News

11 Jul 2022 - ASML: a once in a lifetime buying opportunity

|

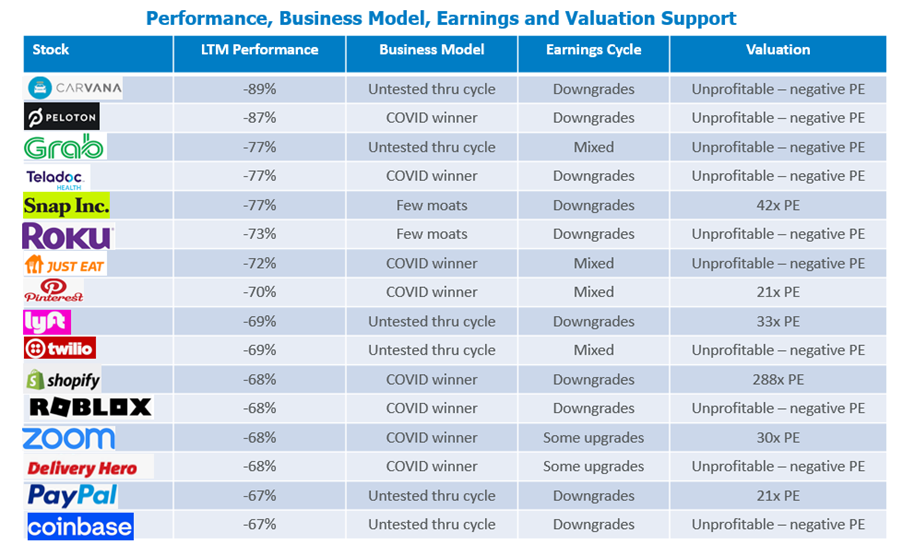

ASML: a once in a lifetime buying opportunity Alphinity Investment Management June 2022 There are 3 important criteria for identifying a once in a generation buying opportunity: 1) confidence that the business model will still be viable in a generation; 2) confidence that the stock has moved out of an earnings downgrade cycle into an earnings upgrade cycle; and 3) valuation support that signals a true buying opportunity, not an opportunity to catch a falling knife. Global equity markets have pulled back sharply in 2022 and it may be tempting to view some previously high-flying stocks as once in a generation buying opportunities. However, caution is needed because many of the worst preforming stocks year to date do not meet the 3 criteria outlined above. The following table shows stocks in the MSCI World Index that are down 65% or more in the last 12 months. Arguably, the vast majority of these do not meet the first criteria of a durable business model that will definitely be around for generations to come. In addition, most of these stocks are not in an earnings upgrade cycle, nor do they have strong valuation support even at these levels. Caveat emptor for these types of stocks

Source: Bloomberg, 31 May 2022, Alphinity Unlike the stocks in the table above, ASML is a high-quality stock that has corrected over 30% from its late 2021 high and meets the criteria of a durable business model, earnings upgrades and valuation support. A Business Model with Staying PowerASML is definitely going to be around in a generation as evidence by the fact that the stock listed in 1995 and has seen a few cycles already. ASML's enviable market share of around 70% provides confidence that there are deep moats around the business that can outlast periods of strong competition or disruption. Looking forward, ASML management likes to talk about the 3 main drivers of their stock being structural (AI, Internet of Things, 5G, Electric Vehicles, etc), cyclical (semi shortages and ongoing semi supply chain disruptions) and geopolitical (reshoring of semi capacity to the US and potentially Europe to reduce the risks associated with China/Taiwan). The combination of these 3 drivers is very powerful and supports a strong long term business case for ASML. Earnings Upgrade CycleASML's 1Q22 result came out slightly ahead while guidance for the FY22 maintained top line growth of ~20% and strong gross margins of ~52%. The bigger earnings story from the recent Capital Markets Day was a substantial upgrade to capacity targets for FY25 based on very strong demand. The potential upgrades here are significant - in the order of +50% revenue potential over the medium term. Valuation SupportASML is currently trading on a PE of less than 30x versus almost 50x PE at the end of FY21. This valuation is now below its 5 year average PE and represents an attractive PEG ratio of just over 1x. Furthermore, ASML's net cash balance sheet, 65% ROE and strong Free-Cash-Flow yield provide confidence in downside support for the stock. As shown in the table below, ASML's valuation support is in sharp contrast to many of the unprofitable or barely profitable tech stocks with no valuation support even at these levels. If markets continue to trend down, then many of the stocks that have been crushed in the last 12 months can continue to fall further. ConclusionStick with high quality stocks with durable business models, earnings leadership and valuation support. In this context, ASML looks very attractive. Happy hunting for once in a generation buying opportunities! This information is for adviser & wholesale investors only |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

8 Jul 2022 - Rate Hike Volatility: Winter Comes in June for Crypto

|

Rate Hike Volatility: Winter Comes in June for Crypto Laureola Advisors 22 June 2022 The S&P 500 was flat in May but at the time of writing is down 5.8% in June and -22.9% ytd. Most financial assets are down negative double digits ytd: Nasdaq -31%, 10-year US Treasuries -15%, and Bitcoin -56%. The growing volatility and uncertainty in the financial markets globally is being driven in large part by the overdue and somewhat chaotic reaction of Central Banks to persistent inflation. The US Fed hiked rates by 75 bps in June - the largest hike in 27 years. The 10-year US real yields soared 150 bps in 60 days and most other bond markets suffered - the Australian 10-year yield rose 57 bps in 2 days. The persistent inflation, made worse by supply chain problems from lockdowns in China and war in the Ukraine, is starting to bite consumer spending and reduce economic growth around the world. In Europe, the 80% rise in the price of natural gas is one problem; the 50% reduction in deliveries by Russia is a worse problem. Europe may not be able to buy all the gas they need for next winter at any price. Investors fearing more volatility may want to raise cash to be "safe". But if cash buys 8% fewer goods and services next year compared to this year, too much cash may not be safe. A well-managed Life Settlements strategy can contribute to investors' portfolios in these turbulent times: it will be non-correlated with the equity and bond market turmoil, and it offers a return that has a strong probability of keeping up with inflation. PORTFOLIO CONSTRUCTION: THE ROLE OF LIFE SETTLEMENTS - The Role of the Laureola Fund in Portfolios of Private Clients and Family Offices Last month we discussed the role of LS in institutional portfolios showing that, mathematically, a small allocation to LS could both reduce portfolio volatility (risk) and increase returns over most 5-year periods because of its diversification characteristics, even if single digits returns are assumed. But there are other definitions of investment risk sometimes used by Private Clients and Family Offices. Some are simple and straightforward, but still very useful in analysis - maybe even more useful. Many strategies that promise diversification in bull markets fail to deliver the needed diversification in bear markets. But the Laureola Fund does. The Fund has outperformed all asset classes (except for commodities) ytd in 2022 including hedge funds as measured by the Barclay HF index (-5.7% ytd). The Fund has delivered positive returns in 7 of the 10 worst months for the S&P since inception, and in 2 of the 3 months when both had negative returns the negative return of the Fund was insignificant. The Fund has helped investors keep up with inflation delivering 6.7% net over the past 3 years. For once the theory and the practice align: The Laureola Fund can make a positive contribution to investors' portfolios in turbulent times no matter what analysis is used. Funds operated by this manager: |

8 Jul 2022 - Why are insurance stocks undervalued?

|

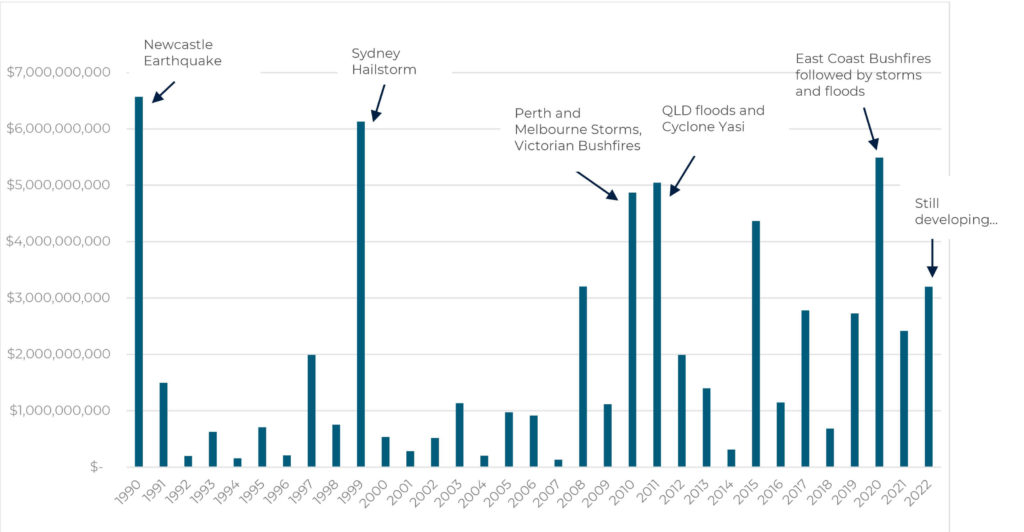

Why are insurance stocks undervalued? Tyndall Asset Management June 2022 There are a number of unique characteristics that make the insurance sector attractive in the current environment, including some company-specific factors which have led to valuation-based investment opportunities. Valuing the insurance sector Valuing insurance companies remains difficult due to the potential mismatch of estimated claims verses actual claims paid which may take years to finalise. Large catastrophes can take several years to be resolved—such as the New Zealand earthquakes—and injury claims can be stuck in the legal process for a long time. As a result, errors in claim loss forecasts can impact a company over many years. As investors, we look at a combined ratio calculation to measure the profitability of insurance companies, which is the sum of operating expenses and claim losses divided by premium revenue. A ratio below 100% indicates profitable insurance underwriting. Chart 1. Insured losses by Financial Years (in constant $2017)

Source: Insurance Council of Australia The chart is a reminder that disasters happen, and that risk is why people buy insurance to protect them from the impact of a disaster. A well-run insurance company prices risk appropriately. Insurance companies have accepted that there is an impact on the size and frequency of claims as a result of climate change, and premiums have increased to reflect this. What makes insurance companies attractive in the current market climate? The current market environment is characterised by rising interest rates, energy price spikes and higher inflation. This has led to a softening in economic growth and growing fears of recession. Stagflation or recession will negatively impact profit margins and valuations for companies. One of the things that makes the insurance sector unique is that premiums are billed and collected up-front, delivering in a premium float before claims are paid. The float is usually large and is invested to generate additional returns on top of an underwriting margin. Typically, this large premium float is invested in a mixture of cash and bonds, and possibly a small proportion in shares and other assets. Insurance companies aim to make an insurance margin which includes a return on the float that is akin to a leveraged investment return, since the return is earned on the premium float. The insurance sector is one of a handful that benefits from higher interest rates, with a 1% increase in rates equating to 10-20% earnings upside. The insurance Industry structure in Australia is attractive, operating as a functional oligopoly with the two major domestic insurers—QBE and IAG—taking approximately 70% market share. What makes the structure of insurance companies different? The business service provided by insurance companies is the pricing and pooling of risk. It does not require an inventory of raw materials or finished goods, freight costs, or energy consumption. Premiums are typically a function of asset value and rise with the insured value. The rate of return on insurance floats improves as interest rates rise, which is the opposite outcome experienced by most companies. Inflation can flow into claims costs, though insurers do generally mitigate this by adjusting premium prices upwards. Furthermore, insurers would face similar pressure and typically be less likely to compete in an inflationary environment. Why are the insurance stocks undervalued? The recent increase in the frequency of disasters and associated claims has weighed on investor sentiment, with concerns that estimated losses and exposure protection limits would be exceeded. To date, the measures in place have provided adequate protection. In addition to claim frequency, a series of operating missteps have dented investor confidence. Most notably, QBE, IAG, as to a lesser extent Suncorp, were forced to raise provisions for Business Interruption claims relating to COVID-19 and to manage costs associated with insurance policy documents incorrectly referencing the Quarantine Act 1908 (rather than Biosecurity Act 2015). IAG was disproportionately impacted by this and had to raise equity. Litigation has so far favoured the insurers, which may lead to the future release of surplus provisions for claims. Investor confidence in IAG waned further after the company suffered humiliating make-goods as a result of failing to apply group policy discounts and payroll errors. Accusations that IAG retained risk to the Greensill financial collapse proved unfounded, with the company clarifying that the business division that had this exposure had been sold and the risk transferred to the purchaser. What are the signs that things are improving? Consistent with IAG and Suncorp's February results commentary concerning premium rate increases, QBE released a performance update in early May which confirmed a healthy 22% growth in constant currency gross insurance premium revenue. QBE indicated that after the increase in risk rates and a 9% reallocation into riskier assets, the expected running yield on the investment portfolio has almost tripled to an exit rate of ~2%. The operating missteps of IAG and QBE have rattled investor confidence. Suncorp has fared better following its focus on cost reductions and dividends, and this has been rewarded by the market through share price gains. We expect a recovery in market valuation and dividend payments from both IAG and QBE as: (i) the cost impact of remediation fades; and (ii) the industry-wide improvements in premium pricing are earned and higher running yields on the premium float are delivered. The valuation, dividend profile, and sensitivity to rates, inflation, and the risk of stagflation leave IAG, QBE, and Suncorp well placed to outperform. And with high dividend payouts expected to persist, the Tyndall Australian Share Income Fund remains happily overweight the sector. Author: Michael Maughan, Portfolio Manager, Tyndall Australian Share Income Fund Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund Important information: This material was prepared and is issued by Yarra Capital Management Limited (formerly Nikko AM Limited) ABN 99 003 376 252 AFSL No: 237563 (YCML). The information contained in this material is of a general nature only and does not constitute personal advice, nor does it constitute an offer of any financial product. It does not take into account the objectives, financial situation or needs of any individual. For this reason, you should, before acting on this material, consider the appropriateness of the material, having regard to your objectives, financial situation, and needs. The information in this material has been prepared from what is considered to be reliable information, but the accuracy and integrity of the information is not guaranteed. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data, and make no promise of future investment returns. Past performance is not an indicator of future performance. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided. |

7 Jul 2022 - The Rate Debate: Leaders indicators warn of global recession

|

The Rate Debate - Episode 29 Leaders indicators warn of global recession Yarra Capital Management 05 July 2022 Leaders indicators warn of global recession Central banks state they are not seeing signs of a recession as they continue hiking rates to curb spiralling inflation. But with forward indicators flashing red across the board, low consumer confidence, declining forward sales, the US yield curve beginning to invert, and the continued drop in the global equities, markets are telling us they see slowing growth ahead. Will the RBA pause in August, or will they continue to tighten at the fastest rate we have seen in 30 years and drive the country into a recession? Speakers: |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

7 Jul 2022 - How will the energy transition impact Asia?

|

How will the energy transition impact Asia? abrdn June 2022 For those who prefer to read, the transcript is below. In this episode, the focus is on energy transition in the Asia Pacific region and a look at opportunities versus challenges.

SPEAKERS Paul Diggle, Deputy Chief Economist Paul 00:06 Hello and welcome to macro bytes the economics and politics podcast from abrdn. My name is Paul Diggle Deputy Chief Economist at abrdn, and today we are talking about the energy transition. It's a topic we have tackled a couple of times before on the podcast. But we're specifically going to focus on the energy transition in the Asia Pacific region in this episode. And that's because the region is a crucial battleground in the world's fight to decarbonize with many large emitters base there. And it's also a region replete with opportunities and challenges as part of that transition. So joining me in this discussion are Jeremy Lawson, our chief economist, and Anna Moss, our climate change scenario, analyst. And Jeremy and Anna have recently authored a paper on exactly this topic, so it's going to be great to get into it with them. So Jeremy, let's start with you. Perhaps you could start by laying out why the Asia Pacific region matters so much in the fight against climate change and the transition to clean energy. So I Jeremy 01:10 think the simplest way to put it is that in the last 20 years, almost all of the net increase in global emissions has come from the Asia Pacific region. That's because you have reductions in emissions in the United States. Here are some other advanced economies, and modest increases in places like Latin America, Middle East and Africa. But they're broadly offsetting service, all of the aggregate increase, and you've got to the three world's largest emitters are based in the region, China and India. And then, as I say, other very large emitters, like Indonesia, and so there can be no energy transition, unless there's an energy transition in the APAC region, any chances of holding temperature increases to one and a half degrees above pre industrial levels, the rest on rapid decarbonisation in the Asia Pacific. And in fact, one of the really important reasons why we don't think that that type of pathway is likely, and even a blue two degree pathway is going to be hard to achieve is because the Asia Pacific region in aggregate, and almost all of the major countries within it are not on net zero trajectories themselves. Paul 02:29 Brilliant. And AIPAC is, of course, a very big region very heterogeneous in terms of the stage of development climate policy in individual countries. Could you give us a sense of some of that heterogeneity that difference across countries? Jeremy 02:45 Well, exactly. So think about it through the prism of net zero targets themselves. So we have everything from net 02 1015 targets in places like Australia, Japan, South Korea, then you have a number of countries on China has got a net zero 2060, objective, India's is net 02 1070. So governments very clearly signaling different different policy pathways. You have some of the wealthiest countries in the world in the region. And still some of the poorest, particularly of us sort of expand to include the Pacific Islands, but also parts of Southeast Asia, and parts of southern parts of southern Asia. The credibility of policy very significantly, funnily enough, China is actually the only country that really has a national carbon pricing regime in place through its emissions trading scheme, whereas actually, the advanced economies who look like they have more aggressive climate targets, have actually not managed to put those types of instruments in place. So actually, the credibility of their objectives is even more under question. And so it becomes very, very important to take these types of variation into account, manufacturing shares of GDP, renewable energy, intensity of the energy system, all these sort of things into account when sort of considering the nature of the risks and opportunities that are going to be facing investors looking to get exposure within the region. Paul 04:18 So I know you're very closely involved in the climate scenario modelling work that you and Jeremy have undertaken. And this is a quantitative framework that we've applied to AIPAC, but also globally to understand different paths for climate change the energy transition, the fortunes of individual sectors and companies. Can you tell us a bit more about the modelling framework? How does it work? What have we done with the modelling? Anna Moss 04:42 Yeah, so we're about to commence what will be our third year of climate scenario analysis. And I'd say that that really reflects the importance that we place on the potential insights that this type of analysis really can provide to us. And I'd say that also our unique approach Ah chi, that analysis also emphasises that commitment, because rather than relying on publicly available tools, and simply relying on off the shelf scenarios, which can typically have more simplistic assumptions that are built into, that they're built upon. And instead, we've created our own bespoke scenarios. And this allows us to input our sectoral and critically here our regional insights and research. And this means that we can create is more plausible scenarios, where regions and sectors are able to vary within a global pathway. So, as Jeremy has illustrated in his outlining of the importance of the APAC region, there are distinct and important characteristics between regions and between countries in those regions. And it's important for scenario analysis to be able to reflect these. So our approach means, for example, we can reflect China's that China's expanded policy commitments mean, it's likely to decarbonize more quickly than the average across emerging markets, or how the policy ambition and the timescales of that ambition for countries like Japan or Australia, for example, are significantly different to those of Thailand and India, for example. But as Jeremy pointed out, because we need to also the credibility of all those targets. It says right, in terms of the simple off the shelf approaches, these tend to focus on, if you like, the stress testing, approach to climate scenario analysis. So that means that they're concentrating on more the tail risks. And this will flag up the major risks and potential opportunities, but it doesn't allow you to consider what would be the more likely impacts of climate change. So instead, we've, we have a large suite of scenarios and that we apply probabilities. And that then provides us with a really good depth as well as the breadth. So this allows us to explore the differing impact impacts of, for example, limiting warming to the degree two degrees, more ambitious scenarios that are critically aiming for the 1.5 degrees, the hothouse world use of a continuation of work where basically current policy fails to scale up. And also the varying degrees in between, including our current view. That is that the likely figure is around 2.2 degrees in terms of global warming. Paul 08:01 Brilliant. So we've got this set of bespoke climate scenarios. And our model takes into account alternative paths for climate change the energy transition emissions, the global temperature rise, and gives us impairments of individual sectors and companies that we might invest in. Jeremy, could you bring to life a little bit what the average scenario looks like? So there's the 2.2 degree temperature rise, but what else do we have in terms of technological path or regulatory path bring this to life for us? Jeremy 08:34 Sure. So I think it's very important for the listing to understand how this framework is built. We have a baseline scenario, which really reflects what we think is priced into assets today across geographies and sectors. And this is a really important starting point for investing, because any investor always has to begin with the question of what is in the price of assets. Then what we do, as I said, we build this array of scenarios, which we think are more likely more plausible, because they build in technology and variation across technology and policy variation across sectors and geographies. And then the mean the probability weighted mean that we generate as a result, then that dictates the extent of the impairment that different securities are exposed to. And this is going to generate very different results than what a standard scenario analytical framework will sort of generate. So they give a couple of examples. We're able to build in the fact that for example, the European Palace sector is decarbonizing more quickly than the power sector in the typical emerging Asian economy. And it's going to matter a lot, because implicitly that means that the carbon price trajectory in Europe in the power sector is going to be higher than it is going to be in emerging Asia. That's also therefore going to significantly influence the after tax. Earning streams of companies differently. So all these things are going to matter quite a lot in terms of what is the demand for products look like? What is the carbon price sort of trajectory look like? How was the ability of companies to pass on changes in carbon prices. So effectively in this model, carbon pricing closes the system, it effectively generates a pathway that ensures that emissions drop in line with the overall sort of temperature, or emission sort of trajectory. And again, if we think about some of the key inputs around, for example, electrical vehicle penetration, or when does global oil demand peak, or how much coal is used in the future, each of these things is going to look a lot different in our main scenario than they do in those extreme tail scenarios. So there's gonna be a lot more fossil fuels use in our main scenario than in one and a half degree or below two degree Well, however, there's going to be a lot less used than in the current policy world says, say most investors, when they gauge a scenario analysis, they're going to get these types of risks that vary widely available, they're commonly used by just kind of precise enough. Ultimately, assets will be dictated by what happens in the real world, not in highly stylized scenarios that reflects the tail probabilities that are very unlikely. And so our The unique part of our framework is the ability to build that in as a feature. And so we're looking for example, for how is BHP Billiton affected by the energy transition, our framework will generate a very different impact than what are the frameworks will. Paul 11:36 Brilliant and one of the findings of the modelling, Jeremy is that the typical aggregate equity market impairment from the transition is often quite small. There are lots of winners and losers. But you find the aggregate they largely net out at a global level. But that's not the case in a pack, is it especially not for some specific countries, say like India, where you find pretty large aggregate impairments to tell us what it is about Asia Pacific equity markets, that mean that you actually get some pretty big aggregate impairments from the energy transition, you're envisaging. Jeremy 12:14 I think the simplest way to explain it is that if you look at, say, equity indices across the Asia Pacific region, for the most part, they had larger concentrations in the sectors that are negatively affected under the transition scenario we have in mind. So for example, energy materials, consumer discretionary, each of these sectors that on average, is negatively impaired in our main scenario. And so naturally, if those sectors have got a larger weight in the indices, that will drag the aggregate down in India's case, for example, in very significant weight to materials, but materials that are in some sense, brown rather than green materials. And so that has a negative effect on the aggregate results. But it is still very important to recognise that even though it's true, that the index level effects are a little bit larger, on average, across Asia, and across emerging economies than in the major advanced economies. That it's still the case that dispersion of the impacts of fair valuation impacts is predominantly a security level phenomenon. Right? So So knowing what country the firm is, in knowing what sector even a firm is, is in tells you relatively little about the true exposures, the different types of climate risk and opportunity. Paul 13:37 And that's the great insight, of course, or of the framework you've built. It allows you to think about individual companies and their exposure to the energy transition, which as you say, Jeremy, varies considerably. And Anna, so a potentially surprising result of your modelling work within a PAC specifically is that Chinese indices actually have quite a low negative exposure to the energy transition. Could you explain why that is? Yeah, so Anna Moss 14:07 as you say, it is quite a surprising result, given the carbon intensity of the Chinese economy. One of the reasons for this is that some of the country's most fossil fuel intensive firms are actually non listed state owned enterprises and that means that the energy sector which is the most negatively impacted sector, and she has a very small weight in the in the aggregate index, as Jamie pointed out, is quite critical that the weight of these sectors within their indices and that results in therefore a smaller set tall drag on valuation for China in comparison to some these other markets. But also, as Jeremy pointed out, this importance of the dispersion within a sector and whilst the the overall whilst overall the energy sector is very negatively exposed. There's still many firms which do show significant uplift in valuation in our mean scenario. And some of these are actually coal producers based in China, which again, is perhaps surprising to people. And that's because coal remains a dominant fuel type in China, under continuation of current policy, and even in the most stricter and early action scenarios, the projected role for coal actually remains a dominant figure for the dominant figure in terms of few types of much longer in China can compared to other regions. And if you add to that, the issue around carbon pricing so as Jeremy pointed out in although they do have this carbon price pricing scheme in place, it is projected the prices still projected remain pretty low in China across our scenario sweet. So those coal producers in the region have the potential to benefit from the continuing demand, whilst at the same time, their regional peers are potentially going to be hit by higher carbon prices. And along with this dwindling demand that they would face that would see them exiting, exiting the market sooner. So although this car, these coal producers do see a large downturn in net zero scenarios, the uplift from these other scenarios is enough to pull through a positive result in the mean scenario. Jeremy 16:43 And it's just a Can I just pulled this out a couple of things to that that are probably work, you will help people sort of understand even more in any sort of asset pricing framework, you will have a discounting mechanism taking place, right, and so the further out, the change in earnings occurs generally will, the less weight it has in the valuation, because in emerging economies, including in China, a lot of the policy action, the most aggressive policy actions projected to take place, say after 2030, the biggest negative effects on fossil fuel usage are occurring in periods that are going to be more heavily discounted within the framework. So another way of thinking about that is if we rolled this all forward 10 years and we were doing the analysis, then those same companies might look quite poorly, they still had the same structure reliance on coal. The other one there's a sector element as well is that the Chinese power sector is definitely on a decarbonisation pathway that a lot of coal is used in the industry sector in China, and industry is the sector, it was one of the sectors that we think is going to decarbonize much more slowly, in part because alternative technologies aren't available didn't, then the sheer growth rate of China can sort of create sort of still healthy demand for coal through that particular channel. So again, it's the real importance of taking these nuances into account rather than sort of, say, coal bed renewables good. It's much more complex than that in terms of modelling. Paul 18:14 Right. And and Or another nuance then is that individual firms can actually take measures to limit their impairment through the energy transition, can't they? So they can they can move to net zero, they can set carbon targets, can you tell us about the sort of measures firms might take that would mean, they they can do well, through the energy transition? Anna Moss 18:39 Yeah, so I guess the the measures really fall into two broad categories. So limiting rising costs from their emissions, and also reducing the risk of, of losing market share as demand for their products and services declined. So sort of changing how they're the products changing the actual products that they're producing. And so the most common measures fall into that first category with companies announcing commitments to reduce emissions. So basically, as the carbon prices rise, they can improve their position relative to competitors by by basically reducing their costs. But also, there are companies that are announcing targets to adjust their revenue splits to move away from their high carbon products, and increased production of low carbon products. So they're not disadvantaged by these these changing demand dynamics Paul 19:37 in the auto industry might be an example of that. Anna Moss 19:41 Yeah, yeah. I'd say definitely the the auto industry is a important one to bring in there. And really, that's so if you consider in terms of the changing in the revenue split, particularly there, you're seeing auto companies announcing In their commitment to change their their split much more favourably towards electric vehicles. And I'd say a lot of the time the devil can really be in the detail. So there can be considerable variation between companies, not just in terms of addition, but also in terms of the the type of permissions that they're including within those targets. And also in terms of whether they're considering the milestones that they'll need to achieve, achieve those those targets. So if we look back at consider our analysis. So climate scenario analysis, although the the policy and technology pathways that underpin it are forward looking, we are working now to introduce a way to incorporate the kind of dynamic responses that individual companies are also likely to make. So we're exploring how to integrate those company level targets into the modelling. But we really do need to consider this this credibility issue. So just as we consider the credibility of targets at country levels, we also need to consider the credibility of these targets being announced by companies. So for that reason, we're also developing a credibility framework in house that can consider the track record in terms of decarbonisation of these companies, how detailed the targets are, and whether these they have these milestones to transition, whether they're operating in jurisdictions where the policy and the regulations, or perhaps like the hinder their plans. And also really crucially, this this issue that the Jeremy touched on earlier about the viability of the technologies that are actually needed to aid their transition, because a lot, a lot of the technological developments that are going to be needed to achieve net zero. In across, most sectors are yet to actually be proven at scale. And in many cases, they've not even made it to market yet. So if you consider going back to your question about the autos, so that's a sector where even where we have proven technology, we're already seeing companies falling short of the targets that that they've set, and majority of the world's car makers already lagging behind with regard to the necessary switch to electric vehicles, Paul 22:50 right. So credibility is absolutely key when assessing individual again, Jeremy 22:54 and again, to emphasise how unique this is because it's already the case in our standard work, we're able to take into account policy variation across sectors and geographies and technology variation way but other frameworks don't. But now our ability to take into account dynamic corporate strategies with a layer of credibility will take this work to the next stage in the next level. So it really needs to be thought of as an innovation that makes it even more relevant to investment decision making. And the framework already was and takes a long way beyond this, the standard risk based assessments that are that are mostly sort of prevailing in the industry. Paul 23:33 And Jeremy, tell us how how we're incorporating this into investment decision making, ultimately, how are our portfolio managers changing their decisions, using this research, this great modelling framework that you and Anna have developed. Jeremy 23:49 So it's very important to emphasise that the modelling the analysis does not dictate any investment decision. It's a model poll, you're very familiar with the strengths and weaknesses of different model their representation of the world, but never a perfect one. And we want to really emphasise that there are things that are going to be influencing asset prices over different frameworks, including the energy transition, you can never sort of fully capture in a single framework. But what it is being used for in large parts of the businesses is like a think of it as a as a screen as an input into decision making helps people sort of understand well, okay, so how exposed might this firm be? How does that weigh against other things that might be influencing you know, the company, how should I think about long term value compared to short term value? Maybe it can be used in the way where it's being used in the way we engage with companies. So a lot of corporates themselves do scenario analysis, but some of them cherry pick those scenarios to represent favourable futures and say, Hey, we're already on the right track. We don't need to do anything. But when we're armed with our own analysis, we can say, Oh, actually, when you look at it this way you're exposed Asia looks a bit different. How are you? You know, how are you counteracting that? So it's sort of it's, I sort of see it as, like any sort of good model as a way to make better decisions to influence the not dictate and make sure that we've just got a better way of capturing of avoiding risk capturing opportunity. Alongside the other things, they're gearing towards the value of companies and, and the way that we make investment decisions over short, medium and long term timeframes. Paul 25:29 Anna Jeremy, thank you both for a fascinating set of insights. The full report on the energy transition in Asia Pacific and how we are using it in our in our modelling in our stock selection, portfolio construction, and company engagement can be found on abrdns website and we'll link to it in the show notes as well. Thank you to you for listening to macro bites, we'd love you to give a like or subscribe to the podcast on your platform of choice. But until next time, Goodbye and good luck out there. 26:08 This podcast is provided for general information only and assumes a certain level of knowledge of financial markets. It is provided for informational purposes only and should not be considered as an offer investment, recommendation or solicitation to deal in any of the investments or products mentioned herein and does not constitute investment research. The views in this podcast are those of the contributors at the time of publication and do not necessarily reflect those of abrdn. The companies discussed in this podcast have been selected for illustrative purposes only, or to demonstrate our investment management style and not as an investment recommendation or indication of their future performance. The value of investments and the income from them can go down as well as up and investors make it back less than the amount invested. Past performance is not a guide to future returns, return projections or estimates and provide no guarantee of future results. |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund |

6 Jul 2022 - National Infrastructure Briefings 2022

|

National Infrastructure Briefings 2022 Magellan Asset Management June 2022 Speakers: Gerald Stack, Head of Infrastructure Time stamps: |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

6 Jul 2022 - You should probably be turning off the news

|

You should probably be turning off the news Insync Fund Managers June 2022 Markets continued to exhibit significant downside volatility as central banks rapidly raise interest rates to bring down inflation. This in particular impacts 'growth' companies, even the highly profitable ones that aren't as impacted by inflation - the type of companies that Insync holds. These forms of growth companies are delivering strong earnings today and are still poised to do so for many years into the future, even if economies contract in the near term. In times like these however markets are temporarily blinded to this reality, and so patience is required. From an investors' perspective, the factual scoreboard across history points out that predicting future inflation is as much a fool's game as trying to guess when to be in or out of various industries, or even equities overall. Over time, what we do know, is that stock prices follow the earnings growth of their businesses, thus this continues to be our core focus. Businesses with very high levels of sustained profitability, reinvesting into runways of growth backed by megatrends, deliver consistently superior earnings growth! Investors wanting a more certain way of growing their wealth must stand firm in times like now to benefit from this proven observation. It means riding out transient event-based situations, such as Russia's terrible war and the recovery from Covid's disruption to global markets. It also probably means turning off the news Companies you own are doing well We invest in businesses (not markets). They sell differentiated products, offer value added services and aren't particularly resource or input intensive. They benefit from pricing power and very high margins, and so rising inflation has less of an impact. They enjoy high cash generation and rock-solid balance sheets (low debt). This enables them to strengthen their businesses during times like now as their weaker competitors struggle or even collapse (e.g. Estee lauder v Revlon). In fact, some will earn even more income on their billions of cash reserves as interest rates rise. A good number of the companies in the portfolio are down between 20% to 30% - for no fundamental reason. Many continue to post very strong sales and earnings, reporting growth between 10% to 15%. So, we're certainly not going to sell them because their stock price went down 30%. If anything, we want to own more.

Adobe is a prime example. There are 3 reasons making it an excellent investment:

Adobe is highly profitable. It has a very high Return On Invested Capital, with gross margins of 88%. It's a dominant force in the creative digital content industry with 50+% of the creative software market. Everyone is familiar with PDF, but the company's suite extends far deeper with professional creative Cloud products like InDesign, Illustrator and Premier Pro, amongst others. When you view an image, video, website, magazine or even an app, there's a good chance Adobe was involved. Sales have grown by 75% (2018-2021), to $15.78 Bn (USD) in 2021. Yet, there is still a very large, long runway of growth left. The total addressable market for its Creative Cloud products is $63bn, and $32bn for its document Cloud products. 92% of this comes from existing happy customers and their subscriptions. We don't know if Adobe's stock price will fall further in the near term, and this doesn't trouble us. What we do know is that it is a dominant player in its industry with projected earnings compounding between 10%-15% p.a. This equates to superior and highly attractive earnings growth, followed of course by the eventual stock price rise. The current market price drop in Adobe drives a widening gap in its valuation versus its short-term price. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

5 Jul 2022 - What to expect from the stock market?

|

What to expect from the stock market? Montgomery Investment Management 23 June 2022 In this week's video insight Roger discusses what could be next for the stock market. We already know that P/E ratios have compressed considerably, and taken into account all of the increase in bond rates. What they haven't done, of course, is priced a very significant recession, nor have they priced the possibility of a financial crisis of any description. But what happens if rates stop rising, and if economies don't go into a recession, and we don't get a financial crisis? Transcript Roger Montgomery: Hi, I'm Roger Montgomery, and welcome to this week's video insight. Well, bearishness pervades almost every corner of the market at the moment. In my travels, in talking to brokers, other fund managers and economists, I don't find many people who are very bullish at all. In fact, most of them expect another leg lower in the stock market. Of course, for me, that starts to become optimistic because if everyone's already bearish, there's not many others left to become bearish. Those who are bearish have already sold, there's not many people left to sell, and so it may be that prices are now on the cusp of a bounce. But rather than speculating about that, let's just think logically about what could happen next. We already know that P/E ratios have compressed considerably, and taken into account all of the increase in bond rates. What they haven't done, of course, is priced a very significant recession, nor have they priced the possibility of a financial crisis of any description. We'll address those two subjects in a moment. But if rates stop rising, and if economies don't go into a recession, and we don't get a financial crisis, then there's a very real possibility that the indiscriminate selling that we've witnessed recently becomes something more discerning and buyers return to the market to look for downtrodden, high-quality growth companies. That's one possibility. The other possibility, of course, is that the deterioration in consumer confidence, such as what we're seeing in New Zealand at the moment, after five interest rate increases there, and a similar event here in Australia is a consequence of rising prices as well as declining property prices, could result in less funding being available to venture capital and private equity companies. If that happened, then that would mean a lot of people who are currently employed, thanks to the altruism of shareholders, could become unemployed. There's also a more significant possibility that those people employed in construction, and remember construction is the third largest employer in Australia, there's a very distinct possibility that those people have less work on. And that's because falling house prices and rising costs make people defer or delay any alterations and additions that they might have conducted on their properties. And so it's significant to think about, or important, rather, to think about the possibility that we get rising unemployment from those sectors of the economy that are being funded by altruistic shareholders, those who have previously had very cheap money or free money to access to be able to fund startups, venture capital and private equity. Or there's a possibility that we see unemployment rising amongst those people in the construction sector. Now, thinking through the transmission mechanism of that, if that happened, then we would get a much more significant decline in economic growth, and then the possibility of a recession goes up. But as I said earlier, in the absence of a recession and in the absence of a financial crisis, and I don't think any of those two things are very likely right now, then we're in a situation where we've had indiscriminate selling, pushing P/E ratios very, very low, and that of course means the possibility of better returns in the future. So if indiscriminate selling gives way to more discerning buying, we'll get an expansion of P/Es again, and that will increase the return available, that would normally be available, rather, just from the earnings growth. So my suggestion now is to start dipping your toe back in. It's not a recommendation of course, but it's something that I'm doing myself. I don't know whether prices will rise from here or continue lower. It could be that the rest of my peers in the market are absolutely correct and we get another leg down. I just don't know. But I do know that there are some mouthwatering opportunities already appearing, and rather than try and predict what prices are going to do next, I'd rather start filling my portfolio with wonderful businesses at rational prices. That's all I have time for today. I look forward to speaking to you again next week, and in the meantime, please continue to follow us on Facebook and Twitter. Speaker: Roger Montgomery, Chairman and Chief Investment Officer Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

5 Jul 2022 - What happens to disruption during a recession?

|

What happens to disruption during a recession? Loftus Peak June 2022 A recession is commonly defined as two consecutive quarters of real GDP decline. It is characterised by falling economic activity, increasing unemployment and decreasing consumer and business confidence: with both groups being more cautious in their spending. Investment spending also slows. The GFC, between mid-2007 and early-2009, was exceptionally bad on all of these metrics, resulting in a significant fall in share markets - the previous peaks of which were not recovered for another five years. And yet, over those same five years, many disruptive companies outperformed the S&P 500 (quite significantly in some instances). How could that be? Over the five years it took the S&P to recover its 2007 high, Netflix's share price grew +731%, Amazon +180%, Apple +164%, Alphabet +30% Source: Bloomberg Then, as now, there were a number of key disruptive trends working their way through the economy. Smartphones were becoming ubiquitous, e-commerce was in its infancy but growing strongly, online advertising was taking hold and streaming was beginning to benefit from faster download speeds. The simple answer is that the disruptive trends benefiting these companies were a greater force relative to the economic headwinds they faced. E-commerce and Amazon For many decades, retail was a story of growing concentration, housed in a physical structure of some kind, from the early day 'mom-and-pop' shops to shopping centres. However, it was the advent of the internet in the 1990s that brought with it the ability for consumers to browse and shop online, a much more convenient solution. Even with logistics networks that were not yet properly built out, e-commerce took market share from brick and mortar retail each year. E-commerce's share of retail in the US still grew at the depths of the GFC between 2007 and 2008 (3.5% and 3.6% respectively), and the trend accelerated to the point until today (aided by superior logistics networks and same day delivery). E-commerce as % of Total Retail Sales in the U.S. Source: U.S. Department of Commerce Online Advertising and Google There was also significant change underway within the advertising industry at the time of the GFC, fuelled by digitisation and the changes to consumer behaviour that it brought about. Time spent online increased, so advertisers needed to follow. This time, however, companies placing advertising had granular targeting capabilities the likes of which were never available for traditional media such as newspapers, magazines, radio and linear television. Once again, a better, more efficient solution had arrived. So while the global market for advertising declined significantly during the GFC (almost -10% in 2009), market share within the industry tells a very different story. % of Total Advertising Revenue by Category (Global)

Source: Magna Some of the more inefficient means of advertising, where reach (the number of people who saw the advertisement) was also suffering, experienced declines of almost -20% at the low of the GFC (linear TV was the only exception, largely a function of increasing - but peaking - growth in pay TV households). These types of advertising never recovered. Meanwhile, online advertising grew +5% at a time when many businesses didn't know whether they would trade the following week. Online growth did slow from +20%, but given the overall market for advertising declined -10%, it resulted in some very large market-share gains. Streaming and Netflix There was also an interesting dynamic occurring in the lead up to and during the GFC in the entertainment industry. Pay TV households in the US were still growing, but streaming was also becoming an increasingly appealing option. It was a new and better way to consume content from the largest and best studios, although often with a slight delay, but without the $100-200/month price tag of cable. That it was a better solution was often lost on those working at incumbent entertainment companies. The head of Time Warner Jeff Bewkes famously stated in 2010 that Netflix was not a threat to media companies and that it was "a little bit like, is the Albanian army going to take over the world? I don't think so." We know how that played out. During the GFC Netflix managed to grow from 7.5 million subscribers to 20 million subscribers by the end of 2010 (a respectable +39%, 3-year subscriber compound annual growth rate). Netflix Subscriber Growth from Inception to 2021 Source: Company Filings Smartphones and Apple The iPhone was launched at the beginning of 2007 and arguably kick-started the mobile revolution (although it wasn't the 'first' smartphone). The product launch came just a few months before early signs of financial stress and at a time when Nokia was king of the mobile market, with market share of almost 50%. But the iPhone was different. There was no stylus or keyboard, it provided access to the open internet in a way that smartphones of the past didn't and there was soon an app for anything and everything (especially functions previously performed by other devices). It was simply a better solution than its predecessors and it was because of this that Apple grew its iPhone sales from nothing in 2006 to 4 million in 2007 and 48 million by 2010. It wasn't just Apple iPhone sales either - smartphone sales showed significant growth, despite higher price tags and severe economic weakness: Number of Smartphones Sold to End Users Worldwide from 2007 to 2021 Source: Gartner There are many new disruptive trends happening right now that are unlikely to change course in the face of economic headwinds. Carmakers aren't going to go back to making more internal combustion engine vehicles, nor are they going to cut back on safety features like advanced driver assistance or digitised infotainment (all of which is powered by semiconductors). Business aren't going to turn back on their digital transformation plans. They certainly aren't going to cut back on their cybersecurity budgets either.

Funds operated by this manager: |

4 Jul 2022 - Where to from here? Tips to dodge the noise

|

Where to from here? Tips to dodge the noise Spatium Capital June 2022 Over the years, Spatium Capital has written about and been interviewed on many topics - the Russian invasion of Ukraine, the Omicron strain, the Delta strain, lockdowns, the rise of ESG investing, Donald Trump, the yield curve inversion…the list goes on. Whilst the famous saying goes, 'there's only two certainties in life; death & taxes', we would argue there's a third overlooked certainty; perpetual worry in the financial markets. Whilst empirical evidence has highlighted time and time again that markets do rise over the long term, and that short-term dislocations are often (not always, however) the best time to invest or start a business within a given market, the ever-present knot exists within each of us - "what if we are wrong, and everything goes to ruin?" Central Banks have played a considerable role in wrapping economies in 'cotton wool' since the Global Financial Crisis (GFC) and more recently throughout the COVID pandemic - perhaps they've even appeased many knots in stomachs. As we once commented, central bank policy has evolved considerably over the last few decades to develop and implement new monetary policies that are reflective of the shifts in modern society. Evidently, the support for these policies can be seen in the outcomes. The most recent monetary responses have led to, as an economist might say, minimising 'deadweight-loss'. That being, when supply and demand are unbalanced, a deadweight loss is a cost to society. Prime examples of this were the central bank interventions during the GFC which protected many of the world's largest interconnected investment and retail banks (and their balance sheets) from triggering a domino effect of collapses and subsequent job losses. The recent COVID-19 era also saw both fiscal and monetary policy pump trillions of dollars into the system with the view to protect businesses and people's livelihoods from collapsing under the financial strain of being forced to stay home. Arguably, both of these central bank responses minimised the amount of deadweight loss in the system, despite 'true' capitalists asserting that by intervening in the natural flow of capitalism, central banks had only deferred these problems to a yet-unlived future. A problem which we appear to now be living through.

S&P 500 annual returns since 2000 - an annual return of 7.1% over the 21 years. Is it then fair to criticise central bankers for fuelling the current monetary environment, given that when they were tasked with deciding how to respond to COVID-19 (which at the time was an unknown-unknown) their most recent precedent was the GFC? Despite the material differences between both the GFC and COVID-19, both had the potential to collapse the financial system on which we all so heavily rely. So, perhaps the response was warranted. However, the current discourse seems to be arguing that central bankers have allowed 'loose' monetary policy to continue long past its due date, thus leaving society with the threat of persistent inflation, continual demand exceeding supply, and interest rate rise that may cripple those who overexposed themselves to a cheap-debt market. With the above being said, defending or recusing central bankers is not our focus nor within the bounds of where we believe we add value. Rather, we have found that as the months have become years, the one guarantee we are almost prepared to give is that when new "unknown unknowns" enter the macro news cycle, you can almost always expect an overreaction. At its inception, the unknown-unknown nature of the pandemic was so unpredictable that it was unlikely to be solved using logic or predictive algorithms. If we consider a less destructive situation, logic or predictive algorithms have a great deal of difficulty trying to predict how many meals a restaurant may serve on any given night, or what time patrons will arrive. This is because the number of variables and potential decision-tree options associated with this task is so diverse that it is almost impossible to be correct. Bringing this logic back to finance, consider how an algorithm might forecast retail, wholesale, and institutional investors' response to a black swan event such as the pandemic. If we thought dinner choices had a lot of variables, investor decision-making might just break the algorithm. Taking it a step further, now introduce the most recent geopolitical challenge, and add an Australian federal election. Central bankers may be forgiven for leaning towards the accommodative stance taken. The beauty about unknown-unknowns is that they personify disruption and despite best efforts or claims made by 'experts', none will see them coming. So, if the third certainty in life is that there will always be a perpetual worry in the financial markets, (you just need to pick the topic you want to read/worry about - as we've shown with our take on Central Banks) we have learned and encourage our readers to consider some general principles to reduce said worry:

Author: Nicholas Quinn |

|

Funds operated by this manager: |