News

8 Feb 2024 - Performance Report: Bennelong Australian Equities Fund

[Current Manager Report if available]

8 Feb 2024 - Performance Report: ASCF High Yield Fund

[Current Manager Report if available]

8 Feb 2024 - Bond Market Insights and Outlook for 2024

|

Bond Market Insights and Outlook for 2024 JCB Jamieson Coote Bonds January 2024 Bonds finished 2023 strongly following the market categorically rejecting the 5.00% level in US and Australian 10-year bonds in October. This has provided a solid base for bonds in 2024 following the global peak in yields and the end to the global central bank hiking cycle. The market was comforted with the lower inflation readings and the weaker set of economic data. Bond supply dynamics also played a part when the narrative of increasing government deficits was alleviated with US Treasury projections in the order of 100 billion less than the market was expecting. Markets have moved to more aggressively price in easing from the US Federal Reserve (US Fed), Bank of England and European Central Bank given declining inflation with goods inflation the driver. While time will tell whether November's cash rate hike from the Reserve Bank of Australia (RBA) was the last in the cycle, our view is that we are either at, or at least very near, the peak in cash rates. If history is a guide, cash rates tend to remain on hold at the peak for an average of eight months. While this is certainly not an exact science, based on what we currently know about the economic outlook and market pricing, we anticipate that the RBA will start to loosen monetary policy in 2024 following in the slipstream of its global central bank counterparts. Predicated on this view, any back up in yields will provide a decent opportunity to increase duration exposure, particularly in the 3-to-5-year sector where historically the curve steepens as markets approach their first rate cut. The monetary tightening has pushed the global credit impulse to its weakest level since the Global Financial Crisis, which implies weaker demand growth moving forward placing pressure on the jobs market. High delinquency rates and credit card balances currently support anemic consumer confidence and may begin testing both consumer resilience and the ability of employers to maintain employment with margins under pressure. The job market in 2024 will be the main determinant of whether we travel down the path of a 'hard landing' with the commensurate aggressive easing of short-term interest rates and much higher bond prices with the recent rally into year-end just an entrée to what can be served up. MARKET OUTLOOK: ARE RECESSIONARY SIGNAL LIGHTS STILL FLASHING RED?US recessionary indicators are all signaling a code red alert. An inverted yield curve persisting for 18 months, coupled with a 19-month sequential decline in the Leading Indicator Index, has an infallible record in predicting a US recession. In a soft-landing scenario, the US Fed will need to make approximately a 300 basis points cut just to reach a neutral rate setting. However, in the event of a full-blown recession, we are anticipating a need for around 500 basis points of easing. The December US Fed meeting validated the end of the hiking cycle in short term rates with US Fed Chairman, Powell commenting that "you want to cut rates well before inflation is at 2%" otherwise it would be too restrictive. The US Fed also downgraded its inflation forecast and alluded to three cuts in 2024 as Powell showed concern over keeping rates too high for too long. The inflation trajectory continues a downward path and heading into 2024 this is expected to persist - we still have some hefty inflation prints dropping out of the index so we should get inflation falling on a year-on-year basis for the first five months of the year if we continue to print similar numbers that have been recorded lately. Continued weakness in energy prices and lower wage growth through a deteriorating employment market would also be supportive of the slowing inflation period. The picture in Australia is also encouraging with the inflation story lagging the global softening prices thematic. Given the transmission mechanism of Australian interest rates, we would anticipate this to play catch up in the first quarter of next year. As the new year commences, 2024 is ripe for geopolitical developments with 40 national elections on the calendar from Taiwan at the start of the year through to the US presidential election in November. The potential for a changing of the guard in foreign policy heightens the chances of an escalation or aggravation amongst countries and should fly in the face of the complacency that currently prevails in risk markets and encourage a flight-to-quality demand for sovereign bonds. After an extended period of ultra-low bond yields, followed by some painful years of adjustment higher, bonds are arguably in better shape now than they have been in several years, offering a sense of stability and optimism for investors in the current financial landscape. Funds operated by this manager: CC Jamieson Coote Bonds Active Bond Fund (Class A), CC Jamieson Coote Bonds Dynamic Alpha Fund, CC Jamieson Coote Bonds Global Bond Fund (Class A - Hedged) |

5 Feb 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

||||||||||||||||||||||

| Clearbridge RARE Infrastructure Value Fund - Hedged | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| ClearBridge RARE Infrastructure Value Fund - Unhedged | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| ClearBridge RARE Emerging Markets Fund - Unhedged | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| ClearBridge RARE Infrastructure Income Fund - Hedged | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| ClearBridge RARE Infrastructure Income Fund - Unhedged | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

|

||||||||||||||||||||||

| Contrarius Australia Balanced Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Contrarius Australia Equity Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

2 Feb 2024 - Hedge Clippings | 02 February 2024

|

|

|

|

Hedge Clippings | 02 February 2024 For most of our readers, this is a welcome back to work in 2024! Notwithstanding the arguments on both sides concerning the rights or wrongs of celebrating Australia Day at the end of January, from a pure productivity perspective, we'd suggest a week into the new year would be a more suitable date. In practical terms by the time January 26th comes along, or more accurately the Monday AFTER the 26th, and taking into account that large sections of the workforce slow down or stop the Friday before the week BEFORE Christmas, that can make it a six week break. Add to that the slowdown in activity in financial markets, and Victoria in particular, following the Melbourne Cup in early November, and no wonder they call Australia the "Lucky Country". Don't expect any politician to hitch their wagon to that idea! Far easier for them to play the divisive wedge on why the date should be changed. I guess it depends on which side of the fence you're looking from. While on the subject of political wedges, reports are that while Dutton might whinge about the government's broken promise around Stage lll Tax Cuts, he's unlikely to actually oppose them given the numbers. And by "the numbers" we mean the number of voters who will benefit from Chalmers' and Albanese's re-adjustments. Don't be surprised if calls for a complete overhaul of the tax system gain traction, but if they do, don't be surprised if GST is left off the agenda, much like it was for the Henry Tax Review almost 15 years ago, which if we recall made multiple suggestions (excluding GST) most of which are still gathering dust. We asked Chat GPT if Henry's Review was successful or not and received this back in a flash: "Ultimately, whether the Henry Tax Review is considered a success depends on one's perspective and the specific criteria used for evaluation. Some may view it as successful for initiating important discussions and influencing certain tax reforms, while others may argue that it did not lead to comprehensive tax reform as originally envisioned." In other words, Chat GPT is having two bob each way, or there's a politician's speech writer moonlighting somewhere in the Chat GPT universe. Where were we? Back to reality. December retail sales were soft, falling 2.7% month on month, and only 0.8% above December 2022. CPI was lower than expected at 0.6% for the December quarter, and 4.1% over 12 months. The quarterly number was the lowest since March 2021, while the annual figure has been falling sharply since its peak of 7.8% in December 2022. We didn't notice any reference or thanks to Philip Lowe in the media - or from his political detractors - but there's little chance of a rate rise when the RBA meets next week for their first meeting of the year. Ditto in the US, but again little appetite from the FOMC for a rate cut, even if markets are champing at the bit for one. Having fought hard to rein inflation in, central banks are unlikely to risk easing too fast or too soon, provided they think they can achieve the economic nirvana of a soft landing. That doesn't seem to be the outlook in China: We covered the collapse of Zhongzhi Enterprize Group briefly in last week's Hedge Clippings, and the demise of leading Chinese real estate group Evergrande this week leaves an even greater hole for the Chinese economy. Evergrande owes money to 171 domestic banks and 121 other financial firms, and has an impact on the entire Chinese banking and consumer sector. There are suggestions that Chinese new home sales are down around 40% for January 2024 YoY. Those figures applied to Australia or the US would be on a 2007 GFC scale, but China being China, there may (hopefully) be no global contagion. However, signs that the commercial office market in the US, and possibly elsewhere, are under stress are cause for concern. News & Insights New Funds on FundMonitors.com Global Matters: 2024 outlook | 4D Infrastructure Airlie Quarterly Update | Airlie Funds Management December 2023 Performance News Quay Global Real Estate Fund (Unhedged) Equitable Investors Dragonfly Fund Insync Global Quality Equity Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

2 Feb 2024 - Performance Report: ASCF High Yield Fund

[Current Manager Report if available]

2 Feb 2024 - Performance Report: PURE Income & Growth Fund

[Current Manager Report if available]

1 Feb 2024 - Performance Report: Bennelong Twenty20 Australian Equities Fund

[Current Manager Report if available]

Unless that is, you have been invested in the US Magnificent Seven. It has been a year of extraordinary moves in things we never saw coming.

1 Feb 2024 - A Fairytale of New York (NYSE and the Nasdaq)

|

A Fairytale of New York (NYSE and the Nasdaq) Marcus Today December 2023 |

2023 has been a year that most Australian investors would like to forget.

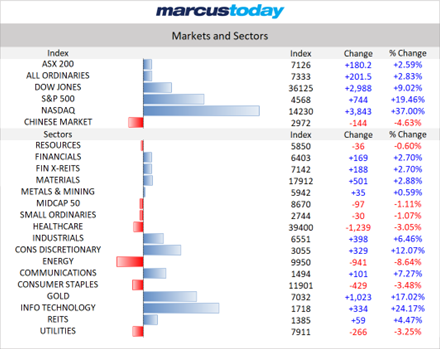

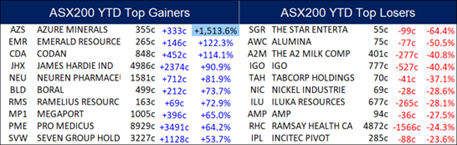

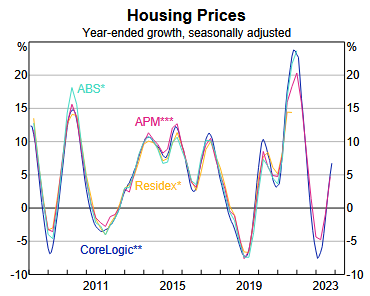

Source: Marcus Today . Source: Marcus Today. Unless that is, you have been invested in the US Magnificent Seven. It has been a year of extraordinary moves in things we never saw coming. Bitcoin is the best performing 'asset' - and I use that term loosely. US Bond markets have staged an extraordinary rally in the last month or so, as yields spiked and then collapsed. Iron ore has defied gravity and hit $200 in AUD terms, almost back to the halcyon days during CV-19, or the big gains we saw before the GFC - and all this without the bazooka stimulus we have come to expect from the Chinese. In fact, Chinese property seems to have gotten worse over the year. Here, the retailers have had a great year despite all the rate rises. Where was that mortgage cliff that traumatised markets? It's coming apparently. Many have suffered, but we now have a pause in the inflation offensive. Rates are normalising. The last decade was abnormal! What happened to house prices? They just kept going higher.

Source: ABS, APM, CoreLogic, Residex. Trophy homes changed hands at record prices. Young people have given up on the Great Australian Dream. The Bank of Mum and Dad took a pounding this year - if you could find them on their holiday in Europe that is. This time last year, lithium was riding high at extraordinary levels, and now we have gone from rooster to feather duster. Much like another white powder craze in milk powder! White line fever. Remember that? A2 Milk (ASX: A2M) hit 20 bucks - madness. Plenty of that around. Gone now though. Some brokers were sounding the warning bell on lithium prices and were 'pooh-poohed' for their view. As General Melchett once said in Blackadder, you should never pooh-pooh a pooh-pooh. Wise words darling, eh? At one stage this year, we had billionaires fighting to keep lithium assets Australian-owned. Hats off to you Gina. You succeeded. Unfortunately, it was at a cost. Quite a big cost. For everyone. In hindsight, it looks like two bald men fighting over a comb. Origin Energy (ASX: ORG) saw off the 'Brookfield Mounties' after a rear-guard defence from Australian Super, though several other icons fell - Newcrest is no longer and OZ Minerals (ASX: OZL) fell to BHP (ASX: BHP). Is the ASX shrinking to greatness? Then there are the gold miners. Who would have 'thunk' that gold would hit an all-time high whilst rates were going higher? Gold pays no dividends and actually costs money to store. It has always puzzled me why we spend so much time and money digging it up, making it into a nice bar shape, and then burying it again in an underground vault. The sector is up 17%. Still, many things in life puzzle me. I struggled with The Book of Mormon! Was that just me? This year we had the rise of AI and the machine. I thought Nvidia was a skin care product until this year! Even AI didn't see that one coming. We also had a year where GLP-1 drugs offered a 'miracle cure' for obesity, and killed CSL (ASX: CSL) and Resmed (ASX: RMD) in the process. More iconic falls. The consensus last year was that the US economy would experience a recession. The question was whether we were going to get a soft landing or a hard landing. Well, no recession. The experts got that wrong too. In fact, there is not much the experts got right. Oil was supposed to hit $100 due to Ukraine, and then Gaza. Nope. Oil is struggling, even if the Saudis are cutting production. What to expect in 2024.Firstly, experts have no monopoly on making daft predictions. Just because they are on TV or interviewed in the media, I think 2023 shows how wrong they can be. There is one certainty in 2024 that even the experts will get right. The US Presidential Election. Everything to play for, and everything to lose. Are we really headed back to the chaos of the Trump era? It seems a distinct possibility. We are not talking about it yet - but we will. The US Election cycle kicks off early in 2024. The experts are still forecasting a recession and a landing of some sorts in 2024. Hard or soft. Similar arguments triggered a war in Lilliput. Which end of the egg to crack? The markets are now pricing in quite savage rate cuts in the US in 2024. The reason is the US economy is crashing. Is it? I am not sure the Fed will be that aggressive. The economy is slowing, but crashing in an election year seems unlikely. Powell will want to keep his job and the Fed independent. Trump is an agent of change. There are two themes that I think will manifest in 2024. Both out of favour. Both troubled, and both seeing serious negativity. The first one is lithium. At some stage, and we are not there yet, the price will have fallen so much that all that supply coming on stream will struggle to get funding. Plenty of it will be uneconomic. All those gold miners who switched to lithium may have to switch back to gold! Remember the dot-com boom? The miners became web-masters and then had to switch back! When was the last time that we saw a high-profile off-take agreement? Yep, I can't remember one. My 'go-to' would be Pilbara Minerals (ASX: PLS). It still has 20% shorted. A market cap of around $10bn with a cash stash and no problems with the US, as far as Chinese ownership is concerned. Remember when Liontown (ASX: LTR) was valued at nearly $7bn for a project still under construction? We are not at peak bearishness in the sector as yet, but at some stage in 2024, there will be a huge bounce. The other one which has been taken out the back is the oil and gas sector. BHP is looking pretty smart with its jettison of the oil and gas assets to Woodside (ASX: WDS). If you had said there would be a war in the Middle East and interest rates would be at 4.35%, there would not be many experts who would have predicted consumer discretionary stocks would be out partying, and oil and gas stocks suffering from a serious hangover. Yet here we are. I think the sell-down in oil has been overdone. WDS is the premier way to go with this, and I still like Karoon (ASX: KAR), which has de-risked from a one-trick pony with the recent Gulf of Mexico acquisition. Both a big and a smaller one are buys for a better 2024. Finally, I was asked to pick a stock for an Advent Calendar segment recently. I had two that I liked: Treasury Wine (ASX: TWE) for a reopening of China year, and Zip (ASX: ZIP). I know. Crazy, but the US consumer is still spending, just finding different ways to pay. I think we are all guilty of that. Regulation is coming here, and that will provide some certainty. The key is the US, the growth of BNPL, and the pesky ZIP balance sheet. Could 2024 be the year we are talking BNPL again? Maybe, but then again, I have been wrong many times before. Why should this year be any different? The good news is that next year, ChatGPT will be writing a similar article, and I will be redundant. You can blame it then. Author: Henry Jennings, Senior Market Analyst, and Media Commentator |

|

Funds operated by this manager: |

31 Jan 2024 - Performance Report: PURE Resources Fund

[Current Manager Report if available]