News

3 Apr 2024 - 10 cognitive biases that can lead to investment mistakes

|

10 cognitive biases that can lead to investment mistakes Magellan Asset Management April 2024 |

|

To be a successful investor over the long term, we believe it is critical to understand, and hopefully overcome, common human cognitive or psychological biases that can often lead to poor decisions and investment mistakes. Cognitive biases are 'hard wired', and we are all liable to take shortcuts, oversimplify complex decisions and be overconfident in our decision-making process. Understanding our cognitive biases can lead to better decision making, which is fundamental, in our view, to lowering risk and improving investment returns over time. Below we outline key cognitive biases to be aware of that can lead to poor investment decisions. 1. Confirmation biasConfirmation bias is the natural human tendency to seek information that confirms an existing conclusion or hypothesis. In our view, confirmation bias can be a significant contributor to investment mistakes. Investors often become overly confident when they repeatedly receive data that validates their decisions. This overconfidence can result in a false sense that nothing is likely to go wrong, which increases the risk of being blindsided when something does go wrong. To minimise the risk of confirmation bias when investing, we attempt to challenge the status quo and seek information that causes us to question our investment thesis. We are always seeking to 'invert' the investment case to analyse why we might be wrong. We continually revisit our investment case especially considering new information and challenge our assumptions. Conducting thorough research is at the foundation of what we do. 2. Information biasInformation bias is the tendency to make decisions based on useless or irrelevant information. The key in investing is to see the 'forest for the trees' and to carefully evaluate information that is relevant to making a more informed investment decision and to discard (and hopefully ignore) irrelevant information. Investors are bombarded with useless information every day and it is difficult to filter through it to focus on information that is relevant. In our view, daily share price or market movements usually contain no information that is relevant to an investor who is concerned about the medium-term prospects for an investment, yet there are entire news shows and financial columns dedicated to evaluating movements in share prices on a moment-by- moment basis. 3. Loss aversion/endowment effectLoss aversion is when people strongly prefer to avoid a loss than make a gain. Closely related to loss aversion is the endowment effect, which occurs when people place a higher value on a good that they own than on an identical good that they do not own. The loss aversion/endowment effect can lead to poor and irrational investment decisions whereby investors hold onto losing investments for too long in the hope that they will eventually recover or sell winning investments too quickly to lock in gains. The loss-aversion tendency breaks one of the cardinal rules of economics, the measurement of opportunity cost. To be a successful investor over time you must be able to accurately measure opportunity cost and not be anchored to past investment decisions due to the inbuilt human tendency to avoid losses. It's important to evaluate the opportunity cost associated with retaining an existing investment versus making a new investment in a portfolio. For example, when investors consider selling an existing investment, they may hesitate due to the fear of losing money, even if a new opportunity could bring better returns. So, understanding this balance may help investors make rational decisions to grow their portfolios while managing risk effectively. We believe investors would make better investment decisions if they understood their risk tolerance (the amount of risk they are willing to accept in order to achieve their investment goals) and took a disciplined approach to weighing up the opportunity cost between keeping an existing investment or not. 4. Incentive-caused biasIncentive-caused bias, a concept introduced by renowned investor Charlie Munger, is the tendency for people to act in ways that align with their incentives, rewards, or self-interest, even if those actions are not in their best interest or the best interest of others. The sub-prime housing crisis in the US is a classic case study in incentive-caused bias. Financiers were lending money to borrowers even though they knew the borrowers had appalling credit histories, and in many cases no income or jobs and limited assets. How did this happen on such a massive scale? We believe the answer can be found in the effect of incentives. At virtually every level of the value chain, there were incentives in place to encourage people to participate. The developers had strong incentive to construct new houses. The mortgage brokers had strong incentive to find people to take out mortgages. The investment banks had a big incentive to pay mortgage brokers to originate loans so that they could package and securitise these loans to sell to investors. The ratings agencies had strong incentive to give AAA ratings to mortgage securities to generate fees, and banks had a big incentive to buy these AAA-rated mortgage securities as they required little capital and produced enormous, leveraged profits. One of the key factors we focus on when making investment decisions is our evaluation of agency risk. We evaluate the incentives and rewards systems in place at a company, to assess whether they are likely to encourage management to make rational long-term decisions. We prefer companies that have incentive schemes that focus management on the downside as well as the upside and encourage management to return excess cash to shareholders. For example, executive compensation that is overly skewed towards share-option schemes can encourage behaviour that is contrary to the long-term interests of shareholders, such as retention of earnings above those that can be usefully reinvested into the business. 5. Oversimplification tendencyIn seeking to understand complex matters people tend to want clear and simple explanations. Unfortunately, some matters are inherently complex or uncertain and do not lend themselves to simple explanations. In our view, investment mistakes can be made when people oversimplify uncertain or complex matters. Oversimplification bias can lead to poor decisions based on overly simplistic or incomplete analyses of complex investment situations. Underestimating risk or misinterpreting data can have negative impacts on investment strategies. We consider that investors should conduct thorough and comprehensive analyses of investment opportunities, consider multiple perspectives, and seek out diverse sources of information. A key to successful investing is to stay within your 'circle of competence'. At Magellan part of our 'circle of competence' is to concentrate our investments in areas we consider exhibit a high degree of predictability and to be wary of areas that are highly complex and/or highly uncertain. Our extensive bottom-up stock analysis and industry research is a critical tool in understanding the underlying fundamentals of individual companies, enabling us to make well-informed investment decisions and build portfolios we believe are positioned for long-term success. 6. Hindsight biasHindsight bias is the tendency for people to believe that they could have predicted a past outcome accurately, even though they were unable to do so in real-time. As an example, many people claimed "I knew it" when the dot.com bubble burst hit in 1998, however very few predicted it. Hindsight bias has the potential to lead to overconfidence in investment knowledge and skills. Investors may start to make irrational and risky decisions as they only remember the instances when they were right and overlook the times when they were wrong. Investors may look for expected outcomes in investment decisions rather than looking at all the possible outcomes. In our view, hindsight bias is a dangerous state of mind as it clouds your objectivity when assessing past investment decisions and inhibits your ability to learn from past mistakes. To reduce hindsight bias, we spend considerable time upfront setting out the detailed investment case for each stock, including our estimated return. This enables us to accurately assess our investment history with the benefit of hindsight. We do this for individual stock investments and macroeconomic calls. 7. Bandwagon effect (or herd mentality)The bandwagon effect, or herd mentality, describes gaining comfort in something because many other people do (or believe) the same. In recent times, we have seen the bandwagon effect or herd mentality with the events that surrounded the GameStop stock event. Where many people saw the rise in stock prices and without proper research jumped on the bandwagon and invested. This impacted a lot of investors who bought the stock due to the fear of missing out and the hype it created. We believe, to be a successful investor, you must be able to analyse and think independently. Speculative bubbles are typically the result of herd mentality. Herd mentality in investing can overshadow rational decision-making and could increase the risk of financial losses. Investors need to recognise the feeling of pressure to conform to popular opinion or follow the crowd and instead consider conducting research and analysis before making decisions, as well as seeking alternative views to challenge the consensus. Our investment process is focussed on deep fundamental research and analysis, backed by an investment team with many years of experience. At the end of the day, we will be right or wrong because our analysis and judgement is either right or wrong. While we don't seek to be contrarian, we have no hesitation in taking 'the road less travelled' if that is what our analysis concludes. 8. Restraint biasRestraint bias is the tendency to overestimate one's ability to show restraint in the face of temptation. The issue for many investors is how to properly size an investment when they believe they have identified a 'sure winner.' We believe, 'sure thing' investments are exceptionally rare, and many investments are sensitive to changes in assumptions, particularly macroeconomic assumptions. Investors need to have in place a well-thought-out investment plan that aligns with their financial goals, risk tolerance, and time horizon. Having a clear plan in place can help to maintain focus on long-term objectives and avoid making impulsive decisions based on short-term market movements. At Magellan, we hardwire restraints or risk controls into our process, which may include placing maximum limitations on stocks and combinations of stocks that we consider carry aggregation risk. 9. Neglect of probabilityHumans often overlook or misjudge probabilities when making decisions, including investment decisions. Instead of considering a range of possible outcomes, many people tend to simplify and focus on a single estimate. However, the reality is that any outcome an investor anticipates may just be their best guess or most likely scenario. Around this expected outcome, there's a range of potential results, represented by a distribution curve. This curve can vary widely depending on the specific characteristics of the business involved. For instance, companies which are well-established and have strong competitive positions, tend to have a narrower range of potential outcomes compared to less mature or more volatile companies, which are more susceptible to economic cycles or competitive pressures. In our portfolio construction process, we carefully consider the differences in businesses to account for the various risks and probabilities associated with different outcomes. This approach helps us construct portfolios that we believe are better suited to navigate the uncertainties of the market. Another error investors may make is to overestimate or misprice the risk of very low probability events. That does not mean that 'black swan' events cannot happen, but that overcompensating for very low probability events can be costly for investors. To seek to mitigate the risk of 'black swan' events, we include businesses in our investment portfolios that we consider are high- quality and long-lasting, purchased at appropriate prices. We believe these companies have a tight range of potential outcomes, reducing the risk of major losses from unexpected events. If we have real insight that the probability of a 'black swan' event is materially increasing and the pricing is attractive enough to reduce this risk, we will have no hesitation in making a material change to our investment portfolios. However, spotting these events isn't easy and doesn't necessarily depend on how much attention they're getting in the media or the markets. As Warren Buffett famously said, "The biggest mistake in stocks is to buy or sell based on current headlines." 10. Anchoring biasAnchoring bias is the tendency to rely too heavily on, or anchor to, a past reference or one piece of information when making a decision. There have been many academic studies undertaken on the power of anchoring on decision making. Studies typically get people to focus on a totally random number, like their year of birth or age, before being asked to assign a value to something. The studies show that people are influenced in their answer by, or anchored to, the random number that they have focused on prior to being asked the question. Looking at the recent share price is a common way investors anchor their decisions. Some people even use a method called technical analysis, which looks at past price movements to predict future ones. However, just because a stock's price was high or low in the past doesn't tell us if it's a good deal now. Instead of focusing on past prices, we look at whether the current price is lower than what we think the stock is really worth. We don't let past prices influence our decisions. We also don't rely solely on the current price when deciding whether to research a new investment. We want to be ready with well-researched options so we can make smart decisions when prices drop below what we believe is their true value. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund 1 Generative AI refers to algorithms that can be used to create new content based on the data they were trained on. This can include audio, images, code, text and more. Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

2 Apr 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

||||||||||||||||||||||

| Ausbil Global Essential Infrastructure Fund (Hedged) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

|

||||||||||||||||||||||

| Barwon Global Listed Private Equity Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| BlackRock Global Impact Fund (Class D) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| BlackRock Diversified ESG Stable Fund (Class D) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| BlackRock Diversified ESG Growth Fund (Class D) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

28 Mar 2024 - Hedge Clippings | 28 March 2024

|

|

|

|

Hedge Clippings | 28 March 2024 Taylor Swift saved the day for February retail sales - or possibly just diverted the consumers' spending away from their normal patterns. Without the one-off impact of 600,000 "Swifties" (including Albo, who took time off from the affairs of State to attend at least one of the seven concerts) the month's retail sales at 0.1% would have only just made it into the positive. Add in the combined effect of concert tickets, clothing, merchandising, accessories, and dining out, and the number nudged up to 0.3%. While some of that would have diverted spending from other outlets and spending, much of the hard earned cash of the Swifties would have left with Taylor herself partly as ticket sales, and partly royalties on clothing and merchandise. News & Insights New Funds on FundMonitors.com Market Update | Australian Secure Capital Fund February 2024 Performance News Bennelong Australian Equities Fund Digital Asset Fund (Digital Opportunities Class) |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

28 Mar 2024 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

28 Mar 2024 - Planting the seed of change: real estate's role in the nature crisis

|

Planting the seed of change: real estate's role in the nature crisis abrdn March 2024 Since publishing our climate change approach for our direct real estate portfolio in 2020, we have focused on mitigating climate risks and decarbonising our real estate portfolios. But our real estate environmental, social and governance strategy also considers wider environmental and social topics, including those associated with nature and in particular biodiversity . How can real estate reduce its negative impact on nature? And how can it have a positive impact and contribute to climate solutions? A focus on natureWe are experiencing a nature and climate crisis. While the spotlight has previously been on climate change, nature is now sharing centre stage. The two issues are interdependent. Some key initiatives have caused real estate investors to sit up and pay attention to the relationship between buildings and nature.

How does real estate affect nature?Real estate contributes directly to four of the five main drivers of nature loss. Therefore, action to reduce the impact in these areas can also reduce risks for real estate assets. Five drivers of nature loss

Green infrastructure creates a positive impactReal estate provides the unique opportunity to have a positive impact at the construction phase of a building, particularly in terms of design. This may involve maintaining existing green areas or improving habitats that are in poor condition. But it can also have a positive impact in the post-construction phase, by implementing green infrastructure (see examples below). This can promote local biodiversity and contribute to climate change mitigation and adaptation. Real estate can also have a positive social impact and provide operational efficiencies. Types of green infrastructure [2]

How does nature benefit real estate investment performance?Green infrastructure can have a positive impact on people, by improving the aesthetics of a building, reducing energy costs, minimising flood remediation costs and improving local air quality. Studies show that there can be a 10% increase in willingness to pay for assets that offer green cover. Green infrastructure can increase property values by around 9.5%. And buildings in close proximity to parks or green spaces also benefit from higher values. Real estate assets with green infrastructure are more attractive to tenants, which can help to reduce void periods and increase rental values. Real estate has a key role to play in the nature crisis. It can reduce its negative impact on nature, and it can have a positive impact and contribute to climate solutions. Nature also has the potential to enhance investment returns and to make buildings more attractive to owners, tenants and communities. Author: Georgie Nelson, Head of ESG, Real Estate |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund Source: 1. United Nations Environment Programme (March 2022) Managing Transition Risk in Real Estate: Aligning to the Paris Climate Accord. |

27 Mar 2024 - Performance Report: PURE Income & Growth Fund

[Current Manager Report if available]

27 Mar 2024 - Performance Report: Equitable Investors Dragonfly Fund

[Current Manager Report if available]

27 Mar 2024 - How to Handle a Correction

|

How to Handle a Correction Marcus Today March 2024 |

|

It has been one year since the bottom of the market on March 23, 2020. Since then, the ASX 200 is up 65.5%... if you bought at the absolute low and sold a year later.

For any fund manager getting abused for not achieving 54.44% in the post-pandemic recovery year, you might point out to your complaining client that the 54.44% was from the lowest low, which existed for a micro-instant on March 23rd 2020 in the most volatile week in decades. That week the market had a range of 18.9%. To have achieved 54%, you would have needed not just the the presence of mind (balls) to buy the market at that micro instant low, but you would have had to have done it amidst unprecedented volatility, and you would have had to go in 100% (no cash). And you only had an instant to do it. If you had waited a week and had caught the top in that second week, then the market has only gone up 26.7% in the last 51 weeks, not 54.44%. Half the 51.59%. Basically, if you missed the bottom of the market by a week and if you had inched in, or pyramided in, not gone all in, you would have lost even more of the gains. There is no one that went in 100% at the bottom. So just in case you get trolled about your performance, you can ask your investor if they really expected you to go all-in at exactly the right micro-instant. Truth is, the convenience of hindsight makes it very easy to complain about fund manager performance, and charts extremes are the most fabulous data points for those complaints. 15 Golden Rules From The PandemicHere are some of the lessons from the last year. Observations about sharp market corrections and their recovery.

At the end of the day, the pandemic year has been great for us as investors. It has been a year of fabulous opportunities. Hopefully you played the game. Look forward to the next great correction. Hopefully we'll all have the vigilance, experience and courage to exploit it, not run from it. Author: Marcus Padley |

|

Funds operated by this manager: |

26 Mar 2024 - Australian Secure Capital Fund - Market Update

|

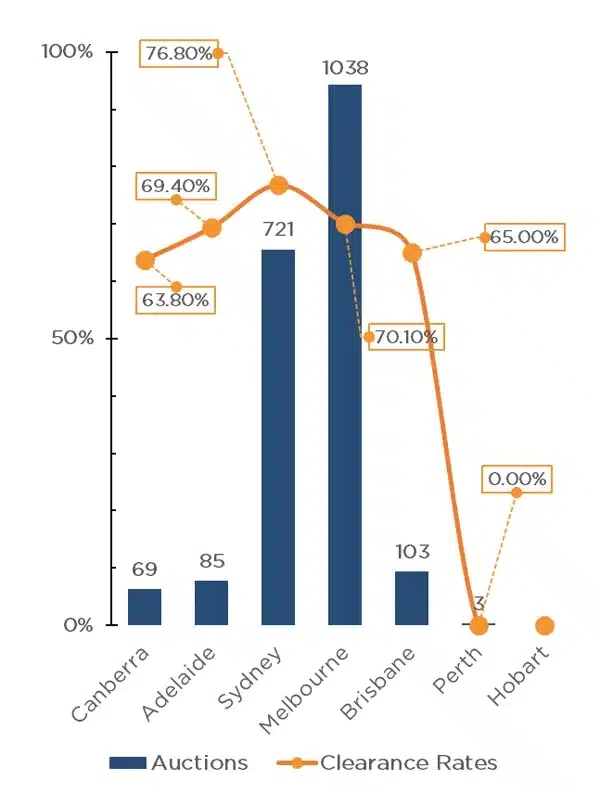

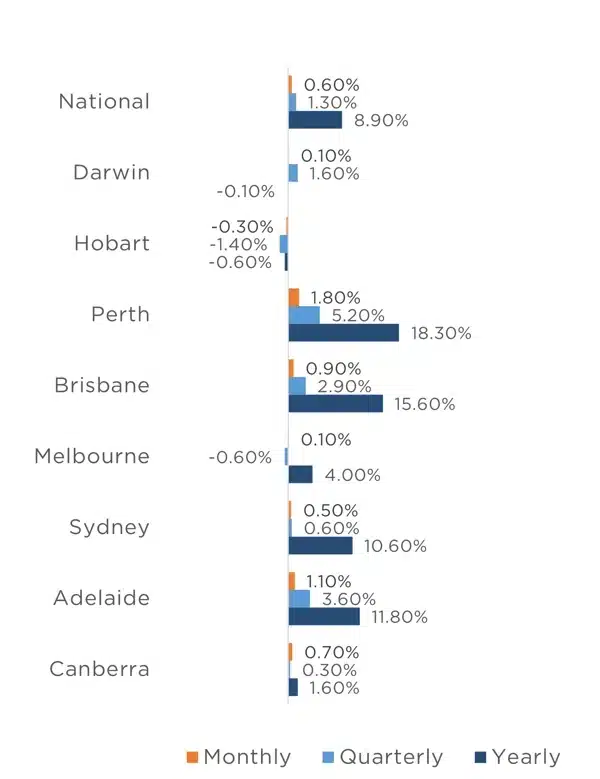

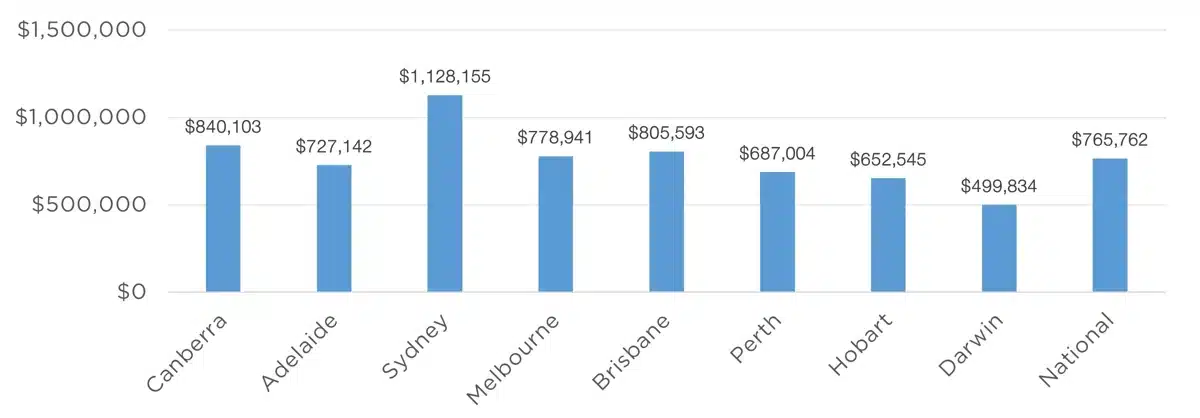

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund March 2024 The first weekend of March saw 2,019 auctions take place across the combined capital cities, down slightly on the previous year's 2,054, however clearance rates were up, 71.8% in comparison to 66.3% in 2023. Melbourne once again led the way, with 1,038 auctions taking place, followed by Sydney with 721, well above that of the other capitals, with Brisbane, Adelaide, Canberra and Perth recording 103, 85, 69 and 3 auctions respectively. The preliminary clearance rate of 71.8% for the weekend indicates that buyers and sellers are on the same page for the most part, particularly in Sydney where a clearance rate of 76.8% was achieved, well above the 68.7% of the same weekend last year. Melbourne, Adelaide, Brisbane and Canberra all managed to achieve clearance rates of above 60% for the weekend, with 70.1%, 69.4%, 65.0% and 63.8% respectively. It is interesting to note that all capital cities achieved a greater clearance rate than the same weekend in 2023, other than Adelaide, where a 72.9% clearance rate was achieved on the same weekend last year. February brought yet another strong month for property prices, with CoreLogic's Home Value Index showing a 0.6% increase across the combined capitals and combined regionals, with all capital cities experiencing growth except for Hobart, where prices fell by 0.3% for the month. Once again, Perth experienced the greatest level of growth, increasing by a mammoth 1.8% for the month, contributing to a 5.2% quarterly growth and an increase of 18.3% annually. Adelaide also experienced strong monthly growth of 1.1%, followed by Brisbane with a further 0.9% increase, bringing the median property value of Brisbane above $800,000 for the first time, with a median value of $805,593, the second highest median value nationally, behind only Sydney with $1,128,155. Canberra, Sydney and Melbourne also experienced growth for the month of 0.7%, 0.5% and 0.1% respectively, with all cities except for Hobart (-0.6%) and Darwin (-0.1%) experiencing an annual increase. Whilst there was no RBA meeting this month, economists continue to believe we are at the end of the rate hike cycle, with many expecting interest rate reductions before the end of 2024. Should interest rates ease, we expect that there will be a bump in property prices. Clearance Rates & Auctions week of 4th of March 2024

Property Values as at 1st of March 2024

Median Dwelling Values as at 1st of March 2024

Quick InsightsValues to OutperformTwo-fifths of valuers surveyed by CBRE have predicted house prices to outperform by up to 10% in Adelaide, Perth, and Sydney. Valuers were also relatively bullish on the apartment sector with 44 per cent predicting prices to increase over the next 12 months. The survey also highlighted a high level of demand from upgraders and downsizers, buyer segments who were less sensitive to interest rate movements. Source: Australian Financial Review Build-to-Rent Builds SteamSalta Properties, is now surging into the build-to-rent sector, with ambitions to create a $3 billion platform and with its first project in inner-city Melbourne close to completion. "We could see that we were heading into a fairly significant housing shortage in Melbourne, and more broadly across Australia," said Sam Tarascio, manager of the firm. The first block is a 94-unit project in trendy Fitzroy North at 249 Queens Parade. To be known as Fitzroy & Co, the building has topped out and is on track to welcome first residents from July into their one, two and three-bedroom apartments. Those tenants can expect a range of resident services, access to shared spaces and a variety of amenities. Source: Australian Financial Review Author: Filippo Sciacca, Director - Investor Relations, Asset Management and Compliance Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

26 Mar 2024 - Performance Report: Digital Asset Fund (Digital Opportunities Class)

[Current Manager Report if available]