News

21 Feb 2022 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

||||||||||||||||||||||||||||

| CAI Global Market Neutral Fund | ||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

Investors Mutual Concentrated Australian Share Fund |

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

Investors Mutual Future Leaders Fund |

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

Investors Mutual Private Portfolio Fund |

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

Investors Mutual Small Cap Fund |

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| Polen Capital Global Small and Mid Cap Fund | ||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||||||||

|

Subscribe for full access to these funds and over 650 others |

||||||||||||||||||||||||||||

21 Feb 2022 - Managers Insights | Equitable Investors

|

|

||

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Martin Pretty, Director at Equitable Investors. The Equitable Investors Dragonfly Fundd has been operating since September 2017. Over the past 12 months the fund has returned +17.36%, outperforming the index by +7.92%, which returned +9.44%.

|

21 Feb 2022 - A company entering 2022 in high spirits

|

A company entering 2022 in high spirits Claremont Global December 2021 As the pandemic kept people at home, we saw a dramatic rise in at-home consumption of spirits and a shift in preferences towards more premium products. We believe both trends driven by the pandemic are sustainable trends. Diageo is currently one of the 14 stocks in the Claremont Global portfolio. In this article we discuss how Diageo's leading market position and unique portfolio of brands ― combined with strong category drivers ― has set the company up for long term success. Diageo (DGE: LSE)Diageo is the world's largest producer of international spirits with a portfolio of over 200 brands sold in more than 180 countries. The company owns a nearly a quarter of the top 100 western-style spirits with key brands including Johnnie Walker, Smirnoff, Capitan Morgan, Baileys, Don Julio and Guinness. Diageo is also the only western company with exposure to Baijiu, the world's largest spirit category, with a majority stake in Shui Jing Fang in China. Diageo - key brands

Source: Company website Superior execution shines in a crisisThe pandemic saw hospitality businesses (or on-trade) close across the world, which represents around one third of Diageo's overall business. However, Diageo's management was quick to adapt to changes in demand, occasions and channels. They activated in-store marketing, focused innovation towards convenience and invested in their online capability. These series of actions paid off, driving a rapid recovery in sales and saw Diageo hold or grow off-trade share in over 85% of net sales in measured markets in FY21. A portfolio that can stay ahead of the curveThe key to Diageo's success is having a well-diversified portfolio that can meet changes in consumer tastes. However, the company has also been able to acquire and build brands to shape their offer towards higher growth opportunities. Diageo's portfolio is strongly placed as they hold a leading position in four out of the five fastest growing spirits categories (see chart below). Diageo is number one in Scotch (1.7x the scale of the nearest competitor), Gin (2x the scale of the nearest peer) and Canadian Whiskey and top five in Tequila (fastest-growing portfolio). Diageo's success in Tequila (see chart below) is a good example of their ability to identify early stage shifts in consumer preferences. Diageo acquired the remainder of their stake in Don Julio in 2014 and acquired Casamigos in 2017. Since acquiring Don Julio, they have increased sales seven-fold and Casamigos eleven-fold. Don Julio 1942 (the aged version) is now the single-biggest luxury spirit brands in the US. Diageo anticipates that 50 per cent of their incremental growth from FY23-26 will be driven by Tequila, which will make the agave spirit their second largest behind Scotch by FY26. Global growth of retail sales value (RSV) by category 2020-25 compound annual growth rate (CAGR)

Source: Diageo CMD presentation Nov 2021, IWSR estimates Diageo - Tequila organic sales growth

Source: Claremont Global, company data. Past performance is not a reliable indicator of future performance. Penetration - spirits continue to be the winning categoryThe spirits category has been winning market share from beer and wine over the last decade and now accounts for 39 per cent of the total global alcoholic beverage market (Total Beverage Alcohol or TBA), which is up from 30 per cent in 2010. While this has accelerated during the pandemic, industry sources expect the consumer shift towards spirits to continue growing at 6 per cent per annum over 2020-25, which is around 3x faster than wine and around 2x faster than beer (source: Diageo, IWSR). Each year more than 50 million consumers reach drinking age which supports growth and Diageo additionally recruits over 40 million new consumers each year. Diageo is the largest international spirits producer, 1.5x the size of its nearest competitor and is well placed to benefit from the attractive category growth. However, there is plenty of room to grow as Diageo has only 4 per cent share of TBA and the company recently set the ambitious target to increase their TBA share by 50 per cent by 2030. Spirits share of TBA

Source: Diageo CMD presentation Nov 2021, IWSR estimates. Global growth of RSV by category (2020-25 CAGR)

Source: Diageo CMD presentation Nov 2021, IWSR estimates. Premiumisation - looking higher and higher up the shelfPremiumisation has been a key growth driver for Diageo as people are drinking less but opting for better quality alcohol ― whether it is moving from illicit alcohol to branded or from black to blue label. Across the industry super premium and premium price tiers have grown by 13 per cent and 9 per cent respectively over the last 10 years, well above budget friendly alternatives (source: Diageo/IWSR). While this trend has also been boosted by lockdowns, at home consumption has remained resilient as hospitality venues reopen and we also expect consumers to drink higher quality beverages while they are out. This plays into Diageo's key strength, as it generates over half of its business from the faster growing premium and super premium price tiers (see chart below). Diageo's super premium+ price tier grew 35 per cent in FY21 (see chart below). We believe the acceleration in premiumisation is sustainable as household balance sheets remain robust and consumers continue to look for affordable luxuries. In the US, the average household spends only $17 per month on spirits, which offers plenty of room for upside. Global growth of RSV by price tier (2020-25 CAGR)

Source: Diageo CMD presentation Nov 2021, IWSR estimates. Diageo total value growth by price tier

Source: Claremont Global, company data. Past performance is not a reliable indicator of future performance Why Diageo continues to be a global leaderWe are attracted to Diageo's global leading position and diversification across regions and spirits. We see Diageo as a quasi-staple, offering solid top line organic growth of 5-7 per cent (a target they recently upgraded), with an attractive and expanding operating margin of close to 30 per cent. The company has also delivered 20 years of dividend increases. Diageo's performance through the pandemic provided clear evidence in the strength of the management team and benefits from reinvestment in recent years, that has made Diageo a more agile company. Diageo is also an industry leader in environmental, social and governance (ESG) and as part of their 2030 goals have made sizeable commitments around positive drinking, inclusion and diversity and sustainability (including net zero carbon emissions across direct operations). Author: Chris Hernandez, Investment Analyst Funds operated by this manager: |

18 Feb 2022 - Carbon, Slavery and Poker

|

Carbon, Slavery and Poker Longwave Capital Partners January 2022 Efficiently adapting an integrated ESG investment process to new information inputs is essential for investors. Richer information helps us identify hidden risks in company operations and focus our engagement on weak actors. In 2021, we enhanced our in-house ESG scorecards with carbon emissions and modern slavery information and learnt a few things along the way. AGM voting season prompted us to wonder if some companies deserve a meme song: If you don't spill me baby I'll do anything I want. One of the persistent aspects of investing over the long term is that information inputs morph in response to corporate trends and regulatory reporting requirements. Investment processes need to adapt to this new information when it's relevant to investment decisions. With this in mind, Longwave was founded with the intention of always keeping an eye on the horizon and adapting to new information inputs. Our core investment philosophy never changes (that Quality small cap companies outperform over the long term). But we recognise that if we can systematically capture new information early, it may enrich or enhance our decision making on the fundamental side of our investment process. This need to adapt to new information is most obvious at the nexus of an integrated ESG approach. At the beginning of 2021 we observed the following changes in the ESG information landscape: carbon emissions data had significantly improved for small caps; companies have started to report their Modern Slavery approach and Sustainable Development Goals have started to turn up in company annual report commentary. At Longwave, our fundamental stock valuations are directly impacted by ESG scores. As more information becomes available, our research management tooling has enabled us to bring in new data and adapt our scorecards as the information landscape morphs. With this in mind, we set out at the beginning of 2021 to enhance our ESG scorecards with information on Carbon Emissions, Modern Slavery statements and SGD's. We love learning new things about companies and this ESG enhancement is no exception. In this report we share what we set out to do and what we learned and a few thoughts about how we think the information needs of ESG focused investors are likely to change in the next couple of years. Carbon We've believed for many years that the early 2020's would eventually be the turning point in the markets' focus and understanding of the gargantuan global task that climate change transition represents. One of our ESG goals for 2021 was to be able to measure Scope 1 and 2 emissions reliably and accurately across our portfolio. Up until this year, accurate GHG emissions data for small-cap companies has been hard to come by and very few companies have been reporting emissions. Our analytical needs are multiple and sit at both the portfolio and company level. We need to be able to:

This year a dataset with reported and relatively high confidence estimates became available for the small-cap universe. We incorporated it into our research management platform and using that as a base, have cross-checked it against reported information and started a conversation with some of the larger companies in the small-cap universe who appear to be outliers. As always with data projects, we learnt a few things during the process:

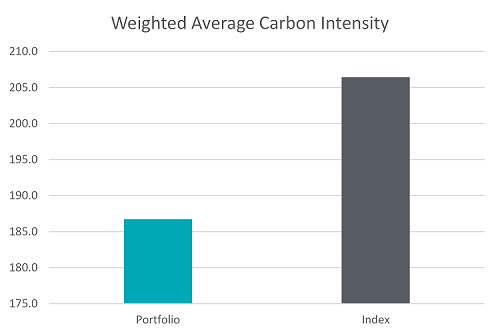

We are now able to see (at the click of a button) the Weighed Average Carbon intensity of our portfolio vs the index both at the aggregate, sector and company level. We were pleased to see that the portfolio carbon intensity is lower than the index without having expressly controlled for emissions.

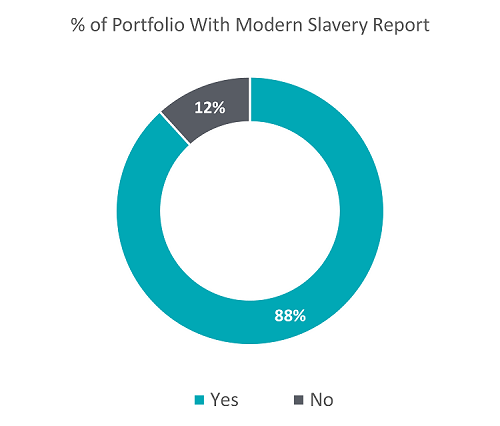

We are also able to track changes in intensity through time. Finally, we used this as an opportunity to think about how the data might be used to reward companies that are making a genuine difference to climate change transition. If we think from first principals about what has to change between 2020 and 2050, companies with emissions intensive operations will need to invest in their asset bases (probably out-of-cycle) to lower their emissions intensity. The role financial markets play in that equation is to both provide the capital necessary for the transition and to reward the improvers with a lower cost of capital. Alongside a transition of the existing asset base, financial markets have a role to play in funding new technology solutions in a range of energy market and industrial equipment verticals. When we look at the Australian small cap universe, the companies with the lowest emissions intensity tend to be in that position naturally (due to business model or industry). As a result, they are unlikely to ever have a significant role to play in moving the economy further towards net-zero. Holding a portfolio of these carbon-light businesses might feel good, but in practical terms, your incremental capital investment (reinvested profit sitting inside each company you own) isn't actually being spent on the effort to transition to net-zero. On the other hand, some of the more emissions intensive businesses (such as Viva Energy) have a significant role to play in transitioning their asset base to net-zero and in the absence of government policy can choose to invest or not invest. We think companies who have higher emissions intensity but show big improvements year on year because they're investing incremental capital to facilitate transition should be rewarded for their efforts. And we think investors who truly want to ensure their money is contributing to transition in the most impactful way should be thinking about how their captive incremental dollar of capital spend is being put to work. Over 2022 and beyond we will use our new dataset to explore these ideas further. Modern Slavery In 2018 the Australian Government passed the Modern Slavery act. Any business with revenues over $100m is required to prepare a modern slavery report that outlines risk of exposure to modern slavery in the operations and supply chains of the company. These reports are supplied to the Australian Government and are generally made public on company websites. Our objective in incorporating Modern Slavery into our Social scorecard in 2021 was to analyse the statements produced by our portfolio holding companies and understand how each company identifies and manages the risks. Modern Slavery is what we think of as a slow-burn hidden reputational risk. A public exposure of particularly bad corporate actors has the potential to lead to large customer boycotts, fines or the need to re-point a global supply chain to higher cost suppliers. A better understanding of just how focused a company might be on these hidden risks can help us avoid or weight the portfolio away from companies with higher exposure. We are now able to see at the portfolio level, what percentage of our portfolio isn't reporting on modern slavery. We will use this to guide some of our ESG engagement in 2022.

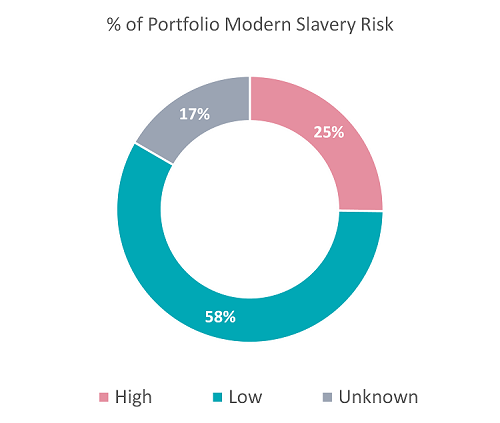

We are also able to see the categorisation of our portfolio (and each company) into high, low and unknown risk. Again, this will help us form targeted engagement in 2022.

This process was rich with learning outcomes:

We will use these learnings to further enhance our qualitative data capture on modern slavery over 2022. Proxy Voting Observations And finally to Poker. We are often blown away by the greed which can be on show in the annual ritual of renumeration reports and votes. Philosophically, we believe that its fine for management to be paid for performance, but our active voting policy clearly spells out that we need to see appropriate and transparent hurdles. What's unique about Australia is that shareholders have the 2-strikes and a board spill tool at their disposal (if greed morphs into avarice). Nine companies in our systematic portfolio this year had board-spill motions put to shareholders. But within that 9, three stood out and prompted a discussion of what we term board-spill poker. Board-spill poker is when a board decide (after a first strike), to make either minor or no changes to the renumeration structure and put it back to shareholders. We can only assume they are intending to call the bluff of the shareholder base (most likely under pressure from founder managers). The remuneration report votes are advisory only, so if shareholders are unwilling to use the consequence option as it was intended, it's a toothless tool. In the absence of material personal consequences for being 'bad actors', the renumeration practices can continue unabated. By way of example, a well known retail company received a 41% AGAINST vote to its renumeration report (second strike), but a full 95% of investors voted AGAINST the board-spill motion. We are happy to say that Longwave was in the 5% of investors who decided that a consequence tool needs to be used. We will be interested to see the 2023 cycle of renumeration reports from these companies, but we wouldn't be surprised if there is no material change to their renumeration practices. Some of the significant vote issues we dealt with over the primary AGM season included 3 board spills, 2 shareholder resolutions and a range of renumeration structures that didn't meet our standards. A healthcare company we own continued to increase the CEO's base salary above inflation, despite having awarded an extremely large LTI package in 2019, followed by a 75% base salary increase in FY20 and large one-off retention bonuses. We had voted for the CEO LTI package two years ago, however we believe base salary increases continued to be excessive. We felt if didn't vote for a spill motion, the directors were unlikely to listen to a significant shareholder issue. A resources company we own put the same renumeration framework to shareholders 2 years in a row after a 93% vote against the Rem report in 2020. The board spill was an easy decision to make; there had been no change to the company's remuneration framework compared to the prior years and it really did solidify our concerns about board independence. We subsequently voted for board candidates (a mix of independent and major shareholder aligned) who we think will better align the renumeration structures to the economic interests of shareholders. Another resources company we own had a shareholder resolution put up that would have required the company to disclose, in subsequent annual reporting, a plan that demonstrates how the company's capital expenditure and operations for its coal assets will be managed in a manner consistent with a scenario in which global energy emissions reach net zero by 2050. We voted FOR this resolution as we believe that improved understanding of financial scenarios for capital allocation and cash flows back to shareholders under a net zero by 2050 scenario would be useful. It prompted us to think about a world in which coal asset-owners publicly publish their responsible shutdown plans matched to transition and how that might impact pricing of the equity. Unfortunately, the resolution was defeated. Finally, a founder-led telecommunications business we own sought to issue options to non-executive and executive directors because of the dilution they had suffered after successive capital-raises to fund the company's acquisitive growth strategy. The board of this company is non-independent. Executives and NED's are adequately cash compensated, and Executives also have in place adequate STI and LTI structures. We voted against this options issuance as we didn't believe the options were appropriate for directors. Options create alignment differences with shareholders which may compromise independence. Additionally, the reason proposed was to counter equity dilution from new acquisitions directors suffer - however all shareholders suffer similar dilution with no options granted, and it is the value accretion from the transaction which is required to add value over and above this dilution. Looking into 2022, as we increase our standards and engagement on environmental and social issues we may use director voting as a way of communicating a lack of action by boards on these matters. Written By Melinda White, Equity Portfolio Manager |

|

Funds operated by this manager: |

18 Feb 2022 - Everyday Respect: Rio Tinto's harmful workplace culture

|

Everyday Respect: Rio Tinto's harmful workplace culture (Adviser & wholesale investors only) Alphinity Investment Management 08 February 2022 Workplace harassment is a serious concern that prevails across the Australian miners. In February 2022, Rio Tinto (RIO) published the findings of an independent review of its workplace culture, a project it pro-actively commissioned in March 2021 to assess whether harmful, discriminatory behaviour occurred within its operations, and if so its extent. The eight-month study was conducted by former Australian Sex Discrimination Commissioner Elizabeth Broderick. It consisted of more than 10,000 people sharing their personal experiences via online surveys as well as 100 group listening sessions, 85 confidential individual listening sessions and close to 140 individual written submissions. We acknowledge the bravery of all the individuals who raised their voices and shared their stories. As shareholders of RIO, we commend the intent and transparency of the report, which should be a catalyst for positive change in the mining industry. Its findings are nonetheless confronting. We are saddened and disappointed by the extent of the bullying, harassment and racism revealed in the review. The report indicates these behaviours are systemic across the organisation, suggesting a broader cultural failing among its Australian mining company peers. Reading the statistics alongside witness recounts emphasises the severity of the problem: 28% of women and 7% of men have experienced sexual harassment at work; 21 women reported actual or attempted sexual assault; and 40% of men and 32% of women identifying as Aboriginal or Torres Strait Islander had experienced racism, as well as discrimination reported against other ethnicities. RIO's workforce is still close to 80% male despite efforts to increase diversity. While the report itself is deeply concerning, we give RIO, and particularly its renewed board and senior management team, credit for proactively launching such a comprehensive examination. The report is not just an act of transparency by RIO: the purpose of the 26 recommendations in its Framework for Action is to demonstrate the company's intent to propagate cultural change well into the future. As investors, the insights and recommendations are eye-opening and will prove valuable in our engagements with RIO and with other companies. Being the first of the Australian mining companies to publish its findings, the degree of media attention and criticism of the report is unsurprising. However, these issues do not appear to be confined to RIO alone. For example, BHP revealed last August that is had terminated 48 employees in the previous two years over sexual harassment claims. Last year's Western Australian parliamentary inquiry into the treatment of women at fly-in-fly-out mine sites received many submissions from mining companies, oil and gas companies, unions and other organisations involved in the industry. This suggests the issues are sadly widespread. Balancing our engagement tone We believe it is important that investors are careful in how they engage with companies that transparently report on difficult topics. If investors are too critical, it will likely deter further disclosures and honest discussion on problems and solutions. It could also discourage other companies from sharing detailed reports. But rewarding disclosure alone, without providing constructive feedback and continuing to engage and monitor progress, won't necessarily drive improvement. It is a double-edged sword and we need to think deeply when deciding how to respond. Instead of striking the messenger, we believe we should recognise RIO's courage in its transparency, focus on fully assessing the situation, and just as importantly, consider the actions that will substantively address the issues raised. So, what next? Evidence suggests that these issues are not confined to RIO alone. We therefore expect that other miners, mining service providers, and oil and gas companies should consider the findings of the report, and implement similar reviews into their own cultures. As investors, we see the findings from the RIO report as an opportunity for us to:

We have since conveyed a letter to investee companies in the mining, oil and materials sector, and others that might face similar issues. It introduced our concerns with the report findings and intent to open the conversation on culture and safety in upcoming engagements. We view this as a chance to raise the bar on how workplace culture is addressed in the resources industry and in Australia more broadly. Attitudes towards heritage management were transformed after the Juukan Gorge incident in 2020, and we now hope to see a similar material shift in the way the management of sexual harassment, bullying and discrimination is approached. Author: Moana Nottage, ESG and Sustainability Specialist |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund |

17 Feb 2022 - Which retailers have weathered the market storm?

|

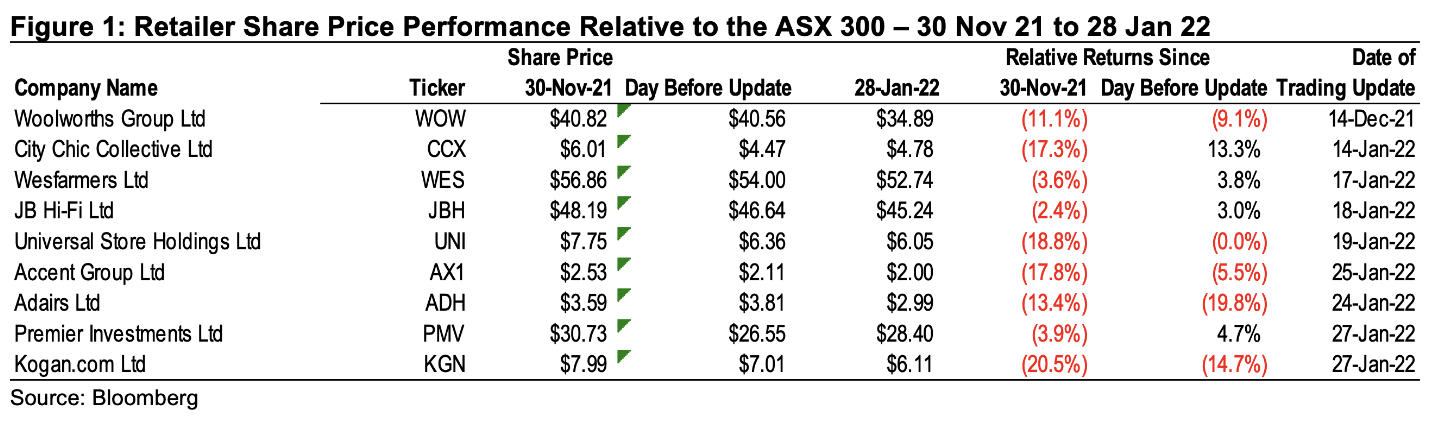

Which retailers have weathered the market storm? Montgomery Investment Management 04 February 2022 In response to recent trading updates, the share prices of many listed retailers have been hit for six. With retail sales falling short of expectations, supply chain disruptions, and the risk of excess inventories, some investors have been spooked, and have headed for the exits. Happily, the price falls have not hit every business, and it's interesting to see which retailers have won the market's approval. A number of retailers have released trading updates in the last couple of weeks. It has been a volatile period for retailers, with the 6 months starting with lockdowns in New South Wales and Victoria. The opening up of these regions was greeted by the market with an expectation of a surge in consumer spending heading into Christmas. Then the Omicron variant took hold, with self-imposed lockdowns severely reducing foot traffic in stores during the later parts of December. This was complicated by its impacts on staff availability and supply chain capacity, adding increased costs and stock availability issues to what was already going to be a period of lower than expected sales. With sales not meeting expectations, on top of a lengthened supply chain due to disruptions, the risk of excess inventories has also increased for the retailers over the last month. Looking at the performance of the retailers that have reported trading updates since mid-December, most have underperformed the market since the end of November. However, most of the underperformance occurred prior to the release of the update, highlighting that the market had already started to factor in a weakening outlook as a result of the Omicron wave. Almost half of the companies have outperformed the broader market since the release of their updates, while the larger companies have generally outperformed the small retailers.

Of course, these impacts are likely to be temporary, but the duration remains unknown at this point and the market does not like uncertainty. The City Chic and Premier Investments trading updates were better than the market feared, with sales holding up better than competitors and more limited disruptions to their supply chain to date. JB HiFi's performance through this period has been better than the market had expected with robust demand for appliances and consumer electronics, while gross margins remained well managed despite increasing freight costs. Wesfarmers noted a material impact on its Kmart and Target operations, while Catch had been impacted by inventory clearance and slowing sales growth as it cycles a difficult comparable period. There has also been a material step up in costs to manage the pandemic adding to the increased investment in the digital part of the business. Sales at Officeworks were also negatively impacted by the combination of lockdowns and omicron in the period. While the performance of these businesses was materially worse than market expectations, the other businesses within Wesfarmers' portfolio offset this deterioration, in particular its chemicals and Bunnings operations, with overall group earnings meeting market expectations. As a result, Wesfarmers has been one of the better performing retailers since the end of November. What is happening to small cap retailers?The share prices of the smaller retailers have been relatively poor performers. This is likely due in part to the more momentum driven nature of the small cap market. The trading updates from The Universal Store and Accent Group indicated that after an initial jump in sales upon reopening in November, sales in December progressively deteriorated. Like for like store sales growth was negative for both companies in December. Universal performed better than Accent through this period but conditions are likely to remain tough through January. The positive was that inventories were in line with normal levels despite the weaker sales outcome. This could deteriorate in January, but the balance sheet of both companies remains in good shape, and a pipeline of strong new store roll out reduces the risk of a build-up of excess and ageing stock. The greater risk is likely to be a shortage of stock if supply disruptions continue through the year. Adairs had been expected to hold up through December given the apparent strength in the hardware and other home categories. It reported sales that were slightly weaker than market expectations, but of greater concern was the dramatic reduction of margins in the period as a result of rising supply chain and freight costs as well as increased discounting to clear stock. Higher staff and warehouse costs created additional operating leverage along with the step up in marketing investment for the digital businesses. The market had not factored the same degree of risk into the Adairs share price. Consequently, the market reaction to the miss was far greater than for other retailers. The question is whether this overstates the medium to long term risk given that at least some of the cost increases that caused the margin miss, such as running the old distribution centre in parallel and elevated staff and freight costs, are temporary. Written By Stuart Jackson Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

16 Feb 2022 - Sustainable Strategy Update

|

Sustainable Strategy Update Magellan Asset Management January 2022 Dom Giuliano, Deputy CIO and Head of ESG at Magellan, provides colour on some promising renewable-energy stocks, the efforts three portfolio companies - Amazon, Eversource Energy and Nestlé - are making to reduce their carbon footprint, and new investment Booking.com. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund |

16 Feb 2022 - Public & private - perfecting the blend - Part 2

|

Public & private - perfecting the blend - Part 2 (Adviser & wholesale investors only) CIP Asset Management January 2022 Continued from yesterday's article - click the NEWS tab at the top of the screen to see our Newsfeed As we noted in part one of our recent primer on private and public credit markets, Public and private - perfecting the blend, the asset class of fixed income has changed dramatically in the past few years. Refer to part one to understand these aspects of present-day credit:

In this conclusion, we examine how co-mingling public and private credit in a single portfolio can be an attractive investment. THE LIQUIDITY TRADE-OFFS BETWEEN PUBLIC AND PRIVATE DEBTIn contrast to private markets, public debt market liquidity, while still ample in some areas like government bonds and bank debt, has become less abundant in the wake of post-GFC regulations that have made "warehousing" securities more capital intensive for market-making investment banks.

Furthermore, with bank market makers holding fewer securities in inventory and dedicating less capital to trading activities, the ability of the capital markets to accommodate rapidly shifting investor flows is compromised. This is exacerbated by different characteristics of the investor base for public debt - with a much higher concentration of leveraged investors who use repo or prime brokerage financing for their government bond holdings and most liquid corporate bonds, magnifying liquidity risk when fundamentals shift. This dynamic doesn't exist to nearly the same degree in private markets, insulating them from these leverage-driven liquidity events that are becoming more common in public markets. Moreover, liquidity is becoming more concentrated in the market's largest public credit issues, which often have large sector concentrations to bank financial credit, a trend that is particularly acute in Australia.

Source: Bloomberg, 19 October 2021 This has already shown to be exacerbated in "risk-off" market environments, as we saw in March 2020. In contrast, private debt markets typically finance smaller companies in less cyclical sectors and have limited exposure to the types of businesses that employ a steady stream of short-term funding, suggesting less exposure to funding risk in private debt markets than in public markets. Examples include banks and large corporates with access to the commercial paper market or who utilise factoring arrangements such as that facilitated by recently collapsed Greensill Capital. This all suggests that the liquidity trade-off for private debt investment in the future may not be as high as it has been historically and will also present a considerable opportunity for credit investors with the flexibility to take advantage of dislocated markets. This is particularly apparent as risk premiums in public markets have declined over time. Time series of risk premiums in public fixed income markets

Real ST Rate is the short term nominal yields less short term break even inflation. Inflation Premium is nominal short term yield over the Real ST rate. Duration premium is the difference between the long term nominal yield and the short term nominal yield. IG Credit Risk Premium is the difference between the investment-grade nominal yield and the risk-free nominal yield (duration adjusted). HY Credit Risk Premium is the difference between the high yield and investment-grade yields (duration adjusted). Source: Bloomberg, ICE BAML Indices, CIPAM calculations On the other side of the coin, private debt presents investors with a differentiated opportunity set that may complement their public debt holdings. Given the complexity of sourcing, structuring and analysing securities in the private markets relative to the public markets, a particularly skilled and sizeable private debt manager may have a notable advantage over the less-adept competition that can't leverage scale to the benefit of their investors.

Furthermore, since private debt strategies typically deploy investor capital over a multiple-year period rather than all at once, managers are structurally positioned to take advantage of shifting opportunities and valuations as they arise. And the limited liquidity in private debt suggests that in difficult market environments investors may be less adversely affected by the distressed selling of other investors and can often better control the ultimate outcome of an investment. THE CASE FOR COMBINING PUBLIC AND PRIVATE DEBT IN ONE PORTFOLIOHaving established that the liquidity divide between public and private debt markets is more nuanced than meets the eye, it stands to reason that perhaps there are good reasons that the two asset classes can coexist in the same portfolio.

However, unlike private equity, where a buyer must be found either by listing the asset on public markets, trade sale or selling to another private equity sponsor, in private debt markets the portfolio manager can manage the liquidity profile of the asset pool through the maturity and/or amortisation profile of the debt itself. This is a very important distinction between the two asset classes, and the critical reason why blending public and private debt in a single portfolio is possible when compared to managing public and private equities. Firstly, the illiquidity premium is also more valuable in a low-rate environment as its contribution to total return becomes more meaningful, as can be seen below. As returns from this risk premium are driven by very different factors to cash rates, duration and credit risk, it thus adds considerable and meaningful diversification to both a blended public/private credit portfolio as well as to a broader multi-asset portfolio. ISOLATING THE RETURN DRIVERS IN CREDIT

Source: CIPAM Calculations, August 2021 In addition, the traditional advantages of robust security selection and asset allocation processes on the public-only side are further enhanced by the differentiated opportunity set available in private markets. Compared to distinct public and private portfolios, a one-portfolio solution can offer investors:

A combined public/private portfolio also has an edge in capitalising on stressed financial conditions, as liquidity at the total portfolio level can be deployed across both public and private markets as appropriate to take advantage of market dislocations. Put another way, it enables investors to average into private debt markets across the cycle in a low-risk way, lowering the timing risk that one might otherwise face putting capital to work in a private-debt only strategy that needs to be fully invested as fast as possible irrespective of the asset class relative value on offer.

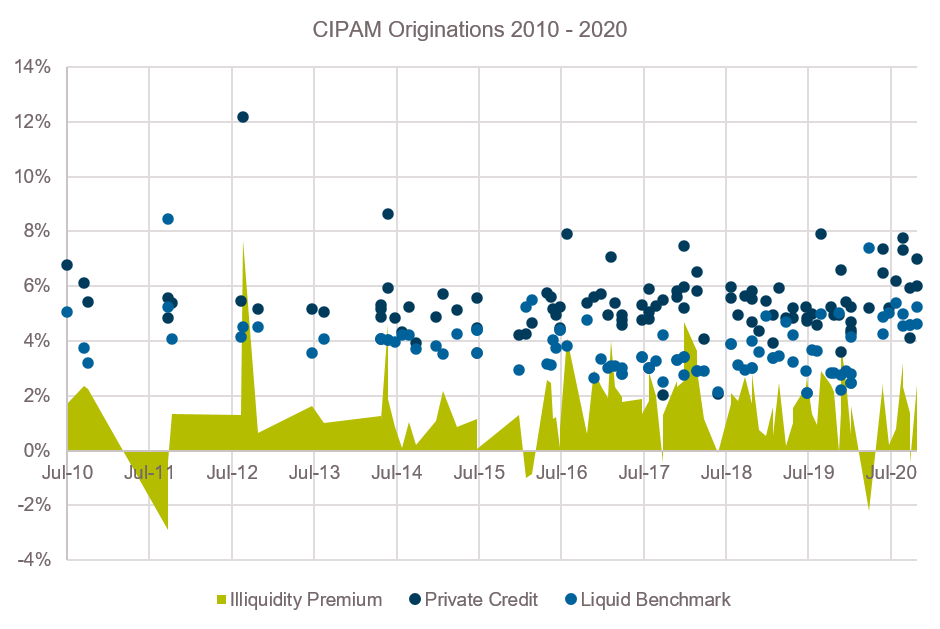

Furthermore, if you take the perspective that illiquidity premium is a real risk premium in the same vein that credit spreads or duration/term structure are as per above, then it can be helpful to analyse how it behaves relative to these other traditional fixed income risk premiums. The variation in illiquidity premiums reflects the inefficiency of private markets, meaning there is a cyclical and idiosyncratic component. Amidst CIPAM's historical deals, for example, historical average illiquidity premiums are 2.2% but there is significant variation. Anecdotally, it appears that the level of the risk premium is lower when public credit spreads tighten (i.e. when public markets are performing well) and higher when they widen. Historical illiquidity premiums in Australian and NZ credit

Dots represent a three-year discount margin on CIPAM-originated private deals. Liquid benchmark is the margin on a three-year bond of the same credit rating as the internal rating on the CIPAM private credit transaction While it may seem counterintuitive, managers of combined public and private debt strategies can also utilise market liquidity to their advantage. In times of dislocation within the liquid markets, new issue volume can slow due to heightened uncertainty. During these periods, agile managers can fill the void by providing much-needed liquidity to companies that might otherwise be able to tap public markets, often with enhanced terms. In addition, structures can be more lender-friendly due to the reduced number of financing solutions available.

Institutional and retail investors need liquidity for any number of reasons. We would argue that asset managers can deliver more attractive liquidity characteristics and capture attractive illiquidity premiums across both public and private debt markets in a combined portfolio than in separate liquid and illiquid mandates that are run in parallel. By delegating this asset allocation to the manager who is closest to liquidity conditions and relative value opportunities across both sides of the public/private spectrum, you can remove many of the frictions faced by an asset allocator having to manage these liquidity demands themselves and give them a known product-level liquidity profile (e.g. monthly liquidity with a 10% gate per month). Part of the liquidity enhancement in a one-portfolio solution is simply a function of the structure of some private investments. The short duration and amortising features typical of private securitisation deals create natural liquidity over time, for example, while private corporate or real estate debt issues also may generate pre-maturity liquidity events should the interest rate and spread environment incentivise borrowers to prepay their loans.

For example, short-duration public investments such as asset-backed securities or investment-grade floating-rate securities can be added to maximise portfolio income while also providing funding, over time, for private investments. Asset allocators running separate allocations or products are less able to do this as they won't be intimately familiar with the amortisation of the private debt profile and/or may have to hold zero-carry cash to fund capital calls for closed-ended private debt allocations with uncertain timing. As the opportunity set evolves and expands - particularly in diverse private markets - combined portfolios may be better positioned to capitalise on innovative new structures as well. This could include innovative structured finance arrangements where unique economics can be extracted by virtue of meeting unique needs (for example, regulatory capital relief structures for banks or unique securitisation arrangements for non-bank lenders or other types of corporates). INVESTOR APPLICATIONS OF COMBINED PUBLIC AND PRIVATE DEBT PORTFOLIOSA product or mandate offering a combined public/private debt strategy can be suitable for a range of investment objectives. These include: 1. Absolute return or higher targeted alpha strategiesBroad and flexible strategies tend to lend themselves to higher absolute or relative return objectives, as the expansive opportunity set naturally presents more possibilities. In addition, as any solution offering a meaningful private debt allocation is very unlikely to offer daily liquidity unless it is prepared to take significant fund lock-up risk, the greater flexibility public/private mandates have in deploying capital can help make absolute-return objectives more achievable, particularly if interest rates rise and credit spreads widen through avoiding redemption risk at the worst possible time and thus enabling higher conviction investing during times of market stress. 2. Liability-aware strategies or goal-based investment approachesFor investors operating in a liability-hedging framework or managing portfolios designed to fund certain future spending objectives at points in time (goals-based investing), public/private debt portfolios offer a number of advantages. For many of these portfolios, this type of highly opportunistic strategy can help generate additional returns and income as a complement to the liquid, high-quality investments held to match those liabilities or goals. In addition, given that many such portfolios have less need for current liquidity than traditional portfolios, we believe that a public/private combination can be beneficial to target higher income and returns and thus drive higher plan funding levels or probability of meeting the specified goal. 3. As a complement to core fixed incomeWith an environment of low interest rates, relatively low credit spreads and potentially declining diversification benefits from duration exposure, we believe investors also should consider an opportunistic-type allocation as a complement to their core strategies. Introducing private debt via a combined public/private portfolio can offer investors modest exposure to this market segment - and its potentially higher income and return levels and diversification benefits - without the complexity and with greater liquidity than a separate private debt allocation would demand. 4. As an alternative to traditional credit strategiesCombined public/private portfolios in one strategy potentially can be used as part of a long-term allocation strategy, allowing managers to deploy capital into private debt opportunistically over an extended period of time whilst maximising carry from public markets and benefiting from the market intelligence and a consistent approach to relative value assessment obtained through activities in both markets. With relatively low yields currently available in public markets, this type of unhurried approach may prove attractive to some investors. CONCLUSIONSThe traditional way of looking at both equity and fixed income asset classes is to divide them strictly along public and private market lines, and to allocate to separate strategies accordingly. While the nature of private equity favours highly binary and time-dependent liquidity profiles, hindering the ability to dynamically allocate across asset classes holistically from a relative value perspective in the same portfolio, the divide in liquidity between public and private credit is much more blurred. Furthermore, the liquidity premium itself has characteristics of being its own asset class from a diversification perspective, applying to both public and private debt assets, and time varying in quantum across the cycle. As demonstrated above, these asset classes have complementary qualities that can be exploited to efficiently manage exposures throughout the cycle, while building a portfolio that provides diversification and yield premium relative to traditional fixed income. Furthermore, an allocation to both public and private credit within a single portfolio management approach maximises an investor's ability to take advantage of dislocations across both markets. Co-authored by: Sam Morris, CFA - Senior Investment Specialist, Fidante Partners & |

|

Funds operated by this manager: |

15 Feb 2022 - Public & private - perfecting the blend - Part 1

|

Public & private - perfecting the blend - Part 1 (Adviser & wholesale investors only) CIP Asset Management December 2021 The structure and valuations of fixed income markets have changed dramatically over the past decade or so. Most obviously, interest rates have decreased dramatically and the compensation for taking traditional forms of fixed income risk have declined in tandem. Some of these changes may unwind as we enter a world of higher inflation and withdrawal of central bank stimulus measures over the coming years, but other changes are much more structural in nature. In particular, regulations requiring banks to hold more capital are likely to persist, with an enduring impact being a withdrawal of banks from competing in certain types of lending and reducing their balance sheet commitments to liquidity provision in public credit markets during times of stress. This is creating both challenges and opportunities for asset managers and their investors as alternative sources of credit provision whilst navigating a disrupted liquidity environment and low returns for their traditional liquid bond portfolios. As such, institutional and retail investors have been forced to adjust their approach to fixed income because of these changing dynamics, with the embrace of private debt markets alongside exposure to traditional public credit allocations in an effort to boost returns. Private debt is a complex asset class that can offer a differentiated opportunity set with unique return, risk, liquidity, and diversification benefits. Part 1 of this paper will explore the issues above and, while Part 2 will examine how co-mingling public and private credit in a single portfolio can offer a solution to many of these issues and may offer one of the best opportunities to maximise the potential of each. Distinguishing between public and private debtPrivate credit is often also referred to as "direct lending" or "private lending" or even "alternative credit." Irrespective of the name, they are basically loans to borrowers originated directly by a non-bank asset manager rather than via an intermediary. Unlike traditional bond issues or even syndicated loans (such as US term and leveraged loans), there is little intermediation between borrower and lender. The lender basically arranges the loan to hold it, rather than originating to sell it. As such, the borrower and the lender have a much closer and more transparent relationship, directly negotiating the terms of the finance. In a recent Economist magazine special report on the asset management industry, one of their concluding forecasts was that private debt would become an increasingly important asset class. As the Economist notes,

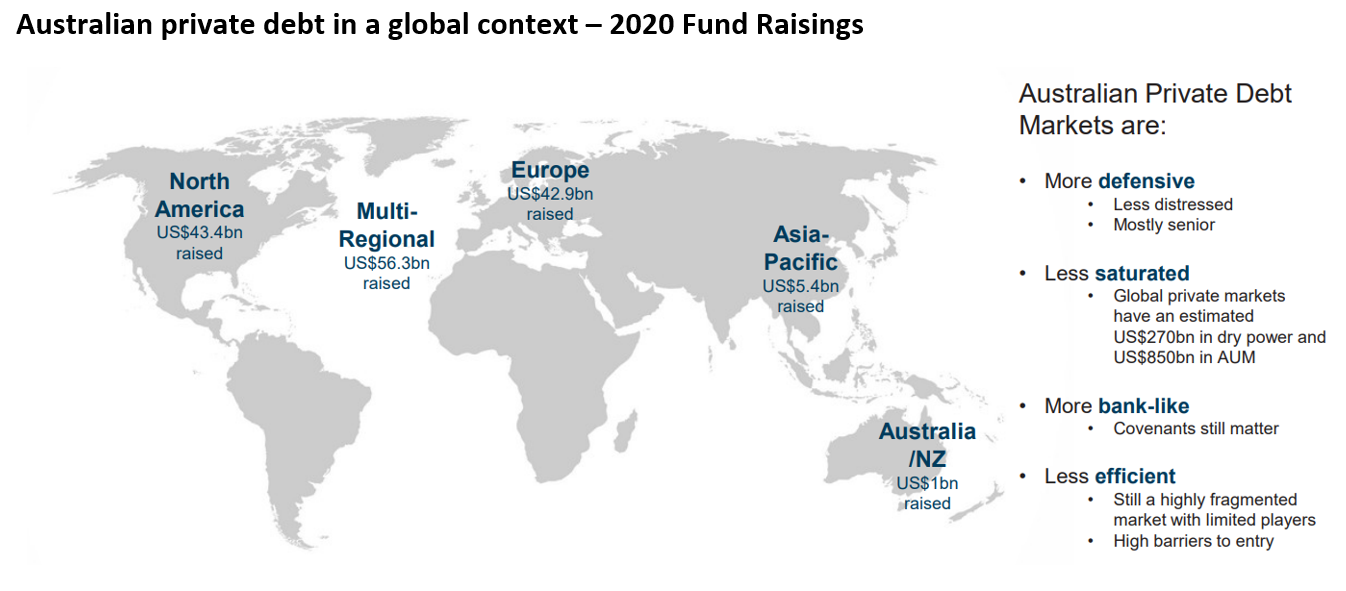

Private debt is now a significant subset of broader credit markets globally. Underlying exposures include private loans to mid-size or non-listed corporates (often backed by private equity sponsors), commercial, industrial and residential real estate loans that sit outside the risk appetite of the banking sector, as well as loans secured by securitised assets such as mortgages, other loan receivables (particularly from non-bank lenders) or 'alternative' cashflow streams such as royalty streams, insurance premiums or solar panel lease payments. A key distinction-and advantage-across many types of private debt is the ability to customise lending terms thus exercise greater control over credit risk protection compared to public markets. Private credit investors can influence or dictate elements such as coupon and principal payment schedule (amortisation), loan covenants, information access and control rights, tailoring investments to their desired liquidity, return and credit risk profile. In addition, this customisation does not come at the expense of returns. By not introducing an intermediary to arrange the transaction, the fees otherwise paid to the arranger can be shared between borrower and lender, enhancing the overall return profile of the investment relative to syndicated transactions. Australia remains a relatively nascent market compared to offshore growth in private debt assets and corporate credit generally. But this comes with significant advantages due to the lack of competition from asset managers bidding down yields and credit protections to obtain deal flow means that underwriting standards and margins remain strong.

Sources: Private debt investor, Prequin, CIPAM Estimates What is the Illiquidity premium and why does it exist?Any risk premium in investing can be thought of as a transfer of economic rents from risk avoiders to risk takers. In equities, for example, there is a strong, academically established risk premium for investing in small cap companies. This is theorised to exist because these stocks often have less liquidity stemming from their lower overall market capitalisations and lower free float for external shareholders as well as less diversified revenue streams and/or robust balance sheets. In many respects, similar arguments can be made for the existence of a higher rate of return expectation for private debt over public credit.

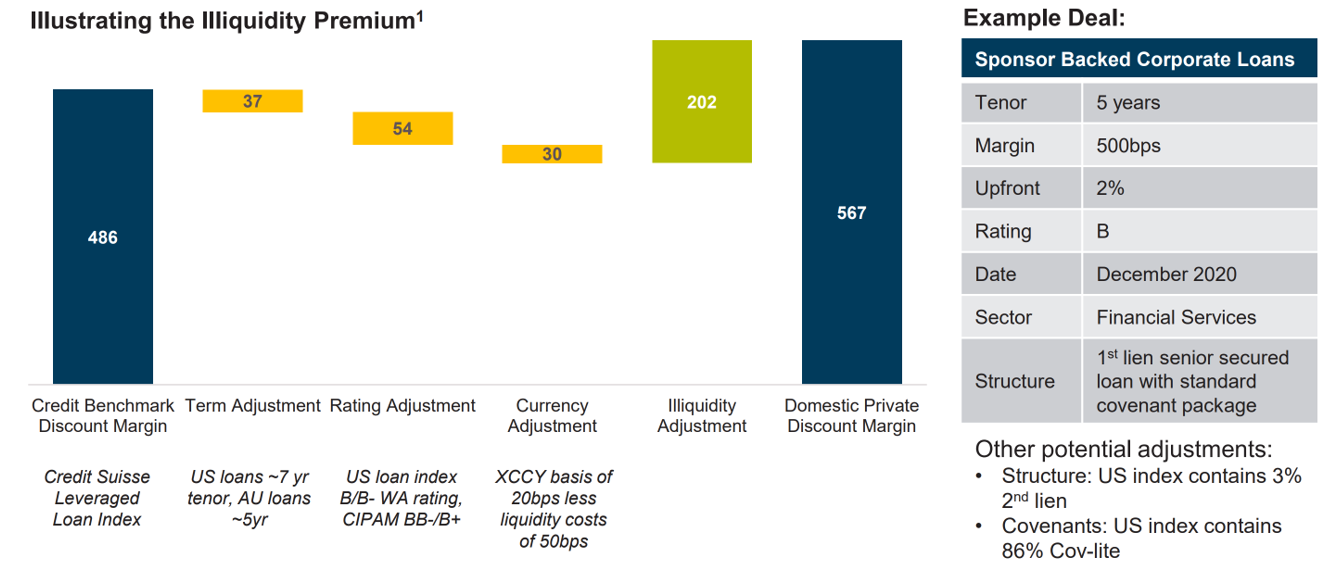

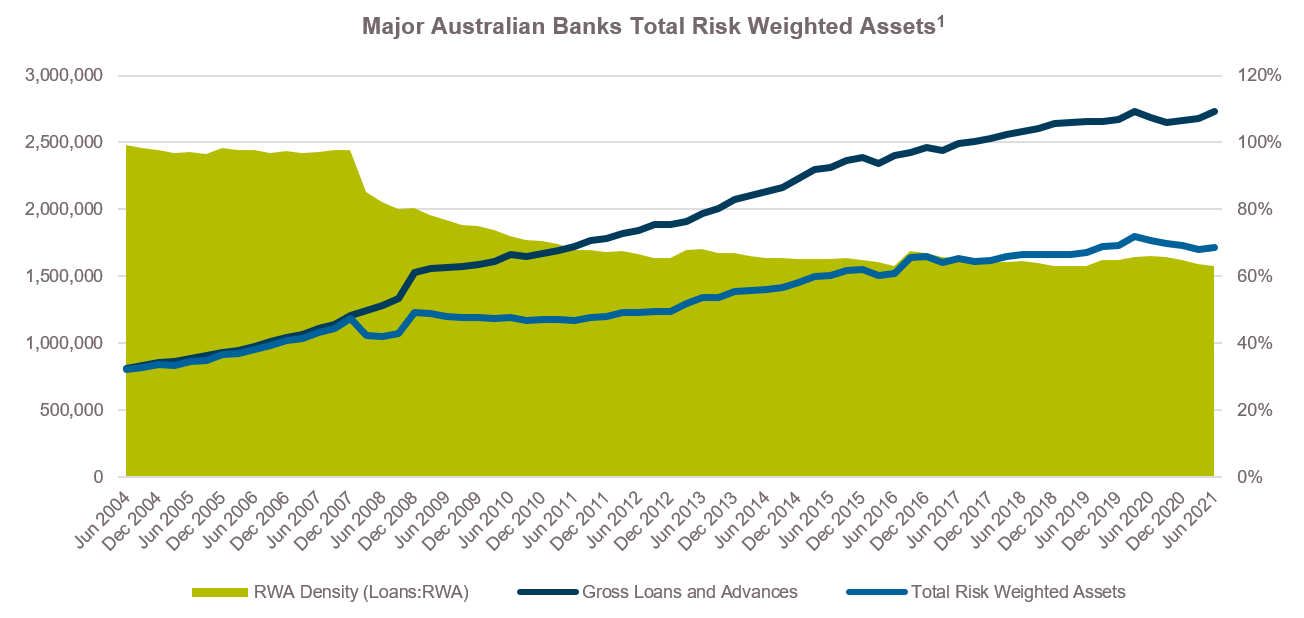

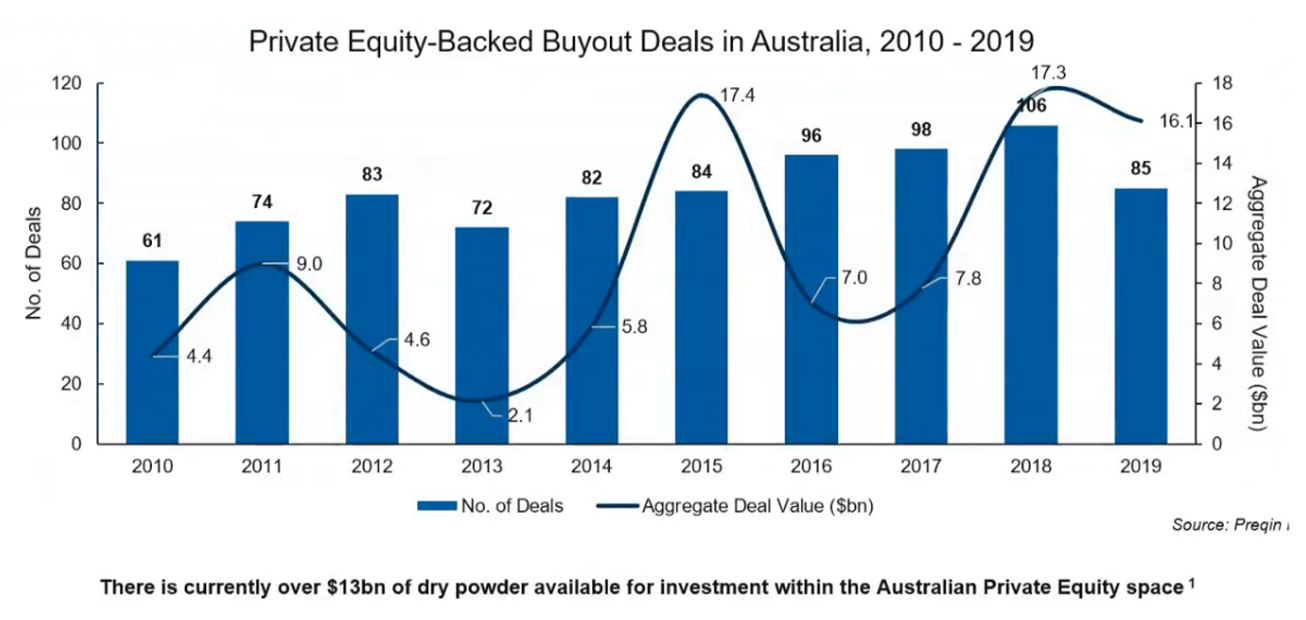

This means that borrowers who obtain financing from such sources must pay a higher interest rate for a given level of implied credit risk to lenders, who need that higher rate of return to justify their reduced flexibility in managing their investment. Thus, by comparing the rate paid between private debt and public debt at the same assumed credit rating or risk level, one can establish a proxy for the quantum of the illiquidity premium. Term Adjustment based on difference between 5 and 3 year discount margins for Credit Suisse Leveraged Loan index. Rating Adjustment based on difference between the Credit Suisse Leveraged Loan index. Currency Adjustment based on the short term rolling cross currency basis of 10 basis points less the cost of holding 10% in liquids at a cost of 4% for hedging purposes. All figures based on 31 December, 2020. But this does not explain why borrowers choose to, or are forced to, access private debt financing in the first place. The Structural Decline in Bank Risk AppetiteObviously a structural decline in bank lending to non-investment grade corporates, commercial real estate debt, non-public asset backed securities financing (such as warehouse funding facilities (2) for non-bank lenders), long-term project finance and other sub-asset classes of the private debt universe due to tighter regulatory and capital rules has decreased the options available to such borrowers. This increased cost to hold risk has meaningfully altered bank business models. As a result, banks have grown more conservative as they now must consider the risk-adjusted returns of potential loans in the context of more stringent and complex capital requirements - pushing them towards prime home loan origination at the expense of lending to businesses, for example. Changes in bank lending patterns have an important implication for investors. Bank securities-both fixed income and equity-should have different risk-return profiles going forward, as investors in bank-issued bonds and stocks are much less exposed to mid-size corporate lending and many types of real estate financing as well as fixed income trading revenue via the balance-sheet activity of their bank holdings. Source: 1 APRA, 2 Standard eligible mortgage with no mortgage insurance While these regulations have made the global banking system safer and have reduced risk to the financial system, certain risk exposures have become prohibitively expensive for traditional banks as a result of the new rules, creating a funding gap that increasingly is being filled by non-bank market participants. These regulations also have ushered in the rise of 'fintech' lending platforms and financial-disintermediation technologies that provide individuals and small businesses access to new sources of financing. Private credit is often an important source of funding for such new business models, particularly via so called 'warehouse funding' prior to them being able to securitise assets into public markets. But other factors play a role as well. The Growth in Private Equity SponsorshipFirstly, the shift toward private markets has been a consistent macro trend over the past few decades: while private markets have grown substantially during this period, the number of publicly traded companies has declined over the past 20 years. As a result, there are more private companies that require debt financing to fund their growth. Therefore, making private loans to private-equity sponsor backed companies is a big source of private debt origination in Australia and offshore.

Secondly, these borrowers are accessing private debt because they are looking for partners they can rely on to participate alongside them in a journey toward their objectives. They are also looking for some degree of flexibility or tailoring to line up the terms of their debt financing with their business objectives as well as speed and certainty of execution (particularly in a time-pressured acquisition financing scenario). Some or all of these factors are why many borrowers are willing to pay a premium over other lending alternatives. Finally, many borrowers in private credit are too small to access liquid capital markets or don't have the revenue and resources to justify paying for and supporting the due diligence of public credit ratings agencies like Fitch, Moody's and S&P or covering the significant fees of an arranger (plus all the other service providers) who are tasked with structuring and distributing a debt package. Thus, private debt markets are an attractive source of funding for acquisitions, organic growth, and scaling through capital investment outside of raising additional equity. In many ways, the making of a loan is analogous to the manufacturing of a product. In some cases it makes sense to have each stage of the manufacturing process (the due diligence, structuring, documentation and syndication) completed by a different party. But often it is more cost effective for a borrower to work with an individual lender who has internalised the manufacturing of a loan for themselves. What the borrower pays in terms of a higher interest rate is offset by the lower cost of the manufacturing process.

Source: Prequin Pro 2020, Australian Investment Council (AIC) Lastly, an important distinction between public and private markets is that private lending markets are inefficient. In public markets, arrangers effectively run an auction process to establish the lowest yield at which they can sell all of the debt. In private markets, there is generally no auction process. Often a borrower will approach a very small number of lenders (in some cases only one lender, especially where there is a long-standing relationship) and consider the overall package- timeliness, flexibility of terms, execution risk (i.e. does the lender have to syndicate some risk in order to do the full deal), quality and reputation of the lender in addition to the cost of the borrowing. This inefficiency is an opportunity for private lenders, who arguably see more deals and have a better idea of risk and return than the borrower (or the borrower's owner), to identify the best opportunities. Continued in tomorrow's Newsfeed - look for Part 2 Co-authored by: Sam Morris, CFA - Senior Investment Specialist, Fidante Partners & |

|

Funds operated by this manager: |

15 Feb 2022 - From a Stroll to a Sprint - Confronting a Faster Tightening Cycle

|

From a Stroll to a Sprint - Confronting a Faster Tightening Cycle Ardea Investment Management 31 January 2022 IIn this episode of The Ardea Alternative podcast, Laura Ryan, Tamar Hamlyn and Alex Stanley discuss interest rate rises in response to inflation and what it might mean for fixed income assets. |

|

Funds operated by this manager: Ardea Australian Inflation Linked Bond Fund, Ardea Real Outcome Fund |

0

0