News

1 Sep 2023 - Hedge Clippings | 01 September 2023

|

|

|

|

Hedge Clippings | 01 September 2023 Reputation and trust are everything! Anyone involved in financial services - irrespective of which side of the desk they're on - is well aware of the importance of reputation and trust, particularly so as an advisor providing financial advice, or as a fund manager investing other peoples' money. Of course, that doesn't stop dodgy operators, normally driven by both their own greed, and assisted by the greed of some investors, from having a go. When it does occur, it inevitably ends up in tears for the investor, and loss of reputation (or worse) for the perpetrators, as the banks discovered during the Hayne Royal Commission. Mayfair 101 is a prime example and one suspects that's the reason head honcho and salesman James Mawhinney is trying so desperately to salvage his reputation. For the record or the forgetful, Mayfair went down the gurgler, along with over $200 million of "sophisticated" investors' money, thanks to some slick advertising and endorsements from some who should have known better. Finally, ASIC took court action to shut the failed operation, and Mawhinney in turn has fought back, and is reportedly set to re-launch Mayfair. However, in spite of 93% of their reviews on Trust Pilot being "5 star", his reputation is forever settled. If anything, the reputation of Trust Pilot as a reliable source of information is tarnished by association as well. Which brings us to the complete destruction (in our view) of the reputation of Qantas, along with that of CEO Alan Joyce. To be fair, the so called "National Carrier's" reputation as a five star airline took a beating some time ago, as service levels, baggage handling, flight delays, and just about every other factor, other than their safety record, went into a spin. More recently, the obfuscation around expiring flight credits (since reversed thanks to widespread publicity including a Senate grilling for Joyce), Qantas Chairman's Lounge membership for Albo's son, and political pressure to block competition from Qatar Airways, has added to their woes. Finally, this week the ACCC finished the job by taking Qantas to court for advertising flights which had already been cancelled. Presumably, the logic behind this was either to garner even more flight credits, or to stop passengers booking elsewhere. Either way, immoral, and in the ACCC's view, illegal. Qantas was once one of the most valuable brands in Australia, and possibly the world. Greed and a simple lack of ethics has destroyed that, and Joyce's reputation with it. Along with Albo's, and the combined Qantas boards', reputations tarnished by association. As the ACCC's case drags through the courts, and the media, the damage will continue. Joyce meanwhile will be long gone, pockets bulging. We pity his successor, who will have to pick up the pieces. While on the subject of handovers and successors, next Tuesday's RBA meeting will be Philip Lowe's last before handing over to his deputy Michelle Bullock. We suspect no change in direction, and that Lowe will leave - as history will show - with an excellent reputation. Some will note his misjudged "no rate rise until 2024" comment "forecast" but he seems to have traversed his "narrow path" well. Finally, last week we included this photo of Mick Jagger and Mitch McConnell. The week's news only confirmed what we all (possibly with the exception of Mitch himself) knew. News & Insights What really matters in investing | Magellan Asset Management Investing Essentials: How a financial adviser can help | Bennelong Funds Management July 2023 Performance News |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

1 Sep 2023 - The dangers of long COVID

|

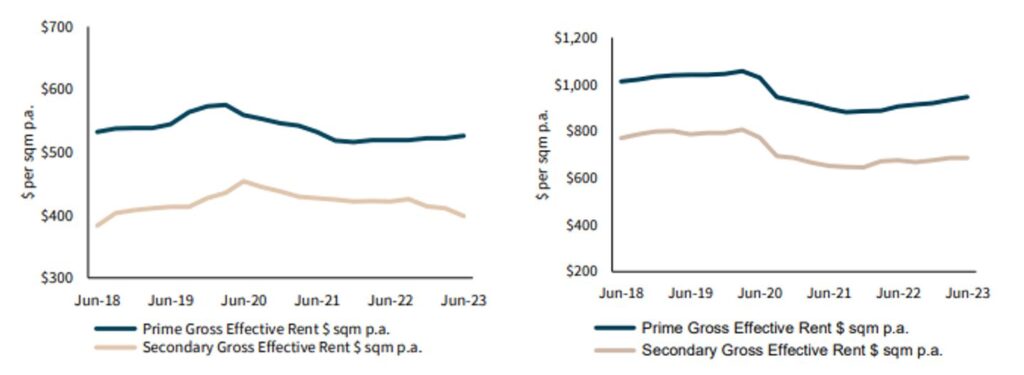

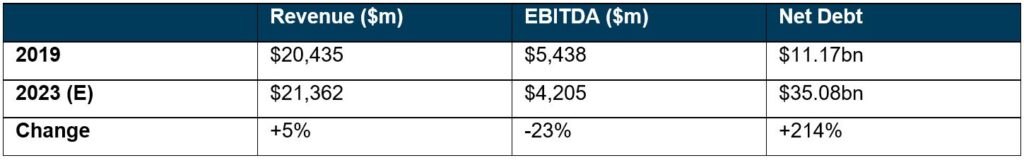

The dangers of long COVID Challenger Investment Management August 2023 Like most, the memories of COVID seem like a dream. For most of society, lives have moved back to normal with a few exceptions such as the working from home revolution. But some are still suffering the after-effects of COVID and are a shadow of the people they were back in those innocent days of 2019. We still talk about long COVID, which refers to a bout of COVID where the symptoms persist for longer than 4 weeks, but these days we are talking about companies and not individuals. A company with long COVID is one where earnings are trailing 2019 levels combined with a balance sheet saddled with more debt. Even if they are still recovering, companies suffering from long COVID may never get back to where they were in 2019. Even if revenues get back to 2019, earnings will be weighed down by higher interest costs and elevated debt levels with balance sheets acutely exposed if a recession does happen in the next few years. If a recession does indeed eventuate, interest costs will likely increase pushing balance sheet repair further into the future. Long COVID could really be looooooooong COVID. In our view, credit markets are not sufficiently pricing for long COVID risk. For an investment grade borrower, long COVID may mean that a borrower can never return to the credit risk profile it had in 2019. For a high yield borrower, long COVID may mean that a borrower is wholly reliant on equity to avoid a default. We've already written about the office sector of the commercial real estate market. Over the last four years, gross effective yields rents have gone backwards as the same time as debt levels have increased. The rise in interest rates has pushed interest coverage close to one time meaning after interest payments there is little ability to pay down debt to right size the capital structure. The only cure for long COVID is for the asset owner to tip in more equity to pay down debt and right size the capital stack but who has appetite for that when asset values themselves are declining. Gross Effective Rents Melbourne (LHC) and Sydney (RHC) Source: JLL Research as at Q2 2023 However long COVID has spread well beyond commercial real estate. Across the ASX300, around 10% of companies have seen earnings decline over the past 4 years and debt increase by 50%. In the United States, 6% of companies have seen earnings decline and debt increase by 50%. Consider the tourism sector. The post COVID rebound feels immense but then so was the hole that COVID created. A good example of this is Carnival Corporation, one of the largest cruise line operators in the world. COVID was a horror period for them with effectively no revenue for two years but over the past 12 months their customers have returned in droves, seemingly putting COVID in the rear view mirror.

While revenues have recovered, earnings are expected to finish 2023 around 20% below 2019 levels before returning to 2019 levels in 2024. Even at 2019 earnings, free cash flow is only expected to be $1-2 billion per annum implying that without an equity injection it would potentially take up to two decades to get back to 2019 levels of debt. While that may seem dire, consider that if a recession takes place and earnings flatline at 2023 levels there will be no free cash flow to pay down debt. Indeed in 2023 net debt is expected to increase by over $1 billion. Despite this outlook, S&P has Carnival B-rated with a positive outlook. Secured debt is rated BB-. S&P sees leverage at around 7 times, improving to 5 times by end of 2024, essentially implying earnings around 15% higher than 2019 levels. The market seems to agree with this sentiment pricing a recent senior secured deal at a spread of 2.85%, broadly flat to the BB high yield index. While it may seem as though we are trying to second guess the rating agencies and even market pricing of Carnival credit risk, that is not our intention. The key point is that sufferers of long COVID are acutely exposed to the combination of elevated interest rates and the risk of recession. We are still far from 2019 levels of health. If earnings flatline, it is difficult to see how borrowers who are still suffering from long COVID can return to health. Funds operated by this manager: Challenger IM Credit Income Fund, Challenger IM Multi-Sector Private Lending Fund |

31 Aug 2023 - Performance Report: Insync Global Quality Equity Fund

[Current Manager Report if available]

31 Aug 2023 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

30 Aug 2023 - Investing Essentials: How a financial adviser can help

|

Investing Essentials: How a financial adviser can help Bennelong Funds Management August 2023 |

|

Many of us want to save effectively, invest well, and generate sufficient funds to pay for a home, children's education, travel and, ultimately, a secure retirement. But navigating a complex financial landscape can be intimidating. Fortunately, there are professionals who can guide you. Seeking the advice of a qualified financial adviser may add significant value over your lifetime. Here is a snapshot of some of the things an adviser can assist with. Budgeting and managing debtIn order to invest, you need to work out where the money will come from. A financial adviser can help you manage your income more effectively by carefully identifying and monitoring your spending patterns and expenses. They can also help you get the full picture on your debt load and work out which parts are:

Insurance: the importance of securityAdequate insurance coverage to provide you and your family financial security is crucial, particularly if you are self-employed or own a business. A mix of suitable life insurance, income insurance, business insurance and general insurance is highly individualised. Your financial adviser's expertise in this area can save you a great deal of time and worry. Building an investment portfolioOnly after budgeting and insurance do we get to investment. Your financial adviser will gather all of the relevant information on your personal financial circumstances, objectives and risk tolerance, and help you choose the right types of investments to fit your needs, personality, goals and time horizon. Your adviser can help you build a diversified investment portfolio, often spread among a range of asset classes to aim for positive returns while balancing the overall level of risk. What's more, they will regularly assess the plan to ensure it continues to meet your needs, altering your investments as you reach different stages of life (for example, wealth accumulation for younger investors versus a steady income stream for retirees). The three pillars of retirementYour financial adviser should be an expert on Australia's 'three-pillar' retirement-funding system: compulsory superannuation, the government-funded age pension, and voluntary contributions by individuals to their super accounts. Australia's superannuation system can seem complicated, and most people can benefit from sound technical advice from a professional - whether it's to maximise the benefits, or minimise the tax burden. What to look forChoosing a financial adviser is an important decision. Ideally, it will be a lifetime partnership (and even a multi-generation partnership, taking care of your family's needs). You need to establish a strong rapport: they will know all about your financial affairs, your dreams and aspirations, and even how you want your affairs managed after you die. You therefore need to ensure the person is a trustworthy and knowledgeable professional, and someone with whom you're comfortable working with over the long term, who can regularly maintain and review your financial goals as you enter different stages of life. There are several professional bodies who may be able to assist you in selecting a financial adviser, such as the Financial Advice Association Australia's find a planner page. |

|

For more insights visit www.bennelongfunds.com Disclaimer The content contained in this article represents the opinions of the author/s. The author/s may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the author/s to express their personal views on investing and for the entertainment of the reader. |

29 Aug 2023 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]

29 Aug 2023 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

29 Aug 2023 - The Rate Debate - Ep 41: Uncertainty abounds in the face of economic challenges

|

The Rate Debate - Ep 41: Uncertainty abounds in the face of economic challenges Yarra Capital Management August 2023 Amidst ongoing economic uncertainties, the RBA has seen fit to keep rates on hold for a consecutive month and wait to see how the lagging effects of 12 rate hikes play out. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

28 Aug 2023 - Performance Report: Argonaut Natural Resources Fund

[Current Manager Report if available]

28 Aug 2023 - Performance Report: Digital Asset Fund (Digital Opportunities Class)

[Current Manager Report if available]