News

4 Jun 2024 - Australian Secure Capital Fund - Market Update

|

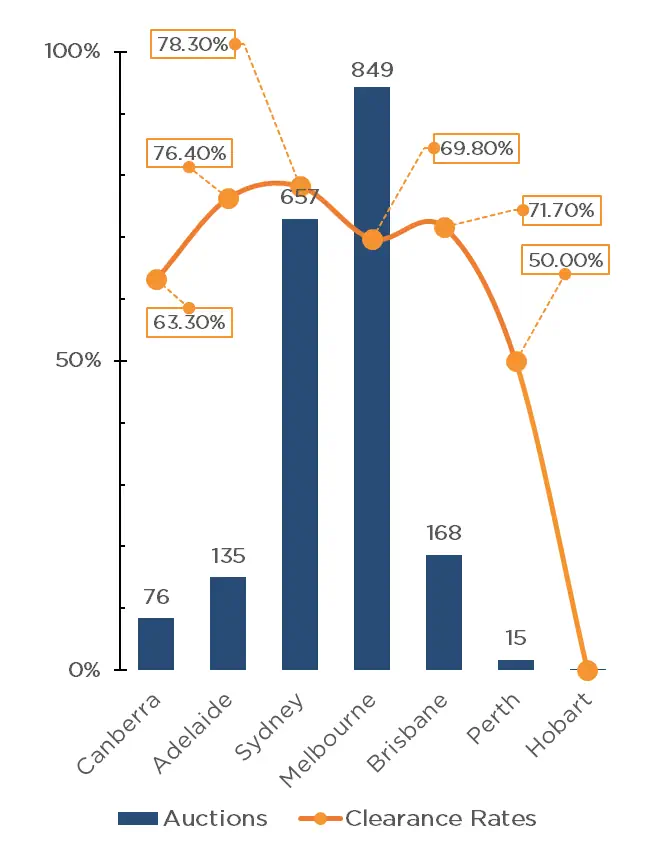

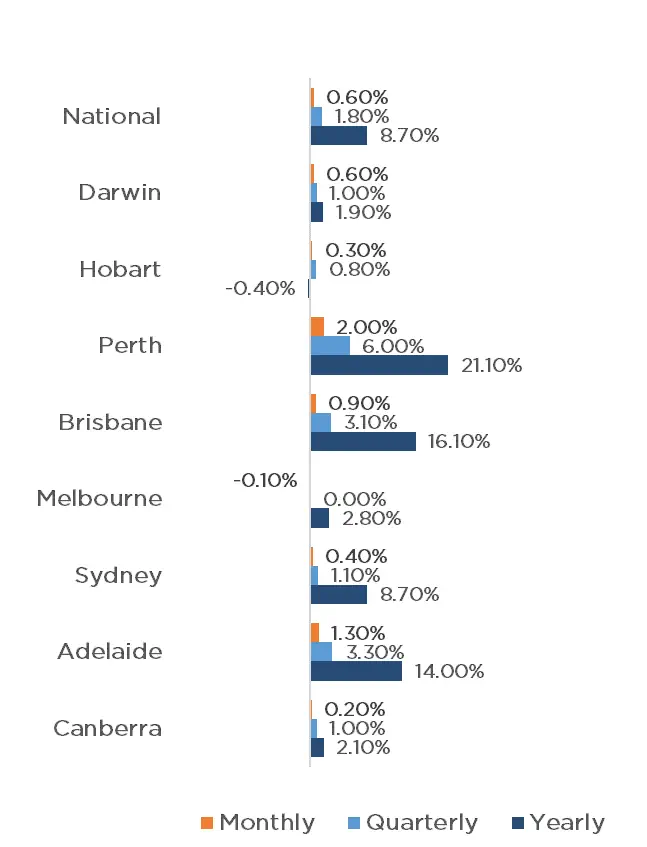

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund May 2024 National property values continue to perform strongly, with CoreLogic's National Home Value Index recording another 0.6% increase in April, the same which was achieved in February and March, resulting in 15 months of continuous monthly growth. Yet again, Perth performed the strongest, increasing by a whopping 2.0% for the month, with Adelaide and Brisbane again achieving the second and third largest growth with 1.3% and 0.9% respectively. Darwin, Sydney, Hobart and Canberra also experienced growth with 0.6%, 0.4%, 0.3% and 0.2% respectively, whilst Melbourne recorded a slight reduction of 0.1%. This raised the quarterly national growth rate to 1.8%, with combined capitals increasing by 1.7% and the combined regions by 2.1%. The RBA meeting on the 7th of May indicated that we may experience higher interest rates for longer than anticipated, and has not ruled out a further increase in rates, however inflation is beginning to fall, albeit at a slightly slower pace than forecasted. However, with the fundamental undersupply of property, we anticipate the property market to remain strong throughout 2024. Clearance Rates & Auctions week of 29th of April 2024

Property Values as at 1st of May 2024

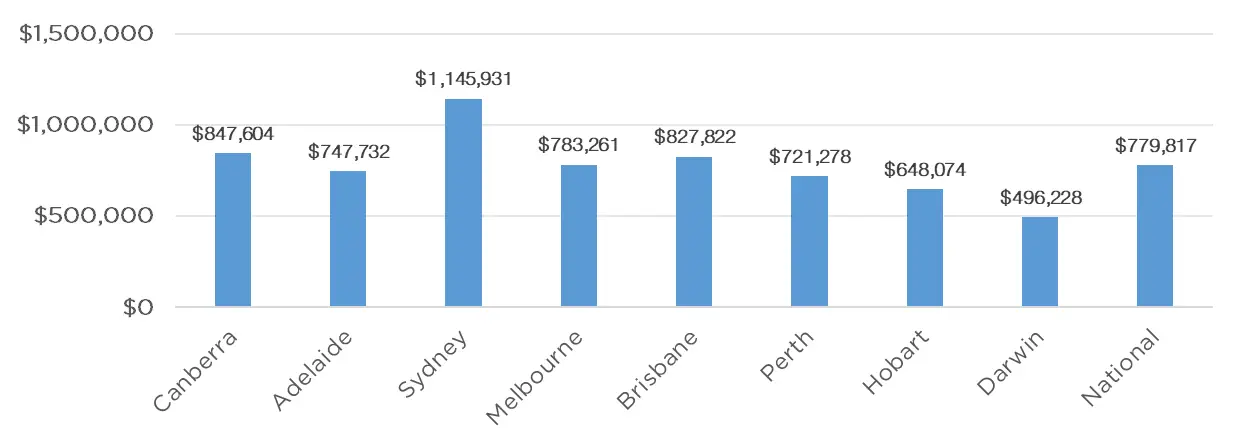

Median Dwelling Values as at 1st of May 2024

Quick InsightsThe Foreign Housing FightIn his budget reply speech, Mr Dutton said he would put a two-year ban on foreign investors and temporary residents purchasing homes in Australia if the Opposition won the next federal election. Ms Tu of "luxury property concierge" firm Black Diamondz, said that, contrary to the perception that foreign buyers were taking housing away from Australians, they injected money into the economy which has helped fund infrastructure and commercial development. We expect this debate to continue until the next election. Source: Australian Financial Review Australia's Race to LoseThere is no doubt that red tape at all levels of government continues to exacerbate the housing shortfall in Australia, with other comparable countries doing a far better job. Victoria and NSW are experiencing the longest average development approval wait times at 144 and 114 days respectively, according to new research by the federal Treasury. Source: Australian Financial Review Author: Filippo Sciacca, Director - Investor Relations, Asset Management and Compliance Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

3 Jun 2024 - Manager Insights | Skerryvore Asset Management

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Glen Finegan, Lead Portfolio Manager at Skerryvore Asset Management. In this wide ranging interview Glen explains the fund's Emerging Market strategy, and what drives a company's selection in the portfolio.

|

This week's release of Australia's CPI result was not what anyone wanted to hear - unless you're a retiree wanting a higher yield on your term deposits.

31 May 2024 - Hedge Clippings | 31 May 2024

|

|

|

|

Hedge Clippings | 31 May 2024 Inflation and Trump are both Sticking Around... This week's release of Australia's CPI result was not what anyone wanted to hear - unless you're a retiree wanting a higher yield on your term deposits. And even if you are, don't expect any media headlines about it. With the April inflation number up 0.1% to 3.6% - the second monthly rise in a row - all the focus on expectations for a rate cut can be pushed further out, and possibly even bringing the possibility of another hike before a fall. Even the 3.6% number, which included seasonally volatile components, obscured the underlying figure of 4.1%, which at least held steady since the previous month, albeit higher than February's rate of 3.9%. Drilling down through the numbers housing was up 4.6% as a whole, with rents up 7.5% - hence governments in general getting twitchy. Within the housing bucket, electricity rose 4.2% which doesn't sound too alarming until you factor in the various rebates on offer, without which the number would have been a whopping 13.9%. No wonder Jim Chalmers' budget included further handouts for electricity consumers! The other area sure to make it to the top of the news pile at present is the cost of housing, and as above, the cost of rents. Governments seem to have suddenly woken up to the fact that there aren't enough new dwellings to accommodate the rising population. April's dwelling approval data released by the ABS this week showed just 13,078 new approvals for the month, down from peak of 23,136 in March 2021, and only just higher than the 12,917 in June 2020 at the height of the COVID crisis. Given the population grew by 172,700 in the quarter to September 2023, and 659,800 over 12 months it doesn't take too much to recognise that much of the housing affordability crisis can be attributed to a severe imbalance between supply and demand. That's economics 101. The problem is that the undersupply has been growing for decades, with a current shortage of dwelling completions around 50,000 per year. Even with the current push to build more dwellings, the backlog won't be cleared in the next 5 or possibly 10 years. The issue is not just building approvals and completions. Availability - or lack thereof - of land, infrastructure, and critically a skilled labour force to actually build the dwelling, will all add to the problem. Governments may well like to say they're addressing the problem. The reality is that housing affordability will remain an issue way into the future. On a much shorter time frame, an equally sticky problem faces the US leading up to November's election. Trump's overnight criminal conviction won't change the view of his diehard supporters - if anything it will galvanise both Donald and his legions of MAGA fans. Equally, it will reinforce the opinion of dyed-in-the-wool Democrats that he's not fit for office. Trump's challenge, and Biden's opportunity, (and challenge) are the traditional conservative Republican voters who'll have an issue voting for either of them, and will thus stay at home on November 5th. Our guess is that the turn-out on the day will decide the race to the White House, not the criminal record of one candidate, nor the age of the other. You'd think that with over 333 million people (2022) and counting, either party could have found themselves a more suitable candidate? News & Insights Manager Insights | Skerryvore Asset Management Trip Insights: Asia | 4D Infrastructure April 2024 Performance News Digital Asset Fund (Digital Opportunities Class) Insync Global Capital Aware Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

31 May 2024 - Performance Report: Insync Global Quality Equity Fund

[Current Manager Report if available]

30 May 2024 - Performance Report: Emit Capital Climate Finance Equity Fund

[Current Manager Report if available]

30 May 2024 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]

30 May 2024 - The Great Reversals

29 May 2024 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

29 May 2024 - Opportunities emerging from rising demand for AI computing power

|

Opportunities emerging from rising demand for AI computing power Alphinity Investment Management May 2024 |

|

The AI boom is likely to drive a surge in energy consumption after decades of sluggish demand. Powering energy-hungry data centres has become a significant bottleneck within the AI capex cycle. We take a closer look at the implications for global energy and gas markets, but also highlight various potential beneficiaries across different industries.

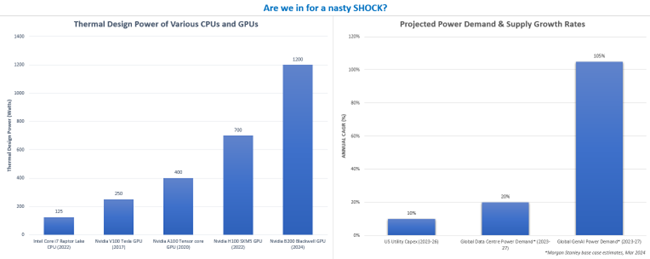

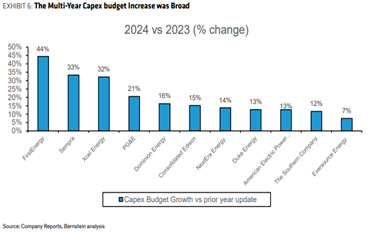

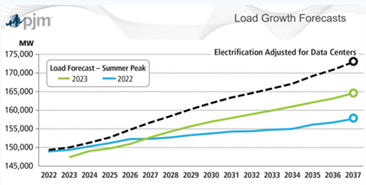

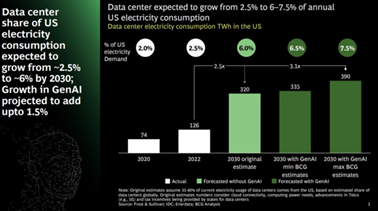

Source: Intel, Nvidia, Morgan Stanley, Company Reports, Alphinity How much energy do data centres consume today and may consume in the future?Generative AI and large language models have sparked strong rallies in some stocks, particularly those directly exposed to data centres. These centres, vital for AI processing, are reigniting electricity demand, challenging the adequacy of power supplies and infrastructure. The energy demand from data centres, already high, is predicted to grow, prompting significant investments in energy infrastructure, including natural gas and power distribution systems. Currently, data centres consume about 2.5% of global electricity, a figure Boston Consulting Group expect to rise to 4% by 2027 and as high as 7.5% by 2030, increasing the U.S. electricity demand at twice the rate of the previous decade. If correct, that will be equivalent to powering ~20% of all homes in the US. This surge underscores the urgent need for expanded power generation to prevent potential blackouts and is driving a meaningful uplift in capital expenditures by utility companies. With the U.S. leading the global data centre market, approximately 40% of global capacity, this trend is likely to be mirrored worldwide, affecting energy consumption and infrastructure development on an international scale.

Did you know?

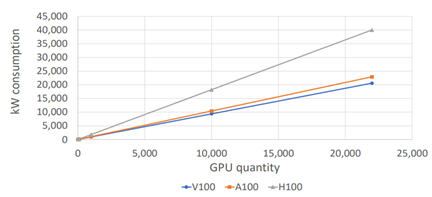

Estimating how this increased demand translates into actual electricity demandBottom-up analysis: GenAI to add 1% of incremental electricity demand growth per annumPower consumption in data centres is calculated by adding server and storage power use, multiplied by power usage effectiveness (PUE) and operating hours. By estimating GPU growth, chip utilization and power efficiency, one can project potential power needs. AI racks can need up to five times more power than traditional ones. AI data centres using GPU clusters, consume 30-100kW per rack. Taking this fact further, mature LLMs such as ChatGPT in inference mode, consume 400-1300 kWh daily, requiring significantly more power as user queries escalate post-training.

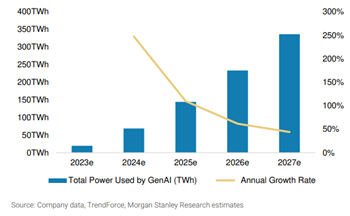

Source: Boston Consulting Group Assuming total GPU volumes rise from ~1.8m in 2023 to ~4m in 2026, custom silicon & GPU utilization rates range between 70-90% and data centre PUEs (a measure of a data centres energy efficiency) decline from 1.5 to 1.3, Morgan Stanley predicts incremental global data centre power usage will rise to 326-460 TWh by 2027, a significant increase from the current 360 TWh, with GenAI contributing about one-third of this demand. Schneider Electric estimates AI will account for a slightly lower 15-20% of the growth. This equates to a 105% compound annual growth rate for GenAI and 20% for overall data centre power, making GenAI's 2027 power demand comparable to Spain's and adding 1ppt of growth to overall electricity demand growth rates.

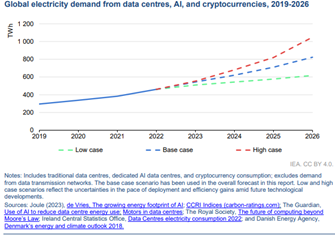

Top-down analysis: AI energy demands to double in 3yrsThe number of data centres are increasing rapidly, exemplified by Microsoft's plan to build up to one new data centre every three days, at the same time as the power intensity increases significantly. As such, BCG predicts U.S. data centre capacity will rise from 2.5% to up to 7.5% of total energy demand by 2030, increasing electricity demand by 260 TWh. McKinsey comes up with similar estimates, foreseeing power needs for U.S. data centres to double from 17GW to 35GW, equivalent to the current combined global capacity of the big 5 tech giants. Globally, institutions like the IEA foresee data centre, AI, and cryptocurrency electricity consumption doubling in the next three years to 1000 TWh, matching Japan's total power use. This surge suggests electricity demand growth could shift from stagnant for the past two decades, to 0.5-2% annually by 2030, raising questions about future supply sources. What source of energy is most likely to meet this demand?Owners of data centres, most of whom have committed to net-zero targets, face a dilemma with surging electricity needs. Renewable energy sources offer intermittent supply with 25-40% capacity factors and when paired with energy storage, higher costs. With the rapid growth in AI demand necessitating immediate and reliable power, gas generation emerges as a logical short-term solution, providing consistent electricity around the clock. Renewables will still grow in importance, especially as the cost of energy storage falls. Nuclear energy & small modular reactors are potential alternatives (see Amazon's DC acquisition), but challenged due to the long lead times to deploy and cost challenges. Recent discussions among CEOs and experts highlight the shifting demand landscape and gas's role in meeting these urgent energy needs.

This could drive an incremental 1% to 1.7% pa of unexpected demand for natural gasBernstein projects that with ~25% of the U.S. incremental demand met by gas-fired generation, an additional ~230 TWh would necessitate ~15GW new gas capacity, increasing gas demand by ~1.1 bcf/d or 1% of the total market. Under Morgan Stanley's scenario--70% renewables and 30% fossil fuels with 70% server utilization--gas demand would rise by ~13GW over 5 years. Jefferies, accounting for upcoming renewable installations and existing energy plans, forecasts an annual increase of 1.6-1.8 bcf/d in gas demand. Consequently, AI could boost U.S. gas demand by 1-1.7% annually in the late 2020s, potentially significant against an already planned 10 Bcf/d of incremental LNG exports (or ~1%). Additionally, this growth in data centre energy use could induce market volatility and regional imbalances. You are already seeing examples of crypto miners building server farms in the Permian where they can take advantage of cheap associate gas. Companies that can take advantage of the volatility through globally balanced gas portfolios and/or large trading capabilities will likely benefit. Addressing one key assumption - advancements in chip power efficiency gainsThis analysis contains multiple complex variables, such as diminishing chip power efficiency, the shifting power requirements as AI models transition from training to inference, and regulatory influences on renewable energy development and new gas infrastructure permitting. A critical factor in this context is compute intensity. Notably, while advancements in chip technology, exemplified by Nvidia's B200 Blackwell, yield substantial efficiency improvements per compute unit, the absolute power consumption continues to escalate, with the Blackwell chip (announced a fortnight ago) experiencing a 43% increase in maximum theoretical load compared to its predecessor, the H100.

Source: Schneider Electric White Paper: Challenges and Guidance for Data Centre Design ConclusionThe tech sector's rapid evolution often outpaces slower-moving industries and governments, potentially causing bottlenecks. While technological advancements may offer some relief, they may not suffice to meet the surging demand for power. Consequently, this growing need is expected to spark a renewed interest in gas-fired generation. Companies such as ConocoPhillips are well positioned to benefit from fulfilling this demand and capitalizing on the ensuing market volatility. Additionally, Alphinity has significant positions in the technology companies that are crucial to the rapid growth of AI, as well as exposure to the "picks and shovels" companies further up the value chain. These businesses are actively addressing emerging challenges, including managing heat generation, enhancing, and securing the electrical grid, and overcoming the scarcity of strategically located land. These include technology companies like Nvidia, Cadence Designs, Alphabet and Microsoft, alongside companies such as Trane Technologies, who are the leaders in data centre cooling solutions. Prologis, who are spending ~US$7-8bn over the next 5yrs to build 20 new DCs. ASML who manufacture advanced AI chip equipment, and Ferguson who supply infrastructure essentials such as pipes and fire suppression for DCs. Furthermore, our sustainable strategy owns Schneider Electric with 20% of sales to DCs and Quanta, the top U.S. grid EPC. Author: Chris Willcocks, Portfolio Manager |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Global Sustainable Equity Fund, Alphinity Sustainable Share Fund |

28 May 2024 - Performance Report: Digital Asset Fund (Digital Opportunities Class)

[Current Manager Report if available]