News

9 May 2024 - Performance Report: Glenmore Australian Equities Fund

[Current Manager Report if available]

9 May 2024 - Powering up European network investment

|

Powering up European network investment 4D Infrastructure April 2024 When talking about the energy transition, naturally, the focus has been on renewable energy. Many an article has been written on the exponential growth in wind, solar and batteries driven by increasing power demand, fossil fuel replacement, and societal concerns driving government and corporate targets towards net zero. The focus on renewables has thus always overshadowed the complementary need for investment in electricity transmission and distribution networks. This is despite grid operators long being vocal about the importance of accelerating investment to adapt to these essential changes in power generation and energy consumption. Networks lagging generation in the race for net zeroIt's estimated that over 80 million kms of grid infrastructure will need to be added or refurbished worldwide by 2040 if countries are to fulfil their national climate commitments on time and in full - equivalent to double the length of existing grids[1]. Currently, only 20% of the $770b USD invested into clean energy goes into network investment[2]. Investors have focused more on renewables given the outsized attention and higher perceived growth prospects. Renewable companies have marketed their sizeable growth pipelines, whilst utilities as owners of transmission and distribution grids, were more constrained by regulators and policy. They needed to be more prudent in their growth assumptions given their defensive position in the market, and with concerns around affordability. Until recently, the low-rate environment supported this thesis, with the market willing to pay more for longer duration renewable growth. However, in the past couple of years, there has been a shift in investor thinking. Improving policy has supported network investmentRegulators, governments, and policy makers have started to appreciate the importance of, and urgency with which, network investment needs to happen for the energy transition. This has translated into improved regulation, more attractive investing regimes, and overall better policy. These changes have seen a materially improved outlook for most (if not all) European utilities with electricity networks exposure. This trend has accelerated in recent months and can continue to accelerate further with ongoing electrification and generative AI-related power demand, which is only just gaining traction in Europe. Some of the recent developments include:

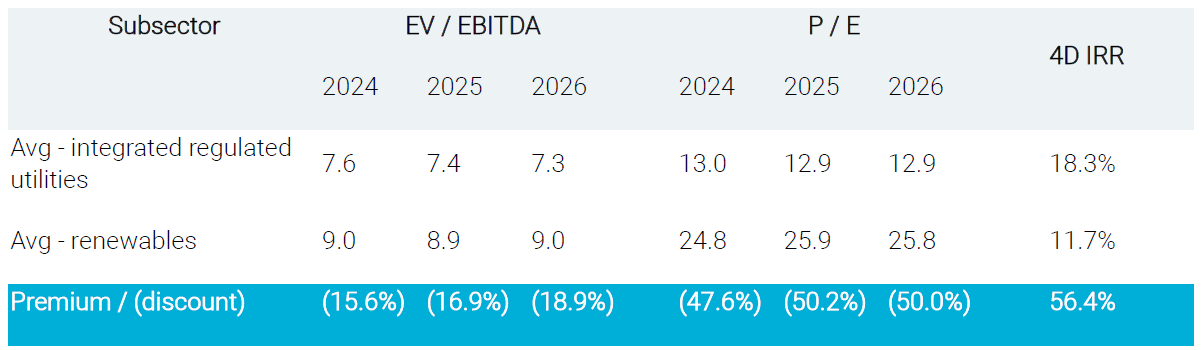

Networks have become more attractive than renewables in a higher rate environmentDespite renewable deployment continuing to accelerate, investors are starting to put more value on the visible, sustainable growth grids offer alongside the more immediate returns on capital. While we invest in both pureplay renewables and network companies, our preference in recent years has been to gain exposure to renewable developers through integrated regulated utilities. These are utilities that operate across the value chain in power generation, networks and in energy supply. We like the higher quality and often diversified (both in terms of renewable technologies and geographies) development portfolios of these companies, along with economies of scale which often provide supply chain advantages allowing for higher returns. Additionally, our research indicates that the market has undervalued and underappreciated both the scale and longevity of growth in their complementary network businesses - which, as mentioned, is only beginning to get more attention and support from governments, regulators, and operators. Capital flexibility in balance sheets, along with the ability to sell / hedge the power generated from renewables directly to retail customers, also provides us with an added level of comfort. Even with the recent outperformance of networks versus renewables, the table below highlights the ongoing disparity between valuations and market multiples across these two sectors.

[4] Integrated regulated utilities are allocating more capital into networksAs the renewables sector has suffered from inflation, cost of capital and power price challenges, we've seen integrated utilities (include some aforementioned) shifting more investment into networks. One of the clearest examples is from Iberdrola - one of our core utility holdings. Iberdrola is an integrated utility operating across power generation, networks and supply in Europe, the Americas and Asia. It's one of the largest renewable developers and network operators globally, and therefore inherently linked to the energy transition. Recognising the challenges in renewables versus the improving outlook for grids - Iberdrola in its 2022 Capital Markets Day started to pivot more towards networks. This foresight and capital allocation flexibility has proved timely. The company doubled down on its network focus in its March 24, taking advantage of policy tailwinds for networks in the UK and US, and reducing its exposure to some of the renewable energy headwinds currently at play (high rates, value creation concerns, supply chain issues, US offshore wind troubles). In doing so, the company highlighted the need to double global annual network investment by 2030 versus 2022, and triple investment by 2030 to work towards global net zero emissions targets[5]. Additionally their analysis revealed the massive long-dated needs for networks, with every 1 euro of renewables spend requiring 1 euro of network spend, and an even higher 1.25 euros in advanced economies[6]. This timely pivot is but one of the reasons we rate the quality of Iberdrola so highly. Utility underperformance provides for greater long-term opportunitiesWhile this growth outlook is unparalleled, the European utility sector has still underperformed the broader market, albeit considerably less than the pureplay renewable companies. Even with these massive growth drivers, the fact remains that utilities are considered a bond proxy and in a high-rate environment with a high opportunity cost of capital, it's difficult for these stocks to outperform. Strong economic data supporting cyclical growth and tech / AI-related trends have amplified this underperformance. While the market currently favours cyclicals over defensive growth, we have used this as an opportunity to increase our positioning in high quality network-focused utilities, such as Iberdrola, National Grid, ENEL and SSE. We believe these are all strong investment propositions given their long-dated defensive growth profiles with a secure regulated returns, which despite increased attention, still aren't being fully appreciated by the market. The content contained in this article represents the opinions of the authors. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. [1] https://www.iea.org/commentaries/the-clean-energy-economy-demands-massive-integration-investments-now> [2] https://www.iea.org/commentaries/the-clean-energy-economy-demands-massive-integration-investments-now>, EMDE refers to advanced, emerging, and developing economies [3] Total five-year investment plan 2024-28 compared to 2023-27 [4] 4D Infrastructure, FactSet [5] Iberdrola Capital Markets Day 2024, IEA [6] Iberdrola Capital Markets Day 2024, IEA Funds operated by this manager: 4D Emerging Markets Infrastructure Fund, 4D Global Infrastructure Fund (AUD Hedged), 4D Global Infrastructure Fund (Unhedged) |

8 May 2024 - Performance Report: 4D Global Infrastructure Fund (Unhedged)

[Current Manager Report if available]

8 May 2024 - Performance Report: Bennelong Australian Equities Fund

[Current Manager Report if available]

8 May 2024 - 420 billion reasons to invest in pets

7 May 2024 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

7 May 2024 - Performance Report: Rixon Income Fund

[Current Manager Report if available]

7 May 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Blackwattle Small Cap Quality Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Blackwattle Mid Cap Quality Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Blackwattle Long Short 130/30 Quality Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Blackwattle Large Cap Quality Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

|

||||||||||||||||||||||

| Seed Funds Management Hybrid Income Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

6 May 2024 - Managers Insights | Glenmore Asset Management

|

|

||

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Robert Gregory, Founder and Portfolio Manager at Glenmore Asset Management The Glenmore Australian Equities Fund has a track record of 5 years and 6 months and has outperformed the ASX 200 Total Return benchmark since inception in June 2017, providing investors with an annualised return of 21.78% compared with the benchmark's return of 8.69% over the same period.

|

3 May 2024 - Hedge Clippings | 03 May 2024

|

|

|

|

Hedge Clippings | 03 May 2024 Jerome Powell's press conference following the US Federal Reserve's FOMC meeting held front and centre attention this week. He started with the good news, saying there's been "considerable progress" towards the FED's dual mandate to promote maximum employment and stable prices - with inflation easing over the past year, and a strong labour market, before quickly pivoting to the bad news - inflation is too high, progress in bringing it down is not assured, and the path forward is uncertain. As such, inflation is showing a lack of progress towards their 2% target, while economic activity is expanding at a "modest pace" consumer spending is robust, the labour market is tight with unemployment at 3.8%. Hence the bottom line was rates stayed on hold at 5.25 to 5.5%. Previous expectations for a May rate cut have gone out the window, and while Powell indicated it's a "meeting by meeting" decision making process based on the data, he considered a rate hike is unlikely. Longer for stronger seems to be the market's mantra and expectation, with expectations for just one or possibly two cuts later this year, a far cry from the six cuts that had been penciled in at the start of the year. For rate cuts to eventuate, Powell said inflation is going to have to move down, not sideways as it is now, or the labour market is going to have to weaken. However the 2% inflation target is the key, not employment or wages. Overall Powell's favourite word in his conference seemed to be "confidence" either lack of it, or needing it before taking action. Locally next Tuesday sees the RBA take their turn, and like the situation in the US, the Board's view will depend on the data. Household spending slowed further in March, growing just 2.1% vs 4% in February, and retail trade numbers are due next week, and are also expected to be under-whelming. In spite of this, and with the most recent CPI number at 3.8%, and wage rises and tax cuts around the corner, makes a rate cut here equally unlikely with market pundits now pushing rate cuts out until 2025. The RBA's inflation target is higher than the FED's hard 2%, but neither want to admit that their respective targets - while admirable - might be too low for the current environment. To do so would be to admit defeat, and neither will want to go down that path. News & Insights Managers Insights | Glenmore Asset Management New Funds on FundMonitors.com Market Update | Australian Secure Capital Fund 10k Words | Equitable Investors March 2024 Performance News Insync Global Capital Aware Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |