News

28 Jul 2022 - Markets muddle through the five stages of grief

|

Markets muddle through the five stages of grief Jamieson Coote Bonds July 4 2022

As the second quarter ends, investors are licking their wounds from negative asset returns as policy withdrawal corrodes asset values around the world. Investor sentiment has swung wildly throughout the year but now seems firmly entrenched in Kubler-Ross's famed five stages of grief - denial, anger, bargaining, depression and acceptance. Make no mistake, things do not look good in the near term for economies as central banks raise rates the world over, lifting interest servicing costs and reducing discretionary spending. Bond markets have already priced in the most substantial and violent rate hiking cycle in generations - far beyond the 2.5 per cent US Federal Reserve rate hiking cycle peak of 2018 that crashed the corporate credit markets (and ultimately the equity market). As investors are entering the bargaining phase of grief, perhaps there is some glimmer of hope emerging, as inflation data and the inventory cycle (the bullwhip effect) can help ease the pathways into 2023. It is very likely there will be some depression as the markets continue to adjust (illiquid assets need to play rapid catch-up to listed assets) and finally an acceptance that our new geopolitical world order requires a vast recalibration of energy and labour markets that will have far-reaching effects, add risk premia to asset classes in higher volatilities and crimp the lofty growth valuations seen in the last cycle. Government bonds led asset underperformance, correctly signalling tougher times ahead for the economy as reopening inflation was turbocharged by the Russia-Ukraine conflict and further China lockdowns. Early in the year, many investors seemed in ''denial'' that markets could fall abruptly, despite the early warning signs from the bond market that funding interest rates would be moving significantly higher, tightening the economy at significant pace despite the economy opening the year in great health. No doubt significant ''anger'' has been experienced as many risk assets followed the lead of bonds over the second quarter, playing catch-up and slingshot in a spectacular fashion (the US Nasdaq is now down 29 per cent). The cult of crypto has been forced to stare into the abyss and contemplate life without self-reinforcing feedback loops, amid nasty infighting among the tribal communities. Australian equities have thankfully been well insulated from larger global declines to date, thanks to heavy commodity exposures which have outperformed significantly so far in a supplyconstrained world. This requires some investor consideration should growth fall substantially, as commodities can flip from leader to laggard very quickly despite supply constraints - in the Global Financial Crisis of 2008, oil fell from $140 a barrel to $44 in a matter of months. Are we somewhere around the ''bargaining'' phase currently - looking for pathways that can deliver a soft economic landing? There are certainly signs that goods inflation has significantly abated in the US - major retailers such and Walmart and Target have reported a surge in inventory accumulation and expect consequential goods discounting as a result. Supply lines are healing, and freight costs have fallen - this is known as the ''bullwhip'' effect, where inventory can flip from deficit to surplus almost instantaneously. Many businesses perhaps over-order inventory, knowing their order may be scaled back, but as supply lines heal one day the entire order arrives and they find themselves overstocked, leading to poor inventory turnaround times. This may also be the result of changing consumer demand, but either way discounting occurs and inflation pressures ease as a result until the excess inventory is cleared to restore equilibrium. This should help inflation begin to moderate, along with a more stable energy complex (oil peaked at $US130 after the outbreak of the Russia-Ukraine conflict; now $US106). However, services inflation is still expected to rise in the near term, leading to an ongoing, volatile series of outcomes in the inflation data. We expect that inflation will moderate over the balance of the year which will help central bankers find a change of narrative towards a ''pause'' of policy from the highly restrictive settings they are currently embarking upon. Sadly, while this improvement in inflation will help lift the angle of decay, we still have some difficult times to navigate as interest rates rise over the balance of the year, as expected by the bond market which has fully priced these expected outcomes. And so the ''depression'' phase may remain ahead as a ''pause'' of policy may help alleviate the declines, they will not bring back the financial asset lunacy of 2021 (anyone for a digital ape drawing for a few hundred thousand?). Assets are finding new valuation ranges for a post-Covid geopolitical world. This is probably a world where inflation can oscillate from inflationary (supply disruptions from war) to disinflationary (capitalism solves the problem) as secular forces clash and government policy stimulates or destroys demand, chasing inflation mandates. Investors must finally find ''acceptance'' that the pandemic uprooted a rule-based system, led to the great resignation, accelerated working from home - essentially it threw the economic and social jigsaw puzzle into the air and pieces have landed all over the place. Incredible government policy saved economies from their stark realities at that time, but the entropy of that volatility has returned and will leave us with a more unstable world. Part of that acceptance will be to realise that asset allocation is paramount for investors, who will be reminded that some equity is worthless, some dividend policies are best endeavours only, some credit will default, and many boring and and conservative assets play a critical role. In combination, strong and diverse asset allocation will generate good outcomes through the uncertainty we continue to face. Contractually and legally binding bond coupons from highly rated governments are close to certain for income investors (unless you think the governments will not exist in time to repay you). They might find growing acceptance in a world where the only certainties are death and taxes. |

|

Funds operated by this manager: CC Jamieson Coote Bonds Active Bond Fund (Class A), CC Jamieson Coote Bonds Dynamic Alpha Fund, CC Jamieson Coote Bonds Global Bond Fund (Class A - Hedged), CC Jamieson Coote Bonds Global Bond Fund (Class B - Unhedged) |

27 Jul 2022 - Consider the evidence for long term returns

|

Consider the evidence for long term returns Glenmore Asset Management June 2022 Market commentary June was a very weak month for equities globally, driven by continued investor concern around the quantum and pace of interest rate increases and a weakening US (and global) economy. Central banks (correctly in our view) appear committed to reducing inflation via aggressively increasing interest rates, even if it means reducing economic growth in the short term. In the US, the S&P 500 was down -8.4%, the Nasdaq fell -8.7%, whilst in the UK, the FTSE fell -5.8%. In Australia, the All Ordinaries Accumulation index fell -9.4%, whilst the Small Ordinaries Accumulation index was down -13.1%. On the ASX, the best performing sector was consumer staples, whilst resources was the worst performer, impacted by lower commodity prices and growth concerns regarding the Chinese economy. The underperformance of small/mid cap stocks vs large cap is not a new situation and has indeed occurred in all of the months in the last five years where the ASX has seen large falls. Whilst we agree that inflation, interest rate rises and weakening economic growth are all valid current concerns for investors, we also believe the falls in stocks across the board have been quite material and hence from a stock specific basis, there are now some very attractive investment opportunities for investors willing to take a 2-3 year view. As always during periods of market stress, it is very important to take a long term view and think about how long the current negative conditions will be in place over the medium term. Whilst concerns around an economic slowdown are warranted currently, we believe in 12-24 months time, this risk is likely to have reduced as central banks are further down the path of interest rate hikes. It is also important to remember that on average, bear markets last for 12-15 months, hence the current challenging conditions will not be in place permanently. Also, we would stress over the next 12- 18 months, whether Australia and/or global economies actually have a recession is not the key issue (even though it will generate a lot of media discussion). Rather for investors in the Fund, the key issue is the investment opportunities that are thrown up from the sell-off in equities, that can provide the basis of investment returns over the next 3-5 years. It should also be noted that as the stock market is very forward looking, stock prices historically fall well ahead of any economic downturn, in particular small/mid cap stocks on the ASX. Funds operated by this manager: |

26 Jul 2022 - 10k Words

|

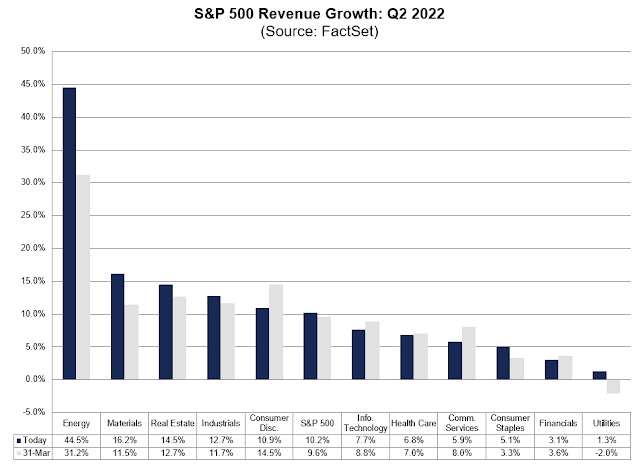

10k Words Equitable Investors 11 July 2022 Revenue multiples have returned to pre-2020 levels for high growth software companies, based on Octahedron's index. The downturn in valuations was accompanied by a 23% year-on-year decline in March quarter VC funding for late-stage and technology growth funding, crunchbase calculated - although it found seed and angel investment held up better, growing 9% year-on-year. The Information found VC firms buying listed tech stocks, meanwhile consensus data from FactSet shows the tech sector is not expected to have been among the strongest growth areas of the S&P 500 in the June quarter - energy and materials stocks have the most expected of them. Kailash Capital shows that price growth for the S&P 500 in the 2017-2021 period has doubled the long-term average return. Finally, Bloomberg charts the rise of self-employment in the US. Octahedron Growth Software Index (EV / NTM Rev) Source: Octahedron Global Venture Dollar Volume by quarter Source: Crunchbase Global Seed and Angel Investment by quarter Source: Crunchbase VC Firms Buying Publicly Listed Shares Source: The Information S&P 500 Revenue Growth Expectations Source: FactSet S&P 500 historical average returns Source: Kailash Capital Americans increasingly shifting to self-employment Source: Bloomberg July Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

26 Jul 2022 - How quickly will central bankers change their tune?

|

How quickly will central bankers change their tune? Eley Griffiths Group July 2022 The downward trajectory of global equity markets continued in June as central banks displayed a willingness to hike rates aggressively in the near term to fight inflation. This hard stance increased concerns of a swift contraction in global economic activity. The US Fed delivered a 75bp rate hike in June, the largest rise since 1994, after May's CPI accelerated at the fastest rate since 1981 (8.6%). Chair Powell signalled another large hike in July to fight inflation "expeditiously." Likewise in Australia, the RBA surprised markets with the largest rate hike in 22 years (50bp) to bring the cash rate to 0.85%. Small resources retracted by 22% on weaker commodity prices and shrinking demand concerns. The price of copper, a 'bellwether' for the economy, dropped below $US8000 for the first time in almost 18 months and is now down 17% year to date. Developers and explorers were sold off more heavily than producers, albeit no one was immune. As a slew of earnings downgrades and profit warnings started to build momentum across the market, outperforming in the month were defensive portfolio holdings. Litigation financer Omni Bridgeway (+5%) highlighted the benefits of being uncorrelated to the broader economic environment at present, as well as announcing the launch of an 8th Fund. With signs of economic fragility proliferating, investors finished the month speculating how quickly central bankers will change their tune. Last week, the closely watched Atlanta Fed's GDPNow estimate of real GDP was slashed to -2.1% in the second quarter, highlighting the prospect that the US economy may already be in recession. As a result, bond markets are now trimming their expectations for future rate hikes and investors are betting the deteriorating consumer and business confidence will be enough for central bankers to call a pause or slow their hiking cycle. Funds operated by this manager: Eley Griffiths Emerging Companies Fund, Eley Griffiths Small Companies Fund |

25 Jul 2022 - The Long and The Short: Finding solace in the short

|

The Long and The Short: Finding solace in the short Kardinia Capital 08 July 2022

|

|

As stocks have wobbled, investors have bemoaned having no place to hide - not even in gold. June alone saw the market fall a whopping 8.97%.

However, short positions across key sectors such as lossmaking, high multiple technology and consumer discretionary stocks seem to be strong contributors to relatively solid fund performance. Inflation sticksMeanwhile, the Australian CPI surged 5.1% for 12 months to 31 March this year, and the US CPI rose 8.6% for May year on year, potentially moving towards levels not seen since 1970-1980. And while last year central banks and economists were calling for the inflation spike to be transitory, the pathway of inflation over the last 18 months has been anything but. Inflation tends to be stickier than imagined.

Source: Bloomberg Of course, the message can change over time, but futures markets are currently forecasting a 170bps increase in US and Australian rates by December.

Source: Bloomberg

Source: Bloomberg It's often said the central banks will keep pushing until something breaks. The only way interest rates will not follow that trajectory is if US summer economic data is so weak that a pause in hikes is considered, which is becoming more likely by year's end. The risk for marketsIf the futures markets are correct, homeowners will see a significant increase in mortgage repayments by December. The RBA's 50bp rate rise in June woke many people up, and the domestic housing market is already coming under pressure. The biggest risk for markets is whether the US enters a recession. If it does, S&P500 could fall another 15% - which would have an impact on Australia. If not, the falls will be more modest. In the global economy, wage pressure continues to build as the consumer is squeezed by higher costs of everything, from rents to fuel. We believe high debt levels make the global and Australian economy particularly vulnerable. The current level of inflation likely also explains why consumer confidence is falling, and it's pushed the University of Michigan index just below record lows. Consumer confidence is a key driver of consumer consumption, which drives around 70% of the US GDP.

Source: Bloomberg Heading for recession?Every recession in the past 40 years has been preceded by an inverted yield curve, and the yield curve inverted in early April. Looking historically, the time interval between inversion and recession averages about 10 to 12 months. The US Fed needs to slow demand and can only do so by delivering "shock therapy" - by impacting consumers' wealth (via stocks and house prices). The Fed will take every rate rise the market gives it, but at the end of the day raising rates is a blunt instrument. It's rare for central banks to engineer soft landings, particularly when inflation is above 5%. So, we believe the US is headed for a recession. This view runs somewhat counter to consensus. Until recently, most US economists had been suggesting there were no signs of a slowdown in US economic data, but the stock market indicates otherwise. There's also, of course, an unwind of the central bank's balance sheet, which started this month in the US. The expansion of central bank balance sheets has inflated share prices in multiples since the GFC. It stands to reason that the opposite is also true. Federal Reserve Chair Jerome Powell's mandate is to tame inflation. We're very early along the tightening journey - we've only had three interest rates rises so far, and the pain may be ahead of us more so than behind us. Although, it's way too early in the rate hiking cycle to think about fighting central banks.

Source: Bloomberg Our outlookWe're long some defensive businesses, including Bapcor, Tabcorp and The Lottery Corporation. Auto parts are generally essential for car maintenance, while lottery tickets have proven to be very defensive during recessions. The market wants current earnings, not future long-dated earnings, and certainly not loss makers. Loss makers have no valuation support and 17% of ASX300 are loss makers (even if some are temporary like FLT, WEB). Some don't even have any significant revenue. This basket is where we are hunting for short ideas. We're short high multiple stocks - those with long earnings duration and loss makers. Of course, a constant risk for us is "bear market rallies" - these can be violent, so we're cautious of being too aggressive in our short book. We haven't seen the capitulation yet. It is worth noting Cathie Wood's beaten-down ARK Invest is still seeing inflows, even though ARK is off c.60%. This shows investors are still looking to buy the dips. The MSCI AC World 12m forward PE has derated from a peak 20x to 14x. However, global equity markets do not yet look especially cheap against history. For example, a drop to the 10x multiple seen during the 2011-12 Eurozone crisis would imply another ~30% derating. We'll be watching the economic data closely, with a particular focus on inflation, bond yields and whether central banks are forced to pause their tightening due to economic damage. |

|

Funds operated by this manager: Bennelong Kardinia Absolute Return Fund |

|

The content contained in this article represents the opinions of the author/s. The author/s may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the author/s to express their personal views on investing and for the entertainment of the reader. |

22 Jul 2022 - How much would higher immigration rates help equity markets?

|

How much would higher immigration rates help equity markets? Montgomery Investment Management 05 July 2022 In this video insight, Roger discusses how the fate of equity markets now hinges materially, but not solely, on the employment picture and the how central banks navigate the very serious choice they have to make between inflation or recession. Transcript Roger Montgomery: Immigration. It's the most convenient solution to the wage pressure now being felt across the developed world, the pressure that could entrench inflation through a wage/price spiral. You may have noticed, hoped-for immigration is not ramping up. From the UK, to the US, New Zealand and here, the world is awash with jobs and nobody to fill them. Consequently, business are forced to pay more, workers and unions are demanding more, and already high supply-led inflation justifies the demands for growth in real wages. So, what happened? Well, you might remember during the worst part of the COVID pandemic, Australia was one of many countries that offered fiscal support to those out of work or underemployed. Here in Australia it was JobKeeper that kept the economy humming. Temporary visa holders however, including international students, and casual workers who hadn't been employed for 12 months were notably excluded from the program. More than a million people in Australia were on temporary visas and they were excluded from the government's support payments; that's about 500,000 international students, 140,000 working holidaymakers, 120,000 skilled temporary entrants, 200,000 bridging visa holders (who were largely partner visa applicants or asylum seekers), and more than 16,000 temporary protection visa holders (commonly referred to refugees). In the absence of support many simply went home and many of those may not want to return. Meanwhile, those that do want to return, or visit for the first time, face egregious airfares thank to limited airline capacity and international air travel operating at about 40 per cent of pre-pandemic levels. The longer the situation persists the sooner inflation ceases being solely a supply chain issue - out of the control of central banks - to a more endemic demand-led issue central banks will be forced to act on more harshly to control. The fate of equity markets now hinges materially, but not solely, on the employment picture and the how central banks navigate the very serious choice they have to make between inflation or recession. The US Federal Reserve is very focused on inflation which is currently at 8.6 per cent. Just recently, The Federal Reserve's Chairman Jerome Powell said it will not let the economy slip into a "higher inflation regime" even if that means raising interest rates to levels that put growth at risk. The U.S. central bank has moved to a do-whatever-it-takes approach with Powell saying "The clock is kind of running on how long will you remain in a low-inflation regime … The risk is that because of the multiplicity of shocks you start to transition into a higher inflation regime, and our job is to literally prevent that from happening and we will prevent that from happening". Thanks to that very tight labour market, demand remains strong and supply chains cannot cope. Consequently, what was previously thought of as being transitory inflation, is becoming entrenched. Higher wage demands come next and following that…a wage price spiral. A slowing economy is necessary to bring down demand, and a recession, in particular for the US and Europe, may be unavoidable as the US central bank leans towards killing inflation at all costs. Meanwhile the liquidity that was injected into the financial system and economy during the pandemic is being withdrawn. US QT 'officially' started in June, but the 'effective' global balance sheet has already shrunk by US$1 trillion since December 2021. In such an environment - money literally being sucked out of markets - it is difficult for asset prices to rise materially or sustainably. And none of that addresses heightened geopolitical risk or a potentially collapsing Chinese economy. Great returns come from buying at low prices and I have presented widely elsewhere on the blog about the arithmetic of investing in growth amid compressed PEs. It may just be that even lower prices are possible. Speaker: Roger Montgomery, Chairman and Chief Investment Officer Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

21 Jul 2022 - Enduring the downturn

|

Enduring the downturn Cyan Investment Management July 2022 |

|

It will be of no surprise (or joy) for readers to hear that market conditions deteriorated significantly from May with indices across all asset classes and geographies diving into the end of the financial year to 30 June 2022.

Outlook

We have been investing for many decades and we know that the best time to invest is when the market is at peak panic. Of course, this is not always easy to do, nobody rings a bell at the bottom, but from what we're seeing and hearing, our company outlooks are far better than the market prices are currently implying and as such we remain particularly confident that the prices of our holdings will improve significantly in the near-term. |

|

Funds operated by this manager: Cyan C3G Fund |

20 Jul 2022 - The nature of a commodity boom

|

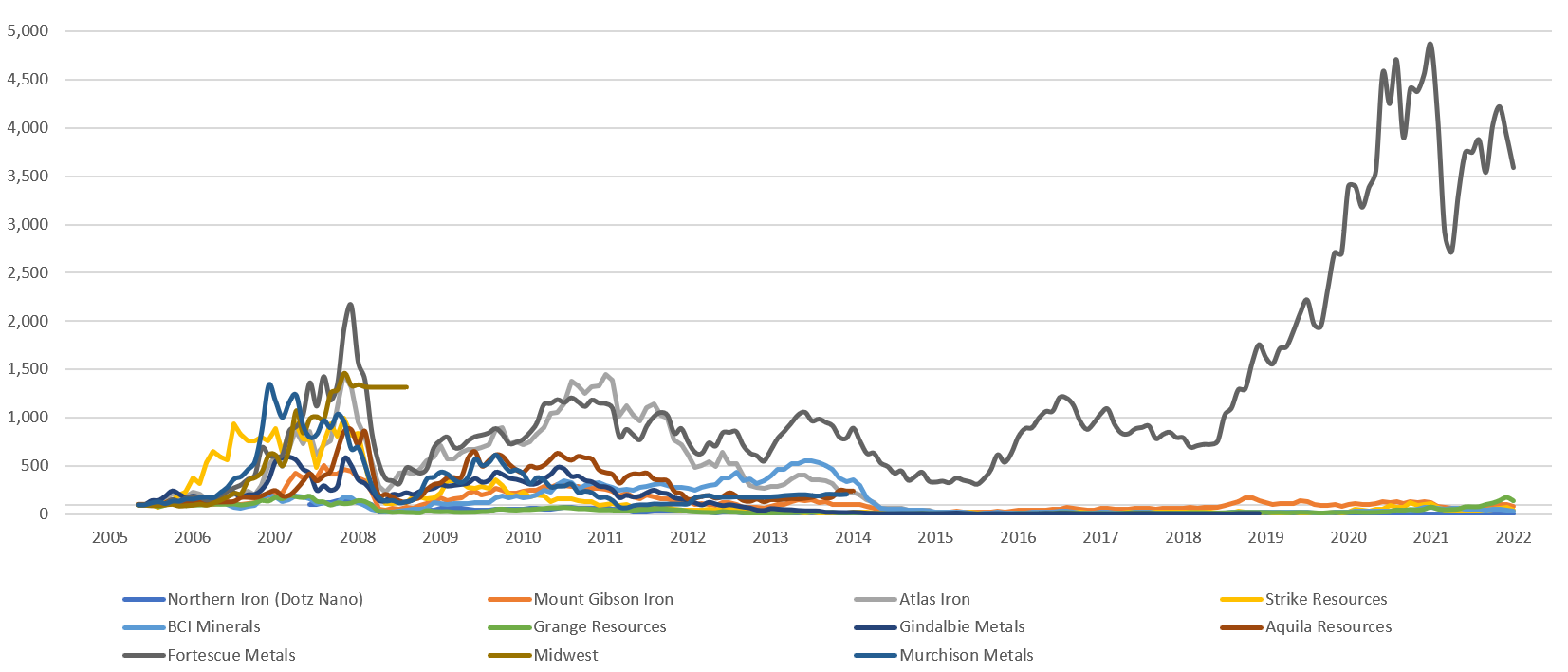

The nature of a commodity boom Eiger Capital July 2022 Speculation in commodity prices and the wave of hype that comes with it is not a new concept. Over the past few hundred years, there are many accounts of the rise and fall of a commodity's price fuelled by speculation and the promise of great profits in short-term trading. Eiger has a team favourite - Tulip Mania. We see this recurring pattern of market behaviour and have used it as a reminder as we follow the current market. Over the last 12 months, we have seen a huge rise in lithium and rare earth prices (which we categorise as advanced materials) following increasing demand for renewables and electric vehicles. We see clear parallels between the market now and the market for iron ore in 2006-2008 as China embarked on massive infrastructure spending. Let's set the scene for our comparison in the early 1630s when conditions in the Dutch republic were prosperous and increasing commercial optimism drove significant economic growth. The price of a single bulb for a desirable Tulip variety could cost the equivalent of a small townhouse in Amsterdam. By the mid-1630s, a strong market for Tulip trade existed within the Dutch Republic on news of rising demand and prices for Tulips in Paris. During late 1636 and early 1637, before planted Tulip bulbs had begun to sprout for spring, prices of Tulips of all varieties began to soar. First, the rarest, most sought-after varieties promising the greatest bloom climbed, but varieties of all shapes, sizes, and quality followed soon after. A Gouda bulb climbed from 20 to 225 guilders, the Generalissimo variety from 95 to 900, and the Yellow Croenen from 20 to 1200 in just a few weeks - the equivalent of 1 month's wage up to 5 years' wage. Credit agreements were formed for delivery of the yet to emerge blooms based merely on the prospective bloom of a bulb of a given size, weight and variety. On 3 February 1637 as spring neared, the Tulip market collapsed suddenly and agreements were torn up. In the years following Tulip Mania, prices of the most desirable varieties eventually returned to their pre-mania levels whilst lower quality, unknown and undesirable varieties never recovered. Those awaiting a healthy payment in the spring of 1637 were left empty-handed. We can't help but take some insight from Tulip Mania and the years that followed. And then the shift to iron ore…Are there parallels with iron ore from 2006 through to 2008? As the world economy continued to recover and grow after a significant disruption in the early 2000s, China began to emerge with significant expansion and an insatiable demand for iron ore to fuel a growing steel industry. Demand continued, main Australian players BHP (ASX: BHP) and Rio Tinto (ASX: RIO) were unable to meet demand, iron ore prices climbed, and new iron ore projects began to surface as they became economically feasible. Of these prospective projects, Fortescue Metals (ASX: FMG) is one that stood out due to its relative simplicity, infrastructure, sheer scale and cost-effectiveness. In 2008 the global financial crisis hit creating significant headwinds and undermining the stability of lenders and the availability of credit. Speculator confidence fell, as did equity prices and therefore miners' ability to raise capital through equity. Only those with strong, pre-existing backing were able to secure the necessary funding to continue their projects. With demand continuing to exceed supply Fortescue was able to complete its project and go on to profit immensely. The timing was everything. As you will see charted below, most projects, however, did not fare so well… Iron Ore (indexed from 1st January 2006)

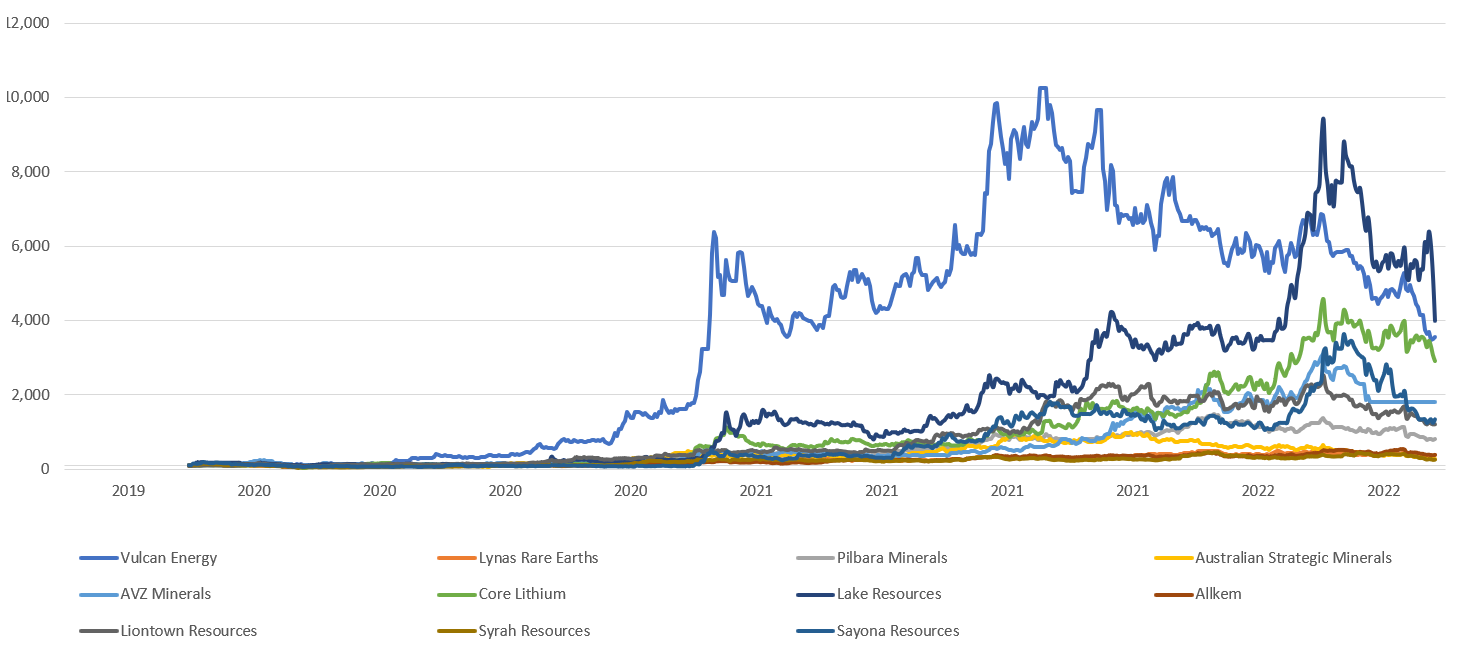

"They have dreamed out their dreams, and awaking have found nothing in their hands" Using January 2006 as an index base of 100, our iron ore aggregate of 11 stocks grows to a peak of 902 (average indexed value of all 11 stocks) by the end of May 2008. Murchison hit an indexed peak of 1340, Atlas 1457, and Fortescue 2167. During mid to late 2008 when the GFC hit, equity markets declined significantly, and debt markets froze. All these companies were in the early stages of their development. Even Fortescue which was in production by now fell using this index to a value of around 350. This still represents a more than 200% return for investors from the start of 2006 but also an 85% decline in 6 months. The timing of the takeout of Midwest could not have been better for Midwest shareholders. In late 2008 China implemented a massive infrastructure program to boost the economy in the wake of the GFC. This lifted our index to around 430 by the middle of 2011. The Atlas Iron share price also lifted significantly during this period. However, we remember well the differences between Fortescue and Atlas during this period. Atlas continued to contract mine the Wodgina iron ore deposit and truck ore to Port Hedland. The Wodgina deposit was never large nor high quality. The company was, however, able to generate significant short term cashflow by taking over the road, camp, and electricity infrastructure from the mothballed Wodgina tantalum mine and avoid heavy investment. Port facilities were also rented. Atlas was never able to repeat this outcome at another location. Infrastructure investment to lower operating costs was never forthcoming. Atlas was ultimately purchased by Hancock Prospecting in 2018 for approximately 1/100 of the peak share price (adjusted for share issues). Atlas, we believe, is a metaphor for the emerging iron ore sector from 2004 onward. Fortescue achieved profitable production with infrastructure and scale, paid down debt, and was then sustainably profitable enough to keep re-investing. It raised significant amounts of capital very early in the China boom when the markets were willing to provide it. Fortescue also got a large amount of infrastructure built before costs in Western Australia rocketed upward in the face of massive LNG investment post-GFC. Atlas and its peers could only make a profit when prices are high. They never managed to thread the needle to achieve lower costs and sustainable cash flow at scale. Fortescue was completely different. It had invested heavily in its own rail and port infrastructure and achieved significant economies of scale by investing the windfall profits it made during this period. It achieved scale economies that have stood the test of time and enabled it to generate the required cash flow to expand infrastructure and the number of mining provinces. It was also able to generate the required profits and free cash flows that allowed it to replace its initial contracted-out mining and crushing operations with its own mining truck fleet and crushing facilities. It now had the freedom to use its strong free cash flow to invest in further capital facilities that lowered its unit operating costs. Ultimately iron ore prices fell from their peaks and all the prospective (i.e. higher unit cost) junior miners either failed or returned to being producers at small volumes with barely sustainable profits. As the chart below highlights, they have all basically disappeared whilst Fortescue now has a market capitalisation of over $50bn. Global Iron ore supply, which was dominated by 3 very large producers prior to the China-led demand boom of 2006 onward, is now dominated by 4 including Fortescue. "A rising tide floats all ships, even the most unseaworthy" ...And finally to advanced materials.During 2021 and the first half of 2022 we have seen a significant rise and fall in the share price of companies with advanced materials mining projects. Early this year there was a sudden surge in the prices of several Australian listed companies that claim 'tier one' or 'world class' opportunities in the advanced materials mining space. This surge has also been associated with many of these companies being included in the S&P ASX 200 index for the first time. Most of these companies, however, have yet to mine a single ton of ore. Ironically it is these companies that have surged the most. EV manufacturers Tesla and Ford have recently engaged prospective lithium projects directly to set up off-take agreements in the hope of securing potential new supply before competitors - others are starting to follow their lead. When considering a potential investment in an advanced materials company, during the current boom we look for, among other factors, one key feature - whether the company is currently mining and processing ore. Like Fortescue in 2008, the heightened interest in advanced materials is now 3-4 years old. The boom is well underway. In the chart on page 5, of the 11 companies we've used, there are only 3 companies that mine, process ore and generate sales (Pilbara, Allkem and Lynas). The rest of the group claims to be at best 1-2 years away from producing any material from a variety of methods such as evaporation of lithium salts from ponds, rare earths as a by-product of mineral sands processing, open-pit mining, underground mining, and even processing of mud containing lithium. Each method has its own benefits and challenges impacting cost, reliability, and scalability. Post-concentration processing of rare earths in particular is very complex. Many projects are in politically very unstable jurisdictions and could face significant environmental, and modern slavery scrutiny from prospective clients. Large auto manufacturers are very protective of their brands and will not want child labour contributing to a hundred-thousand-dollar car. Irrespective of the method, most of the 11 companies are faced with the challenge of pre-production projects to commission infrastructure that will facilitate production. Under normal conditions, commissioning scalable operations is no easy feat and in our experience is rarely completed on budget or on time. In 2022, many companies are faced with labour shortages compounded by disrupted supply chains causing materials shortages and cost inflation. In a June 2022 update from Dacian Gold, we learned that their operating costs had increased 50% in the preceding months, a figure echoed by other gold producers, St Barbara and Evolution Mining. St Barbara highlighted that this issue is not just limited to Western Australia. Ignoring the challenge of securing necessary labour to carry out these projects, and the difficulty in securing materials and equipment, a 50% increase in costs is a significant challenge to proposed project plans and feasibility studies. In the current environment of cost inflation, subdued capital market conditions, and increasing interest rates, obtaining additional funding to meet project targets is likely to be increasingly difficult. These companies must endure winter before they can harvest in spring. We believe that conditions have now replicated the LNG and iron ore investment boom of 2006-2014; Woodside's Gorgon project was never supposed to cost US$40bn and Western Australia lollypop workers were not expected to receive multi-hundred thousand dollar pay packets. With a growing demand for renewable energy generation and storage, and electrified transport, demand for advanced materials has been increasing rapidly. A 3MW wind turbine (key to the renewable energy transition) requires roughly 2 tonnes of rare earth minerals for permanent magnets. In 2021, roughly 31,000 wind turbines were added (~94GW of energy generation) and this figure continues to accelerate. EVs are being ordered at an accelerating rate and require the same rare earth minerals and a significant portion of the global lithium supply. There is a significant deficit in the supply of these materials which is forecast to continue beyond 2030 according to recent research by Macquarie. We see this as a similar mix of factors and positive forecasts to the iron ore market 15 years ago. Yet most companies have disappeared! Despite significant optimism, the price of advanced materials and the enthusiasm of the equity market will likely go through cycles between now and 2030 making the funding and commissioning of new very long-term projects very difficult. The seaborne trade of iron ore is significantly bigger than it was 15 years ago, yet prices and trading conditions have varied significantly over this period. Almost all prospective iron ore hopefuls have gone. These high prices and strong outlook will also attract management and companies more interested in mining the share market as opposed to the ore market. It is often very difficult to know who-is-who before it is too late. Like Fortescue from 2008 onward we believe that 2 companies, Lynas Rare Earths and Pilbara Minerals in the advanced materials space in Australia have "threaded the needle" and have achieved a low unit cost, profitable, scalable position in rare earths and lithium respectively. Both are now generating significant cashflow and can fund ongoing refinements and growth in their operations. Lynas is funding a range of expansion projects in Australia and the US (with significant help from the US Government). Pilbara has just announced a new range of expansion plans including a plan to deploy some of their strong current free cashflow and replace their contracted-out mining and crushing operations with their own mining and crushing fleet. Sound familiar? Just like Atlas discovered, if you outsource all these processes, you are unlikely to make a profitable margin unless prices happen to remain very high after operations commence. We see unfinished projects as now having significant downside from cost overruns and delays in achieving production. We would also note that while we don't regard rare earth and lithium as "bulks" in the iron ore and coal sense and therefore don't require the same scale of rail and port infrastructure, they do present their own unique challenges. Rare Earths are very complex to separate. For example, the Lynas rare earths separation plant in Malaysia has 913 separate solvent extraction processes compared to a typical gold company that has 30-40. Hard rock lithium mining also has its share of difficulties. For one, a particularly hard ore body has its crushing and processing challenges. This is part of the reason why Pilbara chose to use a specialist contract crushing service provider to help derisk the initial commissioning of their new mine in 2018/19. Onsite lithium concentration is more difficult than drill, blast, and ship of iron ore. In most equity market and management presentations, the working capital required when mining commences is materially underestimated. Maintaining a workforce often for over a year whilst encountering operational issues and delivering poor-quality initial products is very expensive and consumes cash. Remember during this period any sales are likely to receive significant penalties for off-spec product. Our advanced materials chart below starts on January 1st, 2020 at a base of 100 and the aggregate of 11 companies hits 2599 at the end of March 2022. We note that this rally covers 821 days before peaking and the length of the rally for iron ore was roughly 880 days to the peak. Advanced Materials (Indexed January 1st 2020)

We see peak indexed values in March 2022 of 3500, 4000, 6000, and even over 9000 for individual companies. We would like to highlight the producing companies, Lynas, Pilbara, and Allkem are hidden as relatively flat lines at the base of the chart. From the late March peak, the advanced materials aggregate is down 40%. Lake resources is the worst hit with a 60% fall. We have used project risk as a key factor in selecting our lithium and rare earths investments. Pilbara Minerals and Lynas Rare Earths remain two of the most attractive options given their proven track record of profitable mining, processing and delivering ore in environments of far lower commodity prices. We see unfinished projects as adding significant downside risk to potential investments and employ lessons learned from iron ore companies 15 years ago. In line with Eiger's focus on companies' ability to generate long-term return, we value companies with proven track records of production as most likely to survive a difficult period and deliver returns. Author: Stephen Wood, Principal and Portfolio Manager, Nick Bucher, Analyst Funds operated by this manager: |

20 Jul 2022 - Uncovering value amid the market sell off

|

Uncovering value amid the market sell off Antipodes Partners Limited June 2022 Tech stocks have borne the brunt of the recent sell off in equity markets and with the Nasdaq firmly in bear market territory, it is unprofitable tech stocks that have been hit the hardest - down almost 60% this year. But amid these sell offs, there can be category leaders that fall to attractive valuations, relative to their long-term growth profile. Seagate Technology (NASDAQ: STX) is an example of this today. It's a beneficiary on the ongoing trend around data moving to the cloud as our lives become increasingly connected, and it's priced at just 8x next year's earnings. In this episode, Alison Savas hosts a deep dive into the company. Part one (2:20): Alison interviews Seagate Technology Executive Vice President and CFO, Gianluca Romano. |

|

Funds operated by this manager: Antipodes Asia Fund, Antipodes Global Fund, Antipodes Global Fund - Long Only (Class I) |

19 Jul 2022 - 'Small Talk' - cold, hard data on FY22

|

'Small Talk' - cold, hard data on FY22 Equitable Investors July 2022 We thought we would review the cold, hard data on the financial year 2022 that came to an end on June 30. The data tables paint a clear picture: companies priced on high multiples coming into the year faced a sobering reassessment of their valuations, as did unprofitable businesses; the only safe haven was the energy/commodities complex; small stocks were shunned by nervous investors, and the tech sector was particularly under pressure. The difference between high EV/EBITDA and low EV/EBITDA stocks in our "FIT" universe was the most stark - an 18% differential in price returns (where we split stocks into three baskets - low, middle and high). Five of the worst six performed stocks were in the Buy Now Pay Later (BNPL) space, led by merger partners Sezzle (SZL) and Zip Co (Z1P) in first and third. The best returns came from an eclectic mix: heart device company Anteris (AVR) and heavy equipment maintenance business Mader Group (MAD). Some of the less obvious takeaways from our "FIT" universe were that: it was not the case that the "dogs" of the prior year were the place to be - the "middle-of-the-road" stocks from FY21 held up best in FY22; and companies with market caps between $750m and $2 billion suffered notably worse declines than those capped under $100m. The wash-up from FY22 is that we are now seeing more attractive valuations AND the recapitalisation opportunities we have been highlighting are beginning to flow. For bottom-up investors like Equitable Investors, we believe the opportunity set will be as rich as it has been in many years and we are keen to engage with investors who want to be part of this "recap" opportunity through Dragonfly Fund.

Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

.png)