News

1 Jul 2022 - Sectors positioned to survive inflationary times

|

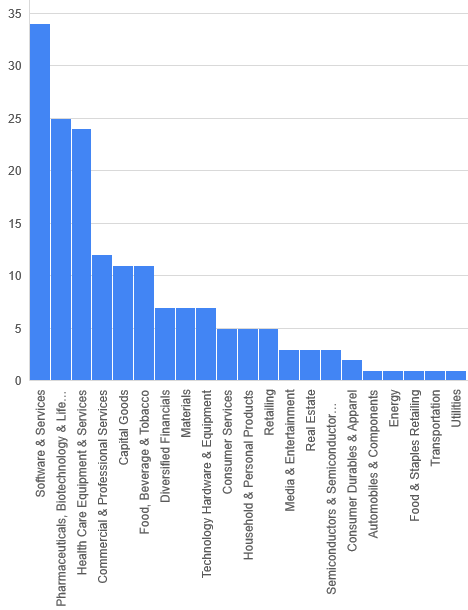

Sectors positioned to survive inflationary times Datt Capital June 2022 Invest in inflation. It's the only thing going up. -- Will Rogers Every day we read about higher costs of food, energy and property via higher interest rates, while our pay packets don't seem to be rising as fast as the cost of living. We're being told to learn to cut back on our quality of life and to expect lower returns going forward from our investment portfolios because of ostensibly more difficult business conditions and, prima facie, higher than typical stock valuations. The spigots of 'helicopter money' opened by central banks all over the world are slowly being closed along with rising interest rates that make the traditional 'safe haven' of fixed income, riskier than recent historical experience would suggest. In addition, the spectre of war is a key risk as the probability of conflicts increases during poor economic times. What is an investor to do? In an environment of low economic growth, high inflation (a situation known as stagflation) as well as tightening monetary and fiscal policy along with geopolitical risks. A sensible thing one can do is to put more onus on tangible, hard assets versus the recent popularity (and erstwhile success) of investing in abstractions. In these adverse market conditions, we believe that it's prudent to get back to the basics. Accordingly, factors such as positive cash flow, positive real returns (post-inflation), relatively low valuation multiples, returns to shareholders via capital initiatives and strong market leadership positions we view favourably. Which asset classes will be resilient?We can use history as a guide in comparing similar environments in the past with the present day. The stagflationary environment in the 1970s is a reasonable comparable in some ways to the present day, with numerous 'oil shocks' experienced analogous to the global 'energy molecule' crisis being experienced today. The sector that experienced the best returns over this decade was the energy sector, with the worst returns coming from the technology sector. Value and small-cap assets performed best throughout the decade, with growth assets and government bonds providing the worst relative returns. Accordingly, we believe the most favour sectors to be going forward to be:

It's important to observe that recent inflation has been driven by shortages and supply chain disruptions. Rising rates are unlikely to control inflation in the short term. Inflation has been labelled the 'silent tax' as it essentially measures the fall in a currency's purchasing power. It reduces the standard of living for the majority, which has the knock-on effect of reducing economic activity and increasing the probability of a recession. Accordingly, it's imperative to invest with those stewards of capital that can outperform the rate of inflation earning a real rate of return, thereby preserving one's purchasing power and quality of life. Passive market exposure may not provide this however, we firmly believe that the appropriate actively managed funds in combination with other uncorrelated assets provide a higher probability of preserving an investor's wealth in real terms. Since August 2018, the ASX200 Total Return index has compounded at an annualised rate of 8.79% per annum. Over the same timeframe, as an example, the Datt Capital Absolute Return Fund has doubled the index return: achieving 17.73% per annum (past performance is no guarantee of future performance) at lower relative risk, despite some of the most turbulent markets in living memory. This demonstrates the importance and value of adding high performing active managers; with the ability to invest within the sectors experiencing tailwinds to a diversified portfolio as a potential hedge against inflation. Author: Emanuel Datt Funds operated by this manager: |

|

Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds no exposure to the stock discussed |

30 Jun 2022 - Scarcity becomes common

|

Scarcity becomes common Magellan Asset Management June 2022

June 2022 Abbott Nutrition, which controls 48% of the US$2.1 billion US infant-formula market, in February recalled three product categories and closed a plant in Michigan after four babies who had consumed its powdered milk became sick with life-threatening bacterial infections even though there was no proven link.[1] By May, the US had a shortage of baby food - as in bare shelves (a nationwide out-of-stock rate of 43%),[2] panic buying, parents resorting to dangerous homemade remedies,[3] and infants hospitalised because not even doctors could obtain the specialised formula they needed.[4] That such a wealthy country has a shortage of baby food symbolises how the world is dogged by scarcity. The global manufacture and distribution of basic, essential and technological goods is muddled. The world's food supply can't get to everywhere it's needed. Countries reliant on imported energy are vulnerable. At an industry level, automobile production is hampered by a lack of parts. Industrial revenue has dropped due to a backlog of orders. Restaurant margins are under pressure. Retail is lacking stock and staff. Building is delayed. Tech companies lack the essential components. Some niche industries such as 'fast fashion' (online-clothing sales driven by Instagram influencers) face collapse. Supply is snarled for (at least) eight reasons, and the damage is magnified because many are occurring at once. The first and underlying problem is that supply lines are too precarious. One hiccup in these over-complicated, sprawling and self-organising production networks causes a shortage. Outsourcing and specialisation taken to the nth degree have meant that multinationals don't even know who are their suppliers. About 70% of 300 companies surveyed by India-based Resilinc Solutions in 2020 couldn't identify their suppliers in China just after covid-19 became apparent.[5] Adding to the mess is that an overreliance on China, just-in-time production, minimal inventory practices and high industry concentration reduce the margin of error for supplies. Even before the crisis in the four-producer US infant-formula market was apparent, a US Department of Agriculture report in February listed tackling industry concentration as "priority one" of six to strengthen the US food supply.[6] The second reason for shortages is climate change. Floods in China, heat waves in India and droughts in the US - more locally, heavy rain and not much sunshine in Queensland - mean crops are failing to enjoy the temperate weather needed for good harvests. Climate-change-related blows to food in storage (electricity failures that lead to a loss of cold storage) and damage to transport infrastructure "could significantly decrease availability and increase the cost of 22 highly perishable, nutritious foods such as fruits, vegetables, fish, meat, and dairy," the UN Intergovernmental Panel on Climate Change warned in March.[7] The other side to climate change is that its solutions are naturally hostile to investment in fossil-fuel production, and oil, gas and coal shortages loom when there is no foolproof replacement. The third reason is a scarcity of labour. Low unemployment means companies are struggling to find enough qualified workers. So firms are forced to cut production. In the US, for every two job openings in March, there was only one unemployed person.[8] A lack of workers has added to shortages when it has manifested as a disruption to transport. Think not enough truck drivers. The fourth reason is 'chipageddon', the term for a lack of microchips over the past two years because demand has outstripped global production capacity. Since a piece of silicon that contains nanoscopic electronic circuits component powers so many goods these days, the result is a shortage of everything from lightbulbs to cars to medical devices.[9] A fifth reason for shortages is the tension between China and the West that is impeding trade and investment - Intel CEO Pat Gelsinger in 2021 said Beijing-Washington strains made it hard for chipmakers to expand production.[10] As well as deterring investment, the politically driven impediments include export bans, tariffs and import quotas. Another reason for the shortages (especially of microchips) is covid-19. Lockdowns and logistic disruptions especially at ports hammered production and jammed container deliveries by ship and truck at a time when government stimulus boosted demand for goods. Freight costs rose so much companies such as Costco, Home Depot, Ikea and Walmart found it cheaper and more reliable to hire ships. China's 'zero-covid' response this year to the Omicron strain is bound to extend 'Made in China' shortages. The seventh reason is Russia's attack on Ukraine, two countries that account for 12.4% of calories traded, much of it to poor countries.[11] Western sanctions to punish Moscow are denying European businesses the Russian oil and gas they need to operate. Blackouts are possible, as are factory closures.[12] The sanctions are blocking the export of the fertiliser that helps farmers worldwide maximise crop output. In Ukraine, the fighting, Russian plundering and sabotage of rural production and Moscow's siege of Black Sea ports are blocking the export of grain staples.[13] Many warn of a global famine. The head of the UN's World Food Programme in May cautioned that hundreds of millions of people are "marching to starvation" in what could rank among the worst humanitarian disasters since World War II. The last reason given here for the shortages is fear of shortages. The panic-driven hoarding that emptied supermarkets of basic goods at the start of the covid-19 pandemic is reappearing in other forms. The US-based International Food Policy Research Institute said by early April at least 16 countries had banned export amounting to 17% of traded calories to stockpile local supplies. The list includes India outlawing wheat exports and Malaysia forbidding poultry trade at a time when 80% of the world lives in countries that are net importers of food.[14] The shortages behind delays, waste, forgone production and lost sales come with notable macroeconomic and political consequences. Economic growth will be lower than otherwise and inflation higher because scarcity makes prices much more sensitive to demand. Even if demand is steady, interruptions to the supply of goods result in the 'supply-side' inflation that central banks can do little to subdue. At the same time, high demand for labour leads to wages-price spirals that enshrine inflation, though at least central banks can calm an overheated labour market with rate increases. But the combination of reduced demand to subdue wages inflation, forgone production from supply shortages and hard-to-suppress supply-side inflation is stagflation. The political consequences of shortages and inflation are the protests directed at authorities that litter history, most prominently when hunger is driving the anger. Sri Lanka's deadly political turmoil and economic collapse is the latest example; all the more tragic because a government decision in 2021 to ban fertilisers and pesticides created a famine.[15] In a world of shortages, how can businesses and policymakers help? Governments are pondering sending in navies to get produce through the Black Sea. So far, too risky. More mundane decisions include that officials can reduce the amount of grain used in biofuels to help the world can feed itself.[16] Policymakers could prioritise fomenting another 'Green Revolution' by encouraging the adoption of 'agritech' to boost crop yields.[17] Business options include proper mapping of their suppliers, 'reshoring' and diversifying sources. Firms can use shorter shipping routes, undertake more frequent stock updates, pre-order and manage inventory levels more prudently. Truth is there are no quick solutions. The age of scarcity will pass but not for a while and not before it has shaken the world. To be sure, the 'everything shortage' is an exaggeration. Many would say that capitalism responded brilliantly to a surge in demand for medical and durable goods during the pandemic.[18] Policymakers are exaggerating the inflationary effects of shortages to shift blame from the excess demand they created with their fiscal and monetary stimulus during the pandemic. The worst appears over for shipping disruptions - peak dislocation seems to have been late last year. Same too for chip production, according to car makers,[19] while US retailers are complaining of too much inventory. But that's due to a drop in demand. Governments are taking action. Washington in June used emergency powers to solve a logjam of imports of modules and components for the solar-power industry.[20] But businesses immediately said this action would impede their efforts to boost domestic production.[21] Whatever the best way to ensure the US advances solar power, governments have the lesser role in solving today's shortages because their conventional economic tools are of little use. By and large, scarcity is a problem that business needs to solve. Babies depend on it. Organic failure In 2019, Sri Lankan President Gotabaya Rajapaksa unveiled "Vistas of prosperity and splendour," his vision for the island nation that had long been self-sufficient in food. Among many goals was one to "promote and popularise organic agriculture during the next 10 years".[22] In April 2021, Rajapaksa embarked on the world's greatest organic farming experiment when he suddenly banned the importation of chemical fertiliser and pesticides and ordered farmers to go organic without any help from imported organic fertiliser.[23] The results are tragic. Within six months, Sri Lankan rice production plunged 20% and rice prices soared 50%. The government was forced to import rice and ease the ban on chemicals.[24] But coupled with the pandemic's blow to tourism, the loss of tea exports to Russia and rising oil import prices, the U-turn wasn't enough. Sri Lanka has collapsed economically and politically. (Rajapaksa was ousted in May.) To some extent, Rajapaksa's shift to organic farming was a reversal of the great advances in farming in the 1960s when emerging countries adopted modern techniques.[25] Led by US scientist Norman Borlaug who won the Nobel Prize for Peace in 1970 for sparking the Green Revolution, crop yields surged, often doubled, across developing countries, especially the Indian subcontinent, thanks to the introduction of "higher-yielding short-strawed, disease-resistant wheat" that demanded the use of fertilisers and pesticides.[26] Organic farming produces up to 50% less food per hectare than conventional farming because it requires farmers to rotate soil out of production for pasture, fallow or cover crops.[27] Amid warnings of a global famine due to a fertiliser shortage and adverse weather, the world needs another technologically driven Green Revolution. Adversity spurs innovation.[28] If babies and others are in want, watch for technological advances in farming to ensure the world can feed itself again. By Michael Collins, Investment Specialist |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund [1] The New York Times. '3 types of baby formula recalled after reported bacterial infections.' 18 February 2022. nytimes.com/2022/02/18/us/baby-formula-recall.html. A shortage of baby formula can hurt older children and even adults. See Washington Post. 'Baby formula shortage life-threatening for some older kids and adults.' 3 June 2022. washingtonpost.com/health/2022/06/03/baby-formula-shortage-metabolic-disorder/ [2] Datasembly. 'Datasembly release latest numbers on baby formula.' 10 May 2022. datasembly.com/ne [3] Bloomberg News. 'Parents are trying homemade baby formula. Doctors say they shouldn't.' 13 May 2022. bloomberg.com/news/articles/2022-05-12/why-parents-making-homemade-infant-formula-should-beware-of-serious-health-risks [4] ActionNew5. '2 Mid-South children hospitalized due to nationwide formula shortage.' 17 May 2022. actionnews5.com/2022/05/17/two-mid-south-children-hospitalized-due-nationwide-formula-shortage/ [5] Thomas Y. Choi, Dale Rogers, and Bindiya Vakil. Coronavirus is a wake-up call for supply chain management.' Harvard Business Management. 27 March 2020. hbr.org/2020/03/coronavirus-is-a-wake-up-call-for-supply-chain-management. The article notes that a Japanese semiconductor manufacturer told Harvard researchers it took a team of 100 people more than a year to 'map' the company's supply networks after the earthquake and tsunami in 2011. [6] US Department of Agriculture. USDA Agri-food supply chain assessment: Program and policy options for strengthening resilience.' 24 February 2022. Page 3. Boosting local and regional markets is one answer.ams.usda.gov/sites/default/files/media/USDAAgriFoodSupplyChainReport.pdf [7] IPCC Sixth Assessment Report. 'Climate change 2022: Impacts, adaptation and vulnerability.' 'Chapter 5. 'Food, fibre and other ecosystem products.' '5.11 The supply chain from post-harvest to food.' March 2022. ipcc.ch/report/ar6/wg2/ [8] US Bureau of Labor Statistics. Chart. 'Number of unemployed persons per job opening, seasonally adjusted.' bls.gov/charts/job-openings-and-labor-turnover/unemp-per-job-opening.htm [9] WIRED. 'Why the chip shortage drags on and on … and on.' 12 November 2021. wired.com/story/why-chip-shortage-drags-on/ [10] BBC. 'Intel chief warns of two-year chip shortage.' 28 July 2021. https://www.bbc.com/news/technology-57996908 [11] International Food Policy Research Institute. 'From bad to worse. How Russia-Ukraine war-related export restrictions exacerbate global food insecurity.' Blog. 13 April 2022. ifpri.org/blog/bad-worse-how-export-restrictions-exacerbate-global-food-security [12] Russia has restricted gas exports to Bulgaria and Poland in April over their refusal to pay in roubles and on Finland due to its application to join Nato. Russia is the world's biggest exporter of fertiliser and within a month of Russia's attack on February 24, Nola urea, a key fertiliser, had surged 60% to a 34-year height of US$880 a ton. [13] The Wall Street Journal. 'Ukraine is struggling to export its grain, and here's why.' 5 June 2022. wsj.com/articles/ukraine-is-struggling-to-export-its-grain-and-heres-why-11654421400 [14] The Economist. 'Why banning food exports does not work.' 25 May 2022. economist.com/the-economist-explains/2022/05/25/why-banning-food-exports-does-not-work [15] Reuters. 'Fertiliser ban decimates Sri Lanka crops as government popularity ebbs.' 3 March 2022. reuters.com/markets/commodities/fertiliser-ban-decimates-sri-lankan-crops-government-popularity-ebbs-2022-03-03/ [16] Håvard Halland, Rüya Perincek, and Jan Rieländer, executives at the OECD 'Links between energy and food must be weakened.' 27 May 2022. Financial Times. ft.com/content/471d4513-176c-4837-a7d4-7ef2609b720a [17] 'Agritech' is the modern term for technology solutions to boost crop yields. The term covers 'agplastics' for when plastic is used in farming for drip irrigation, coverings and much more. It enfolds genetically modified crops and hydroponics and other soil-less farming techniques. Included too are autonomous sprayers, driverless tractors, drones, imaging devices to detect diseases, laser soil analysis, microbes that boost plant growth, robot fruit pickers, vertical farming and the use of artificial intelligence and data sharing to power 'agrobots'. [18] Financial Times. Martin Sandbu. 'Shortages, what shortages? Global markets are delivering.' 15 December 2021. ft.com/content/ea89a152-ca34-4c01-8986-0d019f3cae74 [19] Bloomberg News. 'Carmakers feel chip crisis easing as global growth slows.' 4 June 2022. bloomberg.com/news/articles/2022-06-04/carmakers-feel-chip-crisis-easing-as-global-growth-slows [20] The White House. 'Declaration of emergency and authorisation for temporary extensions of time and duty-free importation of solar cells and modules from Southeast Asia.' 6 June 2022. whitehouse.gov/briefing-room/statements-releases/2022/06/06/declaration-of-emergency-and-authorization-for-temporary-extensions-of-time-and-duty-free-importation-of-solar-cells-and-modules-from-southeast-asia/ [21] The Wall Street Journal. 'White House set to pause new tariffs on solar imports for two years.' 5 June 2022. wsj.com/articles/white-house-wont-put-new-tariffs-on-solar-imports-for-two-years-sources-say-11654482582 [22] Sri Lankan government. 'National policy framework. Vistas of prosperity and splendour.' 2019. Page 25. doc.gov.lk/images/pdf/NationalPolicyframeworkEN/FinalDovVer02-English.pdf [23] US Department of Agriculture. Global Agricultural Information Network. 'Report name: Sri Lanka restricts and bans the import of fertilisers and agrichemicals.' 28 May 2021. apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName [24] Foreign Policy. 'In Sri Lanka, organic farming went catastrophically wrong.' 5 March 2022. foreignpolicy.com/2022/03/05/sri-lanka-organic-farming-crisis/ [25] See 'Green revolution'. Britannica. britannica.com/event/green-revolution [26] 'Norman Ernest. Biographical.' The Nobel Peace Prize 1970. The Nobel Prize. nobelprize.org/prizes/peace/1970/borlaug/biographical/ [27] Bjorn Lomborg. 'Organic farming is turning a food crisis into a catastrophe.' The Australian. 4 June 2022. theaustralian.com.au/inquirer/organic-farming-is-turning-a-food-crisis-into-a-catastrophe/news-story/944625bd3168b212eddccadeaed82640 [28] The Wall Street Journal. 'Fertiliser price surge drives Brazil to high-tech alternatives.' 8 June 2022. wsj.com/articles/fertilizer-price-surge-drives-brazil-to-high-tech-alternatives-11654701075 Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

29 Jun 2022 - Investment environment snapshot

|

Investment environment snapshot Laureola Advisors June 2022 The S&P declined 8.8% in April and by late May was down over 12% ytd. The Nasdaq was down 22% ytd. and Bitcoin down 38% ytd. The 10 yr Treasury finished at 2.9%; the yield has doubled in 18 mos. Concern is growing that the US Fed may be making serious policy mistakes by being weak on fighting inflation and focusing on supporting equity prices. The Fed may have to choose between two evils, both with significant negative effects. The respected economist Mr. El Erian has been vocal on this issue: "I think the Fed is going to have to decide between two policy mistakes ...". Rising rates won't help an economy already showing signs of weakness: new home sales were down 16.6% and business owners are increasingly pessimistic. The geo-political backdrop worsens as Russia and China appear to be allying more closely both economically and militarily. China has chartered 10 extra tankers in May alone to transport Russian oil and the two countries did a joint exercise flying strategic bombers over the Sea of Japan during President Biden's recent visit to Tokyo. Wheat shortages in Egypt (80% of her wheat comes from Ukraine and Russia) recently caused a riot in the streets as the subsidized bakery had no bread. The need for diversification in portfolios is greater now than ever and Life Settlements can provide the required stable, non-correlated returns even in this uncertain world. Funds operated by this manager: |

29 Jun 2022 - Thinking about industrial (and Qantas and Netflix)

28 Jun 2022 - 4D podcast: explaining the country review process

|

4D podcast: explaining the country review process 4D Infrastructure June 2022 Bennelong's Dave Whitby speaks with Greg Goodsell, 4D's Global Equity Strategist, about 4D's unique country review process - an integral part of the business's investment process - and its impact on the portfolio.

For more detail on our country review process, you can read our Global Matters article: Why country risk matters |

|

Funds operated by this manager: 4D Global Infrastructure Fund, 4D Emerging Markets Infrastructure FundThe content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. |

28 Jun 2022 - EM Demographics - will ageing break a 40-year trend?

|

EM Demographics - will ageing break a 40-year trend? abrdn June 2022 Populations in many emerging markets (EMs) are set to age rapidly, with countries facing challenges should they 'get old' before they 'get rich'. Whether economies age gracefully will reflect a complex combination of growth trajectories, the real interest rate environment and policy choices. Demographics affect not just the outlook for economic growth - with population size (and hence labour force) a key building block of the economy - but they also have implications for savers and borrowers (households, firms and governments) via an influence on interest rates. Indeed, while growth is a major influence on the EM investment landscape (stronger economic and corporate earnings growth lift equities), interest rates on debt determine the price of a range of other assets too. Lower rates raise the value of firms' revenue generation and vice versa. It is therefore important to form a view on how demographics will affect both growth and interest rates. Emerging market demographics 'in focus' - implications for equilibrium real interest rates is the second of three research papers that seek to examine the nature and consequences of demographic change in major emerging markets. This second paper hones in on the impact that demographic trends may have on real equilibrium interest rates - a crucial, but unobservable, economic variable. Government bond yields - falling since the 1980sTaking a step back from the current market volatility and concerns about high inflation, government bond yields in developed and emerging markets have been in long-term decline since the 1980s. Sliding developed market and EM yields over this period partly reflect success in bringing down inflation, but they also reflect falling real — inflation adjusted - yields. A large body of academic literature points to an underlying downward trend in equilibrium real interest rates (r*, pronounced 'r star') as the reason. Many papers have concluded that secular trends - including demographics - explain much of the fall in real yields, with the global financial system potentially creating a global phenomenon as markets link savings and investment across borders. This raises a crucial question for investors: if demographic trends are turning, will interest rates be pushed higher? R* as theoryThe equilibrium interest rate is a hard-to-measure theoretical concept. It's closely related to economic growth and is also the interest rate that balances an economy's supply of savings with the demand for investment. Some commentators have concluded that demographics will push up r* as shrinking pools of labour reduce the supply of savings. However, demographics operate via two channels which can work in opposite directions: fewer workers may reduce the number of savers, but they also push down on potential economic growth and therefore investment. R* gazingOur research suggests that over the next five years, demographic composition will typically push up on r* - primarily due to rising dependency ratios as the number of non-workers outpaces workers. But shrinking labour forces are almost always exerting greater downwards pressure. Moreover, other factors influencing potential growth are likely to push equilibrium interest rates in different directions across EMs. On a net basis, roughly half of major EMs may see equilibrium rates pushed down by these forces, while half may see them rise. Over a longer time horizon - say 30 years - the impact of shifting demographic composition potentially creates more meaningful upwards pressure. But even then the outlook varies. For example, China faces a well-known demographic challenge as the result of its now scrapped 'One Child' policy. But even here, falling long-term growth will likely offset the impact on the balance of savings and investments from an ageing society. Demographics aren't destiny for growth, interest ratesDemographics are just one (albeit very important) influence on interest rates over the longer term. The Covid-19-shock, income inequality and technological change are all important drivers too, along with policy choices. Demographics are just one (albeit very important) influence on interest rates over the longer term Indeed, the fracturing of EM-developed market real yields - which had moved in near lockstep until 2013 - implies that domestic policy choices may have become increasingly important. Ageing by itself won't drive interest rates higher, compounding the Covid-19 shock. While demographic trends are becoming more adverse as populations age, the impact on real equilibrium rates continues to be offset in many countries by downwards pressure from slower growth in working-age populations. Additionally, the balance of risks from economic scarring, inequality and technology gives further weight to our research which suggests that few economies will suffer major upwards pressure on r*. Author: Robert Gilhooly, Senior Emerging Markets Research Economist |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund |

27 Jun 2022 - Managers Insights | Collins St Asset Management

|

|

||

|

Damen Purcell, COO of Australian Fund Monitors, speaks with Rob Hay, Head of Distribution & Investor Relations at Collins St Asset Management. The Collins St Value Fund has a track record of 6 years and 4 months and has outperformed the ASX 200 Total Return Index since inception in February 2016, providing investors with an annualised return of 17.87% compared with the index's return of 10.3% over the same period.

|

27 Jun 2022 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

|||||||||||||||||

| DigitalX Fund | |||||||||||||||||

|

|||||||||||||||||

|

DigitalX Bitcoin Fund |

|||||||||||||||||

|

|||||||||||||||||

|

Balmoral Digital Assets Fund |

|||||||||||||||||

|

|||||||||||||||||

|

|

|||||||||||||||||

| PURE Resources Fund | |||||||||||||||||

|

|||||||||||||||||

| View Profile | |||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||

|

Subscribe for full access to these funds and over 650 others |

27 Jun 2022 - 10k Words

|

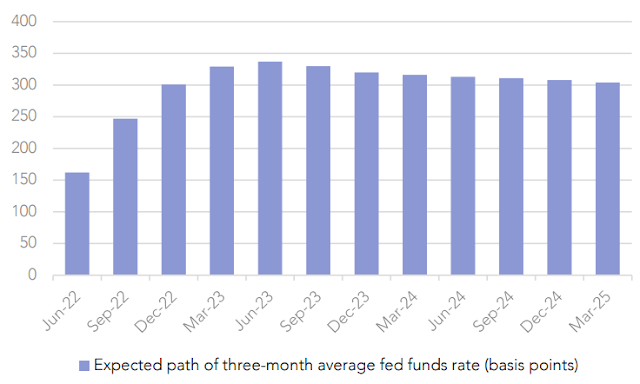

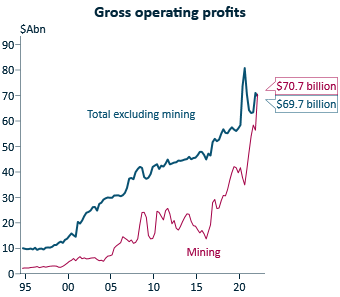

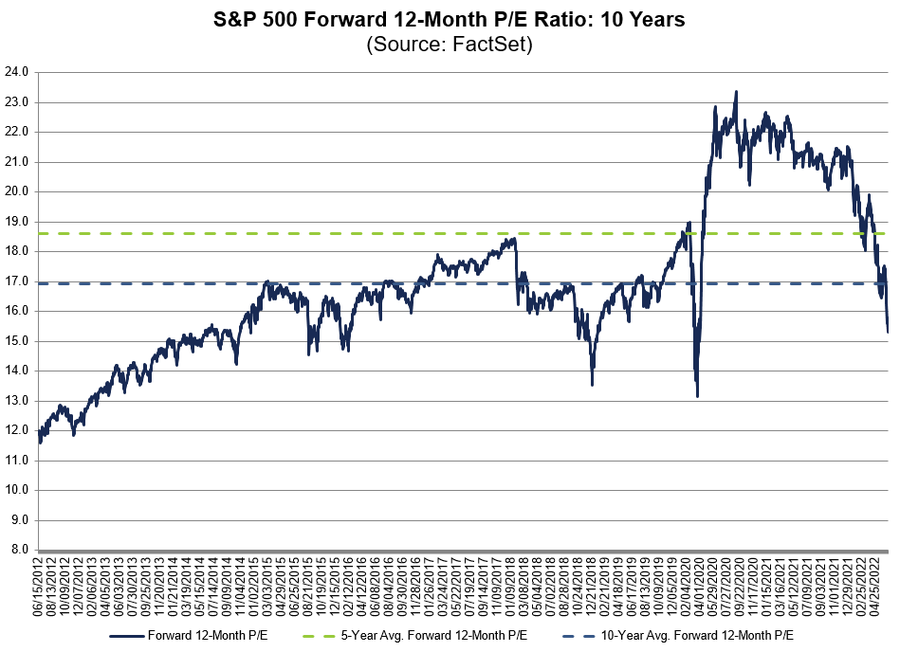

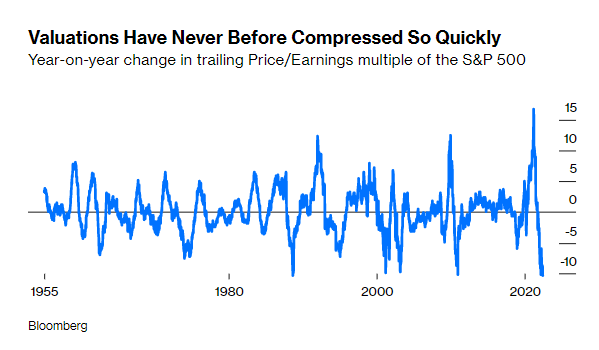

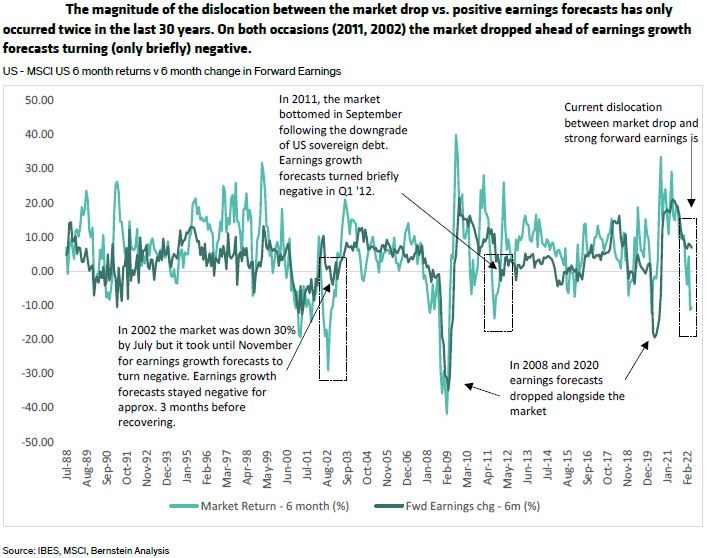

10k Words Equitable Investors June 2022 Price-to-Earnings multiples have been crunched in the calendar year to-date, as FactSet and strategist Christophe Barraud chart - but that begs the question posed by Sanford Bernstein - does this imply earnings expectations will be cut? Global equity capital markets volumes have dropped more than market indices, Equitable Investors highlights, while there are plenty of companies in need of fresh cash. Below-trend economic growth and above-trend inflation is the widely held consensus view of the economic backdrop from the Bank of America global fund manager survey. Off the back of that, the market is expecting the Fed cash rate to settle at ~3%, Wilsons calculates. Back in Australia, ANZ-Roy Morgan Consumer Confidence is strikingly low amid all the talk of inflation and interest rates - search terms that have surged on Google Trends. IFM highlights that Australian mining profits have for the first time exceeded profits in all other non-finance sectors combined.

S&P 500 Forward PE over 10 years Source: FactSet

S&P 500 trailing PE since 1955 Source: Bloomberg, @C_Barraud

Are earnings forecasts about to be downgraded?

Global Equity Capital Markets ($US)

No, ASX-listed cash burners with 12m or less cash at last reported burn-rate

Source: Equitable Investors

"Stagflation" is the most popular economic backdrop expectation

Source: BofA Global Fund Manager Survey (June 2022)

Expected path of Federal Reserve cash rate Source: Refinitiv, Wilsons

ANZ-Roy Morgan Consumer Confidence

Australian web searches for "inflation" (blue line) and "interest rates" (red line) Source: Google Trends, Equitable Investors

Australian Gross Operating Profits Source: ABS, IFM June Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

Source: Sanford Bernstein

Source: Sanford Bernstein