News

18 Nov 2021 - Why froth can't burn your tongue

|

Why froth can't burn your tongue Spatium Capital November 2021 The origin of the term "frothy" - in an investment context - is disputed, but many attribute it to Alan Greenspan. The former Chairman of the US Federal Reserve is believed to have normalised the word in his response to the state of the US housing market in 2005. Since the global financial crisis, the use of this word when referring to the markets has been looked upon ominously. In early 2019, the buzz surrounding the state of the frothy ASX was a lasting discussion. A frothy market is a state in which markets begin trading well above their tangible asset values, often because investors are ignoring fundamentals and making emotionally driven and speculative decisions (periods of which can endure for many quarters, if not years). The reason frothy markets are often so topical is historically these periods precede a burst of a market bubble. At least this was the case for the dotcom bust in 2001 and the housing crash (GFC) of 2007-2008. Given the almost two years since COVID19 first disrupted our lives, perhaps this latest episode is also one for the history books. The current argument we are seeing is the significant growth and interest in alternative 'asset' classes, mirroring the speculation-style dotcom and housing market catalysts for the two most recent frothy periods that preceded a burst bubble. With our eyes firmly on equities, we couldn't help but notice that Bitcoin, the most mainstream of the cryptocurrencies, took the quickest time (12 years) to reach $US1 trillion in market capitalisation. Bitcoin now joins an elite club of trillionaires alongside US household giants Microsoft (44 years), Apple (42 years), Amazon (24 years) and Google (21 years). Whether cryptocurrency will be the catalyst for the next bubble popping will likely only be realised in hindsight, however at the risk of playing into a false causality (falsely assuming events appear related and therefore causing one another) we prefer to remain impartial and observe. So are equities frothy right now? When comparing the equity markets amongst peer asset classes, there is some potential explanation to the current upward trend(s) that have occurred. Considering that many fixed income yields are currently heavily compressed, property rental yields in Australia aren't shifting nearly anywhere as quickly as the capital growth trend line and that bank term deposits are a heartbeat above zero, there is an argument to suggest that the stock market's liquidity, prospective growth profile and risk (in comparison to viable alternatives) is the beneficiary of this struggling peer group. Further, there is an argument to be made that equities, in contrast to some of these alternatives, might fare better in a rising inflation environment - a topic for another time. This enduring low yield environment does however shed light as to why some investors have found themselves including cryptocurrency as part of their asset allocation; when looking at the state of asset classes in this current environment the options for return (via speculation or yield) have become suddenly fewer. The final point we would add goes hand-in-fist with frothy markets; investing at all-time highs. Let's look at the below graph and reference what JP Morgan found when investigating all-time highs. Source: Ben Carlson, A Wealth of Common Sense, 'Investing in Stocks At All-Time Highs' As illustrated, it has been more lucrative over the last 30 years to invest at all-time highs, rather than shying away from these points and thereby attempting to market-time. We feel this is somewhat of an underappreciated phenomenon; whilst the brain naturally seeks out patterns in charts that highlight drop-offs such as the GFC, or the COVID drawdown (and consequently drives feelings of fear aversion and a flight to safety), it fails to identify the many, many times a market reaches an all-time high, and then continues to rise further. Startlingly, on average, key markets such as the US S&P500 set 16 new all-time highs a year. Like with all risk assets, including property, fixed income, shares and others, the long-term success of these asset classes has stood the test of time. The only true certainty is that diversification and patience are your best friends. Further, if diversification and patience are your best friends, conviction likely follows closely behind. As a fund manager, we approach each trading day with the pursuit of identifying mispriced equities and not trying to time this up or down movement of the broader index. Nor do we seek to fluctuate our cash weighting by keeping the fund's total assets 98-99% invested at all times. This approach minimises the human tendency to buy assets when prices are rising (and potentially overpaying) and selling when things get scary (and potentially selling at a discount). By maintaining a smooth and consistent approach to investing, irrespective of the asset class, one can work against this natural tendency. In conclusion, whilst the market might be considered frothy right now, we suggest in light of the above information that this might not necessarily be a bad thing. As Peter Lynch so famously said, "Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves." Funds operated by this manager: Spatium Small Companies Fund |

18 Nov 2021 - Why this market would freak out a Martian

|

Why this market would freak out a Martian Montaka Global Investments 09 November 2021 If a Martian arrived on planet earth today, the global stock market would freak them out. This market is full of peculiarities. Mr Market - the personified term value investing legend Benjamin Graham used to describe the emotional swings of the market - is currently excited about narrative stocks, particularly 'reopening' and 'defensive' companies, and rewarding them with rich valuation multiples despite questionable fundamentals. At the same time, it is punishing companies with reliably growing profits and cash flows, particularly the world's leading mega techs, because of overblown concerns about inflation and regulation. On any given day, the market appears to be swept up in the prevailing narrative. What is missing is an objective outside examination of the facts that anchor sound investment decisions and underpin strong, long-term performance. Three examples of stocks in the reopening, defensive, and mega tech narratives highlight a market that would baffle a rational Martian. Are 'reopening up' stocks good investments? The first thing the Martian would see when he arrived on earth is that, as COVID-19 cases subside around the world, 'reopening' stocks are trading at very generous valuations. One is Royal Caribbean Cruises, the Florida-based cruise company that was severely impacted by the pandemic. When 'no sail orders' were introduced last year, its revenue literally fell to zero. With the reopening, around two-thirds of the company's fleet are now sailing and that should move to 100% over time. But the company's stock price is still one-third lower than pre-pandemic. The 'reopening up' narrative is often persuasive to Mr Market. Surely this investment represents easy money for the taking? Our Martian would say no. For a start, the company's balance sheet has become financially stretched: the ratio of net-debt-to-book-equity has more than doubled from 0.9 times to 2.2 times. So while its stock price is below pre-pandemic levels, its enterprise value (EV) - the company's total value including borrowings - has well and truly reflated back to pre-pandemic levels. So the company is not as cheap as one might think. Royal Caribbean Cruises Source: Bloomberg If our Martian assumed that earnings will return to pre-pandemic levels relatively soon (the company is currently loss-making), they would see that based on its current enterprise value, the company has an EV ratio of 20 times this recovered level of earnings (EBIT). A rational Martian would be bewildered that the market has put such a high valuation on this company. Why would Mr Market be willing to pay such a high multiple of fully-recovered earnings for a heavily-indebted cruise business that remains years away from pre-pandemic profitability - in an industry that will also expand capacity at double-digit rates over the coming years, adding downward pressure to ticket prices? All kinds of 'reopening-exposed' businesses, from airlines, travel agents, and live entertainment businesses, have seen their EVs fully-recover to pre-pandemic levels, despite earnings being years away from their fully recovered levels. Are 'defensive' stocks safe? Meanwhile, our Martian would also hear a narrative around markets being 'stretched' and observe some investors turning to defensive stocks which have become similarly irrationally overvalued. In California, The Clorox Company, a large producer and marketer of branded household cleaning products has a great, defensive business. Households continually buy their bleach, sanitizer, and stain removers irrespective of the natural ebbs and flows of the economy. It makes sense to Mr Market, therefore, that if the markets are feeling toppy, hiding out in companies like Clorox provides some safety. But our Martian would not think this company's stock is particularly safe at all. Its growth has recently turned negative. During the pandemic, its business grew rapidly when Americans rushed to stock their homes with cleaning products. But today that growth is naturally much harder to come by. It is hitting the inevitable 'air pocket' that follows such a drastic pull-forward in demand. The Clorox Company - Revenue Growth Source: Company Filings The company is also being hit by higher costs. The rising costs of commodity inputs and transport are materially impacting on profitability. In the company's most recent quarter, for example, its gross margin fell 10 percentage points relative to the same period in the prior year. Yet Mr Market has awarded the company a valuation that implies strong performance for years to come. Its ratio of EV to next year's earnings (EBIT) is 23 times - a materially higher ratio than even before the pandemic. Our Martian would once again be confused: this hardly feels like a safe investment offering protection from 'stretched' stock prices. Again, this dynamic is not isolated to Clorox. We are seeing similar dynamics in a wide range of branded consumer packaged goods businesses, as well as utilities - all of which are considered by Mr Market to be 'defensive' today.

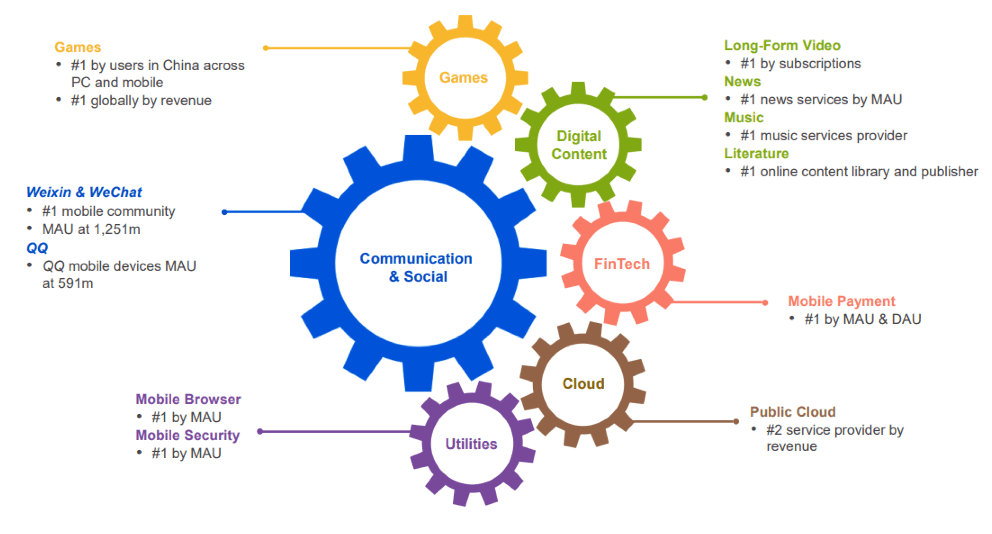

Are mega-tech's best days in the past? While our Martian sees 'reopening up' and 'defensive' stocks trading high, they would also see mega tech companies with great fundamentals being punished amid the 'mega-tech is dead' rotation due to concerns about inflation, regulation or other reasons that seem to justify the narrative Shenzhen-based Tencent is one example. It owns the most widely used digital communications applications in China. With 1.2 billion members in its mobile community, this business owns a privileged platform for social communication (both personal and professional) as well as gaming, news, music, video, e-commerce, and payments.

Tencent - A Platform of Platforms Source: Company Presentation This company also happens to own China's second-largest cloud computing business. It is rapidly building out leading enterprise applications and platform tools, which are the Chinese equivalent of Salesforce, Shopify, Zoom and Microsoft Office. These are not monetised today and, instead, represent valuable future growth options. But despite this powerful position, our Martian would see the stock is seriously undervalued. The ratio of enterprise value (excluding a large portfolio of equity investments) to next year's operating earnings (EBIT) is just 16 times. Unlike the reopening-up and defensive stocks above, our Martian would find this stock very interesting. A business of this quality, growing 15-20% per annum for at least the next five years and beyond, with an attractive collection of large, high-probability future growth options, yet trading at a reasonable price. And it's not just in China where these disconnects between the valuations of mega techs and their high business quality are occurring. In the US, for example, Mr Market is willing to sell you Facebook at less than 18 times next year's operating earnings. To our Martian, buying Tencent and Facebook from Mr Market - and selling him Royal Caribbean and Clorox seems logical. What is an investor to do? So how should an investor play a market that would baffle a rational Martian? It depends on your investment time horizon. Investors looking to make money next week, next month, or even next year have their work cut out for them. Anticipating Mr Market's mood swings - which change on a dime - is not easy and may well be impossible to do on a sustainable basis. But for investors, like us at Montaka, who are seeking to compound capital over the long-term - think ten, 20 years and beyond - the answer is to always let your investment decisions be guided by the facts, such as the strength of business advantages, the long-term growth of industries and the fair mappings of business earnings drivers to present values today. As Benjamin Graham famously told Warren Buffett:

Let the facts liberate you from the short-term mood swings of Mr Market. In the current market that means not getting sucked into short-term reopening and defensive narrative trades and focusing on owning the long-term winning businesses in the world's most attractive markets. Investing for the long-term by looking through the short-term noise means that your portfolio will perform differently to that of your peers but staying the course - as challenging as that can be - will yield the long-term rewards. Funds operated by this manager: Montaka Global 130/30 Fund, Montaka Global Fund, Montaka Global Long Only Fund |

17 Nov 2021 - Australian Equities Market Update & 2022 Outlook

|

Australian Equities Market Update & 2022 Outlook Sage Capital 12 November 2021

Portfolio Manager, Kelli Meagher and Chief Investment Officer, Sean Fenton provide an update on the Australian equities market and the outlook for 2022. |

|

Funds operated by this manager: CC Sage Capital Absolute Return Fund, CC Sage Capital Equity Plus Fund |

16 Nov 2021 - Japan Edges Closer to Confronting China

|

Japan Edges Closer to Confronting China Arminius Capital 05 November 2021 A change of Prime Minister usually doesn't result in much change in Japanese policies, because almost all Prime Ministers are created by the Liberal Democratic Party machine, which pursues power rather than policies. But the new PM, the 64-year-old Kishida Fumio, has made some Cabinet appointments which might lead to major changes. Of course, all the top Cabinet posts went to long-serving party stalwarts in order to pay Kishida's debts to the faction bosses who supported him, but he also added several of the LDP's rising stars to his Cabinet. The most surprising appointment was to a newly created job - Minister of Economic Security. Kishida described the role as "securing strategic technology and goods and preventing technology leaks so we can achieve a self-sufficient economic structure." That translates to ensuring semiconductor supply and innovation, strengthening cyber security, and thwarting Chinese theft of Japanese intellectual property. The new Minister has of course denied that the economic security measures have anything to do with China. What is really interesting about the job is that its theoretical functions cut across several existing ministries, which will cause vicious turf wars with entrenched bureaucracies. The new Minister will only be able to do his job if he has the firm support of the Prime Minister. Fortunately, the new Minister seems to have all the right qualifications and connections. Kobayashi Takayuki is the product of an elite education (Kaisei Academy, Tokyo University Law School) and an elite career path (Ministry of Finance, Japanese Embassy in Washington). On the way, he also picked up a Master of Public Policy degree from Harvard's Kennedy School of Government. We will watch Minister Kobayashi's progress with great interest. Funds operated by this manager: |

15 Nov 2021 - Managers Insights | Collins St Asset Management

|

Damen Purcell, COO of Australian Fund Monitors, speaks with Rob Hay, Head of Distribution & Investor Relations at Collins St Asset Management. The Collins Street Value Fund has a track record of 5 years and 9 months and has consistently outperformed the ASX 200 Total Return Index since inception in February 2016. The Fund has returned 19.50% versus the Index's annualised return over the same period of 11.23%.

|

15 Nov 2021 - Two COVID-19 trends no one is talking about

|

Two COVID-19 trends no one is talking about Firetrail Investments October 2021 Two interesting trends have emerged from the pandemic. Australians are having more babies and they are swapping out their city lifestyle for the beach and bush. In contrast to short term phenomena such as the hoarding of toilet paper, these shifts have potential long lasting implications for the economy and listed companies. In this article we discuss these two trends and the opportunities they have created for companies in the Firetrail Australian Small Companies Fund. COVID baby bump or boom?When large mortality events occur including diseases, earthquakes and wars, birth rates decline and on average, reach a trough some nine months later. As shown in Figure 1 below, this pattern holds for events such as both World Wars and the influenza outbreaks of 1918. Following an initial drop, fertility tends to rebound. Birth rates begin to recover ~11 months after an epidemic and then increase in the subsequent 1-5 years.

The end of World War II sparked one of the biggest baby booms of the 20th century. Could we be at the start of a post-COVID generation? Estimates by academics regarding the post-COVID birth recovery vary widely. The Institute for Family Studies notes that COVID has the potential to boost births over the next four years by anywhere from 0.3% to 40%. We admit this is a wide range to draw a conclusion from just yet. However, recent trends in birth rates and anecdotal evidence provide reason for optimism:

The increase in IVF volumes has benefited portfolio holding Monash IVF. During FY21, Monash recorded a 40% increase in new patient stimulated cycles and there are no signs of a slowdown. New patient registrations in 2H21 were up 8% compared to 1H21, and up 35% on 2H20. ~70% of patient registrations are converted into patient treatments within ~3-6 months. COVID-19 has sparked a behavioural shift amongst Australians. Restrictions on travel and a greater focus on family, health and wellbeing is resulting in a re-direction of priorities. While it is still early days to call it a baby boom, recent birth rates and trends IVF trends indicate we are at the onset of a baby bump. Looking beyond the headline impacts of escaping the cityFor decades the lack of job opportunities in regional areas has seen many Australians relocate to capital cities. Then the pandemic hit. The sudden shift to working from home has made a tree change or sea change possible and more attractive for many Australians. ABS data shows net migration to regional Australia is the highest since records began two decades ago. In the 12 months to March 2021, net migration to regional areas increased 87.1% year-on-year. The impact of demand for housing on prices in regional towns has been widely publicised. Digging beneath the headlines, second order impacts are more interesting and perhaps even more important.

Demand for products and services across some industries increase as more people move to regional areas. Regional houses are larger and hence require more bricks to build and more lights to illuminate. For listed companies with strong brands, regionalisation has created an avenue to expand store footprints, increase sales, and grow market share. Portfolio holding Beacon Lighting is capitalising on this opportunity. It plans to open three additional regional stores this year including Ellenbrook (WA), Butler (WA) and Melton (VIC). The City of Melton, where Beacon Lighting is expected to open a new store in FY22, is one of the fastest growing areas of Australia. 11 new suburbs have been proposed to be added to it! In 2020, the city recorded a population increase of 4.6%, more than double the increase for Greater Melbourne which grew at 1.6%. Increased sales in regional areas often come hand-in hand with supercharged margins. This is a direct result of limited competition and lower costs of doing business. A key cost line for many retail companies is rental expense. Bendigo is over 150km away from Melbourne CBD. Looking at recent advertised rents, it is ~50% cheaper to rent a large retail space in Bendigo than it is in areas close to the Melbourne CBD like Southbank. Going regional also comes with less competition from smaller niche retailers that often compete on price. Regionalisation has created an opportunity for companies like Beacon Lighting to increase sales, grow market share and generate better returns on a per store basis. ConclusionThere are many interesting phenomena that have emerged from the pandemic, many with direct and lasting implications for listed companies. Restrictions on travel and a refocus on family has contributed to a spike in birth rates and IVF volumes. The sudden shift to working from home has driven many Australians away from the cities to regional areas. The baby bump (or potential boom?) and regionalisation trends have created an opportunity for many companies in the Firetrail Australian Small Companies Fund. Disclaimer This article is prepared by Firetrail Investments Pty Limited ('Firetrail') ABN 98 622 377 913 AFSL 516821 as the investment manager of the Firetrail Australian Small Companies Fund ARSN 638 792 113 ('the Fund'). This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person's objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance. Pinnacle Fund Services Limited ABN 29 082 494 362 AFSL 238371 ('PFSL') is the product issuer of the Fund. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited ('Pinnacle') ABN 22 100 325 184. The Product Disclosure Statement ('PDS') and the Target Market Determination ('TMD') of the Fund is available at www.firetrail.com. Any potential investor should consider the PDS before deciding whether to acquire, or continue to hold units in, the Fund. Whilst Firetrail, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Firetrail, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication. The information is not intended for general distribution or publication and must be retained in a confidential manner. Information contained herein consists of confidential proprietary information constituting the sole property of Firetrail and its investment activities; its use is restricted accordingly. All such information should be maintained in a strictly confidential manner. Any opinions and forecasts reflect the judgment and assumptions of Firetrail and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Firetrail. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication. This may contain the trade names or trademarks of various third parties, and if so, any such use is solely for illustrative purposes only. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with, endorsement by, or association of any kind between them and Firetrail. Funds operated by this manager: Firetrail Absolute Return Fund, Firetrail Australian High Conviction Fund |

12 Nov 2021 - 10k Words - November Edition

|

10k Words - November Edition Equitable Investors November 2021 We kick off with Australia outpacing Hong Kong in IPO activity, as highlighted by Bloomberg. We can't avoid the inflation discussion and FactorInvestor charts US inflation expectations, while we go back to Bloomberg for a look at inflation-protected treasury yields, which have not followed the script of 2013. IFM Investors looked at how Australia's monthly inflation (using the Melbourne Institute monthly inflation gauge) was still accelerating in year-on-year terms, despite decelerating in terms of month-on-month increases. Then we turn to equity valuation where Redpoint's Tomasz Tunguz explores the phenomenon of Software-as-a-Service (SaaS) valuation multiples rising to 100x their Annualised Recurring Revenue (ARR); while Axios charts the explosion in valuation of rental car companies, aided by hype around electric cars. Finally, Kailash Capital shows that S&P 500 stocks analysts dislike are priced at a 34% discount to the market, based on a multiple of sales, while stocks that are analyst "darlings" trade at a 17% premium to the market. The unanswered question is whether the pricing is caused by analyst popularity or whether analysts tend to like stocks that are already strongly supported by the market (Kailash suspects there is "self-reinforcing price action as high average returns... force analysts to shift to buy ratings").

Australia outdoing Hong Kong in IPO activity Source: Bloomberg Tracking US inflation expectations Source: FactorInvestor

Yields on Treasury Inflation-Protected Securities (TIPS) now v 2013 Source: Bloomberg Australian Bureau of Statistics (ABS) quarterly headline inflation v Melbourne Institute inflation gauge Source: IFM Investors Listed Software-as-a-Service (SaaS) valuation as a multiple of Annualised Recurring Revenue (ARR) Source: Tomasz Tunguz of Redpoint Market capitalisation of rental car companies Hertz & Avis Source: Axios, FactSet Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog Funds operated by this manager: |

11 Nov 2021 - Three key topics dominating global equity markets

|

Three key topics dominating global equity markets Antipodes Partners Limited 27 October 2021 Three key issues - inflation, the power crunch, and China's economy - reverberated during the third quarter of 2021 and continue to present a complex backdrop for global equity investors. As we move into 2022, we think it will be critical that global equity portfolios are appropriately positioned to provide exposure to the potential opportunities while providing protection against risks that may emerge such as an economic growth shock (perhaps from a hard landing in China), or an inflation shock. There's also the possibility of a combination of both - the stagflation scenario. InflationAntipodes has been saying for some time that we think inflation is going to be more sticky than transient, while central banks have taken the view that near-term inflation will fade.

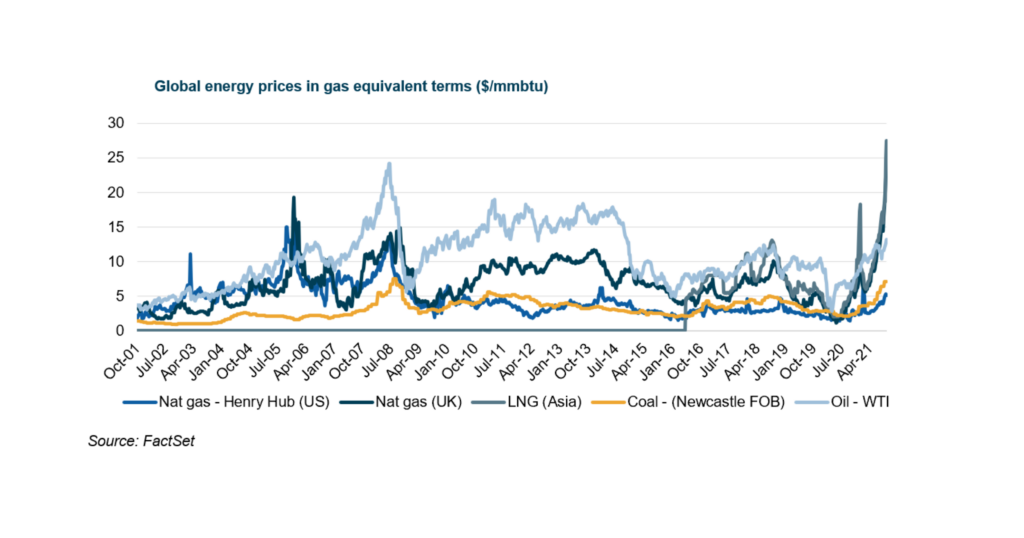

It's almost a certainty that tapering will begin before the end of the year and rate hikes may start from late 2022 as opposed to 2023. The risk is that the Fed is tightening as economic growth is slowing, which may compound the problem. A power crunch?Europe's gas price is at a record high, the US gas price has more than doubled over the year, and oil is back above $80 per barrel, the highest level since 2014. Energy is becoming another pressure point. Europe is facing a shortage of gas due to a strong rebound in economic activity, coupled with supply issues and an underinvestment in power infrastructure. In recent days Russia declined to pump extra gas into continental Europe which compounded fears. Moscow's position may change in the coming months, but even if Russia does decide to supply some additional gas, Europe is unlikely to find enough volume from traditional suppliers to fill the deficit. With LNG and European gas prices equivalent to $150 per barrel of oil we're seeing a shift to burning oil in Asia. This shows how the gas rally is also fuelling an oil rally. Consumers are going to start to feel this. The cost of filling the tank will rise, as will the cost to power and heat homes in the northern hemisphere's peak winter demand season. At the same time, power shortages have hit China. China's power demand has been strong due to domestic and global activity, but hydropower output - which is almost 20% of total power in China - has been hit due to low rainfall, and coal production has also been subdued due to capacity controls and tightening policies around mine safety and emissions. We've started to see shutdowns in high energy intensive industries, and if this accelerates through the broader industrial sector there will be implications for domestic and global economic growth.

The Chinese economyChina has been tightening property policies on and off over the last five years. Growth had become unsustainably high again in the first half of this year, so policy was tightened again to curb speculation and house price inflation. Housing starts began contracting in August, which quickly exposed the weaker property developers. We all know the Evergrande story - but the Chinese banking system can handle an Evergrande default, if it comes to that.

The bigger question is whether an Evergrande default seizes up financing for other developers, which spills over into weaker housing prices and a broader economic slowdown. Residential development accounts for around 10% of GDP, so it's a material contributor to China's economic activity. There would also be implications for commodity prices, particularly commodities where China is a major consumer but an immaterial producer. Copper and iron ore look the most vulnerable here. However, with Government debt less than 70% of GDP, China has the firepower to re-stimulate - and we think it's a question of when rather than if. This time around we think stimulus will focus on consumption, reinforcing the social safety net and decarbonisation. China wants to accelerate its transition to a consumption and services driven economy. To do this, household spending needs to grow at a faster pace than incomes via running down China's extraordinarily high savings rate. With changes in the regulatory backdrop now well-progressed, investors are going to start to re-focus on long-term opportunities, particularly around consumption trends. Funds operated by this manager: Antipodes Asia Fund, Antipodes Global Fund, Antipodes Global Fund - Long Only (Class I) |

10 Nov 2021 - Net Zero - Offsetting our carbon emissions

10 Nov 2021 - We are our own worst enemy

|

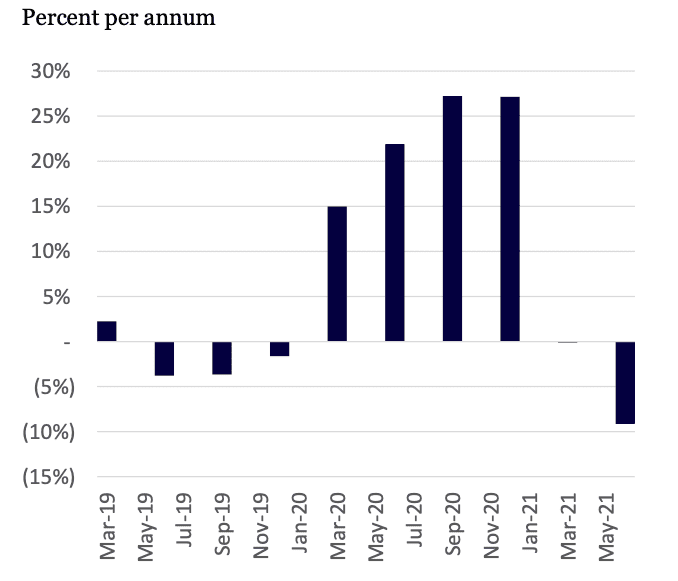

We are our own worst enemy Ty Archibald, Aoris Investment Management 29 October 2021 Most of us read about behavioural biases and acknowledge they exist, yet there is no evidence the financial community is any better at dealing with them. Understanding the impact of biases improves our ability to apply guardrails and combat them, leading to better decisions and investment outcomes. With that in mind, let's look at three of the most common biases, where we come across them in everyday life and investing, and how we can minimise their impact. Optimism biasIt is natural to take the view that good things will happen more often than they do. While positive thinking makes life more pleasant, the evidence suggests excessive optimism can be to our detriment. Optimism bias regularly appears in investment thinking. For example, the graph below shows the change in analyst earnings per share estimates for the S&P 500 across each calendar year from 2006-2020. Of the 14 years included, 10 showed meaningful downgrades. On average, analysts overestimated EPS growth by about two times. The high proportion of downgrades illustrates analysts repeatedly overestimating business prospects at the beginning of each period, demonstrating optimism bias in practice.

Optimism bias can be exaggerated when investing in companies with a wide range of outcomes, where little past information is relied on for the basis of bold future assumptions. By focusing attention on the large potential gains, it can be difficult for investors to visualise potential losses. For example, the electric vehicle market is in its early stages, and it is difficult to gauge how stable the market will be and which manufacturers will ultimately succeed. How can we combat our natural optimism bias without turning ourselves into killjoys? Paying attention to history will help keep our expectations grounded. Social proof biasSocial proof is a phenomenon that involves people copying the actions of others in situations of uncertainty. Humans naturally believe there is safety in numbers and want to fit in with the crowd. We also avoid confrontation, so going along with what others think provides the path of least resistance. Humans feel there is safety in numbers. Investors can panic amid a sell-off and follow the crowd, even if selling is contrary to the information they have on hand. In contrast, at the peak of an economic cycle investors can flock to well-performing stocks in an attempt to ride the momentum wave and avoid the dreaded feeling of FOMO (fear of missing out). FOMO and the impact of herding behaviour can have very real consequences. For example, in Singapore in the 1980s an unexpected bus strike had created an abnormally large crowd at a bus stop outside a bank. Local customers mistook the gathering as people waiting to make a withdrawal, so they too lined up thinking the bank must be in financial trouble if there were so many customers waiting. The bank was forced to shut its doors to prevent an actual bank run. How do we counter social proof? A simple (but not easy) way to combat this behaviour involves developing independent thoughts and conclusions, with reference to objective reasoning and facts and not the "sway" of the herd. Anchoring biasAnchoring bias causes us to rely too heavily on the first piece of information we are given about a topic. We then typically adjust slightly away from the original anchor point when making decisions, even if it has little relevance to the problem we are trying to solve. Anchors are used in negotiations every day. Take the used car salesperson for example, who will always give you their best price upfront. They have now dropped an anchor, and any price you can get below that will seem like a better deal to you when it could still be a price well above the car's value. This will now play a larger role in your decision, rather than more relevant indicators of value such as the age of the car and its current condition.

Similar behaviour regularly occurs in equity markets. Investors have a tendency to anchor on the current stock price and use that as a gauge on where the stock will go in the future, or use current multiples compared to historical values. Like the car salesperson example above, this single indicator has little relevance and offers no insight into the value of the underlying business. How do we deal with anchoring? Dropping your own anchor is an effective way to combat this. Thinking about the value of a business independent of the current price or purchase price can keep the focus on business fundamentals. Key takeawaysIn conclusion, let's reinforce the key considerations for investors when dealing with the three behavioural biases mentioned above. Optimism bias: If we participate in parts of the market characterised by narrower ranges of outcomes, it mitigates the chances of excessive optimism. Exciting themes, emergent markets and unproven technologies are fertile grounds for optimism bias. Social proof bias: Maintain independent thoughts and conclusions. Be wary of herd following behaviour and think carefully about the reasons for a purchase or sale. Anchoring bias: Delay decisions and drop your own anchor. Slowing down our decisions allows us to develop a more holistic view of the problem we are facing and can avoid anchoring off that first piece of information we receive. We can make more informed transaction decisions if we focus on the value of the underlying business, without reference to the current price or our original purchase price. Funds operated by this manager: |