News

11 Dec 2024 -

|

"A is for Ambition": Apple and Amazon Bet Big on the Future Alphinity Investment Management December 2024 |

|

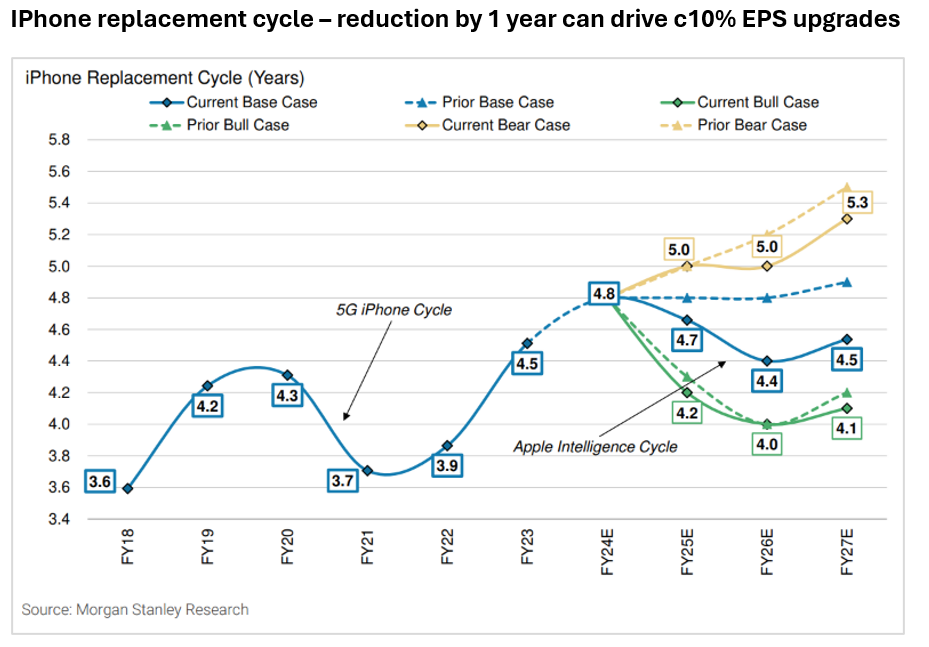

The recent Apple and Amazon third quarter 2024 results revealed further details around the critical leg of their strategies, with these tech giants continuing to lay down markers for how they see the next stage of tech evolution unfolding and staking out positions to profit from it. Looming large in this evolution is AI, with Apple looking to leverage capabilities across what is an enormous ecosystem of 2.2bn active devices while Amazon is focusing on pushing AI applications across their Cloud and consumer business. The recent results also provided key insights into shorter term business performance.  Key takeaway from the result? The key takeaway from the Apple result is that while the gains from the release of "Apple Intelligence" will be significant, they will take time. This was evidenced by the fact that despite this recent result coming in ahead of expectations, it was coupled with a guide for the coming quarter that was mildly below what the market was looking for (Apple guided to revenue growth of low to mid-single digits vs a market that was expecting +7%). This makes sense as "Apple Intelligence" has only just rolled out in the US in recent weeks, and will not become available in the UK, Australia, Canada, and New Zealand until December 2024. Other geographies will follow over the course of 2025. Most importantly, it is also December 2024 before we see a meaningful expansion of the AI features including the long-awaited Chat GPT integration. As such, the powerful iPhone upgrade cycle that we expect to come with "Apple Intelligence" is likely to be a slow burn, with momentum building through 2025 and into 2026. What impressed? The ability of Apple to turn a benign demand environment into double digit EPS growth is impressive. Products growth has been tepid but the higher growth Services business, margin expansion and a buy-back continues to drive EPS growth above 10%. What disappointed? While we appreciate that Apple Intelligence will take time, the pace of the roll-out driving the weaker than expected outlook for 4Q (which is their biggest quarter of the year) was mildly disappointing. However, Apple tend to focus on quality rather than speed, so we do think that their ability to monetise AI across an installed base of 2.2bn active devices is a compelling, multi-year opportunity. Interesting chart? The next phase for Apple is all about an iPhone replacement cycle coupled with an expansion of associated Services revenue. The chart below shows what happened the last time a compelling technology shift occurred, with 5G driving a compression in this replacement cycle. Since the most recent trough in FY21, replacement cycles have shifted out by more than 12 months. A compression of this replacement cycle back towards 4yrs will drive circa 10% EPS upgrades.  What are the key risks? There are a few key risks facing Apple in the coming years. Key among these are:

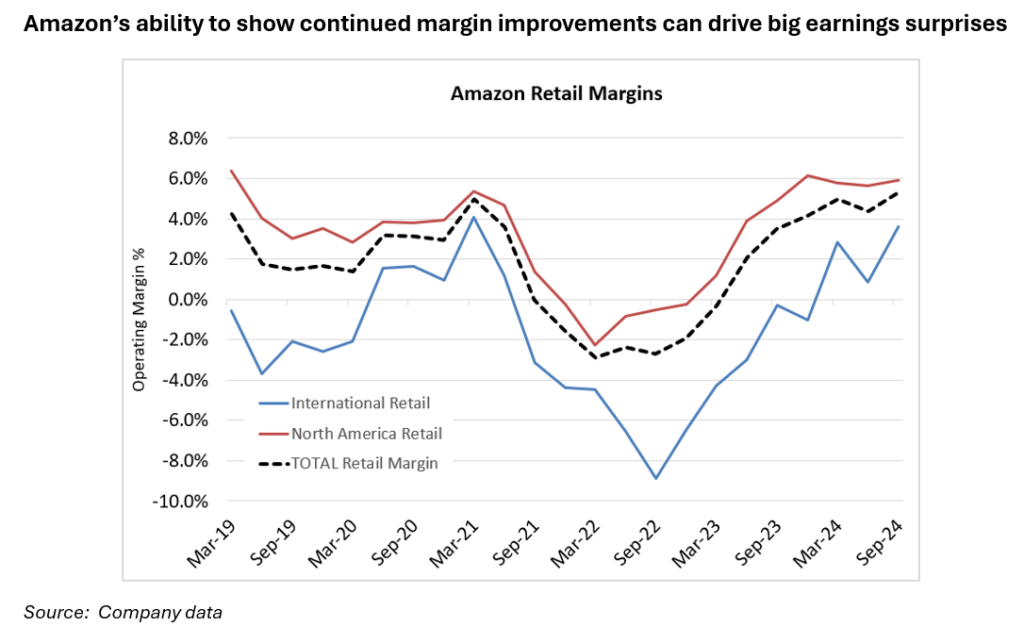

In summary, Apple's ability to monetise their enormous consumer ecosystem is almost unrivalled. They will find a structure through which to monetise Ai, both through device sales but more importantly through an expansion of Ai related Services offerings. There is no company better placed to be the window into Ai for the average consumer.  Key takeaway from the result? Margins, margins, margins. Given the scale of the Amazon business, a mild shift in margin outcomes can drive enormous gains in operating income and EPS. Amazon spooked the market during their 2Q24 results which showed margins for their core retail business to be weaker than expected, which was blamed on everything from mix (lower priced "everyday essentials" in baskets) to building extra satellites for their broadband business. However, come the 3Q24 result last week, all was forgotten as Amazon blew those margin expectations (that they ironically had guided to themselves) out of the water. So, the question becomes, will this margin expansion continue? What impressed? The margin outcome in the core retail business was impressive, particularly in the international segment. Despite pressures from mix and what appears to be heightened competition from legacy retailers (eg Walmart) and Chinese players (Temu, Shein), Amazon generated solid topline growth and exceptional margins. The Amazon cloud business AWS also showed a continuing reacceleration driven in part by AI. A combination of the "law of large numbers" plus optimisations had driven compression in cloud growth rates across Amazon (AWS), Microsoft (Azure) and Google (GCP). However, the advent of AI has driven a reacceleration in cloud growth, which is impressive given the base of business is significantly larger. What disappointed? While it may seem unusual to have any source of disappointment in an exceptionally strong result, the variability of the margin outcomes compared to what management expected could indicate a lack of visibility. While a "miss vs expectations" is very happily received when it is an upside surprise, it does raise some concerns that perhaps next time the "surprise" could be the other way. Interesting chart? Given the scale of the retail business, a shift in margin expectations has a material impact on earnings. A circa 100bps improvement in Retail margins vs current expectations for CY25 would drive a 7% beat in Amazon operating income.  What are the key risks? For Amazon, risks are on a couple of key fronts:

In summary, Amazon's 3Q24 earnings report highlighted the significant earnings potential of the business and underscored the company's strong market position and attractive consumer offerings. However, it is crucial to closely monitor Amazon's ability to sustain margin improvements and effectively navigate ongoing consumer pressures in the future. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Global Sustainable Equity Fund, Alphinity Sustainable Share Fund |

10 Dec 2024 - Mixed market sentiment for 2025 driven by global geopolitics and central bank easing cycles

|

Mixed market sentiment for 2025 driven by global geopolitics and central bank easing cycles Bennelong Funds Management November 2024 The incoming Trump administration has raised uncertainty about the outlook for global markets in 2025, particularly around the implementation of Trump's protectionist policies, according to Bennelong and its boutique partners Canopy Investors, 4D Infrastructure and Quay Global Investors.

The new US administration's activities and policy changes will be very important in driving market sentiment in 2025, and will create both opportunities and risks, according to Canopy Investors' portfolio manager, Kris Webster. "There remains significant uncertainty about the actual policies that will be introduced, and their ultimate impact, making the outlook for 2025 very uncertain. "However, based on Trump's stated policy positions, several domestic US sectors appear well positioned to benefit from his presidency. These include manufacturers, energy companies, and industries targeted for deregulation, for example financials. "Conversely, certain sectors may face headwinds including global exporters to the US, US importers, and companies with substantial China exposure. "Markets have already priced in some of these policy expectations, as evidenced by US dollar strength against major currencies. This dynamic has created increasingly attractive valuations for many high-quality stocks in markets outside the US, particularly those with limited exposure to US policy changes. Mr Webster says a critical uncertainty centres on how these policies might affect inflation and, by extension, interest rates - both of which significantly influence asset prices and highly leveraged companies. "It's possible the US government will moderate its policies around taxation, tariffs, and immigration, if inflation picks up again. "While we don't make short-term macro or market predictions, it is likely that the policy uncertainty anticipated in 2025 will drive increased market volatility. This environment should create opportunities for active investing, particularly in global small and mid-cap companies, where market inefficiencies tend to be more pronounced," he says. For global listed infrastructure, there is likely to be heightened policy noise in the US on what policies are prioritised for actual implementation, according to 4D Infrastructure CIO, Sarah Shaw. "Most notably, these include the 60 per cent tariff on Chinese goods and a universal 10 to 20 per cent tariff on all other countries. These could have an impact on infrastructure assets, in particular port and rail volumes in both export and import countries, with some volumes pulled forward ahead of the anticipated tariff increases, whilst some export markets will be substituted with other destination markets away from the US. "Trump is also looking to repeal some aspects of the Inflation Reduction Act (IRA), which may impact the growth outlook of some heavily US renewable focused developers and utilities. This could lead to an ongoing overhang till we see what is exactly implemented. "This pivot away from renewables and preferring traditional fossil fuels may be positive for north American pipelines if more federal lands are permitted for exploration. An undoing of Biden's pause of new LNG Export terminals will also help the long-term capital plans of those businesses," she says. "Lastly, the proposed policies are inflationary and a reversal in trend of interest rates could be a headwind for US nominal rate utilities which have had an incredibly strong year in 2024" Elsewhere in the world, Ms Shaw says there are divergent economic outlooks. "In Europe demand remains soft with interest rate trajectory down. China continues to struggle with a dormant economic outlook, increasing stimulus. In Brazil, growth continues to surprise to the upside with a reversal in the interest rate trajectory." Ms Shaw says that this macro uncertainty and geopolitical tensions will create volatility and noise, however by separating the attractive fundamentals of infrastructure from this noise and continuing to invest against the inefficiency of markets, investors can capture future earnings and growth in this asset class. "Infrastructure offers a unique combination of defensive characteristics and earnings resilience but with significant long-term growth thematics as well as an ability to capture economic cycles. "The need for global infrastructure investment over the coming decades is clear with five globally relevant and necessary thematics under pinning a multi decade growth story. With governments unable to wholly fund the infrastructure need, there's a significant opportunity for private investors to tap into this growth story. We can think of no more compelling or enduring global investment thematic for the coming 50 years," says Ms Shaw. Chris Bedingfield, portfolio manager at Quay Global Investors, sees a similar mixed story for global real estate assets. "Investors continue to make the mistake of thinking real estate is interest rate driven but the value in real estate can be found by focusing on thematics not influenced by macros factors or politics. "The aging population is a thematic we are focused on and 2025 marks the 80-year anniversary of the end of the second world war, meaning that next year, the first of the Baby Boomers will turn 80, an age where many turn to some type of assisted living. "Retail also continues to look very attractive. The recovery of in-store retail sales since COVID remains well above the prior pandemic trend. We expect good financial results from the best malls in 2025 as landlords continue to mark rents back to economic reality." Mr Bedingfield says there are signs that suggest a positive outlook for global REITs. "Timing the markets is hard. Miss a few good days and long-term total returns can alter significantly. This is especially so for listed real estate. "History suggests listed REITs run in anticipation of US Fed rate cuts and continue to perform for some time after, and we've seen this materialise after the first rate cut in September. "Moreover, higher building costs is already resulting in a shortage of global real estate, as the development equation does not work. This will simply squeeze future tenants, all the more to the benefit of landlords and investors of REITs," he says. The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. |

9 Dec 2024 - How Trump will impact equity markets

|

How Trump will impact equity markets Magellan Asset Management November 2024 |

|

The United States has spoken. President Trump will return to the White House in the new year. But how can we cut through the noise to reveal the investment, economic and geopolitical ramifications? Magellan's Head of Global Equities and Portfolio Manager, Arvid Streimann, has over 25 years' experience of following markets and politics, and over this time has built up a network of trusted contacts, he can offer a measured, independent view of the situation, including his expectations on Donald Trump's policy initiatives and decision making. He's joined by Investment Director Elisa Di Marco for an exploration of the implications of a Republican clean sweep, including the impact on standards of living and consumer sentiment, as well as the potential for deregulation, and President Trump's promise to adopt protectionist policies in an effort to develop self-sufficiency. They share insights into geopolitical dynamics, including U.S.-China relations, Iran and Ukraine, and discuss the risks and opportunities for investors. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Core Infrastructure Fund, Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged) Important Information: Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

6 Dec 2024 - Risks & Issues for 2025 - Part 1

6 Dec 2024 - How Co-Investments are Transforming Affordable Housing

|

How Co-Investments are Transforming Affordable Housing HOPE Housing Fund Management November 2024 Wholesale and sophisticated investors have traditionally pursued two objectives: achieving strong returns while remaining sufficiently diversified. More recently, they've had to consider a third objective, which is to potentially incorporate ESG principles into their investment process. What makes this challenging is that it can feel like there is tension between the three objectives; that pursuing one must come at the expense of one or both of the others. That's why investors will always look closely at any investment option that appears to align with all three objectives. Now that housing affordability has become such a serious social issue in Australia, an opportunity exists for a clever fund manager to offer a new way to invest in residential real estate. To really attract investors, it would need to deliver all three objectives - the prospect of strong returns and prudent diversification, while simultaneously addressing the affordability crisis. Australia's housing affordability problem is getting worseThe reason this kind of idea is now on the radar of the investment community is because, as property prices keep increasing, the affordability crisis keeps growing. The biggest issue is not paying off ever-larger mortgages but saving the deposit required to enter the market in the first place; because, for many people, especially essential workers on lower incomes, property prices can increase faster than their capacity to save. A 2023 report1 from ANZ and CoreLogic found that the time required for people on the median income level to save a 20% house deposit was 10.7 years across Australia, including 15.7 years in Sydney, 11.6 years in Melbourne and 10.8 years in Brisbane. Domain research2 from 2024 found that the sum required for a 20% house deposit more than doubled in Sydney between 2013 and 2023, from $153,361 to $319,062, and almost doubled in Melbourne ($117,574 to $209,455) and Brisbane ($92,153 to $177,657). Meanwhile, a 2023 report3 from the Australian Housing and Urban Research Institute (AHURI) revealed that successive generations have been experiencing lower rates of home ownership. "Home ownership rates at age 30 have fallen from a high of 65% among those born in the late 1950s to around 45% among those born in the 1980s. By age 50 there is incomplete catch-up in home ownership rates - which means that younger cohorts do not close the gap and catch up with their older counterparts. Around 25% of the homeownership gap remains," according to the report. First home buyers are co-investing with the Bank of Mum & DadThe AHURI report noted that parents are increasingly helping their children enter the market, by letting them live rent-free in the family home while they save a deposit, providing direct cash support or going guarantor on a loan. Remarkably, there has been such a rise in Bank of Mum & Dad activity that, in aggregate, it is now "among the top 10 mortgage providers in the country". The report also pointed out the important link between Bank of Mum & Dad support and entry into home ownership. "The receipt of large parental transfers (over $10,000) is associated with a doubling of the rate of transition into home ownership; additional time spent co-residing with parents increases the probability of transitioning into home ownership by around 40% relative to those in rental tenure," according to the report. Two conclusions come to mind after reading this research:

Exploring government co-investment opportunitiesSo what options do people have if they can't access Bank of Mum & Dad support? The most obvious option is to stay in the rental market, but this is tougher than it sounds. As of January 2024, the national rental vacancy rate was at a record-low 0.8%, according to Domain4, making it hard for tenants to find accommodation. As a result, rents5 in the combined capital cities were at record highs at the end of 2023, with median house rents jumping 12.3% in Sydney over the course of the year, 14.6% in Melbourne and 9.1% in Brisbane. That means renters on below-average incomes are being forced out further and further from the city centre. Another option is to try to save a deposit for a home on the outskirts of the city, where prices can still be dear but are much more affordable than close to the city. The downside, though, is that buyers face an exhausting commute if they work in the city's inner ring. A third option is to take advantage of government co-investments. In November 2024, the Senate passed the Help to Buy program, a shared-equity scheme under which the Federal government will make an equity contribution of up to 40% for new homes and 30% for existing homes. This scheme will be limited to buyers with a household income of less than $90,000 for single buyers or $120,000 for couples. New South Wales previously had a similar equity co-investment scheme, called Shared Equity Home Buyer Helper. This offered the same equity contribution (40% for new homes, 30% for existing homes) and had similar income caps. Under the Victorian Homebuyer Fund, the state government acts as co-investors by providing an equity contribution of up to 25%. Income caps apply - $130,485 for individuals and $208,775 for joint applicants. Queensland helps public housing residents buy the home they're renting with the Pathways Shared Equity Loan. The government makes an equity contribution of up to 40%. Western Australia offers equity co-investments of up to 30% through its Keystart program. Income caps (which are variable) apply. South Australia also does property co-investments. Under HomeStart, the state makes equity contributions of up to 25%. Participants' household income must be less than $100,000. Tasmania has a co-investment program called MyHome, which makes an equity contribution of up to 40% for new homes and 30% for existing homes. Income caps (which are variable) apply. In the ACT, the Shared Equity Scheme helps public housing tenants purchase their home through a government equity contribution of up to 30%. Australia's aspiring homeowners need institutional investors to step into the residential property marketCo-investments of the kind launched by state and federal governments play a positive role in making it easier for Australians to get on the property ladder. However there are only so many places available in these programs and they are (reasonably) targeted at people on lower incomes. Yet research shows middle-income earners are just as challenged by home ownership, however are often excluded from government support. To broaden the reach of co-investment, especially to those without the bank of mum and dad, there is a role for private market solutions, sponsored by Australia's deep pool of institutional capital - superannuation. By expanding the reach of shared equity schemes that have been proven to work, more Australians who are dealing with housing affordability challenges and mortgage stress can be assisted. To date, large institutional investors in Australia have not turned their mind to this new co-investment opportunity. This is despite many institutional investors in the UK, Canada and the US having great success in shared equity and shared ownership. Much of this is to do with the narrow focus local superannuation funds have had on residential investing, mainly looking at investing in new rental projects aimed at low-income workers. These projects, often termed 'Build to Rent' carry significant construction and occupancy risk and can require government subsidies to obtain commercial returns. For these reasons, among others, the majority of Australia's institutional investors have found the risk-adjusted returns in affordable housing investments unappealing. Over time, it is expected that local superannuation funds will broaden their residential portfolio construction approach, to ensure they are investing to support their members across both increased affordable rental and home ownership solutions. The latter is important, as home ownership contributes to security in retirement in a way long-term renting cannot, and furthers their mission of enabling Australians to have a dignified retirement. How HOPE Housing Fund Management has made co-investments profitableThe question of how institutional investors can identify opportunities in the affordable housing space, that deliver optimal risk-adjusted returns leads us back to the issue raised at the start of this article: could a clever fund manager create an investment option that not only addressed the housing affordability crisis, but also provided investors with strong returns and prudent diversification, with no need for government subsidies? The answer is yes, thanks to HOPE Housing Fund Management (HOPE/HOPE Housing/Fund Manager), the first co-investor that helps essential workers - such as cleaners, nurses, teachers, social workers and first responders - purchase a home close to work. The Fund Manager successfully closed its first fund, HOPE Fund I in October of 2024, and has recently launched its second fund, HOPE Fund II, pursuing the same shared equity strategy. In the HOPE Housing model, buyers make an equity contribution of around50%, through a deposit and mortgage, and the HOPE Fund II will provide the rest. This significantly lowers the deposit hurdle for essential workers, who often have limited incomes, giving them the chance to not only get on the property ladder but also buy close to the city. The Fund Manager's innovative solution also supports essential workers to stay in their jobs, rather than being forced to switch to a higher-paid profession, just so they can buy a home. HOPE Fund II accepts contributions from wholesale or sophisticated investors, who must invest at least $100,000. These funds are pooled, so investors back a portfolio of co-investment opportunities, rather than just one. As at September 2024, HOPE Fund I has achieved a 11.2%(A) portfolio asset growth since inception, exceeding the broader Sydney property market's 7.3% (B) growth calculated for the same period. HOPE uses pre-purchase independent valuations and an investment committee review process, to ensure buyers purchase investment-grade properties. HOPE's co-investing model offers a different risk/return profile than the Build-To-Rent model and gives high-net-worth and institutional investors the chance to achieve much loved property market returns while helping to solve a hugely challenging social issue. Since establishing in October 2022 , HOPE Fund I has invested in 20 properties that house 31 essential workers (as some households have more than one), as of September 2024. Invest in property, without compounding the problemThanks to HOPE's unique solution, wholesale and sophisticated investors no longer have to make a trade-off between making money and doing good. Now, they can fulfil their investment mandates while helping to solve one of Australia's biggest social problems. What makes this solution so heartening is that it really is win-win - investors benefit, but so do their co-investors, the essential workers who are supported by the scheme. HOPE is leading the way with this Australia-first initiative. As its impact grows, it wouldn't be surprising if other organisations were inspired to create something similar. Webinar Invitation Join us to learn more about how an investment in the HOPE Housing Residential Property Trust works. HOPE Housing Investment Webinar - Wednesday 11th December 2024, 12.00pm - 12.45pm |

|

Funds operated by this manager: HOPE Housing Investment Trust, HOPE Housing Residential Property Trust Footnotes 1 https://media.anz.com/posts/2023/november/undersupply-of-housing-impacts-affordability 2 https://www.domain.com.au/news/house-deposits-have-nearly-doubled-in-the-last-decade-1259217/ 3 https://www.ahuri.edu.au/research/final-reports/404 4 https://www.domain.com.au/group/media-releases/competition-easing-amidst-record-low-vacancy-rates/ 5 https://www.domain.com.au/research/rental-report/december-2023/ Important Information Past performance is not a reliable indicator of future performance. Prospective investors should carefully review HOPE Fund II's Information Memorandum (IM) in full and seek professional advice prior to making any investment decision. For more information about the Fund, please refer to the Investor Disclaimer on our website. The information in this article was finalised in November 2024. (A) The Portfolio Growth since inception p.a. represents the cumulative growth since HOPE Fund I portfolio inception date of 16 November 2022. Portfolio growth is determined by estimating market value of the properties within the Fund's portfolio monthly, using CoreLogic IntelliVal (Automated Valuation Estimate) and PropTrack AVM. The change in total portfolio value is indexed from a base value of 100, established at the inception of the Fund's portfolio, to account for the addition of new properties during the same period. The portfolio growth information does not take into account liabilities or expenses of the Fund and therefore may not reflect overall Fund performance. (B) The CoreLogic Benchmark is derived using the 'CoreLogic Hedonic Home Index reports' for 'All Dwellings' in the Sydney market, since the HOPE Fund I portfolio inception date of 16 November 2022. This is the growth of residential real estate in the Sydney market. The detailed methodology of the CoreLogic Hedonic Home Index can be found on the CoreLogic Australia website. © Copyright 2024. RP Data Pty Ltd trading as CoreLogic Asia Pacific (CoreLogic) and its licensors are the sole and exclusive owners of all rights, title and interest (including intellectual property rights) subsisting in this publication, including any data, analytics, statistics and other information contained in this publication (Data) . All rights reserved. The article has been prepared by HOPE Housing Fund Management Limited ACN 629 589 939 (Investment Manager/Manager/Company/HOPE/HOPE Housing) directed to wholesale clients and is strictly for general information and discussion purposes only, without taking into account your personal objectives, financial situation or needs. Before acting on this general information, you must consider its appropriateness having regard to your own objectives, financial situation and needs. The information provided is not intended to replace or serve as a substitute for any accounting, tax or other professional advice, consultation or service and nothing in this article shall be construed as a solicitation to buy or sell any financial product, or to engage in or refrain from engaging in any transaction. The Investment Manager is a corporate authorised representative (number 001289514) of SILC Fiduciary Solutions Pty Ltd ACN 638 984 602 (AFS licence number 522145). The authority of the Investment Manager is limited to general advice and deal by arranging services to wholesale clients relating to the HOPE Housing Residential Property Trust (Fund/HOPE Fund II) in Australia only. |

5 Dec 2024 - Manager Insights | East Coast Capital Management (From rubber to oats )

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Richard Brennan, Strategy Ambassador at East Coast Capital Management. The ECCM Systematic Trend Fund has a track record of 4 years and 10 months. The fund has outperformed the SG Trend benchmark since inception in January 2020, providing investors with an annualised return of 15.09% compared with the benchmark's return of 6.97% over the same period. Key to its success were high commodity market allocations and a systematic, risk-managed approach, offering strong diversification benefits with low correlation to traditional asset classes like the ASX 200.

|

5 Dec 2024 - The Australian: Donald Trump 2.0 puts global markets on edge

|

The Australian: Donald Trump 2.0 puts global markets on edge JCB Jamieson Coote Bonds November 2024 Uncertainty will reign after the re-election of Donald Trump and the Republican Red sweep on Capitol Hill, giving the Grand Old Party (GOP) a clear mandate for significant change. After a campaign dominated by personal insults and grubby fearmongering, actual hard policy detail is somewhat scant. Initially, markets have responded by backing Trump and team GOP, with risk assets rallying, thrilled with an outlook of perceived positive growth policies centred around tax cuts, deregulation and less focus on environmental issues. However, markets must wait for more detail to truly release the animal spirits, as some touted Trump policies may threaten such growth outcomes by taking momentum out of the economy. Will the bark of Trumpian policy be equal to the bite, or does the "art of the deal" translate into vocal threats without the downside of chosen short-term pain? The US budgetary outlook will provide guardrails to these expectations. 2024 has been a year of toppling sitting governments, as voters remain angry in a post-Covid world with extreme cost-of-living pressures. Opposition parties the world over are being swept into power, only to find that governance in the aftermath of such an environment is quite difficult: it is far easier to criticise from the opposition benches than solve the complex problems in government. While the GOP has a clear voter mandate to lift living standards and restore low and stable inflation, some of the publicly suggested policy combinations threaten to deliver the opposite outcomes if enacted. Such moves could take the gloss off the initial market enthusiasm enjoyed since the election announcement. Trump has touted an across-the-board 10 per cent import tariff as a tool to drive change in trade policies, attempting to level the playing field by making US products more competitive against lower-cost producers, while also encouraging US-based investment. He has also targeted specific countries, such as China, proposing tariffs as high as 60 per cent. While this would help improve the US fiscal position by generating revenue from tariff taxes on imported goods, it effectively acts as a direct tax on American consumers, who would face higher prices on everyday items due to increased import costs. This would raise the general price level, stimulating inflation at a time when the Federal Reserve is lowering interest rates from emergency settings used to combat the last bout of Covid-induced inflation shocks. It would likely be very politically unpopular and, despite the sweeping mandate just received, the midterm elections of 2026 are always in the back of political minds. Trump has similarly proposed cutting up to $US2 trillion in deficit spending by appointing Elon Musk as a change agent to drive efficiency across federal government operations. While reducing waste is beneficial in the long term, the US economy is already reliant on significant government spending to bolster its somewhat slight growth profile―- all things considered―- given the already massive intervention of the government in the economy. The deficit spend is simply unprecedented for non-war times, running at 6-7 per cent of GDP under the Biden administration. Such massive government spending is only generating a tepid 2.8 per cent GDP growth, all while the economy experiences significant positive tailwinds from immigration. Removing such a large amount of spending from the economy would have significant growth implications if not replaced by other positive accretive outcomes such as a productivity enhancement. In these delicate political times, choosing such a deacceleration of economic activity seems an unlikely political choice. Delicate choices and policy combinations need to be made by the Trump administration as tax cuts and spending for growth require financing inside a US budget set up that is already strained after large Covid spending programs. Bond markets are on watch around the sustainability of the US fiscal position, now exceeding $US35 trillion and climbing (120 per cent of GDP), amid concerns that the budget has little room to provide a counter-cyclical buffer should the economy experience any type of recessionary outcomes. Since the election, yields have stabilised, supported by ongoing interest rate cuts from central banks such as Sweden's Riksbank, the Bank of England, and the Federal Reserve. Markets remain cautious, noting the potential risks of politically driven policies that lack economic foresight - highlighted by the swift removal of British Prime Minister Liz Truss after bond markets reacted sharply to her fiscal plans. Until US policy plans are laid out in full, we maintain a preference for Australian and European fixed income assets, which offer stronger fiscal conservatism and higher credit quality. Overall, this environment underscores the importance of diversification, careful monitoring of fiscal policy announcements, and considering exposure to regions with more stable economic policies. Funds operated by this manager: CC Jamieson Coote Bonds Active Bond Fund (Class A), CC Jamieson Coote Bonds Dynamic Alpha Fund, CC Jamieson Coote Bonds Global Bond Fund (Class A - Hedged) |

4 Dec 2024 - The big get bigger - concentrating on the

|

The big get bigger - concentrating on the "Fab Four" Redwheel November 2024 |

|

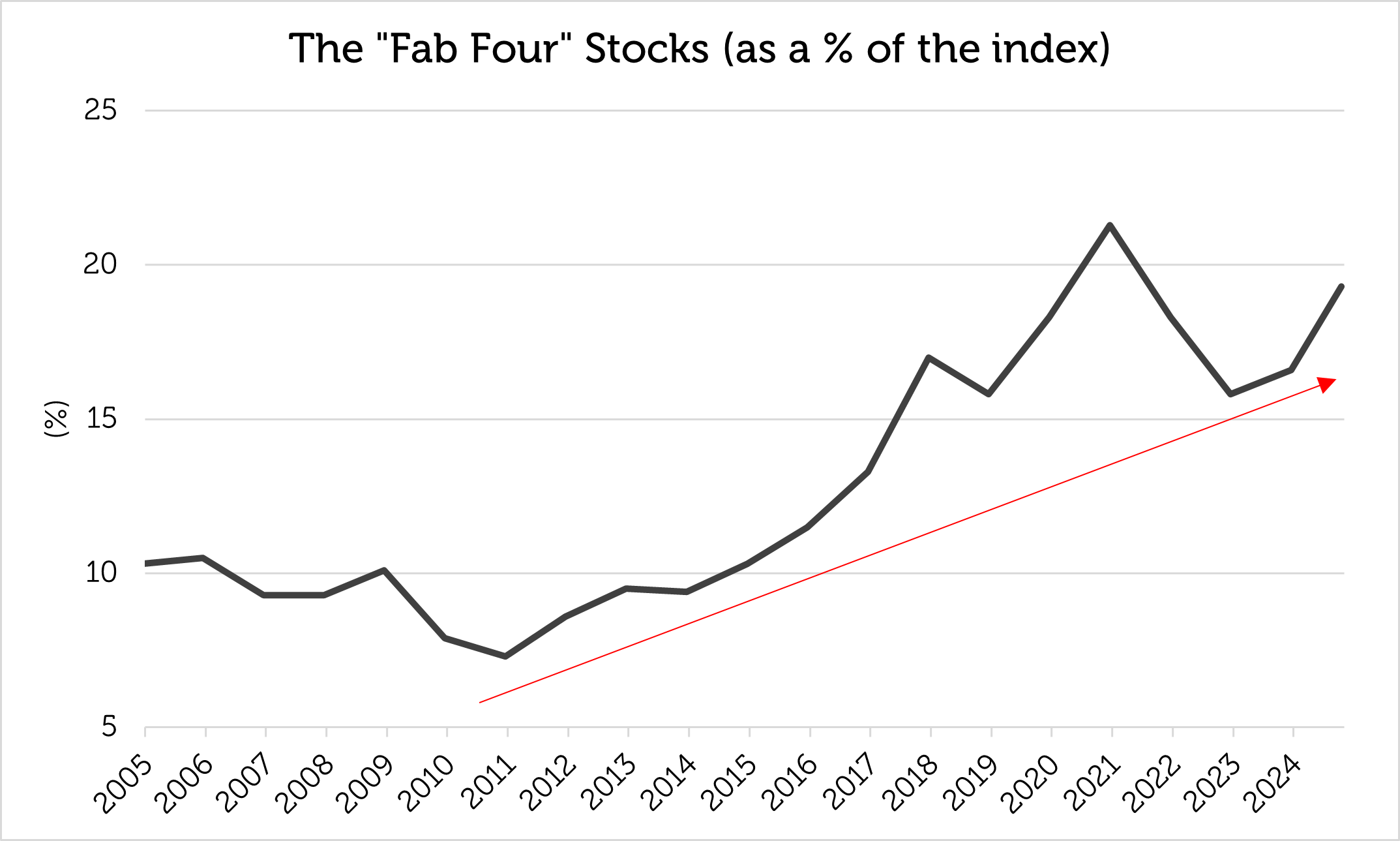

Investors have become familiar with the "Magnificent 7" US stocks that have been important contributors to index returns and comprise over a quarter of the benchmark S&P 500 weight (as at 31 October 2024). The MSCI Emerging Markets Index has an equivalent "Fab Four" stocks, sectors and countries that have come to dominate its composition and performance. The "Fab Four" Companies: Alibaba, Samsung Electronics, Taiwan Semiconductor, Tencent - are they unstoppable? The largest four stocks in the MSCI Emerging Markets Index have increased their combined weight from 8% - 10% in the 2000s to 15% - 20% of the index in the 2020s and have been responsible for a significant proportion of its total return. The same companies have occupied the top four slots in the MSCI Emerging Markets Index since June 2016: Taiwan Semiconductor Manufacturing (TSMC), Tencent, Samsung Electronics and Alibaba.

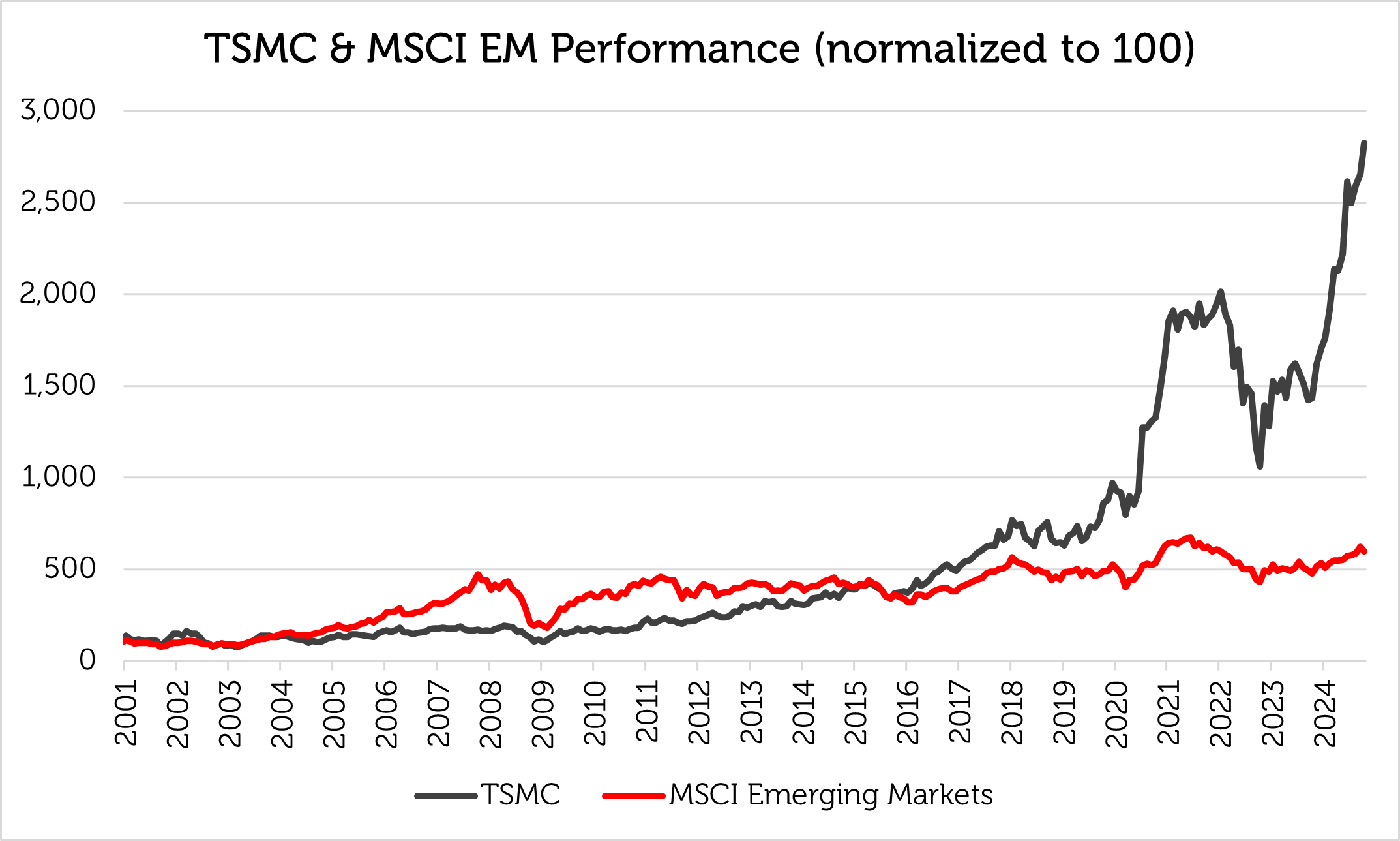

Source: Bloomberg, Redwheel as of 31 October 2024. Past performance is not a guide to future results. Taiwan Semiconductor, the largest of them, now accounts for c.10% of the index, equalling or even exceeding the relative size of Apple, Microsoft and NVIDIA in the Nasdaq Index. Since the beginning of 2001, Taiwan Semiconductor has outperformed the MSCI Emerging Markets Index by about 10% per annum. Up until 31 October 2024, Taiwan Semiconductor has accounted for approximately 35% of this year's total return of the MSCI Emerging Markets Index. At the current weight of c.10%, it has become practically impossible for most fund managers to neutralize or exceed the weight of Taiwan Semiconductor while adhering to guidelines for concentration and diversification. Excessive size and the inability of fund managers to replicate an enormous index weight might indicate that a stock is approaching the end of its outperformance because of a potential lack of new buyers.

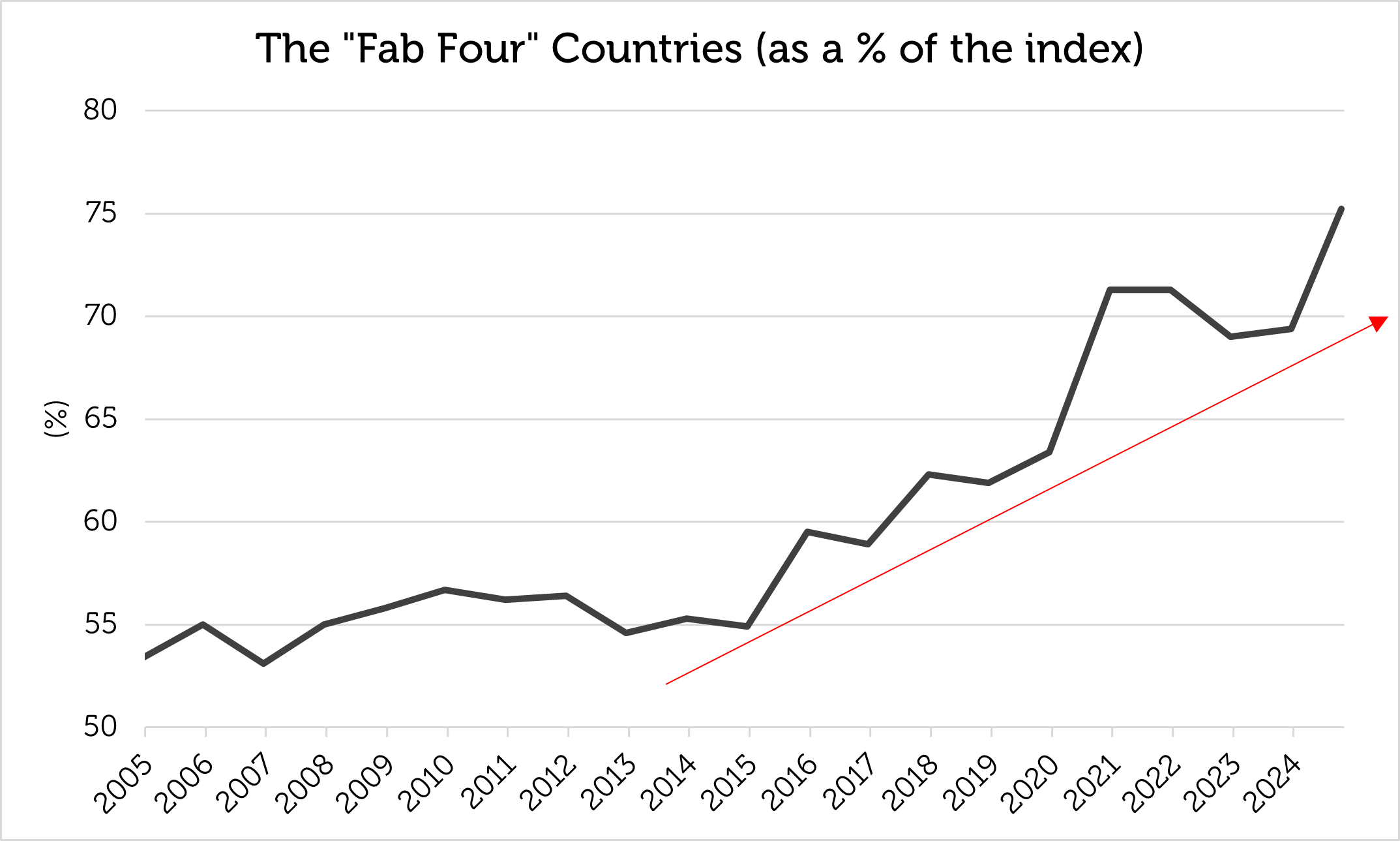

Source: Bloomberg, Redwheel as of 31 October 2024. MSCI Emerging Markets uses the MSCI Emerging Markets Net Total Return Index. Returns in US$. Past performance is not a guide to future results. The "Fab Four" Countries: China, India, Korea, Taiwan - is EM now just Asia? Country concentration mirrors stock concentration, with the same four countries dominating the index, their weight growing from the range of 50% - 60% between 2005 and 2017 to over 70% today (as at 31 October 2024): China, India, Korea and Taiwan. It has been almost ten years since a Latin American country (Brazil) has been in the top four, and nearly twenty years since an EMEA country (South Africa) has made an appearance. The concentration has become particularly pronounced since the mid-teens and means that the other 20 or so countries in the MSCI Emerging Markets Index account for an average weight of just over 1% each, making it difficult to achieve geographic diversification outside Asia.

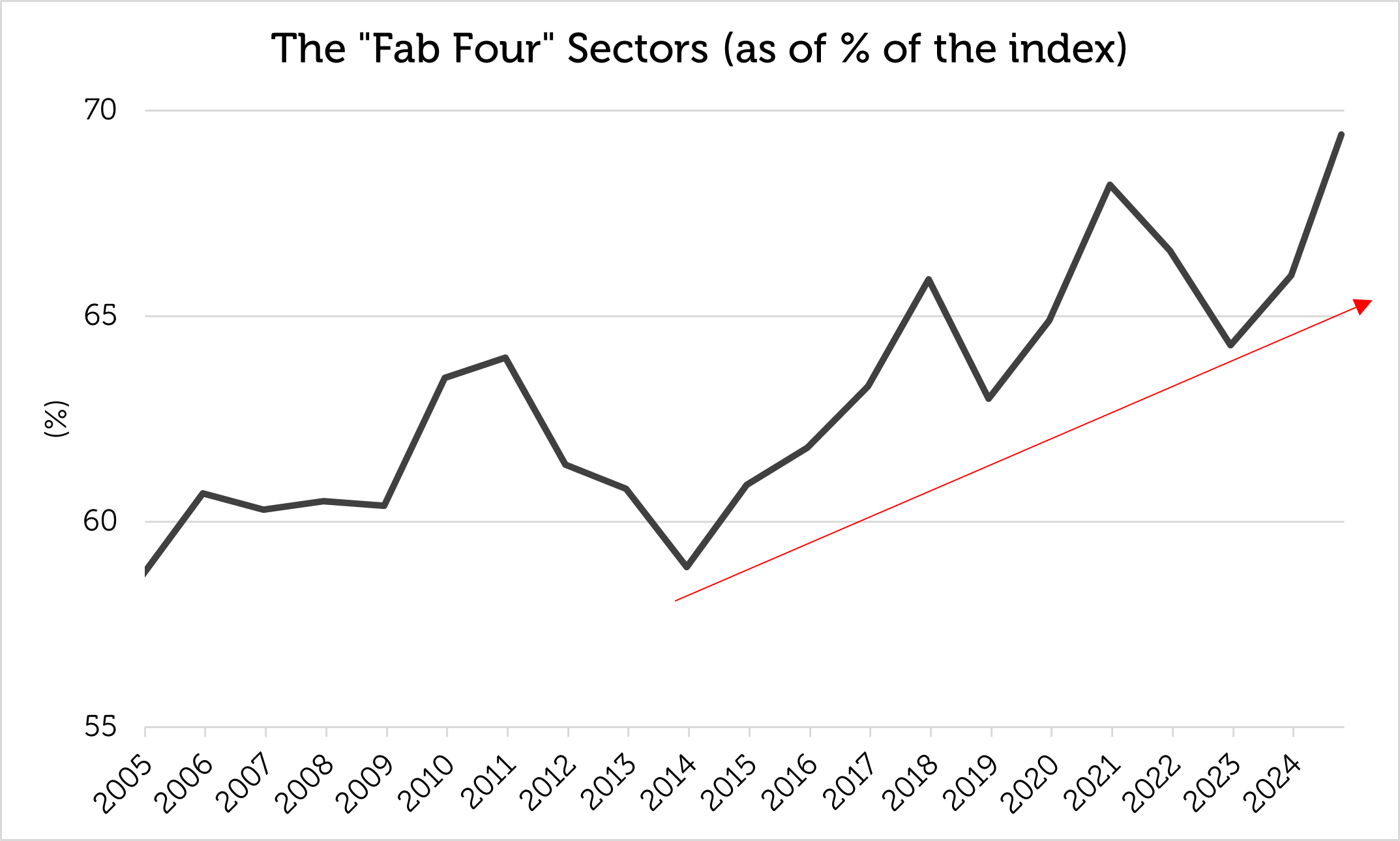

Source: Bloomberg, Redwheel as of 31 October 2024. Past performance is not a guide to future results. China has a uniquely large position, having risen from 6.8% of the MSCI Emerging Markets Index at the start of 2004 to an unprecedented 35.9% at the end of 2020, outperforming the index by just over 1% per annum along the way, but has underperformed by around 9% per annum since the end of 2020. China has dropped back to c.25% of the index but is still the largest country in the investable universe. Excessive weight of, perhaps, over one-third of the index might suggest that a single country is close to its maximum appeal with two dozen other countries from which to choose. The "Fab Four" Sectors: Technology, Financials, Consumer Discretionary, Communication Services The "Fab Four" effect is less obvious by sector, the top four usually comprising around two-thirds of the index and the top two currently accounting for 47% of the index. Although the "Fab Four" sectors have been static, like countries for several years, Energy and Materials used to be significant weights during commodities' bull cycles.

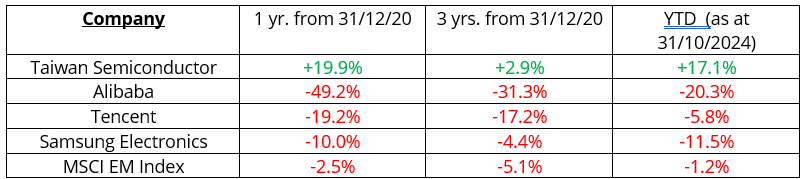

Source: Bloomberg, Redwheel as of 31 October 2024. Past performance is not a guide to future results. What are the lessons of index concentration? 1.Being big is not as good as getting big - the biggest are not always the best The size of a stock in an index is not a guarantee of future returns. In fact, size can be the enemy of returns. For example, of the "Fab Four" stocks at the peak of size concentration at the end of 2020, only Taiwan Semiconductor outperformed the index in the ensuing one and three years.

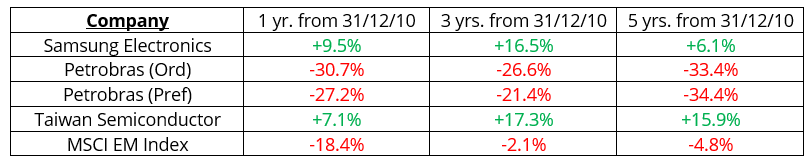

Source: Bloomberg as of 31 October 2024. Returns are in US$, periods >1 year are annualized. MSCI EM Index uses the MSCI Emerging Markets Net Total Return index. Past performance is not a guide to future results. The same is true at the point of minimum size concentration; from 2011 (the point of lowest concentration), Samsung and Taiwan Semiconductor outperformed the MSCI Emerging Markets Index while Petrobras (a member of the "Fab Four" at that time) underperformed. Being a member of the "Fab Four" is no guarantee of being a hit.

Source: Bloomberg as of 31 October 2024. Returns are in US$, periods >1 year are annualized. MSCI EM Index uses the MSCI Emerging Markets Net Total Return index. Past performance is not a guide to future results. What seems to matter is the market theme. For example, it was the Global Financial Crisis in 2008 that dethroned commodities, as Chinese growth decelerated in the 2010s and 2020s. And, while commodities have fallen from their peak, technology stocks have gained in importance globally because of the invention and adoption of digital content, e-commerce and artificial intelligence. An important question is whether the technology sector can maintain market leadership. In the past, its relative performance has coincided with interest rate cycles. We believe a shift in market leadership occurs when there is a change in underlying economic and financial conditions. As the Federal reserve embarks on a rate-cutting cycle, market leadership might finally rotate away from technology stocks. 2. How big is too big? Is 10% a barrier for a single company, and 20% a barrier for the "Fab Four"? There are nearly 1,300 companies in the MSCI Emerging Markets Index. Idiosyncratic risk, internal position limits and diversification requirements make it hard for investors to run materially overweight positions in single issues that reach 10% of the index, implying a possible lack of incremental buyers at such a large size. In addition, the "Fab Four" stocks' dominance peaked at 21% of the index in 2020 and has not yet regained that level, suggesting a possible ceiling on their combined weight and better potential returns elsewhere. 3.Financials and Technology have consistently grown; can Energy and Materials recover? Financials and Technology have dominated index composition, often representing 20% - 25% of the index each. During the Super-Cycle of the 2000s, however, both Energy and Materials represented significantly higher weights in the index than they do today. A change in market dynamics is required for Energy and Materials to rebound, which might be caused by lower interest rates and a resumption of global growth led by China, India and other major emerging markets when interest rates decline. 4. Asia dominates; can India emulate China, and can EMEA / LatAm rebound? The MSCI Emerging Markets Index has become less geographically diversified over the past decade with the "Fab Four" countries now accounting for 75% of index capitalisation. China is the archetype of index dominance, quintupling in size from 6.7% to 35.9% between 2004 and 2020. India has almost quadrupled in size, from 5.8% to 19% over the same period. India has the population, economic potential and high growth rate possibly to emulate the rise of China as a benchmark constituent. EMEA and Latin America probably need a commodity upswing to rebound in the MSCI Emerging Markets Index. Brazil and South Africa were both "Fab Four" countries during the Super-cycle of the 2000s, and Brazil remained a "Fab Four" country until 2014. Because EMEA and Latin America have more representation in the Energy and Materials sectors than in the Technology sector, they have missed the technology boom and have been eclipsed by Asia. 5. What might cause a change in market leadership away from Asia and Technology? A new "Fab Four" generation of countries, sectors and stocks can only occur with the passage of time and a change in macroeconomic drivers. Such a change may be on the horizon with lower interest rates and China's recently announced economic stimulus that is likely to have an impact across the Emerging and Frontier Market universe. On September 18th 2024, the Federal Reserve began a loosening cycle by cutting the benchmark rate by 50 basis points, which should encourage emerging market central banks to reduce rates as well. This could boost economic activity and contribute to a weaker dollar. On September 24th 2024, Chinese authorities announced measures to boost economic growth. As China's domestic economy regains momentum, it should benefit the broader emerging market universe through higher demand for commodities used in manufacturing. We believe that these factors can create strong tailwinds for EM and create the potential for a shift in market leadership away from technology towards commodity producers in EMEA and Latin America. Within our investment process we have identified several themes we see as drivers for commodity demand: Energy Transition, Urbanization, and Reshoring and Defence. We combine a deep understanding of the themes shaping Emerging and Frontier Market economies with fundamental analysis of the companies who are able to harness the opportunities these themes represent.

As we have shown, size is not necessarily a pre-determinant of returns and we believe a thematic approach which seeks to identify the long-term growth drivers in Emerging and Frontier Markets can uncover a compelling set of bottom-up investment opportunities that looks beyond market dominance. Author: Nick Smithie |

|

Funds operated by this manager: Redwheel China Equity Fund, Redwheel Global Emerging Markets Fund |

|

Key Information |

3 Dec 2024 - Australian Secure Capital Fund - Market Update

|

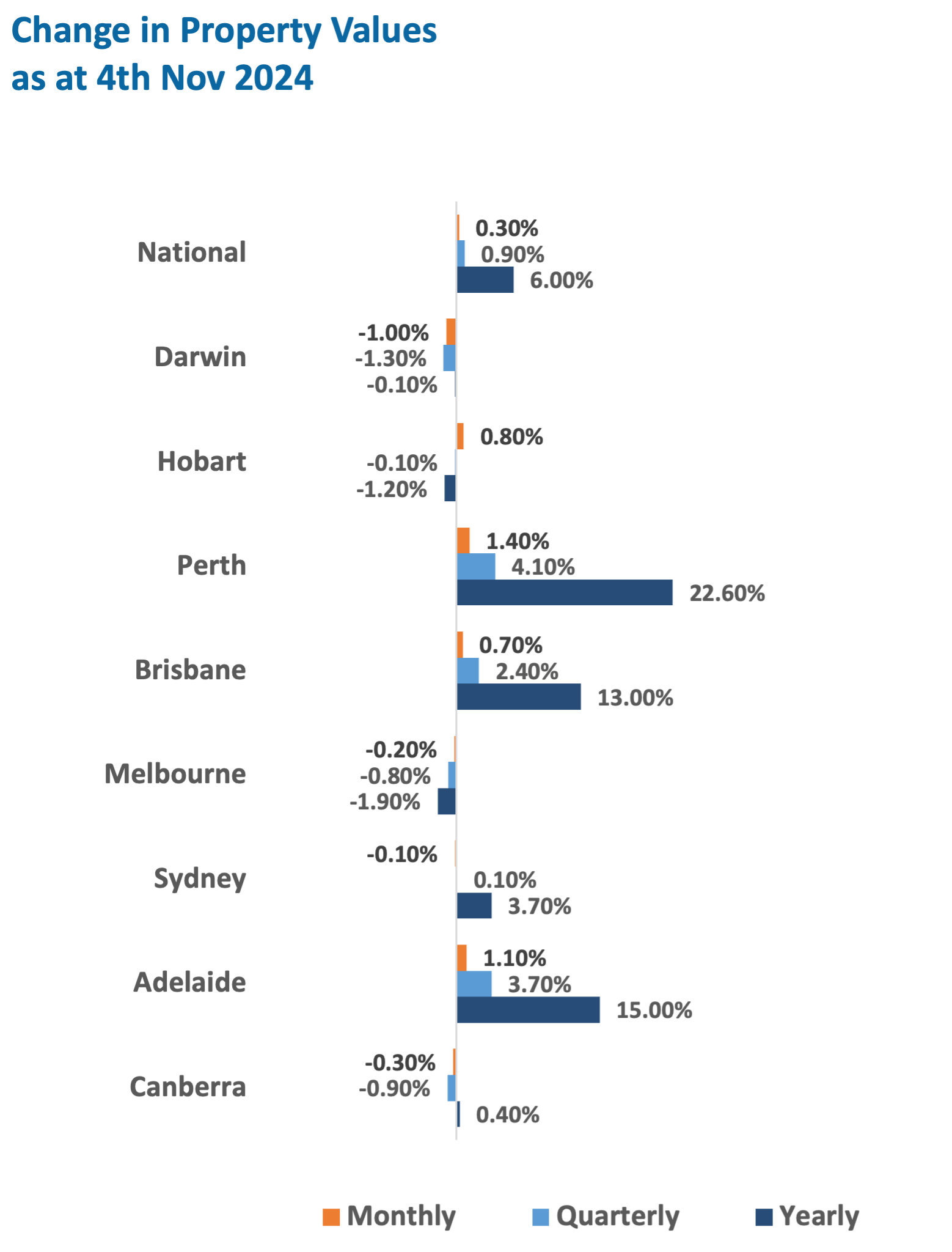

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund November 2024 Australian residential property prices continued to rise for the 21st consecutive month with a 0.3% increase, but signs of easing continue with Darwin, Canberra, Melbourne and now Sydney all experiencing a decline in value according to CoreLogic's National Home Value Index, with losses of 1%, 0.3%, 0.2% and 0.1% respectively. Whilst this demonstrates that it is not all smooth sailing in the Australian property market, Brisbane, Hobart, Adelaide and especially Perth continued to perform strongly with further monthly increases of 0.7%, 0.8%, 1.1% and 1.4% respectively. Whilst the national capitals only saw a 0.2% increase for the month, the combined regionals are still performing strongly with a 0.6% monthly increase. This new monthly data with more capitals and regions beginning to see a reduction or easing in prices, has impacted quarterly data now showing that Darwin, Canberra, Melbourne and Hobart have experienced losses for the quarter (1.3%, 0.9%, 0.8% and 0.1% respectively) whilst Sydney has now only seen 0.1% quarterly growth. Brisbane, Adelaide and Perth have however continued to see significant growth for the quarter, with 2.4%, 3.7% and 4.1% respectively. As we head into the holiday season, and with the RBA remaining hesitant to reduce interest rates, it is expected to continue to see easing amongst the Sydney, Melbourne, Canberra, Hobart and Darwin markets, however the undersupply of property within Brisbane, Adelaide and Perth is likely going to see continued growth despite interest rate pressure. Property Values as at 4th of Nov 2024

|