News

14 Feb 2022 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

||||||||||||||||||||||||||||

| Staude Capital Global Value Fund | ||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| Coolabah Long-Short Credit PIE Fund | ||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

Coolabah Short Term Income PIE Fund |

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

| Ox Capital Dynamic Emerging Markets Fund | ||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| Bentham Asset Backed Securities Fund | ||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| Polen Capital Global Small and Mid Cap Fund | ||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||||||||

|

Subscribe for full access to these funds and over 600 others |

||||||||||||||||||||||||||||

14 Feb 2022 - The upcoming earnings season - like drinking from a fire hose

|

The upcoming earnings season - like drinking from a fire hose Spatium Capital January 2022 Twice a year, the earnings of various ASX-listed companies are reported. First, in February, providing a snapshot as at the end of December, and then again in August, following the Australian end of financial year on June 30th. Many see this as an opportunity to receive a health check on the current results and future trajectory of these listed companies. Despite the best attempts of forecasters, the unpredictable nature of how the market will respond to a company's earnings leaves many working feverishly to calibrate their respective positions, especially when anomalies are rife. For example, it is not uncommon for a company's stock price to increase when the market expects a greater decline in revenue than what is reported. Conversely, if a company does not achieve expected revenue targets (even if these revenues are positive), then it can result in a decline in the company's ticker price as forecasters adjust their valuations.

The 'bottom-line' may not always paint a clean picture, given 'up-and-coming' businesses often reinvest heavily in market share acquisition strategies (such as marketing, or developing new products). This subsequently drives up 'middle-line' costs with the hope of gaining future 'top-line' benefits. Without itemizing each variable that sits within the top to bottom line segments, we trust the point has been made - earnings season is complex. More so now, it seems, with new environmental, social and governance (ESG) metric expectations. Many businesses are now facing significant shareholder pressure to factor in ESG metrics. Whilst driving up middle line costs now, ESG so far appears to have significant customer and employee retention benefits, as well as being the public 'right thing to do'. The cynic may challenge whether these programs are truly driven by ESG good or future 'top-line' benefit. Whereas the optimist might assert that whilst either motive could be true, greater ESG benefit cannot be a bad thing, irrespective of the method(s) used to get there. This discussion calls into question the purpose of a company (generally speaking, to operate in self-interest) vs. the operation of a government (establishing the rules that do not allow this self-interest to operate unfettered). It is the classic economics example of 'who pays for the light bulbs in streetlamps?' The cynic argues that through the creation of jobs and payment of various taxes, it is the company who pays for streetlamp bulbs. The optimist, true to character, would just be happy they don't have to walk home in the dark. If earnings season wasn't already complex enough, the wider adoption of these new metrics can feel like trying to drink water from a fire hose. Like anything that is new, there will inevitably be kinks that need to be ironed out and parameters that need redefining. Perhaps the nirvana for these new metrics and their wide-scale adoption comes through regular policy and regulation revisions that encourage and guide companies to do what is considered socially better. Or maybe the onus is on the companies to willingly take on these new expectations from the community and thereby lobby the policymakers to formalise these shifts. Is only doing the right thing because you were told to do it enough in our customer-aware world? Either way, we suspect this debate is far from over and we watch with great intrigue how this may continue to impact future earnings seasons. We'd argue that this is only going to become increasingly complex in an environment where pundits and analysts are doing their best to quantify and price-in a rise in interest rates, ongoing supply chain constraints and inflationary pressures that are seemingly going unchecked. Relying on strictly linear forms of measurement or analysis is likely to negate an investing edge and conversely, too much information is likely to saturate one's bandwidth with little clarity on how to use it. We'd argue that the best way to navigate earnings season, or any other disruptive market cycle, is to not only remain convicted to one's tried and tested investment thesis, but also keep half an ear to the ground for emerging trends to consider how these might need to be examined |

|

Funds operated by this manager: |

11 Feb 2022 - With so much going on, where should your focus be?

|

With so much going on, where should your focus be? Insync Fund Managers December 2021 Why it's all about Earnings Growth Companies that sustainably grow their earnings at high rates over the long term are called Compounders. Investing in a portfolio of Compounders is an ideal way to generate wealth for longer-term oriented investors that tend to also beat market averages with less risk. This chart shows the tight correlation between returns of the S&P 500 (orange line) and earnings growth (blue line) since 1926. NB: Grey bars are US recessions.

Insync's focus is on investing in the most profitable businesses with long runways of growth resulting in a portfolio full of Compounders. Inflation & interest rate impacts By focusing on identifying businesses benefitting from megatrends with sustainable earnings growth, means we do not need to concern ourselves with market timing, economic growth forecasts, inflation, or the future of interest rates. Throughout the last 100 years we've experienced periods of high economic growth, recessions, different inflation and interest rate settings, wars, pandemics, crisis and on it goes, but the one thing that has remained consistent... Over the long term, share prices follow the growth in their earnings. Media and many market 'experts' continue to be concerned about the risk of a sustained period of higher inflation. They worry over a short-term 'rotation' from quality growth stocks of the type Insync seek to own to value stocks. The latter in many cases is simply taken as equating to lowly rated companies and reopening stocks, such as airlines, energy, and transport. There are 3 problems with this view that can trap investors:

In sharp contrast good businesses remain strong at this stage of the cycle. They continue delivering the earnings growth that propel share prices over the long term. This is what makes their share price progress both sustainable and well founded. High margins and superior pricing power from Insync's portfolio of 29 highly profitable companies across 18 global Megatrends offers "the holy grail" of inflation busting companies. Pricing power, sound debt management and margin control allow great companies to handle inflation and interest rates well. LVMH and Microsoft) are portfolio examples that recently increased prices of their products with no impact on their sales growth. Profitability + Revenue Growth Short term, investors typically fret over interest rate rises and all growth stocks suffer initially, as they adopt an indiscriminate machine-gun approach to selling. Over time however, the more profitable businesses with strong revenue growth start to reassert their upward trajectory in their share prices, as investors appreciate their long-term consistent earnings power. Stocks with "quality growth" attributes, such as high returns on capital, strong balance sheets, and consistent earnings growth, have typically outperformed in past situations similar to what we face today (Mid-2014 through early 2016 and from 2017 through mid-2019. Source-Goldman Sachs).

This is in sharp contrast to stocks with strong revenue growth projections that also have negative margins or low current profitability. They are highly sensitive to changes in interest rates (These stocks propelled the short-term returns of many of the Growth funds in 2021). Many of them lack profit and cash flow, which doesn't give you much downside protection if they don't deliver. Many rely on the constant supply of new capital to fund their operations. These types of companies have very long durations because their present values are driven primarily by expectations of positive cash flows at a distant point in the future. We call this HOPE. As the saying goes; we don't rely on hope as a sound strategy. Stocks with valuations entirely dependent on future growth in the distant future are vulnerable to a dramatic drop in price if rates rise sharply or revenue growth expectations are reduced. This chart (performance of the Goldman Sachs NonProfitable Tech Basket) shows the downside risk to this sector of unprofitable high revenue growth companies. The index has fallen by close to 40% from its peak in February 2021. The index consists of non-profitable US listed companies in innovative industries. Source: Bloomberg Unsurprisingly, popular "new era" stocks held by high growth managers have also suffered a similar fate with examples noted below. Megatrends drive sustainable growth Megatrends enable us to locate the sustainable outsized market growth opportunity stock hunting-grounds (as well as help us avoid those that will dwindle). They are the 'fuel' to quality company's sustainable growth earnings. We are presently in the midst of one of the most disruptive innovation cycles in technological history. Thus, we resist the temptation of concerning ourselves with near term timing based 'market rotations' and changes in 'sentiment'. These distractions will otherwise prevent us from generating outsized returns in the years ahead. PWC consulting estimates that global GDP will be up to 14% higher in 2030 as a result of the accelerating development and take-up of AI. The equivalent of an additional $15.7 trillion USD. Source: PWC Internet of people V Internet of Things Our lives are already being impacted. In the past 5 years alone, almost all aspects of how we work and how we live - from retail to manufacturing to healthcare - have become increasingly digitised. The internet and mobile technologies drove the first wave of digital, known as the 'Internet of People'. Analysis carried out by PwC's AI specialists anticipate that the data generated from the Internet of Things (IoT) will outstrip the data generated by the Internet of People many times over. This is already resulting in standardisation, which naturally leads to task automation and the automatic personalisation of products and services - setting off the next wave of digital progress. AI exploits digitised data from people and things to automate and assist in what we do today, how we make decisions and how we find new ways of doing things that we've not imagined before.

From one of the all-time ice hockey greats, this very apt thought describes the way Insync frames its investment thinking. Despite the market's sentiment shift on the rotation trade, Insync's focus is on where the world is moving to. Data continues to show an acceleration in spending on pets, the rollout of 5G, health & wellness, and digital transformation. Major corporates expect elevated growth in technology to both accelerate and persist for the foreseeable future (according to a Morgan Stanley survey), in areas such as cloud computing, digital transformation and artificial intelligence. CIO intentions indicate that they expect to increase IT spend as a percentage of revenue over the next three years than they did pre-pandemic. The percentage of CIOs planning to increase spend versus those planning to decrease spend is known as the up-to-down ratio. It rose to 9.0, nearly 6x the pre-pandemic 2019 average. The best way to invest in a megatrend isn't always the obvious way! Semiconductors are driving the digital transformation of the world. Covid19 has had a profound impact on so many industries but one of the key areas everyone has started to care about, is silicon chips. This became abundantly clear when new car purchases were dramatically delayed because of chip supply chain shortages. Semiconductor chip usefulness has gone further than any other technology in connecting the world. The companies that produce them enable us to do pretty much everything, from the smartphones in our pockets to the vast data centres powering the internet, from electric scooters and cars to hypersonic aircraft, and pacemakers to weather-predicting supercomputers. Their manufacturing requires a high level of specialist technological know-how as it is a highly expensive, complex and a long process. It typically takes 3 months and 700 different steps to cover a silicon wafer with intricate etchings forming billions of transistors (microscopic switches that control electric currents and allow the chip to perform tasks). Semiconductor chips lay at the heart of the exponential transition that we're going to experience in computing over the next 5-15 years. More than we have ever witnessed before, and it will continue to grow exponentially. For example, AI applications process vast volumes of data-about 80 Exabytes pa today. This is projected to increase to 845 Exabytes by 2025. One Exabyte = One quintillion bytes = one thousand quadrillion bytes. Truly eye-watering numbers.

Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund |

10 Feb 2022 - Global Strategy Update

|

Global Strategy Update Magellan Asset Management January 2022 Hamish Douglass discusses why the less-threatening Omicron variant still comes with inflation implications, why he's recently invested in two companies exposed to structural growth in global travel and why today's stock market reminds him of 1999's. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund |

10 Feb 2022 - Sailing into the wind

|

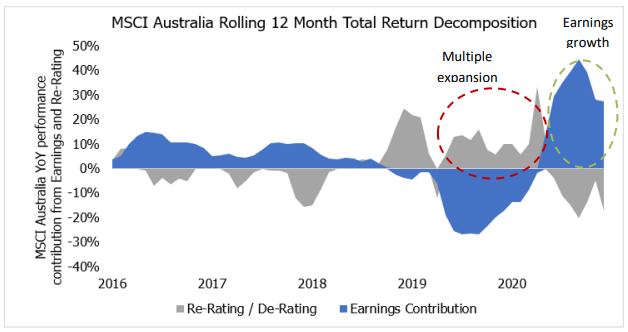

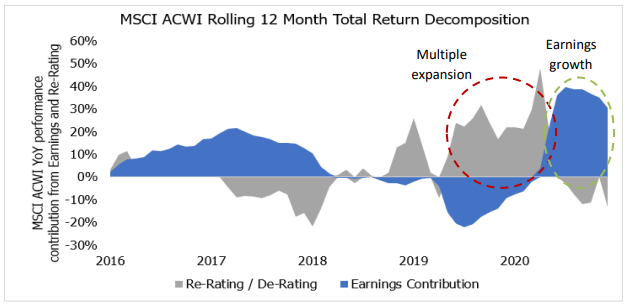

Sailing into the wind (Adviser & wholesale investors only) Alphinity Investment Management 24 January 2022 Sailing into the wind is a sailing expression that refers to a sail boat's ability to move, even if it is headed into the wind. To reach specific points, alternating the wind's direction between the starboard and the port is sometimes necessary. Equity markets similarly require the same agility to adjust for different market cycles and macro implications to deliver consistent returns for clients. The last (almost) two years of Covid-related repercussions have certainly tested even the best skippers' navigation skills and having the flexibility in your process to adjust when necessary has been invaluable. As we head into 2022 with concerns around economic growth and monetary stimulus likely peaking, the earnings cycle potentially maturing, and equity market valuations optically high, investment risks appear to be rising. At Alphinity we continue to let earnings leadership, on a stock by stock basis, guide us through the next phase in the cycle, wherever earnings upgrades may lead us (rather than being tied to a specific style or macro outcome). 2021 - A normal, abnormal yearNothing about the last 24 months since the Covid pandemic started has felt normal. Global equity markets (with Australia no exception) have however followed a surprisingly normal recession and recovery pattern, albeit faster and more aggressive than usual. Consistent with historical patterns, the first stage of the market recovery in 2020 was driven by valuation multiples expanding, with the market pricing in future earnings growth, which did not disappoint and drove the second stage of the recovery into 2021. The two charts below illustrate the similar return drivers of the MSCI Australia and MSCI World Indices, with the former enjoying stronger earnings growth, but also a larger multiple contraction at the index level over the last year. The key question from here is the expectation for each of these drivers (earnings and multiples) as we head into a new year. MSCI Australia following a normal post-recession market pattern - up c60% since the trough with the PE expanding from 14.5x to 20x, currently back down to 18x

Source: BoAML Data MSCI World has added c97% since the trough in March'20 with the PE expanding from 12x to 20x, currently back at 18x.

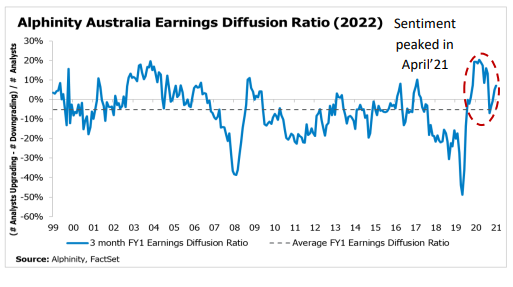

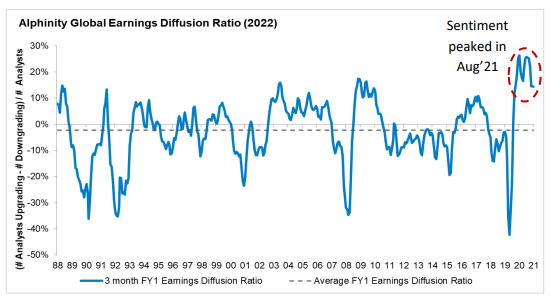

Source: BoAML Data Different points in the earnings cycle heading into 2022Global earnings revision breadth (or earnings sentiment as measured by the Alphinity Diffusion index, being the number of companies getting earnings upgrades vs downgrades) expanded to 30-year highs as analysts started pricing in the strong demand recovery and unprecedented corporate pricing power. Similarly in Australia, earnings sentiment soared to highs last seen in 2003, peaking in April 2021 driven by the early cycle commodity pullback, dropping into negative territory during lockdowns and finally stabilising in November 2021. Generally, these small upgrades still favour pro-cyclical earnings, but we are seeing some selective defensive positive earnings revisions coming through. Australian earnings cycle - Less clouding, but not yet clear

Source: Alphinity, Bloomberg, 31 December 2021 Globally earnings upgrades are still dominating, but the trend is narrowing to fewer stocks. In terms of relative sector earnings revisions, the picture is getting more mixed compared to the clear cyclical and growth leadership we have seen over the last 12 months with some defensive sectors slowly creeping into positive territory. Global earnings cycle - Still positive but losing momentum

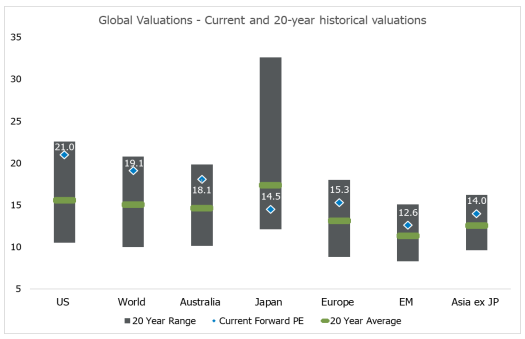

Source: Alphinity, Bloomberg, 31 December 2021 High valuations offer less support and high dispersions increase vulnerabilitiesDespite the recent multiple contractions seen during 2021, most global equity markets are still trading above their long-term averages driven in part by low interest rates and excess liquidity. Strong performance in the last 18 months has seen pockets of the market becoming particularly stretched and therefore vulnerable to material changes in earnings and interest rate expectations, real or perceived. The valuation dispersion between the highest (80th percentile) and lowest (20th percentile) rated stocks is at a record high for the ASX200 and the MSCI World Index, with unprofitable tech a particular standout. Factor and style dispersion were also extremely high during 2020, which makes sense for a year marked by very high uncertainty or a recession and extreme volatility. This dispersion has reduced a bit during 2021 but remains at unusually high levels across several styles, such as value vs growth, given the strong recovery in the economy.

Source: Alphinity, Bloomberg, 31 December 2021 Global equity markets still trading above their long-term average valuations

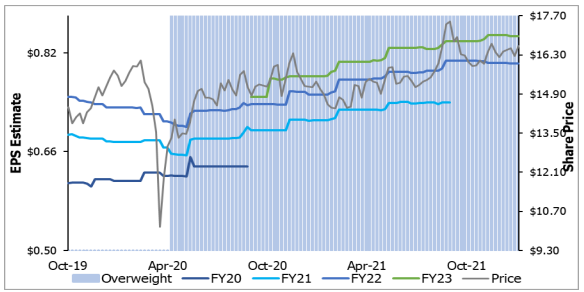

Source: Bloomberg, 31 December 2021 Adjusting the sails for the winds of changeAdd to this peaking, but still robust, global economic growth, stubborn inflation data, likely less central bank support and ongoing uncertainty around new Covid variants such as Omicron, is probably going to make navigating macro influences on markets more challenging this year. The increasing points of uncertainty suggest a more diversified, balanced approach will be required, focused on individual company stories rather than large thematic biases, with flexibility to react to material changes in the investment environment. Introducing some defensive characteristics also seems prudent, as long as you can identify the relative earnings story. Across our Australian funds we continue to follow the individual company earnings and where upgrades are coming from. Along those lines we have added to some more defensive positions such as Sonic, Amcor, Medibank and Treasury Wineries in the last few months. Global packaging company Amcor for example, offers a defensive earnings stream with strong cashflow generation and a solid balance sheet, which allow management the flexibility to do recurring buybacks and potential bolt-on acquisitions. Amcor has beaten earnings and upgraded its outlook at the last 6 quarterly reports, primarily driven by better than expected synergies with Bemis, but also better than feared passthrough of higher resin prices. Amcor's defensive qualities should see it deliver a steady return over the next 12 months and outperform the market on any potential correction. Amcor - offering a defensive earnings stream and strong cashflow generation

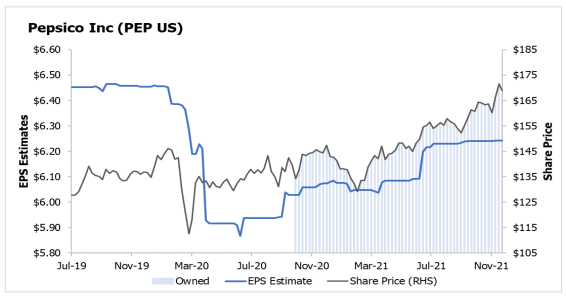

Source: Alphinity, Bloomberg On the global side, we have continued to incrementally reduce our cyclical and higher PE growth exposure in favour of high-quality defensives such as Pepsico, Nextera and Nestle. Pepsi is a high quality, defensive consumer stock with strong pricing power and under-appreciated long-term revenue growth driven by strategic reinvestment under a new CEO, a mix shift to the higher growth snacks segment, targeted M&A and market share gains in beverages. Recent third quarter results displayed broad-based strength across the business, with management committed to offsetting rising inflationary pressures by leveraging strong brand investment and innovation to drive price increases and revenue management. Pepsi - driving earnings growth through strong pricing power and innovation

Source: Alphinity, Bloomberg It seems likely that 2022 will be a more challenging year for markets, especially given the higher valuation starting point. It is through choppy waters like the present that we rely on our agile, style agnostic process to get us to our destination. As Thomas S. Monson once said, we cannot direct the wind, but we can adjust our sails. Author: Elfreda Jonker - Client Portfolio Manager |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund |

9 Feb 2022 - Global equities in 2022: Three key themes to watch

|

Global equities in 2022: Three key themes to watch Antipodes Partners Limited 02 February 2022 In this episode on the Good Value podcast (recorded Monday 31 January, 2022), Jacob Mitchell and Alison Savas discuss three key themes to watch in global markets in 2022:

They also share Antipodes' stock to watch in 2022 - Seagate Technologies (NASDAQ: STX) |

|

Funds operated by this manager: Antipodes Asia Fund, Antipodes Global Fund, Antipodes Global Fund - Long Only (Class I) |

9 Feb 2022 - Time to change your mindset: Prepare for a 5pc cash rate

|

Time to change your mindset: Prepare for a 5pc cash rate Lucerne Investment Partners 04 February 2022 The last time Australia's official cash rate had a five in front of it, the world was going through the biggest financial crisis since the Great Depression. Within the next two years, rates could be back up at that level, bringing a world of pain to borrowers, equity markets and business balance sheets. The prediction comes as share-markets around the world tumble amid expectations the US Federal Reserve will within weeks kick off the next interest rate-rise cycle. "We've already seen rationalisation start to come into the market. We can see that institutions and investors as a whole are no longer prepared to just pay up for these high-growth, expensive companies, many of which are not actually generating profits" If you look at the irrational behaviour happening over the last 12 months, it's resulted in 60 out of the ASX top 200 companies not being profitable. That's alarming. While capital market conditions were favourable over the past two years, with excess liquidity pumped into the system, these hyper-growth businesses were the outperformers. However, these sorts of businesses are highly reliant on capital markets supporting them; they've got to keep going back to the well to survive. That well will run dry quickly if rates jump up to the level, we forecast. I see the Reserve Bank kicking off its own rate-rise cycle by the middle of the year, well before the 2024 start date the central bank was tipping just months ago. The pressure on the RBA intensified last Tuesday, when headline inflation in the year to December 31 was revealed to have surged to 3.5 per cent, while underlying inflation was 2.6 per cent. Many now expecting the central bank to move this year. I am predicting that the fallout for equities from the rate move would result in the share market contracting up to 15 per cent this year. The S&P/ASX 200 Acc. was down over 6% in January on the mere suggestion of a new rate-rise cycle. "We think there's a real risk now that rates are going to increase by amount to 3 - 5 per cent over the next two years" The RBA might try and hold fire as long as they can, but then I think they're going to have to accelerate at a greater rate than what they would have preferred. You could easily see that 3 to 5 per cent occur over an 18-month period from July 1 this year. If you also think about the amount of debt people and institutions have taken on over the last few years, you lift that cost of debt from 2 per cent to 6 per cent or 7 per cent over the next 24 months and it can have dire consequences not only on the property market, but also on equity markets and business balance sheets. The key for investors looking to emerge unscathed is to ditch the recent investing mindset. "Investors who continue with the mindset of traditional investing over the next five years could risk giving away a significant amount of the wealth they've generated over the last five. Now more important than ever, investors need to apply a lot more active management to their portfolio, as opposed to the buy and hold index approach that worked very well over the past decade - invest for tomorrow, not yesterday" The alternative investment manager isn't suggesting investors completely back away from equities, but to reconsider how to best manage that equity allocation. To this point, the Lucerne Alternative Investment Fund (LAIF) has in recent months increased its exposure the energy sector, which has outperformed as constraints to supply chains continue. Ironically, this was a sector ignored by much of the market in recent times with the push toward clean energy. "We feel there is more upside in this sector and some market commentators believe oil could reach USD200 per barrel". Our message to investors out there is to get in front of this and start to think differently. Move away from that herd mentality, which only works well until it doesn't. LAIF, which actively manages a portfolio of alternative funds covering asset classes and themes including long-short equities, volatility, precious metals, resources, digital assets and convertibles, returned ~24 per cent last year, bettering the 22 per cent in 2020. For this year, the fund is tipping it can achieve an 8-12 per cent return, after delivering a return of ~1.5% In January. Author: Anthony Murphy, CEO |

|

Funds operated by this manager: Lucerne Alternative Investments Fund (Fee Class 1), Lucerne Alternative Investments Fund (Fee Class 2) |

8 Feb 2022 - Being Early is Not as Important as Being Right

|

Being Early is Not as Important as Being Right Longwave Capital Partners January 2022 As an investor, you are often urged to act quickly on the latest investment opportunity or regret missing out. For those interested in profiting from long term structural change it seems odd that we would need to act so quickly. Surely a profound opportunity that will change the world over many decades allows you time to sort the wheat from the chaff? If the opportunity is so fleeting delaying action misses all gains, then perhaps it wasn't the structural change it was promoted to be. At the end of 2021, it is now clear that the last 25 years was one of these generational opportunities to participate in the digitisation of, well pretty much everything. The question we ask: how early did you need to be? Well it turns out that when structural trends run for decades, investors are afforded plenty of opportunity to participate and capture these returns. The examples we use are flawed by survivor bias, but we think as time went on the likelihood that Apple, Microsoft, Amazon, Google and Facebook were likely to be structural winners became a lower risk assumption. What returns were lost by waiting until these became the more obvious winners? We start in 1995, when in August Windows95 launched and Netscape IPO'd (Yahoo followed in April 96, Amazon in Jun 97 and eBay in Sep 98). We have marked this as the beginning of the Internet era for public market investors. Let's start with Microsoft. Had you purchased Microsoft in August 1995 and held to end Dec 2021 you would have made 19% per annum over 25 years. If you had of waited until the dot com peak (Mar 2000) that would reduce to 11% p.a. Maybe you wanted to wait until the dot com settled. A purchase in Aug 2004 (when Google IPOd) returned 19% p.a. Maybe you had doubts about Steve Balmer and waited until Satya Nadella became CEO (Feb 2014) - you would have made 33% per annum in the almost 8 years since. In 1995, Apple was still in the wilderness. Steve Jobs had yet to return (1997) and the iPod was still six years away. Holding Apple from 1995 to Dec 2021 has returned 27% per annum (with a near death experience along the way). If you waited until the iPod launched, you got 38% per annum since Oct 2001. Maybe you waited until the iPhone launched (Jun 2007) to achieve 30.5% p.a. Warren Buffett ended up buying AAPL more than nine years after the launch of the iPhone (Nov 2016) yet has still realised a 46% p.a. return over the five years since. We see a similar pattern with Amazon (37% p.a. from IPO, 20% p.a. from dot com peak, 33% p.a. from when Warren Buffett bought in Dec 2018), Google (26% p.a. from IPO, 28% p.a. from May 2017 when Charlie Munger said "we blew it" for not buying Google) and Facebook. None of this was obvious or easy at the time. Looking backwards gives a false sense of inevitability to history that is anything but. The future for electric vehicles, artificial intelligence, robotics, blockchain and genomics may contain generational investment opportunities. Unfortunately, there are hundreds if not thousands of companies vying to be the few winners left standing and reward their shareholders as Apple, Microsoft, Amazon, Google and Facebook (and others) over the past 25 years have done. What is hidden from history are all the failures investors have endured along the way - either companies that failed to meet these lofty goals, or investor temperament that failed to hold onto the ultimate winners through an uncertain path. Flywheels or WaterwheelsAs small cap investors, Longwave invest in much younger industries and businesses than is typical of large caps. It is more likely that the industries and companies we invest in are younger than Australia's banking, mining, insurance, property and supermarket leaders. Just because we are not investing in 100+ year old industries doesn't however mean we spend our time funding businesses that are 10 months old. There is a lot of industry growth lifecycle between 10 months and 100 years - and the current wave of investment neophiles would have you believe any company more than a decade old is ex-growth. Our investment approach is to wait until the likelihood of success is more certain. Not guaranteed - because nothing is - just more certain than largely unproven early-stage companies. One measure of more likely success is the demonstration of a genuine and observable growth flywheel. Flywheels are sometimes over-used however we like the metaphor for the image of internally generated and sustained momentum. We seek flywheels that are self-sustaining. A profitable business with high growth opportunities reinvesting positive cash flows internally (capex, R&D, sales and marketing) to drive higher growth and higher cash flows and higher investments and higher growth etc. Many of the current crop of growth business look more like waterwheels than flywheels. Superficially the effect is similar (more investment -> more growth -> more investment) but the missing part is internal cash generation funding growth investments. Like a waterwheel, these pseudo growth businesses require external liquidity to keep turning. Maybe some of them really are self-sustaining and are using external liquidity to spin faster. Or maybe they are just not going to succeed should this external funding dry up. Every investor has their own philosophy and process and there are many methods we acknowledge we don't pursue that may work for those investors. Our process seeks high quality small companies that have been seasoned by the reality of free market competition to emerge as genuine flywheels, not waterwheels in disguise. Written By David Wanis, Founding Partner, CIO and Portfolio Manager |

|

Funds operated by this manager: |

7 Feb 2022 - Forecasting with Humility

|

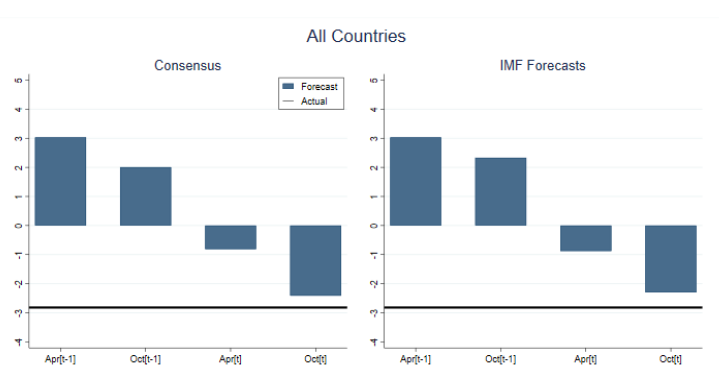

Forecasting with Humility (Adviser & Wholesale Investors Only) Merlon Capital Partners 31 December 2021 "We have two classes of forecasters: Those who don't know - and those who don't know they don't know" - John Kenneth Galbraith The problem with precisionMost forecasts begin with a starting point which is often anchored to current data. Forecasters tend to modestly extrapolate up or down from this level. This tendency to stick close to current conditions or consensus views, limits a forecaster's ability to comprehend the full range of possibilities or the impacts of more extreme circumstances. Research by the IMF explored the ability of economists to predict recessions between 1992 to 2014. It was a disaster. Economists consistently failed to predict a recession in GDP by a significant margin. Even as conditions deteriorated, economists stubbornly anchored their forecasts to the preceding non-recessionary period and adjusted their predictions downwards too little, too late. Figure 1: Evolution of Economist Forecasts in the Run-up to Recessions 1992-2014

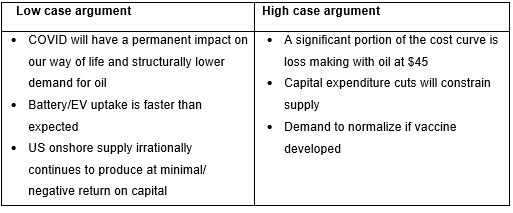

Source: "How Well do Economists Forecast Recessions?" An, Jalles, Loungani 2018Moreover, investment success is not dependent on the preciseness of predictions but instead the variance from the consensus. Equities generally price in the risks and opportunities that the market is aware of. It is often the unforeseen events which have dire consequences or large rewards. The real trick of contrarian value investing is to invest when market pessimism already prices in the most dire scenario such that it is still a reasonable investment even if this comes to pass and a fantastic one should the situation improve. A case study - Oil SearchIn May 2020, in the midst of COVID-19's first wave we initiated a position in Oil Search. This was an extremely volatile time for investors with the everchanging circumstances from the spread of COVID-19 without knowledge of a successful vaccine. The demand shock from global lockdowns, flights grounded and recessionary conditions sent some oil futures sharply into negative territory before recovering slightly to historically low levels. Volatility in oil is not uncommon. In fact, short dated oil futures historically have a standard deviation of 37%. Mixing in the unknowns of COVID, it became a very difficult proposition to forecast the oil price over the next year and beyond. By considering a range of scenarios, we instead weighed up the supporting evidence for a sensible range of outcomes.

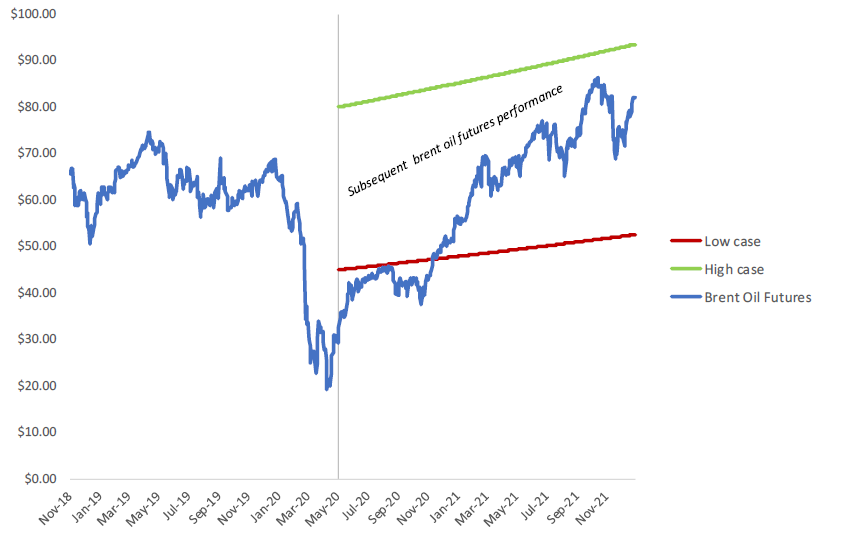

Our fundamental assessment was that supply rationalization and a return to pre-COVID demand was a more likely situation than the alternative, and hence more supportive of the high case argument. Conversely, market estimates were in the range of $40 to $65 /bbl at the time, likely a short-sighted anchoring to recent levels. The Merlon high case of $80 seemed ludicrous by most forecaster's standards. Yet, oil futures hit $80 in November of the following year. Figure 2: WTI Brent Oil Futures and Merlon High/Low range

Source: Bloomberg, Merlon Capital PartnersApplying our range of oil price assumptions yielded the valuation sensitivity of Oil Search for our high/low oil price. With substantial upside to the high case compared to a more limited low case downside, this represented a very attractive risk/reward skew. Having a range allowed us to remain acutely aware of the downside risk as the stock price changed and new information came to light. Figure 3: Oil Search Share Price and Merlon High/Low range

Source: Bloomberg, Merlon Capital PartnersBehavioural pitfallsPart of our investing philosophy is a healthy skepticism of popular opinion coupled with an awareness of our possible misjudgment and human bias. Here are two biases that we observe to be particularly pervasive in equity markets today and where we are vigilant in avoiding. 1. Recency bias. Recency bias favours recent events over historic ones. Like many living with COVID over the past two years, we commonly hear that certain trends are here to stay: Zoom business meetings, working from home, higher in-home consumption, a shift from urban centres to coastal or regional living. While we consider the possibility some of these may be permanent, we are cautious on extrapolating near-term conditions too far into the future. Notably, we saw the recency bias play out in the oil market as forecasts anchored too heavily on COVID conditions. There was little allowance in the market for oil prices to rise above $60 which led to the outsized returns when it did (and to the detriment of those who avoided oil). 2. Overconfidence and Narrow ranges. In Nicholas Taleb's book "The Black Swan" he highlights a study, where students were asked to estimate "how many Redwoods are in Redwood Park, California?" Students would respond with a range between two numbers in which they were 98% confident the answer fell into. 45% of respondents failed. They had used a range that was too narrow due to overconfidence in their ability. These students were the cream of the crop Harvard MBAs. Our human inclination is to narrow our ranges as we gain more knowledge. The more "expert" we become, the higher our tendency to overstate our abilities, and in turn our ability to forecast. And our propensity to become arrogant can blind us to risks beyond our ability to incorporate them. In December 2019, we made public a letter to the Caltex board of directors, alongside our valuation range of $20 to $40 for Caltex, in support of the Alimentation Couche-Tard proposal to acquire for Caltex for $38 including the value of franking credits. The board rejected the offer and the chairman noted our valuation range was too wide. Less than 3 months later the shares traded at $20, triggered by the pandemic, and are currently trading at $30 more than 2 years later. The Merlon ProcessWe utilise a broad scope of possibilities when evaluating companies because it is often the improbable and unpredictable that generates above market returns. It acts to limit our overconfidence in our central case and reflect on what else might go right or wrong.

To our clients and prospective clients, it can be difficult to admit that we may not know how the future might unfold. Will COVID be permanent? How will we be using the internet in the future? Will interest rates return to higher, more normal, levels? In this regard we are more aligned with John Maynard Keynes' view that "it is better to be approximately right than precisely wrong". Two years into COVID-19 the future is no less clear than when we started. This does not mean we fly blindly but rather undertake deep fundamental research to prepare for the possible outcomes. By factoring in best- and worst-case scenarios and being humbly introspective in our forecasting ability, we strive to tilt the odds in our favour. Written By Joey Mui, Analyst/Portfolio Manager |

|

Funds operated by this manager: Merlon Australian Share Income Fund, Merlon Concentrated Australian Share Fund This material has been prepared by Merlon Capital Partners Pty Ltd ABN 94 140 833 683, AFSL 343 753 (Merlon), the investment manager of the Merlon Australian Share Income Fund and the Merlon Concentrated Australian Share Fund (Funds). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed. |

4 Feb 2022 - Y2021 - The Year in Quotes

|

CY2021 - The Year in Quotes Equitable Investors 23 January 2022

It didn't start out this way intentionally but at Equitable Investors we have developed a habit of kicking off each monthly update of the Dragonfly Fund with a quote that resonated or was reflective of that point in time. We find wisdom, common sense and inspiration in many places - not just in the words of the investment greats. From Ron Barron to ron Barassi, the words we drew on for the 12 months of calendar 2021 follow.

January 2021 "Stocks that have a well-recognised brand, or a well recognised story have seen unprecedented buying relative to the rest of the market... this leaves an opportunity for investors that are willing to go the extra mile in researching stocks." ― Fabiana Fedeli, Fundamental Equities Outlook Q1 2021, Robeco February 2021 "We should be careful to get out of an experience only the wisdom that is in it and stop there lest we be like the cat that sits down on a hot stove lid. She will never sit down on a hot stove lid again and that is well but also she will never sit down on a cold one anymore" ― Mark Twain March 2021 "To make money in stocks you must have "the vision to see them, the courage to buy them and the patience to hold them. Patience is the rarest of the three." ― Thomas Phelps, 100 to 1 in the Stock Market April 2021 "The game of life is a lot like football. You have to tackle your problems, block your fears, and score your points when you get the opportunities." ― Lewis Grizzard, Don't Sit Under The Grits Tree With Anyone Else But Me May 2021 "We're guessing at our future opportunity cost... But if we knew interest rates would stay at 1%, we'd change. Our hurdles reflect our estimate of future opportunity costs." ― Charlie Munger June 2021 "There are pockets of what look like appreciable over-valuation and pockets of significant undervaluation... we can find plenty of names to fill our portfolios" ― Bill Miller, Miller Value Partners July 2021 "Those explorations required skepticism and imagination both. Imagination will often carry us to worlds that never were. But without it, we go nowhere. Skepticism enables us to distinguish fancy from fact, to test our speculations." ― Carl Sagan, Cosmos August 2021 "If the Chairman of the Federal Reserve with all the data and tools at his disposal couldn't predict what the 'market' would do, it was unlikely others could either. Which made us focus on investing in well managed, competitively advantaged, growth businesses...not the 'stock market' " ― Baron Funds founder Ron Baron September 2021 "There are two ways you can get yourself revved up - fear of failure and love of success. Personally, I like both things to be working in you, the same as you can win a game at one end of the ground and save it at the other." ― Melbourne Football Club legend Ron Barassi. October 2021 "Many people believe that investors must make the macro decision to be either bullish or bearish. Our preference is to be agnostic, objectively finding absolute bargains... we are neither bullish nor bearish. We are value-ish." ― Baupost Group founder Seth Klarman November 2021 "Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves... In trying to time the market to sidestep the bears people often miss out on the chance to run with the bulls." ― former American fund manager Peter Lynch December 2021 "Most market commentary is focused on... 'expiring knowledge'. This is the headline news that fills our screens today, which in five and 10-years' time we will look back on and realise didn't actually mean anything from a long-term investment perceptive." ― Paul Black, WCM Investment Management Funds operated by this manager: |