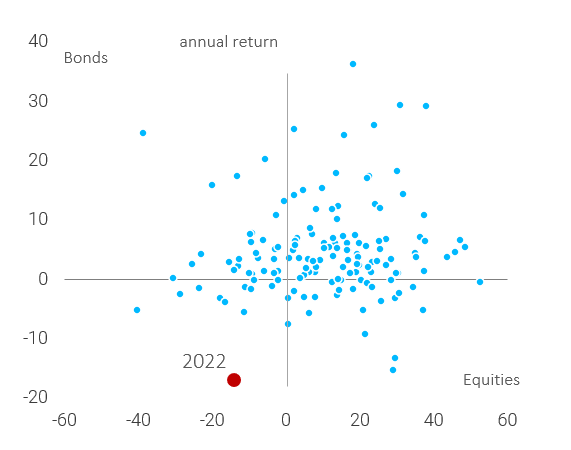

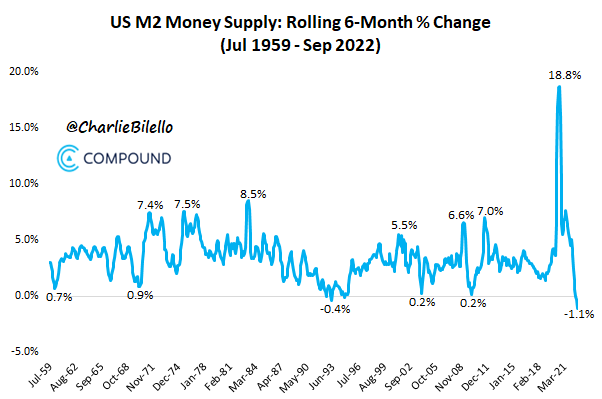

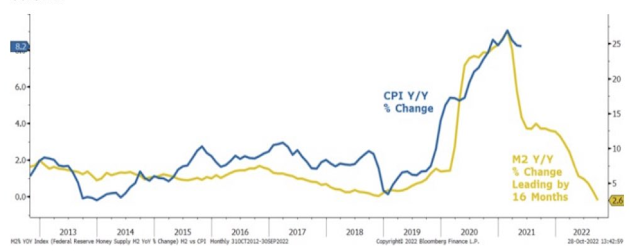

Easy money has driven the ASX300 up in nine of the last 10 years - the rising tide lifted all boats. But now investors are grappling with new financial conditions: inflation is spiking, and global central bank policies are fundamentally shifting. With rate rises now imposing a cost on the use of money, investors are being forced to rethink what defines an attractive stock.

Source: Macquarie

While the contraction in price-to-earnings multiples is well progressed, we are yet to see meaningful earnings downgrades across the broader Australian market. However, as real rates rise we expect further PE multiple contraction coupled with earnings downgrades, making for a challenging investment environment. In this market, track record and earnings quality come to the fore, giving an advantage to a well-structured investment process with a more disciplined approach.

This more challenging long-term outlook for global equity returns guides us towards businesses with our identified key quality characteristics as we remain true to our investment process: seeking out companies with strong market positions in growing industries, and the balance sheet strength and management track record to execute on growth plans.

Here are some of the stocks we believe could outperform over the next five years.

CSL (market cap $137b)

CSL develops plasma-derived and recombinant therapies to treat serious diseases. It also manufactures influenza vaccines, and treats iron deficiency and kidney disease following its recent acquisition of Vifor.

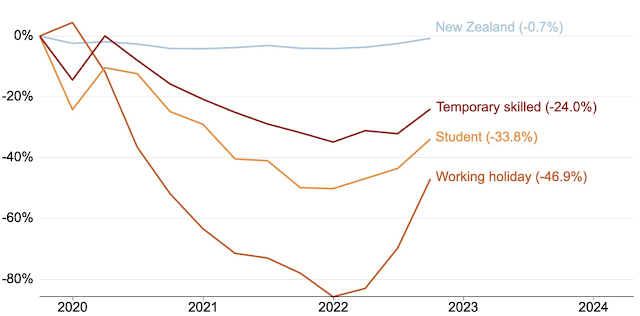

Management has proven adept at maintaining high returns (ROIC 20%+) through consistent product development and innovation to drive growth into existing and new markets. The company has high market shares in industries with strong tailwinds. Gearing is currently elevated following the Vifor acquisition; however, strong cash flows should see this return to a more manageable level. CSL trades on high earnings multiples, but we see valuation as attractive given we are expecting double digit earnings growth over the next few years as plasma collections recover post pandemic.

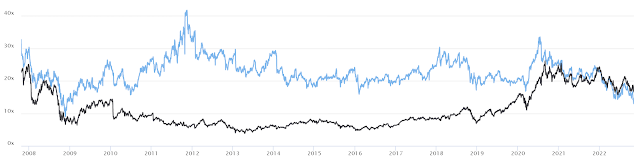

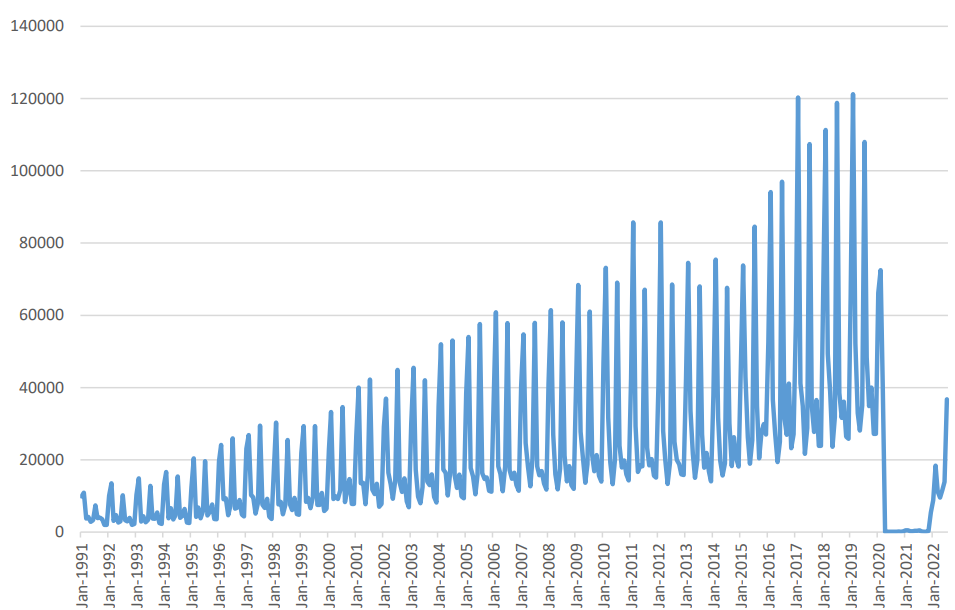

CSL plasma collections now exceed pre-pandemic levels

Source: CSL

HUB24 (market cap $2b)

HUB24 engages in the provision of investment and superannuation portfolio administration and licensee services.

Total funds under administration stands at $68bn, representing annualised growth of +80% over the previous 10 years, as HUB takes first place for net flows across the listed platform space. The company only commands ~5% market share in a large and growing market.

We believe independent platforms will continue to gain market share on a long-term view, while holding revenue margins steady. HUB trades on a PE of 29x with expected EPS growth of ~30%. Given its relative valuation to its sector and strong characteristics - including very sticky recurring revenue, high EBITDA margins at scale (50%+), sector tailwinds, track record and a first-class management team - we see HUB as a key pick.

Lynas Corporation (market cap $8b)

Lynas produces rare earth materials (particularly NdPr) that are used in the electronics, wind turbines and electric vehicles industries. It has a long life, high grade rare earths deposit in Western Australia, and a rare earths processing plant in Malaysia.

Lynas has a very strong balance sheet with cash of $1bn, meaning it can fully fund capex of $1.2b over the next two to three years to expand production capacity from 7.2kt NdPr oxide per annum to 12kt per annum. We believe the strong and longstanding management team will deliver these projects successfully.

The company is highly profitable, and we expect return on equity to remain high at more than 20% over the next few years, subject to movements in NdPr prices. We forecast improving NdPr prices over the next five years as the transition to green energy provides a significant tailwind to the market. With rising geopolitical tensions globally, Lynas holds a strategic position as the dominant ex-China producer of rare earths, with the US Department of Defence agreeing to co-fund the development of two rare earth separation plants in the USA. We believe this warrants a valuation premium.

Lynas is building share in a growing market

Source: UBS, LYC

Pilbara Minerals (market cap $15b)

Pilbara offers high quality exposure to the green energy transition via its long life (26+ years) and low-cost lithium mines in Western Australia. The strong rally in lithium prices - as demand outweighs supply - has resulted in the company generating extraordinary cash flows (cash +$784m in the September 2022 quarter alone). The company now sits on a cash balance of $1.4b and appears fully funded for all announced growth plans, which include spodumene plant expansions and a downstream joint venture with POSCO in South Korea to produce higher margin lithium hydroxide product.

Although the stock is up 50% this calendar year (after a 270% rise in 2021), we believe the company still trades at attractive multiples (FY23 P/E of 8.0x) given the long duration of the green energy theme.

Source: Pilbara Minerals

Resmed (market cap $14b)

Resmed designs, manufactures and markets equipment for the diagnosis and treatment of sleep-disordered breathing and other respiratory disorders, such as obstructive sleep apnea.

It's a structural growth story, with an estimated 1 billion people suffering from sleep apnea, and Resmed is a clear leader with market share of ~60%, a strong track record of high returns and strong cash generation. The company is likely to continue benefiting from a benign competitive environment in the near term. Its major competitor, Philips, is suffering a material device recall, which we believe will see a permanent 10% step up in market share for Resmed.