News

29 Nov 2024 - Trump & Uncertainty

29 Nov 2024 - The Trump effect on small cap stocks

|

The Trump effect on small cap stocks Montgomery Investment Management November 2024 Since 2022, we have predicted that small cap stocks, especially those representing innovative businesses with pricing power, would do well in an environment of disinflation and positive economic growth. Since the end of 2022, the U.S. Russell 2000 Index of small-cap stocks has risen 36 per cent, the U.S. S&P SmallCap 600 index is up 31 per cent, and the S&P/ASX Small Ordinaries index has risen 12 per cent. Interestingly, most of the gains in the Russell 2000 Index (23 per cent) have been recorded since April this year, and the S&P SmallCap 600 is up 21 per cent over the same period. The bulk of the gains over the last two years have occurred in the last two or three quarters. Given the disinflation/ positive gross domestic product (GDP) picture was no different before April and after April, we can put the acceleration down to something else. That something else may just be bets that a Trump election victory would be positive. If so, why have U.S. small caps done well amid a Trump victory? Answering that question may offer some insights into what happens next (for what it's worth, I believe the small caps rally, which commenced in 2022, should continue into 2025, and we should reappraise the situation towards the end of 2025. Domestic focus: Small-cap companies often derive a significant portion of their revenue from domestic operations. The last Trump administration emphasised policies that stimulated domestic economic growth, such as infrastructure spending and tax reforms, benefiting these companies. Tax cuts and jobs act of 2017: Trump last reduced the corporate tax rate from 35 per cent to 21 per cent. Small cap companies generally paid higher effective tax rates compared to larger, multinational corporations. The reduction in taxes disproportionately benefited smaller companies, improving their profitability. Deregulation efforts: The last Trump administration pursued deregulation across various sectors, reducing compliance costs and operational burdens. Due to these policy changes, small businesses, which have fewer resources to manage regulatory complexities, found it easier to expand and invest. Trade policies: The focus on renegotiating trade agreements and implementing tariffs affected multinational corporations more than domestically oriented small cap companies. Large-cap companies with extensive international operations faced uncertainties and potential losses, whereas small caps were relatively insulated. Economic growth and consumer confidence: The period saw steady economic growth and high consumer confidence levels. Increased consumer spending boosted revenues for small businesses that rely heavily on domestic markets. Stronger U.S. dollar: A stronger dollar can negatively impact multinational companies by making exports more expensive and reducing the value of overseas earnings. With limited international exposure, small-cap companies were less affected by currency fluctuations. Infrastructure initiatives: Proposed investments in infrastructure projects promised potential contracts and growth opportunities for smaller companies in construction, manufacturing, and related industries. Together, the first time around, these factors created an environment where small-cap stocks could outperform their larger counterparts. Under a second Trump term, many investors believe the same is in store, which is why the Russell 2000 Index was up five per cent the day after Trump's win. Of course, it's important to remember honeymoons never last and stock performance is influenced by a variety of factors, including global market conditions, geopolitical conflict, investor sentiment, and, most importantly, profit growth. For now, and until late 2025 (and excepting a war with China), I believe small caps will do well. Author: Roger Montgomery Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

28 Nov 2024 - The market has eyes only for Trump

|

The market has eyes only for Trump Pendal November 2024 |

|

SEPTEMBER quarter wages data (the Wage Price Index) was released today and, for the third quarter in a row, sat at 0.8%. This sees a 3.2% annualised pace, though the 1.1% outcome from the 2023 December quarter keeps the annual rate at 3.5% for now. All sector WPI, quarterly and annual movement (%), seasonally adjusted (a)

Source: Wages grow 3.5 per cent for the year | Australian Bureau of Statistics Both private and public wages rose 0.8%. A key factor was awards and minimum wage outcomes, which were set at 3.75% in June, down from 5.75% the previous year. This would be very welcome news for the RBA. Wage growth and underlying inflation are now heading back towards 3%. Given the two feed into one another, it reflects a more sustainable path for the medium term. Recent RBA forecasts have underlying inflation at 3% and wages at 3.4% by June next year. If the RBA has more confidence in reaching these levels sooner, it opens the door for rate cuts in the first half of next year. OutlookIn another time or place, this data would have seen a decent market rally. But the market has eyes only for the future of Trump's presidency. This future is viewed as one of increasing government debt and higher tariff-led inflation in the US, feeding out into the globe. As a result, markets now have only 30% chance of an RBA February rate cut and less than one cut by mid-year. On domestic factors alone, this is very cheap, but reconciling it with Trump is proving the problem. We think the Trump impact will be more mixed outside the US. Australia's trade deficit with the US should see us well down the list of targets, but key trading partners are at the top of the list. Either way, Trump's policies are unlikely to hit hard data until the back half of 2025 at the earliest, making central banks' jobs more difficult for now. We maintain the view that upcoming data leaves a February rate cut wide open. At only 30% priced in, the risk/reward is becoming attractive, and we will use the sell-off as an opportunity to enter positions. Further out the curve remains at the mercy of US bonds which, even at 4.5%, don't seem to be finding widespread support. Australia should outperform but yields may still move higher. Author: Tim Hext |

|

Funds operated by this manager: Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Multi-Asset Target Return Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Pendal Sustainable Australian Share Fund, Regnan Credit Impact Trust Fund, Regnan Global Equity Impact Solutions Fund - Class R |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

27 Nov 2024 - A new era dawns for Hybrids?

|

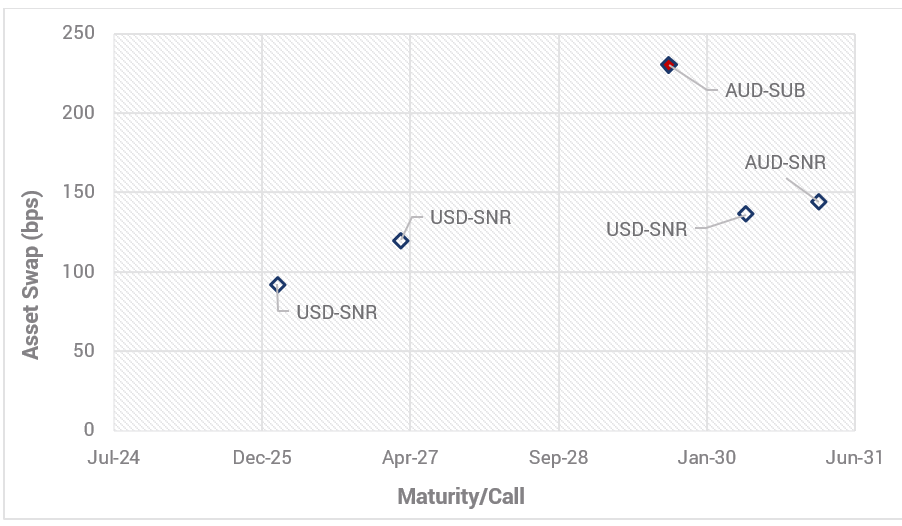

A new era dawns for Hybrids? Yarra Capital Management October 2024 As bank issuance shrinks, corporate hybrids are in the ascendent, with non-financial corporate hybrids potentially instrumental in powering Australia's energy transition. So what do they offer the fixed income investor? Australia's hybrid bond market rarely makes headlines, but in recent weeks it has been firmly back in the spotlight. The Australian Prudential Regulation Authority (APRA) recently revealed plans to phase out Australian banks' use of additional tier one (AT1) capital which APRA believes is riskier, thereby seeking to enhance the overall stability of the banking system. The announcement came on the heels of a surge in interest in corporate hybrids sparked by the successful raising for Australian Securities Exchange (ASX) listed mall operator Scentre Group. Yarra's outlook for Australia's hybrid bond market--of which bank AT1 hybrids make up around $41 billion--considers these latest proposed regulatory changes while focusing on the future potential for hybrids in funding corporate Australia's energy transition ambitions. Investors and issuers alike are now navigating a market partly in transition. More immediately it seems that in the wake of APRA's announcement, some are betting that a shrinking pool of Australian bank hybrids will drive up demand, pushing prices higher and yields lower across Australia's big four banks. Since last month's announcement, spreads for Tier 1 securities have contracted ~16bps--so retail investors are eager to bid up assets and get a larger slice of a shrinking pool. While uncertainty prevails in hybrid bank issuance for now, and short-term opportunities may arise, over the longer-term a broader set of dynamics is emerging for hybrids, particularly in sectors like energy and infrastructure. Expanding role in Australia's energy transitionThe potential scale of the energy transition in Australia offers an exciting growth opportunity for corporate hybrids. As energy transition projects such as new transmission lines and large-scale generation get underway, hybrids can and should play a role in funding the significant upfront capital costs and become a permanent feature of issuer capital structures. We estimate a total system investment of $400 billion is required by 2050 in order to decarbonise Australia's energy market with a focus on new energy generation including investment in wind farms, solar, batteries, and associated transmission assets. It is highly unlikely that equity alone will foot the bill for these expensive projects and that is why we see hybrids as an increasingly popular funding source in Australia's transition to a low-carbon economy, offering flexibility and capital efficiency. The sheer size of the capital requirement means that corporates will need to tap into multiple funding sources, and hybrids offer a lower-cost alternative to pure equity issuance. For large-scale energy transition projects, such as new transmission lines and renewable energy facilities, hybrids offer a way to fund significant upfront capital costs without putting undue strain on a company's balance sheet. For that reason, we expect large blue-chip generation companies like AGL, Origin, APA, and even Woodside and Santos along with transmission companies like Austnet and Transgrid, to tap into hybrid issuance as part of their funding strategies for energy transition plans. The recent success of Scentre's corporate hybrid raising demonstrates this growing interest from non-financial corporates looking to leverage a flexible funding tool, and we expect this interest to grow from here with further non-financial corporate issuance likely in FY2025. While APRA's move signals tighter regulatory scrutiny and a potential decline in AT1 hybrid issuance by banks, there is also the possibility that as major bank issuance retreats in APRA's suggested 2027-2032 transition period, corporate issuers may step in to fill the gap. Bringing it back to fundamentalsAs the APRA development demonstrates, assessing and pricing the inherent risks of hybrids becomes trickier with regulatory change in the mix. But these upheavals should be viewed as atypical events in a sector that is actually offering attractive returns akin to longer term equity market averages, with the 'higher for longer' rates, which are thematic for fixed income assets, here to stay. We are forecasting a new era for tactical fixed income, characterised by sustained, higher yields. In this environment, investors, particularly those focused on investment-grade assets, are increasingly comfortable holding instruments such as hybrids, viewing the attractive yields on offer as ample compensation for assumed risk. We see further opportunities for investors to access the higher yields and risk-adjusted returns that have made the hybrid instrument so popular recently. Further, with APRA's decision to phase out AT1 hybrids, there is an expected shift of a substantial pool of capital, estimated to be around $41 billion, that will be seeking new investment avenues. This development is likely to create significant opportunities for corporate hybrids to emerge as a viable alternative for retail investors who are in search of yield. Consequently, we anticipate that corporate hybrid instruments could play a crucial role in filling the gap left by the diminishing bank hybrid market. This shift could potentially lead to a resurgence of hybrid issuance on the ASX, ensuring that investors continue to have access to the attractive yields they have grown accustomed to with bank hybrids, but now through corporate issuance by larger, investment-grade companies. In addition to the rise of corporate hybrids, another area that warrants close attention as AT1 hybrids are phased out is the potential for Bank Tier 2 paper - that is, subordinated debt which provides an additional layer of protection for banks - to become more prominent on the ASX. It is conceivable that banks may opt for increased Tier 2 issuance as a strategic move to maintain access to retail capital pools and fulfill their capital requirements while they gradually wind down their AT1 hybrid instruments. This strategic shift towards Tier 2 issuance could provide banks with the necessary flexibility to navigate the changing regulatory landscape and continue to meet their capital needs effectively. Hybrids in portfolio constructionA key performance factor here is the issuer's credit strength--when dealing with investment-grade hybrids from strong issuers, the chance of conversion or extension is significantly diminished but investors still get rewarded for taking on what are essentially low-probability events. These features allow investors to effectively double the credit spread, significantly increasing returns without taking on a disproportionate increase in risk. For instance, investors in Scentre Group's recent hybrid issuance picked up a credit spread that was 1.8 to 1.9 times the spread on the company's senior debt, providing a return close to 6%. Chart 1: Scentre Group Bond Curve - 4 September 2024

|

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

26 Nov 2024 - 10k Words | November 2024

|

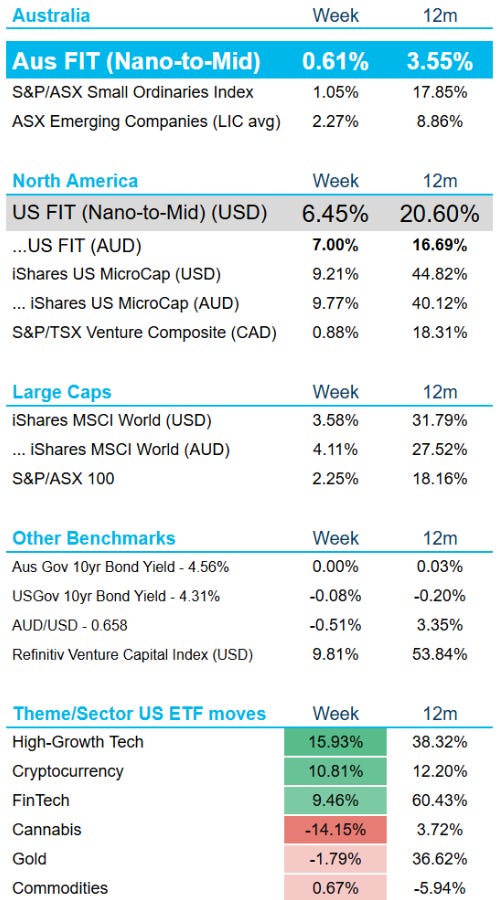

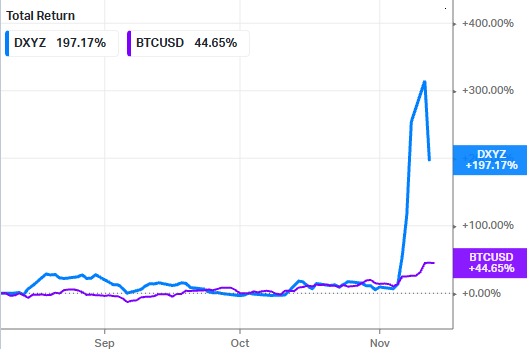

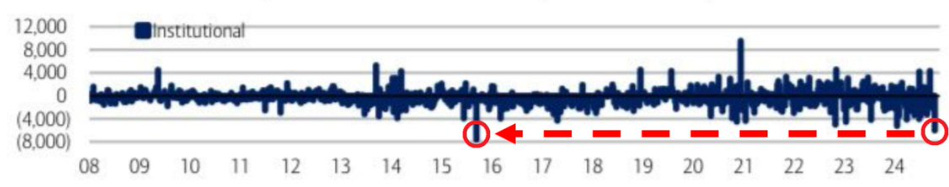

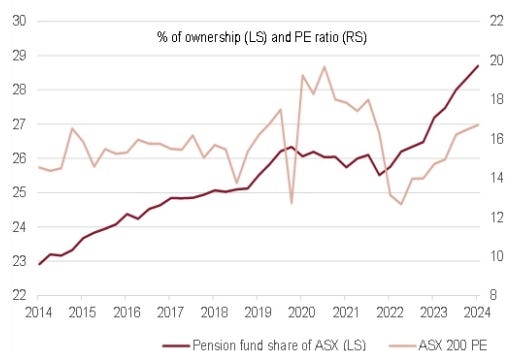

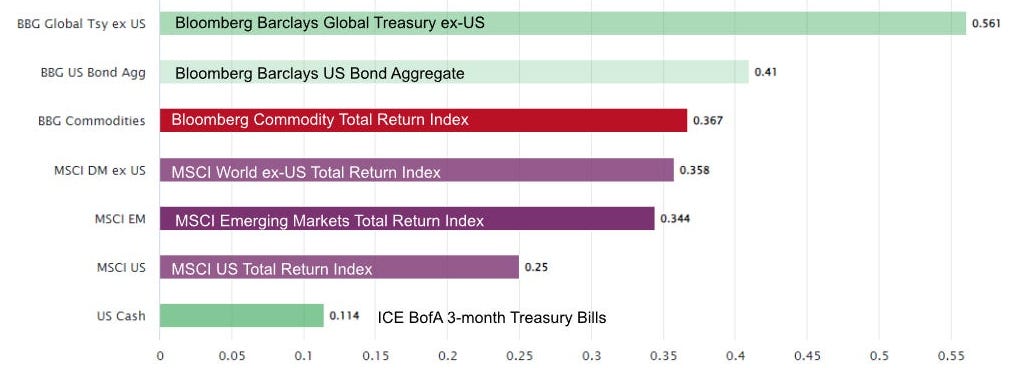

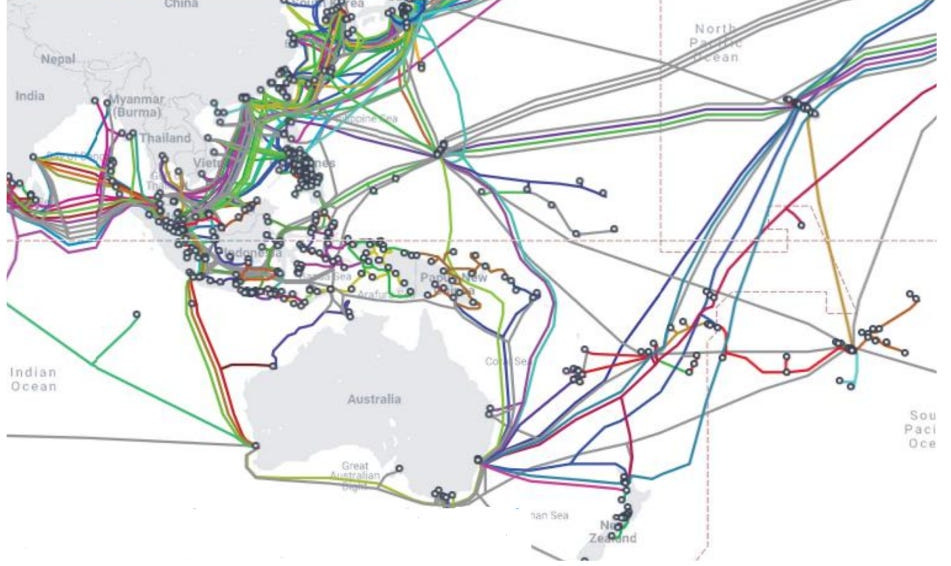

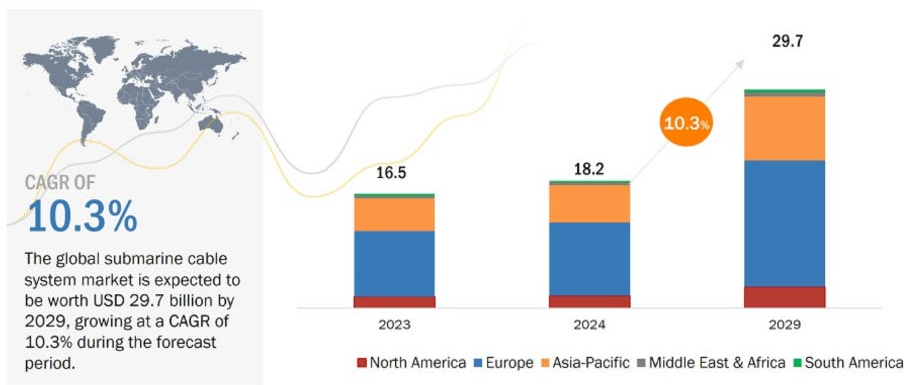

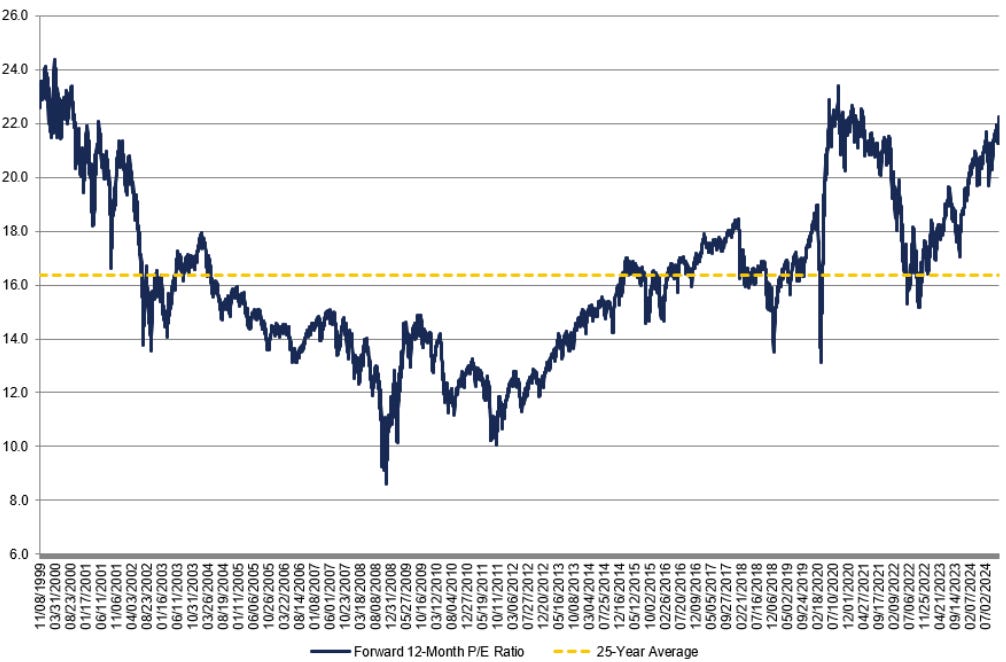

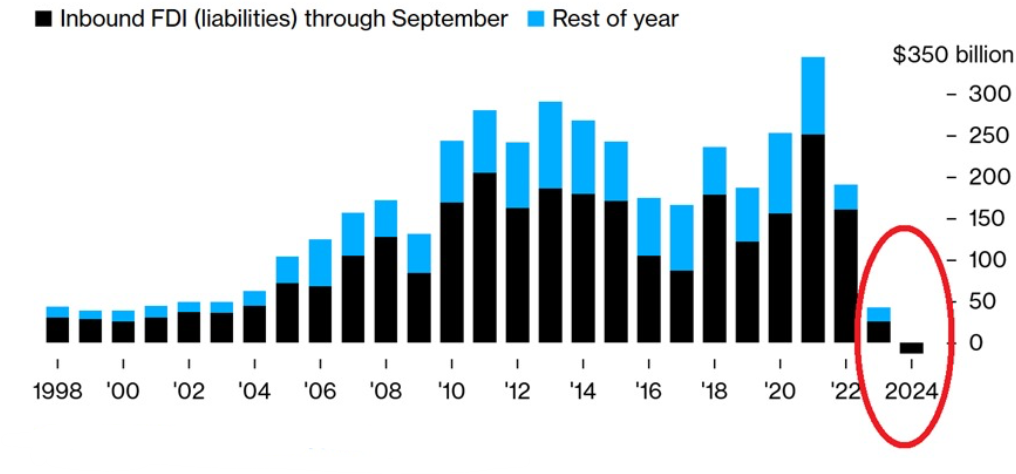

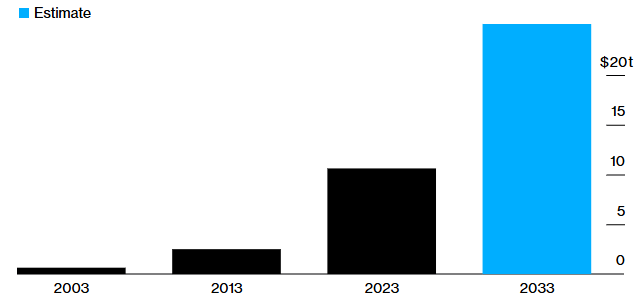

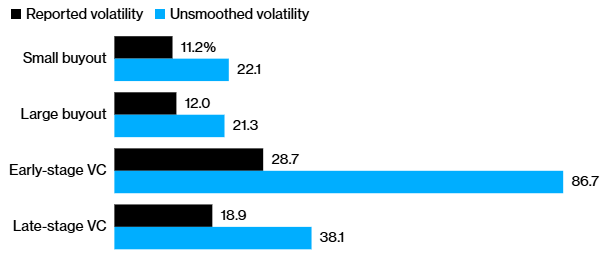

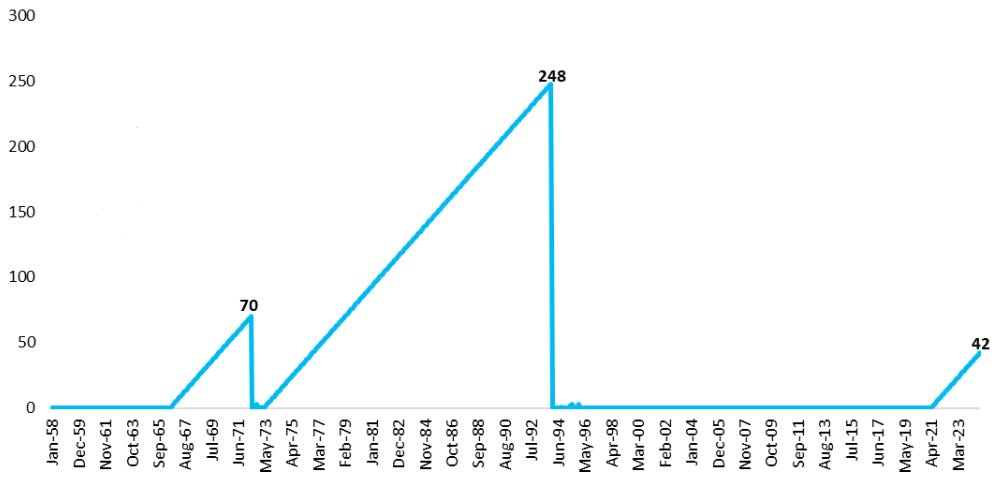

10k Words Equitable Investors November 2024 The "Trump Bump" in full effect, with bitcoin not the greatest benficiary and fund managers allocating away from equities beforehand; the "Super Bump" in Australian equities, as evident in the P/E multiple of CBA; gold's correlation; subsea cable spend creating opportunities; funds flowing out of Chinese investment markets; the boom in private equities and the truth about volatility; and finally the inflation story is not over yet in the US. Benchmark returns in the week of the US Presidential election (Nov 4 - 8, 2024) Source: Equitable Investors' SmallTalk "Trump Bump" for NYSE-listed "closed end" SpaceX investor Destiny Tech100 (DXYZ) outshines bitcoin Source: Koyfin Second largest net sale by institutional clients in Bank of America fund manager survey history Source: Bank of America "Super Bump" for Australian equities Source: Evans & Partners Forward P/E multiple of Commonwealth Bank (ASX: CBA) Source: TIKR Correlations between gold and other assets classes over past six years Source: World Gold Council Rolling 6 month correlation between gold and other asset classes Source: World Gold Council Regional subsea cables being built Source: DXN Limited Forecast spend on submarine cables Source: Research & Markets S&P 500 forward 12-month P/E ratio: 25 years Source: FactSet Foreign investment into China drops in 2024 Source: @Kobeissiletter, China's State Administration of Foreign Exchange Global private equity assets under management Source: Bloomberg, Bain & Co The reported volatility of private funds v "unsmoothed" volatility

Source: Bloomberg, "Amortizing Volatility across Private Capital Investments" (Mark Anson, The Journal of Portfolio Management, Vol 50, Issue 7) US Core CPI Inflation (year-on-year % change) - consecutive months above 3% (seasonally adjusted) Source: @CharlieBilello, Creative Planning November 2024 Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Past performance is not a reliable indicator of future performance. Fund returns are quoted net of all fees, expenses and accrued performance fees. Delivery of this report to a recipient should not be relied on as a representation that there has been no change since the preparation date in the affairs or financial condition of the Fund or the Trustee; or that the information contained in this report remains accurate or complete at any time after the preparation date. Equitable Investors Pty Ltd (EI) does not guarantee or make any representation or warranty as to the accuracy or completeness of the information in this report. To the extent permitted by law, EI disclaims all liability that may otherwise arise due to any information in this report being inaccurate or information being omitted. This report does not take into account the particular investment objectives, financial situation and needs of potential investors. Before making a decision to invest in the Fund the recipient should obtain professional advice. This report does not purport to contain all the information that the recipient may require to evaluate a possible investment in the Fund. The recipient should conduct their own independent analysis of the Fund and refer to the current Information Memorandum, which is available from EI. |

25 Nov 2024 - Global Matters: The data centre opportunity for infrastructure investors

22 Nov 2024 - Macro Research

22 Nov 2024 - Trump wins - what does it mean for sustainability?

|

Trump wins - what does it mean for sustainability? abrdn November 2024 What is the issue?Donald Trump is not known for being progressive on sustainability issues. He has previously promised to withdraw US participation in the Paris climate accord. But in terms of markets, what are the potential implications across sustainability themes from his second term in office? ClimateThere have been concerns that the Inflation Reduction Act (IRA) will be one of the first things to go. But we don't expect a full repeal; reforms are most likely. This is partially because the IRA mainly benefited red states (see below). It's also because Trump is pro-energy and investment, but he's agnostic on the energy source. He has pledged to increase oil and gas licences on federal land, which could happen quickly through an executive order. This also increased under Biden, but the rate is likely to accelerate. Investment in clean tech by voting district* during the Biden Harris Administration as of 10.31.24

$42B - Democratic districts | $161B - Republican districts Source: Bloomberg Opinion Article, Biden Is Giving Red Districts an Inconvenient Gift: Green Jobs, Published June 20, 2024, accessed 06/04/2024.

*Colour represents the voting of the 2022 House Representatives Elections. Investment in Republican (red) and Democratic (blue) districts pre and post the Inflation Reduction Act We expect that the US will withdraw from the Paris climate accord again. This won't happen at COP29 next week, but it will likely affect the US's ambition at the talks. During his campaign, Trump promised to end the "EV (electric vehicles) mandate", even though no such federal mandate exists [1]. We think a rollback of Biden's pro-EV policies, including sections of the IRA that incentivise EV production and adoption, are likely. On the surface, this would be potentially negative for his strong supporter Elon Musk who owns Tesla. Tesla's scale and scope could be an advantage over other EV producers if subsidies were removed. Tesla's stock was up almost 15% on Wednesday 6 November. Reforms to the IRA we think are likely:

*This one is highly complex and could go either way. On one side, continued funding will be highly lobbied by the energy sector. But on the other, Trump is not pro big-government and large tax-payer-funded projects, especially those with low technology readiness. Therefore, we are cautious. However, the funding mechanism that flows through the EPA could become an issue. As the agency's funding is likely to be cut significantly, this will make the final distribution of the funding slow. We also expect increased tariffs on imported clean tech (especially EVs), but not at the level Trump has stated. NatureThe Biden administration strengthened several nature-related regulations, like the Endangered Species Act, and pollution regulations. These should be safe in the short term, as they are unlikely to be an initial focus area. But the likely defunding of the EPA will take the teeth out of the regulations. Alongside the overturning of the Chevron deference (which gave federal agencies powers to interpret laws and decide the best ways to apply them), this will severely weaken the powers of the EPA. SocialThis could become challenging for corporations, as they were previously pressured by employees to make statements opposing government stances during Trump's first administration. Diversity, equity and inclusion are likely to be at risk. Investors looking for greater transparency and action are also likely to face increased scrutiny. Abortion rights were a key campaign topic, but this was more likely to see change under a Harris administration. Given the Republican win, the dynamics of the Supreme Court, and Trump's stated view that abortion rights should be decided on at a state level, we don't expect federal changes. Additional states might implement bans that could lead to repercussions for women's health and wellbeing, and their productivity in the workforce. Interestingly, abortion protections were on the ballots at this election and in many states these passed. Investee companies have faced pressure via resolutions tabled at annual general meetings (AGMs) to refuse employee healthcare benefits to those seeking abortion. A unified Republican Congress is likely to pass the H.R 2 bill. This would require employers to verify whether employees have the legal right to work in the US. If passed, the bill is likely to reduce the undocumented workforce and the flow of new arrivals into the US. It's therefore probable that the migrant workforce will be smaller under Trump, resulting in a negative shock to the labour market. GovernanceThis year, the Securities and Exchange Commission (SEC) introduced new rules mandating company disclosures on climate-related risks. Under a new Republican SEC chair, we expect these requirements to be removed. The SEC also eased restrictions on resolutions at AGMs, leading to a surge in proposals advocating for environmental, social and governance (ESG) issues - particularly climate and employee rights. This has been met with 'anti-ESG' resolutions questioning the allocation of resources to ESG matters and political advocacy, such as women's health rights. The new rules were not unanimously supported and could be reversed, potentially resulting in a rise of 'anti-ESG' resolutions at AGMs. We do not anticipate significant changes to board standards. Final thoughtsThe initial reactions affecting clean-tech stocks are subtle. The trajectory and implications for sustainability and specific stocks will become clearer once the administration's nominations are announced.

Author: Ann Meoni, Senior Sustainable Investment Manager 1https://www.factcheck.org/2023/10/trumps-misleading-claims-about-electric-vehicles-and-the-auto-industry/ |

||||||||||||||

|

Funds operated by this manager: abrdn Sustainable Asian Opportunities Fund, abrdn Emerging Opportunities Fund, abrdn Global Corporate Bond Fund (Class A), abrdn International Equity Fund, abrdn Multi-Asset Income Fund, abrdn Multi-Asset Real Return Fund, abrdn Sustainable International Equities Fund |

20 Nov 2024 - Manager Insights | East Coast Capital Management (Trend friends and navigating uncertainty) )

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Richard Brennan, Strategy Ambassador at East Coast Capital Management. The ECCM Systematic Trend Fund has a track record of 4 years and 10 months. The fund has outperformed the SG Trend benchmark since inception in January 2020, providing investors with an annualised return of 15.09% compared with the benchmark's return of 6.97% over the same period. Topics discussed include: the success of ECCM's trend-following strategy, which recently earned an award for the company's flagship fund; and how global diversification and a focus on trending opportunities can enable consistent performance even in uncertain economic conditions.

|

20 Nov 2024 - US Election 2024: How will markets and sectors respond?

|

US Election 2024: How will markets and sectors respond? Magellan Asset Management November 2024 |

|

Arvid Streimann offers an analysis of why Trump's victory was more decisive than predicted and the key issues that influenced voters' decisions. He provides insights into the market's reaction and shares his expectations for the next 12 months, highlighting which sectors are likely to perform better than others. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Core Infrastructure Fund, Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged) Important Information: Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |