News

2 Jun 2022 - Superbugs are outsmarting antibiotics

|

Superbugs are outsmarting antibiotics Magellan Asset Management April 2022 In 1938, Ernst Chain,[1] a German-born biochemist working at Oxford University, found an article on penicillin written nine years earlier by UK bacteriologist Alexander Fleming.[2] In 1928, by fluke, Fleming noticed a zone around an invading fungus on an agar plate in which the bacteria did not grow. After isolating the mould, Fleming identified it as belonging to the Penicillium genus.[3] But doing anything more with the unstable compound was beyond Fleming's skills, which is where Chain stepped in. He proposed to his supervisor, Australian pathologist Howard Florey,[4] that they isolate, purify and test the compound to see if it could kill microorganisms without harming their host. Florey, seeing penicillin's potential, assembled a team that in 1939 oversaw experiments where only treated mice survived. By 1941, the group was experimenting on sick people. Because a UK stretched by war was incapable of producing enough penicillin, Florey travelled to the US to convince drug companies and officials to produce penicillin. When the US was drawn into World War II later that year, the government took over the mass production of penicillin to ensure the drug would be available for Allied forces. (It was by 1943).[5] In 1942, Fleming, who obtained some of the Oxford team's scarce penicillin, saved a UK woman who was dying of an infection. The Times of the UK published the feat, without referring to Fleming or Florey. Fleming's boss wrote to the newspaper praising Fleming who boasted in press interviews while Florey refused to speak to the media. Thus, many people today wrongly believe Fleming gifted penicillin to the world, even though Chain, Fleming and Florey equally shared the Nobel Prize for Physiology or Medicine 1945 and those in the know thought a self-promoter stole the credit from Florey.[6] What matters more is Florey's vision led to one of history's key medical feats. The drug's breakthrough advantage was how cheap it was to produce. The antibiotic became a worldwide cure and boosted life expectancy, mainly by reducing childhood deaths. By 1954, for instance, pneumonia's death toll on US toddlers had plunged 75% from 1939 levels.[7] Penicillin's wonders inspired the development of other affordable antibiotics that could combat an ever-wider array of ailments.[8] As antibiotics, antifungals, antiviral and other drugs that are grouped as antimicrobials were developed, optimists dared talk of a world without deadly infections. What could go wrong? Four things. First, in the advanced world where prescriptions are regulated, doctors overprescribed and misused antimicrobials. Second, in the unregulated emerging world, people can buy antibiotics (many counterfeit)[9] at pharmacies without prescriptions and even find them at markets and shops. People thus mistreat or overtreat themselves with these medicines because it's cheaper and easier than seeing a doctor. The result is that up to 70% of human use may be inappropriate.[10] Third, 80% of antibiotic use worldwide is to fatten farm livestock and prevent livestock infections.[11] Efforts to curb such misuse have failed.[12] The fourth problem is that antibiotic and antifungal residue is too prevalent in third-world drug-making hubs such as India's Hyderabad. The result? The natural immunity microbes develop over time has accelerated. 'Superbugs' have built resistance to antimicrobials and global deaths from drug-resistant bugs are mounting. Before antibiotics, only about one in 10 million bacteria would prove resistant to antibiotics. Now, given that bacteria vulnerable to antibiotics can't survive, it is estimated that up to 90% of bacteria causing infections are immune to previously effective antibiotics.[13] As for deaths, a study led by researchers from the University of Washington out in January attributed 6.22 million deaths worldwide in 2019 to drug-resistant microbes (of which 1.27 million were a "direct result" of superbugs).[14] A 2016 UK-government-commissioned study predicted that as "routine surgeries and minor infections will become life-threatening once again" deaths would reach 10 million annually by 2050 - by when the accumulated cost of superbugs would be US$100 trillion due to the need to use costlier treatments and longer hospital stays to save lives.[15][16] The University of Washington study suggested five ways to combat superbugs. First, improve sanitation and hygiene, especially for water, to limit infections. Second, prevent infections through vaccinations where possible. Third, reduce antimicrobial use in animals. Fourth, minimise the misuse of these drugs with people. Fifth, boost investment to find drugs that can defeat superbugs.[17] Here lies a key handicap in the battle against infections that fail to respond to treatment. Few superbug-busting drugs are appearing because investment in the field is minimal compared with other spheres of public health. Only about US$1 billion a year worldwide is spent on research to combat superbugs compared with US$50 billion a year tackling HIV/AIDS in low- and middle-income countries[18] or an estimated US$157 billion to be spent on covid-19 vaccines through to 2025.[19] Pharmaceutical companies, which rely on prescription-based sales for revenue, aren't investing enough because they can't recoup an adequate return for three reasons. First, the cheapness of antimicrobial generics makes hospitals reluctant to pay high prices for superbug stoppers. Another problem is that medical facilities use new superbug-busters as a fallback when generic treatments fail. A third hitch is that antimicrobials are taken for a short time only, whereas profitable drugs are usually ones that people take daily for years. The outcome is that sales volumes are too small to make new drugs profitable. As a sign of how fragile are the economics in this sphere, Big Pharma players have abandoned the superbug fight and smaller antibiotic-development companies struggle to survive, even after gaining approval for their finds. A crisis around superbugs is building. A market failure means capitalism can't yet derive a solution to diffuse a foreseeable catastrophe. Governments need to do more when it comes to funding research and offering financial incentives for private enterprise because only alarming levels of deaths will improve the economics. Even though the pharmaceutical industry is likely to solve the problem in extremis, it would be too late for millions of people. To be fair, policymakers are trying to stop the misuse of antibiotics - but with little success in the emerging world. To be fair again, authorities have tried to help develop superbug-busters. The PASTEUR Act of 2021 before US Congress provides incentives for research.[20] The Combating Antibiotic-Resistant Bacteria Biopharmaceutical Accelerator, or CARB-X, which is a public-private initiative, is spending US$480 million from 2016 to 2022 to solve the problem.[21] A UK initiative unveiled in April could become a global template for encouraging research because it offers to pay drug companies a fixed fee for supplying antibiotics.[22] Success might come but moneywise these efforts don't compare with the billions Big Pharma spends on research in lucrative areas. Some superbugs arise out of nature so antibiotic misuse and overuse are not to blame for all of them.[23] Doctors are finding novel ways to combat superbugs. Phage therapy, the use of specific viruses to target bacterial infections, is one of them.[24] But greater efforts are needed. Surely in the medtech age, someone can discover a cure for superbugs. No one will care if self-promoters pinch the credit. A flawed model Before 1870, US pharmacies were virtually unregulated. Chemists sold remedies without prescriptions, heavily promoted quack cures and sold drugs now illegal such as cocaine, heroin and opium. Doctors overprescribed doses to be obtained from pharmacies because they knew chemists watered down medication. Newspapers so relied on advertising by drug companies they downplayed medical mishaps. By 1906, the harm to society was prominent enough to warrant the passing of the Pure Food and Drug Act, the first step in the US to regulate drug marketing.[25] The act gave rise to the Food and Drug Administration, the US's oldest consumer-protection agency. Tougher laws in 1938 meant new drugs required the body's approval and some medicines required doctor prescriptions.[26] This doctor oversight meant the big drug companies founded after World War II aimed their advertising at doctors, not the public - by 1961, about 60% of the advertising budgets of the 22 biggest drug firms was targeted at doctors.[27] Thus formed the pharmaceutical business model, whereby drug companies identify promising molecules, test them, and, once gaining approval, target the medical industry for sales. Success is a 'blockbuster drug' that reaps annual sales topping US$1 billion year after year. The model has provided the world with many wonder drugs but it's flawed at the same time. A major disadvantage is that many discoveries are so expensive as to be unaffordable. Another is a slowing rate of discovery of effective medicines - most of the breakthroughs such as antibiotics, the polio vaccine, heart treatments, chemotherapy and radiation for cancer were discovered between 1940 and 1980.[28] In terms of antibiotics, no major advances have come since the 1980s[29] - new drugs are variations rather than breakthroughs.[30] A third disadvantage with the pharmaceutical business model is that the economics of certain spheres of medical research are so poor Big Pharma avoids the area and specialist start-ups can't survive. Such is the fate of research against superbugs. In 2018, Novartis joined Allergan of the US, AstraZeneca of UK-Swedish origins, GlaxoSmithKline of the UK, The Medicines Company of the US and France-based Sanofi in quitting the fight against infections.[31] One comfort when Big Pharma companies dodge the superbug fight is they often sell their infection-disease research units to small biotechs. The Medicines Company, for instance, in 2017 sold its portfolio to Melinta Therapeutics of the US,[32] while AstraZeneca in 2018 hived off part of its antibiotic research to Entasis Therapeutics[33] (which just announced a promising cure).[34] But Little Pharma is besieged. The World Health Organisation says the smaller and mid-sized companies that dominate the preclinical and clinical antibiotic pipeline are "struggling to find investors to finance late-stage clinical development up to regulatory approval". As such, many companies disappear and so do their finds. Of 15 new antibiotics approved in the US in the decade to 2020, five were shelved as companies applied for bankruptcy or were sold.[35] Take, for example, the experience of Achaogen. The US company collapsed in 2019 after spending about US$1 billion over 15 years to win Food and Drug Administration approval for Zemdri, a drug for hard-to-treat urinary tract infections and one the World Health Organization classes as an essential medicine.[36] Somehow Zemdri is still available. To overcome the overall market failure that prevents the discovery of similar feats, the OECD said in 2017 it would take an extra US$500 million per year over a decade to make available four new 'first-in-class' antibiotics. Governments need to make this happen, just like the US government, thanks to Florey's efforts, ensured enough penicillin for the military in World War II.[37] |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund [1] Sir Ernst Boris Chain. British biochemist. Britannica biography. britannica.com/biography/Ernst-Boris-Chain [2] Alexander Fleming. Scottish bacteriologist. Britannica biography. britannica.com/biography/Alexander-Fleming [3] Robert Gaynes. 'The discovery of penicillin - new insights after more than 75 years of clinical use.' US National Library of Medicine. National Institute of Health. May 2017. ncbi.nlm.nih.gov/pmc/articles/PMC5403050/ [4] Howard Walter Florey, Baron Florey. Britannica biography. britannica.com/biography/Howard-Florey [5] Norman George Heatley. Biography. The Lancet. Published 7 February 2004. thelancet.com/journals/lancet/article/PIIS0140-6736(04)15511-6/fulltext [6] 'The Nobel Prize for Physiology or Medicine 1945.' The Nobel Prize. The prize-awarding committee credited Chain, Fleming and Florey with 'Prize share: 1/3.' nobelprize.org/prizes/medicine/1945/summary/ [7] Robert Gordon. 'The rise and fall of American growth.' Princeton University Press. 2016. Page 465. [8] By 2001, antibiotics had largely rid the US of tuberculosis; incidence of the disease that year was fewer than six cases per 100,000. [9] Financial Times. 'Antibiotic resistance in Africa: 'a pandemic that is already here'. 7 March 2022. ft.com/content/95f150df-5ce6-43cf-aa8d-01ac3bdcf0ef [10] Foreign Affairs. 'When antibiotics stop working.' 28 February 2022. foreignaffairs.com/articles/world/2022-02-28/when-antibiotics-stop-working [11] Foreign Affairs. Op cit. [12] See 'Antibiotic use in US farm animals was falling. Now it's not.' WIRED. 14 December 2021. wired.com/story/antibiotic-use-in-us-farm-animals-was-falling-now-its-not/ [13] Foreign Affairs. Op cit. [14] The study found that one in five deaths were of children under five years old, while nearly 80% of deaths were attributed to three causes: blood, intra-abdominal and lower respiratory and thorax infections. 'Antimicrobial resistance collaborators' (pen name of authors). The Lancet. 'Global burden of bacterial antimicrobial resistance in 2019: a systemic analysis.' Volume 399, Issue 10325. Pages 629 to 655. The study calculated that 1.27 million deaths were the "direct result" of drug-resistant bacterial infections and 4.95 million deaths were "associated" with them, many of them in the emerging world. Published on the web 19 January 2022. thelancet.com/journals/lancet/article/PIIS0140-6736(21)02724-0/fulltext. Excerpt. [15] Review on Antimicrobial Resistance. 'Tackling drug-resistant infections globally.' The review was commissioned in 2014 by then UK prime minister David Cameron. amr-review.org/. In 2019, the US Centers for Disease Control and Prevention warned that, as the US was recording 2.8 million drug-resistant infections a year, people should "stop referring to a coming post-antibiotic era - it's already here". Centers for Disease Control and Prevention. Antibiotic resistance threats in the United States.' 2019. Page V. cdc.gov/drugresistance/pdf/threats-report/2019-ar-threats-report-508.pdf [16] Centers for Disease Control and Prevention. Antibiotic resistance threats in the United States.' 2019. Page V. cdc.gov/drugresistance/pdf/threats-report/2019-ar-threats-report-508.pdf [17] 'Antimicrobial resistance collaborators'. Op cit. Pages 641 and 649. [18] Foreign Affairs. Op cit. [19] Reuters. 'World to spend $157 billion on covid-19 vaccines through 2025 - report.' 29 April 2021. reuters.com/business/healthcare-pharmaceuticals/world-spend-157-billion-covid-19-vaccines-through-2025-report-2021-04-29/ [20] US Congress. 'S.2076 - PASTEUR Act of 2021.' congress.gov/bill/117th-congress/senate-bill/2076 [21] Combating Antibiotic-Resistant Bacteria Biopharmaceutical Accelerator. 'Accelerating global antibacterial innovation.' carb-x.org/about/overview/ [22] 'UK launches world-first 'subscription' model for antibiotic supply.' Financial Times. 12 April 2022. ft.com/content/c7cbebe4-8597-4340-8c55-56c4b423c1d1 [23] 'Hedgehogs had MRSA superbug long before antibiotics use, research finds.' The Guardian. 7 January 2022. theguardian.com/science/2022/jan/06/hedgehogs-had-mrsa-superbug-long-before-antibiotics-use-research-finds [24] 'Phage therapy offers hope in fight against antibiotic resistance and superbugs.' Australian Broadcasting Corp. 15 January 2021. abc.net.au/news/2021-01-15/antibiotic-resistant-superbug-bacteriophage-therapy/12213010 [25] Gordon. Op cit. Pages 222 to 223. [26] Food and Drug Administration. 'FDA history.' fda.gov/about-fda/fda-history [27] Gordon. Op cit. Page 476. [28] Gordon. Op cit. Page 594. Jan Vijg, a Netherlands-born molecular geneticist and author of 'The American Technological Challenge: Stagnation and decline in the 21st century', blamed society's risk aversion for the spluttering growth rate. Medical advances are impeded or abandoned if even a minute fraction of people in clinical trials have adverse reactions. See 'Did we hit our innovation peak in 1970?' The Wall Street Journal. 16 June 2014. wsj.com/articles/BL-REB-26133 [29] See World Health Organisation. '2020 antibacterial agents in clinical and preclinical development: an overview.' 15 April 2021. who.int/publications/i/item/9789240021303 [30] See Monthly Review. 'Superbugs in the Anthropocene.' 1 June 2019. monthlyreview.org/2019/06/01/superbugs-in-the-anthropocene/ [31] Bloomberg News. 'Superbugs win another round as Big Pharma leaves antibiotics.' 13 July 2018. bloomberg.com/news/articles/2018-07-13/superbugs-win-another-round-as-big-pharma-leaves-antibiotics. See also Financial Times. 'How pharma economics hold back antibiotic development.' 7 March 2022. ft.com/content/29292a3c-321d-4187-9ff0-59d70eb796f4 [32] Businesswire. 'The Medicines Company announces definitive agreement to sell its infectious disease business unit to Melinta Therapeutics.' 29 November 2017. businesswire.com/news/home/20171129005573/en/The-Medicines-Company-Announces-Definitive-Agreement-to-Sell-its-Infectious-Disease-Business-Unit-to-Melinta-Therapeutics [33] Fierce Biotech publication. 'AstraZeneca spinout Entasis files for $86m IPO to fund antibiotic phase 3.' 20 August 2018. fiercebiotech.com/biotech/astrazeneca-spinout-entasis-files-for-86m-ipo-to-fund-antibiotic-phase-3 [34] Fierce Biotech publication. 'Entasis' antibiotic bests last resort treatment on path to become new weapon against drug-resistant bacteria.' 20 October 2021. fiercebiotech.com/biotech/entasis-zai-labs-antibiotic-sul-dur-beats-comparator-phase-3-trial [35] Bloomberg News. 'The world's next big health emergency is already here.' 27 January 2022. bloomberg.com/opinion/articles/2022-01-27/after-covid-antimicrobial-resistance-is-the-world-s-biggest-health-emergency [36] See 'Crisis looms in antibiotics as drug makers go bankrupt.' The New York Times. 25 December 2019. nytimes.com/2019/12/25/health/antibiotics-new-resistance.html [37] For suggestions of what governments could do, see 'Tackling antimicrobial resistance ensuring sustainable R&D.' OECD. 29 June 2017. oecd.org/g20/summits/hamburg/Tackling-Antimicrobial-Resistance-Ensuring-Sustainable-RD.pdf Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

1 Jun 2022 - How Nike is crushing digital to take control of its own destiny

|

How Nike is crushing digital to take control of its own destiny Claremont Global May 2022 Many would be familiar with Nike's direct-to-consumer (DTC) strategy, their ambition to generate the majority of sales through their own physical stores and online channels. In this article, we review why we believe the shift to DTC has helped Nike become stronger than ever ― and why the company is increasingly in control of its own destiny due to its ever-improving digital offer and power over product allocation as brand owners. Nike is currently one of the 14 stocks in the Claremont Global portfolio. NIKE INC. (NKE: NYSE)This company needs little introduction, being the world's leading sportswear company with sales of US$44.5 billion in FY21 across the Nike, Jordan and Converse brands. Direct-to-consumer, a clear strategy executed wellNike's DTC strategy was formally outlined in 2017 by then CEO Mark Parker as customers had been increasingly favoring Nike's own channels, and at the same time many wholesale partners were not delivering the level of customer and brand experience that Nike aims for. This strategy was supercharged by current CEO John Donohoe who brought significant digital and e-commerce experience from previous roles as the CEO of ServiceNow and eBay. As shown on the chart below, online penetration has accelerated significantly and in FY21 online sales reached 21 percent of total sales from seven percent in FY17 and DTC (i.e., online + stores) reached nearly 40 percent. This was achieved more than two years ahead of the original targets and momentum has continued as online sales accounted for 26 per cent of total sales last quarter. Nike's direct-to-consumer sales accounted for nearly 40% of sales in FY21. Source: Company reports, Claremont Global. Past performance is not a reliable indicator of future performance

Faster shift to digital underpins new growth ambitions Based on the law of large numbers, it would have been hard to believe that Nike could accelerate sales and earnings growth. However, as online penetration reached an inflection point, in June last year Nike provided new and improved financial targets expecting sales growth of around 10 percent per annum (p.a) and earnings per share growth of over 15 percent p.a. through to FY25. As shown on the chart below, as part of the new targets, Nike now expects online sales to account for around 40 percent of total sales by FY25 and wholesale sales to fall from over 60 percent in FY21 to 40 percent. Nike's sales by channel targets

Source: Company reports, Claremont Global. Past performance is not a reliable indicator of future performance Online and digital investments feeding the virtuous cycle Perhaps the most obvious benefit from the shift to its own channels is that Nike gets to keep the retail "markup" that would normally go to wholesale. As a rule of thumb, Nike generates around double the operating profit from an incremental unit sold online compared to wholesale. However, of equal importance in our view is the fact that when a customer shops at nike.com or in-store, Nike is in control of the customer experience. Nike has more than 300 million members (growing rapidly) and through the company's app universe ― which includes the Nike app, SNKRS, Nike Run Club and Nike Training Club ― Nike has been able to forge enviable customer engagement, while gathering valuable data in the process. Nike members growing strongly (million)

Source: Company reports, Claremont Global.. Past performance is not a reliable indicator of future performance Nike can leverage data from millions of members to deliver a more personalised offer, demand forecasting, insight gathering and inventory management. The company has been increasingly able to offer the right product at the right time, which results in higher full price sales and less markdowns. These benefits have been reflected in Nike's price realisation. As shown below, over the past four years Nike realized nearly a 20 percent improvement in average selling price (ASP). ASP has then contributed 100 basis points p.a. to gross margin on average over the same period. Nike's realized price (indexed ASP)

Source: Company reports, Claremont Global. Past performance is not a reliable indicator of future performance Nike came out of the pandemic stronger than ever We believe Nike's performance through the pandemic provided further evidence of the company's digital success and strong product offer (which is worthy of its own article). Nike not only recovered quicky, but as shown on the charts below, Nike's sales were around 10 percent above pre-pandemic levels (2019), while earnings were 35 percent ahead as the company grew significantly faster than trend. For comparison, adidas' earnings in 2021 were still below 2019 levels. Nike sales and earnings performance through the pandemic (billion, year to November*)

Source: Company reports, Claremont Global. * Figures are year to November for better representation (Nike financial year end is in May). Earnings = operating profit. Past performance is not a reliable indicator of future performance Nike is increasingly in control of its own destiny As the brand owner, Nike has control over product allocation. Over the past four years, Nike has cut the number of wholesale doors by 50 per cent and has now started to reduce allocation to large wholesale partners. For example, earlier this year Nike made the decision to allocate less of their products to Foot Locker. The reduction was sizeable as Foot Locker said that their allocation of Nike products would fall from more than 70 percent of their sales to around 55 percent. Consistent with our view, commenting on Nike's decision the CEO of Foot Locker said at their 4Q21 result call: "One of the things that Nike does the best is they control the flow of these high heat products into the marketplace, which keeps the demand high. So again, they will certainly benefit their DTC with some of that." 2025 targets are not a ceiling, online could be well over 40 percent of salesIt is important to re-emphasise that shift to digital has been driven by the consumer. Nike has continued to win market share and brand 'heat' remains very strong. Therefore, we believe the company has been able to recapture most, if not all of the sales that previously went to wholesale. Based on the company's targets, the wholesale business is still expected to account for around 40 percent of total sales by FY25. Therefore, we believe there will be plenty of opportunity for Nike to increase its online penetration beyond FY25.

Author: Chris Hernandez, Investment Analyst Funds operated by this manager: |

31 May 2022 - Natural gas and midstream assets

30 May 2022 - 10k Words

|

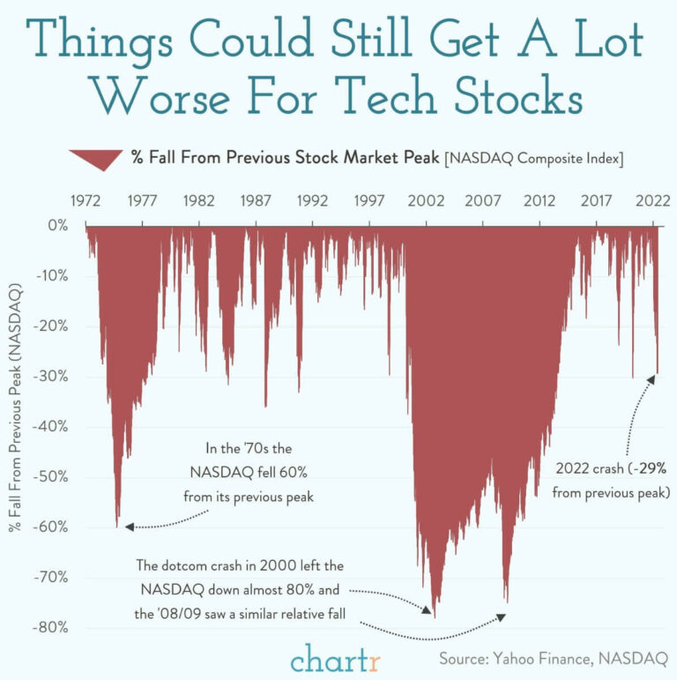

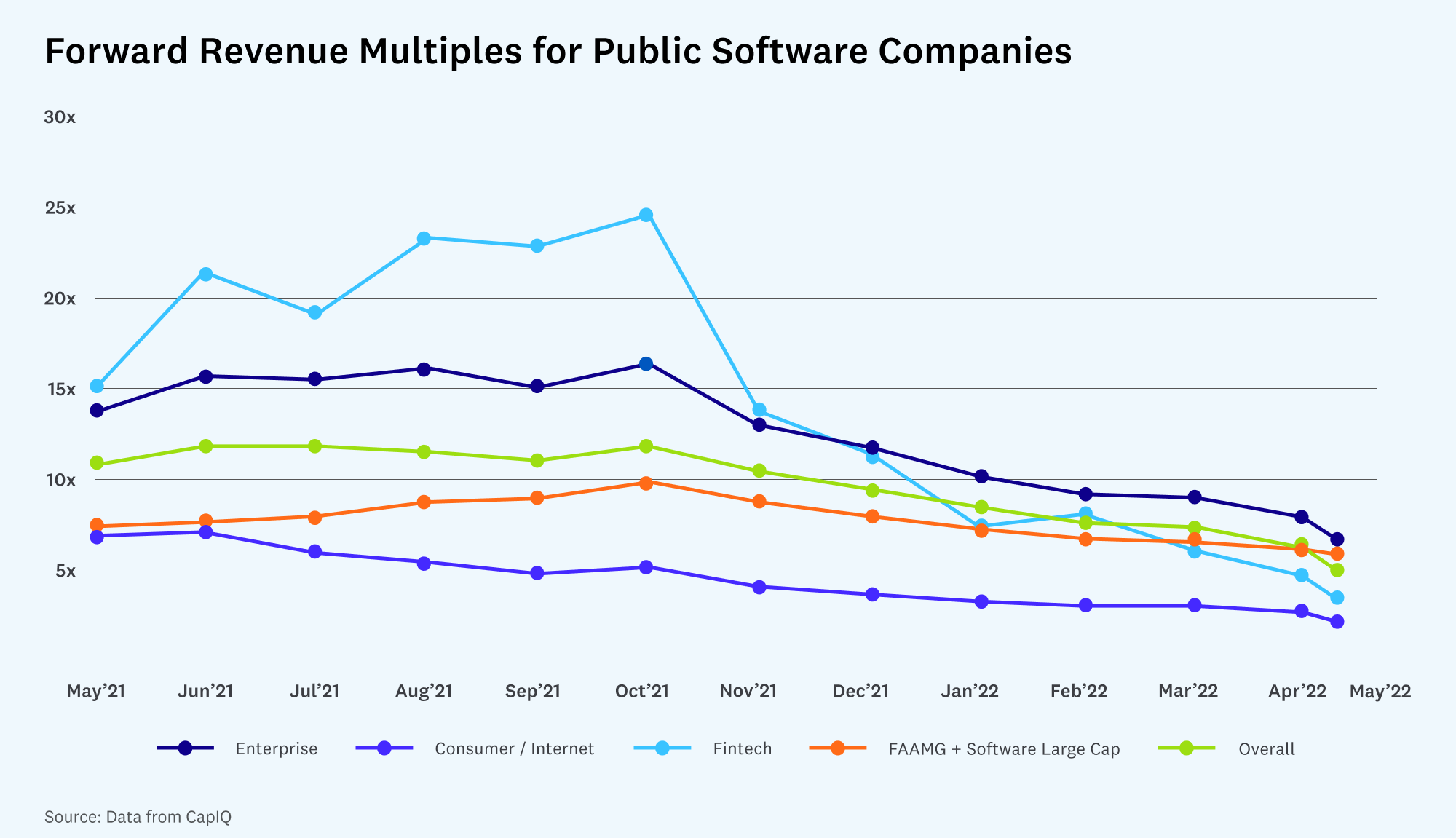

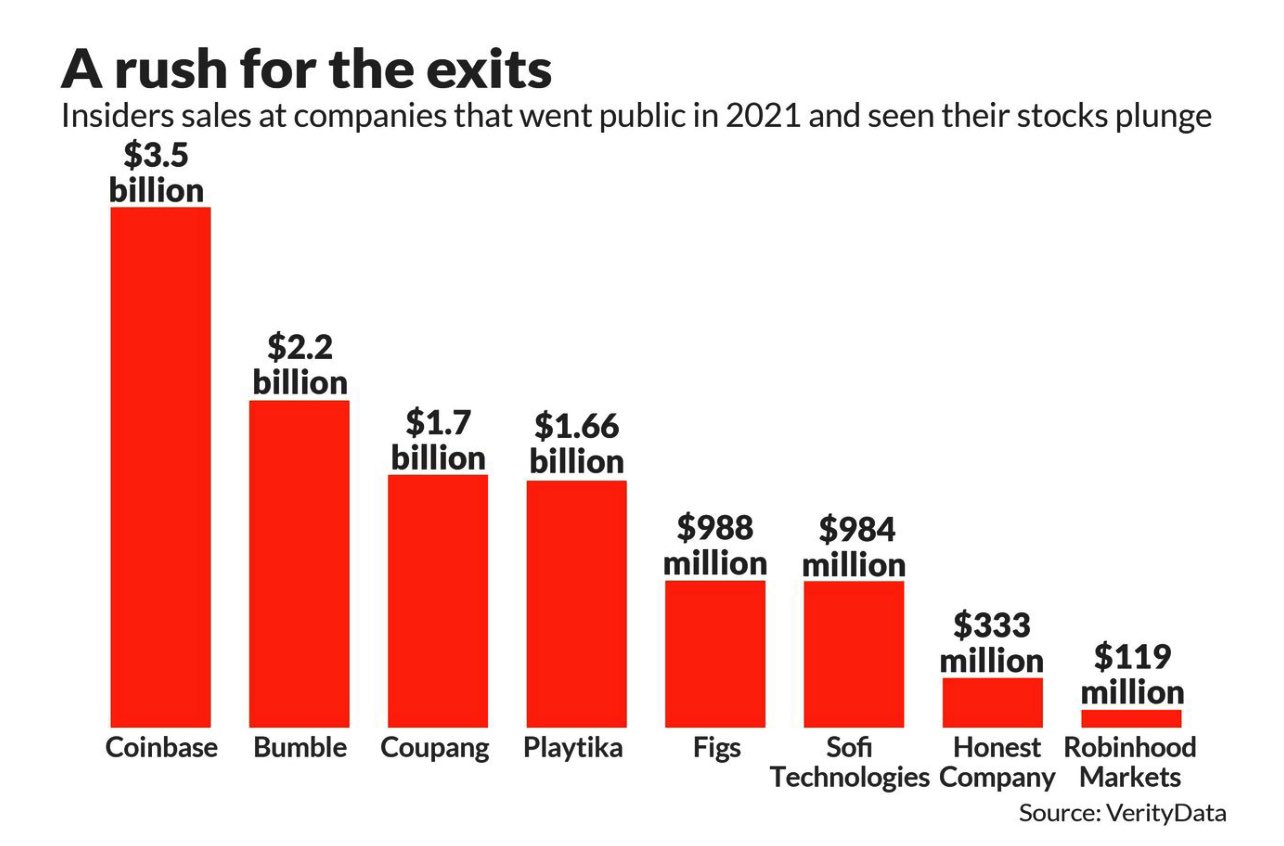

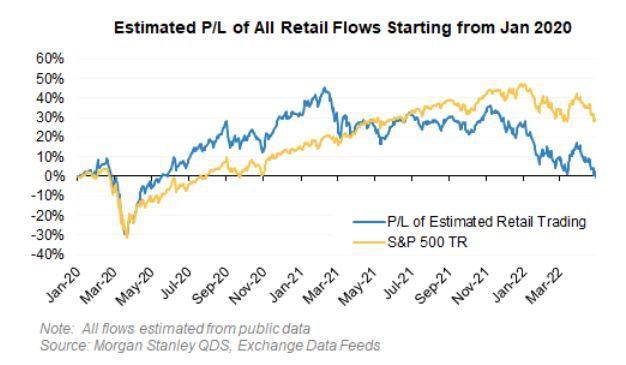

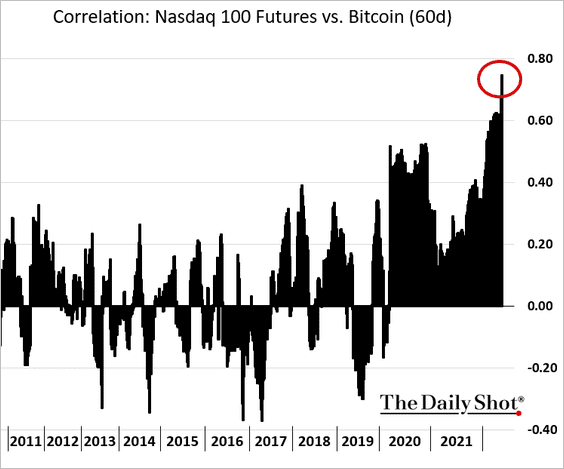

10k Words Equitable Investors May 2022 The drawdown in tech stocks remains in focus with carts from chrtr and a16z, while MarketWatch highlighted the inside selling that occured in 2021's tech IPOs ("You bought. They sold"). Retail investors who had a great time trading in 2020 and 2021 may have lost all that they gained, Morgan Stanley has estimated. The crypto space hasn't worked for punters either as correlation with tech stocks surges, as the Daily Shot charts, and the "hot" NFT space cools rapidly, as charted by NonFungible. Finally, fund managers surveyed by Bank of America have returned from briefly worrying about the Ukraine situation as their biggest tail risk to worrying about inflation and the interest rate environment.

Nasdaq Composite Drawdowns Source: chartr, @_Prathna

Forward Revenue Multiples on Listed Software Companies Source: a16z, CapitalIQ

Insider sales at companies that went public in 2021 Source: MarketWatch, VerityData Estimated gains and losses from US retail flows Source: Morgan Stanley, @trengriffin Correlation between Nasdaq and Bitcoin

Number of Non-Fungible Tokens (NFTs) sold Source: NonFungible.com May 2022 Fund Manager Survey for "biggest tail risk" Source: Bank of America

May Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

30 May 2022 - 3 big megatrends boosting returns

|

3 big megatrends boosting returns Insync Fund Managers May 2022 The strong and consistent returns we obtain for our investors are achieved by investing in businesses that are highly profitable and cash generative, with strong balance sheets. But which ones? Over time, an increase in the share price of a company follows its earnings growth. Investing in those few, well positioned and highly profitable companies benefitting from megatrends, delivers 'best of the best' outcomes. Here are 3 of our 16 big megatrends boosting returns: Household Formation Enterprise Digitisation Internet of Things Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

27 May 2022 - Market Insights & Fund Performance

|

Market Insights & Fund Performance L1 Capital May 2022 WEBINAR REPLAY | L1 Capital Long Short Portfolio | May 19, 2022 Mark Landau, Joint Managing Director and Chief Investment Officer of L1 Capital, provides an update, including a look at key market drivers: Inflation, Energy and Re-opening trade. Funds operated by this manager: L1 Capital Long Short Fund (Daily Class), L1 Capital Long Short Fund (Monthly Class), L1 Capital U.K. Residential Property Fund IV, L1 Long Short Fund Limited (ASX: LSF) |

26 May 2022 - Infrastructure assets are well placed for an era of inflation

|

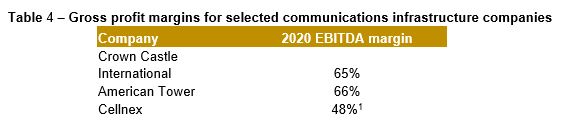

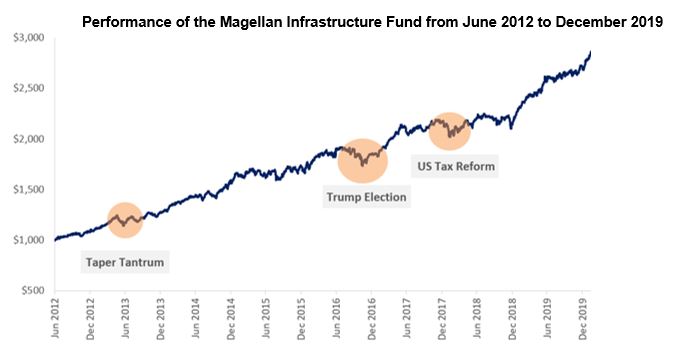

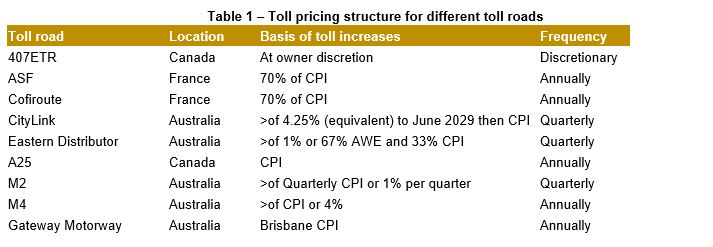

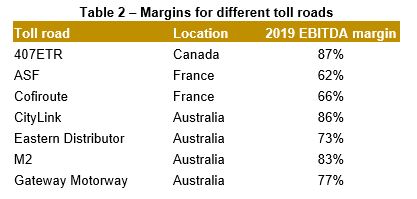

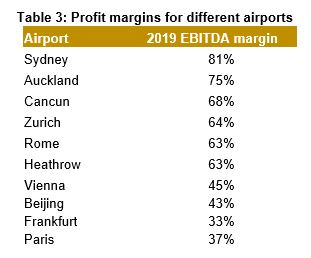

Infrastructure assets are well placed for an era of inflation Magellan Asset Management April 2022 Global stocks struggled early in 2022 because investors were concerned about faster inflation, which has risen to its highest in four decades in the US, a record high in the eurozone and highest in three decades in the UK. Long-term bond yields are climbing (bond prices are falling) because inflation reduces the value of future bond payments. Short-term bond yields are rising as central banks have increased, or are poised to lift, cash rates and terminate, even reverse, their asset-buying programs that supressed interest rates. In times of accelerating inflation and turbulent share markets, investors might find that holding global listed infrastructure securities is one way to help protect a portfolio against inflation. Inflation and asset values Inflation tends to hurt stocks in two ways. One is that inflation reduces the present value of future cash flows, a key determinant of share prices. The other way a sustained increase in inflation undermines stock valuations is that rising input costs and higher borrowing costs reduce profits - unless a business has the pricing power to boost the price of its goods or services to compensate. The lower the expected profits, the less people are willing to pay for shares. Inflation and infrastructure assets As inflation accelerates worldwide, many investors are turning to the few companies that are renowned for their inflation protection. Among these are infrastructure companies. The discussion here assumes companies defined as infrastructure meet two criteria. First, the company must own or operate assets that behave like monopolies. Second, the services provided by the company must be essential for a community to function efficiently. Such companies have predictable cash flows that make them attractive defensive assets. The main sectors within infrastructure are utilities, toll roads, airports, railroads, energy infrastructure, communications (mobile phone and broadcast towers). Each sector exhibits diverse investment characteristics and reacts differently to faster inflation, as explained below. The key thing to note though is most of these businesses are protected from inflation, which should help support their share prices if inflation becomes entrenched. Utilities Utilities include water utilities, electricity transmission (high-voltage power lines) and electricity distribution (urban power lines) and gas transmission and distribution. In most countries, utilities are monopolies. Consequently, government regulators control the prices these entities charge and adjust rates to provide utilities with an appropriate return on invested capital. This process requires regulators to take into account the changes to borrowing, construction and operating costs and changes in the value of the assets that utilities own. While all the regulatory regimes that Magellan considers to be investment-grade feature mechanisms that allow for the recovery of rising utility input and financing costs, the intricacies of different regulatory regimes affect the timeliness of that recovery. Regulatory systems that strike return allowances in real terms, escalate revenues with inflation, and index debt costs to market yields, including those in Australia and the UK, provide the most timely protection against inflation. By contrast, regulatory systems such as those in Spain and the US that strike return and cost allowances in nominal terms protect against inflation with a modest lag. Toll roads The typical business model for a toll road is that a government signs a contract that allows a toll-road operator to collect tolls for a set time and increase those tolls on a regular basis in a defined way. At the end of this contract, the road is returned to government ownership in a good state of repair. In most countries, the toll road is often not the only road route available to motorists. Consequently, the toll road is not a monopoly. The toll road, however, generally exists because alternative routes are much slower. The opening of a toll road inevitably reduces traffic on the free alternative. But over time, the free alternative can become congested more quickly than the toll road. As that occurs, the toll road behaves more like a monopoly and gives toll roads increased pricing power. However, toll price changes are generally pre-defined under a contract. Table 1 shows a cross-section of how toll prices are set in a range of contracts. Sources: Company releases, Magellan As can be seen, the pricing mechanism for many of these toll roads picks up any increases in inflation with minimal lag. Moreover, due to their strong pricing power, toll roads can expect that there will be minimal, if any, loss in traffic when tolls increase so revenues will fully recover the inflationary hit. Additionally, one of the key characteristics of toll roads that insulates them from inflationary impacts is their high profit margins. Table 2 shows the gross profit margins of a selection of international toll roads. The average margin of 75% from the sample is substantially above other industrial companies. Source: Company releases, Magellan The other key area where inflation can hurt profits is by increasing the cost of capital expenditure companies need to undertake. With most toll roads, however, the capital expenditure on operating roads is minimal and generally limited to resurfacing and replacing crash barriers, etc. Airports When looking at airports and inflation, it's best to consider airports as two businesses. The 'airside' operations primarily involve managing the runways and taxiways of the airport. Airside revenue is generated by a charge levied per passenger or a charge levied on the weight of the plane, or a combination. In most jurisdictions, the onus is on the airport to negotiate appropriate charges with the airlines. This side of the operation therefore behaves much like a regulated utility. The other business is the 'landside' operation that involves the remainder of the airport. These operations cover three primary areas: retail, car parking and property development. In most airports, the airport owner does not run the retail outlets. Instead, the owner acts as the lessor and receives a guaranteed minimum rental that is normally inflation-linked plus a share of sales. These revenues are therefore protected from a jump in inflation. The parking operations at the airport generally behave like a monopoly although there is some substitution threat; that is, passengers can use taxis instead of driving. As such, airports have significant ability to increase prices in response to higher inflation. In regard to costs, airport profit margins exhibit much greater variability than toll roads, as evident from Table 3. Source: Company releases, Magellan Efficient airports such as those in Auckland and Sydney are more insulated from faster inflation than those (typically European) airports that are struggling to reduce the workforces that were in place when they were privatised. (Even these less-efficient airports still exhibit higher margins than the average industrial company.) Finally, airports also have the highest capital expenditure requirements of any of the transport infrastructure subsectors. Airside capital expenditure includes widening and extending runways and taxiways. It is generally only undertaken after consultation and agreement with the airlines and regulatory authorities. Over time, airside charges will rise to recover these costs. Landside capital expenditure relates to increasing the retail, parking and general property leasing facilities. Higher inflation may change the financial viability of such capital expenditure. But airports, having an unregulated monopoly in these areas, can increase prices to compensate for inflation. Consequently, inflation is unlikely to hurt the value of an airport asset. Railroads (Class 1 freight rail) The railroads that meet Magellan's definition of infrastructure are primarily North American Class 1 railroads. These railroads typically have no regulator-approved capability to pass through inflation. Instead, their respective national regulators provide for lighter economic regulation using a broad 'revenue adequacy' standard. Thus, regulations have allowed railroad operators to charge rates that support prudent capital outlays, assure the repayment of a reasonable level of debt, permit the raising of needed equity capital, and cover the effects of inflation whilst attempting to maintain sufficient levels of market-based competition. Arguably, this framework has provided railroads with greater discretion around the rates they charge customers and thus, the ability to more than account for inflation. Chart 1 shows how North American railroads have increased rates at levels well ahead of inflation over the past 20 years. Source: US Bureau of Labor Statistics; Federal Reserve and AAR This isn't to suggest that regulation provides the key source of inflation protection for North American railroads. Rather, we think the rails generate most of their inflation protection from pricing power (which is derived from the lack of alternatives and the regional duopolistic regional markets) and operating efficiencies. Energy infrastructure The energy-infrastructure companies that meet our definition of infrastructure have dominant market positions and real pricing power, which is reflected in long-term, typically inflation-linked, take-or-pay contracts or regulated returns. Given the long-term nature of energy infrastructure contracts, pipeline and storage operators typically use pre-agreed price increases to protect real revenues and hedge against rising costs. Given the strategic and monopolistic nature of some assets such as transmission pipelines, some of these pipelines are regulated. Australia, for instance, has a mix of regulated and unregulated gas pipelines. In Canada, tariffs are negotiated within a regulatory framework. In the US, the regulator sets pipeline rates to allow the operator to earn a fair return on their invested capital. All methods protect these companies from inflation. Tank-storage providers that meet our definition of infrastructure need to have terminals in favourable locations and typically sell capacity, predominantly under long-term contracts, with no exposure to movements in commodity prices. Long-term storage contracts are usually indexed in a similar way to pipeline contracts. Netherlands-based storage provider Royal Vopak has long-term contracts (longer than one year) linked to the CPI of the country where the storage takes place (with annual indexation), while the bulk of costs are in the local currency of those countries, which provides a strong hedge against inflation Communications infrastructure Communications infrastructure, as defined by Magellan, is comprised of independently owned communication sites designed to host wireless communication equipment, primarily towers. Although these sites are mainly used by wireless carriers, they may host equipment for television, radio and public-safety networks. Despite the complexities of the technology that underpins wireless communication networks, the business model for these tower companies is simple. These companies generate most of their revenue through leasing tower space to wireless carriers such as mobile-service providers that need a place to install equipment. In return for providing this space, the tower company receives a lease or services agreement that provides a long-term and reliable income stream. The terms of these contracts are usually favourable for tower companies because data demand is strong and competition is low. Thus, leases are long term and revenue increases are priced into the contract. Source: Magellan Even so, we consider some, primarily US-based, communication towers to be relatively more sensitive to changes in inflation than other infrastructure sectors. This is due to communication towers in the US typically having limited inflation protection on the revenue side in the near term. In sum, we consider their protection to be partial. The second order effect of higher interest rates The traditional policy approach from central banks in response to higher inflation is to raise nominal interest rates, which has potentially two effects on our investment universe: The impact of changes in interest rates on the underlying financial performance of the businesses in which we invest; and the impact on the valuation of those businesses. As discussed above, regulated utilities can recover the cost tied to a rise in inflation through the periodic regulatory process. This generally includes the costs of servicing higher interest rates on their debt, thus exposure to interest rates will be limited to the length of time between reset periods, albeit in practice those utilities that are exposed to this kind of risk tend to hedge it by issuing fixed rate debt with a term that aligns with the regulatory period. Overall, the past decade has witnessed a significant lengthening in the duration of the debt portfolio for the majority of infrastructure and utilities businesses. Many of these companies are well protected from higher rates because they have taken advantage of the low interest rates of recent years to lock in cheap, fixed rate debt for long periods. Ultimately, we are confident that any shifts in interest rates will not hamper the financial performance of the companies in the portfolio for the foreseeable future. In terms of valuation, an increase in interest rates can be expected to lead to a higher cost of debt, and an increase in the rate at which investors value future earnings (the higher this 'discount rate', the less investors are willing to pay for future income streams). While our forecasts and valuations take these factors into account, the history of financial markets leads us to expect increasing uncertainty if rates rise or look like rising. Companies that are regarded as 'defensive' are often shunned when interest rates rise as investors prefer higher-growth sectors. However, it is our experience that provided businesses have solid fundamentals, their stock prices over the longer term will reflect their underlying earnings. In recent history, there have been three occasions where we have seen a spike in US 10-year yields of about 0.9%. At face value, these three increases in prevailing interest rates appear to have led to declines in the market value of listed infrastructure. However, if we look over the combined period then a different picture emerges. The following chart shows the performance of the Magellan Infrastructure Fund from June 2012 to December 2019. The chart shows that the hit from higher interest rates was short term. Once the interest-rate rises were digested and it was established that the outlooks for infrastructure businesses were largely unaffected then the share prices recovered. Conclusion Infrastructure remains well placed in an environment of increasing inflation due to its inflation-linked revenues, low operating costs and consequent high margins, with the second order impact of higher interest rates being muted by the lengthening of company debt portfolios over the past decade. These characteristics offer investors a haven when inflation is at decade highs around the world. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund [1] This is on a post-lease payments basis. Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

25 May 2022 - Revenge Travel

|

Revenge Travel Insync Fund Managers April 2022 Why on earth would Experiences thrive with the gloom around today? Put simply-Pent-up demand. Pre-Covid expenditure on experiences had been consistently growing ahead of GDP and its sub-segment, travel, was one of the fastest growing. Most megatrends within Insync's portfolio tend to have low sensitivity to economic cycles but the one sub-segment that suffered temporarily was travel. The extent of the fall in travel was unprecedented. Worldwide a staggering 1 billion fewer international arrivals in 2020 than in 2019. This compares with the 4% decline recorded during the 2009 global economic crisis (GFC).

There has been a lack of visibility on how leisure travel was going to emerge after governments implemented onerous travel restrictions. This was compounded by the shift to working from home with online meetings reducing the need for face-to-face meetings. What we do know is that humans desire to travel is hardwired into all of our DNAs. As travel restrictions have started to ease consumers appear to be making up for lost time. Airlines in the US last month reported domestic flight bookings surpassing pre-pandemic levels! US travellers spent $6.6 billion on flights in February, 6% higher than February 2019. Airlines for America, a leading US industry advocacy group noted that travellers have been eager to book tickets as COVID restrictions lifted. This provides a good indicator for the rest of the world. Our families and friends are all planning new adventures and reunions too. Interestingly, rising jet fuel prices, which have put upward pressure on ticket prices, has so far not deterred travellers who are willing to spend more. Emirates recently added a fuel surcharge and saw booking rise! A number of surveys are painting similar stories. TripAdvisor, found that 45% of Americans are planning to travel this March and April, including 68% of Gen Z travellers. This number will climb higher as the summer season rapidly approaches, as 68% of all American adults will vacation this summer (The Vacationer). No wonder hotels around the United States are nearing or have already surpassed pre-pandemic occupancy. Just try finding a decent, moderately priced hotel room in Sydney, as two of our team have recently experienced. The megatrend of Experiences is accelerating. Finding the right businesses benefitting from the trend is equally important for the consistent earnings growth we seek. It's why Cruise lines, airlines and hotels, whilst obvious picks, don't meet the quality criteria we insist upon.

Recently we reinvested into Booking Holdings after the over-blown pull back in its share price and the Covid event subsiding. It generates prodigious amounts of cash because of their scale and superior margins versus its competitors. As well as delivering a commanding competitive position they also help it in protecting against inflation. Bookings recently overtook Marriott, the largest hotel group, in gross volume booked in 2012, and today stands 70% bigger. Companies with superior business models and balance sheets tend to come through a crisis strengthening their competitive position. Booking Holdings is a prime example. The structural reduction in business travel has made hotels reliant upon OTAs once again to fill-up their rooms. This has been evidenced by recent data showing strong market share gains, in excess of pre-COVID levels. Second is the shutdown of Google's "Book on Google" product, removing the biggest perennial risk to the OTA investment case. The fact that the most powerful online search engine is shutting down this service is testament to the powerful position that Booking Holdings occupy.

Long term, travel looks set to continue to grow ahead of GDP as populations age, emerging market middle classes expand, and discretionary spend shifts more from "things" to "experiences.". Booking Holdings will be a major beneficiary compounding earnings for many years with its share price likely to follow the consistent growth in earnings.

Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

24 May 2022 - Great long-term opportunities come in times of uncertainty

|

Great long-term opportunities come in times of uncertainty Claremont Global April 2022

How are you navigating the current market environment?There have certainly been some rough seas in the first quarter of 2022. Between inflation, rising interest rates, soaring oil prices and the tragic Russian invasion of Ukraine, there's a lot of headline risk. One danger for investors is that they get whipsawed as they attempt to respond to macro and geopolitical risk. However, we don't manage from a top-down macro perspective ― instead, we focus on companies and construct the portfolio to reduce exposure to specific risks. It's a high conviction portfolio of between 10 and 15 companies. All our portfolio companies are listed in developed markets, although typically have geographically diverse revenue. Over the last few months, we've been able to deploy cash and reallocate capital across the portfolio, to take advantage of opportunities where the discount to our estimate of value is greatest. Recent volatility has allowed us to add two new positions to the portfolio - great companies that we've been able to buy at depressed levels. So, you pay no attention to macro?We're macro aware and we control our underlying exposures, so that the portfolio can weather a range of macroeconomic conditions. But we don't spend time attempting to predict macroeconomic outcomes or left tailed events. In Keynes' two groups of forecasters, "those who don't know" and "those who don't know they don't know", we fall in the former category. The list of "unprecedented" events over the last two or three years have been a stark reminder of the limitations of predictions. We are often dealing with uncertainty, not neatly measurable probability. We think the best long-term protection against downturns is by buying quality companies, run by capable management, with strong balance sheets and not overpaying. The average age of our portfolio companies is more than 80 years - they are battle hardened and have proven resilient across many cycles. Our team has a better chance of developing insight into businesses, than predicting which way many macroeconomic variables may align at a point in time ― and then what market outcome may or may not occur as a result. You said you've seen opportunities in this environment. Can you tell us about those?In mid-March we were buying a U.S. tech company and a European luxury goods business. Before we had even disclosed the names of the new holdings, an observer commented the positioning changes were "brave" - which they meant not in the flattering U.S. sense of "that's courageous", but in the British sense of "are you insane?!" Of course, they weren't courageous, nor insane, decisions. We've followed both companies for years and have a high degree of confidence in the quality of the businesses and the sustainability of earnings growth over the long-term. We have waited years for the opportunity to invest at the right price. What were the two positions added?The luxury goods company is LVMH. The company has an extraordinary portfolio of brands, some hundreds of years old, and are well diversified by product and geography. We've owned it before (selling when the price got too far ahead of our valuation) and have always admired the company. So, when LVMH's share price declined 25% in just over a month, we welcomed the opportunity to invest. The tech company is Adobe, the dominant platform for the design of digital content. For many creatives, Adobe is as essential as Microsoft Office is for knowledge workers. Adobe has been growing its top line in the high teens, has extremely high incremental margins, approximately 90 per cent subscription revenues and we expect it will continue to grow EPS in the high teens. In the recent sell-off, the Adobe share price was down approximately 40 per cent from its peak, and at an attractive level relative to our assessment of value. In both cases, while their share prices have declined, the companies continue to perform exceptionally strongly, and tricky markets are usually when the discount to value opens up. What's the process for evaluating the purchase of these two companies?Our process is too detailed to go into here, but at a high level some of the key issues we focus on are:

How did you get comfortable to make these investments amid such uncertainty?The first two points are important in their own right for driving returns. However, buying great companies that have proven resilient through prior cycles also serves an important psychological purpose, which is sometimes overlooked. We need confidence in the ability of our companies to deliver on our earnings expectations, and in turn our valuations, to determine how much to pay and to not waiver when the opportunities present. Without that confidence, we place ourselves in a position where price falls (or rises) alone - rather than facts - are more likely to drive our view of a company's prospects. By bending to the market's view, we would be at risk of buying or selling at the wrong point, particularly when there are extreme price moves. Potentially, being our own worst enemy in undermining the power of compounding. And what if markets continue to decline?The discount to value may open up further and that's ok. We typically increase position sizes over time, rather than moving immediately to a full weight. We're not trying to pick the bottom; just ensure we earn a very healthy return on capital. That means not buying until there is a sufficient margin of safety. It also means making sure we don't go weak at the knees, and we do execute when the opportunity is there. If we do our job well, identifying great businesses and not overpaying, controlling overall portfolio exposure, compounding will take care of the rest over the long-term. We've discussed company risk but practically, how do you manage portfolio risk when you have a bottom-up focus?Put aside the differential calculus, practically, any sensible portfolio management is an attempt to deal with the two core risks: 1) losing money and 2) missing out. There's a spectrum of trade-offs in managing these two risks. Our primary objective is to preserve our clients, and our own, capital (i.e. avoid permanent capital losses); and then position for long-term compounding. Capital preservation is front of mind, so we prepare for a wide range of outcomes, not just the outcome we think is most likely. What we can control is portfolio exposure. We spend the majority of our time thinking about individual businesses, including their earnings drivers, risks, and likely resilience in a range of scenarios. We then construct the portfolio to limit exposure to specific types of risks. For example, we don't want all of our companies to be geared to interest rate rises, and then be wrong-footed if expectations reverse - we want a mix of earnings drivers. In our portfolio today, the earnings of companies such as CME Group, ADP and Aon will be likely beneficiaries of inflation and rate rises. Lowes, Nike and Ross Stores will likely face a headwind from higher interest rates, but that's OK, we don't want to get too far to one side of the boat and be hit by the wave no one saw coming. Author: Adam Chandler, Portfolio Manager Funds operated by this manager: |

.JPG)