News

21 Oct 2022 - RBA shows some patience with a return to neutral territory

|

RBA shows some patience with a return to neutral territory Pendal October 2022 |

|

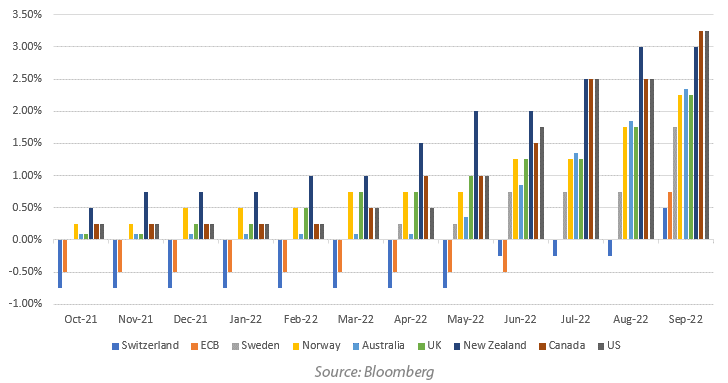

The Reserve Bank of Australia (RBA) surprised the market this month when raising the cash rate by 25 basis points to 2.60%. The market had assigned an 85% probability of the RBA hiking by 50 basis points. Governor Lowe dropped a hint last month that the pace of tightening would slow when he commented that "the case for a slower pace of increase in interest rates becomes stronger as the level of the cash rate rises". It was a case of a rising tide lifts all boats. As the following graph shows, central banks globally continued to tighten monetary policy aggressively in September. In Sweden the Riksbank tightened by a more than expected 100 basis points. The Federal Reserve, Bank of Canada, European Central Bank and Swiss National Bank (the last remaining member of the negative interest rate policy club) all raised their rates by 75 basis points. The RBA, Bank of England and Norges Bank were all in the 50 basis point hike camp last month.

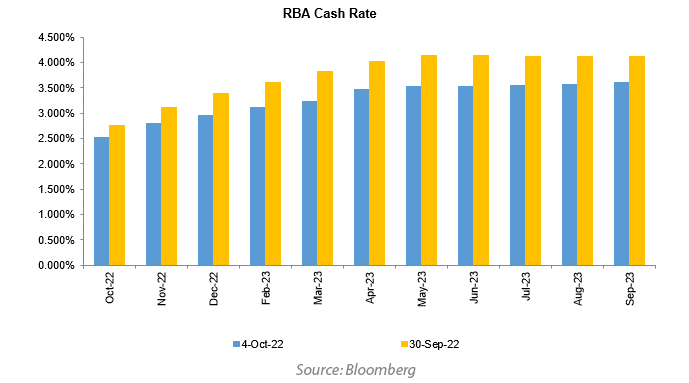

However, unlike other central banks, the RBA has shown some patience with this move. Rate hikes normally take 2 to 3 months to show up in any data given lags between the RBA hikes and the higher rates hitting mortgages. One of the key lines out of the statement yesterday was "One source of uncertainty is the outlook for the global economy, which has deteriorated recently". The UK Government's mini budget released last month was the source of much financial turmoil last month, the moves (and lack of liquidity) were astonishing late in the month. The RBA is also acutely aware of the large amount of fixed rate mortgages that roll off over 2023. The national accounts also reflected a drop in the household savings rate, indicating that the large savings buffers that households have built over the past 2 years may start to be called upon as cost of living pressures rise. The decision to raise by a less than expected 25 basis points yesterday resulted in the market pricing in a terminal cash rate of 3.6% in 1 years time. At the end of September this was around 4.1%.  Back around neutral the RBA now thinks it has time on its side. Their hope will be for better behaved CPI numbers in the quarters ahead. The Sep Quarter CPI, due out later this month, should show elevated yet slowing CPI. Our initial forecast is for a 1.4% increase, although electricity subsidies in WA and Victoria, and a lesser extent Queensland, could mean a lower number. 1.4% would be no cause for celebration but after a 2.1% and a 1.8% in recent quarters it is in the right direction. Governor Lowe will likely take his next round of speeches reiterating their preparedness to tackle inflation with above neutral rates if needed. "The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that" was the final line of yesterday's decision. For now though, reopening of supply chains, anchored inflation expectations and falling commodity prices are working in their favour. The key domestically will be how tight labour markets feed into wage outcomes over the next year. The RBA is prepared for 3.5% to 4% increases to wages, as many agreements are now showing, but will be alert for any trend higher. Immigration is making a welcome comeback and may well impact enough in the next 12 months for the RBA to get their way. However, the jobs market is unlikely to be back at pre COVID conditions until 2024 so the RBA patience, although welcome, may be tested again. Author: Tim Hext, Portfolio Manager and Head of Government Bond Strategies |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

20 Oct 2022 - The Rate Debate: Are central banks at risk of blowing up markets?

|

The Rate Debate - Episode 32 Are central banks at risk of blowing up markets? Yarra Capital Management 04 October 2022 The RBA hiked rates for the sixth consecutive month. With lead indicators showing signs of inflation coming off the boil and European banks starting to see stress, cracks are forming in the credit and equity markets. Have central banks tightened too aggressively risking a recession? Speakers: |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

19 Oct 2022 - Around the world in 200 Meetings, Mary Manning: Sustainable Futures

|

Around the world in 200 Meetings, Mary Manning: Sustainable Futures Alphinity Investment Management October 2022 For the first time since COVID, the Sustainable Futures conference took place in New York bringing together sustainable leaders from across the world. Mary Manning shares the details from her trip where she visited big tech and consumer companies in New York, Seattle and Toronto. Speakers: Mary Manning, Portfolio Manager & Elfreda Jonker, Client Portfolio Manager This information is for advisers & wholesale investors only. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

18 Oct 2022 - 'Small Talk' - Mood Swings

|

'Small Talk' - Mood Swings Equitable Investors October 2022 The market mood swings continued. Huge gains to get things rolling then a sharp reversal, felt most during the US trading session. Maybe the Reserve Bank of Australia (RBA) contributed to the positive start to the week globally when it raised interest rates by less than expected, leading to speculation the US Federal Reserve and others may be of a similar mind. But the Cleveland Fed President said that she has "not seen any evidence to warrant slowing the pace of hikes". Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

17 Oct 2022 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

|||||||||||||||||||

| Schroder Specialist Private Equity Fund | |||||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

| Alceon Real Estate Corporate Senior Master Fund | |||||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

| Bell Global Sustainable Fund (Hedged) | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile

|

|||||||||||||||||||

| Bell Global Sustainable Fund (Unhedged) | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||||

|

Subscribe for full access to these funds and over 700 others |

17 Oct 2022 - The Inflation Reduction Act will drive US' efforts towards net-zero

|

The Inflation Reduction Act will drive US' efforts towards net-zero 4D Infrastructure September 2022

What is the Inflation Reduction Act? On 16 August 2022, President Biden signed the IRA into law having passed through Congress based on the Democrats holding a majority in both houses. The IRA includes US$369 billion in climate and energy spending, the largest energy transition focused spending package ever in the US. It's expected to put the US on track to achieve a 40% greenhouse gas (GHG) reduction against 2005 levels by 2030[1] - which is still a little off Biden's communicated target of a 50-52% reduction[2]. Background to the legislation The components within the IRA were derived from the larger legislative package proposed by the Democrats, the Build Back Better Act (BBB), which was abandoned due to its perceived impact on the budget deficit. Moderate Democrat senator, Rep Manchin, was a key objector to BBB, but was convinced of the merits of the IRA and had the deciding vote in pushing the legislation through the Senate and signed into law. What is included in the package? The IRA spending package incorporates a number of high-level targets, with spending allocated to each. These goals include[3]:

The spending package is primarily financed through the establishment of a new minimum corporate tax rate of 15%, and increased powers of the Internal Revenues Service (IRS) to enforce tax payment. Specific support mechanisms to assist in facilitating the energy transition process are included in the table below. These are intended to improve the economics of clean/renewable energy production to incentivise their adoption. This is not an exhaustive list of mechanisms included in the IRA. Source: White & Case: Inflation Reduction Act Offers Significant Tax Incentives Targeting Energy Transition and Renewables Benefits for US infrastructure-focused companies The IRA improves the economics of clean/renewable energy production for utilities and contracted generation companies in 4D's investment universe. This in turn improves their competitiveness, fast tracks investment and theoretically boosts earnings growth. It should also reduce the cost of energy for the end customer through the application of regulation or competitive dynamics. Regulated energy production Regulation sets the level of returns that utilities can earn on renewable and clean energy investments. Therefore, the improved economics of renewables and clean energy production facilitated through the IRA is passed onto customers through lower energy bills. This improved customer affordability and bill headroom allows utilities to increase the level of investment in the energy transition and grid support, while maintaining affordability. This increased investment is expected to improve earnings growth. Specific regulated utility companies that are likely to benefit from mechanisms included in the IRA include American Electric Power (AEP-US), CMS Corp (CMS-US) and Portland General Electric (POR-US). Contracted energy production For contracted generation companies, or companies that produce clean energy fuels (clean hydrogen, carbon capture) under long-term contractual arrangements, the IRA should result in improved returns. Although, depending on the intensity of competition, these improved returns could be diminished in exchange for lower energy costs for customers. All scenarios should incentivise increased investment and growth for companies. A number of large European-based renewable/clean energy developers have indicated optimism associated with the IRA including Enel SpA (ENEL-MI), Energias de Portugal SA (EDP-LS) and Iberdrola SA (IBE-ES). A standout US contracted generation developer which is likely to benefit from the IRA is NextEra Energy (NEE-US). Midstream oil/gas Midstream companies which are attempting to extend the longevity of their business model by diversifying away from fossil-based commodities to clean fuels such as biofuels, renewable diesel, renewable natural gas, low/no carbon hydrogen and facilitating carbon capture, are likely to have more investment opportunities due to the IRA. The tax credits, rebates, and grants supporting these newer clean fuels improve their economics, making them a more attractive (and realistic) investment proposition. Midstream names such as Kinder Morgan Inc (KMI-US) are going to benefit from the improved carbon capture tax credits, while Enbridge Inc (ENB-CN) investment opportunities will improve through a number of the clean energy credits. Unknown impacts of the legislation As outlined, the spending package is expected to be partially financed through the implementation of a minimum corporate tax rate. The impact on infrastructure companies' cashflow will depend on individual company factors, but could have detrimental ramifications for some. Conclusion The IRA's passage into law in a major piece of legislation in supporting the US' efforts to decarbonise its economy while supporting efforts to develop vertical supply chains for clean/renewable energy in the US. The many support mechanisms included in the legislation primarily improve the economics of clean/renewable energy, and reduce the end cost for customers. Specific infrastructure companies in 4D's investment portfolio that are likely to benefit from the legislation include NextEra, American Electric Power, Enel, CMS Corp, Iberdrola and Kinder Morgan. |

|

Funds operated by this manager: 4D Global Infrastructure Fund, 4D Emerging Markets Infrastructure Fund[1] Environmental and Energy Study Institute: Historic US$369 Billion Investment in Climate Solutions Preserves a Pathway to Keep Global Warming Below 1.5°C - 16 August 2022 [2] President Biden Sets 2030 Greenhouse Gas Pollution Reduction Target Aimed at Creating Good-Paying Union Jobs and Securing U.S. Leadership on Clean Energy Technologies - 22 April 2022 [3] Summary of the Energy Security and Climate Change Investments in the Inflation Reduction Act of 2022 - https://www.democrats.senate.gov/summary-of-the-energy-security-and-climate-change-investments-in-the-inflation-reduction-act-of-2022 [4] The Wage and Apprenticeship Requirements are measures which aim to ensure that 1) contractors and subcontractors are paid in line with commensurate job wage requirements; and 2) a proportion of the workforce are filled by qualified apprentices. The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. |

14 Oct 2022 - The energy crisis is likely to last years

|

The energy crisis is likely to last years Magellan Asset Management September 2022 |

|

Europe is restarting mothballed coal-based power plants because the benchmark electricity price has exceeded 1,000% above its average of the past decade (where prices are set by the marginal cost of the last unit - essentially, the most expensive unit - of energy purchased to balance demand).[1] Electricity prices are spiralling because the cost of natural gas, the marginal fuel in most European electricity markets, has soared 1,300% above its decade average - the shock would be like oil nearing US$550 a barrel. The EU, in response, is imposing wartime-like price controls, rationing and a windfall tax on energy companies.[2] In the UK, the prospect of household energy bills jumping by 9 percentage points of GDP[3] has prompted London to announce emergency measures that, at an estimated cost of 150 billion pounds, is double the cost of the pandemic furlough scheme, and to reallow shale-gas fracking.[4] Norway, where hydropower generates 90% of local needs, may curb the export of electricity,[5] raising concerns cross-border flows could drop, even collapse, across Europe. French nuclear power output is diving due to maintenance and repairs - Électricité de France is only operating 26 of the country's 57 reactors.[6] President Emmanuel Macron, who is fully nationalising the troubled nuclear operator, warns of the "end of abundance".[7] Germany is worried that rage over energy prices driving inflation to near-50-year highs could turn violent.[8] Kosovo is facing two-hour blackouts every six hours, the first European country to display this feature of a failed state.[9] In China, daily hydro generation from the Three Gorges dam on the Yangtze River has dived 51%. Factories have suspended operations and cities are dimming lights.[10] Japan is overcoming its Fukushima fears and returning to nuclear power. Southeast Asia is using coal to replace the liquified natural gas diverted to Europe. South Asia is suffering blackouts because energy is unaffordable. US natural gas prices in August breached US$10 per million BTU, a 400% increase on the recent years, due to demand from Europe. The world faces its biggest energy crisis since the 1970s when soaring oil prices helped create the stagflation for which the decade is renowned. Today's energy blow could be crueller because the energy industry, having overcome the pandemic disruptions that boosted prices for hydrocarbons, is beset by three challenges (broadly defined with some overlap) that are set to persist, if not worsen. The first challenge is the unfavourable state of global politics. Europe's torment is due to the significant cuts to the supply of Russian oil and natural gas that accounted for 40% of its energy needs. Moscow has weaponised gas supplies to inflict economic pain on Europe to undermine public support for arming Ukraine, while the West is seeking to restrict Russian oil sales. Oil and gas prices are likely to stay elevated in the near term because the world's energy system cannot quickly replace Russia's lost hydrocarbons, which equate to about 10% of global energy production.[11] The Middle East is another concern. The return of Iranian oil to world markets could help Europe overcome the loss of Russian crude. But this depends on restoring the agreement on Iran's nuclear capabilities between Iran and the EU, Germany and the five permanent members of the UN Security Council - one of which is Iran's ally, Russia.[12] Moscow could easily delay any new agreement or ensure that any restored pact is short-lived. The second big challenge for energy markets relates to climate change. Droughts and heatwaves in China, Europe and North America are hampering hydropower electricity generation (China, Italy, Norway, Spain and Portugal) while boosting demand beyond capacity to cope (the US). France's nuclear-based EDF has cut production because receding rivers make it harder to cool reactors. Another angle to climate change is that renewable energy generation has not reached a level whereby it can compensate for Russia's lost fossil fuels, hence the return to coal in Europe. Prior to the Ukraine war, Europe already had depleted energy storage due to a less-windy-than-usual weather idling wind farms, a problem worsened by Russia's Gazprom withholding gas above contracted amounts, contrary to normal practice, ahead of the Ukraine invasion.[13] The third challenge for energy markets is overcoming policymaker mistakes. The biggest error is that Europe, notably Germany, became overly dependent on Russian energy, especially natural gas that is not as easy as coal or oil to replace. A second mistake is France has failed to keep operational the country's nuclear reactors that were mostly built in the 1980s and typically supply 70% of the country's power needs.[14] A third error, many would argue, is the world's turn away from nuclear energy after the Fukushima disaster in 2011. Many would say that a fourth blunder was not investing enough in renewables.[15] Plenty of blame will flow if the rising prices that are creating huge paper losses for utilities on Europe's energy derivatives markets spark financial instability.[16] Governments, aware of the risk, have acted to ensure energy companies can meet collateral obligations. Today's energy crisis is still unfolding. The crisis-magnifying characteristics of energy markets - that inelastic demand maximises price increases when supply is troubled - give entrepreneurs the incentive to remedy these shortages. In time, the promise of profit will calm the energy crisis with clean solutions that snap Western dependence on despots. In the meantime, however, the disruption to French nuclear power, European hydropower and Russian gas and higher oil prices could cut global living standards, boost inflation, trigger a recession or worse in Europe, hound those in power, widen inequality within and between countries, trigger social unrest, spark industrial conflict and impede the fight against climate change. The damage inflicted just in Europe will likely make the 2020s energy crisis worse than that of the 1970s. To be sure, this is a crisis centred in Europe and favourable developments in relation to the Ukraine war could calm things. Droughts will break and heatwaves pass. Maybe a sunny, warm and windy winter in Europe and energy substitution and conservation [17] will ease power costs. Efforts are underway to fill gas storage facilities across Europe - but, even at capacity, storage is a fraction of normal winter demand. Countries with gas and other energy reserves such as Algeria, Australia, Qatar and the US stand to gain. The recent fall in oil prices relieves some inflationary pressure.[18] But spot oil prices have declined on China's pandemic lockdowns and concerns about a European recession. The energy crisis largely created by Russia's missing fossil fuels might best be viewed as shorthand for a series of crises around climate change, government finances, inequality, inflation, politics and social cohesion as well. Policymakers have much to solve before European gas and oil prices drop to anywhere near their pre-crisis averages. The blind spot In 2001, Russian President Vladimir Putin addressed the German parliament and in flawless German expressed a desire for warmer ties with the West. "Russia is a friendly European nation," Putin declared. German lawmakers leapt up in applause. One biographer of Angela Merkel wonders: Did Putin notice that in the second row of the Bundestag chamber, an unsmiling future chancellor who grew up in East Germany and spoke Russian remained seated? Merkel barely clapped. She knew KGB "values, loyalties and training are not so easily shed".[19] In 2020, Russian opposition leader Alexei Navalny collapsed after being poisoned with a nerve agent. He survived only because Merkel arranged for Navalny to be medivacked to Berlin. But even as Navalny lay in a coma in the Charité hospital, Merkel refused to cancel the Nord Stream 2 pipeline that would double the amount of gas pumped from Russia across the Baltic Sea to Germany.[20] Nord Stream 1, which has operated since 2011, carries 55 billion m3 of gas a year. Merkel's willingness to allow Germany to become dependent on Russian gas is now regarded as her blind spot. "Every time Obama asked Merkel why she was going ahead with Nord Stream 2, Merkel gave a different answer," a national security adviser to the US administration of Barack Obama recalls.[21] Other German policymakers were just as short-sighted. German Foreign Minister Heiko Maas and others in the German delegation smirked when Donald Trump in 2018 warned Germany it would become "totally dependent on Russian energy if it does not immediately change course".[22] The German laughter reflected the country's desire to reduce reliance on coal to mitigate climate change, eradicate nuclear power plants for safety reasons, save money, and a hope that greater economic ties would improve political ties with Russia. Russia's invasion of Ukraine prompted Germany to block Nord Stream 2. In retaliation, Russia is stifling flows through Nord Stream 1 and Europe is turning to LNG and other fossil fuels. In time, the investment underway in renewables will be a big part of how Europe escapes the folly of relying on a non-renewable fossil fuel under the stranglehold of a hostile autocrat. Once Europe has secured affordable and clean energy, it will be able to close for good those coal plants being refired to overcome today's energy emergency. Global price of natural gas, EU Sources: Company filings Author: Michael Collins, Investment Specialist |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund [1] Europe adopted this marginal-cost policy to prod investment in renewables. The marginal cost of wind and sun creating more power is theoretically close to zero while the marginal cost for fossil-fuel-based production is the cost of the coal or gas. See Yanis Varoukakis, former Greek minister of finance. 'Time to blow up electricity markets.' Project Syndicate. 29 August 2022. project-syndicate.org/commentary/marginal-cost-pricing-for-electricity-disastrous-in-europe-by-yanis-varoufakis-2022-08 [2] European Commission. '2022 state of the union address by President von der Leyen.' 14 September 2022. ec.europa.eu/commission/presscorner/detail/ov/SPEECH_22_5493 [3] Carbon Brief, UK website focused on climate change. 'Analysis: Why UK energy bills are soaring to record highs - and how to cut them.' 12 August 2022. Household energy bills could rise from 4.5% of UK GDP in 2020 to 13.4% of output by next April. Household energy bills include energy spending on homes and cars. carbonbrief.org/analysis-why-uk-energy-bills-are-soaring-to-record-highs-and-how-to-cut-them/ [4] UK Prime Minister's Office. 'PM Liz Truss's opening speech on the energy policy debate.' 8 September 2022. Renewable and nuclear generators will move onto contracts for difference to end the situation where electricity prices are set by the marginal price of gas. gov.uk/government/speeches/pm-liz-trusss-opening-speech-on-the-energy-policy-debate [5] The grid operators of Denmark, Finland and Sweden condemned the move in what should be a border-less market. 'Nordic cooperation - More needed than ever to ensure electricity supply.' Energinet. 19 August 2022. en.energinet.dk/About-our-news/News/2022/08/19/Nordic-cooperation-more-needed-than-ever-to-ensure-electricity-supply [6] Javier Blas. 'Paris faces an even colder, darker winter than Berlin.' Bloomberg News. 29 July 2022. bloomberg.com/opinion/articles/2022-07-29/european-energy-crisis-paris-may-be-first-to-suffer-blackouts-this-winter [7] 'Macron warns of 'end of abundance' as France faces difficult winter.' The Guardian. 25 August 2022. theguardian.com/world/2022/aug/24/macron-warns-of-end-of-abundance-as-france-faces-difficult-winter. / [8] See World in depth. 'Extremists plan 'autumn of rage' to exploit cost of living crisis in Germany.' The Times. 25 August 2022. thetimes.co.uk/article/extremists-plan-autumn-of-rage-to-exploit-cost-of-living-crisis-in-germany-ht6sm5hbc. German inflation reached 8.8% in the year to August. [9] Andrea Dudik. 'A corner of Europe starts living with blackouts again.' Bloomberg News. 26 August 2022. bloomberg.com/news/articles/2022-08-26/europe-energy-crisis-kosovo-learns-to-live-with-rolling-power-blackouts-again [10] Bloomberg News. 'Power crunch in Sichuan adds to industry's woes in China.' 21 August 2022. bloomberg.com/news/articles/2022-08-21/power-crunch-in-sichuan-adds-to-manufacturers-woes-in-china2 [11] International Energy Agency. 'Energy fact sheet: Why does Russian oil and gas matter?' 21 March 2022. iea.org/articles/energy-fact-sheet-why-does-russian-oil-and-gas-matter [12] The Joint Comprehensive Plan of Action of 2015 that restricts Iran's ability to develop nuclear weapons collapsed when the US withdrew in 2018. [13] Russia refused to supply extra gas to Europe to make up for the shortage of wind-driven power. The speculation is the Kremlin instructed Gazprom not to supply extra gas in anticipation it would be weaponising gas after it invaded Ukraine. [14] The industry failed to invest to sustain the reactors and failed to maintain its engineering expertise. See 'French nuclear power crisis frustrates Europe's push to quit Russian energy.' The New York Times. 18 June 2022. nytimes.com/2022/06/18/business/france-nuclear-power-russia.html [15] See Fatih Birol, executive director of the International Energy Agency. 'Three myths about the global energy crisis.' Financial Times. 6 September 2022. ft.com/content/2c133867-7a89-44d0-9594-cab919492777 [16] See ''Lehman event' looms for Europe as energy companies face $1.5T in margin calls.' Oilprice.com. 6 September 2022. See also The Economist, Free Exchange 'Europe's energy market was not built for this crisis.' 8 September 2022. economist.com/finance-and-economics/2022/09/08/europes-energy-market-was-not-built-for-this-crisis [17] See Chris Giles. 'Europe can withstand a winter recession.' Financial Times. 10 August 2022. ft.com/content/c9ec6d9d-a015-402c-a06e-f61b6ad87f92 [18] The US plan to impose a price cap on Russian oil shipments is prompting Russian oil companies to offer discounts on long-term contracts. See Julian Lee. 'Russian oil producers feel the heat' Bloomberg News. 25 August 2022. bloomberg.com/opinion/articles/2022-08-25/russian-oil-producers-feel-the-heat-elements-by-julian-lee [19] Kati Marton. 'The chancellor. The remarkable odyssey of Angela Merkel.' William Collins 2021. Paperback. Page 108. [20] Marton. Op cit. Pages 112 to 113. [21] Marton. Op cit. Pages 113 to 114. [22] 'Trump accused Germany of becoming 'totally dependent' on Russian energy at the UN. The Germans just smirked.' The Washington Post. 25 September 2018. washingtonpost.com/world/2018/09/25/trump-accused-germany-becoming-totally-dependent-russian-energy-un-germans-just-smirked/ Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

13 Oct 2022 - Altor AltFi Income Fund - September 2022 Quarterly Webinar Update

|

Webinar Registration: Altor AltFi Income Fund - Quarterly Webinar Update

|

13 Oct 2022 - Sector Spotlight: Tabcorp

|

Sector Spotlight: Tabcorp Airlie Funds Management July 2022 |

|

Hear from Joe Wright as he provides a backdrop on Seven Group; a diversified investment business operating mining and industrials companies including WesTrac, Coates and Boral. Speaker: Will Granger, Equities Analyst Funds operated by this manager: Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks.. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

12 Oct 2022 - Which companies are posting strong and growing results?

|

Which companies are posting strong and growing results? Insync Fund Managers September 2022 Well, we said things would be positive but volatile for a while yet and we weren't wrong. In this article, we provide examples of companies that we hold which are posting strong and growing results. Yet, their stock prices are slightly down as the world frets about big-picture issues that most of our companies aren't all that impacted by. The 'Lipstick Effect' is just one way they remain resilient, and we look at two holdings doing well from this. Our funds remain ahead of their stated 5-year objectives after fees, even with present shorter-term lows and volatility. The key to this is understanding how earnings eventually are reflected in stock prices and which companies do this well. Patience rewards. It was another volatile month for stock prices as markets focus more on the macroeconomic landscape. This sees most stocks being treated the same, no matter their specific financial circumstances. As markets are presently concerned with short term interest rate hikes, even quality companies posting great results (despite inflation and interest rate settings) are tarred with the same brush as those that are impacted. This is nothing out of the ordinary for this stage of the cycle. Whilst inflation has peaked and gradually heads down, markets are now trying to anticipate what impact higher interest rates will have on the global economy and corporate earnings. The benefit of investing in highly profitable companies with long runways of growth backed up by megatrends, comes the higher confidence around their longer-term earnings growth rates, irrespective of macroeconomic conditions! Whilst an economic slowdown may temporarily reduce the growth trajectories of high-quality compounders, their long-term growth rates tend to be more assured. Insync Megatrend Exposures 2022 August The temptation to time being in or out right now is high, as is the cost. Bank of America found that investor returns in the S&P 500 would stand at just 28% today had they missed just the 10 best days of each 3,650 day decade since the 1930s - a dismal result. It's a whopping 17,715% had they held steady. Market gyrations are not insync with news cycles or with logic. This is why timing is risky. Buffet's metaphor stands... "In the short run, the market is a voting machine but in the long run, it is a weighing machine." Our funds are for long term investors, and this is why it's important to reflect on this. Companies can do well - even now Market sell-downs in periods of volatility often provide the best opportunities to invest for the long term.

There was plenty of bad macroeconomic news over this period to dissuade being invested too. A US debt ceiling crisis in 2011, European debt crisis in 2012, Greek default crisis in 2015, collapse in China' stock market in 2016, Covid-19 crisis in 2020...you get the picture. Home Depot also paid 10% p.a. compounding dividend (they expect to pay a $7.60 dividend in 2022). This means you are receiving well over HALF your original purchase price back in 2009 in dividends from just this year! Patience rewards. We remain confident in the strength and durability of earnings growth in the Insync portfolio companies and see temporary price falls as ideal buying opportunities. Two further examples of highly profitable companies in the portfolio are Lululemon and Ulta Beauty, both benefitting from the Lipstick Effect. In their recent quarterly earnings updates Lululemon reported a 29% revenue increase and a 30% increase in EPS. Ulta Beauty reported a 17% increase in revenues and a 25% increase in EPS (earnings per share). When investors keep focused on the growing earnings power of quality companies, they find their stock prices grow eventually as well. This is especially true for the investor time periods the fund is designed for. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |