News

1 Mar 2022 - Ditching New Year's resolutions in the dust bin

|

Ditching New Year's resolutions in the dust bin Forager Funds Management February 2022 How many New Year's resolutions have you already consigned to the dust bin? If the answer is none, I'm guessing that's probably because you learned long ago that it's futile making them to start with. Change is hard, isn't it? From changing the way we eat and exercise to the amount of time we spend on social media, we tend to be stuck in our ways. You have probably found the same with your investment habits. Do you keep making the same mistakes? Do you swear you'll capitalise on the next market crash only to find yourself still holding excess cash when markets have fully recovered? You're not alone. There are good reasons why it's so hard to change. Our brain plasticity changes dramatically from the time we're 25 years old. We start life with an extremely plastic brain - ready and eager to be adapted to the world in which our body needs to live. It is full of a messy web of billions of connections that offer up many billions more possible future brains. As we experience the world and learn, some connections strengthen and many others are removed until our brains are wired for adulthood (the first six episodes of the Huberman Lab Podcast explain this process in fascinating detail). Roughly 25 years after we're born, that process stops. It is possible to change the wiring (some people who become blind as adults learn to use the "seeing" part of their brains for other purposes, for example). But it is many magnitudes harder than it was in our youth. (In our podcast, Stocks Neat, my colleague Gareth likened the adult brain to driving a Kia Sportage after previously driving a Ferrari - not nearly as fast, or as fun.) This has two important implications. Firstly, what you experience in the first 25 years of life shapes you forever. For the first 16 or so years, your parents most likely control what sort of environment that is. From 16 to 25, though, you have a lot of control over how the world shapes your brain. That is going to be the easiest period of life to form habits, good and bad. Healthy diets, exercise and drug habits can all become a permanent part of life. Unfortunately, most of us perusing the Livewire website are well past the age of 25. For us, it is important to recognise that changing who we are is nigh on impossible. If you, like me, are stuck with the less-plastic brain, we're best off spending our time understanding our strengths and weaknesses rather than trying to change them. What experiences influenced the first 25 years of your life? How do you think that might impact your optimal investing style? If you grew up on a farm like me, you would rapidly grow accustomed to cycles and stress. At least once every summer, I would watch the storm clouds roll down the Wellington Valley and destroy the drying lucerne hay that was our family's livelihood (the smell of rotting hay bales has stuck with me for life). It wasn't uncommon to watch a whole crop float down the river in a flood. It's probably not surprising that my tolerance for risk and capacity to deal with stress is higher than average. Moreover, hard work, patience, and knowing how to live with inevitable periods of hardship have been essential to the growth of Forager Funds. When it comes to investing, at least, very few traits are unequivocally good or bad. My flaws are a result of that exact same environment. A tolerance for risk can be healthy; it can also be dangerous. A strong work ethic can get things done; it can also stunt the growth and development of junior staff. There are many different paths to investment success. The trick is to choose the path that's right for the way your brain is wired. For me, my risk tolerance and understanding of cycles mean I can run a concentrated portfolio of stocks. I can keep cash for market downturns because I know I will be "greedy when others are fearful", as Warren Buffett put it, and often well before the market bottoms. But I need checks and balances around me to ensure I don't take on too much risk, including individual stock limits and thesis roadmaps to stop me becoming overconfident. Someone who grew up with two school teachers as parents might be far less risk-tolerant (my parents were actually both teachers, too, but that was simply a source of funding for the farm losses). A better investment portfolio for them might be a diverse collection of index funds. Knowing they are unlikely to be comfortable investing in times of distress, they should commit to being close to fully invested all the time and, preferably, looking at the market as infrequently as possible. I have some investors as clients who couldn't guess their investment balance with Forager to the nearest 20%. Those who check CommSec five times every day probably view that as lazy and reckless, but these people have been highly successful. They simply worked out long ago that looking at their balance every day only causes them to do stupid things. As long as I am investing my own money alongside theirs, letting me worry about it has been their recipe for success. Introspection can be uncomfortable. And the idea that we are almost impossible to change can be downright scary for some. But, soon to celebrate my 44th birthday, I've found it all quite liberating. Those New Year's resolutions were nothing but a bore to start with. Everyone is different, of course, but that's what makes humans - and investing - so interesting. Written By Steve Johnson Funds operated by this manager: Forager Australian Shares Fund (ASX: FOR), Forager International Shares Fund |

1 Mar 2022 - Winning the war on talent

|

Winning the war on talent Claremont Global February 2022 As global fund managers, one of the most important areas of focus for many of the companies we research is around talent acquisition and retention. This issue goes beyond not just ensuring the brightest minds remain on the books but also extends towards becoming an employer of choice in an increasingly competitive market. This is made all the more difficult due to the growing expectations laid down or justly expected by a labour pool that is, as we stand today, heavily in demand. As a result, it is becoming more and more intrinsic to a company's position within their respected industry to ensure their organisation is, in fact, an attractive proposition for any prospective candidate. A winning talent management strategy therefore should be viewed as a robust advantage, that may prove to be just as critical to the company's long-term success as the competitive moat around the business itself. Employee retention - an 'old school' metric or one to cast a sharp eye over?One metric that can get often overlooked is that of the retention rates of company staff. Whether it relates to a technology business, a retailer, or a consulting firm, the cost of replacing any given employee is greatly underappreciated. According to estimates out of the Work Institute's 2017 Report, the replacement cost for an employer averages roughly 33% of an employee's annual salary for their exit. A company we believe is industry standard when it comes to placing a stringent focus on retaining its talent and expertise is the paintings and coatings business, Sherwin-Williams (SHW-US), which operate close to 5,000 stores around the US. While providing competitive compensation and benefits for its staff, the company prides itself on the discipline of its execution and is known to train staff "like the military". Store managers usually start as graduates but are often treated as business owners. This may sound like a talent strategy from a bygone era, however, this tried-and-tested method from a 155-year-old company creates an exceptionally low staff turnover of 7-8%, or 5-6% for store managers and sales reps. We begin to appreciate how impressive this number is when measured against the US Bureau of Labour Statistics' annual turnover figures across both retail and wholesale channels. Annual US employee turnover by sales channel

Source: US Bureau of Labour Statistics This incredibly low churn creates real loyalty from the company's professional customers, who take comfort in the fact that the staff member they are dealing with on a daily basis is, in fact, an expert in what they sell. "The managers of the big brands have a very clear responsibility. It's attracting and keeping talented people in order to sustain and build the trustworthiness of that brand. There is no clearer objective in the economy. Your economic success depends on expanding and building your economies of trustworthiness." - Robert Reich The company also pushes the notion of upward mobility (everyone knows the CEO started in the stores), providing a tangible path to move into management positions, and areas of increased responsibility, if they remain at the business over the long term. The growing importance of scaleThe aptly termed "war on talent" could not currently be any more evident than in the technology and digital industries. The sheer pace at which the world has evolved in partnership with an accelerated digital transition through the pandemic has pushed demand for top-quality personnel to an extreme level. One of the key dynamics we have noticed is the unmatched strength at which the large technology firms are able to exert when looking to attract talent out of a thinning top-end labour market. These larger technology players are able to offer potential candidates extremely competitive pay and benefits packages, heavy investment in training and strong career progression opportunities ― in addition to offering a meaningful company mission and purpose that may strike a chord with those looking to make a tangible difference in how we live our everyday lives. As we can see in the chart below, many of Sherwin-Williams' competing players are struggling to compete for top-end talent due to the likes of the "hyper-scalers" sucking up this talent at unprecedented rates. The company's older and arguably less-savvy competitors are suffering "brain drain" if desired work experiences, compensation and benefits, or career progression opportunities are not fulfilled. US software engineer and software developer hires

Source: BainAura talent platform, Bain For context, while many companies were furloughing staff amid the pandemic's economic fallout, Microsoft (MSFT-US) saw its employee base rise 18,000 or 11%, with Alphabet's (GOOGLE-US) base also rising net 16,000 employees or 13%. This has developed into a seriously large competitive advantage for the large technology firms and, as current shareholders of both companies, provides us with comfort that they will be able to continually drive innovation and product development with the pools of talent they have in their corner. "What's most impressive is that your team (Google) has built the world's first self-replicating talent machine. You've created a system that not only hires remarkable people, but also scales with the company and gets better with every generation." - Paul Otellini, Former President and CEO, Intel An alternative strategyThis system of managing and curating talent extends beyond simply retaining existing personnel and hiring new staff. The strategy of careful, diligent M&A to bring in experts that not only have the skills to drive sustained innovation and product development but actually want to work for the broader organisation, is one that cannot be overlooked. We see this dynamic present itself in areas such as medical and analytical instruments, where it can be more efficient to bring in a team of scientists or technicians through bolt-on acquisitions into the umbrella organisation, rather than invest in years of internal R&D and training in order to develop specific products or technologies. We have been most impressed by this method of talent management through another one of our portfolio holdings, Agilent Technologies (A-US). Their large team of highly skilled field scientists is one of the most underappreciated assets of their business and the retention of this talent is critically important to the sustainability of their business model. This was shown over the course of the pandemic when they did not move to reduce staff, nor did they cut base pay or hours, as a response to the temporary disruptions across the business. According to Agilent's CEO Mike McMullen, this has led to attrition rates that sit at much lower levels than peers in the market. However, a key piece in the evolution of their team of scientists is the onboarding of R&D teams through focused acquisitions of appropriate target companies, subsequently integrating them into the larger Agilent ecosystem. This can be witnessed through one of their most recent acquisitions in BioTek, a leading cell analysis business, of which then-owners, the Alpert family, sought to sell their company to Agilent as they appreciated the prevailing culture and long-term synergies across their respective R&D teams. "The cultural alignment, the consistency and commitment to the same sort of core values really do matter." - Mike McMullen, Agilent CEO, Goldman Sachs Healthcare Conference, Jan-21 Agilent's stringent focus on an engineering-led culture allows them to present themselves as an attractive suitor to smaller, niche businesses with bands of top-end scientists and experts in their fields that do not necessarily want to be swept into a corporate behemoth. This enables them to not only bolster the talent pool across the organisation but retain them over the long term, which will, in turn, materialise into tangible value creation for shareholders through sustained innovation and product development. Intrinsic to longevityTalent management can no longer be dismissed as simply an HR problem. It is becoming so critical in today's world that if a company mismanages its workforce, a loss of competitive advantage and profitability will present itself as the most likely outcome. The subsequent costs of recruiting, training, loss of expertise, potentially fractured relationships with customers, wage inflation, and cultural tearing all need to be placed in heavy consideration when curating a talent management strategy. We ensure that the businesses we invest in and research at Claremont Global have sound strategies in place to manage their pool of talent, ensuring that they not only retain the best people but also attract top-flight talent in the market to drive sustained innovation and product development well into the future. Authors and consultants, Rob Silzer & Ben Dowell, capture this phenomenon perfectly: "Talent management is more than just a competitive advantage; it is a fundamental requirement for business success." - Silzer & Dowell, Strategy-Driven Talent Management: A Leadership Imperative. Author: Luke Davrain, CFA, Investment Analyst Funds operated by this manager: |

28 Feb 2022 - Webinar | Premium China Funds Management - Asian Equities

|

Webinar | Premium China Funds Management - Asian Equities 2022 has begun with extreme volatility in global equity markets. In this webinar, Jonathan Wu, shares a perspective on Asian markets

|

28 Feb 2022 - Global Matters: 2022 outlook

|

Global Matters: 2022 outlook 4D Infrastructure February 2022 2022 is shaping up as potentially another challenging year, with the combined effects of the ongoing COVID crisis together with evolving inflationary pressures presenting governments and central banks around the world with some challenging policy decisions.

2022 outlook However, the two key factors dominating economic discussions and providing some near-term threat to a generally robust outlook as we enter 2022 are COVID-19 (again) and evolving inflationary pressures. COVID-19/Omicron variant While the ongoing COVID saga keeps pressure on equity markets, we continue to believe it represents a unique buying opportunity for infrastructure investors. The infrastructure investment thematic has not been derailed by COVID, but rather has been enhanced by the pandemic - huge government stimulus programs are fast-tracking infrastructure investment (in particular the energy transition), increasingly stretched government balance sheets will see a greater reliance on private sector capital to build much-needed infrastructure, and the interest rate environment remains supportive of infrastructure investment and valuations. Global inflationary forces Broadly, the price increases are being driven by a combination of supply chain disruptions, causing critical supply shortages of key items (such as computer chips), together with the huge global monetary stimulus pushing up the amount of money in the global economy, with inflationary forces being the consequence (e.g. Australian house prices). Importantly, we are also seeing real wage pressure in certain industries and markets as a result of the combination of COVID disruptions and job rotations as stimulus flows through. This is compounding near-term inflationary pressure. Central banks are already beginning to tighten monetary policy in an attempt to curtail these inflationary forces. After its January 2022 Fed meeting, Chair Jerome Powell said the Fed is ready to raise rates in 2 months. He spoke after the FOMC communicating that it would hike 'soon' and then shrink its bond holdings. Mr Powell declined to rule out tightening at every meeting this year, said officials may have to move sooner and faster on shrinking the central bank's US$8.9 trillion balance sheet, and warned there's a risk of a prolonged period of surging prices. The risk now is that if the Omicron variant continues to spread, this may itself lead to a crimping of global growth just as central banks take their feet of the stimulus pedal, compounding the slowdown. Ultimately, we believe central banks will act prudently and cautiously in easing policy. We are also of the belief that they may let inflation run somewhat ahead of target over the short to medium term to assist in the reduction of headline nominal government debt to GDP levels. But just at the present, uncertainty prevails and caution is warranted. In this regard, infrastructure is an asset class that can do well in an inflationary environment and we believe it is a sensible portfolio allocation at the current stage of the economic cycle. As discussed in a number of our previous Global Matters articles, many infrastructure stocks have built-in inflation protection, either directly linked to tariffs or indirectly through their regulatory construct. As such, in an inflationary scenario some parts of the infrastructure universe, namely User Pays, may enjoy the perfect storm over the short/medium term -interest rates supportive of future growth, economic activity flowing through to volumes, and explicit inflation hedges through their tariff mechanisms to combat any inflationary pressure they may experience. In contrast, Regulated Utilities can be more immediately adversely impacted by rising interest rates/inflation because of the regulated nature of their business. The flow-through of inflation is dictated by whether the Utility's return profile is 'real' or 'nominal'. If the Utility operates under a real return model, inflation is passed through into tariffs much like a User Pay asset. This model is more prevalent in parts of Europe and Brazil, for example, and limits the immediate impact of inflationary pressure - and in fact can positively boost near-term earnings. In contrast, if the Utility is operating under a nominal return model, it must bear the inflationary uptick reflected in certain costs until it has a regulatory reset, when the changing inflationary environment is acknowledged by the regulator and approved to be incorporated in new tariff/revenue assumptions. This nominal model is the standard model for the US Utility sector. As such, those Utilities in a real model will weather inflationary spikes a little better than their nominal peers. However, in terms of interest rates shifts, the issues for both real and nominal models are consistent. For a Regulated Utility to recover the cost of higher interest costs, it must first go through its regulatory review process. While a regulator is required to have regard for the changing cost environment the Utility faces, the process of submission, review and approval can take some time or can be dictated by a set regulatory period of anywhere between 1-5 years. In addition, the whole environment surrounding costs, household rates and utility profitability can be highly politically charged. As a result, both the regulatory review process and the final outcome can be quite unpredictable. The differences between User Pay and Regulated Utility assets should see certain sub-sets fundamentally outperform during a rising inflation/interest rate period due to a more immediate and direct inflation hedge. At 4D we remain overweight User Pay assets and, within the Regulated Utility sector, favour those with real returns. However, should the market overreact to the economic outlook we would use it as a buying opportunity across all sectors. Key ongoing macro themes However, in summary, current investment forces that we at 4D find particularly interesting include the:

What could derail our outlook?

We continue to monitor the near and long-term trends and will actively position accordingly as events unfold. Conclusion |

|

Funds operated by this manager: 4D Global Infrastructure Fund, 4D Emerging Markets Infrastructure Fund |

28 Feb 2022 - Spotlight Series, Feb Edition

|

Spotlight Series, Feb Edition Montaka Global Investments February 2022 The average stock in the S&P 500 has already declined from its peak late last year, while the average NASDAQ Stock is down a staggering 44%! This month's Spotlight Series Podcast unpacks the inflation and interest rate fears, demonstrating why equity markets may well have already overshot to the downside. Speakers: Andy Macken, Chief Investment Officer & Chris Demasi, Portfolio Manger Funds operated by this manager: |

25 Feb 2022 - Big opportunities for small cap investors in IPOs and secondary placements

|

Big opportunities for small cap investors in IPOs and secondary placements Firetrail Investments January 2022

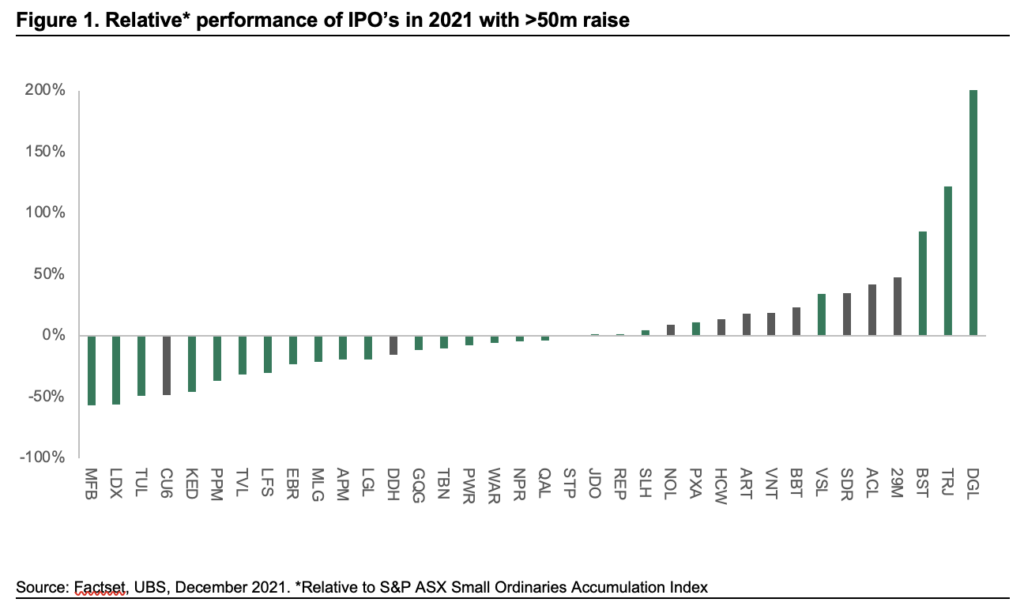

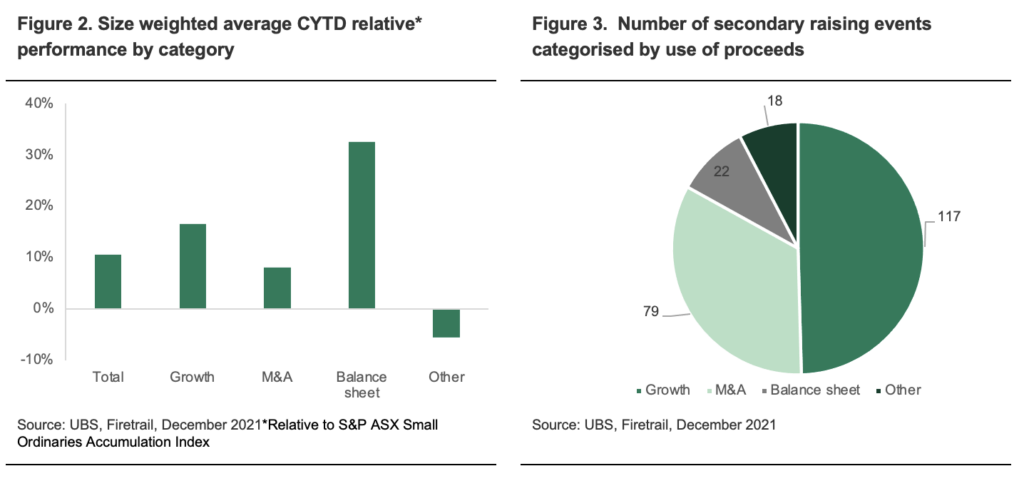

2021 was an exciting year for initial public offerings (IPOs) and placements. 55 companies with an offer price greater than A$20 million made their debut on the ASX during the year. Up a staggering 62% from the year before! Secondary placements experienced a more modest increase, up 6% from 2020. Most equity capital market (ECM) activity took place in the small cap end of the market. Providing a material opportunity for institutional small cap managers like Firetrail to add value for their investors. In this article, we analyse the success of small cap IPOs and placements in 2021, provide key takeaways for investors, and what to expect in capital markets in 2022. We conclude that corporate activity will remain elevated in small companies throughout 2022. Creating meaningful opportunities for investment managers willing to do the work to identify the best opportunities. IPOs and placements outperformed in 2021It wasn't just the sheer number of IPOs and placements that broke records in 2021. Together, new ASX-listings raised a total of A$12 billion! Among them were a record number of billion-dollar floats, such as APM, SiteMinder and PEXA. On the first day of trading, these IPO companies outperformed the market by an average of 20%. However, we did see this outperformance moderate by the end of the year. We saw the inverse occur in the market for secondary offerings. Average day one performance hovered around 10.1%. While calendar year performance rose to 15.4%! The total amount raised by secondary offers was A$37.7 billion. But that doesn't seem like an accurate reflection of performance from a market perspective. Careful stock selection is criticalIf we adjust for the size of the raise, the story changes. We see big declines for first day and calendar year performance for both IPOs and secondary placements. Suggesting that the relative performance is skewed by a handful of big winners. In the IPO space, performance was dominated by a few key players. DGL, a chemical manufacturing and storage group, and Trajan, an analytical science and devices company, experienced greater than 100% returns in the calendar year. To account for this asymmetry, we took the median performance for the calendar year. The median return for IPO stocks was just -4%. Providing a more accurate reflection of capital market performance. Clearly, an ability to pick winners is key to harnessing value from corporate activity. The chart below compares the relative performance of IPOs that raised more than $50 million. While average performance was strong, there were more losers than winners. Through deep fundamental analysis, Firetrail were able to pick the winners this year. The median return from our IPO participation was 18% for the 2021 calendar year (shaded in grey in Figure 1).

The best returning secondary issuances were in companies in need of balance sheet repair. The average placement in this category delivered 33% excess. In many instances we observed that the 'raise' was already priced in by the market. Hence recapitalisation was the catalyst to refocus the market on business fundamentals. The market also rewarded companies raising capital to grow organically far more than M&A. Raisings for growth dominated the market (Figure 3). In contrast, there were few M&A bargains in 2021 due to intense competition for assets. Many companies were willing to pay listed multiples for strategic acquisitions.

Opportunities will remain elevated in small caps in 2022ECM events are a consistent source of opportunity and strong returns for small cap investors. Access to these opportunities is key, and the Firetrail team have a strong track record of leveraging our corporate relationships and fundamental expertise to access attractive corporate opportunities for our investors. Since the inception of the Firetrail Team's Small Companies strategy in 1998, previously the Macquarie Australian Small Companies Fund, these events have contributed an average 20% of the total excess returns, or ~3% p.a. Looking ahead to 2022, low interest rates and high valuations will continue to encourage companies to raise capital. We expect ECM activity to remain elevated and to continue delivering material opportunities for small cap investors like Firetrail. Conclusion2021 was a year of frantic ECM activity and we see no sign of this abating as we move through 2022. As small cap investors, we are excited by the opportunity and potential returns offered by IPOs and secondary placements in the coming year. Our experience shows that meaningful returns are out there if managers are willing to do the work to find them! Funds operated by this manager: Firetrail Absolute Return Fund, Firetrail Australian High Conviction Fund Disclaimer This article is prepared by Firetrail Investments Pty Limited ('Firetrail') ABN 98 622 377 913 AFSL 516821 as the investment manager of the Firetrail Australian Small Companies Fund ARSN 638 792 113 ('the Fund'). This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person's objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance. Pinnacle Fund Services Limited ABN 29 082 494 362 AFSL 238371 ('PFSL') is the product issuer of the Fund. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited ('Pinnacle') ABN 22 100 325 184. The Product Disclosure Statement ('PDS') and the Target Market Determination ('TMD') of the Fund is available at www.firetrail.com. Any potential investor should consider the PDS before deciding whether to acquire, or continue to hold units in, the Fund. Whilst Firetrail, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Firetrail, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication. The information is not intended for general distribution or publication and must be retained in a confidential manner. Information contained herein consists of confidential proprietary information constituting the sole property of Firetrail and its investment activities; its use is restricted accordingly. All such information should be maintained in a strictly confidential manner. Any opinions and forecasts reflect the judgment and assumptions of Firetrail and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Firetrail. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication. This may contain the trade names or trademarks of various third parties, and if so, any such use is solely for illustrative purposes only. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with, endorsement by, or association of any kind between them and Firetrail.

|

24 Feb 2022 - Investment Perspectives: House prices - what's in store for 2022 and beyond

|

Investment Perspectives: House prices - what's in store for 2022 and beyond Quay Global Investors February 2022 |

|

According to CoreLogic, Australian house prices increased +22.1%[1] in 2021, led by Australia's largest city of Sydney (+25.3%). It is likely that there have been a few culprits for this stellar performance, including record low interest rates, healthy household balance sheets, and perhaps a new desire to re-invest in the home as some workers contemplate an extended 'work from home' environment. To be fair, the uplift in residential prices is not a local event. The value of homes has soared across the world, including New Zealand (+27.6%), the United States (+19.1% to October), the UK (+10.0%) and even places like Turkey (+40.0% to October). And for those who believe interest rates drive property prices, the average key interest rate in Turkey during 2021 was 18% (up from 11% in 2020).[2] As we head into 2022, there is an expectation that interest rates are likely to rise around the world in response to recent inflation data. That may be true. However, we do not believe this will be enough to stop the gains - in fact, rising rates may indeed add to further gains (as per Turkey). The biggest risk for investing in residential property is, as always, excess supply. The housing cycle So, is the surge in residential property prices causing a supply response? In Australia, the answer is an emphatic yes.

The surge in new housing starts since COVID is similar, albeit sharper, to the 2015-2018 cycle which ultimately saw prices correct in 2019. We have yet to see any heat come out of the Australian market - completions have yet to increase as they lag starts by around a year. Inevitably, completions will surge this year to match the starts, which may be somewhat ominous for the Aussie housing market. Quantifying the oversupply (if any) We can get a general sense of any imbalances using historical trend data. For example, Australian household starts ran at a consistent 40,000 per quarter between 2000-12, which appears to reflect a balanced housing market (no acceleration or deceleration in supply). Post 2012, supply accelerated as immigration increased. Adjusting for the increase in annual immigration from 1.4% per annum (2000-2011) to 1.7% per annum (2011-2019), steady-state supply can be estimated at ~50,000 per quarter, being household starts of 40,000 increased pro-rata with a higher immigration rate. Using this assumption and based on housing starts data, we can estimate the cumulative supply shortfall since 2010.

Generally, the Australian housing market has defied most gloomy predictions. Indeed, there was almost a small cottage industry dedicated to predicting the imminent collapse of Australian house prices in the post-financial crisis world. However, the chart above demonstrates that there has never been a situation where there has been excess supply of housing in Australia. Accelerating housing starts (as prices rise above replacement cost) were quickly absorbed by new households. For Australia, population growth has generally provided Aussie housing the ultimate 'get out of jail free card' just as the market begins to cool. We made a similar observation in our June 2019 article What now for residential property?, where we reversed our earlier bearish 2017 call. However, with COVID, population growth effectively halted right at the time supply was accelerating. For example, if we were to reduce our household growth assumption to 20,000 per quarter (60% reduction), the residential market would quickly become oversupplied (once current projects complete later in 2022).

We don't believe it is time to call for a market correction just yet, but based on the above chart it seems unlikely recent national residential price growth will be repeated in 2022. What about the US?

Does the US face the same supply headwinds as Australia? To answer, we have applied the same methodology as the Australian analysis above. Specifically:

o 1.2m single family homes per annum (consistent with pre-GFC bubble average) o 0.3m apartments per annum (consistent with pre-GFC bubble average), and

The following charts reflect the result for each sector.

Source: St Louis Fred, Quay Global Investors For single family, there was a significant increase in excess supply leading to the financial crisis, which offers no surprise since prices boomed and were well above replacement cost. However, the single-family sector was crushed post crisis in terms of price (and ultimately resources), resulting in a significant deficiency in supply - even after allowing for the pandemic-induced collapse in immigration. Conversely, US apartments never felt the effects of excess supply in the lead-up to the financial crisis. Also, unlike single family homes, apartment supply recovered more quickly in response to the demographic demands of millennials leaving home in the first half of the 2010s. However, with the decline in immigration there appears to be a growing risk that apartments are moving into excess supply for the first time in decades. Concluding thoughts But by digging into the data, it is clear not all markets face the same risk. The cumulative undersupply in US single family housing is still significant and may take many years to rectify - especially now the sector has a demographic tailwind with the millennials, the largest US demographic cohort, seeking a more stable accommodation to marry and raise a family in a home. The outlook for US apartments and Australian residential is less sanguine. For the first time in decades, there is a real risk these markets are facing a headwind of persistent oversupply, exacerbated by pandemic-induced immigration declines. A word of warning: this analysis is not meant to be all encompassing and each market has its own subtleties and nuances. To be clear, we are not necessarily predicting a 'crash', or even a correction in these markets. The investment market is littered with the dead bodies of housing perma-bears. But it seems clear from the data that right now that one of the best risk return profiles is in US single family housing - which is where the fund maintains a significant investment position. We are more than happy to remain long. |

|

Funds operated by this manager: [1] www.abc.net.au/news/2022-01-04/australia-house-prices-corelogic-data-december-2021/100737080

|

23 Feb 2022 - Intercontinental Exchange

|

Intercontinental Exchange Magellan Asset Management January 2022  In 1997, Jeff Sprecher of the US, who had spent years developing power plants, decided to provide transparent pricing to the US power market. Well before electronic trading of financial securities became the norm, Sprecher paid US$1 for a tech start-up so he could build a web-based trading platform. For three years, Sprecher and his team met oil, natural-gas and power companies to learn what people sought in a trading platform. Some of the innovations that resulted included pre-trade credit limits, counterparty credit filters and electronic trade confirmations - novelties taken for granted now. By 2000, the trading platform was set for launch. Sprecher renamed the shell company Intercontinental Exchange to highlight the trading platform's ability to cross oceans, let alone borders. In 2001, the International Petroleum Exchange of London wanted to evolve from floor to electronic trading. At the time, the exchange was a regional one that offered oil futures contracts and had less than 25% share of the global oil futures market. Intercontinental Exchange, which promotes itself as ICE, saw an opportunity to branch into energy futures and clearing and purchased the exchange. Thanks to the ability of ICE's platform to increase price transparency, handle high volumes efficiently and lower transaction costs, the volume of oil futures traded on what is now called ICE Futures Europe swelled. A regional exchange grew into a global one. From 2007, the year ICE listed (with the ticker ICE), the company went on a buying spree of exchanges. The company snared the New York Board of Trade, which barters commodities such as cocoa, coffee and cotton, ChemConnect, which trades chemicals, and the Winnipeg Commodity Exchange, now ICE Futures Canada that mainly trades canola. A sign of ICE's ambitions was the company's failed bid that year for the commodities-based Chicago Board of Trade. Undaunted, the ICE takeover quest continued such that ICE, which earned US$6.6 billion in revenue in fiscal 2020, owns an exchange arm that boasts 12 global exchanges and six clearing houses that service the energy, agricultural and financial sectors. The haul includes the purchase in 2013 of the New York Stock Exchange, the world's biggest by volume. Among feats, ICE hosts nearly 66% of the world's traded oil futures contracts and is the world's leading clearer in energy and credit defaults. On top of that, ICE's exchange arm manages key global benchmark contracts. This list includes Brent oil, Euribor, natural gas, sterling short and long rates and sugar barometers of performance. In recent years, ICE has branched out such that the exchange business, which brought in 55% of ICE revenue in fiscal 2020, is one of three divisions. The second arm, responsible for 27% of revenue in fiscal 2020, is the fixed income and data services business that sells data and technology to help investors make and execute decisions. ICE assess prices for roughly three million fixed-income securities spanning about 150 countries in 73 currencies, as well as providing advanced analytics and indexes for fixed-income markets. ICE's other business is mortgage technology, which pulled in the remaining 18% of revenue in fiscal 2020. This arm has digitalised the mortgage process to reduce costs and increase efficiencies. The ICE mortgage business is the largest to automate the entire process, is the industry's leading platform with more than 3,000 customers, partners and investors, and the industry's only loan registry. This platform offers significant growth potential as more US mortgage originators are expected to turn to ICE's digitised offering. ICE is a promising investment in three ways. The first is that the exchanges and other businesses possess sustainable competitive advantages that form a daunting 'moat' for the parent company - where moat is a colloquial way to say a company is protected from competition. Most of ICE's earnings are derived from trading and clearing fees from the exchange businesses and linked data. These businesses are moated because they enjoy economies of scale, network effects and industry structure that intimidate would-be competitors. Another moat for ICE is that when it comes to derivatives and listing, there are limited substitutes. The holder of benchmark contracts is favoured in negotiations, even if others are seeking to undercut on price. A second advantage ICE enjoys is that the company is vertically integrated - it controls the execution and clearing of contracts. This enables the company to exert pricing power, attract volumes, and improve counterparty and systemic risk management. The other advantage that makes ICE an attractive investment is the company is well managed. While ICE has a history of disrupting others, the Sprecher-led team has prevented ICE being disrupted. Management has steered the business towards attractive industry structures (derivatives exchanges), unique data sources and value-add analytics. As important, the team has largely directed ICE away from equities exchanges, where regulation and technology have upended the pricing power and volumes over the past 15 years. All up, ICE is well placed to provide compounded returns for its investors for the foreseeable future. ICE, as do all businesses, faces risks. One is that the company's revenue is tied to trading volumes over which it has little influence. The fact that trading volumes often increase in turbulent and falling markets means that ICE is well placed to weather a market slump that falls short of a prolonged 'bear market' where trading was light. ICE's other risk is that its business is exposed to adverse changes to regulations. Moves by regulators to separate execution and clearing, and actions that might reduce trading volumes, would disrupt ICE's revenue. ICE is protected to some extent in this regard because regulators are aware that such moves against exchanges, especially ones that feature large derivatives trading, would boost trading costs, hamper innovation and, possibly, increase systemic risks. ICE, thus, is well placed in a world where Sprecher's vision has helped electronic trading become the norm. Sources: Company filings and website. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

22 Feb 2022 - 10k Words - February Edition

|

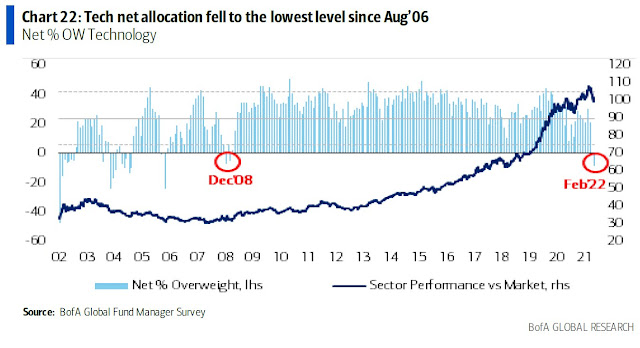

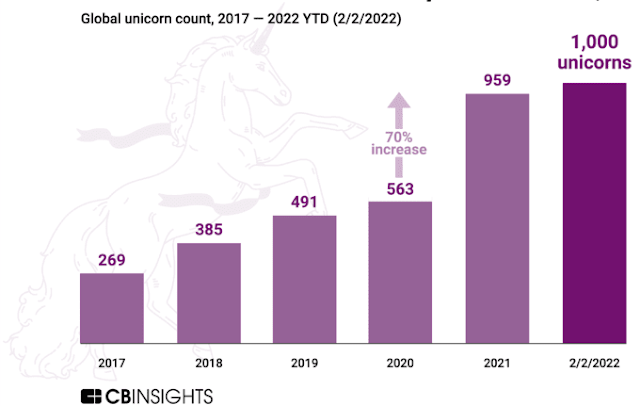

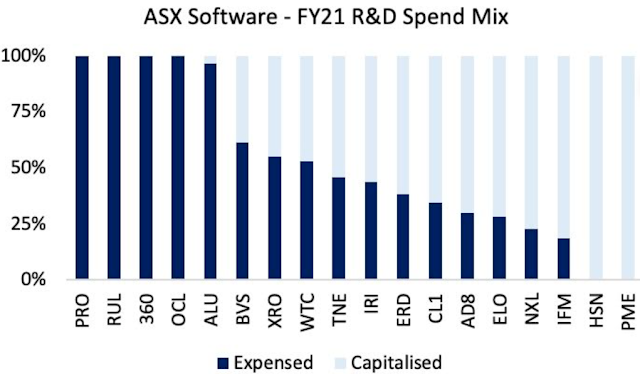

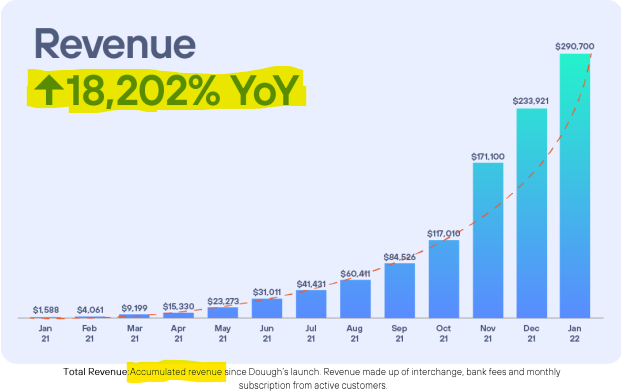

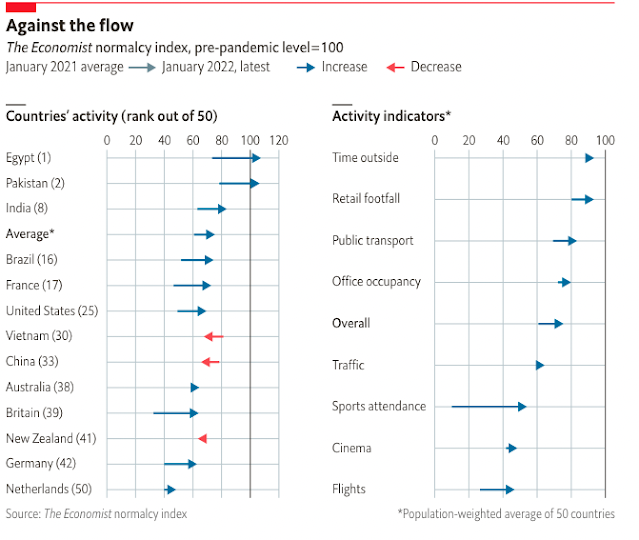

10k Words - February Edition Equitable Investors February 2022 Apparently, Confucius did not say "One Picture is Worth Ten Thousand Words" after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy. You may have noticed that the tech sector has been under pressure lately. Bank of America's monthly fund manager survey shows allocations to the sector are at the lowest point since 2006 - yet in the unlisted world CB Insights has tallied up a surge in "unicorns" to 1,000! Totus Capital made a great point on the significant dispersion between different tech companies' accounting treatment of R&D spend. And ASX-listed fintech Douugh's "accumulated revenue" chart, as highlighted by @lukewinchester9, was definitely an innovative approach to presenting financials. On the COVID-19 front, Bloomberg shows global air traffic is still less than half pre-pandemic levels, while The Economist shows most countries trending back towards "normalcy" - with China a notable exception. Tech net allocation at lowest level since 2006 Source: Bank of America (via @daniburgz) Now there are 1,000 unicorns Source: CB Insights Huge differences in how ASX software companies account for R&D spend Source: Totus, livewiremarkets Accumulated revenue chart by ASX-listed Douugh (DOU) Source: Douugh Limited, @lukewinchester9 Global air traffic less than half pre-COVID level Source: Bloomberg The Economist's "Normalcy Index" Source: The Economist Funds operated by this manager: Equitable Investors Dragonfly Fund

Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog

|

22 Feb 2022 - Manager Insights | Magellan Asset Management

|

|

|

|

Damen Purcell, COO of FundMonitors.com, speaks with Chris Wheldon, Portfolio Manager at Magellan Asset Management. The Magellan High Conviction Fund has a track record of 8 years and 8 months. The fund has provided positive monthly returns 88% of the time in rising markets, and 22% of the time when the market was negative, contributing to an up capture ratio since inception of 83% and a down capture ratio of 88%.

|