News

3 May 2024 - Performance Report: Equitable Investors Dragonfly Fund

[Current Manager Report if available]

3 May 2024 - Performance Report: Insync Global Quality Equity Fund

[Current Manager Report if available]

3 May 2024 - Staying invested in resources stocks: has the bull-market started?

|

Staying invested in resources stocks: has the bull-market started? Janus Henderson Investors April 2024 At the outset of this year, we suggested that investors should stay invested in resource stocks and join us in our patient wait for a long-anticipated bull market in global natural resources. Updating an annual outlook after just one quarter may seem presumptuous, but there have been many very significant developments in the market that have compelled us to restate the case for staying the course. China continues to grow and innovate at an impressive rate. Electric vehicle design, manufacture and exports look set to rapidly impact global markets. Just as the US has skirted a well-anticipated recession, it appears the China slowdown is turning a corner; we expect to see indications that a cataclysmic slowdown has been averted and normal operations resume. Valuations in the stock and property markets are already at low levels and are pricing in very low expectations, so the surprise factor is much more likely to be to the upside from here. Meanwhile, geopolitics remains complicated, but the "return to normal" in the macroeconomic environment seems to be well underway. It is hard to imagine anything more confounding than the extraordinary distortions created by the pandemic, and three significant conflicts (China-US trade, Ukraine and the Middle East). But underlying all these challenges, global trade continues to surprise on the upside and we are seeing some economic and corporate indicators turning positive for growth. We think much of the unmet demand from the past few years may have yet to be fulfilled, which is among the reasons we see a progressively more positive environment for natural resource companies. On the pathway in the bull-market journey for resourcesIf I step back and contemplate on 35 years in the industry, many well-worn aphorisms can give some guidance and yet at times be completely wrong. For instance, it is generally accepted that commodities prices are mean reverting, that is, they tend to move back to their long-run average over time. This is clearly not true. I am imagining being asked a question by my great granddaughter in 2065 as I near 100 years. She says, "Pa, tell me about the Great Inflation of the 2030s." Well, I say, how surprising would it be to have a systematic commodity inflation of great amplitude over a ten-to-twenty-year period when the world is growing, adding two billion more people, and achieving higher living standards. Globally, we have not invested in commodity production adequately for the prior 15 years, so how can we assume per-capita consumption for three quarters of the world's population has been improved in any meaningful way? To illustrate, in the first 10 years of my investing career, copper was a $1/lb commodity, keeping within a $0.65 to $1.40 range, in a period that was mostly a bear market. Then, it traded between $3.00 to $3.50/lb for almost 20 years. Copper deposits are hard to find, develop into mines and operate. Demand is growing, with electric vehicles, storage batteries, and decarbonisation driving growth of electricity grids - all of which is likely to push prices higher. Copper has just moved higher from a broad pricing range in the past three years, it is now trading at circa $4.30/lb. This suggests we have strong support for the metal that is fundamental to modern human existence, given its broad usage e.g. home appliances, transportation equipment, electronic products, electrical grids and building construction. Similarly, oil was a $15 to $20/per barrel commodity, which moved up to $40 to $65, and now looks to be in an $80-$120 range as seen in the past three years or so. These large step changes of around 3x (300%) can also be seen in other key commodities such as iron ore, gold, uranium, lithium. Another way of expressing this is that the commodity index (S&P GSCI) gained around 10% per year, for 15 years into the peak of the China growth boom commodity super-cycle. The subsequent 15 years have seen the commodity index flat to -1% per year for 15 years. (Past performance does not predict future returns). Which areas have the most constructive outlook?Uranium Gold We have always really liked gold companies. This industry has one of the fastest paths to profitable development with the best potential for project investment returns and short payback years. In addition, it offers great optionality on mine extension and additional district gold discoveries. Oil Fundamentals for resource companies remains strongStrong companies with a multi-decade investment horizon don't 'waste a downturn'. The last three years have been a quiet range-trading period with plenty of noise, but below expectation returns (around 4% p.a., vs expectations of +10%).1 But the companies we invest in have executed some of the largest mergers and acquisitions of all time. Remember Newmont bought Newcrest, Exxon is buying Pioneer, Chevron is attempting to buy Hess, BHP divested their oil business, Agnico bought Kirkland Lake, among others. As a result, the balance sheets of many major natural resource companies look exceptionally healthy. Cash generation typically is high, while dividends and buybacks are robust. We believe that companies like these are very well positioned to capitalise on this new commodities cycle with many opportunities for shareholder value creation. Author: Daniel Sullivan, Head of Global Natural Resources | Portfolio Manager |

|

Funds operated by this manager: Janus Henderson Australian Fixed Interest Fund, Janus Henderson Australian Fixed Interest Fund - Institutional, Janus Henderson Cash Fund - Institutional, Janus Henderson Conservative Fixed Interest Fund, Janus Henderson Conservative Fixed Interest Fund - Institutional, Janus Henderson Diversified Credit Fund, Janus Henderson Global Equity Income Fund, Janus Henderson Global Multi-Strategy Fund, Janus Henderson Global Natural Resources Fund, Janus Henderson Tactical Income Fund

1 S&P Global Natural Resources Index All prices shown are in USD unless otherwise stated Bull/bear market: a bear market is one in which the prices of securities are falling in a prolonged or significant manner. A bull market is one in which the prices of securities are rising, especially over a long time. Re-rating: occurs when investors are willing to pay a higher price for an asset, usually in anticipation of higher future earnings/returns. Risk premium: the additional return an investment is expected to provide in excess of the risk-free rate. The riskier an asset is deemed to be, the higher its risk premium, to compensate investors for the additional risk. IMPORTANT INFORMATION Commodities (such as oil, metals and agricultural products) and commodity-linked securities are subject to greater volatility and risk and may not be appropriate for all investors. Commodities are speculative and may be affected by factors including market movements, economic and political developments, supply and demand disruptions, weather, disease and embargoes. Natural resources industries can be significantly affected by changes in natural resource supply and demand, energy and commodity prices, political and economic developments, environmental incidents, energy conservation and exploration projects. Sustainable or Environmental, Social and Governance (ESG) investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than the broader market. There is no guarantee that past trends will continue, or forecasts will be realised. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned. This information is issued by Janus Henderson Investors (Australia) Institutional Funds Management Limited (AFSL 444266, ABN 16 165 119 531). The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Whilst Janus Henderson Investors (Australia) Institutional Funds Management Limited believe that the information is correct at the date of this document, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson Investors (Australia) Institutional Funds Management Limited to any end users for any action taken on the basis of this information. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson Investors (Australia) Institutional Funds Management Limited is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect.

|

2 May 2024 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

2 May 2024 - Tulipmania

|

Tulipmania Marcus Today April 2024 |

|

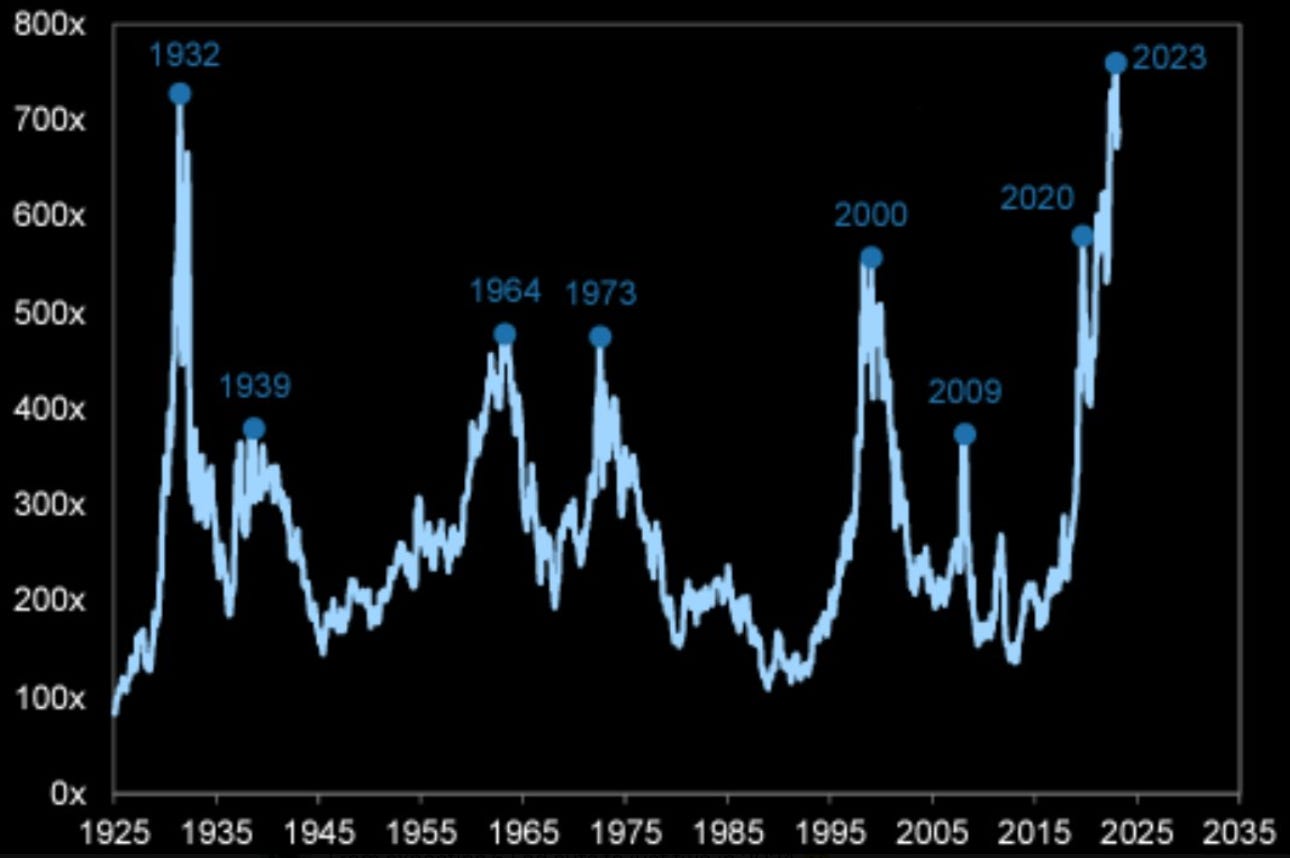

When it comes to the stock market, there are rallies, and then there are bubbles.The media slips into 'bubble jargon' on a whim, but bubbles are rare. At the moment, we are in the middle of an AI Bubble apparently, and a Crypto Bubble. But these aren't bubbles, they are not going to be remembered for long.So let's talk real bubbles. There have been a few, the South Sea Bubble (1720), the Dot-Com Bubble (the 2000 Tech Boom and Tech Wreck), the Japanese Real Estate and Stock Market Bubble (the Tokyo property and stock market peaked in 1989, and the Japanese equity market returned minus 7.3% for the next 22 years), the US sub-prime driven Housing Bubble (that led to the GFC), and the most colourful of all bubbles, Tulipmania. Tulipmania - Let me take you back to 1623. This was a bubble. In tulip bulbs of all things. Some of the highlights:

There has been a lot written about bubbles and how to spot them. Here are the lessons from 400 years ago. How to spot a bubble:

Bubbles create crashes. The Wall Street Crash in 1929 and the Tech Wreck in 2000. When speculative demand, rather than intrinsic value, fuels prices, the bubble eventually, but inevitably, and often dramatically, bursts. But to burst a bubble you need a bubble, and it needs to be blown up tight. What bursts it is a bit irrelevant because it is the tightness of the bubble that matters, not the prick. What bursts it can be inconsequential, after all, a "waterfall starts with one drop". The drop is not the cause, it is the pressure that causes the drop. Keep pumping a price up and it will burst, and the more pumped up it gets the less you need to burst it. Just like the drop and the waterfall, all it takes in a stock market bubble is one seller to take the lead and the whole herd goes over the cliff. There is no conventional logic. No warning. No reason. It just went up too much. Bubbles burst. Inevitable in hindsight. When is that? When this is happening:

And in the stock market:

These are the signs of the bottom, the foundations for a recovery. Equity prices go down, risk aversion peaks, and cash is king, When the best investment a company can make is in its own shares, it's time to turn. When you hear companies announcing big share buybacks and increased dividends, you know the world has become too cautious, and the focus is about to shift from risk to return once again. Buy when others are fearful, they say. Absolutely right. When the herd is at their most fearful, the market bottoms. To identify that moment, you have to be objective. You have to watch the herd, not join the herd. You cannot see the herd when you are part of the herd. You cannot coldly turn and exploit the delusion when you have deluded yourself, when you, too, are doing 200 miles an hour with your hair on fire. Where are we now? We have few extremes. We are in the middle ground. A comfortable rally has us thinking things are overbought, but overbought is not a bubble. Overbought does not provoke a 'wreck' or a 'crash'. And neither are we in the opposite of a bubble. Yields are not historically high. No one fears losing their job. Cash is not busting out at the seams. For now - things are 'normal'. Normal is great. We're making money and sleeping soundly at night. Source: Investopedia Footnotes

Author: Marcus Padley |

|

Funds operated by this manager: |

1 May 2024 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]

1 May 2024 - 10k Words | April 2024

|

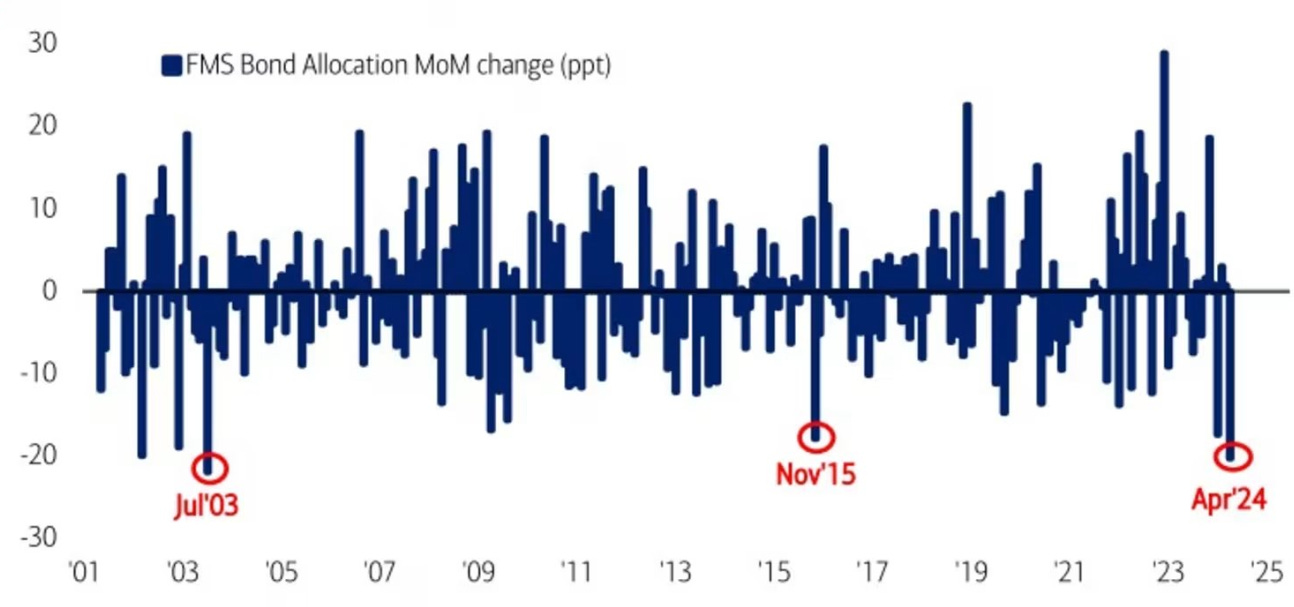

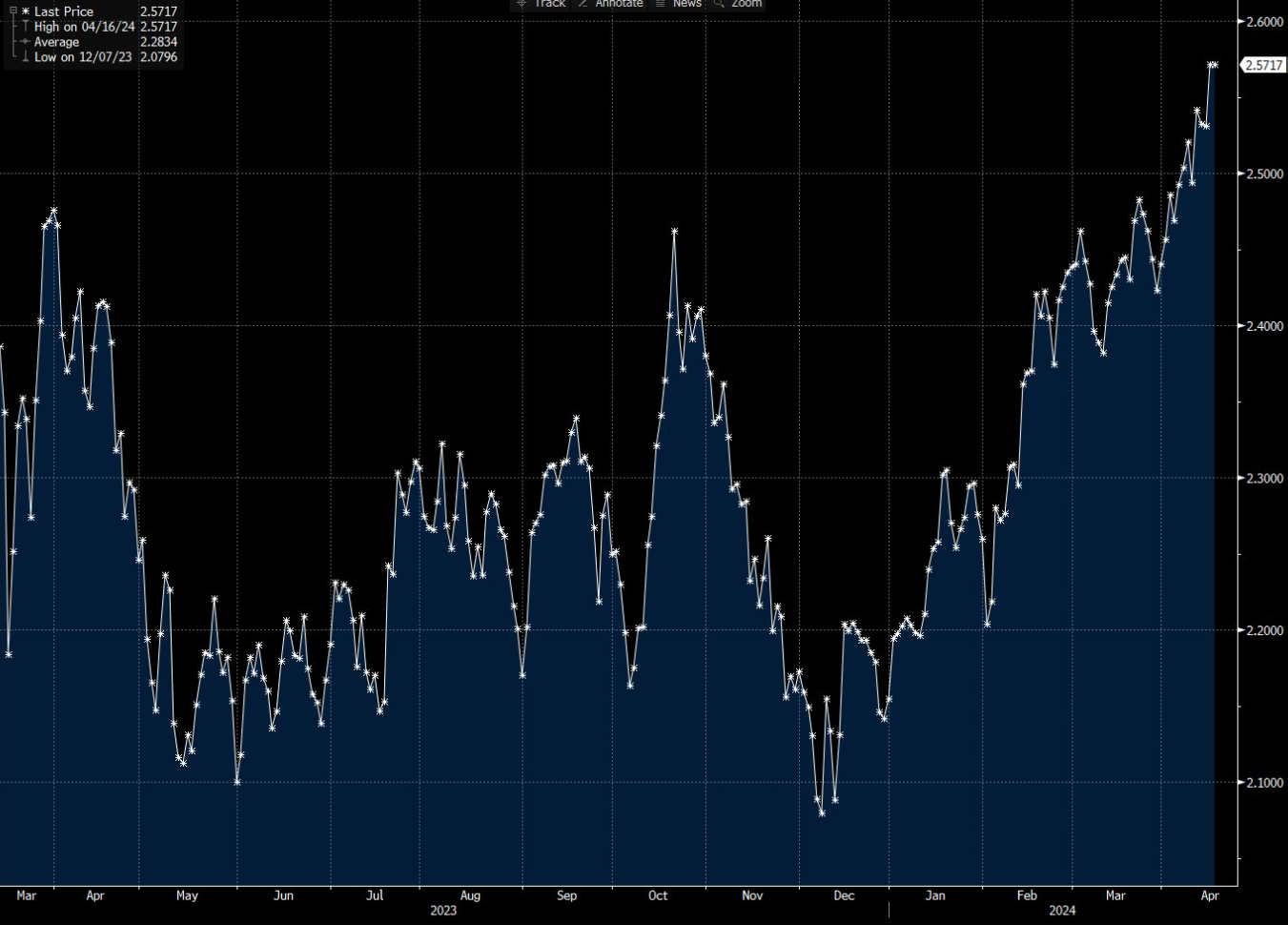

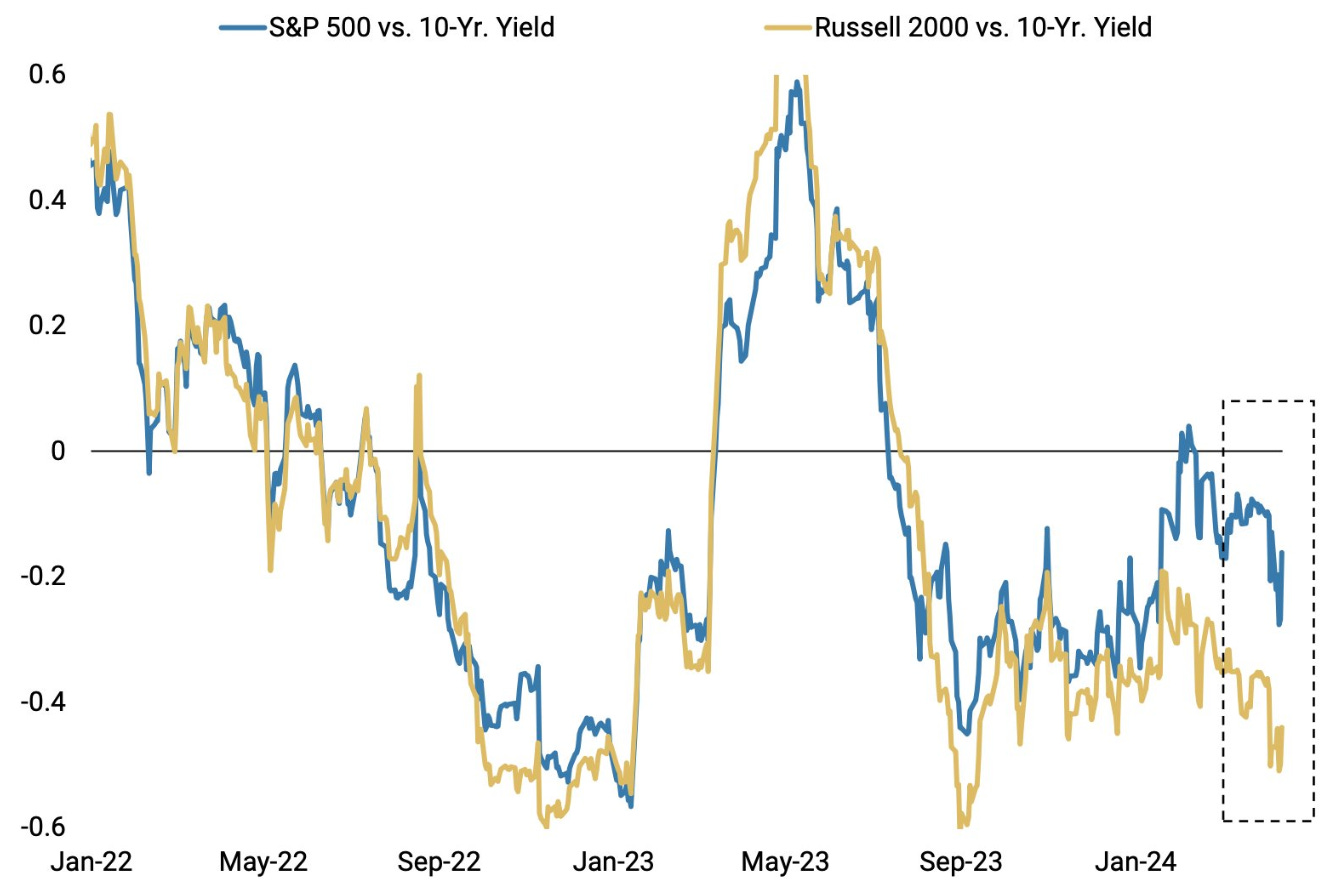

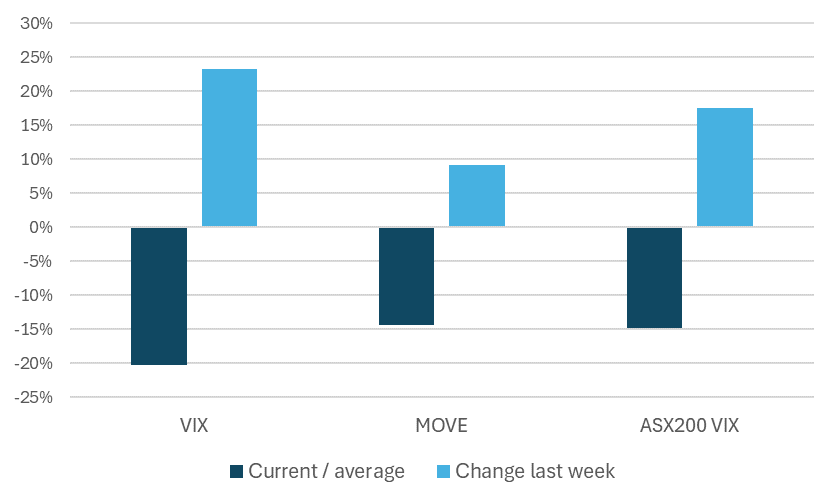

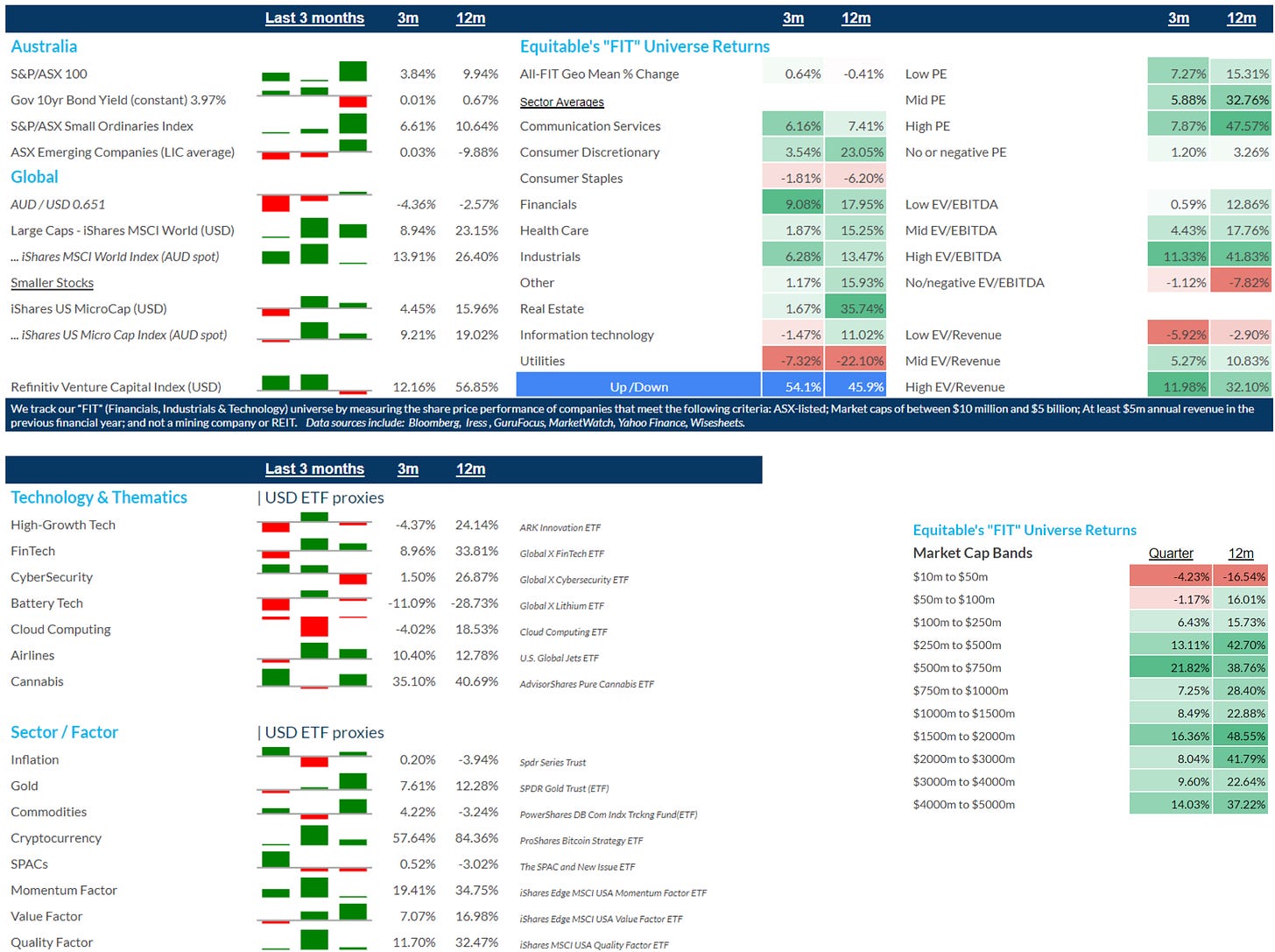

10k Words Equitable Investors April 2024 Bond demand on the slide as inflation expectations climb and the equity risk premium hits a multi-decade low, with the correlation between equities and bond yields turning more negative. The largest stocks continue to crowd out the market. Over in Japan the key equities index has finally returned to its pre-1990 peak. More listed equity is being bought back than issued as IPO activity remains stagnant. Finally we look at shifting volatility and benchmark returns for the March quarter. Biggest monthly drop in Fund Manager Survey bond allocation since July 2003 Source: Bank of America Global Fund Manager Survey Market implied US inflation over the next five years Source: Bloomberg, @lisaabramowicz1 US equity risk premium at a 22 year low Source: Bloomberg Rolling 2-month correlation between US equities & 10-year bond yields

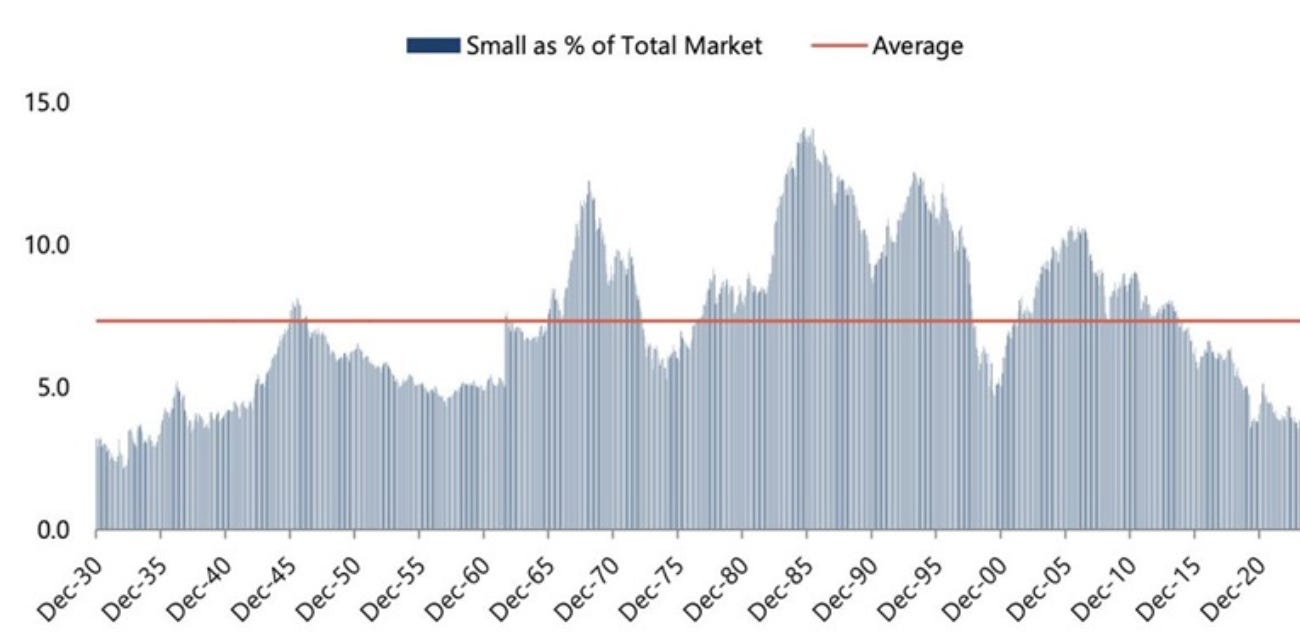

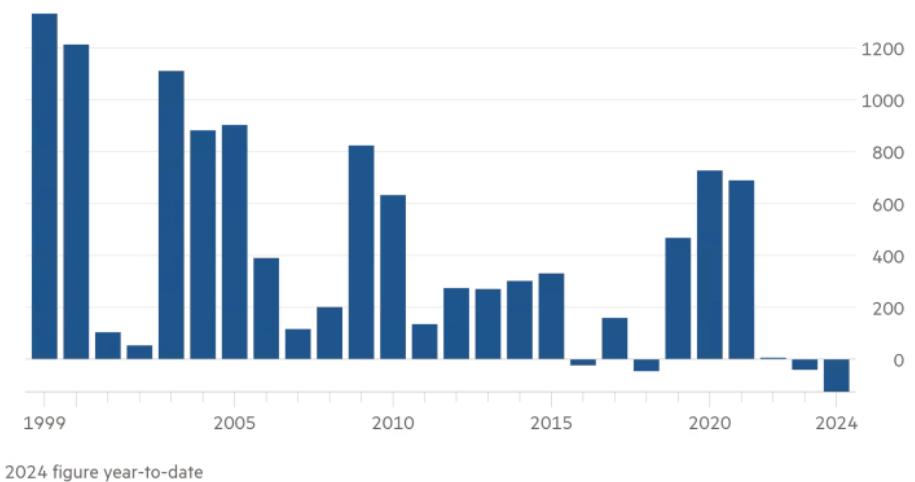

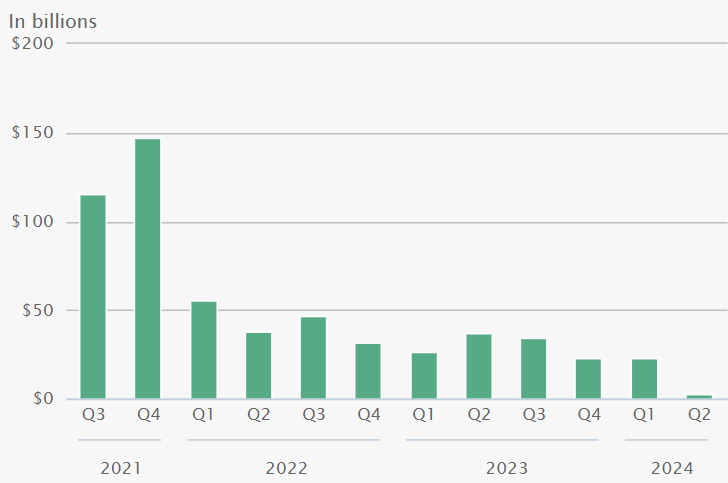

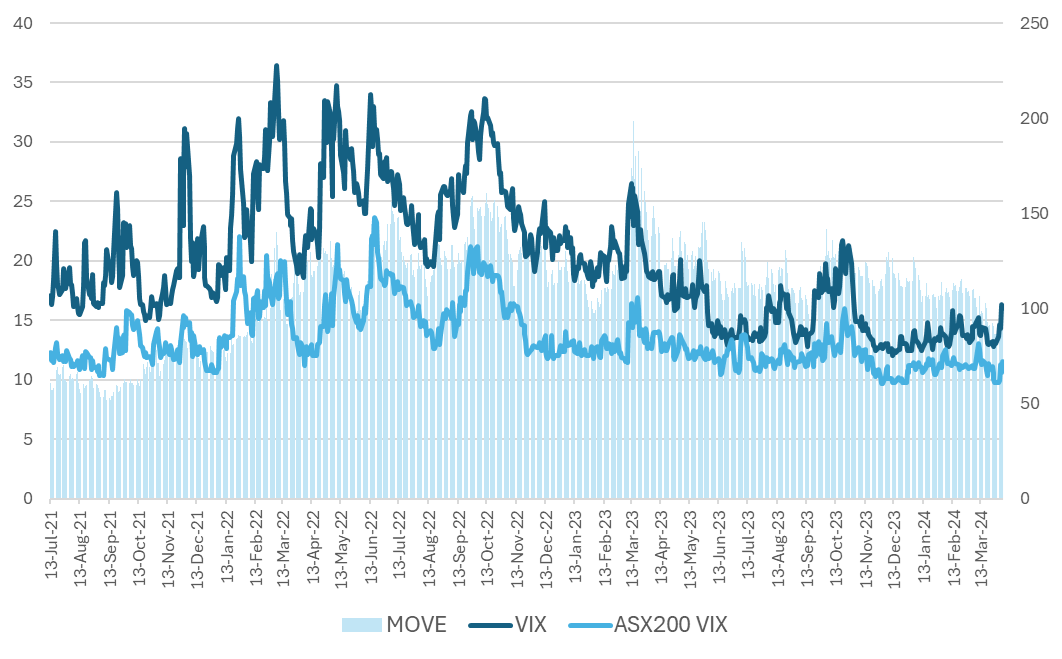

Source: Morgan Stanley Research via @Schuldensuehner Market cap of the largest stock relative to the 75th percentile stock Source: @LanceRoberts, RIAAdvisors.com Small cap stocks <4% of US equity market Source: KobeissiLetter (data from CRSP, The University of Chicago Booth School of Business, Jefferies) Japan's Nikkei 225 finally recovers to its 1999 record Source: Equitable Investors, Koyfin Net share issuance by companies on MSCI All Country World Index, adjusted for price and currency changes ($US billion) Source: Financial Times Global IPOs by quarter Source: WSJ, Dealogic Changes in US bond volatility (MOVE, RHS) v US equity (VIX, LHS) & Aus equity (ASX 200 VIX, LHS) Source: Iress, Equitable Investors Volatility benchmarks v average since July 2021 and move last week Source: Iress, Equitable Investors March Quarter (3 months) performance of key benchmarks and our "FIT" universe of ASX micro-to-mid caps Source: Iress, GuruFocus, Equitable Investors April 2024 Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Past performance is not a reliable indicator of future performance. Fund returns are quoted net of all fees, expenses and accrued performance fees. Delivery of this report to a recipient should not be relied on as a representation that there has been no change since the preparation date in the affairs or financial condition of the Fund or the Trustee; or that the information contained in this report remains accurate or complete at any time after the preparation date. Equitable Investors Pty Ltd (EI) does not guarantee or make any representation or warranty as to the accuracy or completeness of the information in this report. To the extent permitted by law, EI disclaims all liability that may otherwise arise due to any information in this report being inaccurate or information being omitted. This report does not take into account the particular investment objectives, financial situation and needs of potential investors. Before making a decision to invest in the Fund the recipient should obtain professional advice. This report does not purport to contain all the information that the recipient may require to evaluate a possible investment in the Fund. The recipient should conduct their own independent analysis of the Fund and refer to the current Information Memorandum, which is available from EI. |

30 Apr 2024 - Performance Report: PURE Income & Growth Fund

[Current Manager Report if available]

30 Apr 2024 - Australian Secure Capital Fund - Market Update

|

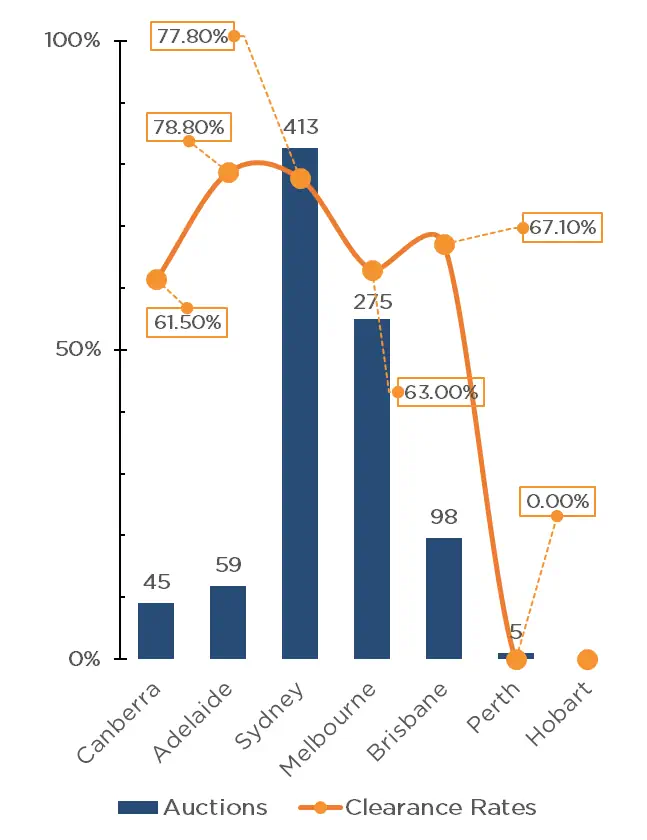

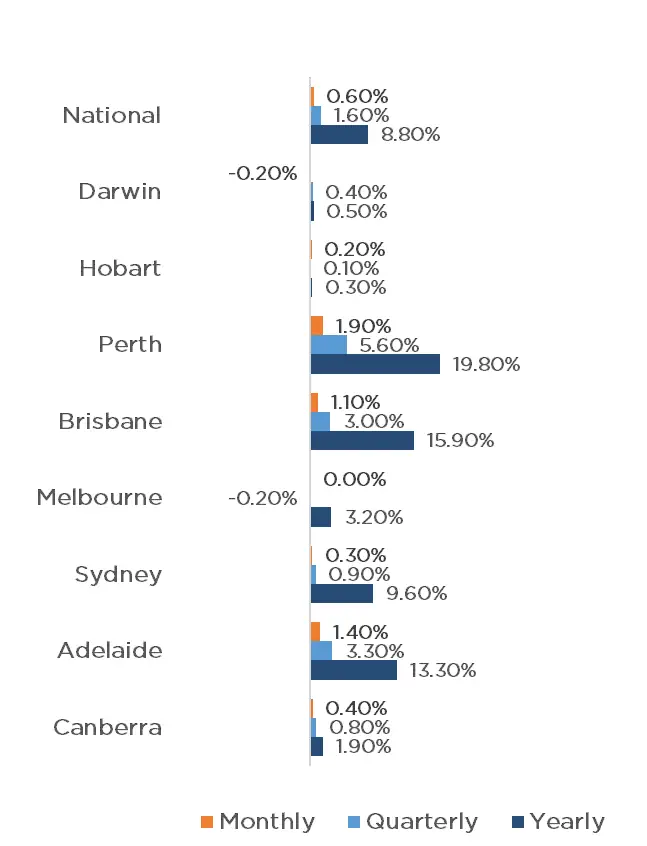

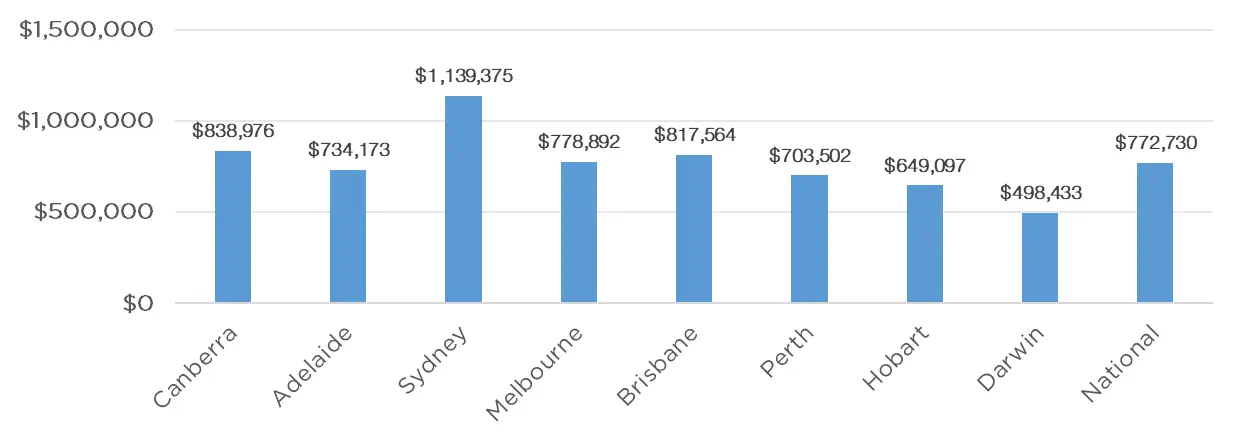

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund April 2024 Property values continue to increase across the majority of the country, with CoreLogic's National Home Value Index recording a further 0.6% increase in March, on par with what was achieved in February, resulting in 14 months of continuous monthly growth. Perth continued to be the strongest performer, increasing by a mammoth 1.9% for the month, followed closely by Adelaide with 1.4% and Brisbane with 1.1%. Signs of cooling have begun in Canberra, Sydney and Hobart, with 0.4%, 0.3% and 0.2% growth respectively. Melbourne achieved parity for the month, whilst Darwin is the only capital to experience a loss, falling by 0.2%. This monthly data contributes to a 1.6% national increase for the quarter, with all capital cities experiencing some level of quarterly growth except for Melbourne, where a 0.2% reduction has occurred. As we wait for the next RBA meeting, scheduled for the 7th of May, there are growing calls by economists for a rate reduction to occur, driven by the continued slowing of GDP growth and falling inflation. Whether or not a reduction is made in May, it appears all but certain that throughout 2024 there will be reductions, which will likely result in a further bump to property prices in the coming months. Clearance Rates & Auctions week of 2nd of April 2024

Property Values as at 31st of March 2024

Median Dwelling Values as at 31st of March 2024

Quick InsightsSteadfast ForecastOxford Economics Australia, a leading economic institute has forecasted median property to grow to almost $2 million in Sydney alone within the next 3 years. "You have a fundamentally undersupplied market and with net overseas migration running at half a million people, a growing participation by foreign buyers, downsizers and cash buyers, demand has outweighed that drag that interest rates would typically have.", said Maree Kilroy, Oxford Economics senior economist. Source: Australian Financial Review Affordability is the TrendThe medium-high end of the Sydney housing market may have finally reached a peak that lower end buyers cannot afford as a flood of homebuyers move into previously affordable suburbs driving prices up. The lower end market has grown 5 times as fast as the higher end in past 6 months, and is likely to continue as more people seek to delay the effect of the housing crisis in their lives. Source: Australian Financial Review Author: Filippo Sciacca, Director - Investor Relations, Asset Management and Compliance Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

29 Apr 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| State Street Climate ESG International Equity Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Pendal Sustainable Australian Share Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Pendal Multi-Asset Target Return Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Magellan Core ESG Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| 5AM Capital Global Equity Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

|

||||||||||||||||||||||

| Gryphon Capital Income Trust (ASX: GCI) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

(1).png)

Now let's turn this on its head and see the opposite of a bubble. These are periods of high opportunity and always occur when the crowd has lost its head in pessimism. This is when watching the herd, rather than joining the herd really pays off. At the end of the GFC. At the end of the pandemic. At the end of the Tech Wreck. When the crowd has lost its objectivity. When everyone is undervaluing everything, when everyone is being too bearish.

Now let's turn this on its head and see the opposite of a bubble. These are periods of high opportunity and always occur when the crowd has lost its head in pessimism. This is when watching the herd, rather than joining the herd really pays off. At the end of the GFC. At the end of the pandemic. At the end of the Tech Wreck. When the crowd has lost its objectivity. When everyone is undervaluing everything, when everyone is being too bearish.:max_bytes(150000):strip_icc()/dotdash-five-largest-asset-bubbles-history-FINAL-7eb958a1ff6e49b7ab9c9f3afbaf9d85.jpg)