asset classes (including US housing again)[13] that have reached record highs in recent years. For sure. But problems arising anywhere could spread to junk bonds and magnify any upheaval. As household-name Warren Buffett warned in February 2020 as covid-19 was going global: "Reaching for yield is really stupid" that could have major "consequences over time".[14] No doubt White in his near-anonymity would agree. No way out On 23 May 2013, minutes were released from the Fed's policy-setting board meeting held about three weeks earlier. The document showed one board member, Esther George, president (still) of the Federal Reserve Bank of Kansas City, disagreed with the decision to keep monetary policy ultra-loose - where the cash rate was at zero and the Fed was buying assets worth US$85 billion a month. George "preferred to signal a near-term tapering of asset purchases", the record showed.[15] That phrase was among warnings about impending rises in bond yields that triggered such a violent reaction on financial markets the episode became known as the 'taper tantrum.' The same day those minutes were released, Fed chairman Ben Bernanke justified an expected tapering by warning Congress that a long period of low interest rates could "undermine financial stability" ... because "investors or portfolio managers dissatisfied with low returns may reach for yield by taking on more credit risk, duration risk or leverage".[16] Jerome Powell now leads a Fed that is buying assets at a rate of at least US$120 billion a month, whereby the central bank creates money (electronically) as an asset on its balance sheet and buys financial securities in the secondary market with interest-paying reserves. As the Fed's balance sheet has bloated by US$6 trillion over the past eight years to stretch to 30% of US GDP (while the total of major central banks is US$18 trillion), the risks are probably greater. While central-bank asset buying in emergencies can stabilise financial markets (as the Fed's corporate-bond buying did in 2020), the question being raised as investors await signs of an imminent tapering is whether prolonged asset buying might prove counterproductive. Disadvantages accruing from quantitative easing (some of which are intertwined with the zero cash-rate setting) build the case for why the asset buying needs to be unwound as soon as it can. One drawback is that asset buying lowers bond yields and thereby hurts savers who rely on interest income. That counteracts, to some extent, the boost lower rates give to the economy. Another is that quantitative easing seems to bolster asset prices to such an extent that risk appears mispriced and capital appears misallocated, while inequality rises. A third is that central-bank asset purchases create a future fiscal liability for taxpayers, even if it reduces government borrowing costs in the short term and the interest earned on a central bank's debt holdings is income for the treasury. Central banks pay a market-based rate of interest to holders of their reserves to stop these sums being lent out and risking inflation. Higher interest rates would thus burden public finances while giving banks unearned income. A fourth is that quantitative easing shortens the duration of the government's debt (by substituting overnight reserves for longer-term securities) at a time when low interest rates mean the government should be doing the opposite. Another is that quantitative easing undermines the independence of central banks - and thus their inflation-fighting credibility - by blurring the distinction between fiscal and monetary policies. A sixth is that, given the fragility of central-bank independence come an emergency, elevated government debt could prompt politicians to pressure central banks not to raise interest rates to control inflation because higher rates might trouble public finances. A further drawback is that central-bank actions can reduce the pressure on political leaders to use fiscal and other policies to help economies, especially if the asset buying reaches into funding the government's deficit. Last, and of relevance to the corporate-debt market, the asset buying can encourage excessive risking taking that results in a crisis. That's why central banks are afraid to reduce, let alone end, their purchases. The UK's House of Lords might best sum up this dilemma with the title of its evaluation of central-bank asset buying: Quantitative Easing - a dangerous addiction? As the report notes in what it calls "the no-exit paradigm," no central bank has managed to reverse its asset buying over the medium to long term.[17] The Fed has probably come closest. Many argue the economy could have absorbed Fed tapering in 2013. The concern now is that Fed tapering could well be the spark of trouble for corporate bond yields. Faster inflation - and US consumer prices jumped 5.4% in the 12 months to August - could hasten the day when the Fed needs to tighten monetary policy. Come any tapering, government yields are likely to rise and so too the premium on junk versus haven assets. At the same time, higher interest rates could slow economic growth and retard company sales. Yet interest payments would still need to be paid and maturing debt replaced by fresh borrowings. Yields on downgraded company debt could soar if the rating reduction were to sink from investment to non-investment grade. Debt reduced to junk ('fallen angels') reduces the number of investors who can invest because they have mandated minimum ratings on investments. Fed members have much to consider as they ponder the ending of the Fed's promiscuous monetary policy, though there's less pressure on Kansas City's George as she has no vote this time.[18] Wonder what the BIS's White, now in retirement, might advise. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund [1] Spiegel International. 'The man nobody wanted to hear. Global banking economist warned of coming crisis.' 7 August 2009. spiegel.de/international/business/the-man-nobody-wanted-to-hear-global-banking-economist-warned-of-coming-crisis-a-635051.html [2] The 2004 annual report charted the risk-taking of US investment banks and warned "uncertainties concerning the housing market could imply some direct and indirect risks to the financial system". Bank for International Settlements. '75th annual report. 1 April 2004 - 31 March 2005.' Pages 131 to 134. 27 June 2005. bis.org/publ/arpdf/ar2005e.pdf. The 2005 annual report noted US subprime mortgage originations in 2005 were seven times 2000 levels and that in the US and the UK "relaxation of lending standards due to competition and greater reliance on securitisation has contributed to a significant increase in lending to more risky households". Bank for International Settlements. '76th annual report. 1 April 2005-31 March 2006.' Page 134. bis.org/publ/arpdf/ar2006e.pdf. The credit risk transfer report of January 2003 is noted for its warnings. bis.org/publ/cgfs20.pdf [3] Spiegel International. Op cit. [4] Claude Borio and William White. BIS working papers No. 147. 'Whither monetary and financial stability? The implications of evolving regimes.' February 2004 dated version of paper presented in Jackson Hole, Wyoming on 28 to 30 August 2003. bis.org/publ/work147.pdf [5] William White. BIS Working Papers No. 205. Is price stability enough? April 2006. bis.org/publ/work205.pdf [6] Ryan Banerjee, Joseph Noss and Jose Maria Vidal Pastor. BIS Bulletin. No 40. 'Liquidity to solvency: Transition cancelled or postponed?' 25 March 2021. Bankruptcies "even fell" in many jurisdictions during 2020. bis.org/publ/bisbull40.pdf [7] Bloomberg data. Bloomberg Asia Ex-Japan US dollar credit China HY Index. [8] Federal Reserve. Primary Market Corporate Credit Facility. Set up 23 March 2020. federalreserve.gov/monetarypolicy/pmccf.html [9] Federal Reserve Bank of St Louis. Federal Reserve economic data. ICE BofA US High Yield Index Option Adjusted Spread. (BAMLHOAOHYM2). fred.stlouisfed.org/series/BAMLH0A0HYM2. On September 30, for instance, the average yield for bonds in the ICE BofA US High Yield Index was only 4.21%. By comparison, the yield on 10-year US government bonds was 1.52%. Three years earlier to the day, the equivalent reading on the High Yield Index was 6.23% compared with 2.85% on the US 10-year Treasury. FRED. ICE BofA US High Yield Index Effective Yield. (BAMLHOAOHYM2EY). fred.stlouisfed.org/series/BAMLH0A0HYM2EY. US Department of the Treasury. Resources center. Daily Treasury yield curve rates 2018. treasury.gov/resource-center/data-chart-center/interest-rates/pages/TextView.aspx [10] The latest OECD report on corporate bonds warned that in comparison to past 'credit cycles' the stock of outstanding corporate bonds "has lower overall credit quality, higher payback requirements, longer maturities and inferior investor protection" - and that was before the pandemic hit. OECD. 'Corporate debt continues to pile up.' Undated but February 2020. oecd.org/corporate/corporate-bond-debt-continues-to-pile-up.htm [11] 'Junk-debt sales soar toward record year.' The Wall Street Journal, quoting numbers for S&P. 19 September 2021. wsj.com/articles/junk-debt-sales-soar-toward-record-year-11632043982 [12] 'Rating agencies caution on corporate debt after US borrowing frenzy.' Financial Times. 18 August 2021. ft.com/content/32a57864-d983-46b0-bbfa-85fd2d2361e5 [13] On August 26, South Korea becomes first big Asian economy to raise interest rates after the central Bank of Korea decided fears over record household debt outweigh surging Covid threat. See Newsweek. 'Are we about to repeat the 2008 housing crisis?' Philip Pilkington. 20 August 2021. newsweek.com/are-we-about-repeat-2008-housing-crisis-opinion-1620249 [14] CNBC. 'Warren Buffett's sobering advice: 'Reaching for yield is really stupid but very human.' 24 February 2020. cnbc.com/2020/02/24/warren-buffett-reaching-for-yield-is-really-stupid-but-very-human.html [15] Federal Reserve. 'Minutes of the meeting of April 30 - May 1, 2013.' Page 9. Released 22 May 2013. federalreserve.gov/monetarypolicy/files/fomcminutes20130501.pdf [16] Federal Reserve. Chairman Ben Bernanke. Testimony. 'The economic outlook.' Before the Joint Economic Committee, US Congress. 22 May 2021. federalreserve.gov/newsevents/testimony/bernanke20130522a.htm [17] House of Lords. Economic Affairs Committee. First report of sessions 2021-22. 'Quantitative Easing - a dangerous addiction?' 16 July 2021. Page 52. publications.parliament.uk/pa/ld5802/ldselect/ldeconaf/42/42.pdf [18] Federal Reserve. Federal Open Markets Committee. 'About the FMOC.' federalreserve.gov/monetarypolicy/fomc.htm Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

8 Nov 2021 - Manager Insights | Longlead Capital Partners

|

|

|

Damen Purcell, COO of Australian Fund Monitors, speaks with Dr. Andrew West, Managing Director and Founder at Longlead Capital Partners. Since inception in July 2017, the Longlead Absolute Return Fund has outperformed the Asia Pacific Index, providing investors with an annualised return of 24.25%, compared with the index's return of 9.34% over the same time period. On a calendar basis the fund has had 1 negative annual return in the 4 years and 3 months since its inception. Funds operated by manager: Longlead Market Neutral Fund, Longlead Pan-Asian Absolute Return Fund, Longlead Absolute Return Fund |

8 Nov 2021 - What the Australian share market has in common with three-minute noodles

|

What the Australian share market has in common with three-minute noodles ST Wong, Prime Value Asset Management 20 October 2021 The Australian stock market has developed a hunger for any next thing, it doesn't even need to be a 'next big thing', just any next thing to fulfil a short-term craving. The market's short-term focus is like basing a diet around three-minute noodles. Three-minute noodles are convenient, they do the job to satisfy your hunger temporarily, but they lack the nutritional make-up to sustain you long-term. The craving for short-term news is creating good opportunities for stock pickers who take a longer term view. For example, the immediate reaction to Australia's borders closing, or re-opening, sees a quick-fire reaction to travel-related stocks such as Flight Centre or Webjet. Lockdowns have also hampered stocks connected with residential property, due to impacts on short-term listings: REA's share price fell 10 per cent after reporting due largely to ongoing lockdowns. Investors are assuming REA will be a COVID loser, but this is a short-term view. Real estate prices globally remain buoyant and interest rates low. A longer term view suggests REA has a superior real estate listing portal that has become indispensable for property buyers and sellers alike. And it has pricing power. REA is well positioned to continue improving its incremental returns on capital through higher prices. While short-term success fills a craving, investors need companies which sustain over the long-term. There are good opportunities for stock pickers by targeting those companies which have enhanced their position during COVID-19. Several quality Australian companies have improved their financial position and are poised to do well as the economy recovers. For example, regional airline Alliance Aviation has shown the foresight to pick up assets on the cheap, and enhance their standing. At Prime Value, we expect these assets, acquired on depressed prices, to make very profitable returns once deployed. Similarly, IDP Education recently acquired the British Council's Indian English language testing business for a great price, improving its position for long-term growth. Looking past the three minutes noodle cravings takes patience and can test even professional investors. But the rewards are investment choices which are more sustainable and robust, less reactionary, and more resilient to market fluctuations - delivering better performance over time. Funds operated by this manager: Prime Value Growth Fund - Class A, Prime Value Equity Income (Imputation) Fund - Class A, Prime Value Opportunities Fund, Prime Value Emerging Opportunities Fund |

5 Nov 2021 - Big trouble in shrinking China

|

Big trouble in shrinking China Yarra Capital Management 21 October 2021 Few would dispute that one of the clear surprises of the September quarter was China's heavy-handed approach to listed education, childcare and property developers. The real question is what prompted such an aggressive response in such a short timeframe. To be clear, the first half of 2021 saw some incremental tightening in credit provision in China, and by the second quarter it was clear that economic momentum was already deteriorating. Xi had already riled markets, instructing Chinese IT firms that the data that they collect is not owned by them but by the State, with once prominent Chinese billionaires and celebrities retreating from view. All the while analysts had been debating for months exactly what Xi means by "dual circulation" and "common prosperity", adding a degree of caution to Chinese related exposures. So it was curious timing for Xi to implement surprise reforms that decimated the business models of education and childcare providers. Moreover, the problems of Evergrande and its enormous liabilities could have been resolved via government intervention had the government chosen to do so in a timely manner. Instead, the administration has allowed concerns to build that Evergrande is not the only developer at risk and, predictably, concerns have now spread to other large developers. The bonds of several Chinese property firms are now under severe pressure. As the world's eyes scour for which other large developers are at risk, attention is fast turning to the impact a swathe of defaults would have on the Chinese banking system, and the outlook for the 30% of China's economy that is dedicated to building homes. Again, the question is why have China's policy makers not intervened sooner and sought to stabilise sentiment? What could possibly be more important? Whilst it's impossible to be sure, the most plausible explanation is a single number came to light that terrified Chinese authorities. For a centrally planned economy, it's difficult to overstate the importance of obtaining the data from the most recent census. It is after all a fully enumerated count conducted on each household collecting information from everything from income, employment, location, and the structure of the family unit. In recent days snippets from the recent Census in China have been released. For background, most serious institutions who model demographic trends, including in China, have assumed that the fertility rate in China would hold around 1.7 children per household. That's below replacement rate, so China was assumed to have its near 1.45 billion population shrink by approximately 200 million over the next 40 years. That's a big challenge with few precedents, particularly for an economy yet to have reached 'developed' economy status. Nevertheless, China has been aware of the problem for some time, and has been focussed on strategies to mitigate a gradual shrinking of its population. What would have been shocking was the news from the census that the fertility rate was not 1.7 children per household, it was just 1.3. To gauge why that's important, if we put that figure into a population simulator, China's population will decline by over 400 million over the next 40 years, 600 million over the next 60 years and more than halve by 2090! Moreover, the structure of the population would become dangerously unbalanced, heavily skewed to older people. With the risk of sounding too melodramatic - that one number changes everything. Assumptions around growth ambitions, fiscal stability, social stability all need to be reassessed. For countries like Australia, what does that mean for future resource demand? Chart 1 - A sharp fall in the birth rate per h hold is a massive shock to China's ambitions Moreover, there is no way of knowing whether the fertility rate finding was merely an aberration or, more worryingly, just part of an ongoing trend. What if the fertility rate continues to fall and doesn't stabilise until around 1.1 children per household? As Chart 1 shows, China's population would plummet by 15% by 2050 and halve by 2080. Under that scenario, within the lifetime of today's Millennials China could go from being the world's greatest emerging power to an economy with severe growth challenges via a rapidly shrinking population. In many ways it helps explain a lot of recent policy announcements. Having success at changing birth rates is notoriously difficult. Falling birth rates have long been correlated with rising living standards, workforce engagement, access to contraception etc. But in China's case the cost of raising a child has been exacerbated by demand that has been fuelled by the belief that private childcare and education is not a luxury, but is rather a necessity for their children's success. Unlike Western economies, rising house prices are seen as a barrier to improving the fertility rate, presumably because higher prices restrict the number of bedrooms a typical family can afford. From that viewpoint, the census data likely provided a catalyst for urgent action. Given the scope of the problem, the announcements made during Q3 in China shouldn't be seen as the end of the matter. Indeed, the policy changes are likely just getting started. Economic growth is just population growth plus productivity growth. Given the census in China is only conducted once every ten years, there is no do-over next year to see whether the low birth rate was an aberration or whether it has stabilised. If the pressure on China's youth was already high to unleash a productivity leap in order to counteract projected population decline projections, then that pressure will now be intense. The question is now whether China's investments in future facing technology (e.g. AI and supercomputing) will be able to generate sufficient productivity growth to alleviate a rapidly aging population. Perhaps, but the Western experience is that the productivity enhancements have come in tandem with the tailwind of strong population growth and globalisation. China has already enjoyed a remarkable period of economic growth fuelled by the combination of: (i) previously favourable demographics, (ii) the transfer of technology from developed nations, (iii) dramatic engagement in global trade aided by the ascension to the WTO; and (iv) rapid debt accumulation.

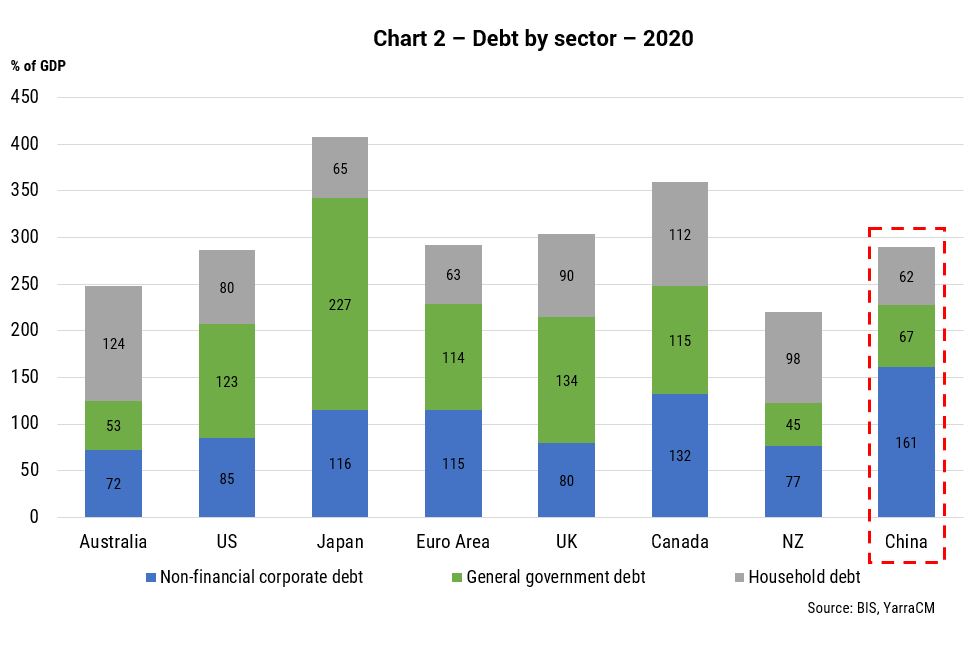

China has been rightly proud of its economic development and is strident in its belief that it has a superior economic growth model. But the drivers of that growth model are all in flux. You can only lever up your economy once, and China's debt is now high by developing nation standards and is already on par with many Western nations (refer Chart 2). China's "dual circulation" policy is in part a retreat to a more self-sufficient model rather than global trade focussed model. China's more adversarial approach to the West will invariably also seize up the flow of capital, ideas and technology. Yet of all these challenges, the biggest may well be whether its need to alter the path of its post-census projected population decline is now also in direct conflict with the disproportionately high contribution of property to its economic growth model. And that is worth thinking deeply about. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

5 Nov 2021 - Distinctively different and driven to perform: Unlocking the opportunity of 'special situations'

|

Distinctively different and driven to perform: Unlocking the opportunity of 'special situations' Colins St Asset Management 27 October 2021 Michael Goldberg (Managing Director / Portfolio Manager) and Rob Hay (Head of Distribution & Investor Relations) from Collins St Asset Management share insights into how 'special situation' investment opportunities have been implemented within the Collins St Value Fund. Recorded 27 October 2021. |

|

Funds operated by this manager: |

4 Nov 2021 - A look at higher-growth Australian businesses

|

A look at higher-growth Australian businesses Forager Funds Management 22 October 2021 Higher-growth stocks, sometimes known for burning through cash, seem to be feeling the pressure lately - particularly against a global backdrop of rising bond yields. But does this mean the boom for higher-growth stocks is over, or are there still opportunities for investing? Senior analysts Alex Shevelev and Gaston Amoros explain that they evaluate stocks using a bottom-up approach - but that an important factor is determining which businesses burn cash at a rate which means they'll need to raise more capital in future, and which should make it through. |

|

Funds operated by this manager: Forager Australian Shares Fund (ASX: FOR), Forager International Shares Fund |

4 Nov 2021 - More tortoise, less hare...

|

More tortoise, less hare... Charlie Aitken, AIM (Aitken Investment Management) 26 October 2021 |

|

We find ourselves at an interesting point in markets. A few recent experiences have prompted me to pen some short observations on what seems to be an insatiable element of 'fear of missing out' currently pervading many asset classes. I recently went to dinner with some friends, and for the first time in many months, we were able to meet up in a restaurant. While I could understand the euphoria about lockdowns ending and life returning to some semblance of normality, I was somewhat surprised to learn my friends were more euphoric about their recent lockdown "investments". Markets have been my professional life now for 28 years, I've seen many cycles and made plenty of big mistakes. As you get older and more experienced, the key is to learn from those experiences and attempt to not make the same mistakes twice. The conversation at this dinner reminded me clearly of the dinner party conversations of late 1999/early 2000: the peak of the dot-com bubble. Back then, I felt like a fool for not owning Solution 6, Davnet and Ecorp, to name a few. I was a young stockbroker, and I was missing out on the greatest money-making opportunity for my clients in decades because I couldn't understand the valuations that were being applied to these new businesses. Fast forward to today and I have exactly the same feeling. Conversations are dominated by what digital coin, cash-burning technology company, venture capital, private equity or pre-IPO fund somebody owns. It's almost a competition to own assets without daily pricing and with the best "narrative". However, when my dentist friends start talking about 'total addressable markets' for their microcap BNPL stock, it does remind me that now is NOT the time in the price or sentiment cycle to lose investment discipline or favour illiquidity. Illiquidity and 'marked to model' valuations are very attractive for a while, but tell that to a lobster stuck in a New England lobster pot as he went looking for a fish carcass. Some investments prove incredibly easy to get into, but impossible to get out of. In a period when there is a "bull market in everything", it is worth reminding yourself that market cycles never really change. Bull markets are born of pessimism, grow on scepticism, mature on optimism and peak on euphoria. This remains true of every asset class and is particularly relevant to the last two years. If my conversations are an indication of broader investor behaviour, then in certain parts of markets there is clear evidence of euphoria. Institutional and professional investors are the "dumb money" who don't "get" the structural changes that are occurring to both industries and valuations. Individual investors feel empowered by what they read on social media, and follow the actions of their fellow individual investors. Forget price to free cash flow: it's all about EV to sales (or EV to TAM, if you want to get really ridiculous). Toot-toot: get on the train, baby! At this recent dinner, after they had finally stopped talking about their own "investments", one of the guests asked me how the fund was going. I said we were pleased with the performance over the last few years, delivering good returns while taking lower risk than the market. I could see the blood draining out of his face and his eyes looking around the room for a more interesting and potentially lucrative idea. He went on: "Your stuff's pretty boring Charlie. I mean, just buying the best companies in the world... it's boring!" For the first time in my professional career, I - the same person who first recommended Fortescue when it was a penny dreadful and Andrew Forrest a pariah - was now "boring"! We all know the fable of the hare and the tortoise. I've been the hare, and it's fun for a while... until you have got to cross an eight-lane motorway. From my experience, I have learned it's much better to be the boring old tortoise who leads a very long and happy life. The tortoise is basically a compounder. In terms of where we are in the investment cycle now, I believe it's time for more tortoise and less hare, because the latter is going to run out of puff. Let me explain why. What has changed over my career is access to information and access to markets for individual investors. In Australia we have also seen huge growth in self-directed investing (SMSF's). When I first started in broking, we literally got a fax from New York about what the Dow had done. Now my 12-year-old daughter has a live-priced watchlist on her iPhone! Now, it is a level playing field in "information" and "access", which combined with the empowerment of individual investors leads to the best short-term "story" or "narrative" attracting the most capital. Where this gets dangerous in terms of potential permanent capital loss, is when narrative and individual investor positioning gets way ahead of fundamentals: in other words, when there is no margin of safety. It is somewhat unsurprising that the asset price response to the combination of the lowest interest rates, largest QE and largest fiscal spending in history has been to see the highest valuations ever, particularly in hard-to-value asset classes. Massive liquidity needed to go somewhere, and given that money is free, it found a home in the riskiest asset classes. What we need to remember is that in the short-term equity markets are a voting machine (the best narrative wins), but in the long-term they are a weighing machine (the best businesses win). It is not the time of the cycle to forget this. It gets harder from here: that is for sure. The rising tide will no longer lift all boats. In fact, the tide will slowly go out as both short- and long-term interest rates rise, fossil fuel prices surprise on the upside as supply remains constrained while the world transitions to a renewable energy future, supply chains remain interrupted, wages rise in tight labour markets, and governments raise taxes to address their enormous post-pandemic debt burdens. Being in the wrong "narrative" asset as those macroeconomic variables become incrementally weaker tailwinds (and in some cases headwinds) could easily see swift reversals in price. From a stock selection perspective, I believe now more than ever its extremely important to own businesses with fortress balance sheets, wide moats, pricing power, healthy margins, and run by disciplined and experienced capital allocators who can resist the temptation to embark on value destructive M&A at precisely the wrong point of the cycle. Inside the fund, we have been lowering our exposure to the IT sector and increasing our exposure to traditional industrial businesses with attractive valuations and great long-term track records of generating high returns on invested capital. We have also raised our cash level a notch as we expect higher short-term volatility and the potential to add to existing holdings or new investments at attractive entry prices. I believe it's a time to be very sensible, very disciplined and very liquid (insofar as avoiding illiquid asset classes). I've seen enough cycles and made enough mistakes that I know it's better to be early when positioning for a different macroeconomic or risk tolerance environment. It's time for more tortoise and less hare. |

|

Funds operated by this manager: AIM Global High Conviction Fund |

3 Nov 2021 - Webinar | Prime Value Asset Management

|

Webinar | Prime Value Asset Management The Emerging Opportunities Fund has combined exceptionally strong returns with a lower risk profile than the market. Hosted by Relationship Manager Andrew Russell, this webinar will outline how this attractive combination is achieved using stock examples to illustrate. We will also provide a brief market update and Q&A with the Portfolio Manager Richard Ivers and CEO and Founder of Prime Value, Yak Yong Quek. This webinar is ideal for those wanting to understand how the fund invests and what to expect of future returns including when it will perform better / worse. Suitable for both new and existing investors. We are privileged to be custodians of our client's capital and hope you will join us to understand how this fund invests and why it is one of the leading equity funds in Australia.

Andrew Russell will host this session with Prime Value's Portfolio Manager, Richard Ivers, and CEO, Yak Yong Quek.

|

3 Nov 2021 - Green Swans

|

Green Swans Arminius Capital 20 October 2021 The world's central bankers have been worrying about green swans lately. The Bank for International Settlements (aka BIS), which is the central bankers' central bank, even held a "Green Swan" conference. What does this mean for Australia's banks? Since the GFC, central bankers have been regularly subjecting the banks they regulate to stress tests. These stress tests are designed to uncover weaknesses in the banks' balance sheets and operating procedures where a "black swan" event might trigger a bank collapse or even another systemic crisis. In the last two years, central bankers have come to realize that climate change creates very large risks for banks' loan books. These new types of risk are called "green swans". The most obvious risk is the effect of rising sea levels on coastal cities. East Asia will be the worst affected, because densely populated coastal cities account for more than half of the region's economic activity - think Tokyo, Osaka, Seoul, Tianjin, Shanghai, Hong Kong, Shenzhen, Guangzhou, Singapore. A 2020 China Water Risk report looked at 20 Asian coastal cities and forecast that the best outcome was that 28 million people, half of the coastal airports, and almost all of the ports would be under water by 2030. Given the real estate purchasing patterns of such luminaries as former Prime Minister Rudd, one could be forgiven for expecting that Australia will be immune to rising sea levels. Observing politicians' obvious brilliance in all things - including climate change impacts to the planet and the economy and not necessarily in that order - surely the incredibly climate conscious K-Rudd would never have purchased a property in Noosa if his manifold scientific knowledge of rising sea levels was incorrect. Readers who are familiar with the Atlantic and Gulf Coasts of the US will know that this coastline is low-lying, either sandy or marshy (*polite cough* like Noosa), so most of the towns there already have a long and painful history of flooding and storm surges. Federal and State governments have started making buy-out offers to homeowners in the worst-affected areas, because every cyclone or flood saddles the authorities with huge costs to handle the emergency, even before they start repairing the damage. For historical reasons, the eastern seaboard of the US is dotted with major population centres. Only some 15% of homes in coastal areas are covered by flood insurance, partly because it is expensive, and partly because the insurer is allowed to walk away at each annual renewal. The mortgage lender is of course stuck with the risk for the whole life of the loan. Consider the recent history of Houston, New York and Miami. In 2017, Cyclone Harvey dumped one metre of water on south-eastern Texas in the space of four days, causing more than USD$125 billion of damage. Superstorm Sandy in 2012 only caused USD$65 billion of damage, but it was a major wake-up call for New York and New Jersey residents who did not understand just how vulnerable they were. Miami, like the rest of Florida, is used to hurricanes and floods, but they have become more frequent and more damaging: what used to be called "100-year floods" are now occurring once or twice a decade. The West Coast is less prone to storms and floods, but its high property values mean that rising sea levels will be very expensive. In California alone, a 2020 study by William Yu for UCLA Anderson Forecast estimated that a four foot (1.2 metres) rise in sea level would affect 66,600 homes and cause USD$68 billion of property losses. Then there is the risk of drought. Prolonged or repeated droughts damage the viability of local agriculture and industry, and eventually the losses to local economies will lead to business closures, job losses, mortgage defaults and out-migration. (Remember the long-term decline of Detroit as the US auto industry encountered the problems of competing imports and new factories in the South.) This year, residents in the US Southwest suffered their worst drought and heatwave since records have been kept, because the winter snowpack was far below average and dam levels were already very low. Against loan losses of this magnitude, the banks' exposure to fossil-fuel industries pales into insignificance. How many bankers will have time to worry about their bad loans to oil companies, when a quarter of their home loan book is under water? (Literally.) France's central bank has already run the world's first green stress tests. In May, the Banque de France looked at the risk exposures of its banks and insurers over the next thirty years. No penalties were imposed - the exercise was intended to encourage banks to incorporate climate risks into their standard risk management frameworks. Central banks in other countries will soon follow suit. For Australia's Big Four banks, climate change is an additional challenge on a plate already heaped high with challenges, namely:

The biggest problem currently facing the Big Four is an absence of organic growth. We continue to believe that, although the banks will track Australia's post-coronavirus recovery, they will underperform the market in the longer term. In the short term, however, the banks are likely to announce share buybacks or special dividends. Therefore we recommend that investors re-assess their bank holdings very cautiously in the next results season. Funds operated by this manager: |

2 Nov 2021 - Webinar | Aitken Investment Management (AIM)

|

Webinar | Aitken Investment Management (AIM) James Aitken is the founder and managing partner of Aitken Advisors - a macroeconomic consultancy based in Wimbledon, England - that works with approximately one hundred of the most influential pools of capital in the world (and also AIM.)

|