News

23 Feb 2023 - The Safeguard Mechanism - What's all the fuss about?

|

The Safeguard Mechanism - What's all the fuss about? Alphinity Investment Management February 2023 The Australian ESG world was sent into a flurry by changes to the Safeguard Mechanism and Australian Carbon Credit Units (ACCUs) that were proposed in January. The Safeguard Mechanism was put in place in 2016 as part of the Emissions Reduction Fund. It essentially set emissions limits (baselines) for high-emitting industrial facilities across Australia and required facilities to buy carbon credits to compensate for any emissions in excess of that baseline. The scheme covers more than 200 individual facilities, each of which emits more than 100 000 tonnes of carbon equivalents per year. These Safeguard Facilities generate almost 30% of Australia's total emissions between them and many are owned by some of Australia's biggest listed companies including BHP, Rio Tinto, BlueScope Steel, Santos, Woodside Energy, Orica, and South32. Last year, when the new Federal Government made a commitment - and legislated - to reduce national emissions 43% by 2030 and reach net zero by 2050, it flagged the need to strengthen the Safeguard Mechanism which would continue to encourage Australia's largest emitters to reduce emissions. The Government finally released its position paper in January which proposed changes to the scheme. Although many expected this would be the final say on the changes, the Government has committed to one more round of feedback (due 24 February), before final changes will come into force on 1 July 2023. There are a number of key changes to the scheme which may mean many companies will exceed their baselines at a facility level (at least initially), however, this will be more of an issue for companies which have most of their operations in Australia. The Safeguard Mechanism will have less of an impact on companies like BHP, that operate globally, since the facility level impact will be diluted at the group level. Changes to the schemeA few important changes to be aware of:

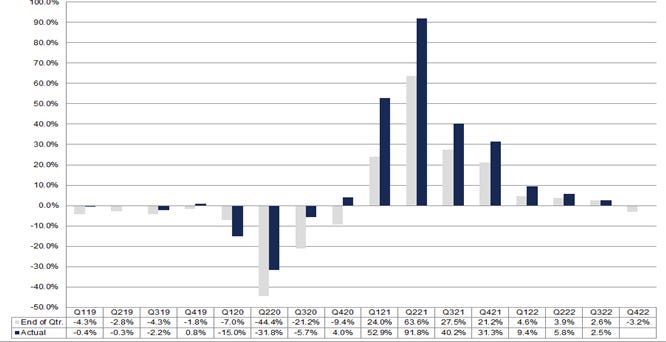

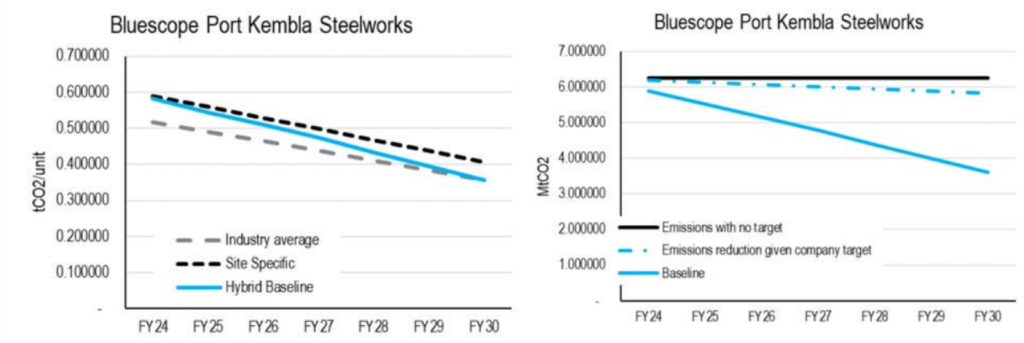

For example, the graph below shows the change to the baselines for Bluescope Steel's Port Kembla asset. Assuming its production remains largely consistent, there would be a 14% difference between emissions at the facility and the baseline requirements in 2030.

|

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

22 Feb 2023 - China re-opening post COVID

|

China re-opening post COVID 4D Infrastructure February 2023

While it was always a matter of when (not if) China would reopen, the abrupt change in stance has reaffirmed and brought forward multiple domestic and global investment opportunities, and could also support a global economy that was rapidly weakening. In this article, we summarise key policy changes, the improving macro outlook, and what the reopening of the world's second biggest economy means for global listed infrastructure investors. COVID-zero policyOn December 26, 2022, China's National Health Commission (NHC) announced that its COVID prevention and control management would be downgraded from class A (covering bubonic plague and cholera) to class B (SARS, AIDS, anthrax), effective from January 8, 2023. Class B relinquishes the power of local authorities to quarantine patients and close contacts, and lock down regions. Since dismantling its zero-COVID policy, China has been grappling with what's shaping-up to be the biggest COVID outbreak ever seen. By mid-January, many local authorities had indicated that daily cases had passed the peak. However, we anticipate an uptick in cases following the Lunar New Year holiday, particularly in country and rural areas. It remains unclear just how severe and widespread the outbreak is, given the government stopped universal testing and changed how it defines COVID mortality. Additionally, the abrupt policy change caught many domestic operators off guard, preventing immediate normalisation of business activity to pre-COVID activity levels. These impediments include labour disruptions (either through infection or re-training requirements), capacity and/or services shortages, entry restrictions imposed by other countries, and passport renewals/visa applications. While this may weigh on sentiment and economic activity in the near term, we expect pent-up demand, willingness to spend and policy support measures to continue to reduce bottlenecks and drive a consumption-led rebound in economic activity relatively quickly. The Chinese roadmap to reopening post-congressImproving macro outlook - in country and globalChina held its annual Central Economic Conference in late December 2022. Emerging from the conference, policymakers set sights on growth in 2023. Officials called for targeted and forceful monetary policy and strengthened fiscal policy. The aim is to expand domestic demand, with priority given to employment, and boosting consumption. Despite no official nationwide economic growth target being set, most provinces, municipalities and autonomous regions have unveiled their GDP growth targets for 2023, with rates ranging from 4.0-9.5% and an average of 5.95%. Consumption, investment, stimuli and policy are core pillars of the rebound. Most targets remain above the forecasts by foreign institutions and agencies, which range between 4.5-5.5%, although we have recently seen upward revisions to these following the re-opening. (Notably, IMF increased its growth forecast to 5.2% in late January-23 from 4.6% earlier projected in November-22). At 4D, we look for the underlying data and other proxies that support the headline growth numbers. Specific to infrastructure, these include expressway traffic, railway patronage, airline passengers, gas & electricity consumption, port throughput data and plant utilisation rates. Outside of infrastructure, data includes retail sales, new car sales, new property development and sales. We accumulate and amalgamate this data as a thermometer to gauge economic activity. The re-opening of China could also benefit a world anticipating its own domestic slowdown. For example:

Xinhua News Agency - Passengers crowded at the North Railway Station, Shenzhen waiting to cross into Hong Kong as cross-border services resumed for the first time since January 2020 Infrastructure sectorInvestment in infrastructure has been a key pillar of China's stimulus plan for decades, supporting and boosting economic growth in times of need, such as post the GFC and, more recently, throughout the pandemic. Fixed asset investment increased 5.1% to CNY57.2 trillion in 2022, up from 4.9% in 2021 and 2.9% in 2020. The table below summarises the opportunities across the key infrastructure sub-sectors from re-opening and related policy/stimuli at both a domestic and international level. The Chinese roadmap to reopening post-congressOn forward earnings estimates, despite the recent market rally, we highlight that Chinese listed infrastructure names remain undervalued, trading well below pre-pandemic levels and 5-year averages. Undemanding valuations and strong tailwinds in 2023 set the stage for a strong re-rating. Source: Bloomberg ConclusionInfrastructure will be both a key driver and a beneficiary of China's reopening, and the central government's focus on increasing domestic consumption and economic recovery. We anticipate more stimulus and policies promoting growth over the coming months, particularly post the plenary National People's Congress in March. This will bring forward the infrastructure investment needed to support the emerging middle class, continued urbanisation, decarbonisation goals and wealth equality. The reopening has a wide-reaching impact, fostering multiple tailwinds not just within China but across our larger global listed infrastructure universe. At 4D we are capitalising on this via direct investment in China (toll roads, gas operators and ports) as well as at a global level (second wave for airports, midstream in the US and commodity transportation in Brazil, North America). |

|

Funds operated by this manager: 4D Global Infrastructure Fund, 4D Emerging Markets Infrastructure FundThe content contained in this article represents the opinions of the authors. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. |

21 Feb 2023 - Will Australia survive or thrive? What to expect in 2023

|

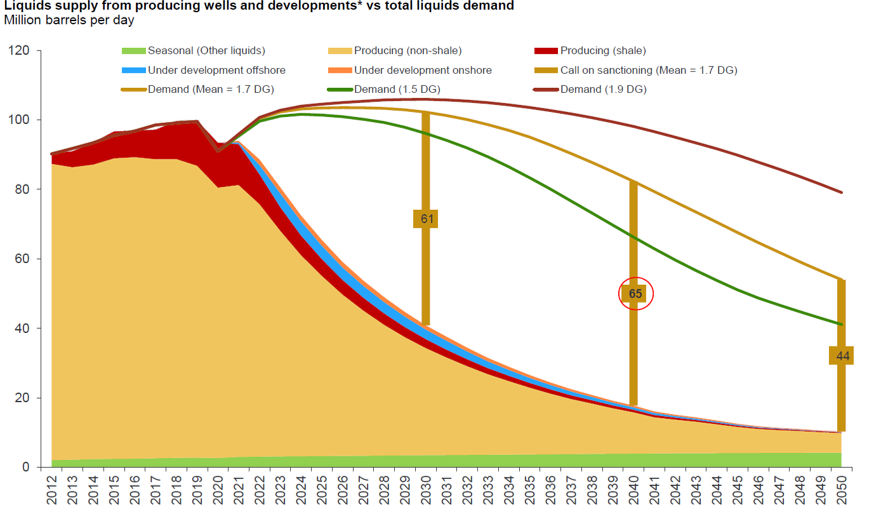

Will Australia survive or thrive? What to expect in 2023 Tyndall Asset Management December 2022 Strange Bedfellows - Super cycle in renewables and oil & gas The super cycle in renewables is in full flow and, perversely, oil and natural gas will remain a beneficiary until sufficient new renewable capacity is created. The current renewable energy solutions of solar and wind are estimated to be some 10 times more metals intensive then the fossil fuel plants they are replacing. The life cycle of the current renewable solutions are substantially less than a typical coal or nuclear power station which last 30-50 years. The critical minerals required for global decarbonisation include rare earths, lithium, cobalt, copper and nickel. The world currently does not have sufficient reserves to fulfill the net-zero aspiration. Therefore, we expect prices will remain elevated, with Australia in a pivotal position given our resources inventory to help deliver on the energy transition (refer Tyndall's ESG Insights: The value in securing critical minerals). Oil development is down substantially, with cashflow from the major integrated oil and gas companies spent on buybacks, natural gas and renewable projects like solar, wind and hydrogen. Shareholder activism and government pressure have contributed to oil producers reducing capex and development spend. Traditionally, there has been a tight relationship between oil prices and drilling/development. This relationship appears to be broken, and even in the short cycle unconventional prospects onshore in the USA, companies are drilling less despite the attractive economics. Given oil reservoir production typically depletes by 10-15% p.a., there appears to be a substantial supply gap going forward, despite demand decreasing. Norwegian oil and gas consultant - Rystad, estimate that 61m barrels of oil per day need to be developed by 2030 when using the 1.7-degree scenario (refer Figure 1). Figure 1: Demand for oil outstrips supply

Source: Rystad The three horseman of the apocalypse — energy, interest rates and labour cost Increasing energy, interest rates and labour costs are substantial headwinds for many companies and as margins continue to come under pressure, we expect downgrades throughout 2023. Labour pressures are being felt in both wages and from the global impact of apparent labour shortages. Given this is felt across various sectors, it is difficult to envisage a short-term fix outside of a substantial economic downturn. The impact of monetary policy tends to lag by 12-18 months, meaning the Australian economy is yet to feel the full impact of tightening monetary policy. Full employment and an above-average savings rates have softened the impact. The wealth impact of housing weakening further in 2023 will eventually put the brakes on consumption. The canary in the coal mine during slowdowns driven by interest rates is normally a discretionary consumer pullback. Consumer discretionary sales currently remain high with little evidence of pain felt by retailers. We expect commentary in the February 2023 reporting season may provide some early signs of both margin and top line growth pressures. The combined impact of the materially higher cost inputs of energy, interest rates and labour should become clear over 1Q 2023. Margins are currently at high levels, and we expect pressure, particularly in companies and industries that have little pricing power to fight the inflationary forces. We see little respite in energy and labour outside of government intervention, whereas interest rates may roll over when Central Banks consider they have the inflation under control. Be prepared for the profit downgrades. China — exiting COVID Zero The changes observed over the past 20 years of visiting China have been incredible given the combination of a growing middle class and high annual GDP growth. The Chinese Communist Party (CCP) is cautious to not upset the mass population. This is in contrast to an outsider's view which tends to believe China's people are frightened of the CCP. The catalyst for the recent COVID pivot from the CCP over COVID restrictions were the large demonstrations, often violent across China, from citizens frustrated by the restrictions. Interestingly, western governments ignored and, at times, violently pushed back on similar demonstrations. The CCP has now relented and recently announced 10 optimisation measures that mark the tipping point of the country's economy reopening. Therefore, in 2023 we are likely to see China go through a typical reopening phase similar to what we have observed across most western countries, resulting in consumption and GDP increasing. Australia may be a beneficiary of China reopening as consumption and demand increase. Both services and materials demand will rise, with oil and natural gas being a notable beneficiary. Recession risk rears its ugly head The aggressive tightening of global monetary policy aimed at slowing the economy is likely to move many countries into recession territory. It appears to be a fait accompli that Europe and the UK will dive into recession, and the debate is still ongoing on whether the USA will dip into negative GDP growth. Australia has the benefit of the world desiring its resources and agricultural products, and thus the probability of a recession appears lower, albeit in many ways this is just semantics given a slowdown is coming. Inflation and interest rates — the return of the "old normal" Inflation will reduce as COVID supply chain issues and the Ukraine war impacts alleviate. However, inflation will remain stubbornly higher compared to the past 10 years given obvious structural changes including labour shortages, persistent supply chain disruption and constrained supply of some goods. Technology innovation and productivity will need to accelerate to offset these pressures. Demographics, meanwhile, are negative for many countries, with a slowing population, particularly within advanced countries including China. Australia benefited prior to COVID with strong immigration but, overall, the combination of increasing demand (consumers) and decreasing supply (workers) is not great arithmetic. Global demand for labour currently is high. We hope central bankers have learnt their lesson, given they kept monetary policy too low for too long and entered COVID with very low interest rates. It is difficult to envisage interest rates being that low outside of an emergency, meaning higher interest rates are here to stay. The net result is that higher interest rates and inflation imply that long duration assets should further derate. Getting deglobalisation right

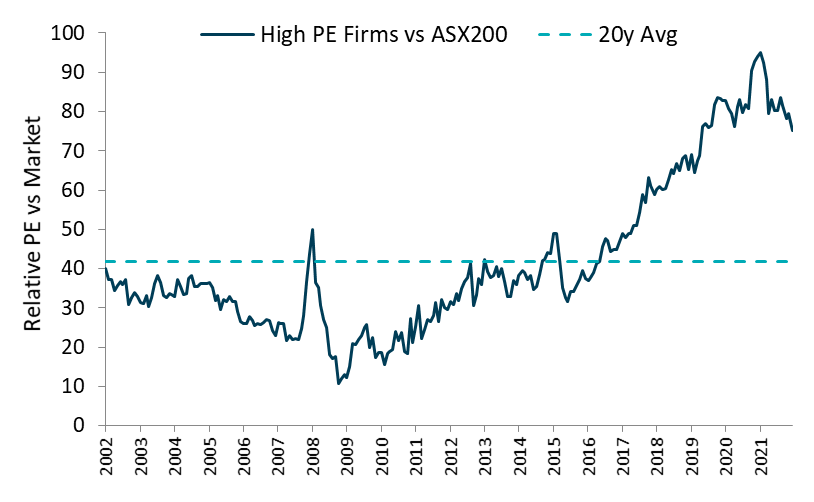

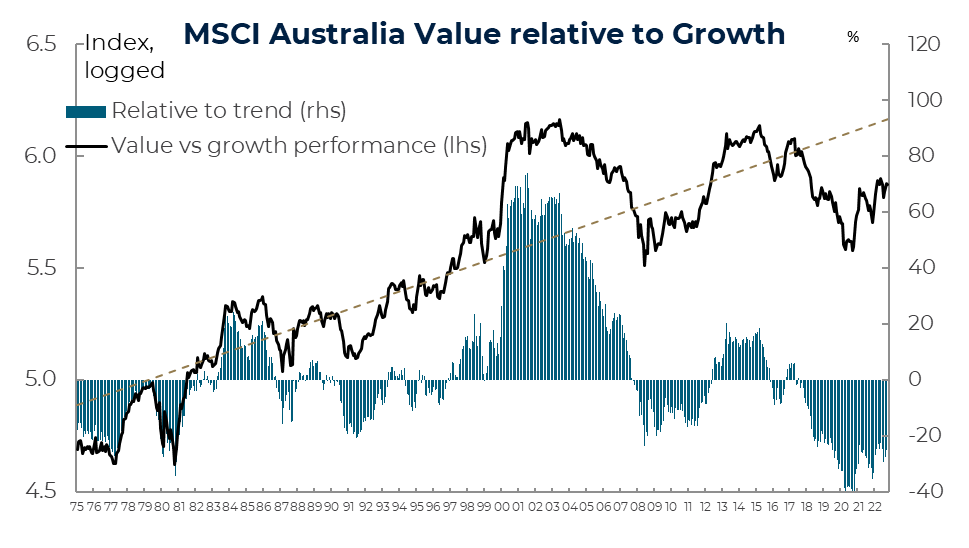

Globalisation, together with China essentially selling deflation to the world over the past 20 years, will pause and perhaps even retreat. Companies and countries have recognised that relying on single supply chains or countries is risky. COVID and the Ukraine War have illustrated these risks, and we are starting to see governments develop plans to mitigate these risks. In one example, new chip manufacturing plants are being built in the US and governments are helping to fund the critical minerals required for the pathway to net zero. Additionally, the Australian Government provided an AU$1.2b non-recourse debt facility to Iluka Resources to help fund their rare earths processing facility in West Australia. This was unprecedented for the Federal Government and illustrates how countries are viewing the access to reliable and secure supplies of critical minerals. Most recently, the US passed the Inflation Reduction Act of 2022 (IRA), which directs nearly US$400b in federal funding to clean energy, with the goal of lowering carbon emissions by the end of the decade. There are strings attached, with many of the IRA tax incentives requiring domestic production, domestic procurement requirements or from a country with a free-trade agreement. Australia could be a beneficiary of this given our relationship with the US, which includes a Free Trade Agreement. The bottom line is that deglobalisation is inflationary and will continue placing pressure on inflation for many years to come. Value investing makes a big comeback Tyndall has always viewed value investing as a philosophy rather than a factor. Our process has always aligned with the approach from Benjamin Graham, the father of value investing. Tyndall values companies based on their sustainable earnings capacity. We determine the intrinsic value by capitalising the sustainable or mid-cycle earnings of every stock under coverage. At its core, value investing is buying companies that are trading below their assessed net worth, maintaining a disciplined and patient approach. The valuation gap between growth and value remains at extraordinarily high levels despite a recent narrowing (refer Figure 2 & 3). The tailwinds for growth post the GFC are unlikely to return anytime soon. Higher inflation and interest rates are here to stay, and thus we expect the elevated valuations still being priced for growth will derate further. A disciplined and bottom-up valuation approach will deliver alpha during these times. Figure 2: High PE firms trade at a 75% premium to the market - well above historical averages. US LNG capacity forecasts

Source: Goldman Sachs Figure 3: Value on track to outperform over the next few years

Source: MSCI Author: Brad Potter, Head of Australian Equities Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund Important information: This material was prepared and is issued by Yarra Capital Management Limited (formerly Nikko AM Limited) ABN 99 003 376 252 AFSL No: 237563 (YCML). The information contained in this material is of a general nature only and does not constitute personal advice, nor does it constitute an offer of any financial product. It does not take into account the objectives, financial situation or needs of any individual. For this reason, you should, before acting on this material, consider the appropriateness of the material, having regard to your objectives, financial situation, and needs. The information in this material has been prepared from what is considered to be reliable information, but the accuracy and integrity of the information is not guaranteed. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data, and make no promise of future investment returns. Past performance is not an indicator of future performance. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided. |

20 Feb 2023 - Australian Secure Capital Fund - Market Update

|

Australian Secure Capital Fund - Market Update January Australian Secure Capital Fund February 2023 January saw property prices fall nationally by 1%, which was less than December and the smallest month to month decline since mid last year according to CoreLogic's national Home Value Index. Prices fell across all capitals by an average of 1.1%, however regional housing values continued to record a milder rate of decline at -0.8%. Hobart saw the largest reduction (-1.7%), followed by Brisbane (-1.4%), Sydney (-1.2%), Melbourne (-1.1%), Canberra (-1.0%), Adelaide (-0.8%) while the falls in Perth and Darwin were less significant at (-0.3%) and (-0.1%) respectively. The quarterly trend however is pointing to a reduction of the in the pace of decline, and despite the falls every capital city and region is still recording home values above pre-pandemic levels. Contributing to the reduction of dwelling values, is the fall in demand. Capital city dwelling sales were down -29.4% on previous year figures, with listings -22.2% below the same time last year meaning that most home owners who are considering selling are sitting things out with no pressure to sell into this market. Weekly auction activity has begun to increase in 2023, with 706 auctions taking place across capital cities last weekend achieving a 67.9% clearance rate which we consider positive. Melbourne recorded the most auctions with 259 auctions taking place at a clearance rate of 68.3% (67.5% last year), followed by Sydney with 202 auctions and a strong clearance rate of 71.6% (66.3% last year). Adelaide achieved the best clearance rate for the weekend with 76.8% (81.8% last year) for their 105 auctions whilst Brisbane and Canberra were lower with clearance rates of 59.6% (80.1% last year) and 52.2% (85.5% last year) respectively. Whilst property prices will undoubtedly be linked to the movement in interest rates we do believe we are nearing the end of the rate rise cycle, with some banks already beginning to reduce the fixed rates for 3 and 5 year terms. The resurgence in overseas student migration will also see the rental market remain tight and help support yields across the residential property market. As a result we do believe housing values will stabilise over the coming months as some level of confidence returns to the market.

Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund Source: Australian Financial Review

|

||||||||||||||||||||||

17 Feb 2023 - Battleground ESG issues for 2023

|

Battleground ESG issues for 2023 Yarra Capital Management January 2023

As we look forward to the year ahead, we have been reflecting on where we are likely to see the most prominent sustainability issues (sometimes called 'ESG' or environmental, social and governance issues) surface for companies in the year ahead. Our predictions include continuing to see the big issues, such as climate change, remain centre stage but shift from a conversation about disclosures and targets to issues of quality and substance. Alongside climate, we will see companies scrambling to make sense of an expanding environmental mandate to include understanding their implications on nature and biodiversity more broadly. We see a big year ahead for social topics, including industrial relations and labour rights, as well as a resurgence of issues pertaining to social license to operate. And, as ever, good governance will continue to be a key driver of value, particularly with the continuing rise of cybersecurity issues and companies having to navigate an increasingly complex landscape of material issues. Our predictions for the big battleground ESG issues for the year ahead are: Environment1. Climate change issues are evolving towards quality:

2. Nature, food and water security and biodiversity will be the newest everywhere topic:

Social3. Industrial relations and labour rights and conditions will become increasingly material:

4. Social license to operate makes a 'comeback':

Governance5. Data security and privacy evolves to include issues of data sovereignty:

6. The 'G' factor will drive corporate responses to an evolving landscape of material issues:

Beyond the E, S, and GBeyond the individual issues surfacing under the E, S, and G banners, we also see trends toward positive investment opportunities, including: 7. Scale will be the focus for the new wave of purpose driven capital:

8. Sustainability, ESG and Impact are no longer distinct approaches to investing:

Author: Dr Erin Kuo, Yarra's Chief Sustainability Officer |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

16 Feb 2023 - The path to clean, secure and affordable energy

|

The path to clean, secure and affordable energy Nikko Asset Management January 2023

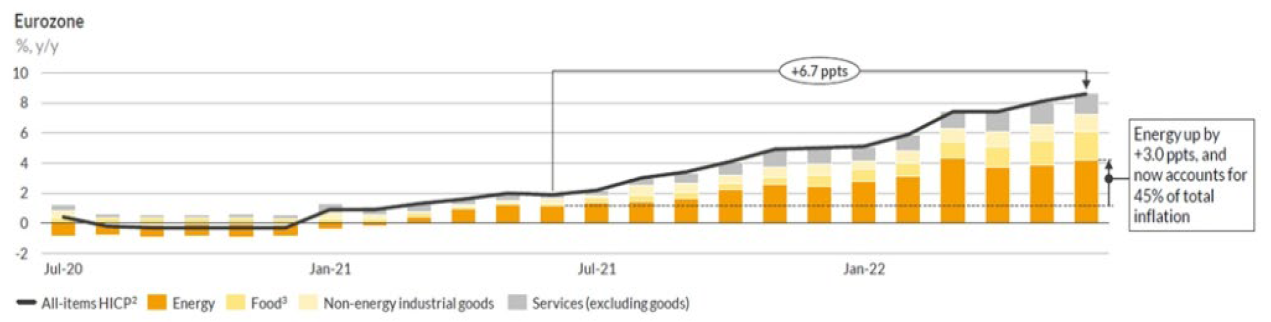

The changing seasons are nature's way of reminding us that time moves on. And it is the same in the Russell household, where my youngest is approaching 18 and his late weekend nights are his way of telling me change is arriving in our home too. There is a dawning that I am heading into a new stage of life. It is exciting, but after 20 years of bringing up a family, I also admit to being a little scared of what the next chapter will bring. In markets we often get obsessed with short-term changes but it can be the slow structural moves—such as a child leaving the home—which can have a more profound longer-term impact. Bear markets exist for a purpose. They expose the heavy misallocation of capital that in this bear market happened because finance was too easy. While capital is now more rationed, energy too can no longer be taken for granted. Of course management teams of energy companies have been aware of this for some time, as they have witnessed their own cost of capital rise as the shale revolution unwound and climate change took hold. In bear markets time horizons are compressed and dreams are often shelved as rising costs force management teams to make difficult choices. These choices impact different stakeholders, often over different time horizons, which explains why companies adopting a stakeholder approach with purpose could be better equipped to navigate their way through difficult times and eventually, when the next bull market begins, may be better placed to solve the significant challenges facing society over the coming decades. Choice One: Energy affordability versus long-term energy transitionEnergy markets and policies have changed as a result of Russia's invasion of Ukraine, not just for the time being, but likely for decades to come. The environmental case for clean energy needed no reinforcement, but the economic arguments in favour of cost-competitive and affordable clean technologies are now stronger—and so too is the energy security case. But solving for clean, secure and affordable energy is not straight forward. Energy is an input to making substantively everything in the modern world. So when we have shortages—as we do now—the rising costs of everything acts like a tax on consumption. Primary energy costs at the start of the last century were about 4% of the global GDP. Today, primary energy accounts for about 12% of total GDP, which is similar to that achieved in the two oil shocks in the 1970s.1 Direct energy makes up about 45% of European inflation (Chart 1). However, we also know that 10%-15% of all primary energy goes into making food for the world's population—which adds to the inflationary pressure. If other associated links to energy are added, we can estimate that approximately 75%2 of inflation is driven directly and indirectly by energy costs. Our current energy crisis is a core element of today's inflation and until we solve energy's supply problems, we expect inflation to remain stubbornly above most central banks' 2% targets. Chart 1: Headline inflation rate with component contributions - Eurozone

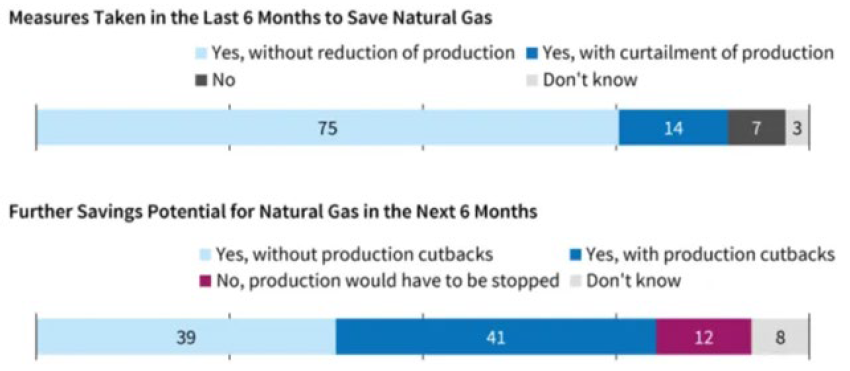

Source: Aurora Energy Research, GOV.UK, Eurostat, U.S. Bureau of Labor Statistics, MarketWatch Today, for every US dollar (USD) spent globally on fossil fuels, USD 1.5 is spent on clean energy technologies. But by 2030, under the net-zero emissions by 2050 scenario, every dollar spent on fossil fuels will be outmatched by USD 5 on clean energy supply and another USD 4 on efficiency and end-uses.3 If clean energy investment does not accelerate, higher investment in oil and gas will be needed to avoid further fuel price volatility, while also putting the 1.5 degrees Celsius goal in jeopardy. But if we accelerate clean energy today at the expense of fossil fuels, we will only exacerbate our energy shortages, given the short-term draw on valuable energy sources made by solar and wind. These are long-term versus short-term choices that even the experts have difficulty reconciling (Exhibit 1): Exhibit 1: IEA illustrates the challenge between short-term affordability and long-term energy transitionInternational Energy Agency (IEA) executive director Fatih Birol: "If governments are serious about the climate crisis, there can be no new investments in oil, gas and coal, from now - from this year". ("No new oil, gas or coal development if world is to reach net zero by 2050, says world energy body", The Guardian, 18 May 2021) IEA's 2022 outlook: "Ahuge increase inenergy investmentis essentialto reducethe risksoffutureprice spikes and volatility, and to get on track for net zero emissions by 2050… an average of almost USD 650 billion per year 'will be' spent on upstream oil and natural gas investment to 2030, a rise of more than 50% compared with recent years". (IEA "World Energy Outlook 2022", November 2022) The most suitable near-term solutions include projects with short lead times that bring oil and gas to market quickly, but also includes areas such as capturing some of the 260 billion cubic metres of gas that is wasted each year through flaring and methane leaks4 to the atmosphere—a key driver of our investment in Emerson. Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy's portfolio, nor constitute a recommendation to buy or sell. 1Thunder Said Energy, "Energy Shortage: fear in a handful of dust?", November 2022 Demand efficiency and productivity could also be key and in this field, there has been significant progress. A recent German IFO survey suggested that most companies—in this case 75% of those that use gas as a primary energy source in their production—have found ways to reduce gas usage in the last six months while still meeting production targets (Chart 2). Chart 2: Reduction of natural gas consumption in the production process (%)

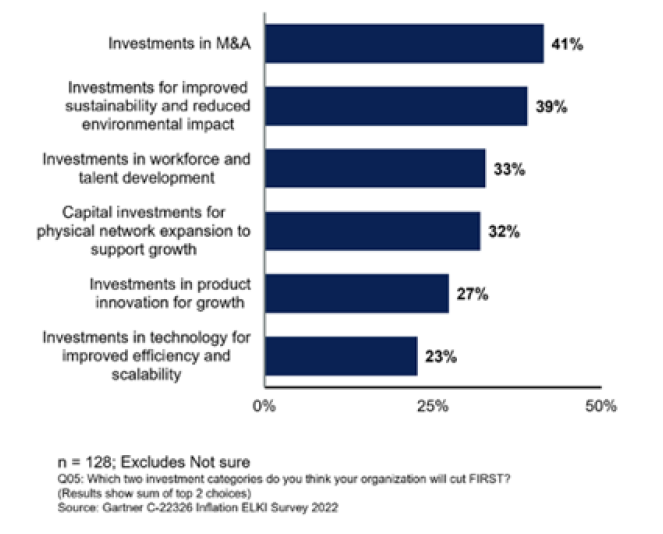

Source: IFO Business survey, October 2022 In fact energy efficiency is the number one place to look for solutions to this energy crisis. While energy costs soar, CEOs are expected to look at ways to make their businesses more resilient and reduce their energy burden. Paybacks on energy efficient investments will be very high, in our view, and are unlikely to be shelved if and when a recession starts. We see this providing tailwinds for long-term holding companies such as Schneider and opportunities within the energy services companies, where cash flow returns could accelerate to double-digit levels. This is certainly a significant part of the reason for our more recent investments in Worley & Schlumberger Choice two: ESG recession versus stakeholder capitalismRecent market history suggests that commodity prices will correct with a recession and if central banks have their way, a recession is exactly what we may get. Our own experience tells us that we should prepare for where the cuts might be. Some are obvious—such as advertising and marketing. These cuts have already started as can be seen by the demise of Google or Meta. For many others their earnings recession is just starting. Corporates are also expected to cut capital projects and the following June 2022 Gartner poll provides some insight into where these might be (Chart 3). The results are not surprising—but significant reductions in investment for improved sustainability and environmental impact is worth raising. Chart 3: Investment categories to be cut first—surveys

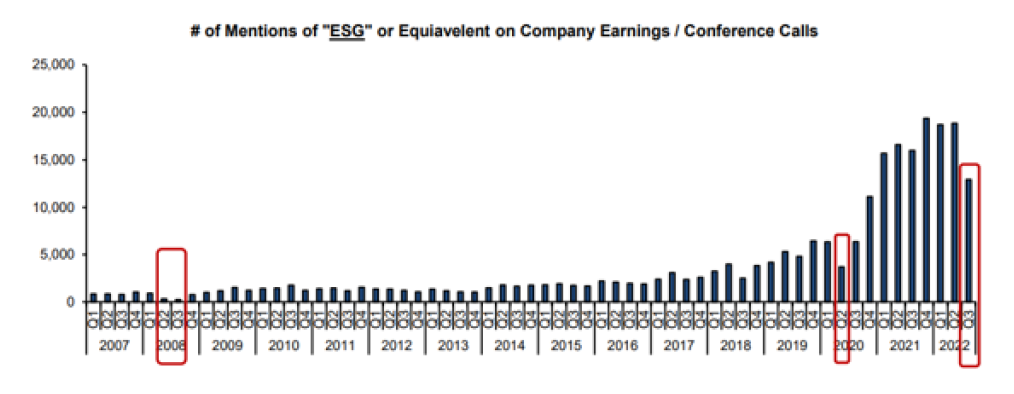

Source: Gartner, July 2022 Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy's portfolio, nor constitute a recommendation to buy or sell. While corporates may sharpen the knife on sustainability, what is surprising to many is the backbone behind policy changes in Europe and the US (among others) which instead of accelerating fossil energy supply, are expanding incentives and targets for alternatives, such as wind, solar and hydrogen. The REPowerEU Plan was launched by the European Commission earlier in 2022 to reduce the European Union's (EU) dependence on Russian fossil fuels in a direct response to the Ukraine invasion. The plan calls for the EU to consume 20 million tonnes (mT) of hydrogen by 2030, instead of the 5mT target previously quoted in the Fit For 55 policy announced just a few months before, as an example. If we feared a clash between decarbonisation and short-term energy needs, decarbonisation seems to remain society's number one target. The bull market for ESG data and integration has been stratospheric. Changing demographics, rising inequality, the rise in the importance of externalities such as nature and increased influence of the state through regulation all have a part to play. But as was the case in prior recessions, we should expect ESG to be less of a focus for management teams as they divert their attention to short-term challenges or for some simply staying afloat (Chart 4). In our view, expensive virtue signalling does not perform well during recessions (e.g. Tesla). Chart 4: Long-term bull market for ESG—with a few blips

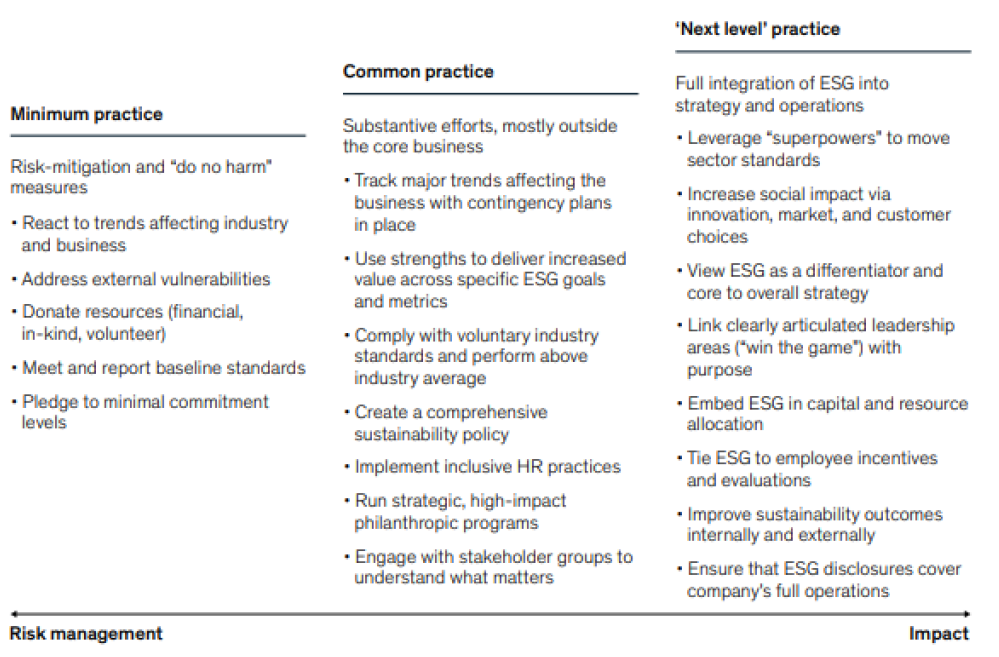

Source: Bernstein research and Bloomberg, October 2022 In terms of energy shortages, we may play out the 1970s again. We also appear to have returned to that decade to question the role of shareholder primacy, with both business leaders and politicians (e.g. business round tables and the Davos Manifesto), suggesting we are on the verge of a fundamental reshaping of society. This slow, structural change is of course not new and ESG is a key cog if stakeholder capitalism is to work. Given the shift to stakeholder capitalism is such an ideological shift, it shouldn't surprise anyone that we are now seeing an ESG backlash, the most vigorous of which is targeted at greenwashing. Survey evidence around sustainability suggests trust is low. For example, three out of four institutional investors do not trust companies to achieve their sustainability targets and commitments.5 And of course, the measurement of ESG data is fraught with difficulty; while credit ratings correlate 99%, the correlation of external ESG ratings ranges between 38% and 71%.6 For some, ESG is leading to a significant misallocation of capital and is morally bankrupt. 7 8The situation has prompted some regulators, such those in the predominantly Republican US states, to try and alter the direction of travel and ban ESG investing altogether. Yet, many companies today are making major decisions, such as discontinuing operations in Russia and protecting employees in at-risk countries. They also continue to commit to science-based targets and to define and execute plans for realising these commitments. This indicates that ESG considerations are becoming more—not less— important in companies' long term decision making. In fact, at Nikko Asset Management we believe companies should adopt a stakeholder approach. Companies must approach externalities as a core strategic challenge, not only to help future-proof their organisations but to deliver meaningful impact over the long term. Some companies that have already built purpose into their business models and are demonstrating they benefit multiple stakeholders are already showing success, such as Microsoft or lesser known companies, such as Compass Group. Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy's portfolio, nor constitute a recommendation to buy or sell. 5Edelman, "2021 Trust Barometer Special report: Institutional investors", November 2021 In recent years, boards of directors have become increasingly focused on corporate purpose. This is partly driven by a sense that purpose drives corporate culture, helps attract and retain talent and is increasingly a differentiator when it comes to customers and suppliers. External pressure on corporate boards to define purpose better has come from investors, who are themselves being asked to justify their own investments on the basis of ESG as well as financial considerations. A single, clearly marked path that every business should follow does not exist. Strong corporate leaders recognise that social expectations constantly evolve and we believe that it is the company's purpose that guides management, fund managers and owners through difficult times. A recent Mckinsey study developed a framework for summarising key ESG approaches. This highlights characteristics of those at the forefront of stakeholder capitalism, fully integrating ESG into strategy and operations—listed as "Next Level Practices". Companies adopting stakeholder capitalism are seen to be enhancing their company's competitive positioning. They have purpose and can articulate why stakeholder capitalism is creating a competitive edge (Exhibit 2). Exhibit 2: Corporate approach to ESG and stakeholder capitalism

Source: "How to Make ESG Real", McKinsey, August 2022 They are a more attractive place to work for their employees—retention rates are higher than peers—successfully fighting the war for talent, while some are discovering new solutions needed to solve many of our current problems, such as climate change. We can already see success in many of our own holdings—such as Danaher, Sony or John Deere to name a few. These companies are creating their very own superpowers, enhancing their franchise and management qualities and creating value (Exhibit 3). Exhibit 3: Examples of Future Quality purpose statement "Helping realize life's potential" (Danaher) "Fill the world with emotion, through the power of creativity and technology". (Sony) "We must act with urgency today to make the lives of our customers, workforce, and all those we serve better tomorrow". (John Deere) Reference to individual stocks is for illustration purpose only and does not guarantee their continued inclusion in the strategy's portfolio, nor constitute a recommendation to buy or sell. Our own experience is supported by academic research. Work by Ariel Babcock et al. titled "Walking the Talk: Valuing a multi-stakeholder strategy" links the importance of stakeholders and stronger operating performance across a number of metrics.9 These management teams are committed, empathetic and demonstrate with full and transparent disclosure of data that they are on a journey of continuous improvement. They invest with a long term investment horizon and are prepared to make difficult decisions, some with potential trade-offs across different time periods. But when backed by a clear purpose statement that creates value for all key stakeholders, these management teams can "walk the talk". Remuneration and incentive schemes are linked to measurable ESG targets and integrated reporting—such as diversity targets or emission reduction targets. And they are preparing themselves for further regulation such as the introduction of separate ESG reporting under what is known as "Double Materiality". ConclusionIn conclusion clean, secure and affordable energy is likely to be one of the major challenges of this decade. Given we need abundant energy to complete the energy transition, we believe fossil fuel companies that are actively enabling transition to low carbon society can be part of the solution. They often understand how to deliver global energy at scale and have the balance sheets capable of enabling the transition to clean energy. We also believe companies adopting a stakeholder approach will be better equipped to solve the significant challenges facing society over the coming years, and that a clearly defined purpose will help guide management teams through the challenges and choices they will have to make. After all, it is the choices made today that will define the Future Quality returns of tomorrow. 9Ariel Babcock et al., "Walking the talk: Valuing a multi-stakeholder strategy", FCLTGlobal, 17 January 2022 Author: Johnny Russell, Investment Director, Global Equity Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund, Nikko AM New Asia Fund, Important disclaimer information |

15 Feb 2023 - Is now a good time to start considering smaller companies?

|

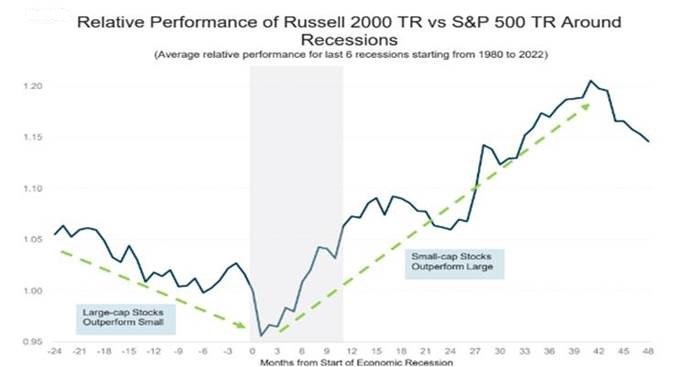

Is now a good time to start considering smaller companies? abrdn January 2023 Last year was terrible for equities. A war in Ukraine, soaring inflation, higher interest rates and weak economic growth all weighed on sentiment. Globally, both small and large caps were firmly in negative territory. Large-cap indices like the S&P 500 were dragged down as technology companies (such as Meta and Tesla) and stocks with high valuations sold off. Meanwhile, risk-averse investors shunned small caps as economic conditions deteriorated. And what about the future? Given the gloomy backdrop, investors are likely to avoid smaller companies for much of 2023. On the surface, this decision seems understandable. History shows that smaller companies tend to underperform larger ones during economic downturns. But dig a little deeper and a surprising conclusion presents itself: the time to start allocating capital to small caps might be sooner than investors think. Small caps outperform earlier than expectedThere are widely agreed assumptions about the performance of smaller and larger companies in different economic scenarios. Chart 1 shows the relative average performance of US small caps versus large caps, before, during and after recessions (dating back to the 1980s). Of course, each recession is different, with different mechanisms at play. Nonetheless, three factors stand out. Chart 1 Source: Bloomberg, William Blair Equity, December 2022 Firstly, larger companies tend to outperform their smaller rivals before, and at the start of, recessions. This makes sense. In economic slumps, risk-averse investors typically favour safer assets. In the equities space, this means more mature, well-established larger companies. Their markets are often less volatile and earnings more stable. By contrast, investors view smaller companies as riskier investments. Many businesses aren't as entrenched as bigger firms. Earnings and profit margins can therefore come under pressure in times of upheaval. Secondly, these factors are turned on their head when we exit a recession. In recovery periods, smaller companies usually outperform their larger rivals. By their very nature, small caps are nimbler and able to react faster than large caps to changes in the business environment. Smaller firms can therefore take advantage of the new opportunities a growing economy offers. The consequent rise in investor risk appetite also helps smaller companies. So far, so predictable. But the third point is not widely known: smaller companies have historically started outperforming large caps soon after a recession starts. As you can see from Chart 1, this rebound can begin as early as three-to-six months into a recession. That's because the market tends to price in an economic recovery before it happens. Yet this phenomenon is not part of the traditional small/large-cap narrative. We believe this disconnect creates opportunities for active investors. A potentially attractive entry pointSmaller companies trailed their larger peers in 2022. In Europe, it was the worst relative year since comparative data began (see Chart 2). This has had a knock-on effect on valuations. Historically, European smaller companies have traded at an average premium valuation of 21%1 above that of larger peers, thanks to superior small cap growth and earnings potential. However, at the close of last year, this difference dropped significantly and is currently at 9%. Given the potential rebound as we exit recession, this could represent an attractive entry point for long-term investors. Chart 2 A similar dynamic is at play in the US. Here, the valuation discount of small caps relative to large caps is as wide as it has been in more than 40 years (Chart 3). We believe this creates excellent long-term opportunities. Indeed, after US small caps reached a similar level of 'cheapness' in early 2001, small-cap stocks materially outperformed larger caps over the subsequent three-, five- and 10-year periods1. Chart 3 What about today's high inflation, high interest-rate environment?As we highlighted, every downturn has its own characteristics - and this time is no different. Today, elevated inflation is a major factor (although it remains benign in much of Asia). Developed market central banks have responded by aggressively hiking rates. The medicine appears to be working. Eurozone and US inflation has retreated from summer highs, recording 9.2% and 6.5% in December, respectively1. Nonetheless, it will take time for inflation to reach pre-pandemic levels. But we believe high inflation shouldn't worry small-cap investors too much. Many smaller companies operate in niche industries or areas of the market with few players. They're also often a critical link in complex supply chains or wider manufacturing processes. As a result, they can dictate higher prices despite their size, allowing them to pass on costs to protect their margins. They also have the agility to change where they source goods and materials, further helping to control costs. What about elevated interest rates? Many assume that higher rates hurt small caps more than larger caps. That's because many small caps are starting out and have weaker balance sheets and lower profit margins. This is the case for some businesses. However, as anyone watching the headlines knows, several larger companies have also been found wanting in the world of higher interest rates. In short, durability frequently comes down to the quality of the company. The importance of qualityThat's why we focus on high-quality firms, irrespective of the macroeconomic backdrop. That is, those with low leverage, strong profitability and consistent earnings. True, quality has underperformed in 2022 as many investors rotated into value stocks. But with the economy deteriorating, we believe investors will increasingly favour companies with robust business models, pricing power, healthy balance sheets and unique growth drivers. Final thoughts…So is now a good time to start considering smaller companies? The traditional answer would be a resounding 'no'. The world economy is forecast to slow further in 2023, with a recession possible in the first half of the year. However, as we have shown, smaller companies might be more resilient in the current inflationary climate than many assume. Using history as a guide, we can also see that smaller companies start to rebound quicker during economic downturns than is widely assumed. With valuations depressed, investors could therefore potentially pick up great long-term opportunities at a discount. Author: Anjli Shah, Investment Director, Smaller Companies Team, Equities |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund 1 Bloomberg, 31 December 2023 |

14 Feb 2023 - Magellan Global Strategy Update

|

Magellan Global Strategy Update Magellan Asset Management January 2023 |

|

Magellan's Portfolio Managers Nikki Thomas, CFA and Arvid Streimann, CFA, discuss how they are viewing the current inflationary environment and chances of a recession. They explain how Magellan's Global Portfolio is positioned to manage these risks and take advantage of thematic investment opportunities. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

13 Feb 2023 - 10k Words

|

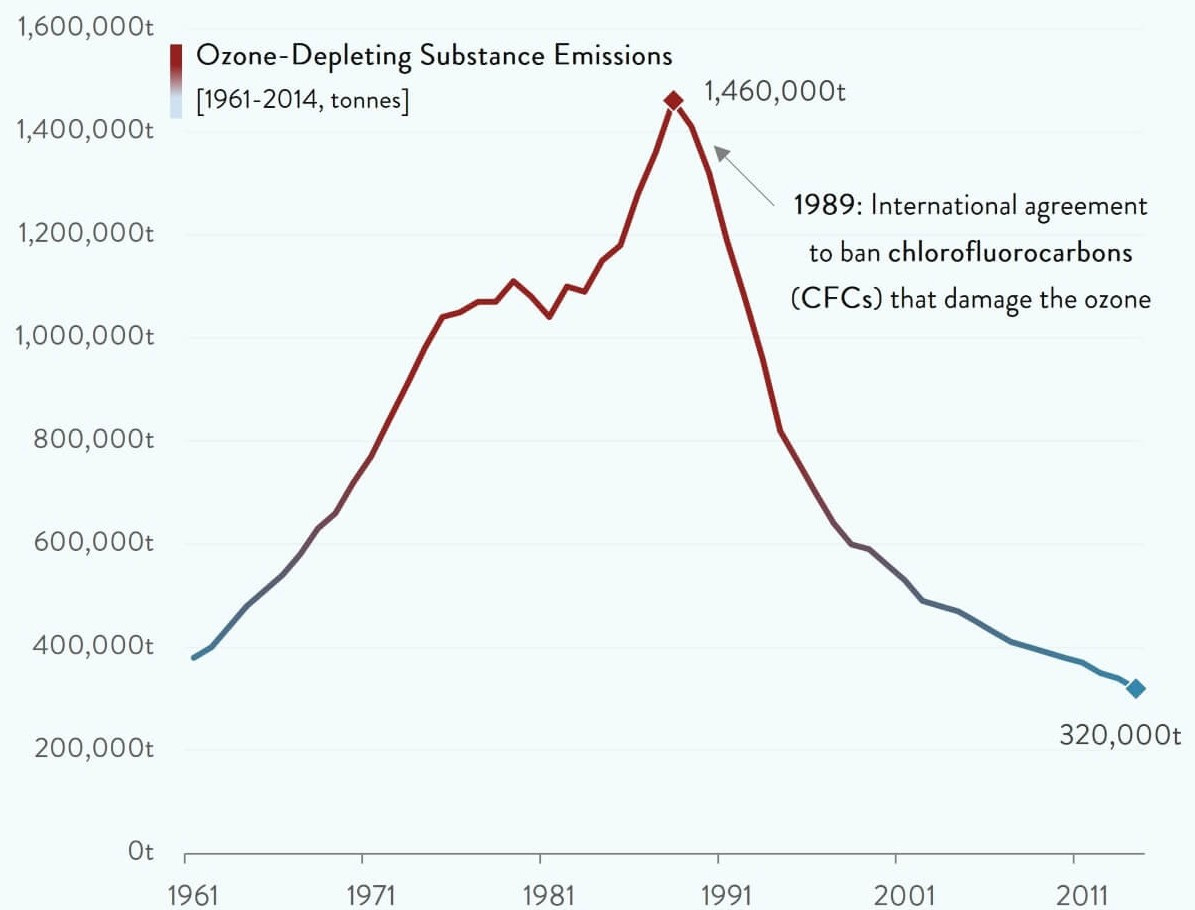

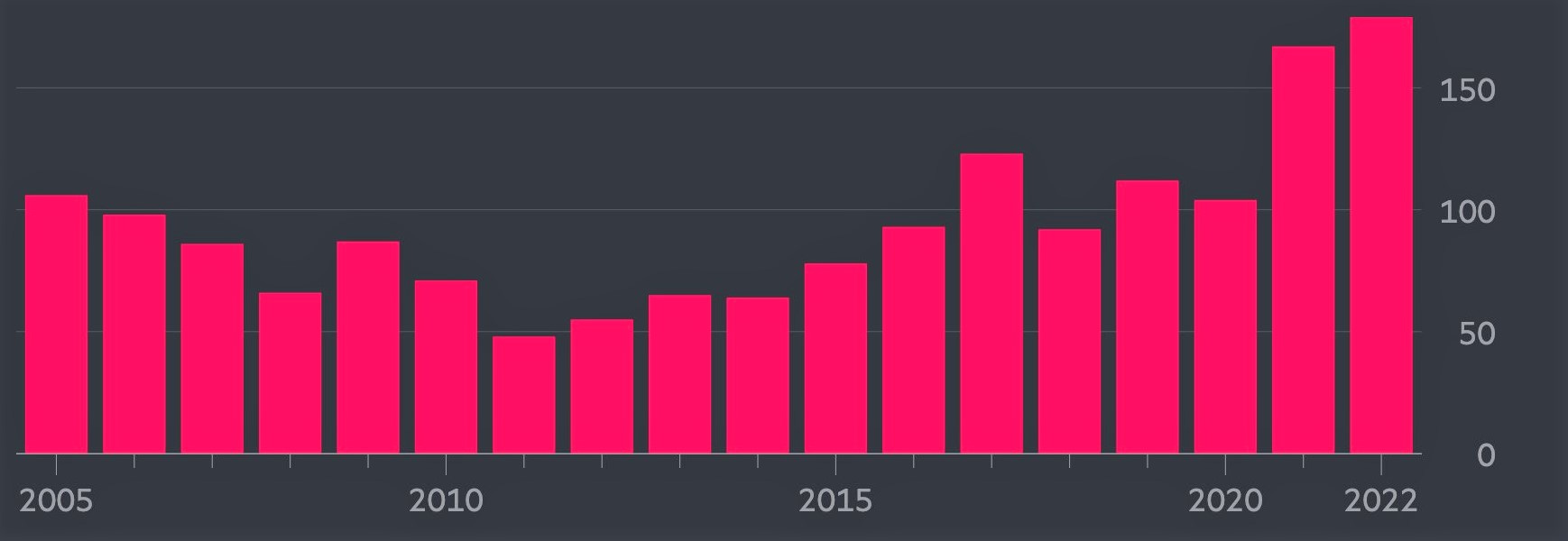

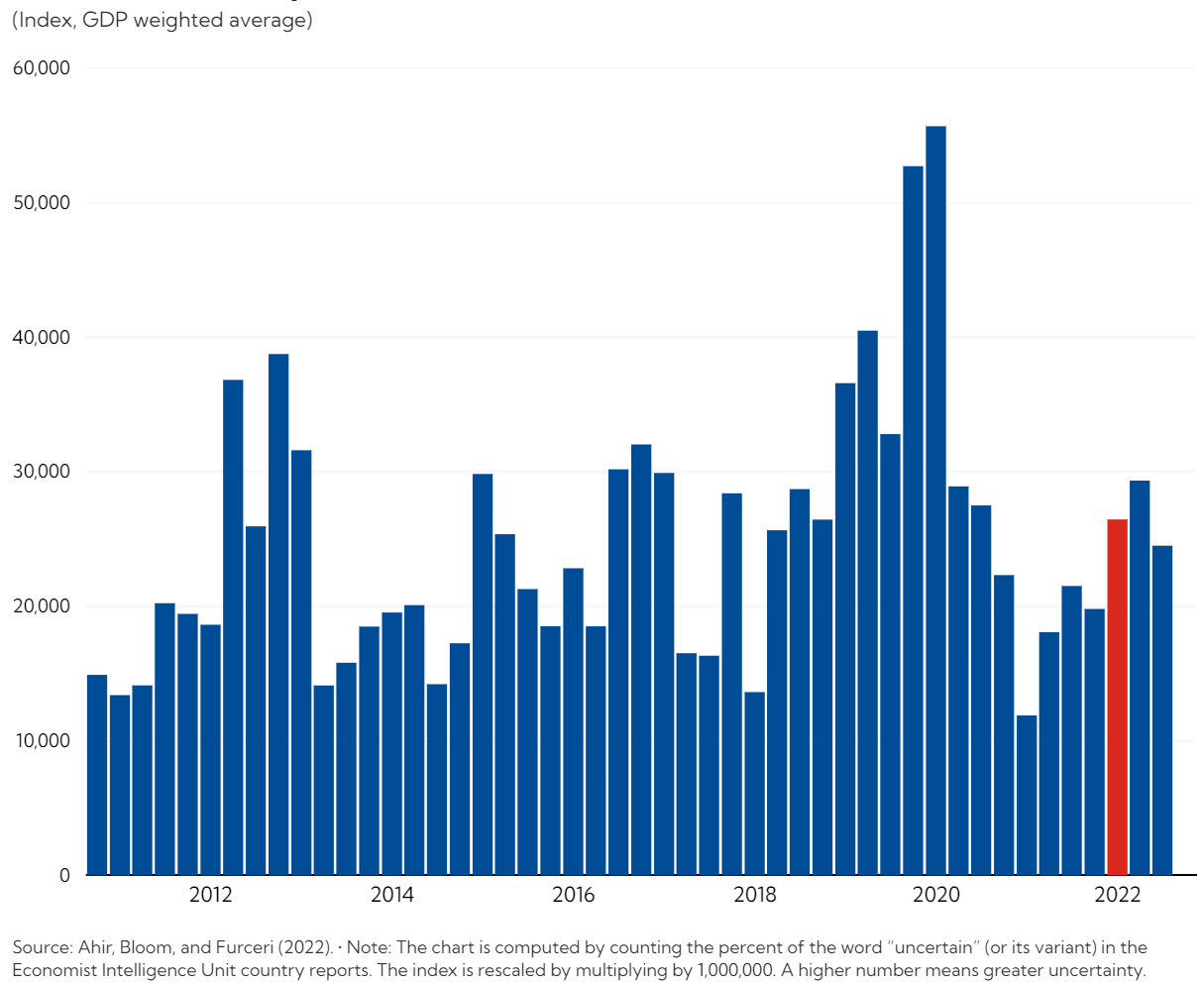

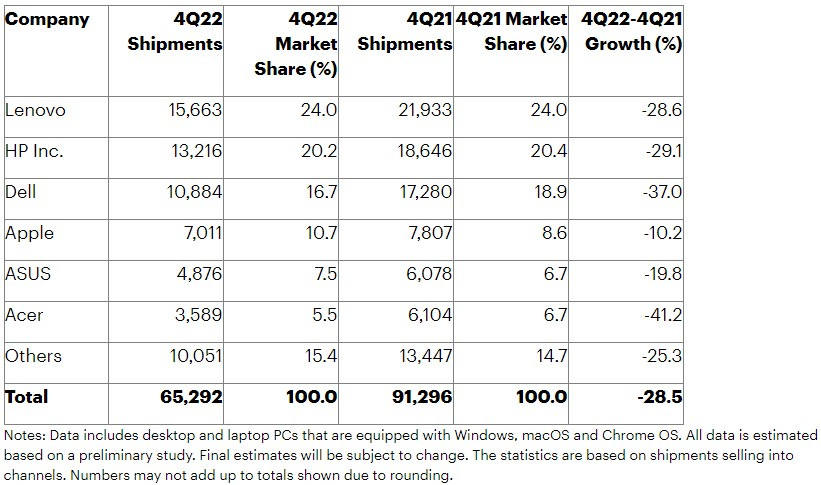

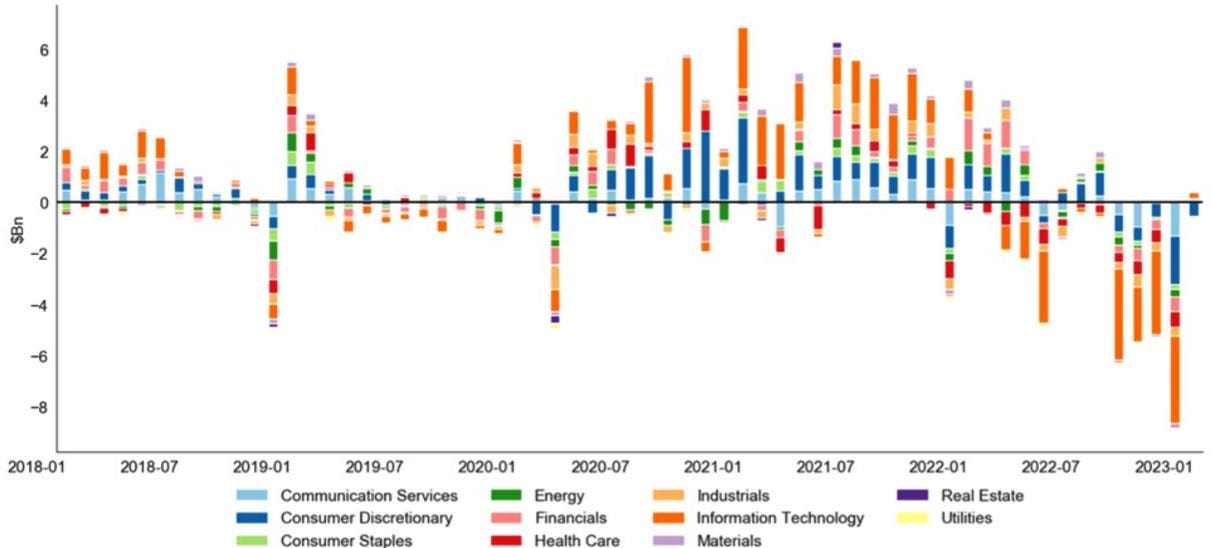

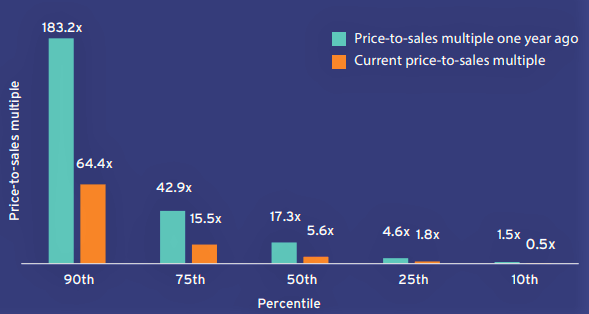

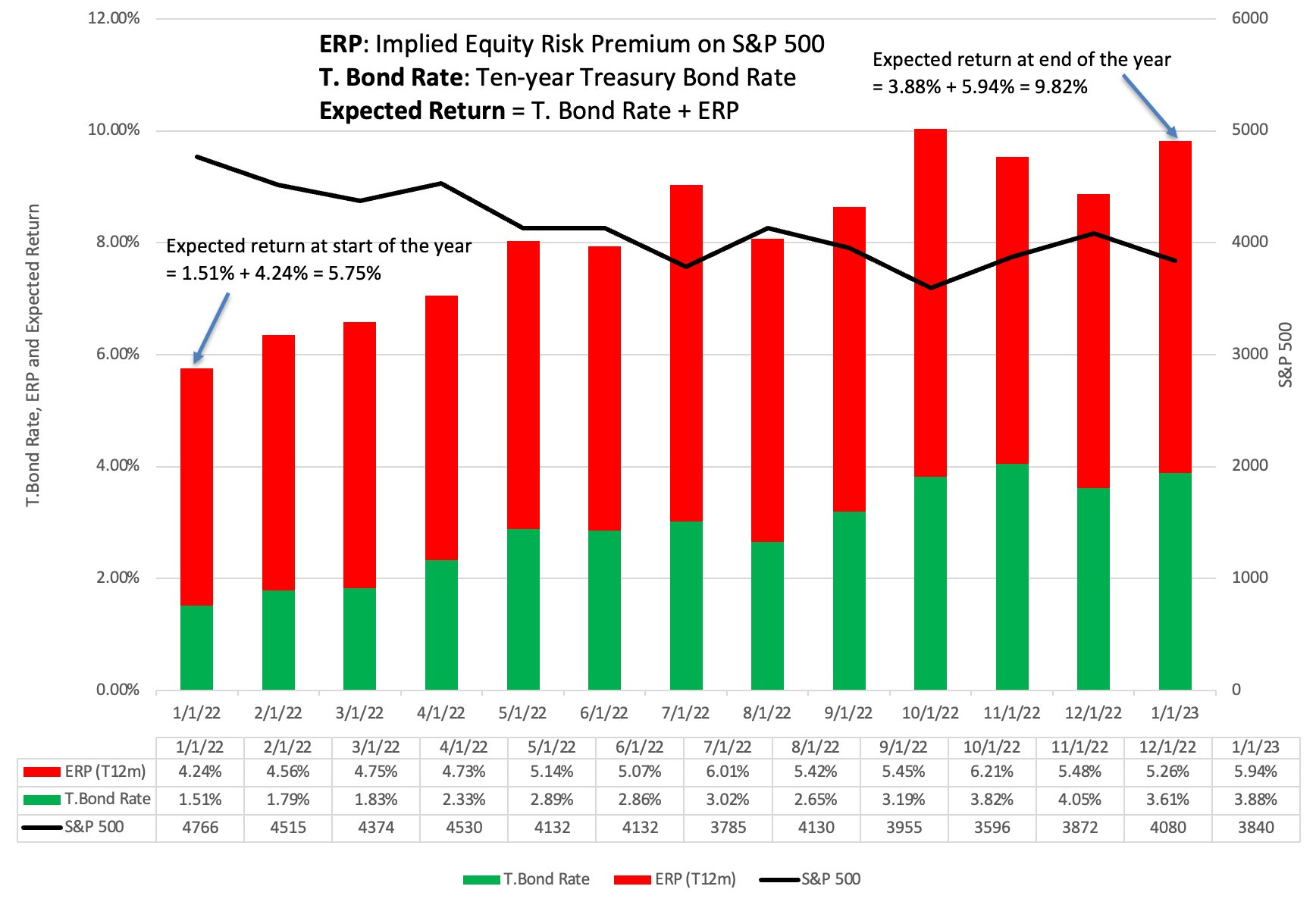

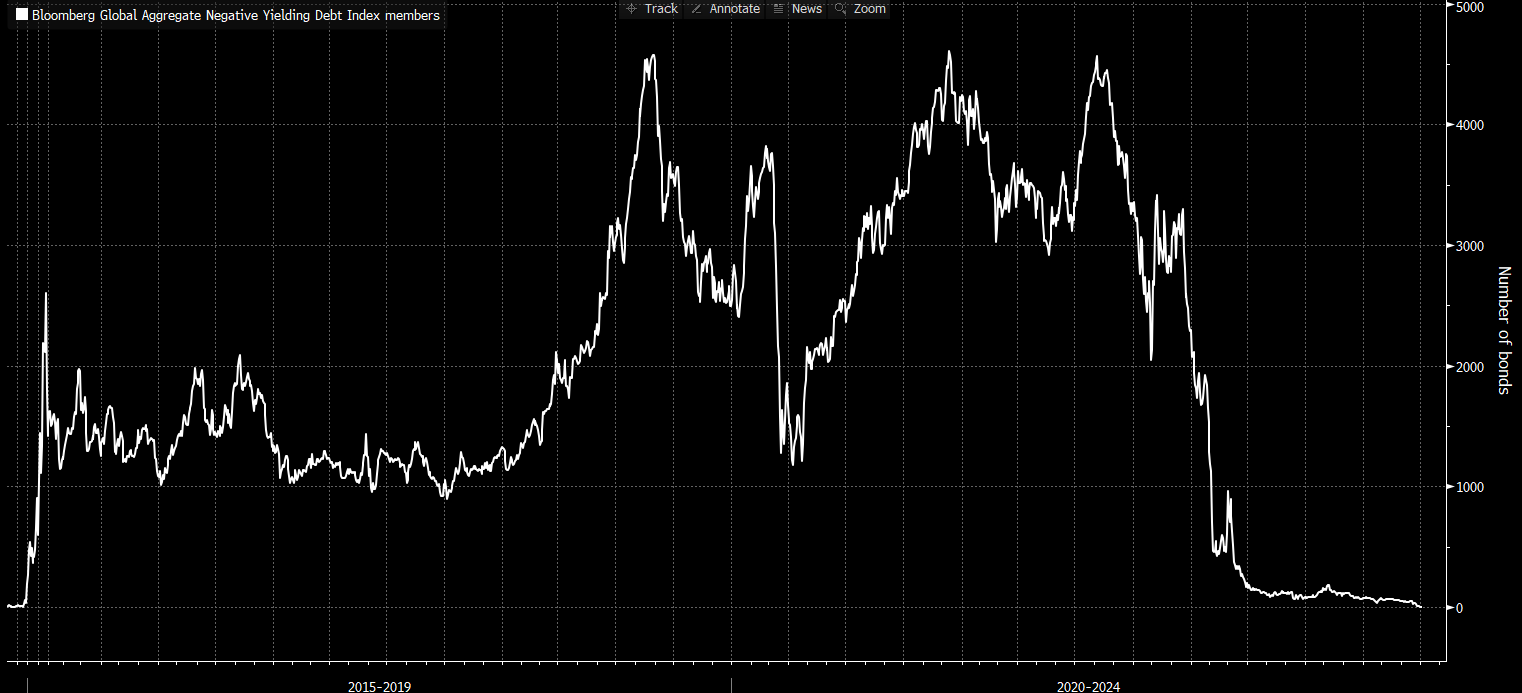

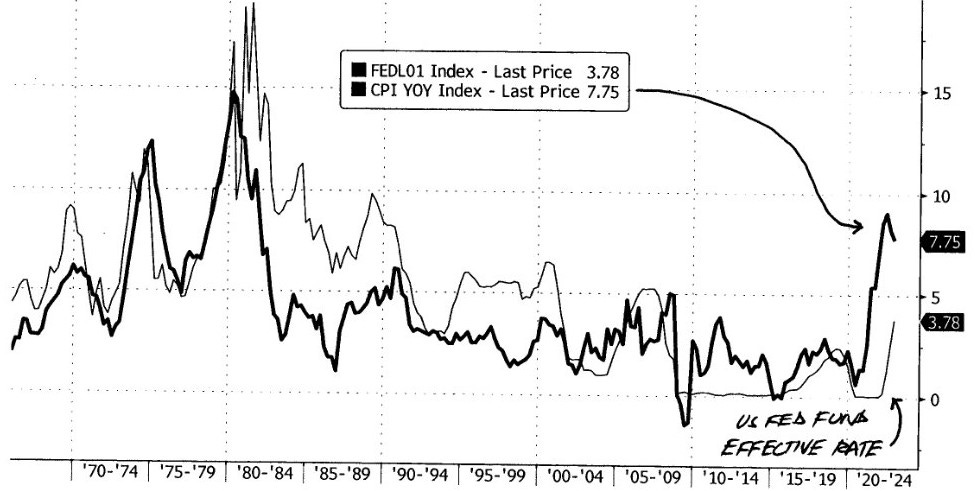

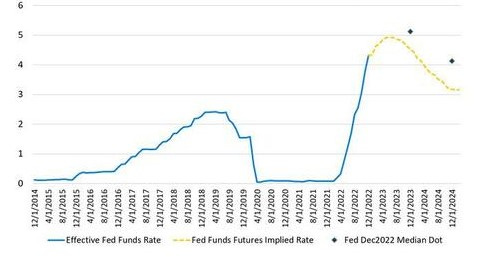

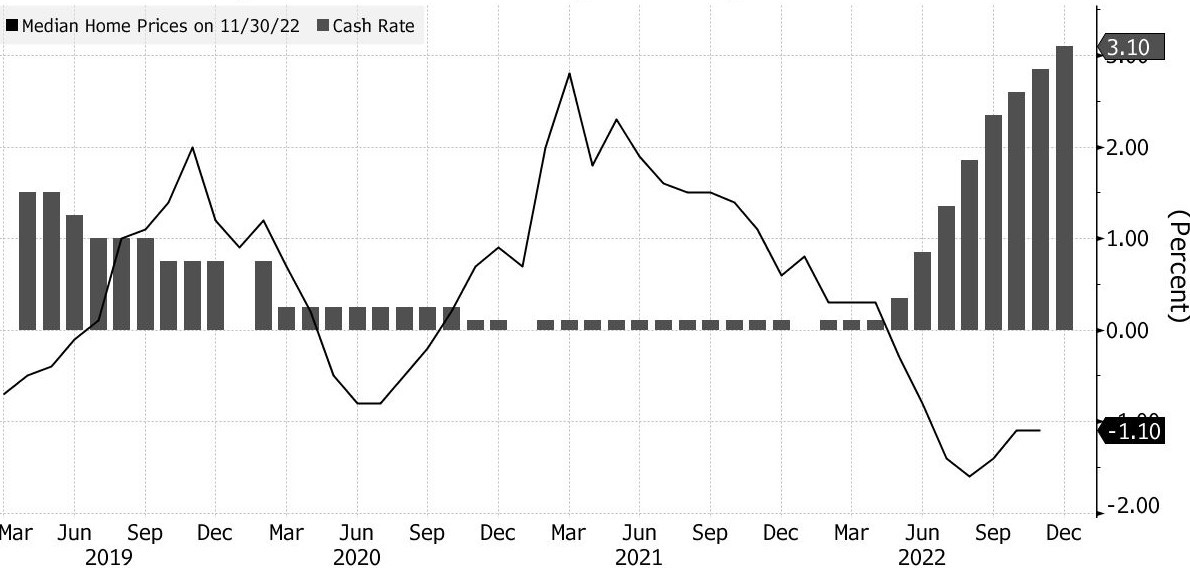

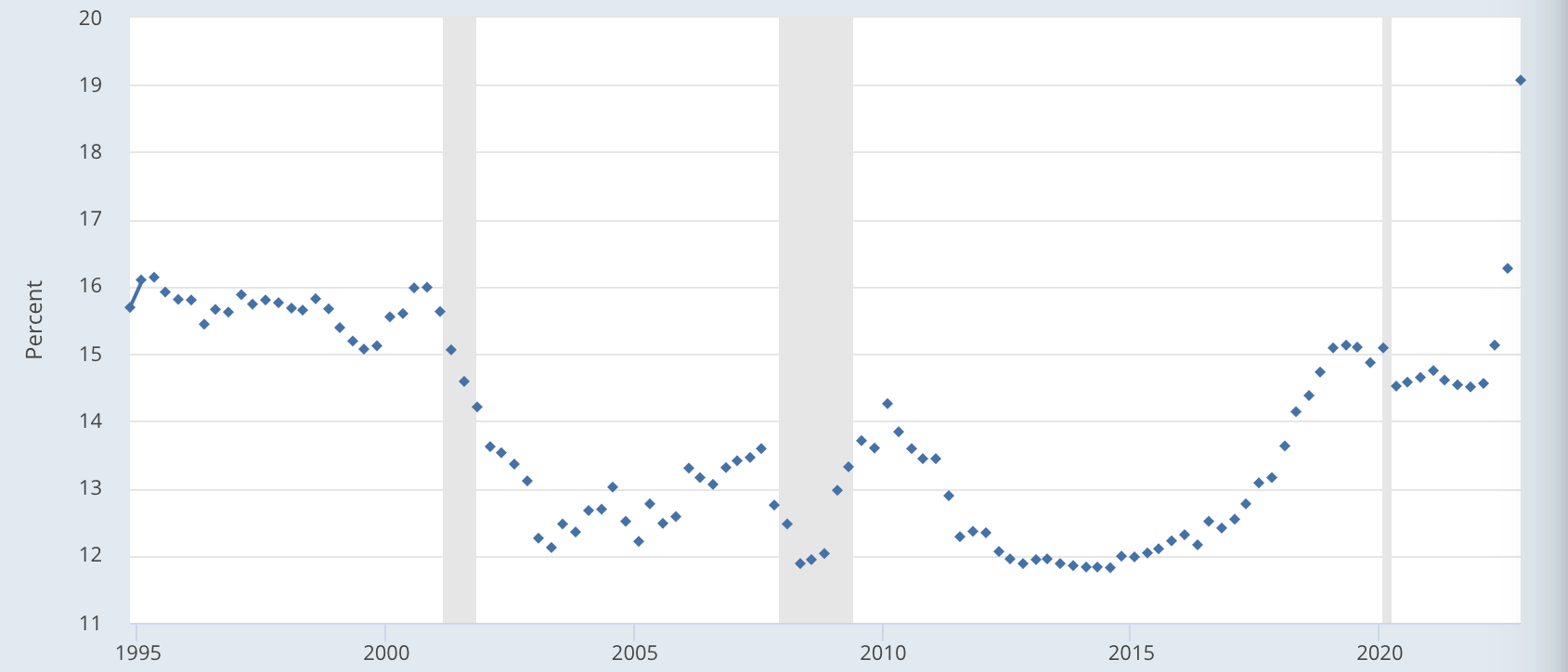

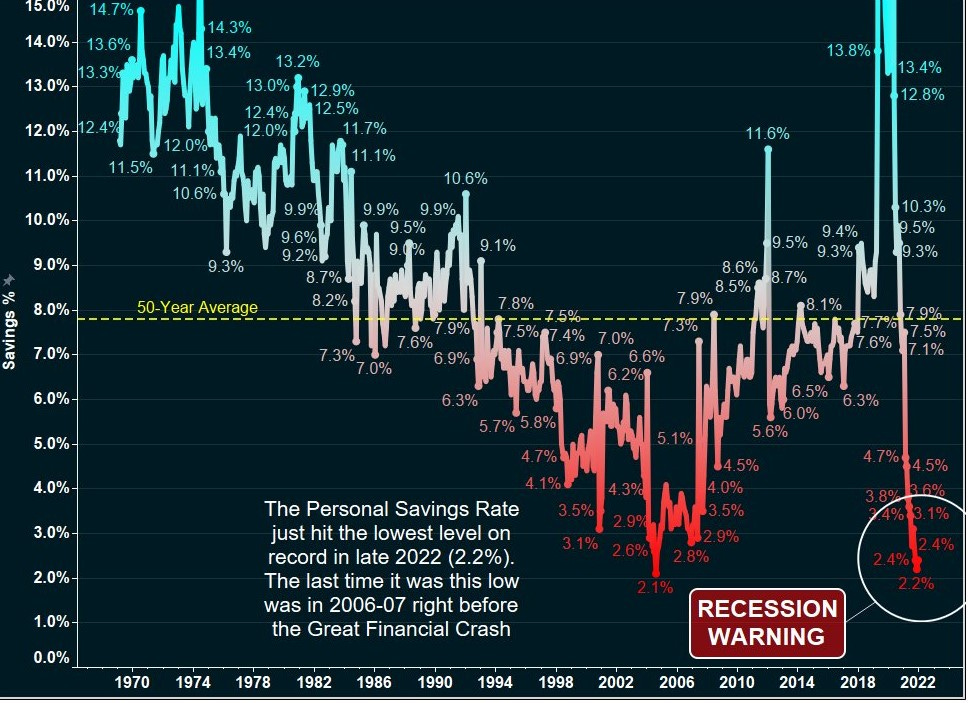

10k Words Equitable Investors January 2023 If there was a year in investment markets where swearing was justifiable, 2022 would be a great candidate. The FT shows us swearing reached new heights on company conference calls. Maybe swearing in 2023 will find a new peak as the feeling of greater uncertainty remains - just look at the IMF's plot. Gartner's estimate of a 28.5% year-on-year decline in global PC sales may cause a few to swear, at least privately. Net flows into tech, as charted by JP Morgan, were hammered right through to the end of 2022. Of course it was the unprofitable segment of tech that Charles Schwab's @LizAnnSonders shows taking the most heat. We can also see that pain in the price/sales multiple contractions highlighted by The Macro Compass' @MacroAlf. There can be no doubt the cost of capital has jumped - Professor Damodaran's expected equity return estimate has increased >4% while Bloomberg's negative yield bond chart lost its last member. Two different schools of thought fight it out over what the Fed needs to do to curb inflation - CLSA shows that when US inflation has spiked above 5%, the Fed had to lift rates to "within spitting distance" of the inflation peak; but DoubleLine is backing the bond market's lower implied rates over the Fed's expectations. Economist @C_Barraud picked up on the decline in Australian house prices as borrowing costs surge. Credit card rates are surging too, as per FRED data, and re: venture consulting sounded the alarm on personal savings in the US diving. The cost of debt is also a growing problem for governments, @CharlieBilello highlights. Looking forward to reporting season, Bespoke sees market expectations in the US have been pulled back across almost all sectors. FactSet's aggregate of S&P 500 earnings estimates shows a 3.9% decline is now the consensus for the December quarter - but the actual earnings growth rate has exceeded the estimated earnings growth rate at the end of the quarter in 38 of the past 40 quarters. Finally, some good news - chart brought to our attention the progressive healing of the ozone layer. Bull market in swearing - frequency of swearing on conference calls Source: AlphaSense, Financial Times

World Uncertainty Index - Ukraine invasion spike in red Source: IMF Global PC shipments in December quarter of CY2022 Source: Gartner Thematic net flows split (excluding ETFs) Source: JP Morgan, @wallstjesus Performance of non-profitable tech stocks (US) Source: Charles Schwab's @LizAnnSonders, Bloomberg Price-to-sales for VC-backed IPOs (US) Source: Pitchbook, Morningstar, @macroalf US Equity Risk Premium Source: Aswath Damodaran The last of the negative yielders Source: Bloomberg When US inflation has spiked above 5%, Fed Funds Effective Rate has had to follow Source: CLSA via @nomad_cap Fed Funds Rate - Market Expectations v Fed Projections

Source: DoubleLine

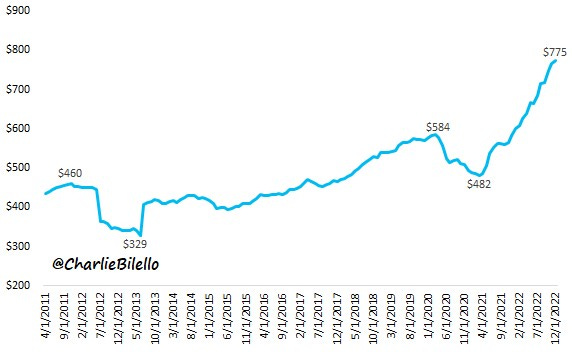

Australian home prices slide as borrowing costs surge

Source: CoreLogic, RBA, @C_Barraud

US credit card interest rates surge Source: FRED, Blockworks US personal savings rate hit the lowest level on record in late 2022 Source: re:venture consulting Interest expense on US public debt outstanding Source: @CharlieBilello

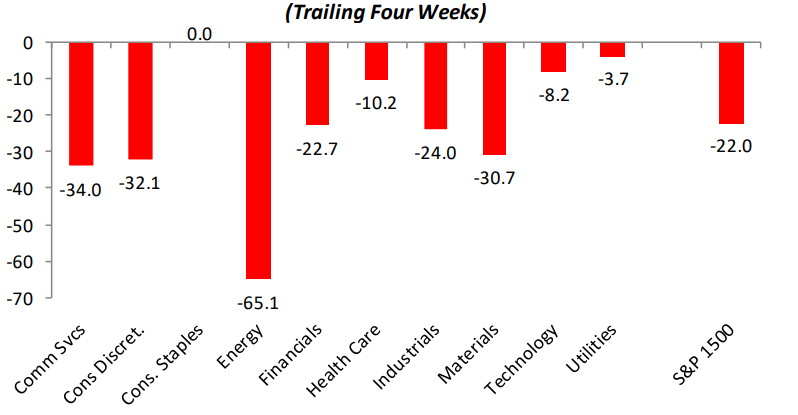

US S&P 1500 EPS revisions by sector - the sptread between positive and negative

S&P 500 quarterly earnings growth - estimates and actuals Source: FactSet The ozone layer is healing Source: Hegglin et al, Chartr

January Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

10 Feb 2023 - Review: The Price of Time (The Real Story of Interest) by Edward Chancellor

|

Review: The Price of Time (The Real Story of Interest) by Edward Chancellor Channel Capital January 2023 For professional investors and advisers only Edward Chancellor was already the author of two books in my top ten investment books list; Devil Take the Hindmost: A History of Financial Speculation and Capital Returns (the latter is a compendium of investment letters written by Marathon Asset Management and edited by Chancellor) and I would now add a third to that list. The Price of Time: The Real Story of Interest is an extraordinary book which illustrates the problems created by setting interest rates too low and by the rapid expansion of credit through the use of historical examples ranging from John Law's Mississippi Scheme to the Wall Street Crash and Japanese bubble of the nineteen eighties. Interest rates are the anchor for the valuation of asset prices and once they reach zero, any valuation can usually be justified, and bubbles occur. These bubbles have ALWAYS burst with enormous economic costs but that is only part of the damage wrought by low interest rates. As Chancellor notes today's ultra-low interest rates have contributed "to many of our woes, whether the collapse of productivity growth, unaffordable housing, rising inequality, the loss of market competition or financial fragility. Ultra-low rates also seemed to play some role in the resurgence of populism". As much as mainstream media would like you to believe that all of the UK's economic woes can be pinned on Liz Truss's mini budget, Chancellor explains that these issues have been years in the making and can be mostly traced back to the faulty economic thinking of the central banks. This book should be required reading for anyone involved in financial policy making from politicians to treasury officials and to central bankers. If I thought they would read it, I would willingly buy a copy for Andrew Bailey and the rest of the Monetary Policy Committee but I suspect they have little interest in reading anything which conflicts with the current economic orthodoxy no matter how wrong it has been. Author: Ian Lance, Fund Manager |

|

Funds operated by this manager: CC Redwheel Global Emerging Markets Fund, CC Redwheel China Equity FundKey information: No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor's investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only. |

Source: Bespoke Investment Group

Source: Bespoke Investment Group