News

24 May 2022 - Equity risk premium

23 May 2022 - A brave new world

|

A brave new world Kardinia Capital May 2022 |

|

The topic on everyone's mind is: what does the balance of 2022 have in store for investors?

Inflation bites. Meanwhile, the most recent Australian CPI inflation number surged to 5.1%. For anyone renovating (or who knows someone who is), it comes as little surprise that a key upward driver was housing construction costs as well as higher fuel prices. The US CPI came in at 8.5% for March year on year on its way to 10% and beyond, potentially challenging the highs we had in 1970-1980. Once the inflation genie springs from the bottle it's hard to stuff back in. Back in the 70s it took a rotation of three individual US Federal Reserve Chairs to tackle inflation: it was only when Volcker took the helm in 1979 and drove the federal funds rate to 20% that inflation finally broke - along with the global economy. This time we think the Fed will not repeat its past mistakes, and inflation will be tackled faster. That won't be easy, however, as inflation is already becoming entrenched. Coles recently reported food inflation in the March quarter of 3.3%, and suggested that price rises were only just getting started. Higher energy prices lead to higher food prices, and energy has just gone through a decade of depressed spending in new and expanded production: there simply is not enough oil and gas to satisfy global needs, particularly as sanctions continue to be placed on Russia. Our view is that oil prices have not seen their top, notwithstanding the Brent oil price is currently sitting 60% higher than 12 months ago. The following chart shows the outperformance of the technology sector over the energy and materials sectors. The NASDAQ has beaten the global energy and materials sectors by a factor of 4 over the past decade. However, given the tech sector's long-dated earnings profile with rapidly rising interest rates, we believe this gap in performance will close.

Interest rates on the up The Fed has already raised interest rates twice this year, and the market is forecasting two more 50bps rises in June and July followed by a rate hike every meeting for the remainder of the year. The only thing that could halt that trajectory is if US summer economic data is so weak that a pause in hikes is considered. We saw the US equity market fall 6% during the US Fed's taper program in 2013 and the US Fed quickly reversed course - though that may not be as easy this time, with Powell's mandate being to tame inflation. In the meantime, as equity markets rise the Fed will take every rate hike it can get. The Reserve Bank of Australia took the opportunity to raise rates by 25bp to 0.35% at its May meeting, above market expectations. The rate increase was immediately passed on in full by each of the major banks. It has been a long time since Australians have experienced rising home loan rates (11 years, in fact) and we expect a considerable impact on consumer discretionary spending as belts are tightened. Former Australian Prime Minister Malcolm Fraser once said "life wasn't meant to be easy" and we think the Australian consumer is about to find out just how hard life can be in a rising interest rate environment. The consumer discretionary sector of the Australian market is down 15% already this calendar year, and that's before many of its constituents have downgraded profit expectations (which we expect to occur over the next 12 months). The benefit of a long short capability We do not expect the Australian equity market to produce significant returns for investors this calendar year. Notwithstanding, Kardinia has the added flexibility of shorting which many managers in Australia do not possess. In the last 2020 pandemic equity market sell off, the ability to short individual shares and the market resulted in Kardinia falling only c.4% when the market fell c.36%. For a long short fund there are opportunities on both the long and short side to make a return in these markets. So how does that translate into the portfolio? • With a global economic slowdown within the next 12 months a real possibility, household budgets will continue to squeeze. We believe consumer discretionary stocks are at risk. Our key exposures are currently long consumer staples and inflation beneficiaries such as oil, resources (including 'green' metals); and short high multiple stocks, long duration earnings stories and loss makers. |

|

Funds operated by this manager: Bennelong Kardinia Absolute Return Fund |

|

The content contained in this article represents the opinions of the author/s. The author/s may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the author/s to express their personal views on investing and for the entertainment of the reader. |

23 May 2022 - Interest rate hikes and high debt suggest the markets, the economy or both will break simultaneously

|

Interest rate hikes and high debt suggest the markets, the economy or both will break simultaneously Wealthlander Active Investment Specialist 06 May 2022 World stock markets are facing much consternation over key issues including high inflation and the path of interest rates, the Ukraine war, and the Covid pandemic in China, all acting to disrupt supply and global trade. Against this background, traditional stock market value measures such as price-earnings ratios are still near the high end of historical valuations in many countries, earnings margins are beginning to come under pressure and consumer confidence is decreasing as costs increase. This does not bode well. Australian inflation is 5.1% per annum, and US inflation was last measured at a rather impressive 8.5%. The US experienced negative real economic growth in the last quarter, suggesting a stagflationary economic environment. It was only last year that you would be laughed at for suggesting stagflation (we did so we know), and the RBA governor was telling the market how foolish they were for even suggesting a rate increase as a possibility in 2022. How times change! Supply disruptions combined with ridiculously easy fiscal and monetary policy are the reasons for the significant recent lift in inflation globally. Central banks currently have interest rates set near record lows. They believe they have to lift interest rates to try to stop inflation from becoming overly entrenched, despite the supply-side issue. Interest rates tend to move in waves; they historically do not go up and down consecutively, instead tending towards trending. Thus, changes in direction are important and closely followed by markets. This time could be the same, but not necessarily so. For most markets and their participants, the extent central banks will move rates is currently the most relevant and important factor for investment decision making. The bond market is pricing aggressive rate increases, which to many market participants - us included - appear unrealistic. US Government Debt to GDP averaged 64.54% from 1940 until 2021, reaching an all-time high of 137.20% of GDP in 2022. US household debt to income is above 77%, while Australian debt to household income is just under 200%; historically, approximately 65% is normal. Many other countries have high debt levels, following further government spending to support economies during Covid or at the consumer end due to higher house prices or credit expansion during a period of record-low interest rates. How will central banks and markets react to this economic background? Secondly, it will be very tempting for central banks to try and ultimately "under-respond" to high inflation as they need to act to inflate the debt away and will become scared again about deflation and a financial crisis should they overdo rate increases and see markets and economies collapse. This could occur much earlier than most believe. The unfortunate reality is central banks don't control everything that goes on in an economy, albeit are loathe to admit it. Monetary policy only has a limited effect on supply-side inflation and ultimately to be effective at addressing this must kill demand i.e., induce a recession. A recession is hence a realistic expectation if central banks are to be taken seriously. Ultimately, it will be very important how far central banks go. A policy mistake lies beyond every decision they make from here. The Reserve Bank of Australia recently lifted interest rates slightly, announcing that the cash rate would increase by 0.25% to 0.35%. Incredibly, this was the first interest rate rise in over 10 years. This appears to be a small opening shot against inflation but it is not until rates are closer to "neutral" that we will know how far they are prepared to push it, and neutral cash rates may be lower than ever before. We would suggest that central banks will continue to lift interest rates, however, to a more limited extent and less than what is priced in. This is because we think something meaningful will break long before they manage to meet the expectations of the bond market, or alternatively, they'll aim to tolerate higher inflation and raise rates cautiously over a more extended period while talking a tough game and hoping inflation will have some dips. Investors, many of which have only had limited experience of inflation and how it can have dramatic effects on the purchasing power of cash over a number of years, will need to pay close attention to central bank actions. Macroeconomics matters now like never before. Market falls could be dramatic because the risks are high and because of the influence of passive investors who don't know what they own, only that they expect it to go up. Passive investors might wake up one day and decide they're over-allocated to risky assets due to their backwards-looking models that simply don't match the times, providing constant selling pressure. A geopolitical and technological disruptive period Geopolitical risk should be front of mind as the era of (relatively) peaceful prosperity appears over. Power games are occurring on a grand scale and the stakes are big. One wrong step and it is literally kaboom. When people with a history of following through on their threats start threatening the use of nukes, nuclear strikes must be considered a realistic possibility (like it or not). Investors also need to be aware that we are headed into one of the most technologically disruptive periods in history. The integration of technology into many businesses will see certain companies thrive and many others prove uncompetitive. For example, artificial intelligence, robotics, and the move to the electrification of transportation will have positive benefits for technologically innovative companies over time, while having negative effects on companies unable to implement or use these new technologies productively. Will the commodity and mining boom continue? The move towards reduced carbon is an ongoing important secular thematic and we are hence allocating towards an active strategy investing in carbon futures to benefit from needed and likely carbon price increases over time. While technology stocks and disruptors are understandably lagging today as rate increases decrease the value of long duration stocks and some of these stocks are absolutely detested, should the central banks not follow through with the priced rate increases and/or reverse their policy, these stocks may see some respite from their entrenched bear markets later in 2022. Real productivity growth is an important secular need that some technology stocks will provide and benefit from overtime, while many others will fail to reach profitability and hence continue to disappoint or disappear. Precious metals will also benefit if positive real rates fail to be sustained, which we think is likely in most Western economies in the absence of good policy choices, due to large debts, worsening demographics and mediocre leadership. Asset allocation and stock selection will hence become a bigger driver of investment returns in this new unstable and dangerous period in world economies and markets. The days of the index approach are hence numbered as broad real returns will likely continue to prove disappointing, and certainly so to anyone with reasonable or high expectations. Being overly concentrated or convicted may also be highly dangerous in such an uncertain and risky world (many funds are already down 40 or 50% from highs using such an approach!). A humbler and more diversified yet still highly active and selective approach is, in our view, more able to manage the risk and uncertainty, smooth the return path and keep losses to more tolerable levels. The primary dangers for investment markets are (1) an overly aggressive interest rate stance by central banks, which we would see as an explicit policy error, or (2) an escalation of the war or a new war. Covid policy in China is an x-factor but one would think likely to resolve over time. If there is one thing we would leave you with, expect to be surprised. We're in a new dangerous investment era where surprises will prove commonplace, and arrogance and an inability to be flexible may prove deadly. Being humble, cautious and backing good research and prudent risk management might not (yet) be very popular but it will be soon enough. It provides a greater chance of being effective and avoiding the disastrous downdrafts which we expect will afflict many investors in 2022. Funds operated by this manager: WealthLander Diversified Alternative Fund DISCLAIMER: This Article is for informational purposes only. It does not constitute investment or financial advice nor an offer to acquire a financial product. Before acting on any information contained in this Article, each person should obtain independent taxation, financial and legal advice relating to this information and consider it carefully before making any decision or recommendation. To the extent this Article does contain advice, in preparing any such advice in this Article, we have not taken into account any particular person's objectives, financial situation or needs. Furthermore, you may not rely on this message as advice unless subsequently confirmed by letter signed by an authorised representative of WealthLander Pty Ltd (WealthLander). You should, before acting on this information, consider the appropriateness of this information having regard to your personal objectives, financial situation or needs. We recommend you obtain financial advice specific to your situation before making any financial investment or insurance decision. WealthLander makes no representation or warranty as to whether the information is accurate, complete or up-to-date. To the extent permitted by law, we accept no responsibility for any misstatements or omissions, negligent or otherwise, and do not guarantee the integrity of the Article (or any attachments). All opinions and views expressed constitute judgment as of the date of writing and may change at any time without notice and without obligation. WealthLander Pty Ltd is a Corporate Authorised Representative (CAR Number 001285158) of Boutique Capital Pty Ltd ACN 621 697 621 AFSL No.508011. |

20 May 2022 - Mid-Cycle correction or a new bear market?

|

Mid-Cycle correction or a new bear market? Watermark Funds Management April 2022 The question everyone is asking, Is this a mid-cycle slowdown or have we moved into a new bear market for shares? We are firmly in the latter camp. The balance sheet recession that followed the financial crisis was a powerful deflationary force. Households and businesses de-levered while governments exercised fiscal restraint allowing Central banks to reflate without creating inflation. Low growth with deflation was a 'goldilocks' era for risk assets, not too hot and not too cold. In Fig 1 below, you can see four very clear and discrete mini business cycles of four years each starting in March of 2009, as Central Banks' eased and then tightened policy. Together they make up the 14-year secular bull market in shares. The cycle has turned, the bear is here

In each reflation episode, real interest rates moved lower and lower and 'financial assets' such as shares and bonds, moved higher and higher. At the same time as real interest rates turned negative, capital was re-allocated away from short-duration 'hard' assets such as commodities. The share market has followed each of these business cycles peaking on each occasion at the blue advance line in Fig 1 as it has once again in December of last year. As policy support is once again withdrawn we have moved into the next 'cyclical' bear. Market bulls will have you believe policymakers can engineer yet another soft landing, pivot, and reflate one more time. It's highly unlikely this time however as we no longer have these deflationary tailwinds, instead, we have inflation at the highest level in 40 years in many western economies.

In the last tightening cycle in 2018 (Fig 2), the US Federal Reserve started raising interest rates much earlier while the economy was still expanding rapidly (PMI was rising). They didn't even reach the neutral interest rate however where policy pivots from accommodative to restrictive (the dotted line) before economic activity fell sharply and they were forced to reverse course and ease rates again. Back then, inflation was barely at 2%, and the Fed was still trying to push inflation higher! US Federal Reserve Target Interest Rate

This time will be very different, they are late and are tightening as growth slows. Furthermore, to bring inflation back under control, theoretically, policy must 'overshoot'. They need to move beyond the neutral rate (dotted line) to slow demand enough to stimy inflation. Goldman Sachs have suggested this overshoot may require interest rates as high as 4% or above to curb inflation. Interest Rate markets are clearly well below this level today and with an inverted yield curve, bond investors are already signalling a recession is ahead. Given central banks are late and tightening into a slowing economy and the need for a policy overshoot to curb inflation, the prospect of a recession in advanced economies next year is high. A soft landing and another round of asset reflation is equally unlikely. Not just any bear. A new secular bear.This will not just be a 'cyclical' bear market like the four prior episodes but the beginning of a new secular bear where shares move sideways for many years to come. As with secular bulls (the last one lasted 14 years), secular bears typically last 10-15 years

A secular bear market

Strategists often refer to the 1970's secular bear as a precedent for what lies ahead. You can see in Fig 3 above this was not a unique period. Inflation eventually kills most secular bull markets and that should be our base case this time also. It is dangerous to expect this time will be different. Within this secular bear we will still have the four-year business cycle playing out as shares rise and fall, but within a broadly sideways trend. A new secular bear for bonds alsoWith the return of inflation, it looks like the 31-year secular bull in bonds is also now complete. It is clear from the momentum signal in the bottom panel below the low for bond yields (the high for bond prices) is in. Most risk assets are priced off the long bond - the very low yield on these securities has led to a re-rate of other long-duration risk assets like shares. The P/E re-rate of shares and for growth shares in particular is an extension of the depths bond yields have fallen too. As commodities are an inflation hedge, secular trends in commodities have historically been negatively correlated with financial assets. You can see this indicated in red below. A new secular bull market in commodities has probably begun. Secular bear in bonds/a secular bull in commodities

US Treasury Yield % (10 year) Further confirmation of a reversal in bond prices is near to hand. In Fig 5 below you can see bond yields across multiple durations are pushing up against the 30-year downtrend as we speak. If yields break through here, we will be at a seminal moment for risk assets. The 30-year tailwind for share market valuations will have reversed. How it plays out for shares this year

Following the strong bear market rally in March, shares are likely to track sideways in the months ahead but will fall short of prior highs. It is still too early for a major draw, shares still offer decent profit growth this year and analysts are still upgrading profit estimates. Furthermore, with money pouring out of the bond market, investors have few alternatives other than to invest in shares. The next major drawdown in the share market is likely to occur later in the year as economies slow and the street starts cutting profit estimates. As shares start to move lower and investors come to realise there will be no Central Bank bailout this time around, share markets will fall hard led by mega-cap technology - the last and largest bubble still to burst. Closer to home, we may well see a replay of the Teck Wreck and the GFC where the lucky country once again misses the recession bullet given our exposure to a resurgent resources sector. Given our markets' heavy weighting to resources, the ASX may still make a new high in the months ahead. From here, I would advise thinking of the Australian share market as two discrete markets - the All Industrials share market which today is still 7% below the August 2021 high and a resources market which is making new highs as I write this piece. Don't chase it though, the initial advance in commodities is nearly complete. As late cyclicals, resource shares will also fall in the second half of the year as global growth slows. Funds operated by this manager: Watermark Absolute Return Fund, Watermark Australian Leaders Fund, Watermark Market Neutral Fund Ltd (LIC) |

19 May 2022 - Nestlé: innovation strengthens the moat

|

Nestlé: innovation strengthens the moat Magellan Asset Management April 2022 Vrimp, the vegan alternative to shrimp, is made from peas, seaweed and konjac root, a vegetable found in Asia. The vEGGie, a vegan egg, is a mixture of soy protein and omega-3 fatty acids. Wunda is a pea-based alternative milk. Offered too are the Vuna, a vegan tuna alternative, and vegan burgers, while an experiment is underway to make vegan chicken that comes with fake skin and bones. These products add to the plant-based dairy alternatives for chocolate, coffee, creamers, ice cream and malt beverages. Such are newest offerings of the Swiss-based Nestlé, the world's biggest food and drinks maker, as it responds to the latest twist in consumer demand. The innovation drive extends to the staples that bring in so much of Nestlé's revenue, which reached 87.1 billion Swiss francs in fiscal 2021, a jump of 7.5% on an organic basis from 2020 and the fastest pace in 13 years. Coffee (26% of fiscal 2021 sales) has benefited from the launch of Starbucks at Home, a tie-up with Starbucks and Nespresso, and a revamped approach to producing Nescafe instant coffee. Bean selection is now approached in much the same way as wine makers grade grapes and there's an organic option. Of note is that in 2021 Nestlé scientists discovered two novel plant varietals of the coffee tree that produces Robusta beans. The result is a jump in yields by up to 50%, lower carbon emissions and people can now enjoy a super-premium barista blend in their soluble coffee. And every second of every day, the world enjoys another 5,500 cups of Nescafé, including the premium Nescafé Gold. The pet care staple (18% of sales) has become personalised (animalised?) and much science has gone into producing healthy high-end labels. In many parts of the world at production volumes that achieve economies of scale, Fido can receive a unique blend of dog food and supplements delivered to the home with his name stamped on the front. For house pets so inclined, there's a pet food line where insects and plant protein from fava beans and millet are mixed with meat. Pet carers are considered too. Improved online ordering means people don't have to lug home heavy packets. The KitKat staple, which was revitalised by a marketing campaign in Japan in 2014 that exploited how the Japanese pronunciation of KitKat (kitto katto) resembles the phrase 'you will win' (kitto katsu), now has stand-alone stores. These 'KitKat bars' offer almost countless flavours including a vegan option (KitKat V) and let people devise their own recipes - 'create your break'. Such is the revamp of a company with a history stretching to 1866 since Mark Schneider became CEO in 2017. Key drivers of success under Schneider include a switch into healthier products such as plant-based foods and vitamins and supplements, and a focus on novel products and faster times to market with the latest offerings. Schneider has reinvigorated the company's portfolio of assets by conducting at least 85 divestments and acquisitions over the past five years. Nestlé shares are trading around the record high set in November last year because investors recognise that an overhauled company with great brands is enjoying a virtuous cycle kicked off by digitalisation. The enhanced consumer insights improve innovation, which leads to the creation and successful launch of better products produced at economies of scale that bestow an unassailable competitive advantage on the company. What brands the company has. Nestlé has 31 'mega-brands' including Coffee mate, Haagen-Dazs ice cream, Maggi noodles, Milo, Nescafé, Nesquik, Nespresso, Purina pet care and San Pellegrino mineral water. Each has loyal consumers, which means these products command a premium price and superior access to supermarket shelves. Each generates global sales of more than one billion Swiss francs every year. Nestlé, in all, boasts 2,000-plus brands that are sold in 186 countries and many hold the No. 1 or No. 2 positions in their categories. The brands are split across seven segments. These are in order of fiscal 2021 sales: powdered & liquid beverages (28%), pet care (18%), nutrition & healthcare (15%), prepared dishes & cooking aids (14%), milk products & ice cream (12%), confectionery (9%) and water (5%). Nestlé's great brands mean the company has steady cash flow and earnings streams no matter the state of the economy. As such, the stock has a 'defensive' appeal, which is why it's held up better than most during the share slide so far in 2022. Since Nestlé is well positioned to achieve its sales growth target of 4% to 6% in coming years, the stock is likely to generate superior returns for investors for a long while yet. To be sure, Nestlé products face ferocious competition. Some products (chocolate) are struggling to boost sales. But the success of coffee and pet foods make up for these laggards. The health push exposes the food processor to charges of hypocrisy because many of its goods are unhealthy and cannot easily be made wholesome. But the company is out to reduce that percentage and sales show junk food is popular enough. For all its global reach, Nestlé is overexposed to a downturn in the US, where it sources about 33% of its sales and profits. The company has warned that higher costs for its agricultural ingredients, packaging, energy and shipping threaten margins. Russia's invasion of Ukraine has intensified that challenge, especially that wheat and energy prices are rising. But as a third of sales come from premium products, Nestlé is better placed than most of its peers. A business that has changed so much since two Americans established the Anglo-Swiss Condensed Milk Company 156 years ago (that eventually merged with a company Henri Nestlé founded to sell milk-based baby food one year later) is used to overcoming challenges. If Nestlé can make such a successful start to going vegan and vegetarian (sales of 800 billion Swiss francs in fiscal 2021), what can't it do? Sources: Company filings and website, Bloomberg News and Dunn & Bradstreet. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

18 May 2022 - Perception vs Reality: When a good story trumps rationality

|

Perception vs Reality: When a good story trumps rationality Colins St Asset Management April 2022 |

|

|

Despite our best efforts, human nature dictates that in life and in investing we often find ourselves making irrational decisions. That's not to say that those decisions aren't reasonable, but instead that most people prefer to act 'reasonably' rather than rationally.

In the early 1900's a doctor by the name of Julius Wagner-Lauregg began testing the premise that a fever as treatment for certain ailments could dramatically reduce mortality. He tested his theory on patients with neurosyphilis and discovered that his patients (with an induced fever) had twice the survival rate of patients left untreated. Dr Wagner-Lauregg went on to win a Nobel Prize in 1927 for his discovery before Penicillin was discovered and made his treatments redundant. Nonetheless, his research clearly identified the healing properties of a fever, and its usefulness in treating illness. Yet, despite his discovery, and despite the fact that modern medicine recognises the fever's role in the healing process, I know very few people who wouldn't immediately offer their sick child Panadol at the earliest signs of an increased temperature. The challenge is that what we know and how we feel are in direct conflict. We may recognise the benefits of the fever, but at the same time, we can't stand the thought of our child suffering. The same is often the case in investments. Even for those not speculating, for those who know the underlying value of a business, it's no easy feat to watch the value of one's holdings fall (considerably) and not feel the pull of the emotional pain of that loss. The Cost of Loss: Most parents and investors act reasonably in their avoidance of pain and suffering. Reasonably, but not rationally. Rational investment decision making requires one to look past how they feel about an idea, and instead focus on the numbers. However, that is a concept far simpler in principle than in practice. You see, psychological studies have often found that the pain felt from an investment loss is considerably greater than the joy felt by a gain. In fact, that loss:gain coefficient is thought to be as high as 2.5x. Take a moment for yourself as you read this now to consider what your own loss:gain coefficient might be. Consider a coin toss scenario (a 50/50 toss). Now consider a meaningful stake; a potential loss of $250,000 (for some that might be $200, or $2million). How much would you need to be offered to win in order to risk losing that $250,000?

The psychology is very interesting, and within that psychology lies the vast majority of our opportunities as fund managers. Our role is quite simple: recognise those emotional drivers that push investors into irrational decision making, and when the difference between the reasonable and the rational is wide enough, to take advantage. Keeping Things Simple: Even in the face of identifying emotional behaviours in the market it's not enough. At the risk of stretching an analogy, there are plenty of tasty looking fruit on the tree, and common thinking seems to be that investors should focus first on those lowest hanging fruit. We take a different approach. We don't want to pick fruit at all. Why stretch and stress when there are wonderful ideas already lying on the floor. I'd rather pick up a watermelon (investment idea) off the floor than stretch to pick an apple any day of the week. And there are plenty of 'watermelon' ideas available to those looking for them. They aren't necessarily as exciting as the more complex highly prospective ideas, but they are simple, they are profitable, and there is far less chance of falling off a ladder (getting oneself into financial trouble) if you aren't climbing one. "The fewer the steps between an idea and its success the better." That may seem anecdotally obvious, but the numbers describe a very compelling story. Imagine for a moment that we were investing geniuses. So good are we at investing that we could accurately predict outcomes at a rate of 70%. Now by most accounts, a 70% accuracy rating in investing terms would generate extraordinary outcomes. Simply by predicting earnings outcomes would mean that we are right 7 out of 10 times, and no doubt our results would be great. But what if, on top of having to accurately predict earnings, we also needed to predict market growth rates, or margins, or the outcome of a strategy adjustment? Well, if we need to predict two factors accurately to generate a positive investment outcome, our strike rate falls from 70% to (70%x70%) 49%! If we are required to accurately predict three factors to generate a positive outcome, that rate falls all the way down to 34%. The more decisions we need to get right, the lower our strike rate. And from what started off as an enviable and impressive 70% very rapidly deteriorates to getting things wrong more often than getting them right. It's not just unnecessary to invest in complex ideas, it's hubris to think that we as investors have the capacity to know the full impact of each variation and how it may play out in markets. Recognising the importance of keeping things simple truly is the ultimate indication of investing sophistication.

|

18 May 2022 - The forgotten asset class set to outperform in 2022

|

The forgotten asset class set to outperform in 2022 Yarra Capital Management 05 May 2022

Against a backdrop of economic and geopolitical uncertainty, rising inflation and rate hikes, Australian investors are searching for investments that can benefit from these evolving market conditions. With credit spreads at attractive levels, now might be the opportune time to have exposure to hybrids and credit. With minimal returns on cash continuing to underpin strong demand for hybrid securities, we anticipate demand for yield to remain robust throughout 2022, resulting in strong returns over the year for this asset class. The upside of rising interest ratesRising inflation, above average GDP growth and the unwinding of quantitative easing (QE) in 2022 has seen financial markets reprice interest rate expectations. The rising rate environment will push the outright return on hybrid securities higher, without having a material impact on spreads given the strong economic backdrop. Given most hybrids are floating rate, investors will benefit via higher income from these rising short-term rates. Strong balance sheets you can bank onAustralian banks are the largest issuers of hybrids domestically and their balance sheets are in fantastic shape, with capital ratios at historical high levels. COVID-19 provided Australian banks with access to cheap funding via the Term Funding Facility (TFF), which provided them with a degree of funding certainty and lower funding costs. Following the withdrawal of the TFF in 2021, new bank issuance is coming to market at attractive credit margins, providing the ideal environment for active credit managers to identify the most positive risk adjusted opportunities. For instance, bank senior credit margins are significantly off their TFF lows, which is leading to an attractive re-pricing across all bank capital issuance (refer to Chart 1). Overvalued growth sectors are likely to lead an equity market sell off similar to 2000 - 02, but are unlikely to impact credit market returns. Chart 1: Bank senior credit margins - Well-Off their TFF 2021 lows

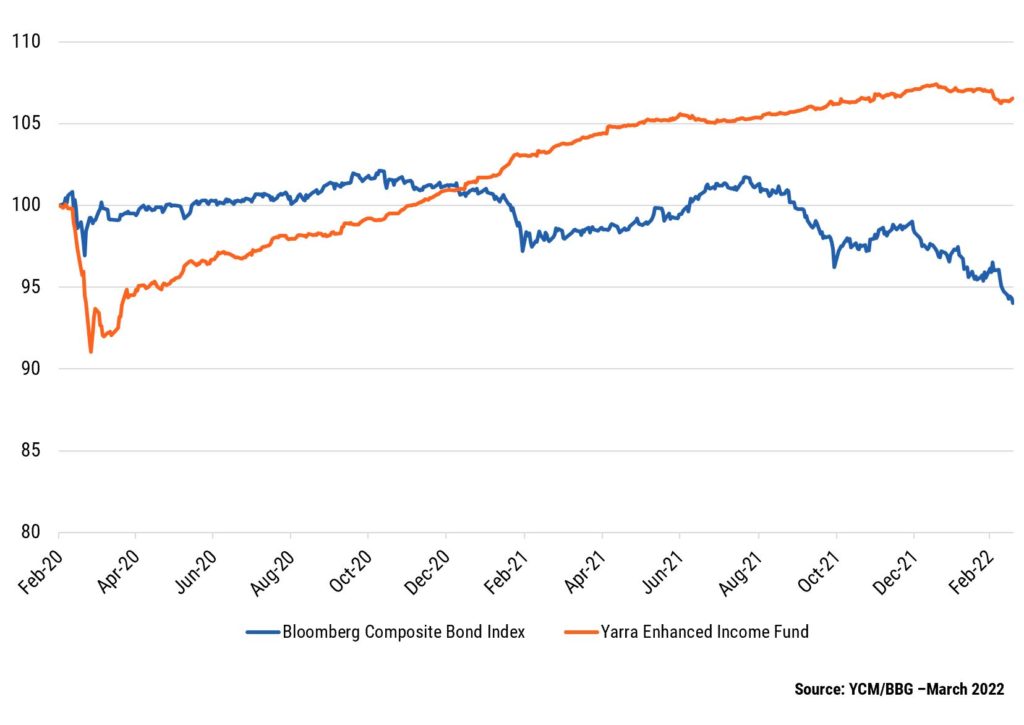

The higher the carry (running yield of an investment), the greater the protection it offers investors from adverse movements in credit margins. The carry for the Yarra Enhanced Income Fund is currently sitting at ~3.0% above cash. Based on an average portfolio maturity of ~3 years, we'd need to see an extreme 1.0% move wider in credit margins to wipe-out the carry. However, given the robust economic backdrop in 2022, we expect credit margins to remain relatively stable throughout, adding to floating rate credit's income generating credentials. This benign outlook is in contrast to the capital losses currently being observed in traditional fixed income due to the reset in interest rates and real yields. Usually, a rise in real yields will impact the value of everything long interest rate duration, from traditional fixed income to most equities. That's not the case with floating rate credit, since its short duration offers protection to portfolio valuations from rising interest rates. This is observable in EIF's outperformance compared to traditional fixed income (Bloomberg Composite Index) since February 2020 (see Chart 2). Chart 2: Floating rate credit with carry continues to outperform fixed rate with little carry

Making the gradeIn a world that seems to be getting riskier by the minute, investment grade hybrids look to be a safe haven for investors. Here's why:

Getting exposure to hybrids and creditBeing able to access fixed rate securities for floating rate portfolios remains a key competitive advantage for Yarra's clients. The Yarra Enhanced Income Fund invests in high yielding, floating rate credit and hybrid securities to deliver better returns than traditional cash management and fixed income investments. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

17 May 2022 - What have rubber bands got to do with successful stock selection?

|

What have rubber bands got to do with successful stock selection? Insync Fund Managers April 2022 Lifting of pandemic restrictions has generated an overly enthusiastic view that economically sensitive companies will rebound quickly across many business sectors. Insync deliberately has no exposure to stocks of this ilk. We favour companies that are not only are some of the most profitable companies in the world but are also expected to consistently grow their earnings at high rates regardless of how the global economy performs. As the earnings growth across our portfolio continues to compound at high-rates, the gap grows ever wider between their stock price and their valuations (currently circa 50%+ below valuations). In these shorter periods of relative underperformance, a tension permeates in markets. This creates ideal conditions for entry as a sudden 'snap-back' in stock prices can occur very quickly. Snap backs are triggered by a change in market conditions, an event or simply the market recognizing the big disparities between the companies promising to deliver to the ones actually delivering. We liken it to an elastic band. The more you stretch it (the widening of the gap between valuation and share price), the greater the likelihood of a rapid 'snap-back'. Whilst it's impossible to time exactly when the snap back will occur, when it does do so, it delivers strong outperformance to those stocks with the real underlying earnings and profits to support a sustainable uptick in their price. At the same time, the reverse occurs for those presently leading this latest bout of exuberant price growth. We like value but we are not value Investors. We recently had an extensive meeting with a fund researcher where we took him through our valuation approach. One of his key conclusions was that Insync is a 'value investor'. Whilst we would not describe ourselves as value investors based on conventional metrics (just buying companies based on low Price/Earnings ratios), an important part of Insync's process includes building a high degree of confidence in understanding the worth of a company's future cashflows beyond its present state. To make money involves finding companies where the value we see is significantly greater than the price we have to pay. The current investor exuberance around chasing returns in hyped up sectors has the Insync portfolio of quality growth companies trading at circa 50% below our assessed valuations. A question to ponder is this..... Would you buy into highly profitable businesses if you could buy them at such a large discount? And after doing all your investigations and crunching the numbers, its forward earnings were compounding strongly. Or would you buy a very richly valued popular business whose forward looking numbers don't support its price but everyone was enthusiastic about it today? This is the choice that investors face and this sets up perfect conditions for the Insync portfolio to deliver strong returns. P.S. Insync is of course categorised as a 'Quality Growth' Investor. Traditional valuation metrics are losing their predictive power. PE (Price/Earnings) and PB (Price/Book) ratios have been declining in their ability to predict value. The main reason is in the "E" part of the P/E ratio. Our modern global economy is increasingly driven by intangible assets. Items such as intellectual property, R&D, brands, and networks. In the last decade or so this has accelerated to dominate in many key industries. In the past capital equipment and other tangible assets used to figure large on balance sheets.

'Intangibles' now represent 84% of the market value of the S&P 500 as depicted above. The old focus supported the old P/E and P/B ratios suitability. The problem occurs when it is applied to this new world - to the industries and companies that invest heavily in intangibles. It creates a misleading and distorted picture.

By example, when Pfizer invests R&D in a new drug for Covid-19 (forecasted to generate sales of US$45.7 Bn this year), or Amazon spending on building their cloud capability (sales of US$60 Bn expected from this division), these investments are classified as intangibles. They have to be expensed through their income statements. This means it significantly depresses their earnings today despite these 'investments of expenditure' creating significant sales and profits for many years to follow. Their resulting P/E and P/B ratios are thus negatively impacted. This is important to remember when investing for the future. Beware of using the rear-view mirror. Life has changed. Fastest decline in history. By way of contrast, old-industry companies, say a steel company, has to invest heavily in property and machinery (tangibles). The accounting rules treat these investments as capital expenditures. It immediately goes onto the balance sheet and does not detract from that year's earnings unlike intangibles. Effectively this inflates its present earnings and the book value. P/E and P/B ratios look good.

This inconsistent treatment of the drivers of future growth between intangibles and tangibles leads to wrong conclusions on what actually represents good value and what does not. P/Es are thus not a useful indictor for industries with high intangibles, and even more misleading if taking an average across a broad index. Conventional portfolio blending methods. Many research houses lump funds managers into simplified groupings primarily based on P/E ratios. Growth managers tend to be holding businesses with higher than market average P/E or P/B ratios. Value managers holding a portfolio of low P/E ratios, and GARP or Core managers somewhere in-between. Not only is this old measure being over-used to compare managers in the same group, it is further adapted as the primary means of blending managers across entire client portfolios and investment models. People tend towards simplicity even if its misleading. Given the change in intangible expenditures this is an increasingly unwise approach for professional advice givers. It is also worth noting that P/B and P/E ratios represent two of the three variables used to determine stock inclusion in the widely followed style index, MSCI World Value. The key driver of future earnings - intangibles, is not being appropriately reflected in the income statements and balance sheets in a rapidly changing economy. Accounting rules have not yet adapted. This, we strongly contend, is a key reason for the long-term underperformance of Value indices post the Global Financial Crisis. Intangibles- a key to investing in today's world Even though it is impossible to measure the value of intangibles precisely, it is essential for investment professionals to come up with a logical approach to incorporate intangibles into their decision making; otherwise, they risk being relics in this new age of information. At Insync we have developed a systematic way of incorporating the cashflows that intangibles are delivering into our valuation methodology. This results in a more accurate assessment of the value of a business and a key reason of our successful stock selections. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

16 May 2022 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

|||||||||||||||||

| GQG Partners Global Equity Fund - AUD Hedged | |||||||||||||||||

|

|||||||||||||||||

|

GQG Partners Global Equity Fund - Class A |

|||||||||||||||||

|

|||||||||||||||||

|

GQG Partners Emerging Markets Equity Fund - Class A |

|||||||||||||||||

|

|||||||||||||||||

|

|

|||||||||||||||||

| Longreach Energy Income Fund | |||||||||||||||||

|

|||||||||||||||||

| View Profile | |||||||||||||||||

|

|||||||||||||||||

| Microequities Value Income Fund | |||||||||||||||||

|

|||||||||||||||||

| View Profile | |||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||

|

Subscribe for full access to these funds and over 650 others |

16 May 2022 - Earnings growth is becoming a priority

|

Earnings growth is becoming a priority Montgomery Investment Management April 2022

Over the years I have often sat alongside guests on a TV or radio panel and heard them conclude the easy gains have been made. For the first time in many years I agree. In recent years investors have made substantial gains from equities but a close look at the driving force behind those gains is likely to reveal investors won because the tide was rising. Sure, many companies grew their earnings too but there were a huge number of companies whose share prices went parabolic despite the absence of earnings. A rising tide does indeed lift all boats, but don't mistake a rising tide for genius, or so the axiom goes. Since 1979, without exception, every period of inflation and or rising interest rates, was accompanied by a contraction in price to earnings (PE) ratios. And using data back to the 1980s, we find the decline in the earnings multiple is greatest when interest rates move up from lower starting levels, just as we are witnessing now. For the last four decades, whenever inflation or interest rates have risen, the multiple of earnings investors have been willing to pay for a share in a company has declined. In every one of the seven phases when US 2-Year Treasury yields rose between 1980 and today, the US S&P500 12-month forward PE Ratio declined. In other words, if Jerome Powell and his team at the US Federal Reserve continue on the path articulated in our blog post The End of Zero, investors can kiss goodbye the easy wins resulting from shares simply becoming more popular, and that rising popularity being reflected in ever expanding PE multiples. I will go so far as to suggest we are, right now, in a period of adjustments to a regime of lower PEs. Plenty of investors haven't yet worked that out and this can be seen in the steep gains for almost all equities amid the hope and talk of peace in Ukraine. Fundamentally however, rates are rising. And while I think rates will rise by less than the most bearish forecasts, the impact on PEs is already underway. Going forward Investors should now be looking at the quality of their portfolios and seek at least some exposure to high quality growth. If a company, with earnings of $10 per share, sees its PE of 35 times fall to 25 times, the share price will decline 28 per cent, from $350 down to $250. Plenty of high-quality growth companies have experienced this, and worse. And that represents a new opportunity. In an environment of high short-term inflation expectations history tells us not to expect expanding PEs. If the best we can hope for is PEs remain static, the way to generate capital growth will be from earnings growth. If the PE ratio for our hypothetical company stays at 25 times earnings, the share price will return to $350 provided earnings grow 40 per cent to $14 per share (E$14 x PE25 = Px$350). The work investors need to undertake now is to uncover those companies able to grow. One place to look is among those companies enjoying structural or megatrend tailwinds. And if among those companies you also find a capital light and highly profitable business with net cash on the balance sheet, more power to you. Avoid capital intensive, low growth, mature, cyclical, geared businesses, or those with lumpy contract-type revenues, and those exposed to discretionary spending (unless they are on a store roll-out tear) and those companies playing in the revolving door of capital - paying out cash, they need later, as dividends today and subsequently raising dilutive capital to replace it. In the next period investors will be wise owning businesses selling products and services with inelastic demand and the recipients of non-discretionary spending. Think of Microsoft - nobody is going to cut their subscription to Microsoft Office just because Jerome Powell said interest rates are going up, or because Putin decides to invade Ukraine. Inelastic services like Microsoft Office are entrenched in the daily systems of hundreds of millions of businesses and individuals. That durability provides Microsoft low cyclicality, higher profitability, stable, recurring and growing cash flows and little or no need for debt. Another company that comes to mind is held in the Polen Capital Global Growth Fund; Adobe. Adobe's Digital Media products enjoy a near monopoly and are "industry standard". Adobe creates and markets software for creative professionals and hobbyists. Its digital media segment supplies 70 per cent of revenue and 90 per cent of it is recurring. Meanwhile its SaaS based digital marketing solutions for enterprises produces 24 per cent of revenue, while Print & Publishing is two percent. In 2011 Adobe commenced a transition to annual subscription-based sales, forever altering the company from a "boom, bust" product cycle business to a predictable, subscription-based model. Unsurprisingly the company generates a return on invested capital of 33 per cent, a return on equity of 43 per cent, has US$1.1 billion of net cash on its balance sheet, produced earnings growth in 2021 of 23.6 per cent, free cash flow growth of 29 per cent and an operating margin of 45 per cent. They are numbers most businesses owners would be envious of. But when Adobe recently announced it was ceasing new sales to Russia and not collecting on subscriptions there, the share plunged nearly 10 per cent. Great! Since its share price highs last year, the shares have declined 37 per cent. Sure, the rate of growth that saw revenue of US1.6 billion in 2004 rise to US$15.8 billion in 2021 may slow but this is a structural growth story, a very high-quality company and remember, shares prices generally track earnings if the PE remains constant. And finally, let us say interest rate rises have the desired effect of reducing inflation. Well, what follows is disinflation and in a disinflationary environment, when the economy is still growing, PEs expand again. That would be icing on the cake for investors who heed the suggestion to invest in quality growth after share prices have been slammed by contracting PEs. Author: Roger Montgomery, Chairman and Chief Investment Officer Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |