News

27 Jan 2023 - The net-zero journey: creating a just transition for workers

|

The net-zero journey: creating a just transition for workers abrdn December 2022 A 'just transition' refers to the way the world transitions to low-carbon energy sources. It is a crucial part of the climate agenda. A just transition aims to minimise adverse impacts from the energy transition and to see everyone share its benefits - including workers, suppliers, communities and consumers. The journey to net zero will have uneven effects across industries and countries. One key aim of a just transition is to support vulnerable workers by creating green, high-quality jobs and helping equip workers with the skills necessary for achieving net zero. Net job impactsThe prevailing view is that the transition to a net-zero economy would lead to more job gains than job losses. According to McKinsey's calculation based on a net-zero 2050 scenario, the transition could create around 200 million jobs and displace around 185 million jobs. This could result in a net impact of around 15 million more jobs by 2050.1 These job gains include around 162 million jobs in operations and maintenance across different sectors of the economy, and around 41 million jobs associated with spending on physical assets needed for the net-zero transition by 2050. The International Labour Organisation (ILO) paints an even more positive picture, estimating that a net increase of 18 million jobs by 2030 is possible.2 What sectors and countries will be most affected?According to the ILO, most of the job creation that results from the energy transition will happen in construction, electrical machinery manufacturing, copper mining, renewable energy production, and biomass crop cultivation. Most of the job losses will occur in petroleum extraction and refinery, coal mining, and thermal coal. In addition, the shift to electric vehicles will require fewer workers for production, leading to net job losses - something that is already happening within the sector. The impact on jobs also varies by country, depending on its economic exposure to the net-zero transition. The transition would unevenly affect lower-income and fossil-fuel-producing countries, such as Pakistan, India, Bangladesh, Kenya, Nigeria and Indonesia. How companies manage the impacts of the transition on their workforce will pose considerable investment risks and opportunities for investors These tend to be countries with a relatively higher proportion of jobs, gross domestic product and capital stock in sectors that are more exposed to the transition - that is, sectors with emission-intensive operations, products and supply chains. Significant fossil-fuel resource production also creates high exposure for some countries, such as Qatar, Russia and Saudi Arabia. Investment implicationsHow companies manage the impacts of the transition on their workforce will pose considerable investment risks and opportunities for investors. There are two types of risks facing companies within the sectors that are most exposed to the energy transition: restructuring risks and human-capital risks. Firstly, when it comes to restructuring risks, the most obvious of these is operational disruption caused by mass redundancies. This can lead to costly pay-outs and challenging labour relations. Research shows that the top performers with higher restructuring management practices tend to be concentrated in Europe. This is also the case for companies within the fossil-fuel and emission-intensive sectors, which indicates that European companies are relatively more prepared for a just transition. Secondly, human-capital risks mainly manifest as skills mismatches and shortages, which can impede a company's progress on the green transition. According to the International Energy Agency (IEA), the energy sector already faces difficulty hiring qualified talent to keep pace with the growth in clean energy. If solar and wind installations reach four times today's annual level by 2030, as called for in the IEA's net-zero scenario, these labour constraints could impede the world's ability to accelerate the shift to a low-carbon future.3 According to the ILO's survey, while most countries have environmental policies, there are only a handful of countries with corresponding policies at either the national or the regional level for skills development. These are Denmark, Estonia, France, Germany, the UK, the US, China, India, South Korea, the Philippines and South Africa. Similarly, few countries have incorporated skills for the green transition into the formal vocational training curriculum.4 Companies also have an important role to play in identifying and anticipating skills, and in providing access to jobs and training for the green transition. In practice, this can be done in partnership with the government and educational organisations. Investors need to understand how these risks are being managed. For example, through our own extensive engagement with auto makers, we have learned that the industry is managing these risks through early retirement schemes, upskilling of the existing workforce, and proactive engagement with trade unions. In general, to understand how companies are managing these risks, investors can focus on four key indicators:

ConclusionThe energy transition will have a significant impact on employment. It will lead to the creation and displacement of millions of jobs. While the overall net impact is likely to be positive, the projected job gains will concentrate in sectors like renewable energy, electrical machinery and construction. From a geographical perspective, a higher level of disruption to the labour market is expected in developing countries that rely heavily on fossil-fuel and emission-intensive sectors. How companies and governments manage these impacts will present risks and opportunities for investors. Our ongoing research and engagement aim to understand the social impacts and potential risks to our investments from the energy transition. Our research in this area is expected to expand and grow in the future, in conjunction with our ongoing climate change, human rights, and labour and employment work. For example, building on our focus on workers in the energy transition, we will also consider the perspectives of communities and consumers, in order to integrate further insights into our investment process. Author: Ziggy You, Sustainability Analyst and Elizabeth Chiwashenga, Senior Sustainability Analyst |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund 1. The net-zero transition: Its cost and benefits | Sustainability | McKinsey & Company |

25 Jan 2023 - Cashflow pothole in energy transition journey

|

Cashflow pothole in energy transition journey Yarra Capital Management December 2022

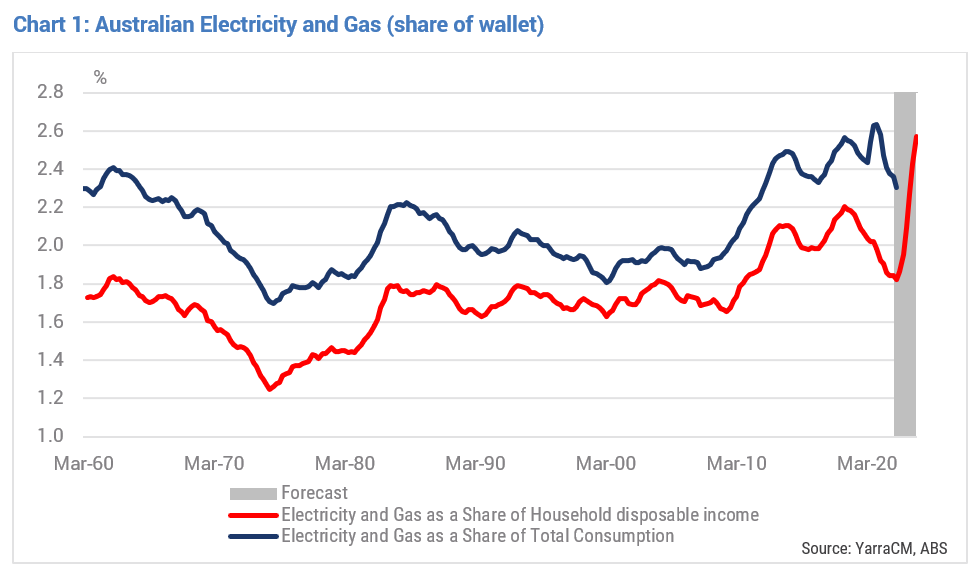

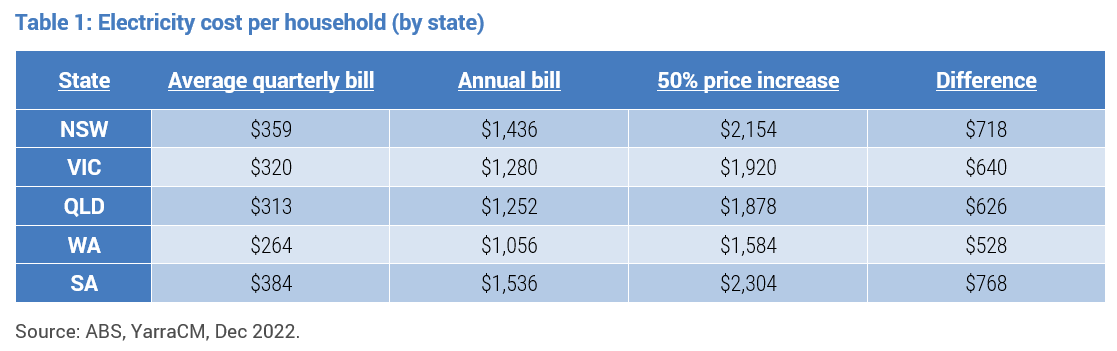

By now, people whose eyes don't immediately glaze over once discussions of personal or national budget are broached are well aware of an upcoming spike in their electricity and gas bills. However, for the majority of the Australian citizenry the 'sticker shock' from the increase in utility bills will still be felt in real time. Tim Toohey, Head of Macro and Strategy, details why for many Australians this will merely compound an already dire cashflow situation. For context, the Australian Treasury has assumed that electricity prices will rise 20% (y/y) by late 2022 and a further 30% in 2022-23. This will take utilities to an unprecedented share of wallet in 2023, some 2.6% of household income by Dec 2023 (refer Chart 1). While that may not sound like a particularly scary figure, it's 25% above the 10-year average and 49% above the long run average dating back to 1960. It will also represent the biggest one year rise in utility bills in the post-War period. The cause for the spike has been well documented. A surge in global coal and energy prices in reflex to the invasion of the Ukraine was the dominate force, some unfortunate timing of coal-fired power station maintenance and some less than transparent behaviour by market participants all played a role. Yet the cause of the trend rise in utility costs is less well understood at the household level; the rapid transition to renewables is unravelling the economics of running coal and gas-fired generation at an even more rapid rate.

This is not to say that decarbonising the grid in an expeditious manner is not necessary or desirable. It merely means that the cost of the transition will be felt well beyond well-heeled investors asked to dig deep into their pockets to finance the capital cost of the transition. Indeed, it is the consumer that will invariably be forced to pay for the potholes in the road to decarbonisation as firms seek to recover the cashflow hit from declining economics of traditional generation via higher power bills. Utility companies know this. Politicians should know this. Households largely have no idea that they are ultimately on the hook if best intentions of a smooth energy transition turn to custard somewhere along the journey. To overwork the analogy, we have barely gotten the car out of the driveway with a long journey ahead to a known destination but without a clear map of how to get there. We don't have enough cash in our wallet to complete the journey, some of the roads have not yet been built, and the kids who have been fighting politically for years before getting in the car are continuing to do battle in the backseat. For those of us scarred from family car trip holidays at this time of year, we are collectively at the point where optimism and excitement at the start of a trip are about to be overwhelmed by the reality of a long-haul car trip in the Australian heat. The feeling of sizzling hot car seats, the taste of Aerogard inadvertently sprayed into a protesting mouth and the injustice as youthful back seat rebellion is brutally supressed by the front seat elites. Yes, it's going to be a long and painful journey. But to get a sense of who will bear more of the cost, we can look at the average quarterly electricity bill across different dimensions.

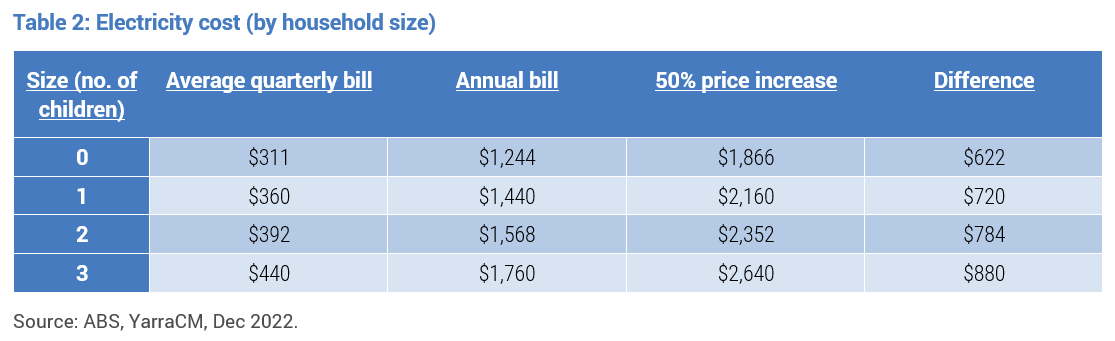

By household size (refer Table 2), the more children you have the greater the power bill increase (and the more time the parent spends wandering around the house turning off lights left on by their children).

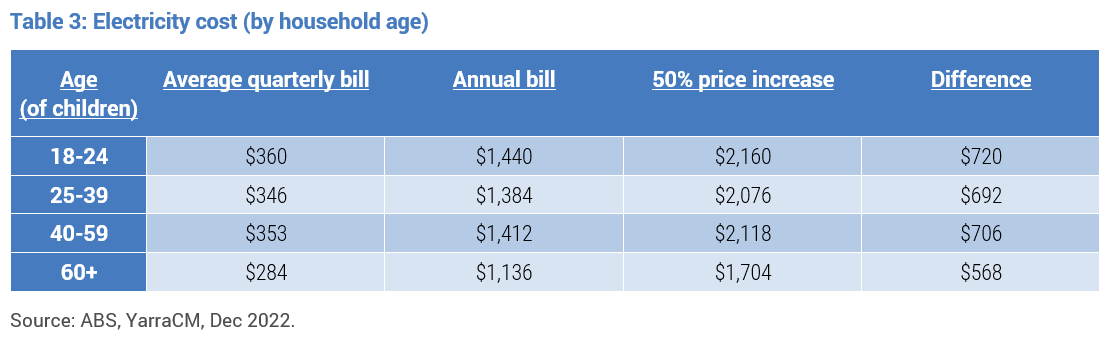

By age, it's the young that will feel the pain more acutely (refer Table 3). Indeed, Gen Z (18-24yo) power bills will swamp the bills of Baby boomers (60+) by $150 p.a. Yes, despite the moral superiority of youth, it seems it takes more power to fuel video gaming sessions in the wee hours and to charge the armoury of devices required to keep your social media presence tip top!

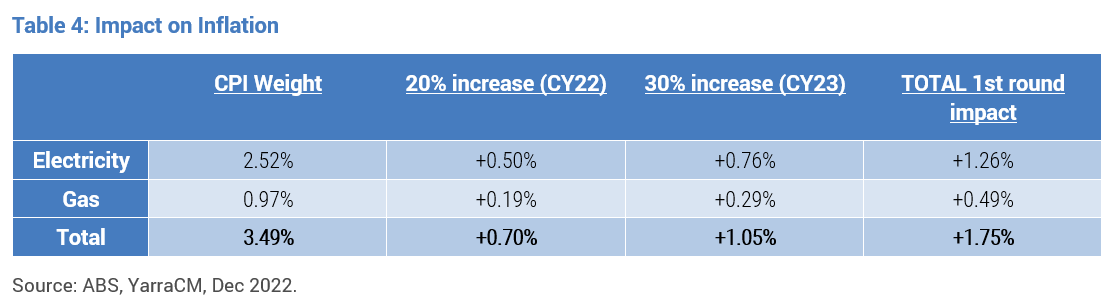

From the perspective of a top-down economist, the addition increment to inflation from rising power and gas bills could add 1.75% to inflation by the end of 2023 in first round impacts and potentially a further 0.35% in second round effects (Refer Table 4). That's a lot, but that's an average estimate. From the perspective of young households with multiple children living in the Eastern States, the impact will be larger and more painful.

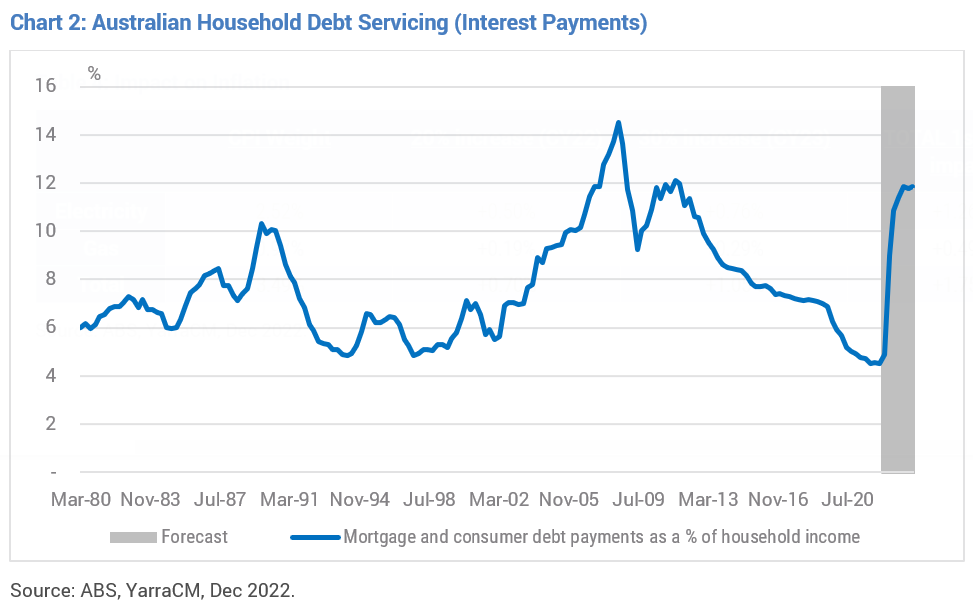

Worst still, this is the slice of the population that are most at risk of rising education, health, insurance and housing costs. We all know that the interest payments on the stock of existing total household debt are set to rise incredibly sharply in 2023, compounded by the roll off of fixed rate mortgages (refer Chart 2).

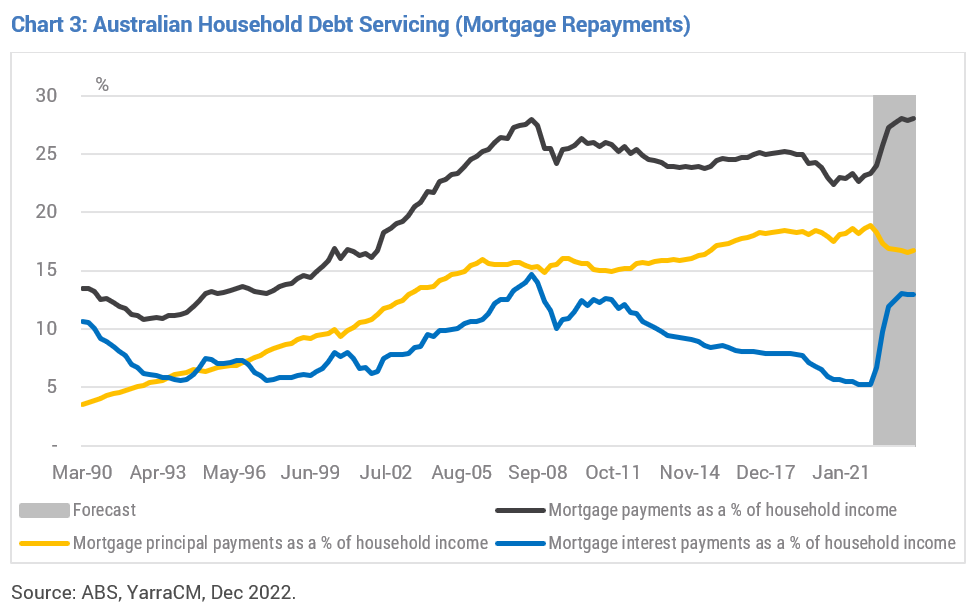

In conjunction with principal payments, debt servicing for the average household is set to breach the prior record during 2023 (refer Chart 3). Again, this is for the average household. The situation for young mortgaged households is far more dire, not to mention a rising proportion of the recent new homeowners who are now entering negative equity scenarios for their homes.

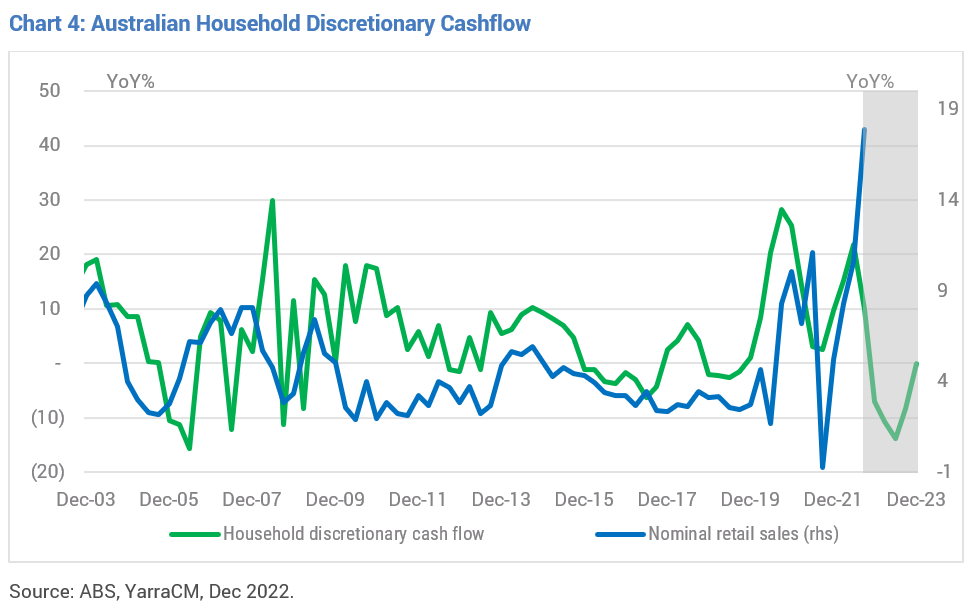

This will place an enormous impost on a large section of society. Nobody likes having their discretionary income squeezed and nobody likes an unexpected spike in their gearing ratio via falling asset prices. Even if we assume the ongoing robust growth in wages and employment in 2023 the impost of higher interest costs, utility costs, insurance costs and rents will be sufficient to see average discretionary cashflow fall by 15% by mid-2023 (refer Chart 4), and much more for young households with large families and large mortgages.

Given, retail sales growth normally closely tracks our measure of discretionary cashflow, we expect that retail sales will slow from the rapid rate of close to 20%(y/y) to zero growth by mid-2023. Note, this is likely the best-case scenario. It could easily be worse if sub-trend economic growth reveals labour market weakness with a lag, as observable in all prior downturns. The argument that Australians have accumulated 'buffers' via $260bn in 'excess savings' since the pandemic and via pre-payments on mortgages will exceed additional interest payments - for most borrowers at least - is illusionary. While this might be true in an accounting sense, the RBA is likely asking itself the wrong question. It is not a question of how big a 'buffer' is before tightening policy will hurt, it is why did households accumulate such a buffer in the first place? And is the economic outlook improving or deteriorating? Excess fiscal stimulus obviously contributed to the initial saving spike, but what if the ongoing accumulation of savings was more about de-risking asset exposure in an uncertain time or because a large cohort of the population is simultaneously entering retirement (COVID may have expedited this decision for many Baby Boomers). If this is the case, then the 'excess saving' is not suggestive that a consumption boom lies ahead that threatens future inflation. Quite the opposite: in times of rising economic uncertainty households tend to initially lift their saving rate. They do not decrease it. There has been ongoing debate whether the government has a role to play in capping utility costs. And, if so, whether that should be at the company level or the consumer level. Given the recent history of firms profiteering through the crisis by lifting prices rather than absorbing margin pressure and the impending cashflow hit for households, the answer should be obvious. More importantly, if the government wants to keep everyone in the car playing nicely during the initial phase of the energy transition, then the answer is very much yes: utility costs need to be controlled. Let's just hope that there are enough fiscal resources and goodwill to get us to that new energy destination as quickly and efficiently as possible. Author: Tim Toohey, Head of Macro and Strategy |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

24 Jan 2023 - 10k Words

|

10k Words Equitable Investors December 2022 December's chart are largely lifted from an Equitable Investors slide deck. We can't really avoid taking a look at inflation and interest rates - so that is where we start with charts from Bloomberg showing the expectation for a sharp inflation correction in the US in 2023 (and a view on why based on Academy Securities' view of inflation drivers). Central bank policy rates remain, in the main, below inflation rates, as @charliebilello tabulates. CY2022 is almost gone and we can look back at capital markets and see sharp declines in the availability of funding - global equity capital raising volumes down 65% and Australasian down 54% year-on-year, using dealogic data. High yield debt issuance plunged even further. Crunchbase reckons that in global venture capital markets, seed funding dropped by a third, early stage halved and late stage is down by 80% compared to November 2021. Finally, Cliffwater shows us how private equity has outperformed since 2000 (in a period that coincides with historically low interest rates) and Refinitiv's Venture Capital Index gives us an idea of how alternative assets may have faired in 2022 if they were priced daily. Implied inflation (starts Dec 9) Source: Bloomberg Inflation Drivers (estimated) Source: Bloomberg, Academy Securities Global Central Bank Policy Rates (as of Dec 8, 2022) Source: Compound/@charliebilello Global Equity Capital Market Volumes ($USb)

Source: WSJ, Dealogic Australian Equity Capital Market Volumes ($USb) Source: WSJ, Dealogic High Yield Debt Capital Markets Source: WSJ, Dealogic Global Venture Capital Funding Source: Crunchbase Composite Private Equity Performance (US State Pensions) Source: Cliffwater Refinitiv Venture Capital Index Over 5 Years Source: FT December Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

23 Jan 2023 - Outlook Snapshot

|

Outlook Snapshot Cyan Investment Management December 2022 |

|

As a broad statement, it feels as if the market is in somewhat of a holding pattern. Even the central banks seem uncertain about the economic outlook. For example, in June last year, the governor of the US Fed, Jerome Powell, explained ''I think we now understand better how little we understand about inflation''. Further, RBA stated that interest rates would stay low until 2024. It has subsequently increased rates by 300 basis points (bp) with the most recent rise of 25bp taking the cash rate to 3.1%. The tightening of monetary policy has been swift and aggressive, which has thrown equities markets into a spin. As stated in our September monthly report: "We believe the most-likely first positive catalyst for a stock market recovery will be a line of sight as to when the interest rate hike cycle will end. Most central banks in developed economies are rapidly and aggressively raising rates. Stock markets hate this. We don't know if this monetary policy strategy will curb inflation as hoped, but an end to this cycle could provide a clear positive catalyst for a shift in sentiment for equities." The market is currently consumed by this issue and economists seem to be at the centre of every discussion. Gareth Aird, Commonwealth Bank's head of Australian economics, had previously forecast the RBA's rate hike in early December would be the last but he has updated his predictions after the RBA signalled more rate rises. He stated, "The tweak in forward guidance was not as material as we anticipated and as a result, we shift our risk case to our base case....We now expect one further 25 basis point rate hike in February 2023 for a peak in the cash rate of 3.35 per cent". Chief Economist at AMP Shane Oliver believes the cash rate has now "peaked" -- with a high risk of one final 0.25 per cent hike to 3.35 per cent in February. By end 2023 or early 2024 he expects the RBA to start cutting rates. However, that value doesn't get released in a straight line, and we are in the middle of one of those frustrating periods at the moment. But the market is forward looking, so investors waiting for genuine clarity around the economy may well find that the market has already moved ahead of them this year. |

|

Funds operated by this manager: Cyan C3G Fund |

20 Jan 2023 - Three Ways to Profit in 2023

|

Three Ways to Profit in 2023 Wealthlander Active Investment Specialist November 2022

A year ago, we communicated that inflation and geopolitical risks would dominate 2022. Early in 2022, we predicted the recession would strike within 18 to 24 months. We now expect that the outlook for 2023 will be dominated by the following economic drivers: US and global recession, volatile inflation outcomes, and continuing geopolitical risks. This provides tremendous challenges to traditional equity and property-centric portfolios and great opportunities for unconstrained active management. Let us explore three ways we expect to benefit from this outlook to position and profit in 2023. (1) Precious Metals and Other Commodities Geopolitical risks remain extreme, and war is a highly profitable business for some instrumental people and entities, with the Pentagon again being unable to pass an audit. The war in Ukraine is at risk of escalation and is no closer to being resolved. The Middle East remains a risk, and China and Taiwan remain unresolved. Politically the world appears to be fracturing both regionally and ideologically, and many important countries are now openly flouting US hegemony and working on deepening and developing their own trading and financial relationships. Precious metals was our favoured asset class for 2022 (and one of its top performers) and remains a must to own given the political and economic environment. Gold could easily reach new highs in 2023, offering diversification and some reasonable prospect of substantial gains. As part of a diversified portfolio, we also perceive opportunities in oil, uranium, speciality metals and food. (2) Active Management, Hedging and Shorting Even bonds may provide opportunities. Convertible bonds currently appear attractive as equity substitutes and offer better downside protection. Government bonds with duration have two-sided risks albeit they may still suffer under structural inflation, capital withdrawals or central banks unexpectedly holding their nerve and keeping policy tight for longer. Nonetheless, they will likely provide tactical opportunities to own small weightings. Liquid alternatives and trading strategies appear attractive for their low market sensitivity and their ability to protect capital. These include long/short approaches, relative value opportunities, contrarian trading, carbon trading and event-driven strategies. These strategies don't rely upon favourable equity markets to do well and provide a cash alternative, offering better capital preservation in weak markets. It is not necessary to lock up money for 7-10 years in illiquid alternatives to get the benefits of diversification, as liquid strategies provide attractive opportunities while so many stocks remain overvalued.. Investors in large commercial property managers like Blackstone are finding out that favourable published returns are not available to them when they want to redeem. Investors in some large Australian super funds could also potentially suffer similar issues, particularly if economic and financial market conditions further deteriorate. Stock picking will likely offer good opportunities into 2023, both long and short and even among some very large market leaders. Tesla looks to be the gift that keeps on giving on the short side, with the reality of strong competition, insider sales and lower growth in a recession bringing the company's valuation back down to earth. (We have successfully shorted Tesla more than once in 2022 and will likely do so again). Numerous still highly priced growth stocks are likely to disappoint further and will provide good hedging opportunities during market weakness in the early part of 2023. Companies like Zoom still fall into this category. Numerous "high promise" but currently unprofitable companies have had a disastrous 2022 whilst diluting shareholder equity by issuing large share and option incentives to management. Many large quality companies and household names where investors are hiding also appear overvalued; companies like McDonalds and Coca-Cola are trading at greater than 30 times earnings with modest growth and consumer sensitivity. Blackrock provides an opportunity to short passive management. Many commercial property stocks will likely be strong shorting opportunities, given the sector's disastrous outlook. Later in 2023, there may be significant opportunities on the long side in small caps and selective growth companies to play a recovery. On the long side, selective resource stocks still offer good longer-term opportunities, but many managers need to be avoided in the space due to demonstrably poor risk management and track records. If 2022 has proven anything at all about many money managers, it is that too many are like passive funds and rely upon rising markets, offering little risk management or capital preservation on the downside. Poor downside risk management can reveal who to avoid and switch away from! (3) Genuine Diversification and Differentiation We expect that markets will remain challenged in early 2023 as economic mismanagement, increased corruption and malfeasance, geopolitical, valuation, and volatile inflation and interest rate pressures continue haunting broad market outlooks. This will again prove highly challenging for passive management, which must wear all these factors to its detriment. Genuine active management, fundamental research, risk management and conservatism appear essential in this environment. We still see the end of a previously favourable period of globalisation and peaceful prosperity. Wages pressure, demographic issues and greater protectionism, regionalism, autocracy and greater socialism, along with less workforce participation, mean the labour and capital balance is shifting. Higher structural inflation and volatile inflation outcomes in coming years, along with various tail risks, must be carefully considered when building a portfolio and mean that the portfolio of the 2020s should be fundamentally different from years past. It is essential to be more conservative and have better diversification in this environment rather than simply gambling on strong financial asset returns, as the latter approach is best suited to a period that has now gone. 2022 has shown that many bottom-up investors who ignored these crucial top-down factors have been severely punished, for example, by holding large allocations to growth stocks or investing in what were traditionally defensive investments such as government bonds. Funds operated by this manager: WealthLander Diversified Alternative Fund DISCLAIMER: This Article is for informational purposes only. It does not constitute investment or financial advice nor an offer to acquire a financial product. Before acting on any information contained in this Article, each person should obtain independent taxation, financial and legal advice relating to this information and consider it carefully before making any decision or recommendation. To the extent this Article does contain advice, in preparing any such advice in this Article, we have not taken into account any particular person's objectives, financial situation or needs. Furthermore, you may not rely on this message as advice unless subsequently confirmed by letter signed by an authorised representative of WealthLander Pty Ltd (WealthLander). You should, before acting on this information, consider the appropriateness of this information having regard to your personal objectives, financial situation or needs. We recommend you obtain financial advice specific to your situation before making any financial investment or insurance decision. WealthLander makes no representation or warranty as to whether the information is accurate, complete or up-to-date. To the extent permitted by law, we accept no responsibility for any misstatements or omissions, negligent or otherwise, and do not guarantee the integrity of the Article (or any attachments). All opinions and views expressed constitute judgment as of the date of writing and may change at any time without notice and without obligation. WealthLander Pty Ltd is a Corporate Authorised Representative (CAR Number 001285158) of Boutique Capital Pty Ltd ACN 621 697 621 AFSL No.508011. |

19 Jan 2023 - Oil drops to lowest level of 2022 but supply-demand is likely to tighten over the medium term

|

Oil drops to lowest level of 2022 but supply-demand is likely to tighten over the medium term Ox Capital (Fidante Partners) December 2022 The low oil price today is a result of weak demand (global economic malaise) and increased supply (US strategic oil reserve release). These factors will likely normalise in coming quarters. Over the longer term, demand is set to pick up driven by China opening up and the secular economic growth of other emerging economies. Demand is likely to significantly outstrip supply given the lack of investment that has gone into the sector.

Oil price has pulled back from over US$120 per barrel in June to less than US$80 per barrel over the last week. The oil market is factoring in a short-term slowdown in demand as rising interest rates start to impact real economic activities globally. We remain optimistic about the return potential of the energy sector in the coming years. Approximately 100M barrels of oil are consumed globally each day. A surplus or deficit of 1% or ~1M barrels can lead to significant price move. At present, oil demand is artificially low and is still below pre-covid levels. In China, oil demand is ~1M barrels per day below 2021 levels because of Covid lockdown, and global jet fuel consumption is ~2M barrels per day below 2019 levels. In terms of supply, the US government has been releasing its strategic petroleum reserves, adding 0.8M barrels a day to global supply since March 2022. This will slow as we go into 2023. As a result of the short-term demand and supply distortions, OPEC+ is cutting output by 2M barrels per day by the end of 2023 to support prices, illustrating supply discipline that can be flexibly applied to uphold a quasi-price floor if required going forward. Over the longer term, it has been evident that the members of OPEC+ has been struggling to produce to their quotas over 2021 and 2022. This is likely a result of a lack of investment in oil projects over the last decade. The upside for oil price can be significant as China opens up and other emerging economies continue to grow. Supply will struggle to keep up. Major oil companies in Europe are attractively valued and are trading at a significant discount to many of the oil majors in the US. Even at an oil price of US$70, European energy companies are typically trading on 5xPE, 15% free cash flow yield, compared to 14xpe and 7.5% free cash flow yield for the Americans. Ox has selective investments in some of the leading players in this space. The current pullback in oil can create additional investment opportunities for 2023, of which we are on the lookout. Funds operated by this manager: |

18 Jan 2023 - Australian Secure Capital Fund - Market Update

|

Australian Secure Capital Fund - Market Update November Australian Secure Capital Fund November 2022

Property prices continued to fall across the nation with values declining a further 1.00% throughout November. This brings an approximate 7.00% (average of $53,400) decline since national property prices peaked in April of this year. Whilst this marks the seventh month of decline, the rate at which prices are declining is beginning to soften, with the 1.00% reduction being the smallest since the 1.60% monthly decline in August. Queensland again recorded the most significant monthly reduction, along with Tasmania with a 2.00% reduction in the Home Value Index. New South Wales, Canberra, Victoria and South Australia also experienced a reduction in value with 1.30%, 1.20%, 0.80% and 0.30% respectively. Western Australia remained stable, and the Northern Territory actually saw a small increase of 0.20% for the month. Record low vacancy rates of 1.00% have allowed unit prices continue to remain somewhat resilient, recording a 0.60% reduction for the month, bringing 4.70% reduction since prices peaked. The number of auctions held in the last weekend of November remained considerably below that of last year, with 2,393 auctions taking place as opposed to 4,251 last year. Whilst well below that of last year, the number of auctions were up 4.10% on the previous weeks results and were in fact the highest since a weekend in mid-June recorded 2,528 auctions. Clearance rates across the nation were also down on last year's figures, with only 61.50% of auctions clearing (down from 68.50% last year) indicating that vendors may not yet have responded to market conditions. Adelaide again recorded the highest clearance rate for the weekend with 65.90%, followed by Sydney (64.20%), Canberra (62.80%), Melbourne (61.00%) and Brisbane (47.40%). Source: Article, Report Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

17 Jan 2023 - Glenmore Asset Management - Market Commentary

|

Market Commentary - November Glenmore Asset Management December 2022 Equity markets globally were stronger in November. In the US, the S&P 500 was up +5.4%, the Nasdaq rose +4.4%, whilst in the UK, the FTSE 100 increased +6.7%, boosted by its heavy mining weighting. On the ASX, the All Ordinaries Accumulation Index rose +6.4%. Utilities were the best performing sector, boosted by the takeover bid for index heavyweight Origin Energy, which was up +41% in the month. Materials was the next best sector, driven by investor optimism around China loosening its covid lockdown measures. Telco's, financials and technology all underperformed in the month. Bond yields declined in November as investors started to become more positive that the pace of interest rate hikes from central banks will moderate along with some signs that inflation has potentially peaked. In the US, the 10 year bond yield fell -30 basis points (bp) to close at 3.74%, whilst in Australia, the 10 year rate fell -23bp to 3.53%. During the month, the RBA increased interest rates by 25bp for the seventh month in a row, taking the official cash rate to 2.85%. The A$/US$ rallied in the month, up +6.0% to close at US$0.68. Commodity prices were broadly higher. Nickel rose +23%, whilst copper, aluminium and lead also rose between +6-8%. Thermal coal rebounded +11.4% after an -18% decline in October. Also of note, iron ore was up +25.6% after falling for seven months in a row. Brent crude oil fell -10.0%. Funds operated by this manager: |

16 Jan 2023 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

|||||||||||||||||||

| Collins St Convertible Notes Fund | |||||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

| Capital Group Global Total Return Bond Fund (AU) | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

|

Emit Capital Climate Finance Equity Fund |

|||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||||

|

Subscribe for full access to these funds and over 700 others |

16 Jan 2023 - The Investment Outlook 2023

|

The Investment Outlook 2023 abrdn December 2022 As we look back on 2022, to describe the year as eventful seems an absurd understatement. So many events have dominated the news, each individually significant, and in aggregate almost overwhelming in consequence, both politically and economically. Here's a reminder of just a few of those events:

Climate crisis uncertaintyYet all these things will be relatively short-lived in their impact (and manageable) when compared to the existential threat that continues to grow relatively unabated from our failure to make progress on constraining global warming to the agreed target of 1.5°C. COP 27, the climate change conference held this year in Egypt, largely failed to expand on commitments made a year earlier with regards to phasing out fossil fuels, despite all the strong statements made around the necessity to do so. The one major step forward was the agreement of a deal that has been sought for over 30 years to launch a fund for 'loss and damage' to support those nations most exposed to the consequences of climate change. But details and financial funding have not been agreed. We can already observe more extreme weather events - notably the recent floods in Pakistan - which have devastating effects on impacted economies and contribute to the risk of a steady but dramatically expanded flow of migrants to other countries. Don't give upBut, as the old saying goes, where there are challenges, there are also opportunities. Here's where we see them:

Reasons to be optimisticIt's easy to be overwhelmed by all the uncertainty. That said, we've also seen steady progress in many places that may offer an antidote to the gloom:

2023 may well be a pivotal year for markets amid the economic challenges that remain. While these are clearly important, we mustn't take our eyes off potentially existential long-term issues. Author: Sir Douglas Flint, Chairman of abrdn |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund |