News

14 Dec 2023 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

14 Dec 2023 - Performance Report: Bennelong Emerging Companies Fund

[Current Manager Report if available]

14 Dec 2023 - Why government bonds remain a natural choice

|

Why government bonds remain a natural choice JCB Jamieson Coote Bonds November 2023 As we approach the eagerly anticipated end of the rate hiking cycle, investors are considering how to position portfolios for what comes next, while trying to navigate the current higher rate, higher inflation environment. Perhaps now, more than in any other cycle, the role of bonds in portfolios is being questioned after negative annual returns were experienced in 2022. In this article, we discuss why 2022 was such a difficult year for investors across the board, why higher rates aren't necessarily a bad thing for active bond investors and why the valuable role bonds play in a diversified investment portfolio hasn't changed. 2022 - AN EXCEPTION RATHER THAN THE RULEWhen it comes to making the case for bonds, perhaps the biggest objection comes from those who saw 2022 as a serious flaw in the argument. Bonds traditionally play the role of what many refer to as 'portfolio insurance' - offsetting equities' losses during market upheaval - but in 2022 they failed to perform this function. SO, WHAT HAPPENED?Bond returns have two main enemies, inflation, which erodes their value, and rising interest rates, which reduces the value of existing bonds because higher rates of income are available elsewhere. In 2022, we had both inflation and higher rates in tandem, as central banks aggressively hiked rates in a bid to bring inflation back to tolerable levels. As active bond investors, we've managed portfolios through a number of crises, and to put 2022 in context, this was one of the biggest bond market sell-off events since the great depression. We see this as an exception to the rule, rather than a 'new normal'. While financial market downturns typically see equity markets sell off and bond markets surge, rapid rate rises and inflation result in both asset classes suffering. The history books are punctuated by market crises, and while history doesn't repeat, looking to a previous episode of severe negative returns in 1994, interestingly this was followed by a period of outperformance in 1995. 2023 hasn't been a turnaround year like 1995 was, but we remain of the view that 'boring bonds' can quickly turn around in a correction event and that timing the market is impossible. The old adage of 'time in the market, not timing the market' holds true in bonds also. Chart 1: Australian Government Bond Market and Equity Market Annual Returns since 1993

Source: Bloomberg AusBond Treasury 0+ Yr Index vs S&P ASX 200 Accumulation Index. As at 27 November 2023. HIGHER RATES AREN'T ALL BADIncreasing interest rates in the context of an actively managed bond portfolio invested over the medium to long term is not necessarily bad. Higher rates restore their value and defensive properties relative to equities and active management enables bonds to be traded on the secondary market, before they mature, meaning that the negative effects of rising rates can be managed. In the post GFC period of ultra-low interest rates and bond yields, the ability of bonds to deliver meaningful returns and their defensive characteristics were much more limited than they are today in a higher interest rate regime. In essence, the cushions have now been re-inflated and bonds are now in better shape than they have been for years. If anything, the case for holding bonds has strengthened, particularly if rates have risen too high, too quickly and an economic downturn looks imminent. A TRIED AND TRUSTED DIVERSIFIER

Regardless of the path ahead for cash rates, bonds remain a vital diversifier. Whichever way an investor constructs a portfolio, a diversified range of return sources across asset classes can help mitigate risk. The top left quadrant of the chart above illustrates events where bonds have provided positive returns, during crises where equity markets were strongly negative. This shows the value of diversification and the traditional portfolio defence role of government bonds in action. CONCLUSIONLooking ahead, we believe the delayed impact of the rapid rise in interest rates on the economy could result in an economic downturn, with central banks cutting interest rates well into 2024 to stimulate economies. In that scenario, allocations to government bonds are typically sort after, driving bond prices and returns higher. About once every decade bond investors are rewarded for their patience and time in the market and we believe that the cyclical nature of the economy, and our analysis suggests that this time is coming.

Funds operated by this manager: CC Jamieson Coote Bonds Active Bond Fund (Class A), CC Jamieson Coote Bonds Dynamic Alpha Fund, CC Jamieson Coote Bonds Global Bond Fund (Class A - Hedged) |

13 Dec 2023 - Performance Report: Glenmore Australian Equities Fund

[Current Manager Report if available]

13 Dec 2023 - Performance Report: 4D Global Infrastructure Fund (Unhedged)

[Current Manager Report if available]

13 Dec 2023 - Investing Essentials: Diversification - The shield against investment volatility

|

Investing Essentials: Diversification - The shield against investment volatility Bennelong Funds Management November 2023 |

|

As any investor will tell you, investing can be a rollercoaster. Not all investments behave in the same way - different types of investments behave differently under certain economic and market conditions. Some may go up while others go down. Some may be entirely negatively correlated. This is where diversification comes in. Essentially, diversification means investing across a range of different investment types that behave differently across a full investment market cycle. While nothing will give you an absolute guarantee against loss, spreading your investments across different investment categories and types of assets limits your exposure to individual related risks. Risks can be in the form of market risks, where the market may become less valuable for assets within a particular class due to external factors, like interest rate changes, war, or weather events. Or, they can be asset-specific risks, which come from the performance of investments or companies themselves, often dependent on management's performance, operational activities or competitor actions, for example. There are all sorts of ways to diversify your portfolio to mitigate these risks. Diversification can occur across asset classes (e.g. equities, property, cash), industries (e.g. telecommunications, agriculture, financial services), or regions (e.g. countries, markets, economies). Diversifying by asset class For example, commodities like gold may not have a correlation to real estate. Diversifying by industry For example, if you decide to invest all your money into one type of agricultural crop such as wheat, then adverse weather conditions could wipe out the crop rendering your entire investment worthless. But if you had invested across other industries that aren't impacted by weather, such as healthcare or financial services, only a portion of your savings would be impacted by this weather event. Diversifying by region For example, one region may be in economic expansion while another is in contraction. Exposure to different currencies, and to different political and regulatory environments can have an impact on an investment. Having your investment diversified across asset classes, industries and regions is important for investment success, and helps to ensure that your range of investments don't all perform in the same way at the same time. Therefore, overall investment returns may be achieved in a less volatile way, relative to holding only one or two different assets. In determining the right asset allocation for your portfolio, you'll need to consider the overall risk and return of each asset, and how different assets correlate with each other. It's also important to determine your own risk and return level that you are comfortable with and able to tolerate. Diversification serves as somewhat of a safety net, capturing the potential benefits of various investments while mitigating the risks associated with market fluctuations. It's always important to remember that any decisions you make should be in line with your own financial objectives, as each person's investment needs will be different. |

|

For more insights visit www.bennelongfunds.com Disclaimer The content contained in this article represents the opinions of the author/s. The author/s may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the author/s to express their personal views on investing and for the entertainment of the reader. |

12 Dec 2023 - Performance Report: Skerryvore Global Emerging Markets All-Cap Equity Fund

[Current Manager Report if available]

12 Dec 2023 - Performance Report: Airlie Australian Share Fund

[Current Manager Report if available]

12 Dec 2023 - The real risk of wildfires to US infrastructure investors

|

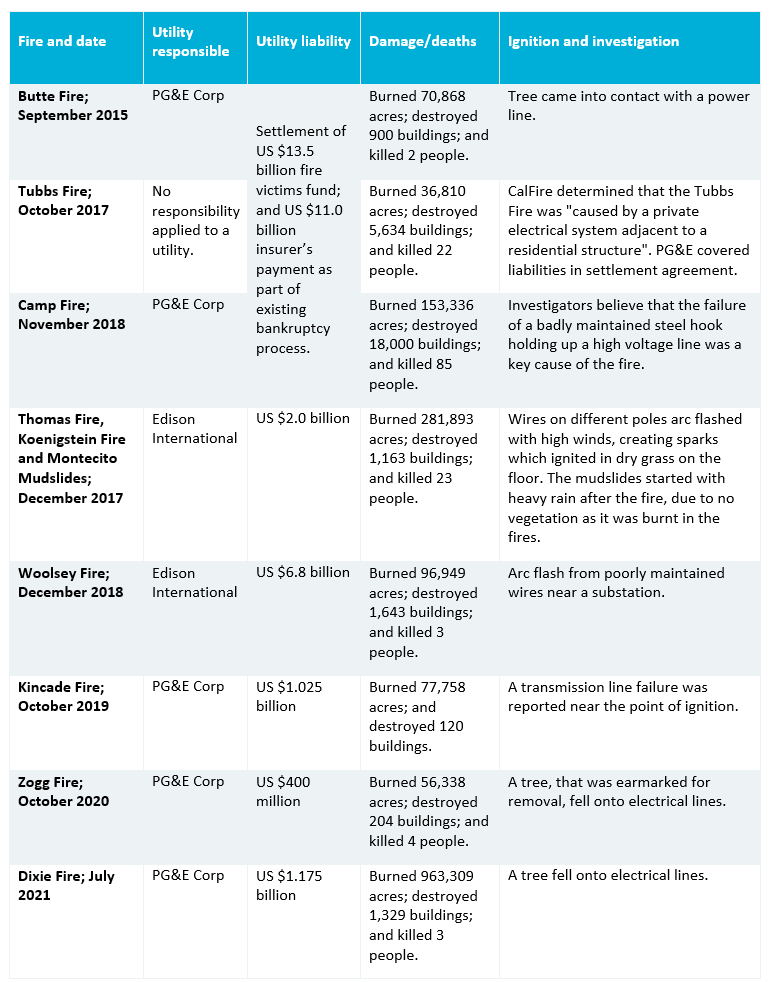

The real risk of wildfires to US infrastructure investors 4D Infrastructure November 2023 This article focuses on wildfires in the US, and their impact on utility companies in our universe. Five of the ten most destructive US wildfires since records began in the mid-to-late 1800s have occurred since 2013[1]. Climate change driven by human intervention has, through attribution analysis, been proven to be a key contributor to the increased frequency and ferocity of fires in the US. These fires are a real risk for utility companies and their investors, and with global temperatures continuing to rise, it seems the issue could intensify going forward. In our recent Global Matters article, Extreme weather risks and their impact on investors, we outlined the observed link between extreme weather events and climate change globally. Here, we'll focus specifically on wildfires and their impact on US utilities. Wildfire ignitionsWildfires are somewhat unique compared to extreme weather events - even though conditions are exacerbated by global warming, wildfire ignition is usually started by lightning strikes, human intervention (accident, negligence or intent), or electric utility equipment. There have been numerous examples in the US where electric utility company assets have ignited wildfires, which have gone on to cause significant third-party damage. The utility therefore faced billions of dollars in litigation liabilities, well in excess of their insurance protection. This has resulted in significant financial losses, cash liability payments, and increased probability of corporate financial distress, which itself has social ramifications. It started in CaliforniaThe detrimental shareholder impact of wildfire liabilities experienced by Californian utilities is well known. PG&E Corp (PCG-US) and Edison International (EIX-US) were most negatively affected by wildfires ignited by company assets over the period 2017-2021. Courts in California have adopted a unique application of the legal concept, inverse condemnation. It applies legal liability on electric utilities for all third-party damages caused by a fire which the utility's assets are found to have ignited. The courts' application of inverse condemnation removes the legal requirement to prove negligence on behalf of the utility in order to enforce third-party liabilities, which is required in other states. The courts have assumed the utility will recover these third-party property damages from customer bills, but the Californian utility regulator has been reticent to allow this. A number of fires were found to be ignited by utility assets in the state, incurring significant third-party property damages, as well as civil, regulatory and criminal penalties.

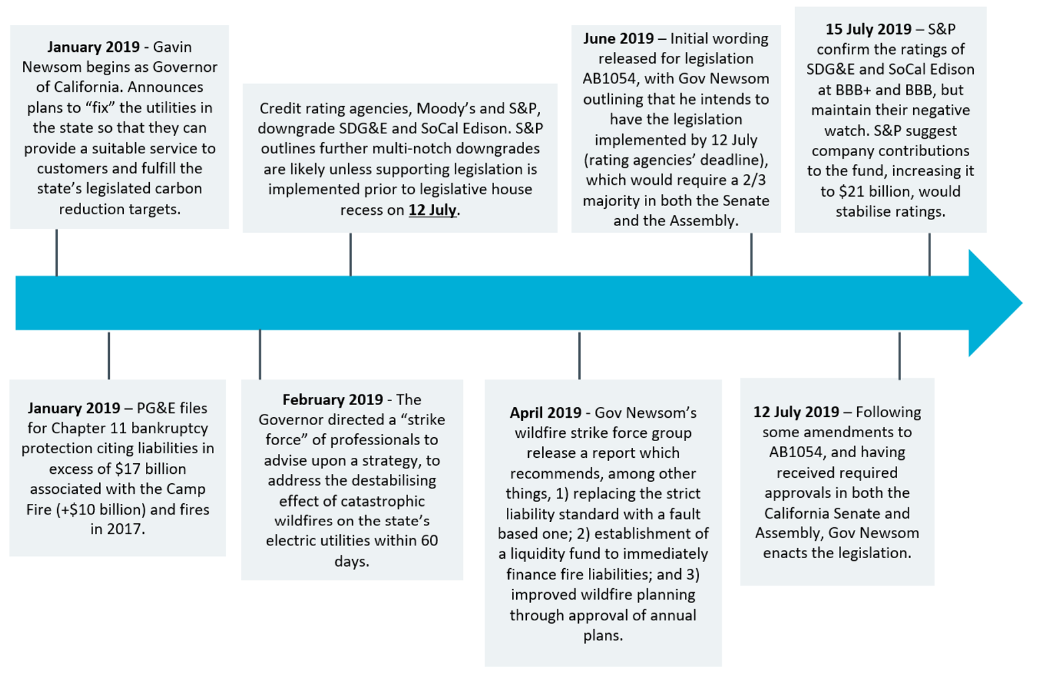

Source: California Board of Forestry and Fire Protection (CAL Fire) PG&E filed for bankruptcy protection in January 2019, due to the quantum of liabilities facing the company at the time. This process rendered the remaining equity value in the company zero. As part of PG&E coming out of bankruptcy, the company negotiated with legal representatives of uninsured wildfire victims and insurance companies of the Butte, Tubbs and Camp Fires to make payment of $24.5 billion (partially through an established fund) for property damages. However, it became clear that the situation for the utilities in the state was untenable. In 2019, Governor Newsom began his gubernatorial tenor in California. He identified wildfire risk as a key risk to the state, and understood that properly functioning and sustainably financed utilities were needed to deliver the energy prerogatives of California. He went about establishing a framework to mitigate wildfire liabilities for utilities which are prudently operated, in order to improve their credit assessment and ability to finance themselves. The below timetable summarises legislative steps taken, and the corresponding credit rating agency response.

Legislation SB 1054 not only established a wildfire liquidity fund which would finance wildfire legal liabilities sustained by the utilities, but it also established a process of ensuring that the utilities were prudently operating their electricity assets and were taking reasonable steps to mitigate the ignition of wildfires. If classified as a prudent operator under an annual certification, the utility can recover any fire liabilities in customer bills or from the established liquidity fund. Since 2018/19, companies have significantly reviewed their operational management of fires, and invested billions of dollars in 'hardening' their networks to avoid future fires. Key initiatives include:

The major electric utilities in California experienced significant share price corrections associated with the wildfires, and only recently have started to recover. The market seems to appreciate steps taken by the companies and state legislators in mitigating future fires, combined with the liquidity fund and pre-prudency test in avoiding future legal liabilities when fires do occur. But recent developments suggest wildfire risk is not specific to California... More recent experiences of wildfire riskInvestors thought that debilitating financial damages from wildfire risk was limited to Californian utilities because of the state's unique application of inverse condemnation. The requirement in other states, to prove utilities have acted negligently, was perceived as a mitigant against them incurring similar legal liabilities, unless negligent. That view may be changing. PacifiCorp litigationIn June 2023, unlisted electric utility, PacifiCorp, received an Oregon court decision relating to its alleged involvement in five major fires which burned across the state in October 2020. The fires burnt 850,000 acres of land, causing damage to around 4,000 homes, and killing at least 11 people[2]. Despite PacifiCorp not having been found responsible for ignition of the fires by any formal body at the time of writing, a jury court made a number of decisions including:

The jury found PacifiCorp negligent in failing to shut-off power to its 600,000 customers during a windstorm, despite warnings from officials. The company did not have any established power shut-off process, and argued the ramifications of cutting power would have broader and serious ramifications. The decision that PacifiCorp was liable for the fires also means that the company is likely to incur further actual and punitive damages associated with approximately 2,500 householders under a separate class action lawsuit. A very basic assessment suggests PacifiCorp could be liable for billions of dollars associated with this class action lawsuit. There is a clear risk of financial distress for the company. Maui fires of 2023The Maui fires that started on 8 August 2023 destroyed more than 2,700 structures, and killed 97 people, with 31 unaccounted for as of 18 September 2023. An investigation is ongoing into the cause of the fire, but Maui County has already filed a lawsuit against a subsidiary of the utility company, Hawaiian Electric Industries (HE-US), based on suspicions that the fire was ignited by the utility equipment (uninsulated wire contacted dry grassland when strong winds downed a wooden power pole). Hawaiian Electric has suggested that the lawsuit is imprudent in pre-empting the outcome of the formal investigation into causation. The share price of HEI fell from the closing price of $37.36 on 7 August, to $12.85 as at 17 October 2023 (a 65% decrease) based on legal risk associated with the fire. There is conjecture as to the prudent operation of the network on behalf of Hawaiian Electric, but the findings in the PacifiCorp case clearly show a high legal risk being faced by the company. Other exposed companiesA number of other companies are also exposed to wildfire risk in the US including:

4D's approach to mitigating the riskThere is no doubt that the environmental conditions for wildfires are being exacerbated by climate change. In doing nothing, utilities will be at greater risk of wildfire liabilities (physical and legal) as global temperatures increase. Many utilities are enhancing their operational preparedness and investing in 'hardening' the network to mitigate the risk of fire ignition. Governments and fire authorities are also focused on reducing the fuel for fires, being able to respond effectively to fires after ignition, and protecting prudently operated utilities from legal liabilities. At 4D, we undertake significant due diligence to understand utilities' operational preparedness and investment plans in hardening their networks against wildfires. We also keep abreast of legal and regulatory developments in utility operating jurisdictions to ensure the companies aren't exposed to risks that they cannot mitigate through prudent operation of their networks. This due diligence flows through our capex modelling and values, as well as our quality assessment of the utilities' jurisdiction, asset quality and management. We will exit a position, or rule a stock uninvestable, if there is a real risk of unquantifiable liability. |

|

Funds operated by this manager: 4D Global Infrastructure Fund (Unhedged), 4D Global Infrastructure Fund (AUD Hedged), 4D Emerging Markets Infrastructure Fund For more information about 4D Infrastructure, visit https://www.4dinfra.com/ The content contained in this article represents the opinions of the authors. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. [1] https://earth.org/worst-wildfires-in-us-history/ |

11 Dec 2023 - Performance Report: Bennelong Concentrated Australian Equities Fund

[Current Manager Report if available]