News

20 Oct 2023 - Performance Report: Emit Capital Climate Finance Equity Fund

[Current Manager Report if available]

20 Oct 2023 - Performance Report: Bennelong Concentrated Australian Equities Fund

[Current Manager Report if available]

19 Oct 2023 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

19 Oct 2023 - Australian Corporate Performance in Indigenous reconciliation.

|

Australian Corporate Performance in Indigenous reconciliation. Tyndall Asset Management October 2022 With the upcoming Voice referendum in Australia, the nation stands on the cusp of a significant constitutional change, emphasising the acknowledgment of Aboriginal and Torres Strait Islanders as the original inhabitants and the establishment of an Aboriginal and Torres Strait Islander Voice to Parliament. Here we aim to assess Australian corporate performance in the context of the indigenous reconciliation journey, particularly focusing on Reconciliation Action Plans and their varying stages. Reconciliation Action PlansReconciliation Action Plans (RAPs) seek to enable organisations to take meaningful action to advance reconciliation. Based around the core pillars of relationships, respect and opportunities, RAPs aim to provide tangible and substantive benefits for Aboriginal and Torres Strait Islander peoples, increase economic equity and supporting First Nations self-determination. The four stages of a RAP are as follows:

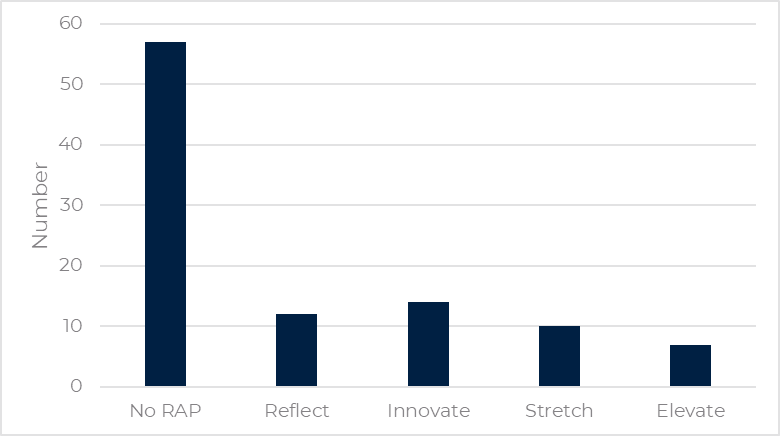

Corporate Performance and RAPsThere are presently 43 companies in the S&P/ASX 100 with RAPs in place. These companies are distributed across the Reflect, Innovate, Stretch, and Elevate stages. Notably, 57 companies in the ASX 100 do not have RAPs, suggesting that there is room for growth in corporate engagement in indigenous reconciliation. The breakdown of companies by RAP stage and their associated values in the ASX 100 is as follows:

Figure 1: S&P/ASX 100 RAP Breakdown (number)

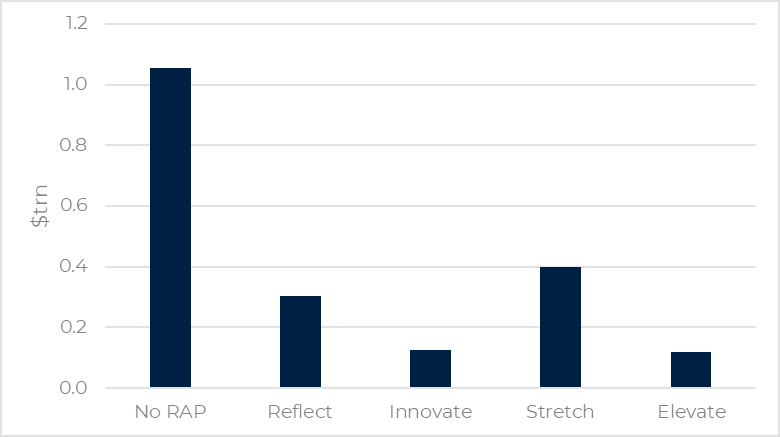

Source: IRESS, Reconciliation Australia, Tyndall AM, Oct 2023. Figure 2: S&P/ASX 100 RAP breakdown (total market cap)

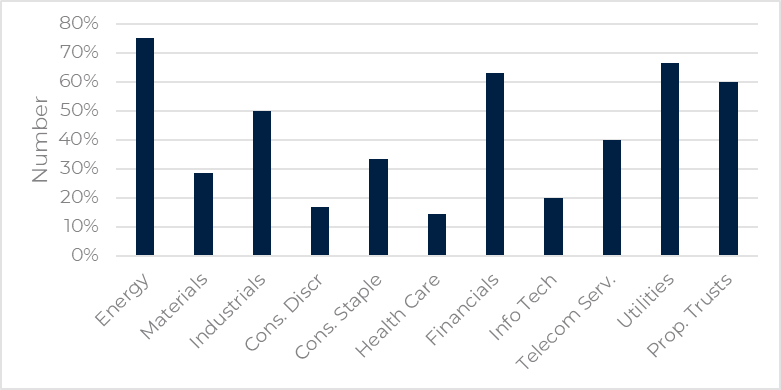

Source: IRESS, Reconciliation Australia, Tyndall AM, Oct 2023. Additionally, sector-wise analysis demonstrates varying levels of engagement with RAPs:

Figure 3: S&P/ASX 100 RAP breakdown by industry

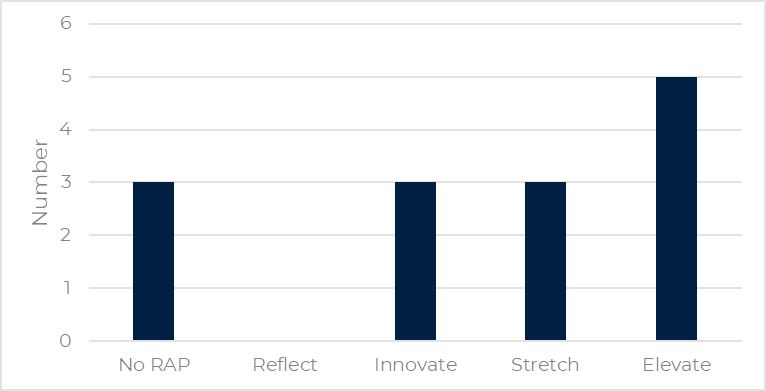

Source: IRESS, Reconciliation Australia, Tyndall AM, Oct 2023. Specifically relating to the Voice referendum, it is interesting to note that 14 of the top 20 listed companies in Australia have expressed public support for the Voice. Somewhat surprisingly, of these 14 companies only 11 currently have RAPs. Less surprisingly, none of those 11 companies are at the Reflect stage and the majority are at the Elevate stage or beyond - essentially companies that are more progressed in their own reconciliation journey. Figure 4: S&P/ASX 20 Voice Support

Source: IRESS, Reconciliation Australia, Tyndall AM, Oct 2023. Incorporating Reconciliation into our ESG approachESG has always been a critical part of the Tyndall investment process. More recently we have added structure to the process via the development of an ESG scorecard amongst other longstanding initiatives including active ESG engagement and independent thought on ESG related matters. While social issues and diversity and inclusion performance have always been considered, we have recently updated our scorecard to specifically reflect where companies are at in their RAP journey. Conclusion Regardless of the outcome of the Voice referendum, it is clear that corporate Australia will play an increasingly significant role in progressing indigenous reconciliation efforts. This includes fostering genuine relationships, creating inclusive workplaces, and supporting initiatives that empower Aboriginal and Torres Strait Islander peoples. The pre-Voice referendum assessment of Australian corporate performance in the indigenous reconciliation journey through RAPs reveals both progress and areas for improvement. While a notable number of companies have embraced reconciliation through the RAP framework, a significant proportion is yet to make a commitment. Encouragingly, there appears a growing understanding and acknowledgment of the need to meaningfully engage with indigenous communities. Author: Michael Ward, Senior Research Analyst Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund |

18 Oct 2023 - Performance Report: Cyan C3G Fund

[Current Manager Report if available]

18 Oct 2023 - Performance Report: Digital Asset Fund (Digital Opportunities Class)

[Current Manager Report if available]

18 Oct 2023 - European student accommodation: testing the theory

|

European student accommodation: testing the theory abrdn October 2023 As the new academic year kicks off, students in Europe are confronted with a shortage of good-quality student accommodation. Relative to the UK, the purpose-built student accommodation (PBSA) market in Europe is at a much earlier stage in its evolution. The demand for higher education in Europe is rising, driven by a steady increase in domestic and international students. In 2002, only 22.5% of adults living in the EU were educated to degree level. By 2021, that figure had risen to 40% - the European Commission's long-term target [1]. Momentum remains strong, with access to tertiary education still under the spotlight. In 2022, student enrollments increased or remained stable in 87% of European cities. Rising international student populations are further exacerbating the demand in Europe, too. With limited supply, these fundamental drivers are creating a compelling opportunity for investors to source long-term stable cashflows from the sector. Investment in European PBSA hit €15.4 billion in 2022. This was 47% higher than 2021, 37% higher than 2019 (pre-Covid levels), and 39% higher than the five-year average. Our research on more mature PBSA markets, like the UK, demonstrates how this opportunity can evolve.

Examining the provision rateIn 2022, PBSA occupancy rates averaged 98% in Europe's major cities [2], a level that far exceeds commercial real estate sectors. The demand has also been counter-cyclical to gross domestic product. When there's a downturn in the economy, the demand for student beds rises as more people either enter tertiary education or extend their studies beyond undergraduate degrees. Even during the pandemic and strict lockdowns, university admissions remained resilient and even grew in some cases. However, the provision rates tell the true story. The average provision rate (defined as the student-to-bed ratio) in Europe is 25%. This ranges from 4% in Italy to 33% in the UK. At a city level, London is 31%, Amsterdam is 29%, Copenhagen is 21% and Munich is 15% [3]. With high inflation, debt and construction costs, development activity is insufficient to absorb current and future demand from both domestic and overseas students. Even if all planned developments go ahead, the European provision rate will remain less than 15%. This leaves students at the mercy of individual landlords in the private rental market, which can mean they end up living further away from university campuses. Private accommodation is often more costly because of open-market rents, non-inclusive energy bills, travel, and extra costs for entertainment and facilities. Importantly, a lesser 'student experience' means institutions risk falling behind the current expectations of domestic and international students in an increasingly competitive environment. 'Internationalisation' in higher education'Internationalisation' is the process of integrating cross-border students into European institutions [4]. The top 10 universities in Europe are in the UK and Germany, of which international students account for between 19% and 73% (London School of Economics 73%, University of Oxford 42%, ETH Zurich 41%, and LMU Munich 19%) [5]. This proportion has grown considerably in recent years, owing to a rise in English Taught Bachelors (ETBs), which accommodate a broader range of students. The UK, Germany, the Netherlands and Italy comprise the largest population of English-taught students. International students tend to want higher standards of accommodation in bespoke premises, with higher security than domestic students. A shortage of suitable PBSA stock is a limiting factor for institutions that want to attract this important source of revenue. For investors, this type of PBSA can provide scope for specialisation, with higher premium units and longer-term lets available for overseas students. Chart: Countries accounting for highest past enrolments Source: Studyportals, abrdn, June 2023 Diversifying the student baseFor European PBSA assets, it is less common for investors to have a lease with a university or a business operator. It is more typical to have exposure to individual tenants and turnover. This is critical as the risk of higher void rates can have a more direct impact on performance in European PBSA. Schemes that are backed by a diverse range of international students tend to support more resilient cashflows. Where there is a strong dependency on one source of international student, there is a risk that the source slows or is diverted. Brexit is a good example of a structural shift that can happen almost overnight. The number of EU students coming to the UK plummeted by 50% in 2022, after Brexit-related changes meant they lost their discount on tuition fees. Non-EU international students have filled these places, but this has changed the dynamic in the UK market. In addition, student visa reforms and anti-immigration laws hinder future enrollment rates from Europe, in particular. In the UK, the highest number of international students are from China, India and the US. European student flows are more fragmented, though, driven by a shared colonial history, languages, politics and geographical relationships. In France, most students are from Africa, given the shared colonial ties; Portugal has the most Brazilian students because of their colonial and economic links; and Austria and Germany receive students from each other as they share a common language and are neighbouring countries. The chart shows the differences in student flows and the implied opportunities and risks within the international student mix. The diverse range of international students is a distinct advantage for European PBSA. With the UK government introducing stricter policies, EU institutions are an emerging alternative for international students. This trend could allow the EU to close the gap on the UK. It's not a one-way ticket, though. The Netherlands is another maturing PBSA market that is home to many top universities and international students. But it could cap international student enrollment and recruitment in the future. The tight housing market in major Dutch cities is a major political issue and there are simply not enough beds to supply all students with good-quality accommodation. It's all about distinctionGiven the demand and supply fundamentals, we believe there will be strong potential opportunities for investors to grow meaningful allocations in good-quality and well-located European PBSA. The deglobalisation trend that has been fuelled by geopolitics, means investors cannot simply 'wing it' when it comes to European PBSA. It is important to focus on the best university towns and cities, backed by the most diverse range of student flows, and a strong and growing domestic student population.

Author: Hong Bui, Real Estate Investment Analyst, Europe, abrdn |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund |

17 Oct 2023 - Performance Report: Quay Global Real Estate Fund (Unhedged)

[Current Manager Report if available]

17 Oct 2023 - Glenmore Asset Management - Market Commentary

|

Market Commentary - September Glenmore Asset Management October 2023 Globally equity markets in September declined materially driven by rising bond yields. In the US, the S&P 500 fell -4.9%, whilst the Nasdaq declined -5.8%. In the UK, the FTSE 100 outperformed, rising +2.3%, due to its heavy resources and lower technology weightings. In Australia, the All-Ordinaries Accumulation Index fell -2.8%. Energy was the best performing sector (brent crude oil rose +9.8%), whilst real estate and technology were the worst performing sectors, both impacted by rising bond yields. Small caps underperformed as investor risk appetite weakened, with the ASX Small Ords Accumulation Index falling -4.0%. In bond markets, the US 10-year bond yield climbed +43bp to close at 4.54%. Its Australian counterpart saw the yield increase +46bp to 4.49%. The increase in bond yields was the main story for financial markets in the month and was driven by expectations that high inflation will be more persistent and hence require more rate hikes from central banks over the next 6-12 months. The Australian dollar was flat, closing at US$0.64. Funds operated by this manager: |

16 Oct 2023 - Performance Report: Kardinia Long Short Fund

[Current Manager Report if available]