News

28 Mar 2022 - Like kites, do portfolios rise against or with the wind?

|

Like kites, do portfolios rise against or with the wind? Spatium Capital March 2022 For the runners, cyclists or outdoor sportspeople within our readership, a handful of circumstances will almost always result in a proverbial groan: headwinds. That gust of wind that makes turning that corner on the bike or spending the next half of a game with a wind impediment less enjoyable, is unfortunately a part of exercising amongst the elements. Headwinds, as it were, have become known as such a physical inconvenience that they are also a common analogy for when situations in life are met with obstacles that inhibit progress. The counter to a headwind therefore is a tailwind, where benefits and/or privileges fuel our progress, bypassing or simply overcoming the obstacles (or headwinds) that come our way. If we then take this concept and apply it to a fund manager's portfolio, how many would attribute their performance success to an investing skill or purely an outcome of a bull market? Put another way, did the manager overcome genuine obstacles (a headwind) to achieve success, or were they the beneficiary of a rising market (a tailwind)? Recent research published by social scientists Dr Gilovich and Dr Davidai in 2016 suggests that people are more likely to both recall and overweight their headwinds more poignantly than those of their tailwinds. Their theory claims that when people benefit from a tailwind, the satisfaction is adapted to quickly and is relatively short-lived, whilst a headwind's dissatisfaction is 'consumed' over a longer-period. Using the sporting analogy at the top of the above paragraph, many can relate to the internal monologue that goes on when a headwind is faced; often, longing for the tailwind. Usually, this monologue does not end until the tailwind is experienced. At which point, a brief sense of relief is felt and the team or individual go about adjusting to the new advantage. Almost without a second thought! This tendency to recount information in a way that confirms one's view (confirmation bias) that they had more obstacles than benefits has been coined by Gilovich and Davidai as the headwind-tailwind asymmetry. It is suggested that because a headwind is an obstacle that needs to be addressed, whether that be in a career, sport, relationship or an investment context, there is a greater propensity for these events to be etched into our memories. Their very existence can in fact precede critical junctures and choices in our lives. Conversely, a tailwind is a privilege that often goes unseen by its very nature of not necessitating significant effort or attention. It's harder to recount a privileged education, upbringing, career opportunities or investment successes when they were already occurring without requiring effort. At Spatium, we pride ourselves on having outperformed the benchmark (a headwind) without having a beta in excess of the benchmark, or resorting to leverage or gearing within the fund (an easy 'tailwind' during a rising market environment). Conversely, when the market winds inevitably change, Spatium has had a long-term average of losing only half as much as the benchmark. When assessing managers, portfolios, or even individual companies, one must be critical: "has this business overcome genuine headwinds, and has the strength, knowledge and processes to do so again in the future" or, "has this business simply benefitted from structural tailwinds", such as declining interest rates, or similar paradigm shifts, those of which may be unlikely to be repeated at the same amplitude (or in the case of rising interest rates, potentially work as a headwind) into the future. In aggregate, one should enjoy just as many tailwinds as headwinds over the years, with the key focus being maximising ones advantage during tailwind periods, and remaining convicted to persevering through intermittent headwinds. Author: Jesse Moores, Director |

|

Funds operated by this manager: |

25 Mar 2022 - How private debt can help guard against rising inflation

|

How private debt can help guard against rising inflation Revolution Asset Management March 2022 With rising global inflationary pressures mounting, a range of factors are converging to create a new inflationary era. From the demand distortions and supply dislocations associated with the COVID-19 pandemic, geopolitical risks, as well as monetary and fiscal tightening, these factors are expected to increase volatility across financial markets in 2022. The reality of higher inflation and interest rate hikes has prompted asset owners to review their current defensive fixed income allocations and assess the level of risk protection required in order to earn the investment returns needed to meet their targets. Income generated by traditional fixed income sources such as fixed rate bonds are now harder to find. Strategies across private markets, in particular private debt, may be well equipped to deal with the ongoing market volatility and changes to interest rates. In periods of higher inflation, private debt can offer investors a level of protection - being a floating rate asset class means the underlying yield increases as inflation and interest rates increase. Additionally, the long term, patient capital nature of private debt, and the ability to absorb and pass on rising costs mean these strategies can actually benefit from inflation. But senior secured private debt can offer more than that. It's a defensive allocation that can help to preserve capital and provide genuine diversification and yield, whether through the right sub-sectors of private debt or the underlying assets well-positioned to flourish during an inflationary environment. The Australian investable private debt universe is large, and we believe the most attractive sub-sectors include leveraged buyout and private company debt - in businesses with brand and customer strength operating in non-cyclical industries; private and public Asset Backed Securities such as floating rate quality mortgages; and loans to stabilised commercial real estate assets with annual contracted rent. Risk mitigation in senior secured private debt also relies heavily on strong credit discipline. A proactive approach to risk management can help build greater resilience in changing market conditions such as inflationary environments. Revolution Asset Management believes the outlook for private debt remains positive. With a robust deal pipeline, deployment into 2022 is set to be strong. In private company and leverage buy-out loans, the M&A boom of 2021 drove three times the level of activity vs the prior year and 40% higher vs the five year average, and with international borders reopening, this is expected to fuel activity in 2022. In private Asset Backed Securities, warehouse funding is reaching A$10 billion and continues to offer very attractive relative value compared to public Asset Backed Securities. In the current market, we are witnessing significant growth particularly in non-bank lending activity in Australia and New Zealand, which continues to provide attractive opportunities for our portfolio and helps quality non-bank lenders realise their growth plans. Allocating more to higher-yielding, floating rate assets such as private debt could be one strategy to minimise interest rate sensitivity of fixed income portfolios and guard against inflation risk, while at the same time increasing and diversifying sources of return. Author: Bob Sahota Funds operated by this manager: Revolution Private Debt Fund II, Revolution Wholesale Private Debt Fund II - Class B DISCLAIMER This information has been prepared by Revolution Asset Management Pty Ltd ACN 623 140 607 AFSL 507353 ('Revolution'). Performance numbers provided are as at the date of this article, and subject to change. Although every effort has been made to verify the accuracy of the information contained in this document, Revolution, its directors, officers, representatives, employees, associates and agents disclaim all liability (except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this document or any loss or damage suffered by any person directly or indirectly through relying on this information. The information in this document is not financial product advice and has been prepared without taking into account the objectives, financial situation or needs of any particular person. All investments involve risk. Past performance is not a reliable indicator of future performance. |

24 Mar 2022 - Interest rates, bonds and listed real estate

23 Mar 2022 - Pet Humanisation Megatrend

|

Pet Humanisation Megatrend Insync Fund Managers March 2022 Since 1988, The APPA National Pet Owners Survey has delivered comprehensive consumer research studies about pet ownership, pet care practices and preferences in product and services consumption of America's pet owners. Below are some of the highlights that are particularly noteworthy - Pet ownership is up

Spending increased

Millennials are the largest 'pet parents'

Spending is up post pandemic, as 'pet parents' are more than ever before willing to sacrifice more of their paycheques to provide premium care and services for their pets. The $100 Bn pet industry is poised to nearly triple to $275 billion by 2030 (Morgan Stanley). An annual compound rate in excess of 14% p.a. growth. The American Pet Products Association is a not-for-profit industry association founded in 1958 and is headquartered in Stamford, Connecticut. The APPA represents more than 1000 pet product manufacturers, importers of pet products and suppliers of products for non-pet livestock as well. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund |

23 Mar 2022 - How Alphabet is using AI to power its future business success

|

How Alphabet is using AI to power its future business success Montaka Global Investments March 2022 Most investors suspect that AI sits at the core of Alphabet's key businesses (Search, YouTube, Cloud, etc). But many are still underestimating how AI is creating unimaginable opportunities in completely new industries for the technology giant. Like Microsoft and its cloud computing division Azure, Alphabet's AI capabilities appear to be following a similar path of explosive growth after years of incubation. Below we look at 4 ways that Alphabet is using AI to significantly enhance its businesses, respond to competitive threats, and also generate solutions to some of the world's most pressing problems (such as renewable energy) that we couldn't imagine solving just a few years ago. We expect these 4 examples - and AI more broadly - to make Alphabet even more mission-critical to customers, open immensely larger markets for the company, and drive increased profitability for many years to come - all of which will continue to underpin Alphabet's role as a core holding in Montaka's investment portfolios. 1. Google Search - Like a duck ...Alphabet is obviously best known for the ubiquitous Google Search engine that has maintained its competitive advantage for over two-decades and holds over 90% global market share. This is a frightening feat in an industry that innovates as quickly as technology. Unsurprisingly, the incredible moat that surrounds Search has its foundation drenched in Alphabet's most cutting-edge AI research and development. In many ways Google Search is like a duck, the query box has not changed for over twenty years, but while it might look calm on the surface, it is paddling like crazy underneath!

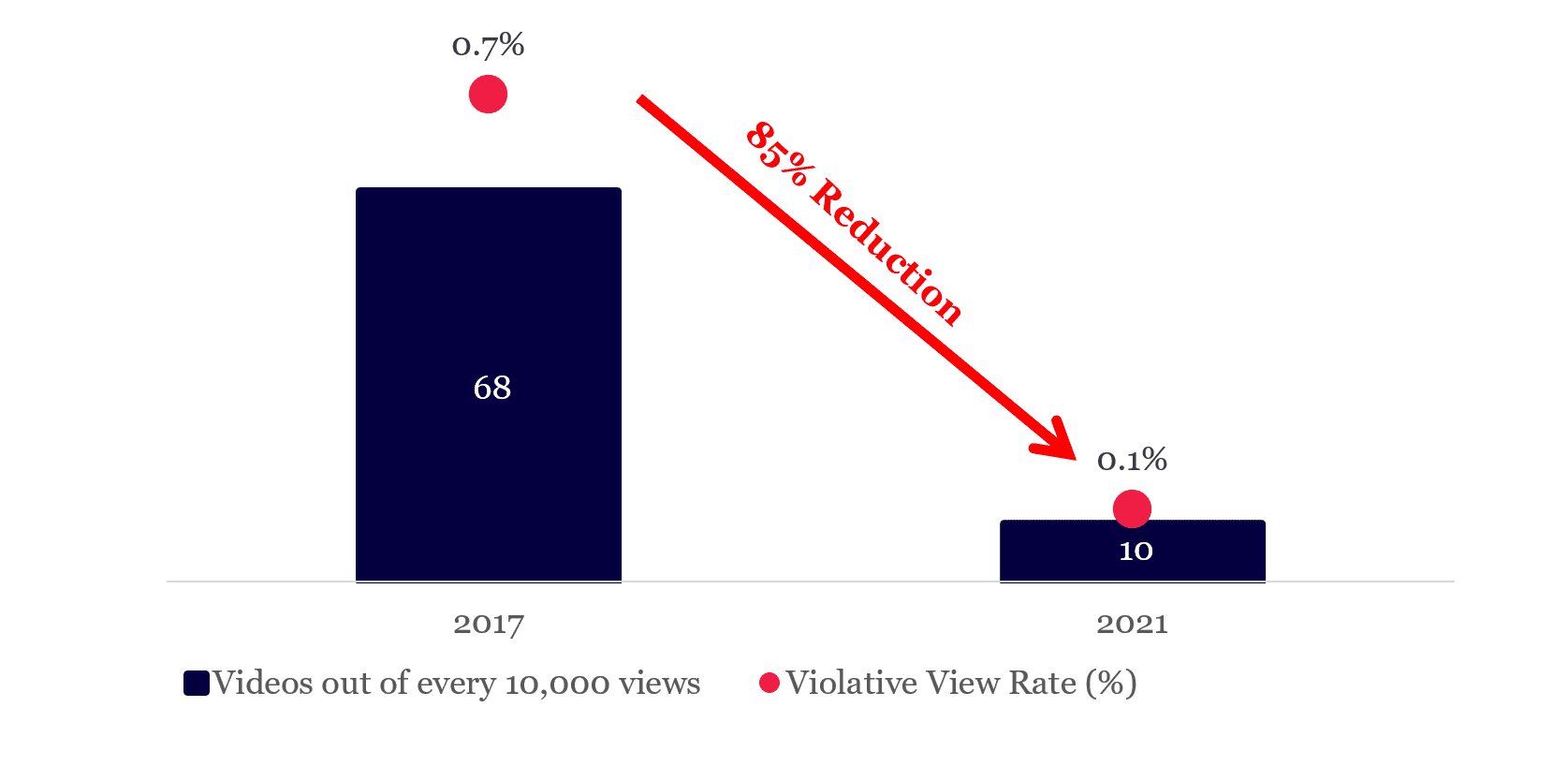

For example, at the end of 2019 Google Search incorporated BERT, a neural network-based AI technique for natural language processing, which was hailed by Alphabet as the "the biggest advancement made to Search in the last five years". Just two years later (2021), Alphabet introduced MUM, a next-generation AI and a step-change enhancement to existing capabilities noting; "MUM is a big advancement in Search, 1,000 times more powerful than our current systems. It has the ability to learn and transfer knowledge across 75 languages". Incredibly, the speed at which these mind-blowing AI breakthroughs are being melded into Google Search is accelerating. And just this year (Feb 2022), Sundar Pichai (CEO) revealed on Alphabet's Q4 2021 earnings call, that Search was now running a new AI architecture called Pathways. He highlighted that "AI models are typically trained to do only one thing, but with Pathways, a single model can be trained to do thousands, even millions of things". This is expected to represent a major enhancement to Search quality and add further monetization options to the business. 2. YouTube - AI helps Alphabet clean up contentAI is also driving enormous efficiencies at YouTube. Alphabet's YouTube is the largest online video platform in the world, with over two billion monthly active users who watch more than one billion hours of content per day and upload 500 hours of new content per minute! Operating a network of this scale is a herculean engineering feat, but more impressive is how Alphabet is applying artificial intelligence to make the platform safer and more trusted for consumers and advertisers. At the scale YouTube operates, it is physically impossible for humans to moderate every piece of content that is uploaded. This is a huge problem given the size of YouTube's userbase and their voracious appetite for video content. Explicit and inappropriate content can have a significant impact on children, promote violence, spread disinformation, and alienate advertisers. It is no secret that many online platforms struggle with the problem of content moderation which will remain a perpetual challenge. However, Alphabet has made incredible progress using its cutting-edge artificial intelligence. Utilizing AI and promoting trusted sources across YouTube has resulted in a mind-blowing 85% reduction in content that violates YouTube's policies. Alphabet's AI decimated inappropriate content on YouTube

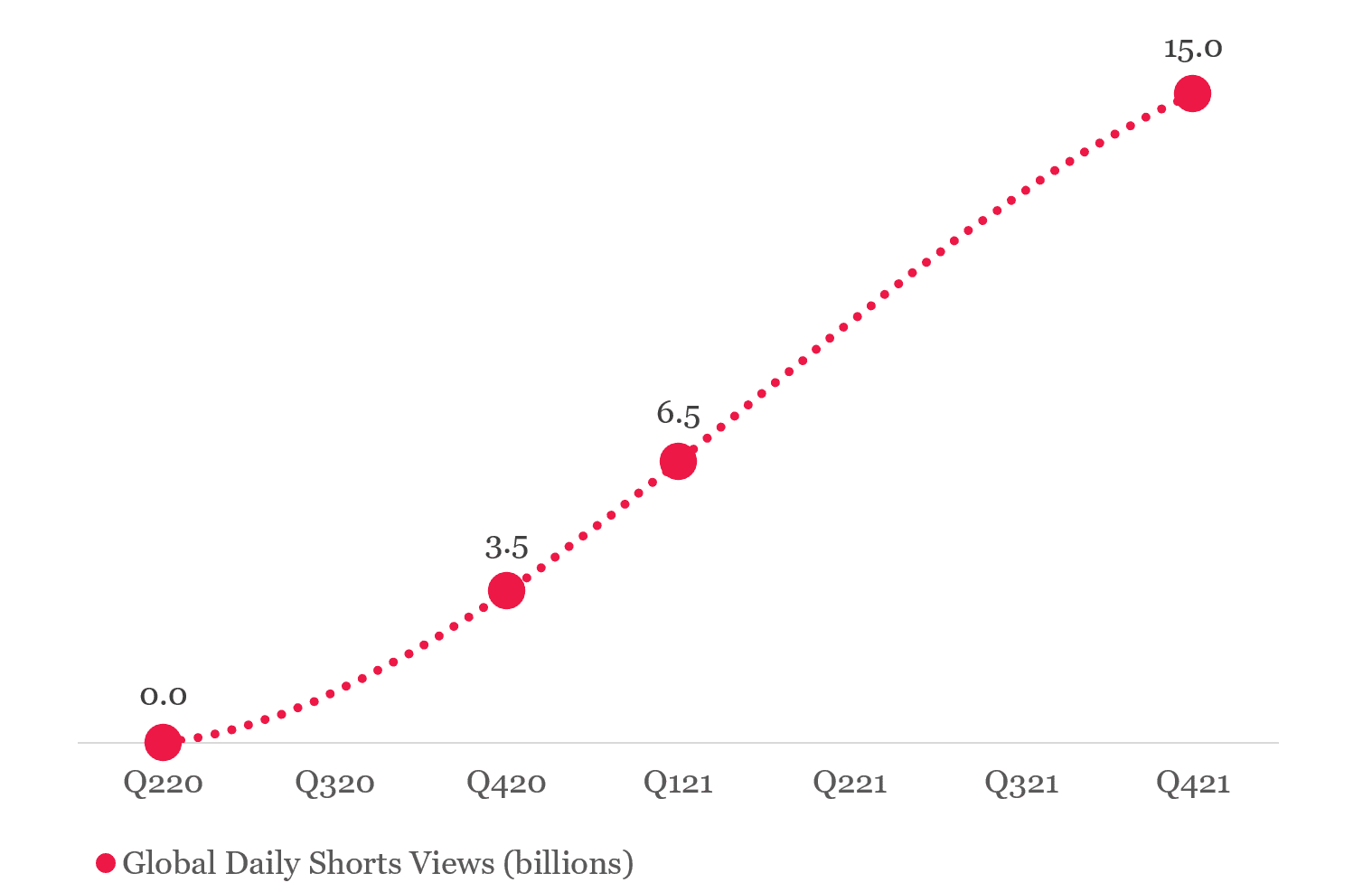

Source: Alphabet, Montaka Alphabet can now detect nearly 95% of all violative content on YouTube with automated AI flagging and address it before it becomes a problem. These results were driven by the application of scalable, automated AI technologies which will likely continue driving margins higher across YouTube as the need for expensive, manual human moderation of content fades. The high-grading of content on YouTube also makes advertisers more confident that their brands and products are promoted in an appropriate fashion, drawing more advertising dollars to the platform and incentivizing creators to produce more content (flywheel). 3. AI is accelerating Alphabet's ability to counter new competitionAI is also helping Alphabet to quickly adapt to competitive threats. Early in the pandemic Alphabet identified TikTok and its highly addictive, AI-enabled recommendation engine as a competitive threat. TikTok's engagement numbers were growing extraordinarily quickly as consumers demanded short-form, vertical videos during lock-down and were flocking to the platform. The speed with which Alphabet was able to create YouTube Shorts and address this video content gap in its ecosystem, highlights Alphabet's incredible leadership across AI and how it can be applied to support and enhance its core business. YouTube Shorts was created as a concept in the depths of the pandemic and has now grown to over 15 billion global daily video views inside of 18 months. This is a startling demonstration of exponential growth, YouTube's ecosystem, and the power of Alphabet's AI. Alphabet's AI enabled the creation of YouTube Shorts

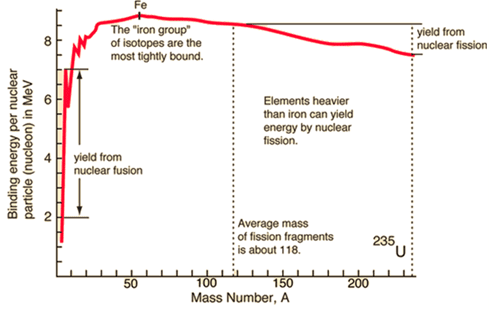

Source: Alphabet, Montaka While TikTok does not disclose global daily views, it is believed to have 4 to 5 billion in the U.S. alone and many more globally. It is a serious competitor that may have impacted the business more dramatically if not for Alphabet's extraordinary AI capabilities that enabled YouTube Shorts to be so successful.Source: Alphabet, Montaka. Interestingly, YouTube Shorts has largely been focused on engagement, user experience and product market fit, rather than monetization. Alphabet has significant runway ahead with respect to this incremental revenue stream with CEO Sundar Pichai noting "there's a lot more to do, [it's] super early...[we are] testing how shopping can be integrated with Shorts...the opportunity space here is pretty broad and it's exciting". 4. AI is helping Alphabet to solve the unsolvableAI is also helping Alphabet address some of the world's most intractable problems, including sources of renewable energy. The ocean potentially contains an unlimited source of carbon free and costless energy, if only we had the technology to unlock it. If we could find a solution to nuclear fusion, we could turn a single glass of seawater into a full year of power for an entire household. It would produce virtually no emissions and be available on-demand ... but it has long been science fiction. That is until DeepMind, Alphabet's cutting-edge AI division took on the problem. Nuclear fusion is the process that powers the sun and all the stars in the universe. It involves smashing hydrogen atoms together (fusion), rather than splitting uranium atoms (fission) and releases quadruple the amount of energy of a typical nuclear fission reaction. Nuclear fusion produces four times the yield of nuclear fission

Source: HyperPhysics A major challenge of nuclear fusion is the temperature required to perform it. Given the enormous gravitational pressure at the core of the sun, nuclear fusion can be achieved at around 10 million degrees Celsius. However, this level of pressure is not possible on earth. In fact, we need an environment that is 10 times hotter than the core of the sun for nuclear fusion. There is no material that can withstand such high temperatures, so fusion needs to be achieved in a plasma (super-heated gas) and held inside a continually changing magnetic field to control the reaction, something that is incredibly difficult to do. A further constraint around nuclear fusion research has been the ability to run experiments. To create a fusion reaction, scientists use a machine called a 'tokamak' to simulate sun-like conditions on earth. However, after three seconds of activity the tokomak needs 15 minutes to cool down. Software-based plasma simulators are even slower and require several hours of compute time to simulate just one second of real-time data. This is a highly inefficient way to carry out research, effectively rendering nuclear fusion a pipedream given our inability to address the problem. Enter Alphabet's DeepMind, in what has been hailed a major breakthrough and published in the prestigious scientific journal Nature, constructed an algorithm built on AI reinforcement learning to control the magnetic fields that govern plasma in a fusion reaction. DeepMind's algorithm predicted it would be able to control a real-life reaction for two seconds which was then applied to a real-life tokamak. The AI was spot-on. It controlled the plasma reaction exactly as predicted in the real-world. Over-time it is hoped Alphabet's AI will produce algorithms that enable plasma reactions to go on far longer than two seconds, and move humanity a step closer to solving the eternal problem of nuclear fusion. If successful, Alphabet's nuclear fusion AI would likely be sold as-a-service to customers looking to produce energy from this source. Potentially unleashing an explosive new revenue stream for Alphabet in the future. Inside a Tokamak Fusion Reactor (Illustrative)

Source: Financial Times A TECHNOLOGICAL INFLECTIONArtificial Intelligence is enhancing all areas of Alphabet's business, from those with valuable monetization models including Search, YouTube and Cloud, to emerging opportunities like autonomous driving (Waymo). Increasingly however, AI is creating opportunities in unexpected areas that Alphabet has not historically participated, raising the potential for it to disrupt entirely new industries and create brand new revenue streams in areas such as energy, biotechnology and beyond (i.e. real-options). Investors overlook and take for granted that silently sitting beneath the surface of Alphabet is perhaps the most cutting-edge AI apparatus the world has ever seen. It represents an insurmountable competitive advantage that will continue to strengthen for decades to come and propel the business forward in unimaginable ways. For readers interested in exploring AI from a broader and more general perspective, we cover many of our key insights in our AI Whitepaper which readers can access here. We believe that the months and years ahead will present opportunities to make attractive, multi-generational investments and we are prepared and well-positioned to take advantage of these. Note: Montaka owns shares in Alphabet (Google) Author: Amit Nath, Senior Research Analyst Funds operated by this manager: Montaka Global Fund, Montaka Global Long Only Fund DISCLAIMER |

22 Mar 2022 - Supply chains, logistics and inflation

|

Supply chains, logistics and inflation Forager Funds Management 07 March 2021 In this video, Steve Johnson and Chloe Stokes discuss a topic that's been top of mind for many investors: cost inflation and what it might mean for the future. The impacts have been pretty widespread so far, Steve says. For example, supply shortages have resulted in product mark-ups from the likes of Installed Building Products (NYSE:IBP), while online beauty retailer Adore Beauty's (ASX:ABY) customer acquisition costs have increased significantly as competition for its customers increases, and fast-fashion retailer Boohoo's (LON:BOO) margins have taken a hit due to significant increases in freight costs. |

|

Funds operated by this manager: Forager Australian Shares Fund (ASX: FOR), Forager International Shares Fund |

22 Mar 2022 - War. What is it good for?

|

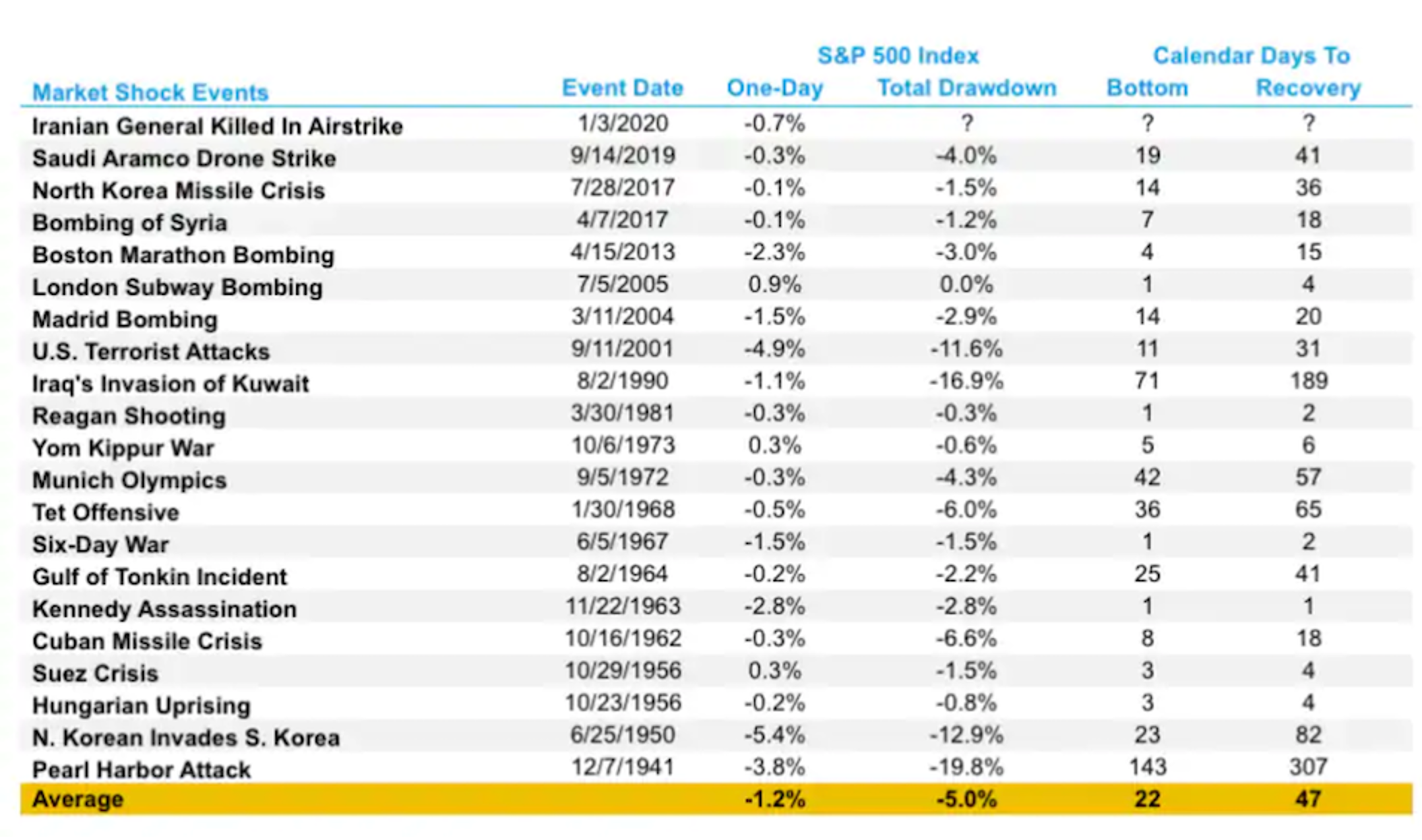

War. What is it good for? Montgomery Investment Management March 2022 Edwin Starr's classic 1969 anti-war song, War, asks: "War: What is it good for?" and responds emphatically "absolutely nothing." It's hard to argue with the sentiment. But it turns out Starr was not completely correct. You see, despite the terrifying carnage and destruction, war can often be a fruitful time to invest. Let me be clear: I detest armed conflict. War should be avoided at all times and not prompted by immature despots, seeking acclaim they can only take to their grave. With Russia and the Ukraine on the brink of war, and with markets predictably reacting negatively, I thought it is worth revisiting the enquiries I made the last time an armed conflict threatened to destabilise the world and markets. History suggests past conflicts have not inflicted permanent pain on investors. It has indeed been wise, historically, to invest at the depths of the conflict when fear was at its extreme. Research by LPL Financial, conducted in 2020, of market reactions to past geopolitical crises confirms stock market investors have mostly shrugged off geopolitical conflicts as some sectors and companies have continued to generate profits. Of course, that latter observation doesn't let investors off the hook because stocks can, and frequently do, move independently of the performance of the underlying business. Table 1, from 2020 by LPL Financial reveals however investors would be wise not to sell into the fear and weakness but instead, remember that there have been dozens, if not hundreds, of conflicts in the past and the stock market has survived. This of course is not to diminish the very real suffering at the hands of tyrants and dictators, which democratic allies should pull all stops to prevent. Table 1. A summary of geopolitical events and stock market reactions

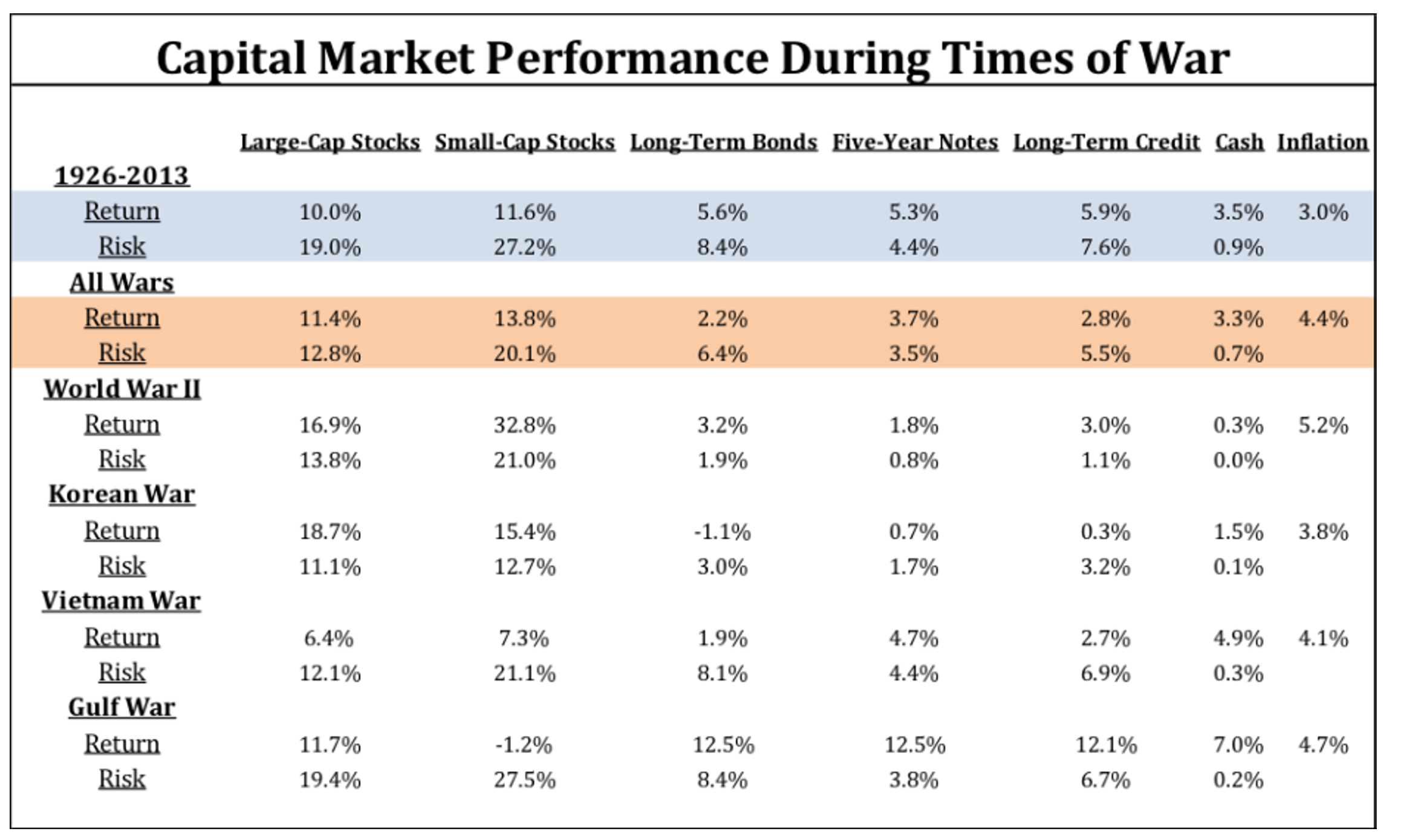

Source: LPL Research, S&P Dow Jones Index, CFRA. 1/6/20 Let's put the current invasion of Eastern Ukraine by Russia into some perspective. Following the outbreak of World War I in 1914, the Dow Jones declined almost a third within six months. Business ground to a halt and liquidity in the stock market vaporised as foreign investors sold US stocks to raise money for the war effort. The NYSE (New York Stock Exchange) closed on July 31, 1914. The world's financial markets closed their doors by August 1. The NYSE was closed for four months. It was the longest suspension of trading, and circuit breaker, in history. Almost immediately, however, a substitute trading forum called the New Street market emerged and trading began offering economically meaningful liquidity but impaired price transparency. Closing the stock exchange for a third of a year would be unthinkable today. It was unthinkable then. To wit: "If at any time up to July, 1914, any Wall Street man had asserted that the stock exchange could be kept closed continually for four and one-half months he would have been laughed to scorn."[1] It must have seemed grim for stock market investors, especially for anyone with capital tied up and locked down. After the stock market reopened in 1915, however, the Dow Jones rose more than 88 per cent. 1915 recorded the highest annual return on record for the Dow Jones Industrial Average. From the start of World War I in 1914, until its end in 1918, the Dow Jones rose 43 per cent or about 8.7 per cent annually. The Second World War must have seemed primed to be a whole lot worse. From the start of WWII in September 1939, when Hitler invaded Poland, until it ended in late 1945, the Dow Jones rose 50 per cent - equivalent to a compounded seven per cent per annum. In other words, the two most damaging conflicts in history saw the stock market rise meaningfully. On 7 December 1941, when the Imperial Japanese Navy Air Service attacked the U.S. naval base at Pearl Harbor, Honolulu, by surprise, stocks opened the following Monday down 2.9 per cent, but it took just a month to regain those losses. And then, when the allied forces invaded France on D-Day on June 6, 1944, the Dow Jones barely reacted and rose more than five per cent over the subsequent month. Caveat(s) According to research conducted in 2015, into U.S. military conflicts after World War II by the Swiss Finance Institute, stock prices tend to decline in the pre-war phase and recover when war commences. But when war is a complete surprise, stocks decline. Another study, published in 2013 by Mark Armbruster, of Armbruster Capital Management, examined the period from 1926 through July 2013 and found that stock market volatility was actually lower during periods of war. "We looked at returns and volatility leading up to and during World War II, the Korean War, the Vietnam War, and the Gulf War. We opted to exclude the Iraq War from this group, as the Iraq War included a major economic boom, and subsequent bust, that had very little do with the nation's involvement in a war. "As the table below [Table 2.] shows, war does not necessarily imply lackluster returns for Domestic stocks. Quite the contrary, stocks have outperformed their long-term averages during wars. On the other hand, bonds, usually a safe harbor during tumultuous times, have performed below their historic averages during periods of war." Table 2. Capital market performance at times of war

Source: Mark Armbruster/CFA Institute In recent years, the 9/11 attacks and the Global Financial Crisis in particular, have trained investors to expect central banks to rescue them through the repression of financial market volatility. Moreover, the belief and hope the initial conflict doesn't escalate, drawing in the rest of the world, has also been supported by real world experience. Investors have thus been conditioned to eschew an overreaction. It is probably the fear of an all-inclusive war that inspires investor reaction to even the most minor of conflicts involving powerful nations but investors do well more often than not, when they remain invested, take advantage of weak prices and correctly bet that sober hearts and minds will prevail. Most of the time it is economic and idiosyncratic fundamental factors that impact security prices. Very rarely, a solitary exogenous event is influential enough to override the usual factors and impact market returns materially. Based on research of history and the above data, however, war and geopolitical conflicts shouldn't be counted in that category. Author: Roger Montgomery, Chairman and Chief Investment Officer Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund [1] Noble (1915, p. 87). |

21 Mar 2022 - Manager Insights | DS Capital

|

|

||

|

Chris Gosselin, CEO of Australian Fund Monitors, speaks with Rodney Brott, CEO & Executive Director of DS Capital. The DS Capital Growth Fund has a track record of 9 years and 2 months and has outperformed the ASX 200 Total Return Index since inception in January 2013, providing investors with an annualised return of 14.56% compared with the index's return of 9.07% over the same period.

|

21 Mar 2022 - Learning from historians as well as from history

|

Learning from historians as well as from history Equitable Investors 11 March 2022 Responding to cannon fire in the bay, the citizens of Melbourne armed themselves and gathered in Port Melbourne in September 1854, believing a Russian attack that media commentators had warned of was upon them. Twenty eight years later, Melbourne's Age newspaper warned that "it would be comparatively easy for Russia to bring down an overwhelming force from the neighborhood of the Amoor without awakening the suspicions of the British naval officers at China or Japan." The city's populace was then stirred by a series of articles claiming to have proof of a planned invasion - allegedly deciphered copies of telegrams between the Russian Minister of Marine and a Russian Admiral. But the cannon fire in 1854 was actually from a friendly ship, the Great Britain, that was celebrating its release from quarantine. And the telegrams of 1882 and stories of imminent invasion that surrounded them were a hoax. No invasion obviously ever eventuated. The Ballarat Courier described it as a "stupid and offensive affair". Melbournians (or a portion of them) had taken what they read in the newspapers at face value. They may have considered newspapers to be a trustworthy source. Gold had been discovered and wealth created that others might be envious of. There was a feeling of isolation given the distance from Great Britain. Russian ships had visited Victoria as they followed the winds on a "great circle" route to get from Europe to the northeastern region of their vast country. Information fragmentsThe tragic war that is being waged in Ukraine is generating volumes of information and disinformation around the clock. It is far easier now in the social media era than it was in the 1850s for investors to be exposed to incomplete fragments of the truth or deliberately misleading information that causes their imagination ro run away and make decisions hastily. This Ukraine war triggered panic when Russia attacked a Ukrainian nuclear power plant, Zaporizhzhia, which is understood to be the largest nuclear power plant in Europe. Images of heavy fire led to fears there would be a melt-down on a scale greater than Chernobyl. Not to underplay the potential risks of what is going on in Ukraine, the reality was in this case that it was a training building at the power plant that caught fire, not the nuclear reactors. And the experts tell us, with reference here to Bloomberg's reporting, that the reactors are "housed inside containment buildings that will protect them from plane crashes, tornadoes, bomb attacks, and explosions caused by the escape of flammable fission by-products". Learning from Historians as well as from History Students of history (the tales of Melbourne's Russian fears are sourced from this investor's long forgotten Honours Thesis in History) need to know how to research and dig for relevant information. But that is only half the battle. Historians must also be able to critically assess information. Who or what is the source? What was the intended audience? What motives and bias come into play? These skills are equally valuable to investors awash in live feeds from around the world - especially when a social media algorithm may be pushing one particular blinkered view or perspective on them. Author: Martin Pretty, Director Funds operated by this manager: |

18 Mar 2022 - What to expect from markets during the Russia and Ukraine war

|

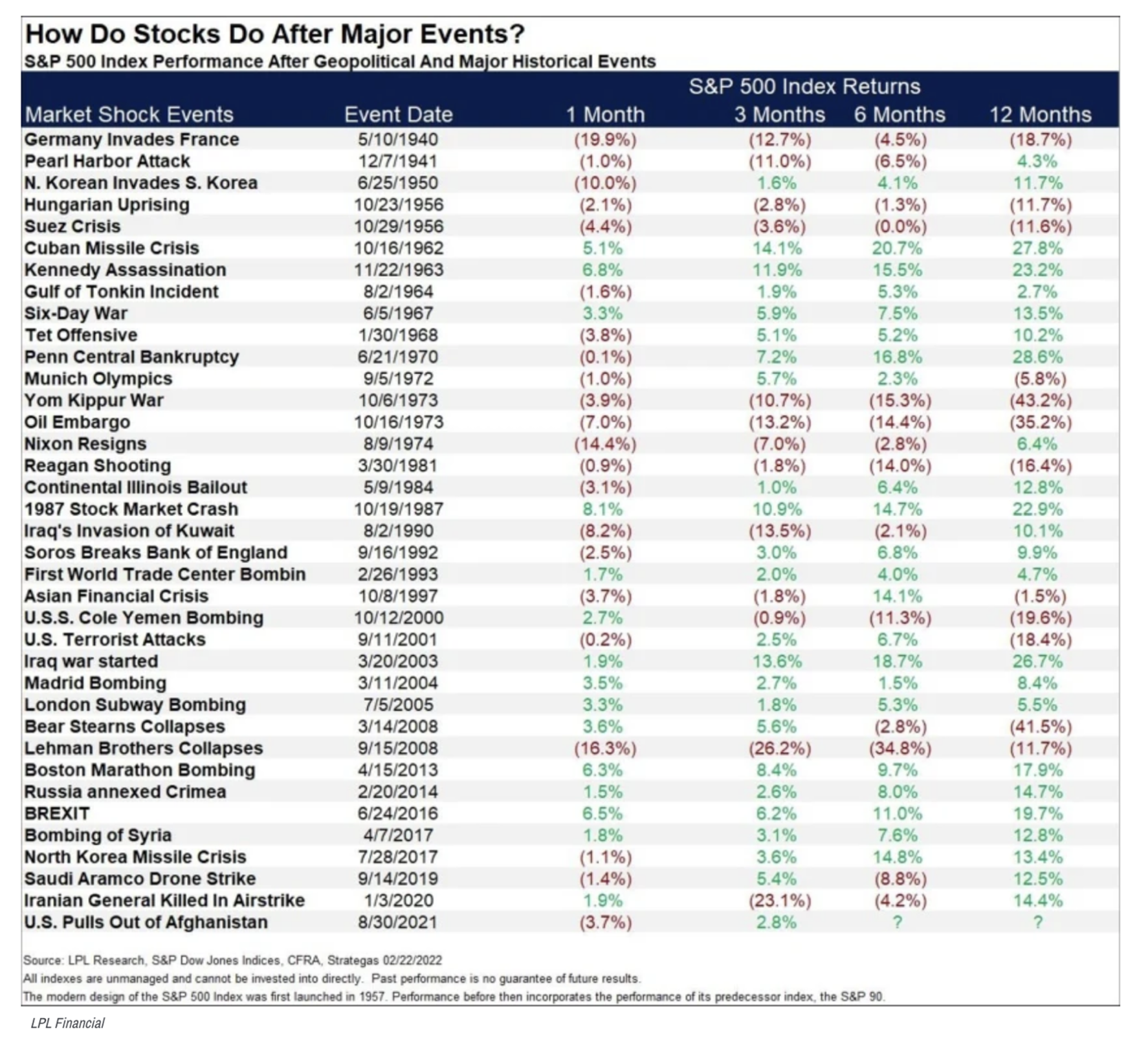

What to expect from markets during the Russia and Ukraine war Montgomery Investment Management March 2022 Roger reveals the past market performance following major geopolitical or historical events since World War II. A discussion on the economic implications invariably begins with energy markets. Booming logistics has created an energy crisis driving oil, from negative prices just under two years ago, to nearly a hundred dollars a barrel today. Commodities prices have also soared with Ukraine one of the world's larger exporters of iron ore. Transcript Roger Montgomery: A week or so ago we wrote about historical precedents with respect to the equity market returns amid war. The summary; equities tend to decline in the prelude to war and rise when the first shots are fired. When we have seen divergence from that historical pattern it is because there was no prelude. Between 1914 and 1918, the period that defines WWI and between 1939 and 1945 - defining WWII - the Dow Jones rose 8.7 per cent and 7 per cent per annum respectively. During the two periods that arguably define the worst military conflicts in modern history the markets rose. Most-conflicts-since-then have been relatively short-lived. Have a look at this table courtesy of LPL Financial. It reveals past market performance following major geopolitical or historical events since WWII. The bottom line is, in the absence of a recession, the market appears to eventually shrug off conflict. None of this is to diminish the very real horror of the humanitarian crisis unfolding in the Ukraine, the mounting loss of life and thousands of families and individuals displaced as they leave their homes and relationships for safety across the border. For each conflict or crisis, investor uncertainty stems from the presence of elements that make it more unique (and worse) than those that preceded it. With respect to Russia's unprovoked invasion of the Ukraine, we have, according to various press reports, an unhinged kleptocrat, with a finger on a phalanx of nuclear weapons. Maybe this time is indeed different. And let's not forget investors were already nervous about inflation and rising interest rate before Putin's aggression. Indeed, the prevailing inflationary climate may have had something to do with his timing. Booming logistics has created an energy crisis driving oil, from negative prices just under two years ago, to nearly a hundred dollars a barrel today. Commodities prices have also soared. US inflation hit a four-decade high and perhaps, Putin seized the opportunity thinking the west might be loath to impose sanctions that drive prices higher. But the Ukraine is one of the world's larger exporters of iron ore and some 600 million people in Europe and elsewhere are fed by the country's agriculture sector. Conceivably, Putin underestimated the West's determination to secure this important source of food and mineral commodities. But more important than letting commodity supply fall under Putin's control, maybe it is the West's determination to defend democracy that Putin has underestimated. Keep in mind, the stock market can remain elevated for some time - even as a train wreck is obviously approaching. Eventually however it succumbs to a wave of panicked selling - much as a deer or rabbit transfixed by headlights succumbs to the vehicle careening towards it. Investors need to watch for the point at which the Allied's words, sanctions and the supply of arms to Ukrainian civilians is inadequate to defend democracy and the Ukraine. Putin's persistence - and it is clear his pride won't tolerate anything less - and the failure of diplomacy, would be negative for risk assets. A consequent delaying, by central banks, however, of both quantitative tapering and interest rate increases is a positive. If diplomacy does succeed, the focus will return to inflation, interest rates and the risk of a wage price spiral. In either case the possibility of a pronounced correction is one investors should be ready to take advantage of. If I was to make one prediction it is that in a several years' time, we will have seen a correction but we will also have seen peak inflation and the effect of automation on productivity and wages, which will be incredibly positive for high quality businesses, those with pricing power and those growing into their-potential-to-be-a-multiple-of-their-current-size. Speaker: Roger Montgomery, Chairman and Chief Investment Officer Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |