News

14 Sep 2022 - Cracking the code on digital advice

|

Cracking the code on digital advice abrdn August 2022 The financial advice industry has long touted the inevitability of digital solutions to close the financial advice gap in Australia, but there has been little progress to date. Industry players are reluctant to dive in thanks to red tape and complex rules, while a lack of regulatory support is stifling overseas investment and the local fintech community. But with the recent change in Australia's federal government and with the Treasury's Quality of Advice review into the affordability and accessibility of quality advice underway, the industry has a unique opportunity to call for the changes needed to bring digital solutions to the fore. In our view, now is the time to bring fresh thinking and establish an environment to promote robust digital advice solutions that enhance the lives of Australians and reduce anxiety around retirement planning. Glitches in the current modelAdvisers have been leaving the industry en masse due to the increased burden of ongoing accreditation and regulatory compliance costs in the wake of the Hayne Royal Commission. More than 3,000 advisers (16% of the market) left the industry in 2021, with a further 2,387 advisers predicted to leave in 2022. 1 This has also put upward pressure on the cost of advice. The median ongoing fee for advice rose to $3,256 a year in 2021 - an increase of 41% since 2018 - pricing out most Australians who say they want advice.2 Industry players widely accept that digital solutions can solve this problem by achieving a wider reach at a lower price point. But no company has successfully solved the challenge of providing digital financial advice in Australia, even though proven technology exists overseas. "No company has solved the challenge of providing digital financial advice in Australia, even though proven technology exists." Advice groups and investors are reluctant to launch digital financial advice in Australia because the rules are not clear. The risk either of losing their licence or of facing financial recourse from the regulator is seen as too great. Under the current model, the Australian Securities and Investment Commission (ASIC) is set up to be a code and conduct enforcer as opposed to helping firms to get their solutions over the line in a compliant manner. Unless this changes, overseas companies with existing solutions looking to expand their footprint to other markets, as well as local fintechs and established financial institutions, will be hesitant to do so here in Australia. Sparking innovation through collaborationOther government jurisdictions have taken a proactive approach to support financial services companies in developing innovative digital advice solutions and bringing them to market in a compliant way. The Monetary Authority of Singapore, for example, works directly with the financial sector to accelerate technology adoption. It launched the Fintech Regulatory Sandbox in 2016 to empower companies to experiment with digital solutions by relaxing legal and regulatory requirements for a limited period. Similarly, the UK's Financial Conduct Authority created Innovation Pathways to help financial services firms launch innovative products. It provides clear guidance on rules and offers one-to-one discussions with a dedicated case manager. We believe Australia's advice industry would see more early innovation if ASIC had a similar mandate. In our view, increasing ASIC's responsibility to help launch new digital initiatives by taking a more hands-on approach would not only accelerate innovation, but also attract more investment from companies in markets with well-established digital advice solutions. In developing the digital advice journeys, there should be an opportunity for regulators to help shape the solution, agree on the objectives and test the solution with clients in the marketplace to ensure intended outcomes can be met. Proven technologies can fast-track digital adviceThe good news is that proven digital solutions could be fast-tracked for the Australian market if the regulatory environment were to change. For example, digital advice journeys have been tried and tested by tens of thousands of abrdn's UK clients and have helped to close the financial advice gap in the UK. These could be adapted quickly for Australia's market. Dubbed bionic advice, abrdn's UK offering provides a hybrid between digital automation and the services of a human adviser. Clients digitise key information about their goals, lifestyle and other data inputs - freeing up paraplanning time and driving down the cost of advice. One of abrdn's UK digital journeys, for example, provides guidance to clients approaching retirement. Clients enter their data into digital tools to estimate their retirement income and model various scenarios. At this point, clients can choose to engage an adviser to finish off their retirement advice plan based on the digital inputs they've already provided. The innovation breakthroughs in bionic advice are where we see a much lower price point to access advice and reduce the advice gap. Advisers can then focus entirely on the value-add part of the journey, providing genuinely helpful advice. Author: Jason Nyilas, Head Of Retirement and Digital Innovation, Australia |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund 1 https://www.ardata.com.au/wp-content/uploads/2022/05/AFALandscape2022-AB_R2.pdf 2 https://www.ardata.com.au/wp-content/uploads/2022/05/AFALandscape2022-AB_R2.pdf |

13 Sep 2022 - Australian Secure Capital Fund - Market Update

|

Australian Secure Capital Fund - Market Update August Australian Secure Capital Fund August 2022

Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

|||||||||||||||||||||||||||||||||

13 Sep 2022 - Macro is still in the driver's seat

|

Macro is still in the driver's seat Novaport Capital September 2022 Hear from Sinclair Currie, Principal and Co-Portfolio Manager at NovaPort Capital, as he shares his insights on how smaller companies fared over the past few weeks as they reported their earnings to the market. While at first glance the numbers were better than expected, what was conspicuously absent was forward looking guidance. Sinclair will share his insights on the themes that were uncovered, how various sectors performed, and the standout stocks - good and bad. He will also discuss how investors can navigate an inflationary environment by following the fundamentals. Funds operated by this manager: NovaPort Microcap Fund, NovaPort Wholesale Smaller Companies Fund |

12 Sep 2022 - Managers Insights | Collins St Asset Management

|

|

||

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Rob Hay, Head of Distribution & Investor Relations at Collins St Asset Management. The Collins St Value Fund has a track record of 6 years and 6 months and has outperformed the ASX 200 Total Return Index since inception in February 2016, providing investors with an annualised return of 16.78% compared with the index's return of 9.42% over the same period.

|

12 Sep 2022 - The Investment Case for Private Credit

|

The Investment Case for Private Credit Altor Capital August 2022 |

|

Private credit thought piece - FundMonitors.com: The Altor AltFi Income Fund (Fund), which specialises in SME and mid-market corporate private credit, is one of a number of Australian fund managers which invests in private credit via listed and unlisted managed funds. The Fund invests in private credit instruments and has a target distribution rate of 10% p.a. payable quarterly. It has a track record of over 4 years and has achieved 11.62% p.a. to 30 July 2022. The Manager undertakes a robust investment process, which involves a deep understanding of each investment it makes, including the borrower's key drivers, asset position and funding requirements, and looks at credit opportunities through a private equity lens prior to moving to credit assessment. The Fund works with management to design a loan structure that meets the objectives of both parties. These debt instruments could vary from senior secured facilities, equipment financing, acquisition financing, management buyouts or research and development lending. Altor's value-add and active management strategy seeks to mitigate risk and focus on maximising returns by being actively engaged with the business post-transaction, whether at the board level, or in a strategic role. The Opportunity Australian Small and Medium Enterprises (SMEs) are starved of capital primarily due to the continued reduction in banks' lending appetite for lending coupled with a domestic debt capital market that lacks the scale and depth compared to overseas counterparts. This funding gap in the market provides private credit investors with opportunities to deploy capital into the sector through structures that protect capital while exhibiting excellent risk return profiles. The 2021 SME Banking Insights Report, commissioned by Judo Bank and conducted by East and Partners showed that one in four SMEs is unsuccessful in obtaining finance. The third edition of the report which includes SMEs with a turnover of up to $50m found that the funding gap for this segment was $119.2 billion. This is a result of changes to regulatory and prudential regimes which have seen banks reduce and withdraw offering credit particularly to the mid-market corporates and SMEs. The gap also provides an opportunity for private credit managers to find high quality loans within the SME segment.

The Asset Class Private credit refers to a range of debt investments that are available to companies or those requiring capital to fund specific projects. A borrower has obligations to make predetermined principal payments in addition to interest and fees which generate a return for the lender. The borrower has a contractual obligation to repay the capital at a pre-determined future date. Private credit investments can deliver higher returns from a higher interest rate, upfront fees and in some cases attaching equity instruments over the underlying business that is borrowing the money. The investments are illiquid, in that they cannot be freely traded in a secondary market. This compares to other credit investment such as investment grade bonds and high yield bonds which can be traded in a secondary market but typically trade OTC, experiencing large bouts of volatility. Investments are privately negotiated with the borrower and there are various features such as loan structures and controls to provide protection to the lender, as well as interest rates and the potential for complementary equity and options to generate additional returns. The Investment Case Private credit portfolios, if structured properly, have the potential to generate superior risk-adjusted returns relative to other asset classes. Australian investment portfolios are generally underweight fixed income at both institutional and individual investor levels compared to global investors. Australian portfolios have a 14% allocation to fixed income which decreases further when analysing Australian Self-Managed Super Funds' 2% allocation to fixed income. This compares to 36% in the United Kingdom, 22% in the United States and 28% across the world. There are numerous benefits associated with investing in private credit which include:

Private Credit in a Rising Interest Rate Environment As interest rates rise, driven primarily by inflation, private credit provides several resilient characteristics that benefit investors. Firstly, pricing of private credit loans is a key feature, with variable loans benefiting from a rising interest rate environment. Interest rates based on a base rate plus a margin mean that investor income rises alongside interest rate increases. For loans priced with fixed interest rates, short duration loans is a mitigating factor, allowing the lender to reprice debt at higher interest rates as loans mature. Another defensive characteristic is the underlying business model of the borrowers in the loan book. In high inflationary environments, a portfolio of companies that can pass on cost increases to customers and maintain margins, safeguarding investors against rising input costs such as wages and raw materials. Loan origination is typically done via private negotiation, offering investors protection as lenders negotiate better terms, including a senior secured structure, covenants, and attaching equity exposure, each of which can make investments more defensive. Private loans have also historically offered relatively low volatility as private credit managers are not forced to mark to market its assets daily due to constant re-pricing experience in tradable public markets. This provides more stable returns during periods of market volatility. Finally, credit quality and fundamentals of issuers generally improve with economic recoveries, meaning private credit managers are generally well positioned for a rebound in economic activity once the new business cycle begins. Author: Benjamin Harrison, CIO | Portfolio Manager Funds operated by this manager: |

9 Sep 2022 - Higher US interest rates test the world

|

Higher US interest rates test the world Magellan Asset Management August 2022 |

|

New York's Plaza Hotel, in financial circles, is best known for when the finance ministers of France, Japan, the UK, the US and West Germany gathered in 1985 to suspend the free-float of the US dollar. The problem the ministers sought to solve was the US dollar had soared 44% since 1980 because US interest rates had jumped over that time. The world was worried that the subsequent widening of the US trade deficit could prompt Washington to restrict imports. Under the Plaza Accord, the G-5 agreed to lower the US dollar over the following two years. The intervention, which drove down the US currency by 40%, is still the biggest manipulation of the US currency since it was floated in 1973.[1] Another Plaza Accord might be needed in coming times.[2] Once again, rising US interest rates are boosting the US dollar to heights that trouble the world. Against the 'real broad dollar index', the US currency has surged 10% over the past year to its highest since this index was compiled in 2006.[3] The US dollar is likely to stay strong because the Federal Reserve needs to smother inflation that reached a 41-year high of 9.1% in the 12 months to June. The Fed raised its benchmark rate from about 0% in March to between 2.25% and 2.5% in July and more rate increases are almost certain. Higher interest rates in the world's largest economy always present challenges for the world. Today's trials wrought by higher US rates, however, could be more troubling than usual because the pandemic and Russia's invasion of Ukraine are magnifying the standard threats posed by higher US interest rates while minimising the usual benefits. Three difficulties stand out, starting with the higher greenback. A stronger US dollar comes with advantages and disadvantages. Among pluses, a rising US currency eases US inflationary pressures via cheaper imports. The flip side, however, is the rest of the world confronts an inflationary shock in three ways. First, US exports cost more in other currencies. Second, trade priced in US dollars between non-US parties becomes more expensive in other currencies. An IMF paper in 2020 estimated about 40% of global invoices are priced in US currency and that countries doing so "tend to experience greater US dollar exchange pass through to their import prices".[4] The third inflation threat is that today's strong US dollar is unusually coinciding with higher oil prices due to the Ukraine war, which magnifies the increase in oil prices in other currencies. In the past, high oil prices have usually coincided with a feeble US dollar.[5] To counterattack the inflationary threat of a high US dollar, central banks from Canada to Singapore to Saudi Arabia to Switzerland are unexpectedly boosting key rates in bigger steps[6] to support their currencies in what has been dubbed a 'reverse currency war'. The term 'currency war' was coined in 2010 to describe how central banks were lowering currencies to help exports. The futility is that all countries can't push their currencies in the same direction at the same time.[7] The eurozone is especially vulnerable to US-dollar-imported inflation, even allowing for an export boost to the US. The euro in July fell to a 20-year low (below parity) against the US dollar, to mark a 14% drop since January 1. Higher import prices, pandemic disruptions to supply and higher food, energy and commodity prices stemming from the Ukraine war propelled eurozone inflation to a record 8.6% in the year to June. In response, the European Central Bank in July raised its key rate by 50 basis points to 0%, to end eight years of negative rates. While the ECB's delay in raising rates has undermined the euro, the lag and tumbling currency are more because the eurozone's economic fundamentals are so weak.[8] The ECB is worried that inflation will drive yields on the sovereign debt of indebted euro members to levels that trigger another financial crisis and possible exits from the common currency. A second challenge of higher US rates is they hamper the US economy. US GDP, which is about 70% consumer spending, contracted over the first six months of 2022.[9] The immediate outlook seems problematic because the fiscal stimulus tied to the pandemic and supply disruptions have boosted inflation to levels that trouble consumers. US consumer confidence in June fell to a record low as surveyed by the University of Michigan, which has tracked US consumer sentiment since 1952.[10] A weak US economy means the high US dollar is not offering its usual boost to world exports - as it did in the first half of the 1980s. The third challenge of higher US interest rates is they bludgeon emerging countries, especially those that have borrowed in US currency or have currencies linked to the greenback. As at May 31, the IMF said eight poorer nations were in "debt distress" and another 30 countries were at "high risk".[11] Since then, Bangladesh, Ghana,[12] Pakistan and defaulting Sri Lanka have asked the IMF for aid. Many are concerned another 1997-style Asia crisis is festering in South Asia.[13] Indebted economies have been weakened by the pandemic and face a cost-of-living crisis resulting from the Ukraine war. The fact that emerging countries are overwhelmingly borrowing in local currencies is failing to insulate them from higher US interest rates and a stronger US dollar. A Bank of International Settlements paper in July warns how the currency risk has only shifted to creditors who invest on a US-dollar basis.[14] Thus, capital is still fleeing emerging countries. The Institute of International Finance estimates international investors yanked US$38 billion from emerging markets in the five months to July. Outflows each month from February to July mark the longest periods of consecutive monthly net outflows since records began in 2005.[15] Emerging-country currencies tumbled accordingly - many by more than 20%. The linked inflation threat has forced central banks to raise rates to support currencies at a time when the IMF is warning that the pandemic and Ukraine war have widened current-account balances enough to trigger populist protectionist measures.[16] Concerns are rising that economic turmoil could lead to political instability. "Food and fuel inflation threatens to rip poor societies apart," warns Murtaza Syed, acting governor of the Central Bank of Pakistan.[17] Central banks are far from winning their battles against inflation.[18] The accelerated loop triggered by a pandemic-and-war-distorted world whereby higher US rates force other countries to raise rates could run for a while yet. The best hope for the world is that something - ideally, a decline in US inflation, but even a US recession - dampens US interest rates and averts financial upheavals in the eurozone and emerging countries. To be sure, US interest rates are still historically low and the US dollar is well below its 1985 peak. But that matters less when government, corporate and personal debt are so high. US inflation might have already peaked - US inflation eased to 8.5% in the year to July - and the Fed might slow rate increases. But the crest of inflation could matter less than the stubbornness of inflation. If US inflation only slows gradually, US interest rates will stay elevated. The pity is that in a world of floating exchange rates central banks outside the US, for all their domestic political independence, are tied to a Fed that misjudged inflation.[19] There's no solution, let alone an international accord, shaping to alleviate the dangers. The unsolvable handicap Economists Barry Eichengreen of the US, Ricardo Hausmann of Venezuela and Ugo Panizza of Italy chose 'The pain of original sin' as the title of their 2003 study of emerging countries. They presumably judged this Christian concept best describes an insurmountable inherent flaw.[20] The study was a landmark because it was the first to focus on the importance of the currency denomination of foreign debt for emerging countries. The trio found the health of emerging economies depended much more on the currency breakdown of foreign debt than other aspects of macroeconomic stability such as the soundness of monetary and fiscal policies and human and physical capital accumulation. They found the foreign-currency makeup of foreign debt governed "the stability of output, the volatility of capital flows, the management of exchange rates and the level of country credit ratings".[21] The trouble is emerging countries need to borrow to develop. But they are generally unable to borrow in their local currency, the inherent weakness they can't overcome.[22] The trio's paper was written when only 2.7% of emerging debt was sold in local currency.[23] It's widely acknowledged that emerging countries that borrow in foreign currency are vulnerable if their currencies plunge. To reduce this weakness, bodies such as the IMF and the World Bank have long encouraged emerging countries to borrow in local currency. And they have. Over the past decade, more than 80% of the increase in emerging-country debt was in local currency - the ratio topped 95% from the end of 2019 to 30 September 2021.[24] This is why the BIS paper on the failure of local borrowings to insulate emerging countries from currency risk is so sobering. The BIS finding means the tendency of troubles in one emerging market to infect others is as primed to detonate as always. Average gross government debt in emerging markets stood at an estimated 64% of GDP at the end of 2021, according to the IMF. The pandemic drove a 10-percentage-point jump in that ratio.[25] Companies in emerging countries are estimated to have borrowed about 14% of global GDP.[26] Emerging countries are the hardest hit by the blows to living standards from the Ukraine war. They are vulnerable to a Fed boosting US interest rates and a rising US dollar. Calls for a new Plaza Accord are bound to intensify. Nominal broad US dollar index since 2006 Author: Michael Collins, Investment Specialist |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund [1] Jeffrey Frankel. National Bureau of Economic Research. 'The Plaza Accord, 30 years later.' NBER working paper series. Working paper 21813. December 2015. nber.org/system/files/working_papers/w21813/w21813.pdf [2] See 'Surging dollar stirs markets buzz of a 1980s-style Plaza Accord.' 18 May 2022. bloomberg.com/news/articles/2022-05-18/surging-dollar-stirs-markets-buzz-of-a-1980s-style-plaza-accord [3] Federal Reserve. Foreign exchange rates - H.10. 'Real broad dollar index - monthly index.' federalreserve.gov/releases/h10/summary/jrxwtfbc_nm.htm. Currencies such as India's rupee are at record lows against the greenback while others such as the euro are close to record lows. [4] IMF. 'Patterns in invoicing currency in global trade.' Emine Boz et al. IMF working paper WP/20/126. July 2020. Page 2 and 13. imf.org/en/Publications/WP/Issues/2020/07/17/Patterns-in-Invoicing-Currency-in-Global-Trade-49574 [5] See Javier Blas. 'In the oil market, the strong dollar is the world's problem.' Bloomberg News. 8 June 2022. bloomberg.com/opinion/articles/2022-06-08/record-oil-prices-in-europe-asia-strong-dollar-is-becoming-the-world-s-problem [6] See 'Central banks embrace big rises to bolster currencies and fight inflation.' Financial Times. 17 July 2022. [7] See Jeffrey Frankel. 'Get ready for reverse currency wars.' Project Syndicate. 25 May 2022. project-syndicate.org/commentary/strong-dollar-high-inflation-reverse-currency-wars-by-jeffrey-frankel-2022-05 [8] See Paul Krugman. 'Wonking out: The meaning of the plunging euro.' 15 July 2022. Krugman here explains how the eurozone's weak fundamentals correspond to the analysis of exchanges rates in German economist Rudiger Dornbush's classic paper of 1976, 'Expectations and exchange rate dynamics'. nytimes.com/2022/07/15/opinion/euro-dollar-fed-ecb.html [9] The US economy shrank at an annualised rate of 1.6% in the first quarter and 0.9% in the second. [10] University of Michigan. 'Surveys of consumers.' June final results. 24 June 2022. The index fell to a record low of 50.0 in June 2022 compared with 85.5 a year earlier. In July, the index rose to 51.1, a result described as "relatively unchanged, remaining near all-time lows". data.sca.isr.umich.edu/ [11] IMF. 'List of LIC DSAs for PRGT-eligible countries.' 31 May 2022. LIC stands for low-income countries. DSA stands for debt sustainable analysis. PRGT stands for poverty reduction and growth trust. imf.org/external/Pubs/ft/dsa/DSAlist.pdf [12] See 'How Ghana makes a success out of failure.' The Economist. 5 August 2022. economist.com/middle-east-and-africa/2022/08/05/how-ghana-makes-a-success-out-of-failure [13] See 'South Asia debt woes evoke fears of another 1997-style crisis.' 4 August 2022. bloomberg.com/news/articles/2022-08-03/india-sri-lanka-pakistan-debt-woes-evoke-memories-of-1997 [14] "Exchange-rate fluctuations induce shifts in portfolio holdings of global investors, even in the absence of currency mismatches on the part of the borrowers," the paper says. Boris Hofmann et al. 'Risk capacity, portfolio choice and exchange rates.' BIS working papers. No. 1031. Bank of International Settlements. 15 July 2022. bis.org/publ/work1031.htm [15] Financial Times. 'Emerging markets hit by record streak of withdrawals by foreign investors.' 31 July 2022. ft.com/content/35969b19-86db-4197-a419-b4a761094e9a [16] IMFBlog. 'Global current account balances widen amid war and pandemic.' 4 August 2022. blogs.imf.org/2022/08/04/global-current-account-balances-widen-amid-war-and-pandemic/ [17] Murtaza Syed, acting governor of the Central Bank of Pakistan. 'Now is not the time to neglect developing economies.' 3 August 2022. https://www.ft.com/content/f0e2df4c-f64b-4820-b3b3-27389b256ecf [18]IMFBlog. 'Soaring inflation puts central banks on a difficult journey.' 1 August 2022. blogs.imf.org/2022/08/01/soaring-inflation-puts-central-banks-on-a-difficult-journey/ [19] Financial Times. 'The Fed's rate increases are a matter of high interest for everyone.' 28 July 2022. ft.com/content/db77664b-084a-462e-8dc1-1b127fac1b35 [20] Barry Eichengreen, Ricardo Hausmann and Ugo Panizza. 'The pain of original sin.' August 2003. Berkeley. eml.berkeley.edu/~eichengr/research/ospainaug21-03.pdf [21] "That the external debts of emerging markets are disproportionately denominated in foreign currency goes a long way towards explaining why their economies are more volatile and crisis prone than those of their advanced-country counterparts," the trio conclude. Barry Eichengreen, Ricardo Hausmann and Ugo Panizza. Op cit. [22] Stephen Mihm, professor of history at the University of Georgia. 'Strong dollar always clobbers developing nations.' Bloomberg News. 27 July 2022. bloomberg.com/opinion/articles/2022-07-27/strong-dollar-always-clobbers-developing-nations [23] BIS. Op cit. Table 1. Page 28. [24] Reuters. 'Emerging markets drive global debt to record $303 trillion - IIF'. 24 February 2022. reuters.com/markets/europe/emerging-markets-drive-global-debt-record-303-trillion-iif-2022-02-23/. 'Total global debt dips, but emerging market debt hits record high.' 18 November 2021. reuters.com/business/total-global-debt-dips-emerging-market-debt-hits-record-high-2021-11-17/. The article quotes data from the Institute of International Finance. [25] IMFBlog. 'Emerging economies must prepare for Fed policy tightening.' 10 January 2022. blogs.imf.org/2022/01/10/emerging-economies-must-prepare-for-fed-policy-tightening/ [26] Lorenzo Forni and Philip Turner. 'Global liquidity and dollar debts of emerging market corporates.' Vox EU. 15 January 2021. voxeu.org/article/global-liquidity-and-dollar-debts-emerging-market-corporates Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

8 Sep 2022 - ESG: Why inclusion matters - even for astronauts

|

ESG: Why inclusion matters - even for astronauts Pendal August 2022 |

|

Investors should look for evidence of inclusion right across a business - even in product design, says Regnan's head of engagement ALISON EWINGS

IN 2019, NASA planned one small step for women: the first all-female space walk from the International Space Station. But it did not go as planned. The problem? There weren't enough medium-sized space suits to go around. "Truly inclusive decision-making goes beyond the workplace," says Regnan's head of engagement, Alison Ewings. "By broadening the approach to consider customers and society at large, you're more likely to have products and services that meet the needs of a wider range of people." Ewings says it is not uncommon for products and services to be designed without proper consideration of inclusion. "We're seeing companies talk about their experience of employing more women only to come across things like no availability of uniforms suitable to be worn when you're pregnant. "We've seen personal protective equipment the wrong size for women. We've seen machinery that cannot be operated by people under a certain height. "These are product and service decisions made well before a company discusses how to implement a diversity and inclusion program." Beyond employee experience Taking inclusion beyond the day-to-day employee experience is an important insight for investors. "Can the impact you have be improved by thinking about how you deliver that more inclusively?" says Ewings. "So, if you're a health company, who are you including in your trials? "For an education provider - if you can reach a broader audience in a developing country, the impact of what you can do about changing those people's lives is far more significant if you approach the delivery of your product and service with an inclusion lens. All companies can benefit from taking an inclusion approach to product and service design, says Ewings. "It can be simple things like supermarkets offering quiet hours for people with autism or older people who find loud noises and bright lights an overwhelming experience." And while diversity has been the watchword for businesses seeking to bring broader talent into an organisation, research shows equity and inclusion are the critical factors in realising the performance potential of a diverse workforce. Regnan's award-shortlisted research report Beyond diversity: Equity and inclusion as an overlooked opportunity for investors (PDF) found that a focus on diversity without equity and inclusion can undermine the very benefits offered by diversity. Three inclusion factors Regnan's research outlines three inclusion factors that investors should take account of when assessing companies:

The benefits of focusing on equity and inclusion within the workplace is equally relevant to the experience of customers and the broader community and is therefore of interest to impact investors, says Ewings. "A true focus on inclusion thinks about what it means for decisions that these organisations make and the products and services that they offer." Organisations that embrace equity and inclusion can apply these skills to their core operations unlocking opportunities to positively impact a wider constituency, and potentially with greater potency. A more intentionally inclusive approach to problem solving also enhances the pool of ideas for how to tackle major societal challenges, she says. Author: Alison Ewings, Head of Engagement, Regnan. Regnan is a Pendal Group business. |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

7 Sep 2022 - Spotlight Video|Portfolio Builder

|

Portfolio Builder FundMonitors.com September 2022 |

|

|

|

In this short 3 minute video we build a portfolio from scratch including adding annual re balancing and adding and allocating to new funds. It will show just how easy it is to get the most out of your managed fund portfolio. |

7 Sep 2022 - Around the world in 200 Meetings, Jeff Thomson: Financial and Consumer Staples

|

Around the world in 200 Meetings, Jeff Thomson: Financial and Consumer Staples Alphinity Investment Management August 2022 Within the tech sector, the delineation in terms of performance between the winners and the losers in the current environment is becoming clear. What are the key elements that depict the winners and losers? Trent discusses the fundamental themes from his two recent trips to the US which were structured around two technology conferences - the Morgan Stanley conference and the JP Morgan Conference.

Speakers: This information is for adviser & wholesale investors only. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

7 Sep 2022 - Is the best value for Australian credit not in Australia?

|

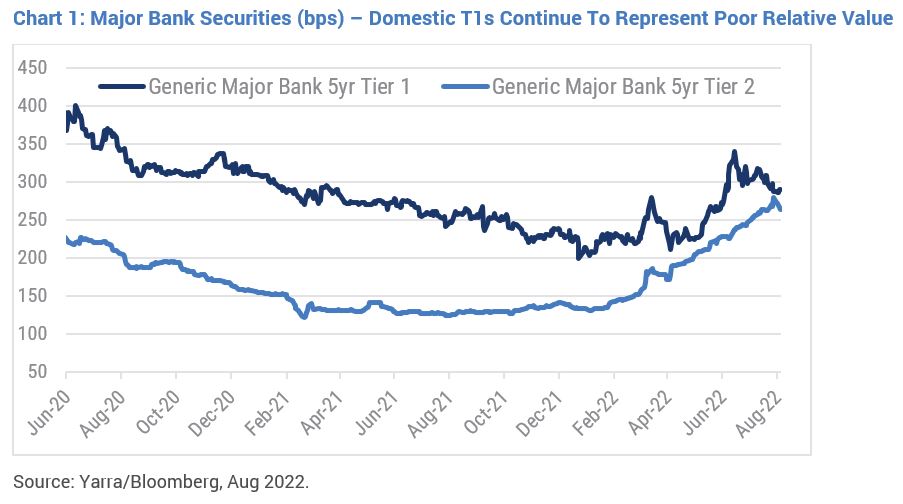

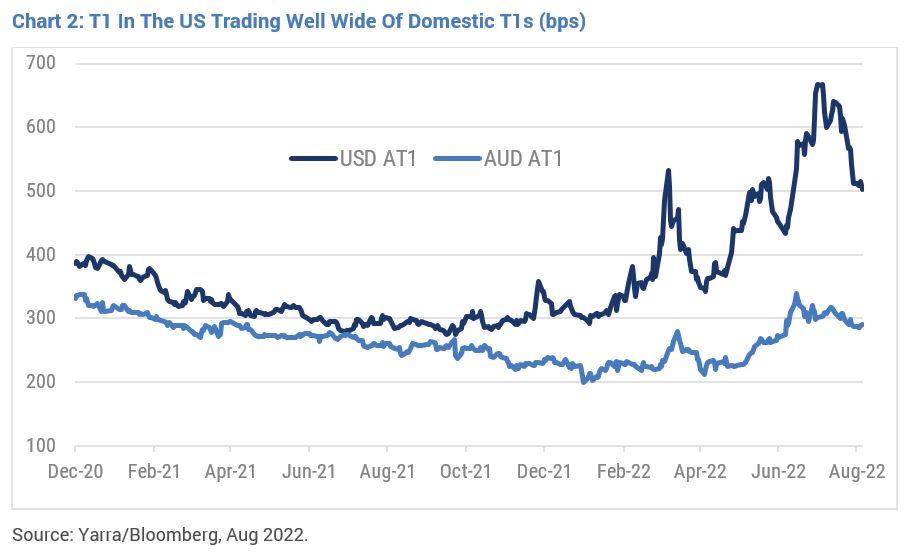

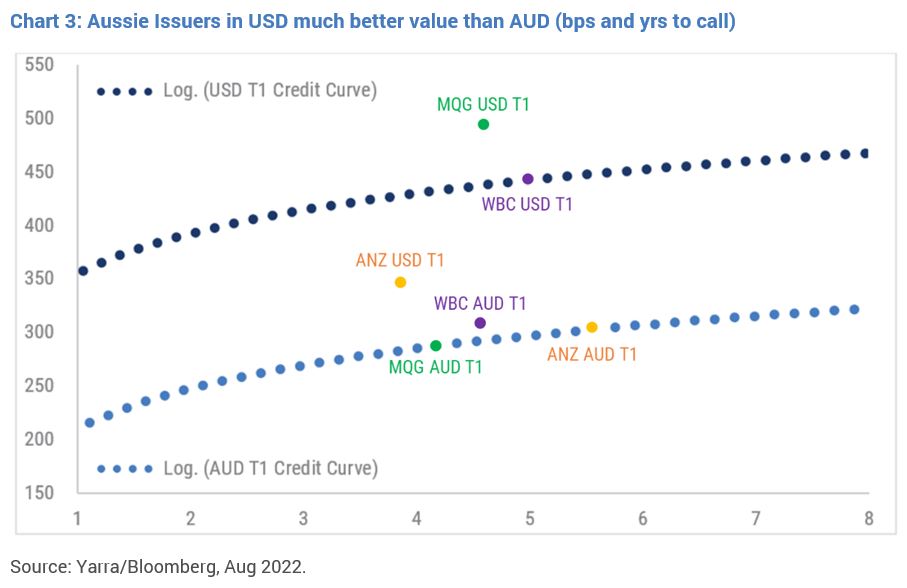

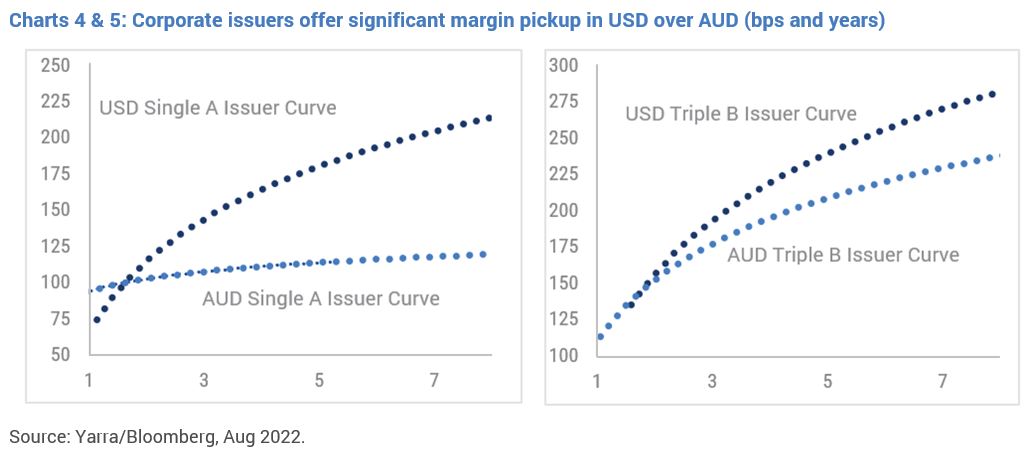

Is the best value for Australian credit not in Australia? Yarra Capital Management August 2022 While Australian Major Bank T1s are rightly held in high regard, their USD-issued equivalents now trade at a substantial premium and offer much higher risk-adjusted returns. Investors able to access Australian credit in offshore markets remain at a distinct advantage to those constrained to local shores. Our readers may recall a research piece we compiled in May where we highlighted just how expensive major bank BBB- rated Tier 1 (T1) hybrid securities were compared to the lower risk major bank BBB+ rated Tier 2s (T2). At the time, T1 credit margins were trading just ~40bps wider than T2 despite being two notches lower in credit quality. Incredibly, that gap has narrowed further to just ~20bps following the recent T2 issuance from NAB and ANZ which priced at very attractive margins of BBSW+280bps and BBSW+270bps respectively (refer Chart 1). Moreover, based on historical averages, T1s currently look incredibly expensive and should be trading ~200bps wider of current valuations. Interestingly, based on offshore T1 pricing, it seems this disconnect in bank hybrid capital pricing is more of an Australian phenomenon. After diverging in late 2021, there is now a dramatic gap between the two, with US T1s now trading ~200bps wider than their Australian comparatives (refer Chart 2). Looking at T1 curves in Chart 3 - the US (dark blue line) and Australia (light blue line), there are several opportunities for domestic investors to extract a significant premia by choosing the US dollar denominated Australian T1s and hedging out the currency and interest rate risk. We recently purchased a meaningful size of the 2027 Westpac USD T1s. The security swapped back to a credit margin of BBSW+480bps, ~200bps wider than the equivalent ASX-listed security, with all currency and interest rate risk hedged throughout the life of the security. By comparison, given their more attractive pricing domesticly compared to T1, the same pick-ups in credit margins offshore are not currently available in bank senior or T2 segments. However, there are similar opportunities in Australian corporate credit with both the single A and triple B rated curves for Australian issuers significantly wider in USD than in AUD (refer Chart 4 and 5). This approach is enabling us to harvest higher risk adjusted returns across most sectors of Australian credit, while maintaining diversity across the spectrum of household Australian names which are a mainstay of most equity portfolios but typically do not issue debt in AUD. This long list includes major corporates such as BHP, Rio Tinto, Brambles, Bluescope and CSL, to name only a few. Where it makes sense to do so, the Yarra Higher Income Fund is investing in Australian issuers across major currencies; hedging out currency and interest rate risk to optimise risk adjusted returns. With a current yield at ~5% which we expect will increase alongside rising interest rates, the Fund remains well placed to continue delivering consistent monthly income to its investors. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |