News

17 Jan 2022 - Managers Insights | Collins St Asset Management

|

|

||

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Rob Hay, Head of Distribution & Investor Relations at Collins St Asset Management. The Collins St Value Fund has a track record of 5 years and 11 months and has consistently outperformed the ASX 200 Total Return Index since inception in February 2016. The Fund has returned 18.65% versus the Index's annualised return over the same period of 11.3%.

|

17 Jan 2022 - Four ways to massively improve performance in 2022

|

Four ways to massively improve performance in 2022 Wealthlander Active Investment Specialist 07 January 2022

We observe many investors with poor performance despite strong markets in the last few years. Here are some ideas to help you address this in 2022. 1. Acknowledge the reality of your performance to date Acknowledging the reality of this means accepting you're not using the best investment approach out there and there are better investment options than you struggling to be your own portfolio manager - or relying on those who don't deliver and untrustworthy people or institutions that often charge fees for delivering ordinary returns. It means recognising that genuine expertise is worth finding and paying for and that it can add much more value and manage risk better than you have been doing. 2. Get rid of your under-performing broker or adviser There is a big advantage to being invested in a fund where the fund is the only source of revenue for the firm. Firstly, the performance is clear, known, real and routinely calculated and produced by a third party, and secondly, the firm should only be remunerated by you the client and not have its main source of business being something that is using your money for some other benefit. Ideally there is a clear alignment with the firm's principals invested in the fund themselves and paid mainly on performance, and not for asset gathering through having large amounts of assets or large base management fees. That way, you actually have a much better chance of performing and can easily track your performance. Some advisers are competent but many are not, and many trap their clients into convenient but perennially under-performing investment approaches. Few are out there looking how to do a better job for their clients by having them invested with the best boutique investment managers globally. Some invest their wholesale clients in the same assets as their retail clients for their own ease of business, when they should be invested differently to take advantage of all the benefits that wholesale investors have. 3. Think outside the square 4. Acknowledge the investment cycle This means single digit returns from here are much more likely than double digit returns (at best). And that risk management is now much more important to reduce the increased risk of large losses if valuations revert to longer term averages or inflationary pressures persist forcing a tightening in central bank policies. Hence, it makes more sense to move to investment approaches with good prospective returns, better inflation protection, and much better protection from large losses than simply being long only and loaded with equity and property risk. In fact, locking in high returns by reducing equity and property investments in favour of alternative strategies means that the abnormal gains of the last few years become permanent capital gains, protecting your wealth against the risk of large losses from market falls. In summary Step 1: Measure your performance across your entire portfolio in 2021 and be honest with yourself. If you are in a position where some of your investments have delivered little then avoid hope as a strategy or being frozen or convinced into doing nothing. Cutting your losers is a good strategy. Step 2: Assess the value that has been added by your current broker or adviser relationships and stop using under-performers as these relationships are meant to add value to your bottom line, otherwise you are paying them for nothing or for treating you as a fool. Many of us are mistakenly loyal to long held relationships with sweet talkers that simply aren't in our interests. Step 3: Investigate alternative investment offers as there are many out there that are available to wholesale investors which better align with common investor objectives than traditional investment approaches. Step 4: Consider the investment cycle and ask yourself is this an environment where you think you can realistically continue using the same approach to achieve your desired returns. If not then consider alternative approaches better suited to today's investment prospects and risks. There are many simple things you can do to protect your hard-earned capital and still make money, even in a more adverse investment environment. Acknowledging the realities above is a crucial step in getting there.

Author Dr Jerome Lander, Founder and CIO Funds operated by this manager: |

14 Jan 2022 - Fixed-income Alternative - Life Settlements (part 2)

|

What are the Benefits of Life Settlements for Society? Laureola Advisors January 2022 Alignment with ESG principles is becoming imperative in investment management. A majority of Australians expect their super or other investments to be invested responsibly and ethically. In addition to the expectation of returns not being compromised, investors also expect these investments to have a real environmental, societal or governance impact, not just "ethics washing." Due to slow-changing legacies, popular investments such as equity and bonds, funds usually start their ESG journey through implementing negative screening to exclude investments whose activities are considered harmful. However, it is still difficult to directly link the remaining assets to having actual positive ESG impact. These assets might just be less harmful. Positive ESG impact assets are not immediately obvious because most investors are not used to the idea that assets that service a societal need can be profitable. The opportunity in life settlements shows how helping others can be profitable too. How can an investment in life settlements, where returns are made when the insured dies, be a social good? The positive impact that can arise from an investment in life settlements is improved physical and financial wellbeing of senior citizens in the US (where the most active life settlements transactions market operates). An investment in a life settlements fund can help vulnerable retirees and tackle three ESG-related issues in the US: There is a shortfall of retirement savings in the US The National Institute of Retirement Security estimates that approximately 44% of people born between 1944 and 1979 are at risk of having insufficient income to meet basic day-to-day expenses in retirement. Due to the savings shortfall, seniors cannot access long-term care The average middle-class senior citizen does not have sufficient savings to cover the cost of long-term care. When accounting for long-term care costs, 69% of households are at risk of being unable to maintain their standard of living in retirement. Instead of helping to ease this shortfall, life insurance policies add to the burden with regular ongoing demands for insurance premiums while the senior is alive. Every year since 2009, over 33 million life insurance policies terminate prematurely which means the policyholder does not realise a benefit from the policy despite paying premiums for decades. The American Council of Life Insurer reported over 90% of life policies terminate without paying a death benefit in 2018. Life settlements provide a solution to these issues by providing a cash payout to the seniors and by shifting the burden of the insurance premium to life settlements investors. By investing in this asset class there is potential for:

Researchers from London Business School estimated in 2013 that the value unlocked by the life settlement market is on average about four times greater than that of the surrender value offered by insurance companies. While life settlements might not look like a candidate as a force for ESG- aligned investing, its fundamental raison d'etre is to address a societal need for better retirement provision. In return for such social good, life settlement investors can obtain stable, uncorrelated returns which has historically been in the teens. Written by Tony Bremness, Managing Director & Chief Investment Officer This is a follow-up article to yesterday's release 'What is a Life Settlements Investment?". Funds operated by this manager: |

14 Jan 2022 - Omicron: The facts that matter

|

Omicron: The facts that matter Antipodes Partners Limited 14 December 2021 Just as the global economy started hitting its reopening stride, Omicron has seen uncertainty return. First identified in Botswana, Omicron spread to South Africa where the alarm was raised on the 24th November. Since then, the variant has been confirmed in almost 40 other countries. With around 60% of the global population fully vaccinated - the question is, how big a threat is this? There are many unknowns when it comes to this new variant. These, along with the key facts we do know, plus the important signposts investor should track are discussed with Antipodes' healthcare portfolio manager, Dr Nick Cameron, in the latest episode of the Good Value podcast. Here are some of the key takeaways. Transmissibility and severityThe Omicron variant has around 30 mutations in the spike protein - many more mutations or changes in the virus than we have seen in previous variants (of which many are new/novel). The spike protein is the key protein responsible for - and necessary for - the virus to enter or infect cells and cause symptoms. Omicron has quickly become the dominant strain in the Gauteng province in South Africa. The infection growth rate profile appears higher than prior waves but importantly hospital admissions data looks more consistent. Given borders between South Africa and many other countries were open to travellers for some time prior to the knowledge of the variant, it's no surprise Omicron has spread around the world. Omicron appears highly transmissible but even if it's more transmissible, this doesn't necessarily mean its virulence (capacity to cause more severe disease) is also increased. Early signs suggest disease severity may not be any worse than Delta. For example, most hospitalised patients in South Africa had mild symptoms and few required high-level care. While there are a number of mutations in the critical areas of the spike protein, there are many parts of the Omicron spike that remain unchanged. The immune system, including both T cells and neutralising antibodies in vaccinated people and in those that have recovered from prior infection (and have "natural immunity") should "remember" the unchanged parts of the virus, and provide some protection against severe disease and death. Based on this, countries with high vaccination rates and high rates of community infection in prior waves will likely be the best protected. Vaccine effectivenessGiven Omicron has so many mutations it is no surprise to see a marked reduction in the efficacy of current vaccines. The most recent lab data shows the current two-dose regime of existing vaccines aren't as efficacious against the Omicron variant, but it's still too early to say how this lab data translates into real world protection against severe illness and deaths. Boosting with current vaccines appears to lift protection, but this is likely to be short-lived. It increasingly appears an Omicron specific booster will be required, particularly for the more vulnerable populations like the elderly and those with higher-risk profiles for severe disease. mRNA vaccine makers Pfizer and Moderna have already started developing new boosters which are specific to the Omicron variant - Pfizer's candidate could be available in March 2022. More will be known on vaccine effectiveness in the coming weeks as more lab data results become available. The key metric for investorsFor investors, monitoring hospitalisations over the coming weeks will be key in assessing the extent of the risk posed by Omicron and the risk of further lockdowns. So far, early indications suggest hospitalisation rates for Omicron appear low and vaccinations rates also appear to be lifting following the Omicron news. If vaccinated people, and particularly those that have also recovered from prior infection, are shown to only develop mild flu or cold like symptoms, this would be a positive sign in the fight against COVID-19. And positive in terms of the reopening continuing. But it will take some time to collect enough data to confidently determine whether the Omicron variant is a threat to overloading health systems. Two attractively priced healthcare opportunities amid the Omicron threatSanofi (EPA: SAN) Sanofi is more than just a drug developer. A material portion of its earnings (~35%) comes from its vaccines and consumer health businesses both of which are more defensive, long-duration businesses compared to traditional drug development. Sanofi is a leading manufacturer of vaccines, globally - it's one of only three scale flu vaccine manufacturers, and has a broad portfolio including polio and meningitis as examples, and a full pipeline of vaccines under development including two COVID-19 candidates. Vaccines are attractive businesses. They require large scale manufacturing, are highly regulated and have high barriers to entry. Sanofi's consumer health business is also one of the largest globally. Sanofi has a collection of well-known, over-the-counter medications and supplements and these businesses are very stable, generate high free cash flow and operate in markets which have more room to consolidate. When separately listed they can demand multiples of around 25x. Finally, its drug business is one of the least exposed to patent cliffs over the next decade, has limited US drug pricing relative to peers, and a solid balance sheet with ample firepower to transform its pipeline. The company's earnings are growing faster than peers, around the mid-teens level, and Sanofi is valued at just 11x earnings. Walgreens (NASDAQ: WBA) Walgreens has around 9,000 pharmacies in the US. In fact, ~80% of the American population lives within 5 miles of a Walgreens so the scale of their physical presence is a key competitive advantage. But what really excites us is that Walgreens is leveraging its extensive retail footprint to provide healthcare services. Walgreens is transforming its physical locations into health hubs which will provide a range of healthcare services such as primary care, chronic disease management, vaccinations and specialty pharmacy services. All while the traditional prescription and retail offering continues. Not only is Walgreens becoming a one-stop shop for healthcare needs, the margin profile of health services is much higher than the pharmacy business alone. Over time this could become a material driver of earnings growth and margin upside if the company is able to execute on its plans. Once the healthcare services offerings are fully ramped up, the company's long-term earnings growth profile could reach 12-13% p.a. including buybacks, and it's valued at just 10x earnings. The market is not pricing any value for the potential in health services and we see this a great pragmatic value opportunity. Alison Savas, Client Portfolio Manager |

|

Funds operated by this manager: Antipodes Asia Fund, Antipodes Global Fund, Antipodes Global Fund - Long Only (Class I) |

13 Jan 2022 - 10k Words - December Edition

|

10k Words - December Edition Equitable Investors December 2021 FundMonitors closed for the end-of-year break before we could release this edition of the regular missive from Equitable Investors. Read and enjoy - the next issue will follow soon!

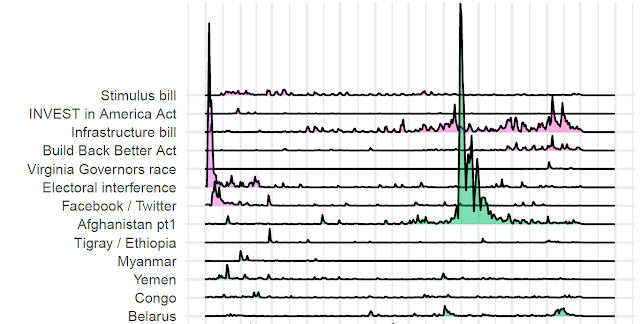

Our final 10k Words for CY2021 kicks off with The Economist's first cut on what events captured audience attention in the media during the year. We then range across Morgan Stanley's chart on China property sector's importance to commodities, the surge in VC investment in cryptocurrency startups illustrated by The Economist and Bloomberg's ranking of countries through time based on their COVID-19 vaccine penetration. We get into equities with Bespoke showing ETFs don't necessarily fulfill the diversification function that is expected of them and finally Equitable Investors' analysis of what has worked and what hasn't worked in CY2021 for ASX-listed micro-to-mid caps. Impact of 2021 global events as measured by media activity (an initial draft analysis) Source: The Economist China property sector's contribution to commodity demand Source: Morgan Stanley VC funds piling into cyrptocurrency startups Source: The Economist

COVID-19 vaccine doses per 100 people Source: Bloomberg

Sector ETFs not so diversified Source: Bespoke

Quarterly average returns & CY2020 YTD return for ASX micro-to-mid caps by size (market cap) Source: Equitable Investors, Sentieo

Quarterly average returns & CY2020 YTD return for ASX micro-to-mid caps by sector Source: Equitable Investors, Sentieo

Quarterly average returns & CY2020 YTD return for ASX micro-to-mid caps by valuation band Source: Equitable Investors, Sentieo Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog Funds operated by this manager: |

13 Jan 2022 - Fixed-income Alternative - Life Settlements (part 1)

|

What is a Life Settlements investment? Tony Bremness, Laureola Advisors January 2022 The sale in the USA of a life insurance policy to a 3rd party

Imagine having the ability to benefit from the diligent financial habits of middle America. Like most residents of advanced countries, Americans have a tradition of establishing a life insurance policy as they start a family, take on a mortgage or build their own business. Over a period of responsible financial discipline, the children become independent, and debt is paid off. The need for insurance cover diminished. Some policyholders realise that their life policy is a financial asset and would seek to cash in its value. Unfortunately, there is a low level of understanding of the options available to cash in life insurance policies. This resulted in over 90% of life policies being terminated in the US without paying a death benefit in 2018. To provide a better outcome, the life settlements market was formed to match policyholders wishing to sell their unwanted cover to investors looking for a non-correlated asset class with the potential for stable returns. A life settlement market will give policyholders additional options in obtaining a higher value of their policies. A life settlement transaction starts with a policyholder selling their life insurance policies to an investor (usually a fund). The life settlement investor buys the life insurance policy from the policyholder and commits to paying future insurance premiums until the insured person dies. The investor then collects the death benefit payout from the insurance company as the concluding repayment of the life settlement transaction. The path of an illustrative policy is shown below. Illustrative example - assume a life settlement transaction backed by a policy with a death benefit of $100k Hence, a life settlement transaction is clearly win-win transaction for the seller and for the investor. The returns to the investor are embedded in the benefit payout collected upon the maturity of the policy. Most market observers estimate a long-term range of 6-12% p.a. as potential returns going forward as long as the portfolio is managed properly. Written by Tony Bremness, Managing Director & Chief Investment Officer Tomorrow, we continue this release with a follow-up article 'What are the Benefits of Life Settlements for Society?' Funds operated by this manager: |

13 Jan 2022 - Government policy outlook for 2022

|

Open for business - Australia embracing digital assets Holon Global Investments December 2021 Since Holon's beginnings in 2018, the digital asset conversation has evolved rapidly. Back then, Bitcoin was a dirty word, and the scandals of Initial Coin Offerings only demonstrated the 'wild west' attitude of an immature crypto-world. Skepticism by the traditionalists was strong. Now, with an estimated 100 million+ users (including leading payment companies and global corporates), and a market value of USD$1Trillion and growing, Bitcoin is no longer a dirty word, it's just a word. Institutions are quickly seeing Bitcoin (and other digital assets) as a valuable hedge against the volatility of the modern world. Investors (especially younger investors) are seeing that they have access to a store of value (wealth creation) opportunities as an alternative to the current financial system that has, and is, failing them. And to meet this demand, new banks are being established (for example Avanti Bank in Wyoming, USA) to specifically custody Bitcoin for customers - with this trend accelerating. It seems that cryptocurrencies and digital assets, more broadly, are becoming mainstreamed. How things have changed in just a few short years! But where is Australia in all this? Holon has worked with Australian governments to discuss the accelerating digital economy across the political divide, particularly as we believe that data generation and storage requirements, driving Web 3.0, are being vastly underestimated by the market. While there has always been interest and an acknowledgement of where things were heading, we saw little real action. Indeed, the major banks, and particularly the Reserve Bank of Australia, have been active 'resistors' - either attempting to delegitimize digital assets or dismissing them altogether, and even going to the extent of de-banking digital businesses. With all of this, there was a sense that Australia needed to be dragged kicking and screaming into the digital age. 2021 was different. In October, we were pleasantly surprised that the advice contained in Holon's submissions to the Australian Securities and Investments Commission's (ASIC) crypto-related financial products consultation paper and the Senate Select Committee on Australia as a Technology and Financial Centre was reflected in the Senate Select Committee's recommendations to the Australian Government enabling the Web 3.0 economy and ASIC's guidance to the financial services industry. Digital assets, and their custody and handling as financial products, were now being taken seriously. There was also acknowledgment that greater legal, business and investment certainty was needed to drive dollars into the Australian economy, rather than away from it. The underlying message was that we desperately needed to avoid the 'digital-desertion' that we had been seeing (not unlike the 'brain-drain') - where young, talented digital companies are forced to move off-shore because of the uncertainty (and hostility) they faced at home. However, this may just have come to an end. We have to thank the Chair of the Senate Select Committee, Senator Andrew Bragg, who led the charge to begin pushing for much needed regulation of digital assets in Australia and, as a consequence, helping to publicly legitimize them. From being 'well behind the eight-ball', Australia may have a chance to be a unique player on the global scene. As a bigger surprise, and a significant affirmation to the work of the Senate Select Committee, the Federal Treasurer announced on 8 December that the Australian Government has agreed in principle with several core tenets of Senator Andrew Bragg's report. The Treasurer said that the impending reforms would be 'fast-tracked' as they are the 'most significant' in 25 years and will progress in two phases - with the most urgent and immediately implementable changes being consulted upon in the first half of 2022, and the remainder by the end of 2022. The Treasurer stated that the Government will commence consultation on the feasibility of a retail Central Bank Digital Currency in Australia - a digital asset issued by a central bank and linked to a sovereign currency for better consumer protection and connection the global financial system - with advice to be provided by the end of 2022. In relation to payments, cryptocurrencies and digital assets, the Treasurer stated that, by mid-2022, the Government will have:

By end-2022, the Treasurer indicated that the Government will have:

Overall, the Australian Government's commitment to these reforms, based on the recommendations of the Senate Select Committee, are welcomed as they are advantageous to the future of Holon's Web 3.0 cloud storage operations and digital asset management business. However, there's still some way to go to enact any regulatory reforms, but this is the clearest signal from Government that Australia is now embracing digital assets and 'open for business' - and at Holon, we're proud that we were (and will continue to be) an active part of the policy making that is bringing it about! Luke Behncke, Executive Chair Funds operated by this manager: |

12 Jan 2022 - Capturing the most lucrative part of a company's growth

|

Gino Rossi, Portfolio Manager for the Spheria Global Microcap Fund talks about the trajectory of company growth and how investors might view the stages relative to returns. Spheria Asset Management is a fundamental-based investment manager with a bottom-up focus specialising in small, mid-cap and microcap companies. Its investment philosophy is to purchase securities where the present value of future free cash flows can be reasonably ascertained and the security is trading at a discount to their intrinsic value, subject to certain criteria.

|

||

10 Jan 2022 - Insync Strategy - Megatrends

|

3 big Megatrends boosting returns Insync Fund Managers December 2021 Many of the companies in the Insync portfolio delivered strong quarterly earnings numbers and particularly in these 3 Megatrends. Over time, the increase in the share price of a company follows its earnings growth. Exuberant sentiment may propel it further temporarily but eventually it is this facet that determines its price. Investing in highly profitable companies benefitting from Megatrends provides this strong earnings growth. Not only higher than global GDP over a full economic cycle but also often surprising most investors in terms of both magnitude and duration.

Our focus is on delivering strong consistent returns for our investors, with less risk, over the investment cycle. We do this by investing in businesses that are highly profitable and cash generative, with strong balance sheets. This means they are less reliant on external funding to fund their future growth, and extremely well positioned to be a major beneficiary of Megatrends. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund |

10 Jan 2022 - The necessity of yield in 2022

|

The necessity of yield in 2022 Janus Henderson Investors December 2021

Key takeaways

No pain, no gain. At least that's the old saying. But portfolio management is a well-developed science of managing risk, of finding large or small opportunities that - when combined in a diversified portfolio - may produce a little bit more return with the same risk as a passive benchmark, or the same return with a little less risk. Or, ideally, some combination of both. As such, portfolio management is the science of finding as much gain with as little pain as possible and, in our view, 2022 is likely to be a year where active portfolio management could shine. If the second half of 2020 was an environment where a bond investor wanted as much corporate credit risk as possible (taking advantage of hugely dislocated valuations because of COVID-19), we think that opportunity largely ran its course in 2021. Investment-grade corporate bond spreads could tighten further by the end of next year. But if they do, it is more likely to be modest than not. And if they don't, the relatively small yield they offer does not provide much return for the risk tolerance such a position requires. When the Bloomberg US Aggregate Bond Index is offering a yield of just 1.7%,1 it just doesn't take much of a rise in interest rates or a widening in corporate bond spreads to risk giving it all back. Corporate fundamentals remain robustThis doesn't mean we aren't positive on the outlook for the US economy, and select pockets of the corporate bond universe. We are. Broadly speaking, corporate fundamentals are still strong in aggregate, with consensus earnings-per-share (EPS) growth estimates for the S&P 500® Index near 7.5% for the next 12 months.2 And, historically, corporate bonds have performed well during the early part of a US Federal Reserve (Fed) tightening cycle. In 2016 and 2017, for example, the Bloomberg US Corporate Bond Index returned 6.1% and 6.4%, respectively.3 It wasn't until toward the end of the tightening cycle, in 2018, when performance suffered, and the index fell 2.8%.4 However, current valuations suggest this effect may already have been anticipated. Because, despite the recent uptick to near 1.0%, spreads of the Bloomberg US Corporate Bond Index remain near historical tights.5 But if investment grade corporate credit has, historically, performed well during the early part of tightening cycles, the high yield market has been even more impressive. In 2016, for example, the Bloomberg US High Yield Index returned 17.2%,6 which makes some intuitive sense. After borrowing substantial sums when official interest rates were relatively low (and they were 0% in 2020 and 2021), many companies' liquidity profiles improved significantly. Now, flush with cash and the expectations that income could potentially remain strong on the back of a still-recovering economy, more companies have begun a process of repairing their credit profiles. High yield bond spreads, like investment grade corporate bond spreads, may also be pricing in much of the good news. But high yield is different in that the significantly higher yield the index pays is meant to be compensation for defaults. And the outlook for defaults has rarely looked so good. The current "stress ratio" (that is, the number of bonds trading below 80 cents on the dollar), which can be a great indicator of default rates, has improved dramatically in recent quarters. Indeed, we believe corporate bond defaults peaked in early 2020 and expect they will decline further in 2022. Simply put, when defaults (pain) are expected to be low, the relatively high yields (gain) being offered deserve the attention of active portfolio managers. While it helps that the Fed, as recently as 2020, signalled it would support the high yield market should a major crisis occur, we think the asset class' risk/reward profile remains a bright spot in an otherwise low-yielding/tight-spread world for government and corporate bonds. In our view, volatility in the high yield market is more likely to come from external, macro factors than from concern about any individual sector or company. The Fed is expected to begin an interest rate tightening cycle next year and while that is usually cause for caution, the recent surge in inflation and the uncertainty about how fast it may fade are likely to add to the uncertainty. Volatility should also be expected from both good and bad news regarding the COVID-19 virus. On the one hand, news like Pfizer's COVID pill is cause for celebration, while the emergence of the Omicron variant is more concerning. Most importantly, we expect volatility in 2022 - whatever the cause - may have an outsized impact on returns, given how low government and many corporate bond yields are today. This is not to suggest that investors should rethink their overall allocation to bonds. On the contrary, we believe a core allocation to bonds can often play an important role in reducing the volatility of an investor's overall portfolio. But with yields as low as they are, more - and more active - portfolio management, in our view, is needed. As we do not believe the Fed beginning to raise interest rates or new variants of the COVID-19 virus will add enough uncertainty to derail an economic recovery of the magnitude we see across the globe, we think investors should stay invested in bonds. But some diversification would help, and - where fundamentally appropriate - favouring higher yielding securities may help thicken the yield cushion against future volatility. 1Bloomberg, as of 3 December 2021.

Credit spread/spread: The difference in yield between securities with similar maturity but different credit quality, eg, the difference in yield between a high yield corporate bond and a government bond of the same maturity. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing spreads indicate improving creditworthiness.

This information is issued by Janus Henderson Investors (Australia) Institutional Funds Management Limited ABN 16 165 119 531, AFSL 444266 (Janus Henderson). The funds referred to within are issued by Janus Henderson Investors (Australia) Funds Management Limited ABN 43 164 177 244, AFSL 444268. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Past performance is not indicative of future performance. Prospective investors should not rely on this information and should make their own enquiries and evaluations they consider to be appropriate to determine the suitability of any investment (including regarding their investment objectives, financial situation, and particular needs) and should seek all necessary financial, legal, tax and investment advice. This information is not intended to be nor should it be construed as advice. This information is not a recommendation to sell or purchase any investment. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. This information does not form part of any contract for the sale or purchase of any investment. Any investment application will be made solely on the basis of the information contained in the relevant fund's PDS (including all relevant covering documents), which may contain investment restrictions. This information is intended as a summary only and (if applicable) potential investors must read the relevant fund's PDS before investing available at www.janushenderson.com/australia. Target Market Determinations for funds issued by Janus Henderson Investors (Australia) Funds Management Limited are available here: www.janushenderson.com/TMD. Whilst Janus Henderson believe that the information is correct at the date of this document, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. |

|

Funds operated by this manager: Janus Henderson Australian Fixed Interest Fund, Janus Henderson Australian Fixed Interest Fund - Institutional, Janus Henderson Cash Fund - Institutional, Janus Henderson Conservative Fixed Interest Fund, Janus Henderson Conservative Fixed Interest Fund - Institutional, Janus Henderson Diversified Credit Fund, Janus Henderson Global Equity Income Fund, Janus Henderson Global Multi-Strategy Fund, Janus Henderson Global Natural Resources Fund, Janus Henderson Tactical Income Fund |