News

11 Apr 2024 - Performance Report: ASCF High Yield Fund

[Current Manager Report if available]

10 Apr 2024 - Performance Report: Bennelong Concentrated Australian Equities Fund

[Current Manager Report if available]

10 Apr 2024 - Performance Report: Delft Partners Global High Conviction Strategy

[Current Manager Report if available]

9 Apr 2024 - Performance Report: Bennelong Australian Equities Fund

[Current Manager Report if available]

9 Apr 2024 - Performance Report: Rixon Income Fund

[Current Manager Report if available]

9 Apr 2024 - Exchange Traded Funds

|

Exchange Traded Funds Airlie Funds Management March 2024 |

|

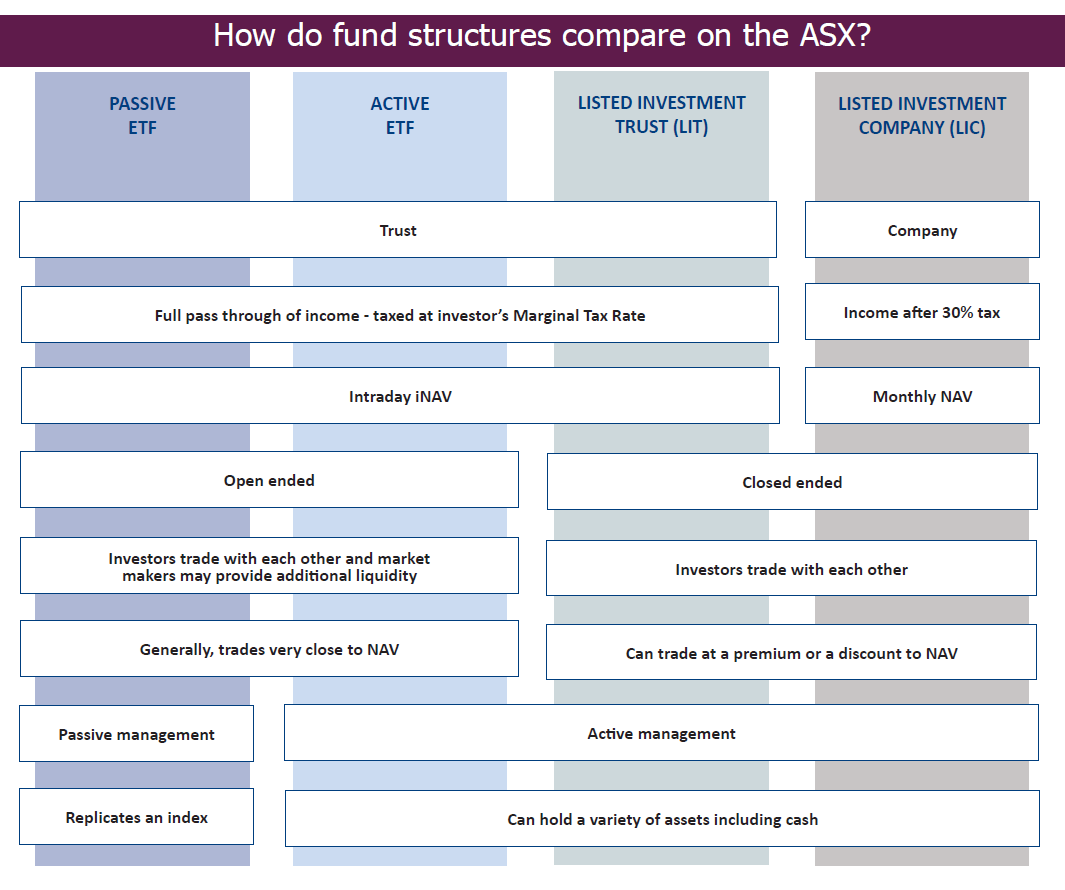

Exchange Traded Funds (ETFs) are a simple way for investors to gain access to a wide range of asset classes. They are open-ended funds whose units trade on a securities exchange (Exchange), just like an ordinary listed security. They enable investors to gain access to a portfolio of securities in one easy transaction - either online or through a stockbroker. Passive ETFs have existed since 1993 when State Street launched the SPDR S&P 500 ETF in the US. Passive ETFs typically track an index (such as the ASX200 index) and the portfolio is updated regularly (generally quarterly) to reflect changes in the reference index. Active ETFs, where an investment manager is actively managing a portfolio of securities, have existed globally for some time. However, there have been few choices available to investors as investment managers have been reluctant to publish their portfolios daily. In Australia, Active ETF issuance started to evolve in early 2015 when issuers and regulators agreed on a portfolio disclosure regime that balanced the needs of investors who want to know what they are investing in with the protection of the investment manager's intellectual property (its portfolio holdings and active portfolio decisions). What are the similarities?STRUCTURE In Australia, both Passive and Active ETFs are generally registered managed investment schemes, a type of 'unit trust', that trades on the Exchange in the same way that a share in a company trades on an Exchange. Like any share or unit traded on an Exchange, investors can buy or sell units in the ETF from each other through the Exchange. TRANSPARENCY Investors have transparency as to the value of the underlying fund and the composition of its portfolio through regular disclosure provided on the Exchange and the ETF issuer's website. The value of the ETF's underlying investments is generally provided in the form of the net asset value (NAV) per unit and an indicative intraday net asset value (iNAV) per unit, which generally updates throughout the ASX trading day. The level of portfolio disclosure will generally depend on whether the ETF is a Passive ETF or an Active ETF and, in the case of the latter, adhering to regulatory guidance on portfolio holding disclosure. Passive ETFs will either provide an iNAV per unit and/or full portfolio disclosure on a daily basis. Active ETFs that employ an internal market making model will generally provide daily net asset value and iNAV per unit, monthly fund updates and a full portfolio comprising names and weights of the investments on a quarterly basis. LIQUIDITY In seeking to ensure there is efficient trading in the secondary market of ETF units and with the objective of having the trading price track the underlying NAV, ETF issuers put in place additional liquidity arrangements. As ETFs are open-ended funds and can issue and redeem units, they are able to facilitate these liquidity arrangements. Passive ETF issuers largely outsource the provision of liquidity to third-party market makers or authorised participants such as institutional brokers. Market makers trade an inventory of units on the Exchange and are able to apply or redeem with the ETF issuer to settle their net trading position. These market makers form their own view of the NAV of the ETF and provide bids and offers in the market around that value, within the bounds of their own balance sheet risk appetite for providing this liquidity. Active ETF issuers either follow the same market making model as Passive ETFs or opt to be internal market makers where they seek to provide sufficient liquidity for the ETF. This means that the ETF might, at any time, be providing bids and offers in the market around the issuer's assessed value of the units at that time. TAXATION Being unit trusts, both Passive and Active ETFs allow a full passthrough of income on a pro-rata basis such as dividends, franking credits, capital gains and discounted capital gains income and net income is taxed in the hands of the end investor. What are the differences?TYPES OF INVESTMENTS With an Active ETF, a portfolio manager will undertake stock research to determine which underlying securities or stocks to hold and in what percentages. They will then actively manage weightings of the stocks depending on stock valuations, industry trends and views on macroeconomics. They can also hold cash to manage the overall risk of the portfolio and to take advantage of opportunities when markets move. A Passive ETF tracks an index. This can be over a broad-based stock market index, a sector index, custom-built indices or indices comprising fixed income, credit, commodities and currency. They can either fully replicate an index by buying all the securities that make up the index or they can be optimised by buying the securities in an index that provides the most representative sample of the index based on correlations, exposure and risk. Passive ETFs can either attempt to track their target indices by holding all, or a representative sample, of the underlying securities that make up the index or instead of physically holding each of the securities they can hold synthetic exposure to securities by using derivatives such as swaps to execute their investment strategy. How many ETFs are available on the ASX?As at the end of January 2024, there were 325 Active and Passive ETFs available on the ASX with over $178 billion* in market capitalisation.

|

8 Apr 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Schroder Multi-Asset Income Fund (Wholesale Class) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Schroder Global Emerging Markets Fund (Wholesale Class) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Schroder Global Sustainable Equity Fund (Wholesale Class) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Schroder Sustainable Global Core Fund (Wholesale Class) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Schroder Global Recovery Fund (Wholesale Class) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Schroder Equity Opportunities Fund (Wholesale) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

5 Apr 2024 - Hedge Clippings | 05 April 2024

|

|

|

|

Hedge Clippings | 05 April 2024 US Federal Reserve Chairman Jerome Powell pushed back expectations for an early (and multiple) cut to interest rates, saying they're still likely, but only at "some point" this year, saying that "solid growth, a strong but rebalancing labour market, and inflation moving down towards 2 per cent on a sometimes bumpy path" was going to make the timing of an easing - and possibly even the outcome - anything but certain. The same can be said about the timing of a rate cut in Australia, with expectations being pushed out, and the market pricing in only a 10% chance of a move (down) at the RBA's May meeting. The AFR reported this week that the median forecaster in their survey of 39 economists is tipping November before there's a cut, but their expectations have been extended for the past year. News & Insights New Funds on FundMonitors.com 10 cognitive biases that can lead to investment mistakes | Magellan Asset Management |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

5 Apr 2024 - Assessing the impact of green bonds

|

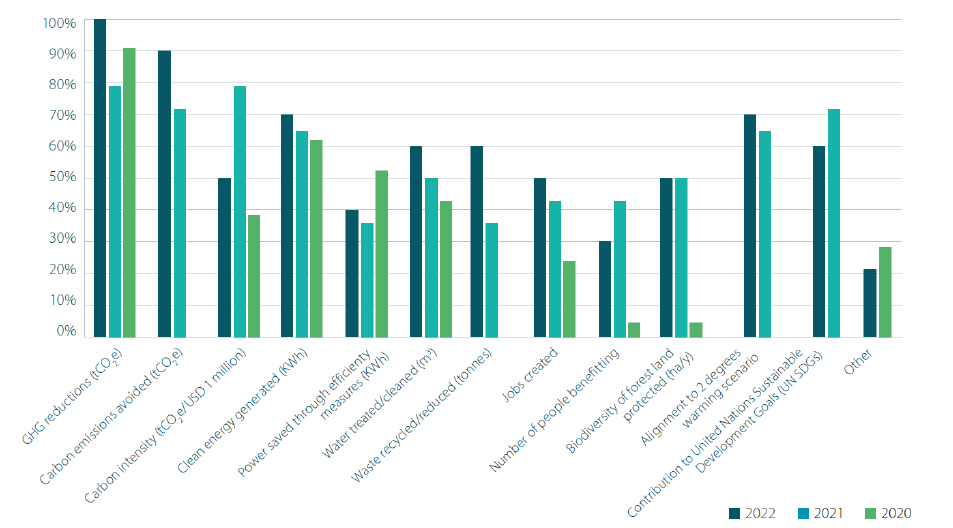

Assessing the impact of green bonds Nikko Asset Management March 2024 The green bond market has experienced tremendous growth since 2007, but despite its rapid success, there are still barriers to overcome. In particular, assessing the impact of green bonds continues to be a contentious topic. Due to a lack of standardisation among both issuers and regulators, gathering, grouping and communicating fund-level impact data is challenging, as are efforts to ensure green bonds continue to represent the interests and requirements of investors. Nonetheless, measuring the impact of green bonds is an essential component in ensuring their continued success. Which metrics matter most to green bond investors?As one would expect given the increasing appetite to understand the real impact of investments, most green bond investors track alignment with the United Nations Sustainable Development Goals (SDGs). SDGs are a great basis for mapping the use of proceeds to clear and understandable environmental and social outcomes. Indeed, many of the most common metrics required by investors - including greenhouse gas reductions, CO2 emissions avoided and carbon intensity--have become established components in impact reports from issuers. Please see an Environmental Finance survey from 2022 in Charts 1 and 2. Green, Social, Sustainability and Sustainability-Linked Bond Principles designed by the International Capital Market Association (ICMA) have been widely accepted as the common framework to provide transparency on the issuance of labelled bonds. All issuers aligned to ICMA Principles are committed to report on the allocation of proceeds, which is generally accompanied by impact metrics. While the IMCA Principles are a useful starting point to gather and compare how proceeds are being used by issuers, and the impact they have, the principles themselves are broad and not prescriptive. This means that the reporting quality and consistency between issuers can still vary widely. Some issuers will report their allocation on an aggregated portfolio basis, rather than on a bond-by-bond basis. Others may not specify what proportion of a specific project is financed by the green bond proceeds--making it almost impossible to measure bond-specific impact. In recognition of this, while adhering to IMCA Principles is a good starting point, investors seeking to meaningfully understand the impact of green bonds and want to be able to compare and contrast between different green bonds, continue to demand better quality impact reporting from bond issuers, and increasingly look to do so through issuer engagement. Chart 1: What environmental metrics are your firm most interested in?

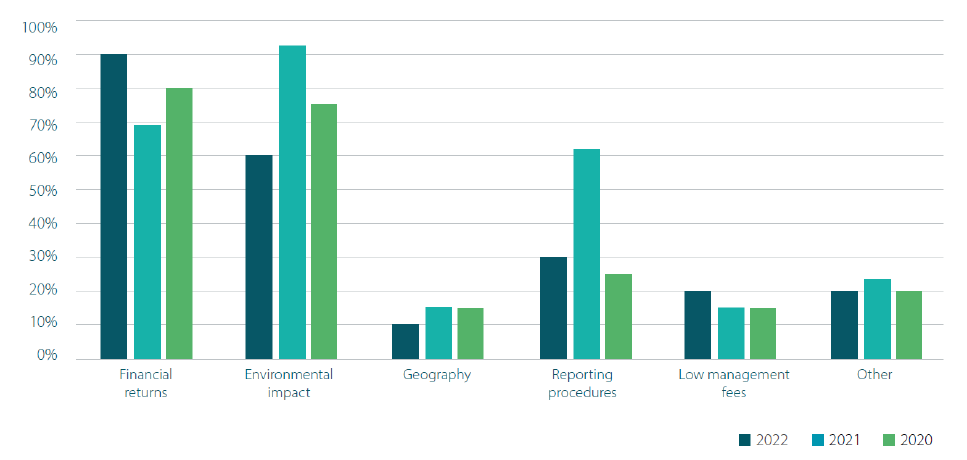

Source: Environmental Finance survey (2022) Chart 2: What are your firm's main criteria when choosing a green bond fund to invest in?

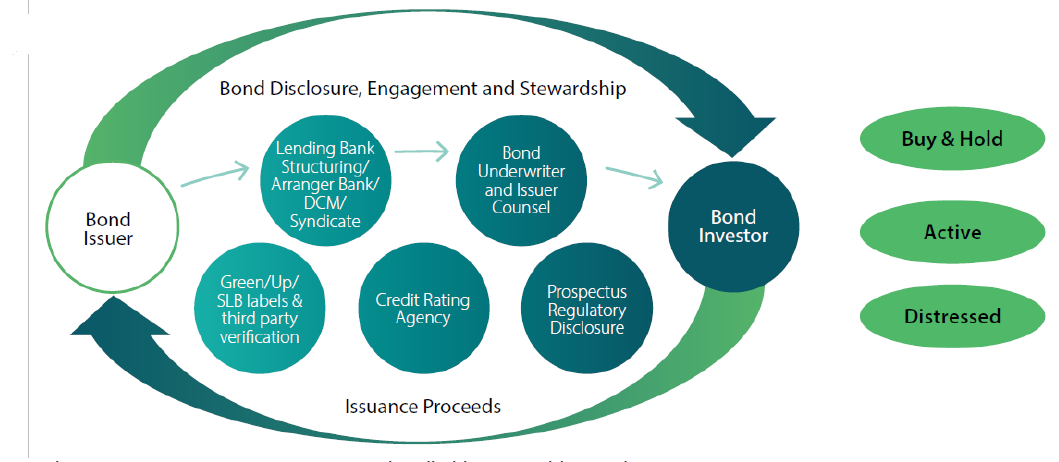

Source: Environmental Finance survey (2022) Engagement throughout the lifecycleThe IIGCC Net Zero Bondholder Stewardship Guidance advocates a long-term financing lifecycle-based approach. This presents a useful illustration on how engagement can support better impact measurement and reporting. The lifecycle includes the following steps:

Chart 3: Bond market ecosystem

Source: https://www.iigcc.org/resources/net-zero-bondholder-stewardship-guidance Regulatory challengesNew 2023 requirements surrounding the introduction of the EU Taxonomy have imposed additional regulatory responsibilities on fund managers. While initially focusing on climate environmental objectives, 2023 revisions have included a wider set of sustainably-orientated economic activities, namely:

Nikko AM's perspective is that although the EU Taxonomy is helpful for determining whether an economic activity can be considered environmentally sustainable, it is not the only approach and is less well adapted to companies beyond the EU. The EU Taxonomy could be considered as sometimes too stringent in its quantitative demands, given the availability and quality of data. Currently we do not use the EU Taxonomy to measure impact in our own funds. That said, we do recognise it has value in terms of monitoring, as well as highlighting certain key elements that any sustainable investment process should possess. What next for green bond fund impact reporting?Although impact reporting among green bond issuers is improving, the quality and consistency of impact reporting can still vary significantly. Without being properly addressed, this lack of standardisation on reporting could have deeper consequences for the industry as a whole. The lack of consistent data is not only an issue for our own analysis but also for our client's reporting expectations. The less transparent an issuer is, the less likely the bond will be included in a sustainable fund. However, progress is being made, and the global significance of green bonds means that specialist data providers are increasingly looking to provide comparable impact data for analysis and reporting, using assumptions and methodology to understand impact. Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information |

4 Apr 2024 - When Private Equity Would Be Laughed Out of The Boardroom

|

When Private Equity Would Be Laughed Out of The Boardroom Redwheel March 2024 |

|

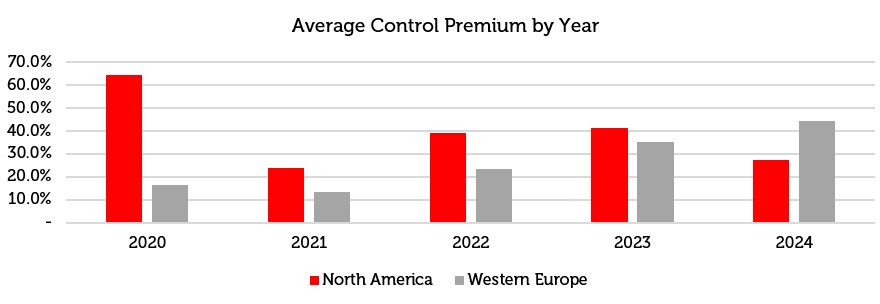

In recent decades, fuelled by lower and lower interest rates, we observe many large investors across the world have been re-allocating funds away from public markets, and into private assets - be those private equity or private credit vehicles. The theory behind this approach is that there is an 'illiquidity premium' to be earned by owning assets that are locked up for longer, boosting the returns of the investors relative to those who own assets that are freely traded on the open market. Leaving aside the veracity of that conjecture - with some who have argued plausibly that, in fact, investors pay not to see the mark-to-market volatility of their portfolios [1] - one curious aspect of the private markets, as compared to public markets, is worth noting. When buying companies outright, private investors necessarily need to negotiate over a single price for the entire company, a process involving numerous Board members, bankers, lawyers and accountants on all fronts, not to mention the shareholders who will be the ultimate beneficiaries of the sale proceeds. In that process, it is common for bidders to offer a "control premium", an excess of the current market price of the company that convinces shareholders to sell, and ostensibly represents the value to the buyer of having control of the company. These premiums can range anywhere between 10% and 100% in excess of the current market value of the company, with average premiums in the ~40% range, a figure we would view as not insubstantial.[2]

Source: Bloomberg, at 11 March 2024. 2024 control premium is year-to-date. The information show above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice. By contrast, when public market investors like us want to invest in a company, we don't consult the Board or its advisors on what price they'd like us to pay - we just go into the market and buy shares from whomever is willing to sell them to us, at the prevailing price, even if that price is so low that a Board of Directors would never dream of accepting it for the entire enterprise. By its nature, then, buying the same previously-listed company in a private equity fund or structure will cost more than simply buying shares on the open market - increasing the hurdle of corporate performance that will be required to earn investors a good return. In this sense, we believe us public market investors have a huge advantage, with the ability to make purchases at prices which we consider often so ludicrously low that any private equity firm - when trying to pay the same price for the entire company - will be quite literally laughed out of the Boardroom. This is more than simple conjecture: in the past two weeks, two companies held in our portfolios - Curry's and Direct Line Group - have received unsolicited buyout offers from parties seeking to take them private, and both have (we think quite rightly) firmly rejected those offers as materially too low. Of course, no one made any such objections or consternations to us when we bought our shares on the London Stock Exchange for those same companies at similar prices (or, dare we admit, even lower prices). It is intriguing, then, that many large institutional investors - principally large pension funds - continue to eschew public markets in favour of private markets [3], especially in markets such as the UK, where public market valuations are undemanding in our view. Yet, as the Curry's and Direct Line example shows, this discount is not available to private bidders at prevailing prices: Boards are well aware of the despondency embedded in their market valuation, and are not going to let their shareholders be wrestled out of their companies for unfair prices. If you are the Trustee of a pension fund investing in private markets, then, you may wish to ask your CIO if they allocate to investors paying a premium to own the same assets that we get to buy without one. As value investors, we aim to earn a superior investment return over the long-term by paying material discounts to intrinsic business value. This opportunity, however, is effectively available only in public markets, where we can buy small pieces of companies - which is, after all, what shares truly are - from sellers on the open market, and to do so at prices that we consider as so eye watering that any self-respecting private bidder would not dare to suggest. As Curry's and Direct Line bidders Elliot and Ageas have learned recently, there are some potentially fantastic opportunities available in the public markets - but that these are often available only to public equity investors, and are perhaps simply too good for private bidders to access. Author: Shaul Rosten |

|

Funds operated by this manager: Redwheel China Equity Fund, Redwheel Global Emerging Markets Fund |

|

Sources: [1] Richardson, S. and Palhares, D., 2018. (Il) liquidity premium in credit markets: A myth?. The Journal of Fixed Income, 28(3), pp.5-23; Cliff Asness, AQR, (https://www.aqr.com/Insights/Perspectives/The-Illiquidity-Discount) [2] Eaton, G.W., Liu, T. and Officer, M.S., 2021. Rethinking measures of mergers & acquisitions deal premiums. Journal of Financial and Quantitative Analysis, 56(3), pp.1097-1126 [3] E.g. https://www.bloomberg.com/news/articles/2023-12-11/investors-to-increase-allocation-to-private-credit-survey-shows, https://www.pionline.com/pension-funds/calpers-mulls-boosting-private-assets-allocation, https://www.ftadviser.com/investments/2024/02/15/half-of-advisers-to-increase-allocation-to-private-assets/, https://www.funds-europe.com/investors-bullish-about-private-capital-allocation/ Key Information |