News

25 Jan 2022 - Airlie Market Outlook, January 2022

|

Airlie Market Outlook, January 2022 Airlie Funds Management 17 January 2022 |

|

Matt Williams, Portfolio Manager, offers his views on the year ahead, the challenges he sees for Australian companies and discusses investments in the portfolio. Funds operated by this manager: Airlie Australian Share Fund |

24 Jan 2022 - Peer Groups

|

Peer Groups FundMonitors.com If you are interested in how a particular fund has performed compared to its competitors or how different sectors have performed against each other, you can use FundMonitors.com to access and compare peer groups. |

|

|

24 Jan 2022 - Why you can be cautious on markets and 100% invested

|

Why you can be cautious on markets and 100% invested Aoris Investment Management 14 January 2022 2022 began with global stock markets around record levels, leaving many investors primed to sell equities. However, timing the market is more likely to reduce your returns than enhance them. Importantly, you can be cautious on the market and 100% invested provided you're in the right stocks. Here's why. A December 2021 Livewire reader survey found that 'overvalued stock bubbles' are the #1 concern of readers, by a factor of two! Many investors have an opinion, often strongly held, on whether the stock market in aggregate is cheap or expensive. If the market is viewed as being too pricey, they may increase the cash weight in their portfolio with a view to buying back into equities at lower prices. While conceptually appealing, history shows that attempting to profit from the market's zigs and zags along its upwards journey is far more likely to detract from investment returns than add to them. Aswath Damodaran, a highly esteemed Professor of Finance at New York University's Stern School of Business, has studied market timing strategies. He looked at asset allocation mutual funds in the US, so called because rather than being 100% in equities they can time the market by moving between stocks, bonds and cash. As such, they should do better than the equity market. Over the 10 years to 1998 these market timing funds on average underperformed the S&P500 by 5.0% p.a. I recall telling clients in January of 2013 that markets are fully priced and to expect a zero return from the index in the coming year (the S&P500 put on 30% that year!). I've learnt a few things since then. Today, I have no view, positive or negative, on the value or the direction of the equity market in totality. Nor do I believe it's necessary to have one as an equity manager. Timing the market is an example of what is known as the fallacy of composition, meaning the belief that what is true of the whole is also true of all the component parts. It's common for investors who've formed a view on the equity market in totality to then project this view onto all equities - all stocks and all funds. However, the returns from any individual security will look nothing like the average. Thinking about equity market indices in aggregate misses the vast dispersion of stock returns within an index. To illustrate this dispersion, in 2021 the returns of the best 20% of the global equity market exceeded those of the worst 20% by almost 90%.

What matters is what you own, which in the case of Aoris is just 15 exceptional businesses. The index is mostly made up of businesses you don't own. I've seen many poor investment decisions made as a result of confusing these two constructs. What matters is what you do own. The index is mostly made up of businesses you don't own. If you own the right type of business, and you own them at or below their fair value, then time is on your side and being fully invested makes sense. By the right type of business, I mean those that have been around a long time, are understandable, have leadership positions in growing markets, and grow earnings per share at an attractive rate on a sustainable basis. I believe the intrinsic value of the 15 companies we own at Aoris is rising at a rate of around 10% a year and I believe we own them at or below their intrinsic worth. Therefore, cash represents a considerable opportunity cost. To hold $1 of portfolio capital in cash rather than in one of our companies, in the expectation that its share price may fall 10% or more from an already attractive level, would not be judicious. I believe it is far better to invest all of one's portfolio capital in these types of businesses and participate fully in that 10% p.a. growth in value. To maximise your long-term returns, recognise the futility of trying to optimise short-term returns. Invest to win the main game, the long-term game. Recognise that your equity portfolio is not the equity index. Rather, it's a discrete set of businesses whose returns will look nothing like the market average. If the businesses you own are profitable, durable, competitively strong and growing in intrinsic value at around 10% p.a., and you own them at or below today's fair value, then it makes sense to be fully invested. Written By Stephen Arnold, Managing Director & Chief Investment Officer Funds operated by this manager: |

21 Jan 2022 - Sitting On The Mountain, Watching The Tigers Fight

|

Sitting On The Mountain, Watching The Tigers Fight Arminius Capital 11 January 2022 According to the Chinese zodiac, 2022 is the Year of the Tiger. Tigers are bold, powerful and dangerous, but in Chinese astrology they are also impulsive, short-tempered, and have difficulty getting on with others. There is an old Chinese saying about "sitting on the mountain, watching the tigers fight", which means that, when the situation is violent and confusing, it's best to stand back and see how things work out. There are a lot of tigers around this year:

The outlook for the Australian share market is better than for most of the world. Inflation is low, wage pressures are minimal, and the Federal election due by end-May is unlikely to produce major policy changes. As investors focus on fundamentals, stocks with solid earnings will come back into favour, and speculative stocks will lose popularity. For the big four banks, 2021 was the year of recovery: 2022 will be much harder, and the big banks are likely to underperform. Funds operated by this manager: |

20 Jan 2022 - Distinctively different and driven to perform Unlocking the opportunity of 'special situations'

|

Distinctively different and driven to perform Unlocking the opportunity of 'special situations' Colins St Asset Management January 2022

|

|

|

|

|

|

Michael Goldberg (Managing Director / Portfolio Manager) and Rob Hay (Head of Distribution & Investor Relations) from Collins St Asset Management share insights into how 'special situation' investment opportunities have been implemented within the Collins St Value Fund. Recorded 27 October 2021.

|

20 Jan 2022 - Mineral Resources

|

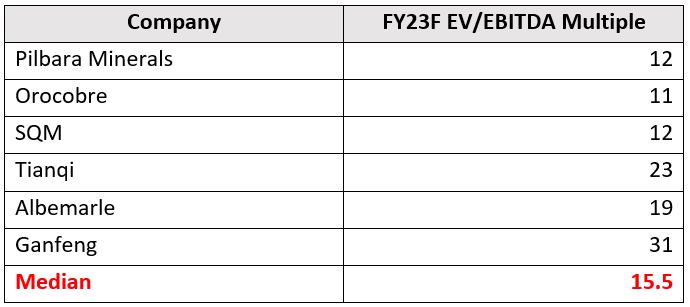

Mineral Resources Emma Fisher, Airlie Funds Management 12 November 2021 The cheapest lithium stock in the market. I know, I know. Bullish thought pieces on lithium are as dime a dozen today as Warren Buffett quotes in a fund manager investor letter. However, we think there is a standout sleeping giant in lithium that is incredibly cheap right now and worth discussing. The precipitous fall in the iron ore price since August has wiped more than 35% off the value of Mineral Resources (ASX:MIN), which now has a market cap of roughly $7.3 billion. We are astounded at the valuations the market is willing to ascribe to 'pure-play' lithium companies and consider Mineral Resources the cheapest lithium stock in the market. Let's compare it to one such pure-play peer, Pilbara Minerals (ASX:PLS), which has an asset right next door to Mineral Resources' Wodgina mine. Pilbara Minerals has a market cap of roughly $7 billion, so basically the pair are neck and neck in valuation. Comparing Mineral Resources with Pilbara MineralsPilbara Minerals' assets add up to 536 kt p.a. of spodumene capacity, consisting of two mines: What about future expansion plans?Pilbara Minerals is aiming to expand production to 1 million tonnes p.a. of spodumene (so roughly double what it produces today). The company has given no firm dates on these expansion plans so we consider them longer-dated (five-plus years). What is $1 billion in lithium earnings worth?Lithium producers are trading on elevated multiples. If we look at FY23F EV/EBITDA for major lithium producers globally, multiples range from 11 times to a whopping 31 times for Ganfeng, with a median EV/EBITDA of 15.5 times.

If we ascribed all of Mineral Resources' current enterprise value to its future lithium EBITDA potential of $1 billion, it equates to 7 times. Valuing the lithium assets in line with the low end of peer multiples, at 11x EBITDA, gives $58 per share value versus the current share price of $38. In short, the fear around a falling iron ore price has created a unique opportunity to buy the cheapest lithium stock in the world, Mineral Resources. A quick Google Translate from English into Buffett yields: "be greedy when others are fearful". Written By Emma Fisher, Airlie Portfolio Manager |

|

Funds operated by this manager: Airlie Australian Share Fund |

19 Jan 2022 - 10k Words - January Edition

|

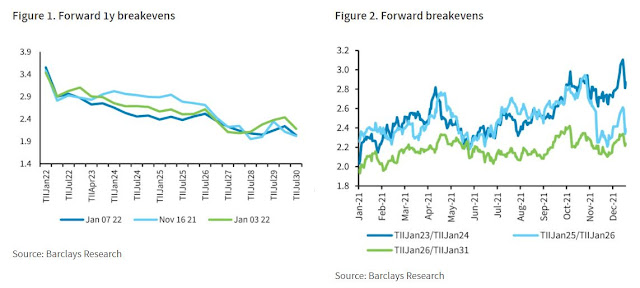

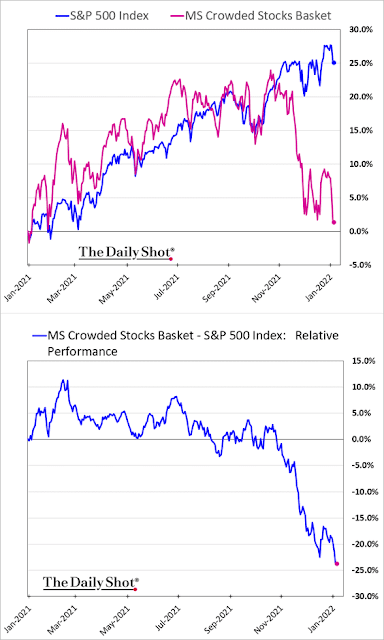

10k Words - January Edition Equitable Investors January 2022 Happy New Year to all! There's plenty of chart action in January covering inflation and interest rates. The implied probability of a Federal Reserve rate hike in March 2022 of at least 25 basis points has surged, as @charliebilello highlighted on Jan 6 (and had to update for a further surge a day later). Barclays set out the break-even rates (break-even inflation is the difference between the nominal yield on a fixed-rate investment and the real yield on a similar inflation-linked investment). On equities we see "crowded trades" and retail sentiment take a dive, courtesy of Morgan Stanley and @lizannsonders. Indeed Hiring Lab provides us a little insight into why unemployed Americans aren't hunting for work with urgency. Meanwhile, the number of Australians thinking this year will be better than last has slumped according to a Roy Morgan poll. Federal Reserve Rate Hike Probabilities (Jan 6, 2021) Source: @charliebilello

Federal Reserve Rate Hike Probabilities (Jan 6, 2021) Source: @charliebilello

Break-evens on inflation-indexed bonds Source: Barclays via Bloomberg

Collapse in "Crowded Stocks" Source: Morgan Stanley via The Daily Shot

Goldman Sachs Retail Sentiment Index Source: Ann Sonders

Why unemployed aren't showing urgency to find a job Source: Indeed Hiring Lab

Only 37% of Australians expect 2022 will be 'better' than 2021 - down 22% points on a year ago

Source: Roy Morgan Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog Funds operated by this manager: |

18 Jan 2022 - Managers Insights | Glenmore Asset Management

|

|

||

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Robert Gregory, Founder and Portfolio Manager at Glenmore Asset Management. The Glenmore Australian Equities Fund has a track record of 4 years and 5 months and since inception in June 2017 has outperformed the ASX 200 Total Return Index, providing investors with an annualised return of 25.88% compared with the index's return of 9.99% over the same time period.

|

18 Jan 2022 - Volatility Returns, Uncertainties Grow

|

Volatility Returns, Uncertainties Grow Laureola Advisors 21 December 2021 The S&P 500 was down 0.8% in November but this disguised higher volatility in many sectors and stocks as investors digested the end of QE and ZIRP. As we approach year end, investors are forced to deal with increasing uncertainties across the investment landscape: equity valuations, inflation, real world shortages, and the new Omicron strain. Bank of America strategists calculate the real earnings yield on US equities at -2.9%, a level last seen when Harry Truman was President. US insider selling is at record highs: 48 top executives have each sold more than $200 ml of shares. More Chinese developers are defaulting on their debt including Kaisa Group and China Aoyuan. Inflation continues to surprise Central Bankers: November CPI was up 6.8% y-o-y. Gasoline is up 55% in 2021, oil up 48%, and wheat up 23%. Lithium is up 300% as are electricity prices in Europe, which is bracing for rolling blackouts this winter if the weather is colder than average. The Omicron variant has caused many governments to reverse the re-opening measures which will have negative effects on the economy, possibly exacerbate shortages, and potentially add to social unrest. Faced with this wall of uncertainties, investors are placing more and more value on the genuine non-correlation and stable return profile available from the asset class of Life Settlements. SPECIAL REPORT - Potential Effect of Omicron Variant. Omicron is the name of the latest SARS-Covid variant and the 5th to be officially labelled a variant of concern. It spread quickly through S. Africa, is already the dominant strain in Europe, and has found its way to 60 countries including the USA. It is a development that could potentially impact the Life Settlement industry so needs some analysis, despite "Covid fatigue" and the fact that all current data is preliminary with many unknowns. There is strong evidence that Omicron spreads more quickly: some countries report a doubling of Omicron cases every 2- 3 days. It manages to get past most vaccines (although booster shots probably offer some protection) but produces a much higher percentage of cases that are mild. Death and hospitalisation rates appear lower than earlier variants. The USA is still battling the earlier Delta variant. When Omicron cases spike, as they will in all countries, the reaction of individuals and Governments is unknown. But the range of scenarios suggests a positive impact on the investment strategy: lock downs and travel bans (as in Europe) will reduce economic output and may force more to sell their policies. There will be some deaths and the overall effect on mortality will probably be modest, but is unlikely to decline. If the surge of cases or fear causes sick people to cancel their hospital visits and treatments, this could have an impact. The effect on Life Settlements across the scenarios ranges from no change to significantly positive. It will have the opposite effect on most other asset classes, demonstrating once again that Life Settlements has the ability to deliver positive returns when others can't. Funds operated by this manager: |

18 Jan 2022 - Fund Selector

|

Fund Selector FundMonitors.com FundMonitor.com's Fund Selector also allows you to filter your search by individual criteria. You can filter by strategy, fund structure, fund size, and a range of other metrics. |

|

|