News

16 May 2023 - 10k Words | May Edition

|

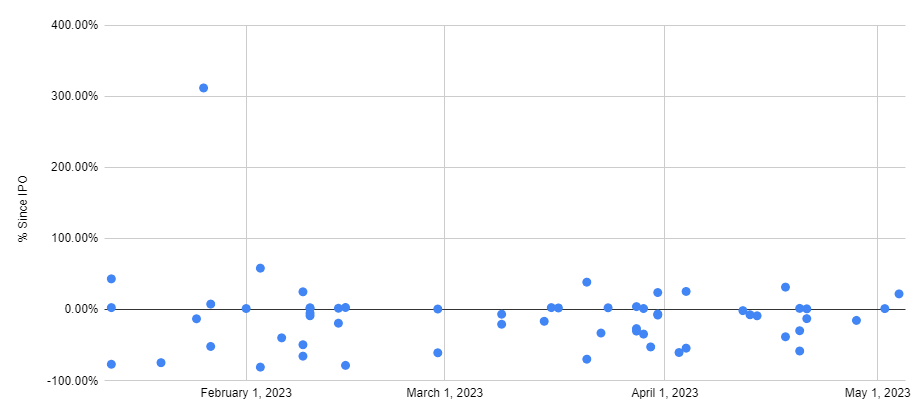

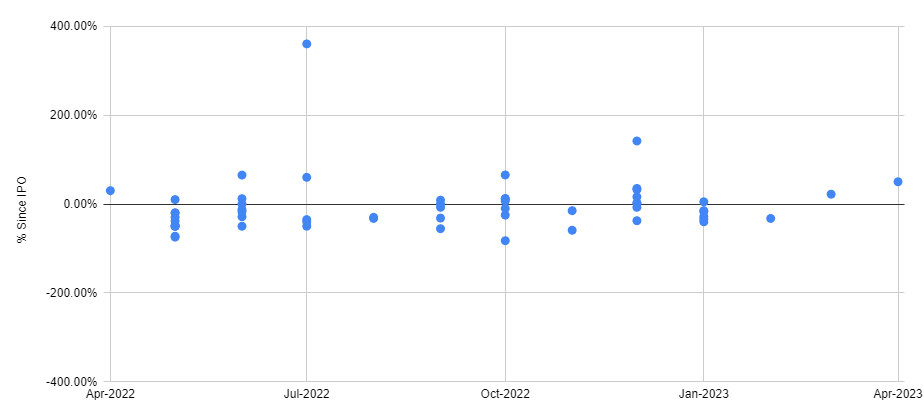

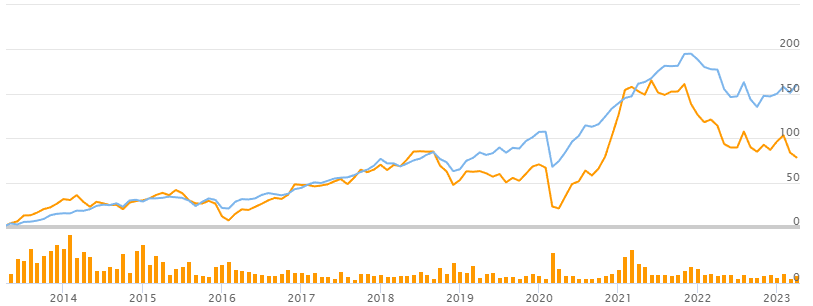

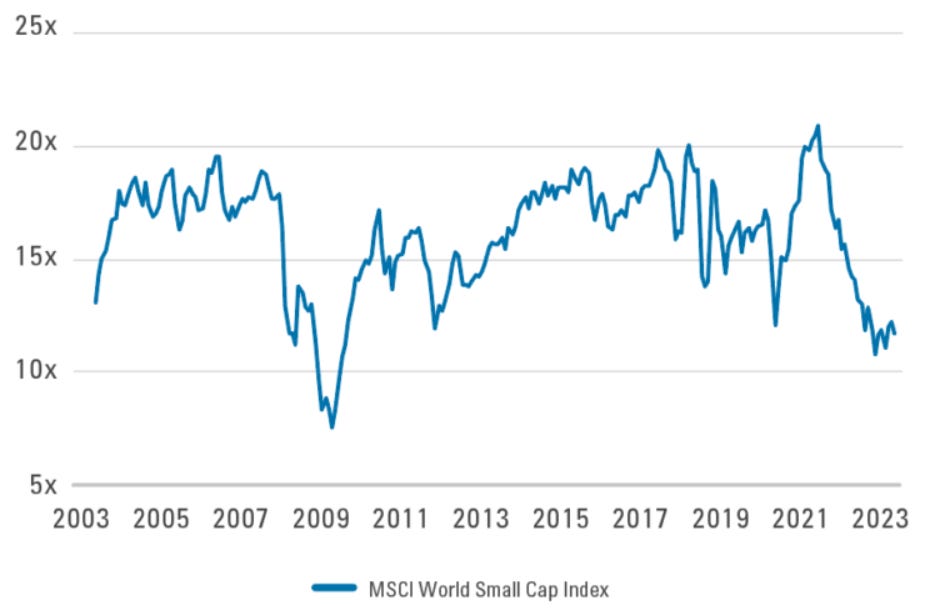

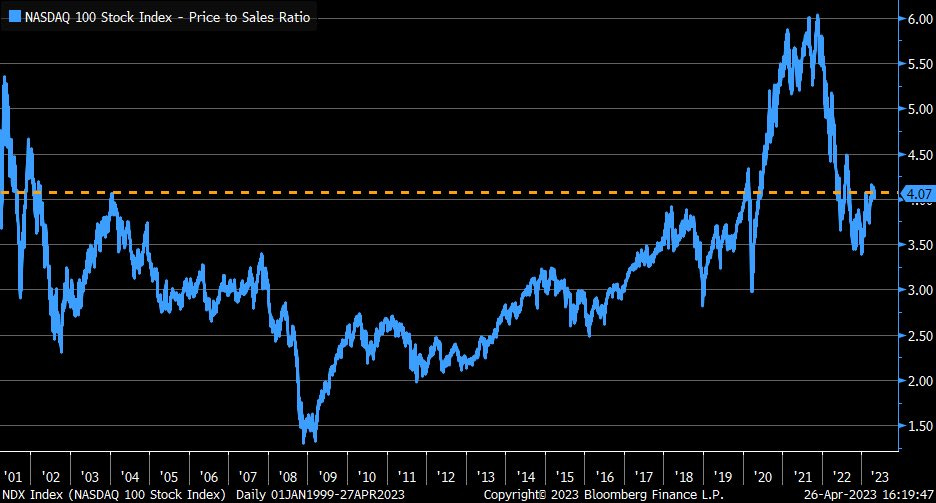

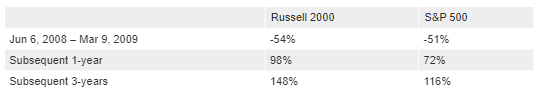

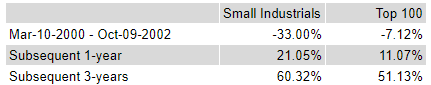

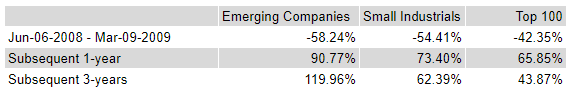

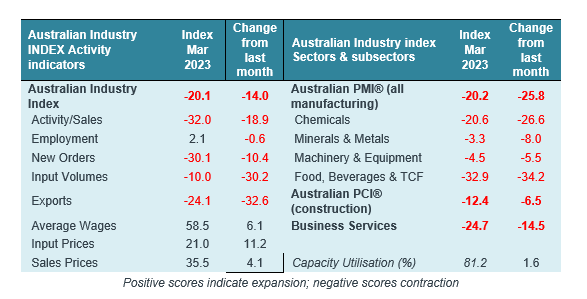

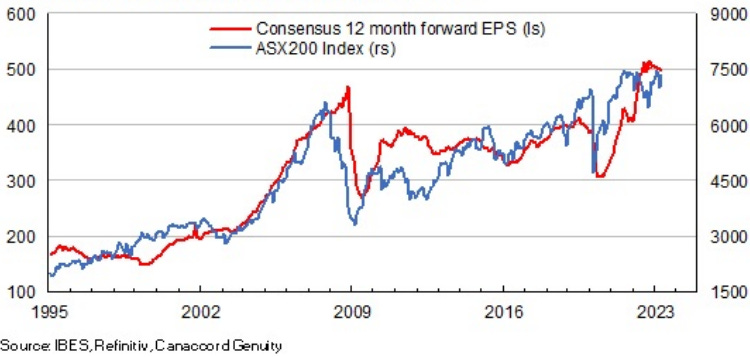

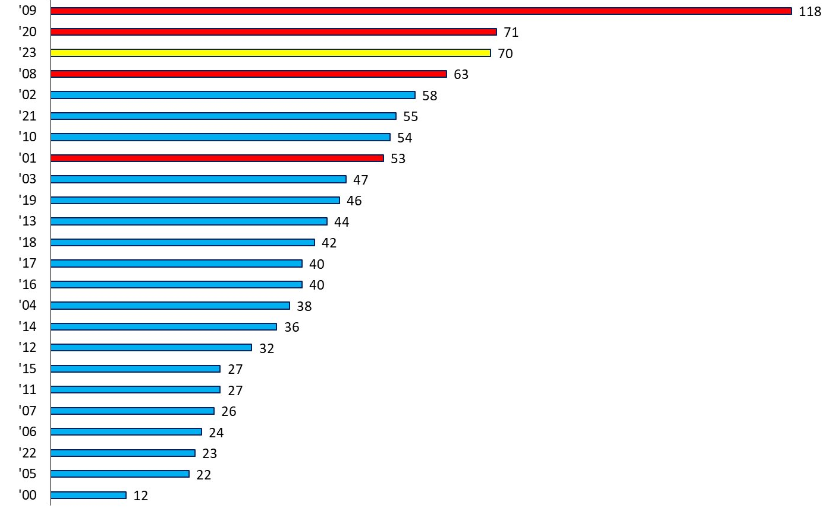

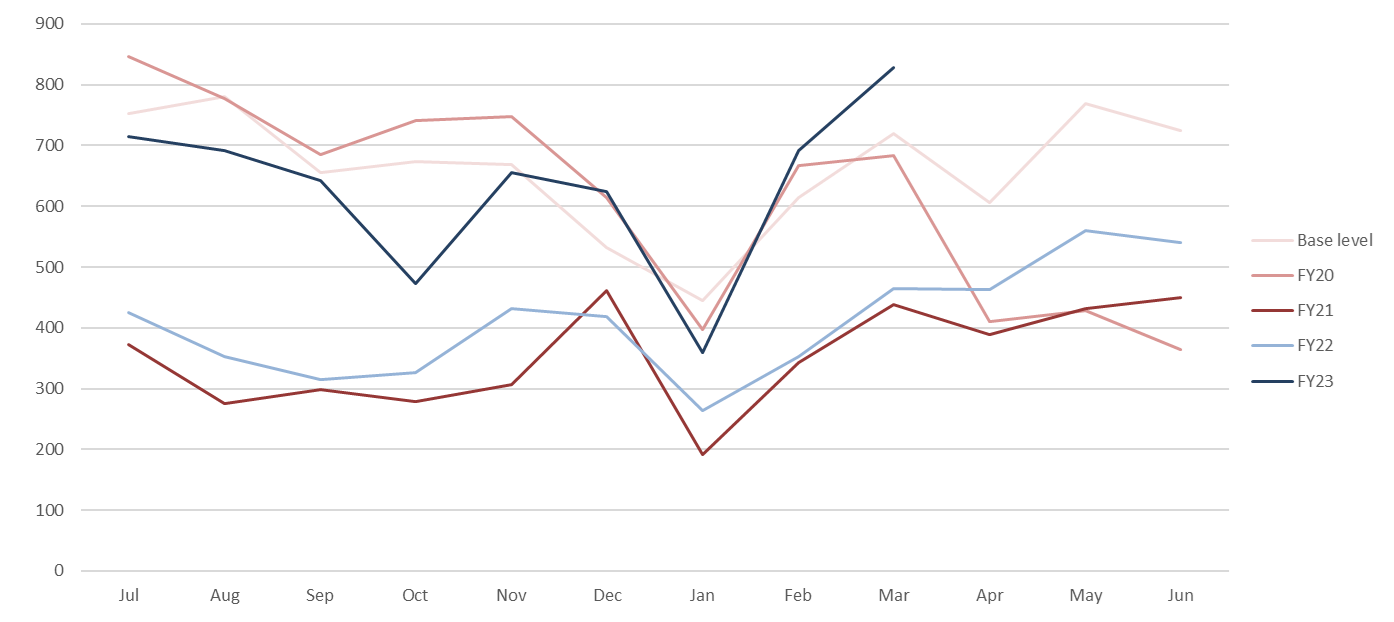

10k Words Equitable Investors May 2023 Miserable IPO returns have been the story even though Kenvue got away with a 22% stag on day one of its US listing last week; a gap has opened between small and large stocks with the "jaws" notable in both price movements and valaution comparisons; in that context it is interesting to see how smaller stocks have outperformed historically coming out of market drawdowns; in Australia the industry survey looks negative but S&P/ASX EPS revisions haven't really been notable; insolvency is on the rise as is US consumer credit card debt; and finally for whoever is advising the state fo Victoria, credit ratings do matter. Distribution of returns from US IPOs by issue date (2023 to date) Source: Equitable Investors, StockAnalysis Distribution of returns from ASX IPOs by issue date Source: Equitable Investors ASX small caps (SSO - orange) v large caps (STW - blue) Source: Equitable Investors, TIKR US micro caps (IWC - orange) v large caps (IVV - blue) Source: Equitable Investors, TIKR Past 20 Years World Small Cap P/E Ratios Source: Pzena Nasdaq 100 Price/Sales Ratio Source: Charles Schwab & Co. US small caps v large caps during & after the "dot-com bubble" Source: abrdn US small caps v large caps during & after the GFC Source: abrdn S&P/ASX small v large during & after the "dot-com bubble" Source: Equitable Investors, Iress S&P/ASX small v large during & after the GFC Source: Equitable Investors, Iress AIG Industry Index Source: IFM, AIG Consensus EPS expectations for S&P/ASX 200 Source: Cannacord Large bankruptcies ($US50m+ liabilities) - Jan-Apr count for 2023 Source: Bloomberg, @jsblokland Australian companies entering external administration for the first time (FY23 = black line) Source: ABS US Consumer Loans (Credit Cards & Other Revolving Plans, All Commercial Banks) Source: @glightfinancial, FRED Government Bond Yields and their S&P credit ratings Source: Equitable Investors, worldgovernmentbonds.com May Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

15 May 2023 - Airlie Quarterly Update

|

Airlie Quarterly Update Airlie Funds Management April 2023 |

|

Emma Fisher, Portfolio Manager, provides her views on the current market environment and discusses her recent trip to Europe where she visited CSL and QBE Insurance, which are two holdings in the Airlie Australian Share Fund. Author: Emma Fisher, Portfolio Manager Funds operated by this manager: Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks.. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

12 May 2023 - Why investors shouldn't desert quality banks

|

Why investors shouldn't desert quality banks Pendal April 2023 |

|

Here, Pendal's head of global equities ASHLEY PITTARD makes the case for quality banks ahead of a likely US recession

THE turmoil among global banks over the past six weeks has created opportunities for investors, with Swiss based UBS and Wall Street giants JP Morgan and Wells Fargo the top picks, says Ashley Pittard, our head of global equities. "I think UBS is a standout for the next ten years as an investment," he says. "You want to invest in a bank that's one or two in its market, and has high quality management. "Bank stocks can go down in a crisis environment, but the quality banks don't go broke and that's a key point." Banks should do well in coming quarters as they reprice credit and achieve higher margins. "Near term, interest rates have stopped rising and the yield curve is flattish or even inverted. "But if we fast-forward through the year, we believe there's going to be a recession in the US. That would likely mean the Federal Reserve will have to cut rates into next year. "The yield curve will steepen and that's good for banks because they borrow short and lend long and they are going to get a wider spread. That will feed back in a couple of years' time into higher earnings." The current turmoil could push out weaker lenders who aren't pricing loans rationally - which would help the top banks. Short-term risks Pittard warns there are risks in the short term. "What are the write-downs going to be, particularly if the recession is hard? That's the big near-term risk. "That's why you want to be with the highest quality banks - number one or two in their market." On UBS, Pittard says its metrics are strong. It has just absorbed its second largest competitor, has a 30 per cent plus share in retail banking in Switzerland, and is the number one global bank for ultra-high net worth individuals. Importantly, UBS has strong management, he says. "The new CEO, Sergio Ermotti, is the Tom Brady of European banking," Pittard says, referring to most successful quarterback in US football. Ermotti left the bank in 2020 after a successful stint, and then took the top job again on April 5. "He first came to UBS after the global financial crisis and got them out of high-risk investment banking, increased market share in their ultra net worth business, and boosted dividends and the stock price. "He just grinds away. He gets costs out of the business, right sizes the riskier parts and gives money back to shareholders." Pittard says two US bank stocks worth looking at are JP Morgan, run by the very experienced Jamie Dimon, and Wells Fargo, run by Charles Scharf. "Dimon is the last remaining US bank CEO who actually went through the GFC," Pittard says. "Scharf got the CEO job at Wells Fargo in late 2019 and has cleaned it up and ticked all the boxes." In terms of why the global banking sector found itself in its current situation, there are several factors, Pittard says. "There were poor management practices. There's also been mishandling of the repricing of the rapid interest rate changes over the last year. You've also had volatility around what the US Federal Reserve is going to do." Pittard says there's also a regulatory overlay. "When Donald Trump was in power, he rolled back some of the banking regulations that were put in place directly after the global financial crisis which meant the regulation of smaller banks, like Silicon Valley Bank, was lighter than regulation of the big banks," Pittard says. "Also stress testing of the bank last year didn't consider large jumps in interest rates, which is what actually happened." Author: Ashley Pittard, Pendal's Global Equities |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

11 May 2023 - What to do about Stock Based Compensation?

|

What to do about Stock Based Compensation? Eiger Capital April 2023 |

|

The tech sector sell-off that began in early 2022 has seen a renewed investor focus on 'disciplined growth'. We think this is investor code for a shift to positive operating free cashflows and the end of equity market funding of operating losses. Lossmaking tech is now on the nose. The equity market sell-off has also led to greater scepticism at the increasing use of alternative corporate earnings measures such as 'underlying' profits. These are often presented by companies that want to adjust (i.e. increase) statutory reported earnings for 'one-offs' and 'non-cash' items. A common adjustment of concern for investors, especially popular with companies in the tech sector is the issue of SBC. Companies are able to report higher underlying earnings (or more to the point reducing underlying losses) by using the justification that SBC is a 'non-cash' item and thus should be added back to statutory earnings. We are unconvinced with this argument as we reason below. SBC is a real cost of employment and thus should be accounted for in reported statutory earnings. Let's start with a "101" on SBC - what is it?SBC is quite simply an alternate form of compensation paid to company employees, often as a substitute for a cash salary. There are two main types. SBC is equity in the business that employees work for and is most typically issued either in the form of employee stock options or otherwise as restricted stock units (RSUs). It is common for both types of SBC to vest over a specified time period and often subject to some conditions (most commonly just tenure at the company). SBC is not a new innovation. It has been around in the US for more than 70 years. Although employee stock options did exist in the US pre-WW2 their unfavourable tax treatment meant they were little used. Very few executives had executive stock options prior to 19501. Then shortly after the war their issuance started to rise quickly with the introduction of the 1950 Revenue Act. This new law allowed for lower capital gains tax treatment on the sale of executive options. As a consequence, executive stock option issuance jumped to around 18% of top US executives remuneration, just one year later. Nevertheless, stock options remained mostly restricted to top company executives until the early 1960's. Late that decade Robert Noyce and Gordon Moore (of "Moore's law fame), two of the original founders of Fairchild Semiconductor (the inventor of the silicon chip) established a new company called Integrated Electronics. This company was later renamed Intel and was one of the first companies to use employee stock options more broadly as a tool to incentivise the staff of their new company. Once again, their use rapidly increased during the dot-com boom of the late 1990's. This popularity was again sunk by dotcom bust of 2001. Many recipients of SBC found themselves on the hook for large tax bills despite the value of their options now being mostly worthless. More recently, SBC has again blossomed with the FANG led tech bull market of the late 2010's / early 2020's. High inflation and the end of zero interest rates globally from mid 2022 has led to a tech industry selloff that has again put SBC back onto investors' radars. Why do companies issue SBC?SBC is most commonly issued to staff by early stage 'startup' tech businesses for a number of reasons.

What are the problems with SBC?There are a number of concerns for investors arising out of the payment of SBC and not just the issue of the cost of SBC not being appropriately reflected in earnings.

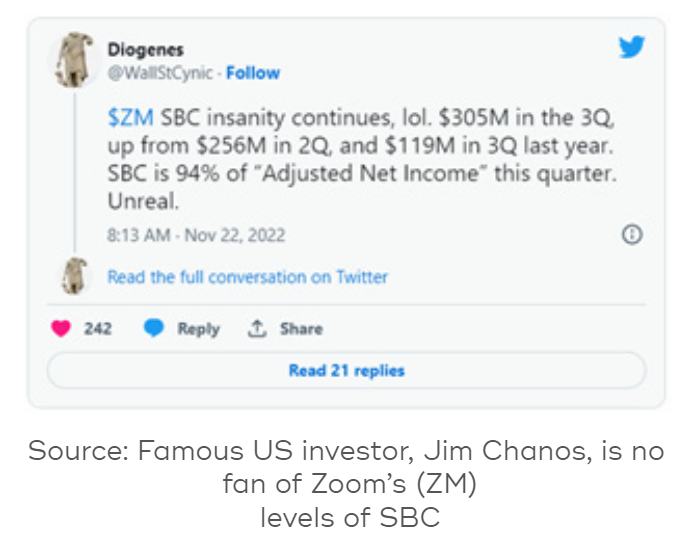

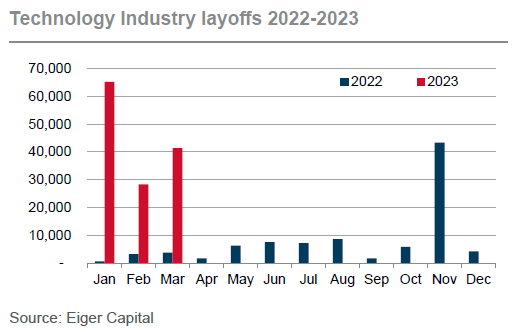

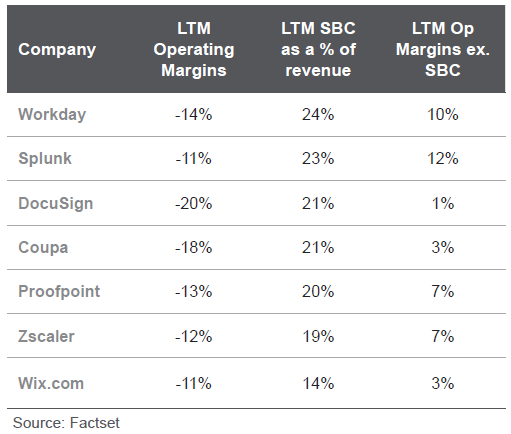

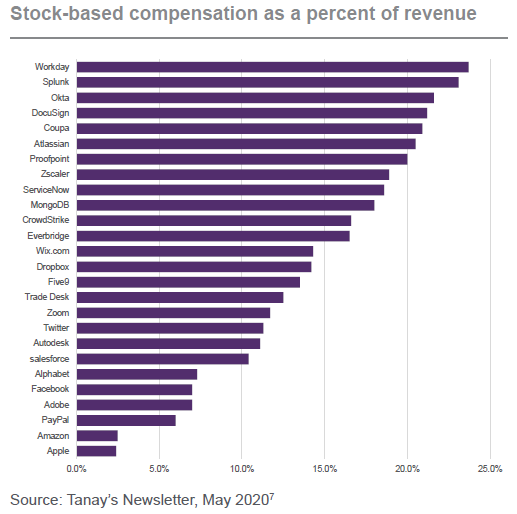

A recent Barrons3 article highlighted the now more common practice of many large companies in the tech industry. More of them are using SBC for a greater proportion of their total employee compensation. As revenue growth rates have slowed and correspondingly tech valuations have dived, this practice is increasing the anxiety of many investors who consternate at the growing ownership dilution of their business. The article points out that average stock-based compensation for the US tech industry rose from just 4.2% of revenue in 2012 to 10.5% in 2020, and then more than doubling a year later to 22.5% in 2021. At these levels SBC has moved well away from its tech industry origins as a tool to align and motivate small teams in early-stage businesses. Instead it is now "part of the culture and the expectation from software company employees"… with the consequence being that… "an increasing amount of shareholder value (is) being transferred to employees and away from investors, as companies dole out more stock at lower prices". Perhaps the most egregious recent example of the above practice has been pandemic beneficiary Zoom. SBC became very entrenched as part of employee expectations during the good times when the share price ran up from US$70 in Dec 2019 to a peak of almost US$600 (+760%) less than a year later in Oct 2020. However rolling forward to late 2022 with the share price back at US$70 (-88%), employees who unlike shareholders need to be compensated for the lower share price, requiring the company to issue significantly more SBC than when its share price was US$600.  According to Kelly Steckelberg, Zoom's CFO, this was done to ensure workers were not "feeling that they're being undervalued"4. Unfortunately this resulted in very large levels of dilution for suffering shareholders, who's feelings were apparently less important to the CFO. The one possible fly in the ointment for employee SBC is that the rising level of tech industry layoffs is eroding the current culture of expectation. If tough times continue then tech sector remuneration will undoubtedly come under more pressure. The consequences will not only be lower levels of SBC but also possibly lower levels of total absolute compensation, although evidence of the latter is yet to be seen.  Not all of the tech industry has been exploiting SBC-adjusted underlying earnings. Some of the larger profitable tech companies such as Alphabet (Google)5 and Meta (Facebook)6 have long since moved away from an 'underlying' earnings measure that excludes SBC. They recognise that it is indeed a true cost of attracting and retaining staff and account for it as a proper expense. Unfortunately many other large but still unprofitable tech companies continue to rely on SBC as an 'underlying' earnings adjustment to help hide the fact that their margins are miserable on a fully costed basis. The tables and charts below show some well-known names such as Adobe and DocuSign as the biggest serial users of SBC.   Final thoughtsWe may in the not-too-distant future see SBC returning to its origins of tech start-up land. It is here where the cost of equity dilution to investors is more than offset by the 'blue sky' value creation potential that a highly motivated and well-aligned small tech team can deliver. Author: Victor Gomes, Principal and Portfolio Manager |

|

Funds operated by this manager: Eiger Capital Australian Small Companies Fund 1 https://secfi.com/learn/history-of-employee-stock-options This material has been prepared by Eiger Capital Pty Ltd ABN 72 631 838 607 AFSL 516 751 (Eiger). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed. |

10 May 2023 - The Rate Debate - Ep37 - Did the RBA fuel the fire or douse the flames?

|

The Rate Debate - Ep37 - Did the RBA fuel the fire or douse the flames? Yarra Capital Management April 2023 Despite the RBA's massive rate "U-turn" and their insistence that we are in the final stage of the hiking cycle, has it come too late to stop a recession? Chris Rands and Darren Langer examine the factors influencing the market and reveal their expectations of the economy and the Australian credit market in episode 37 of The Rate Debate. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

9 May 2023 - A once in a generation opportunity

|

A once in a generation opportunity Insync Fund Managers April 2023

A revolution in global consumption is occurring. Imagine a world where the centre of economic gravity shifts away from Europe & North America. This presents a staggering $10 trillion consumption growth opportunity over the next decade. This global megatrend has reached a critical tipping point. The rapid expansion of middle-income sectors across developing countries, particularly in Asia, is reshaping the global economy.

Not Just a China Story Whilst China's middle-class growth is well-known, it is less recognized that of the 1 billion Asians joining the middle class by 2030, 380 million will come from India, the largest contributor to this increase. India's consumer market is set to triple to $6 trillion by 2030, making it one of the biggest consumption stories. India's consumer class is characterized by a young, geographically dispersed population. It offers significant potential for growth in consumer spending. In contrast, China's consumer class is older and aging, although more affluent, and is concentrated in cities. Smaller nations in Asia are still juggernauts when compared to say, Australia. Indonesia's middle-income class is the size of Australia's entire population. Then there is Malaysia, Vietnam, and so on. Navigating the risks Investing in the emerging middle-income consumer requires smarter research and better insight than ever before. It also requires strong risk management. Simply buying a basket of offshore companies with large 'footprints' in these regions is no longer sufficient. Nor is investing directly due to the more risky and volatile nature of local stock exchanges. International brands face challenges when embracing Guochao due to potential repercussions in both Human Rights and political considerations. Nike and Adidas lost market share in China to locals such as Anta Group as a result. Guochao is especially popular amongst the 270 million Gen Z-ers. They're redefining China's consumer economy and will continue to do so throughout their life stages. This is neither new nor particularly Asian. It shares similarities to the emergence and power of the USA Baby Boomers decades earlier. The preferences and spending habits of this large rapidly growing group are therefore crucial to understand. With a higher-income middle class estimated to hold 160 million households by 2030, China remains a critical target group for consumer brands. They are driving demand for higher-quality goods and services, from healthcare and education to luxury goods and travel. Given the dangers and challenges in these markets however, how can an investor benefit without taking on undue risks?

Being focused and careful Insync's research targets only the most viably attractive companies, focused especially on the increased spending by higher-income middle-class consumers (annual disposable income is $45,000-$100,000 (PPP)). Global companies are usually better placed to then allocate capital to these economies and manage currency and political aspects from a stronger position than fund managers. Our work has determined that the number of companies benefitting from this trend that can also grow profitably going forward is fewer than what was available pre-Covid. Stock selection is key. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

8 May 2023 - Magellan Global Fund Update

|

Magellan Global Fund Update Magellan Asset Management April 2023 |

|

Global Portfolio Managers Nikki Thomas, and Arvid Streimann, discuss the unfolding interest rate cycle and the effect it's having on market sentiment and company valuations. They provide an update on the portfolio's recent performance and its positioning for the current environment. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

5 May 2023 - Resilience and attractiveness of Asian local bonds

|

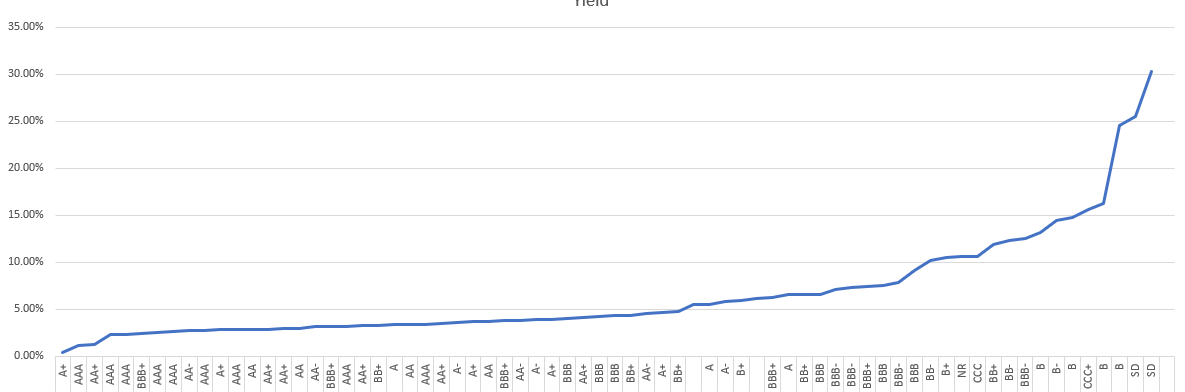

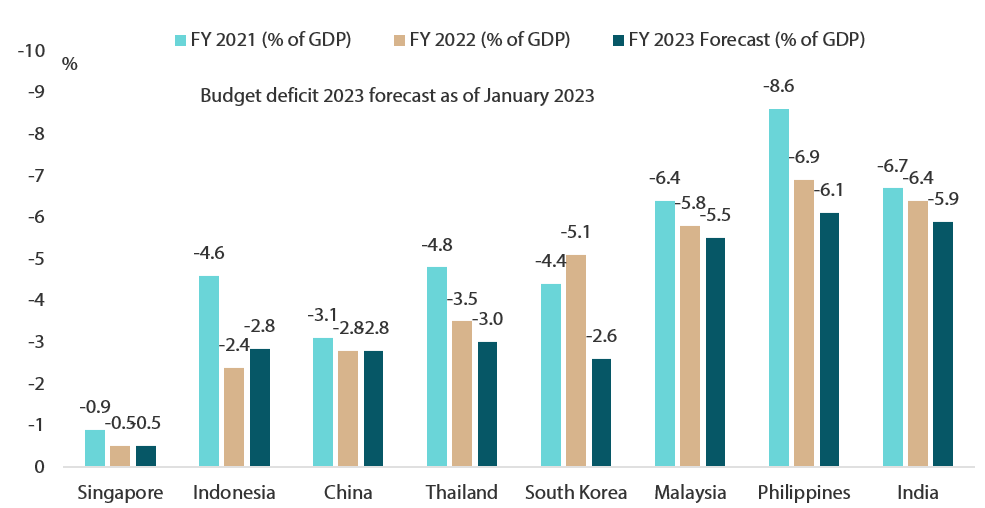

Resilience and attractiveness of Asian local bonds Nikko Asset Management April 2023 Asian local bonds have outshone global peers over the past five years From 2018 through 2022, financial markets around the world had to endure a prolonged trade war between the US and China, a global COVID-19 pandemic, rising inflation, elevated oil prices and widespread geopolitical upheavals—namely the Russian invasion of Ukraine. Another key stress factor global markets had to withstand since early 2022 was the aggressive monetary tightening by the US Federal Reserve (Fed) and other major central banks, many of which have implemented a series of interest rate hikes to quell decades-high inflation. Still, Asian local bonds (also known as Asian local currency bonds, as they are denominated in the currencies of their home countries) have shown great resilience under such trying times. As a group, these regional bonds have outperformed their global peers by a big margin over the past five years (see Chart 1). Local government bonds of India and Indonesia, for instance, turned in impressive gains of more than 43% and 40%, respectively, in local currency terms through 2018-2022, whereas those of Malaysia, the Philippines, China and Thailand all marked decent returns ranging from 9% to 21%. Conversely, most government bonds of the US, Europe and Latin America generated losses in local currency terms over the corresponding five-year period. Backed by strong fundamentals and high-quality yields (as most Asian local currency government bonds have investment grade credit ratings) coupled with lower foreign ownership (compared to five years ago) and the potential appreciation of local currencies versus the greenback, Asian local bonds currently look attractive as a fixed income asset class. In our view, regional local bonds will continue to perform well for the rest of 2023 and beyond as inflation rates in the region trend lower and Asian central banks refrain from further interest rate hikes. Moreover, we believe that the Fed, which recently hiked rates by 25 basis points (bps) at its Federal Open Market Committee (FOMC) meeting on 22 March, is near the end of its rate hike cycle. At the moment, given the ongoing global banking crisis, the market is pricing in less than a 50% chance of the Fed hiking rates at its next FOMC meeting in May. In addition, there are other supportive factors that are expected to increase the appeal of Asian local bonds, namely the post-pandemic narrowing of Asia's budget deficits, which will lead to lower issuance of local currency bonds, and the possible inclusion of these regional bonds in established global fixed income indices. Chart 1: Asian local bonds outshine global peers

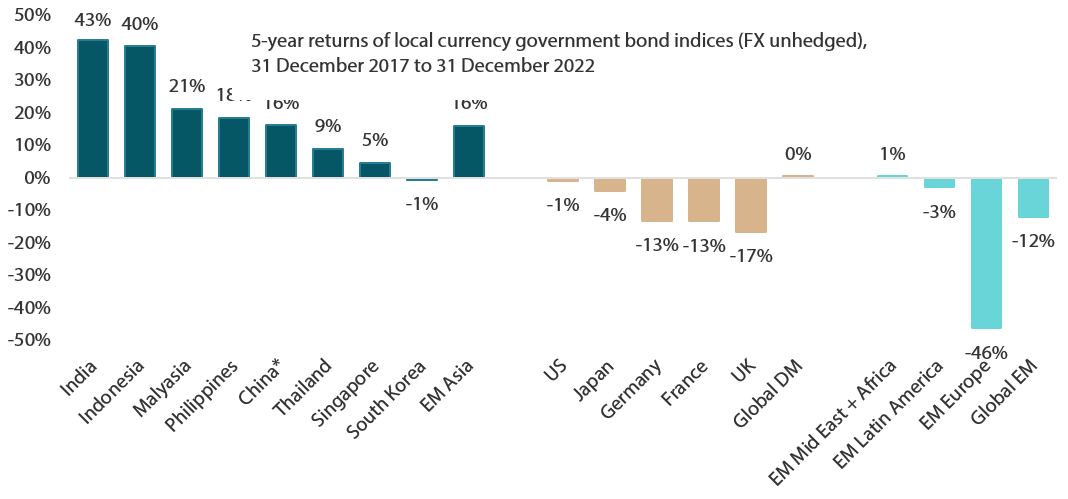

Source: Markit iBoxx, JP Morgan, Bloomberg For individual countries, we use Markit iBoxxGlobal Government Bond Indices as proxies except India, which uses iBoxxAsia India Government Index. For emerging markets composite indices, we use JPM GBI-EM Index and its sub-indices. For Global developed markets, we use JPM Global Bond Index (GBI) as proxy. *China bond index's inception was February 2019 and it has less than five years of track record. Budget deficits of Asian countries set to narrow As Asian fixed income investors, we are especially watchful of the fiscal stance of countries within in the region. During the COVID-19 pandemic, notably in 2020 and 2021, almost all Asian countries experienced increases in their fiscal deficits as they were implementing expansionary fiscal stimulus to support their respective economies during periods of lockdowns and social restrictions, which had a negative effect on business and economic activities. With the region's economies reopening amid a return to normalcy following the pandemic, various countries in Asia are now adhering to stricter fiscal discipline and have started to trim their fiscal deficits, which are forecasted to narrow this year (see Chart 2). Chart 2: Asia's budget deficits are likely to narrow going forward

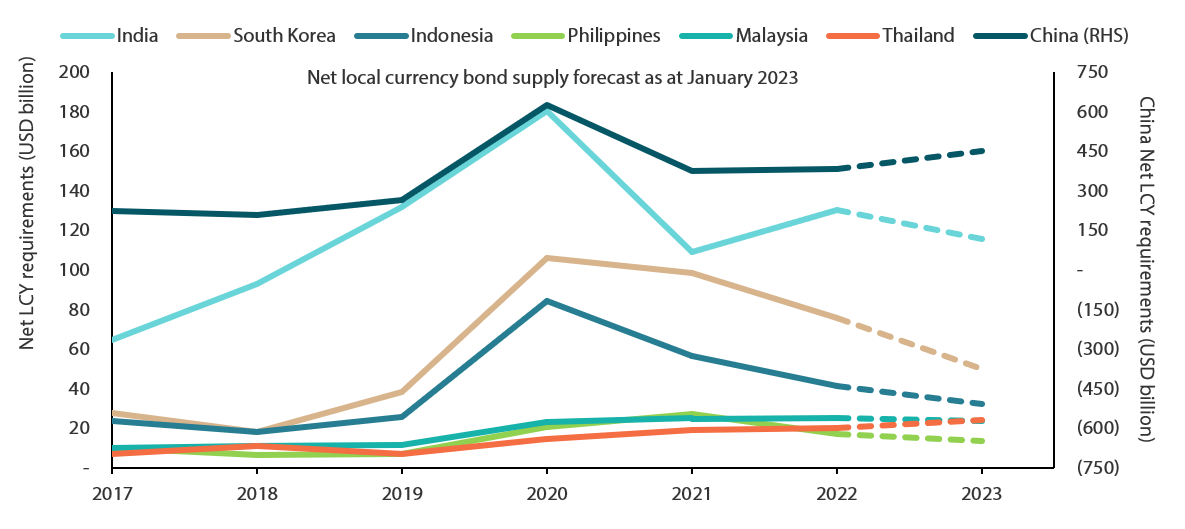

Source: MOF India, Moody's, official sources, Bloomberg, January 2023 Note: India's data comes from MOF India and Philippine's budget deficit forecast is from Fitch. A case in point is Indonesia, which has managed to narrow its fiscal deficit substantially, from -4.6% of GDP in 2021 to -2.4% in 2022. Moreover, for 2023 the Indonesian government has set a budget deficit target of 2.85% of GDP, below its statutory limit of 3%. But what implications will a reduction in the fiscal deficits of Asian economies have on regional local bonds? To start with, we expect lower fiscal deficits to ease the financing pressure faced by Asian governments and, as such, lead to a lower issuance of local currency bonds. A cutback in net issuance or supply of Asian local bonds is generally supportive of bond prices. We expect the net local currency government bond supply of most Asian countries to be lower in 2023, as compared to 2022 (see Chart 3), creating less downside price pressure for regional local bonds over the next few quarters. Chart 3: Net issuance of Asia local currency bonds projected to be lower in 2023

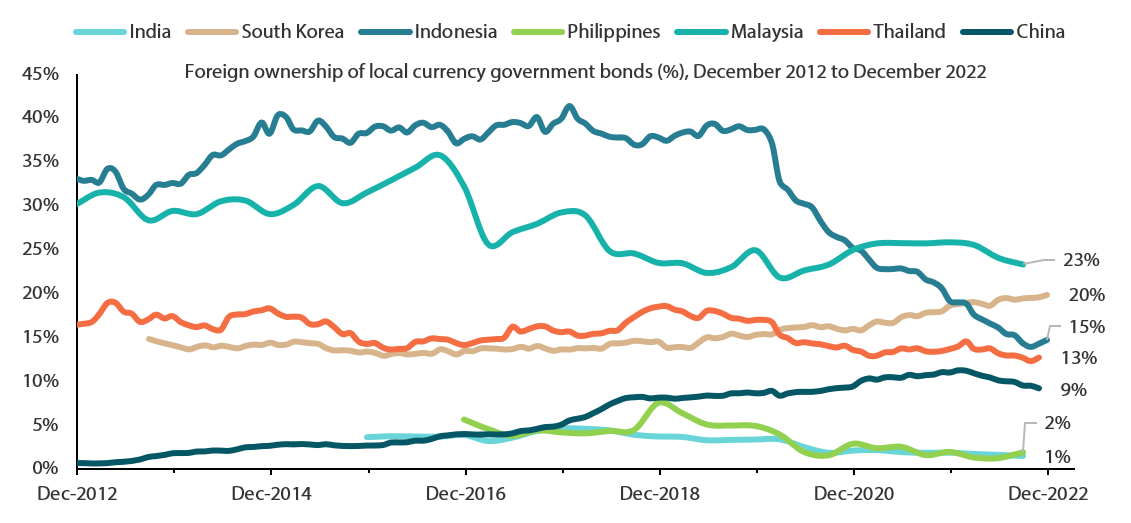

Source: ANZ, January2023 Ample room for inflows into regional bonds Since March 2022, when the Fed started to embark on an aggressive tightening of monetary policy with a series of outsized rate hikes to tame rising inflation, we have seen an outflow of funds from Asia, with the move exacerbated by the strengthening of the US dollar. However, in our view the aggressive rate hike cycle by the US central bank may not persist, given the ongoing banking crisis in the US and Europe. In addition, we believe that the Fed is now nearing the end of its tightening cycle as red-hot inflation in the US cools. Indeed, US annual inflation, as measured by the headline consumer price index (CPI), has been coming down since June 2022. For instance, the latest US annual inflation rate slowed for an eighth consecutive month to 6% in February 2023, the lowest since September 2021. Likewise, the magnitude of the Fed's interest rate increases has gradually shrunk since mid-2022, from a series of 75 bps hikes in June, July, September and November to 25-bps hikes in February and March 2023. At the moment, the Fed has to intricately balance the taming of inflation with its effort to avert a full-scale turmoil in the banking system. In the coming months, a possible pause in the Fed's tightening cycle amid a slowdown by the world's largest economy may help to stabilise the global rates market, resulting in an improvement in risk appetite. This could potentially prompt foreign funds to return to Asia as the greenback weakens. We believe that such developments will support Asian currencies and regional bonds. As at the end of 2022, foreign investors' positioning in Asian local bonds (see Chart 4) was light relative to previous years. But once the environment turns more conducive for regional bonds, we expect inflows to Asia to resume. Another factor that could spur more inflows of foreign funds into regional bonds in the near future is the possible inclusion of some Asian government bonds in established global fixed income indices. South Korea is seeking the inclusion of its government bonds to the FTSE World Government Bond Index (WGBI); similarly, India is pursuing the inclusion of its government bonds in the Bloomberg Barclays Global Aggregate Index and the JPMorgan Government Bond Index-Emerging Markets Global Diversified Index. Chart 4: Foreign holdings in Asian local currency government bonds remain low

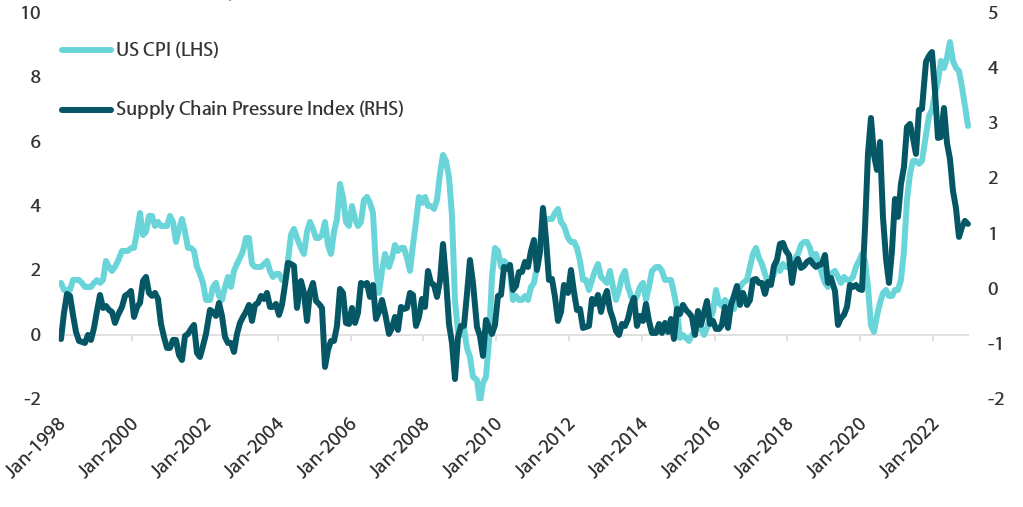

Source: ANZ, January2023 Regional central banks seen halting rate hikes as inflation in Asia eases Russia's invasion of Ukraine in February 2022 and the subsequent sanctions against Moscow by many developed countries have led to a diminished supply of major food staples, such as wheat and vegetable oils. As a result, Asia's inflation, which is largely driven by the volatile food component, rose steeply in the first three quarters of 2022. Although global food prices remain elevated amid the ongoing war in Ukraine, price pressure has eased of late, especially in the fourth quarter of 2022, as new supply chains were established. All in all, the pressure in the global supply chain is easing (see Chart 5). We see easing pressure leading to a decline in global inflation, especially in US CPI, as suggested by a recent research paper by economists from the Federal Reserve Bank of New York (New York Fed), which projects annual US CPI normalising to 3.8% within 12 months. Global supply factors are measured by the New York Fed's Global Supply Chain Pressure Index (GSCPI), which uses various global price indicators, including the producer price index and the CPI of the US and the EU. The New York Fed's academic projection of a substantial easing of US CPI in 2023 to below 4%, which is a level consistent with a soft-landing scenario, is based on the assumption that the GSCPI normalises to its historical average over 12 months. Chart 5: Global supply chain pressure is easing

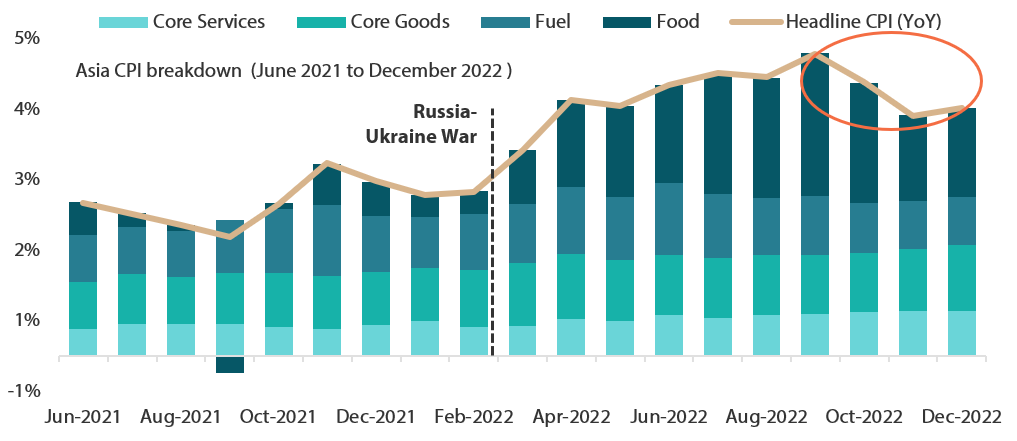

Source: Bloomberg, January 2023 At the same time, the cost-push pressure (namely the food price component) that drove Asian inflation is coming down and softening Asia's inflation outlook (see Chart 6). As inflation in the region ebbs (as evidenced in the February CPI of countries such as South Korea, Thailand, China, India, Singapore and the Philippines), Asian central banks are likely to slow the pace of monetary policy tightening. As of March 2023, several regional central banks, such as those of South Korea, Indonesia and Malaysia, have already suspended rate hikes as inflation in their countries has eased. Chart 6: Price pressure that drove inflation in Asia is easing

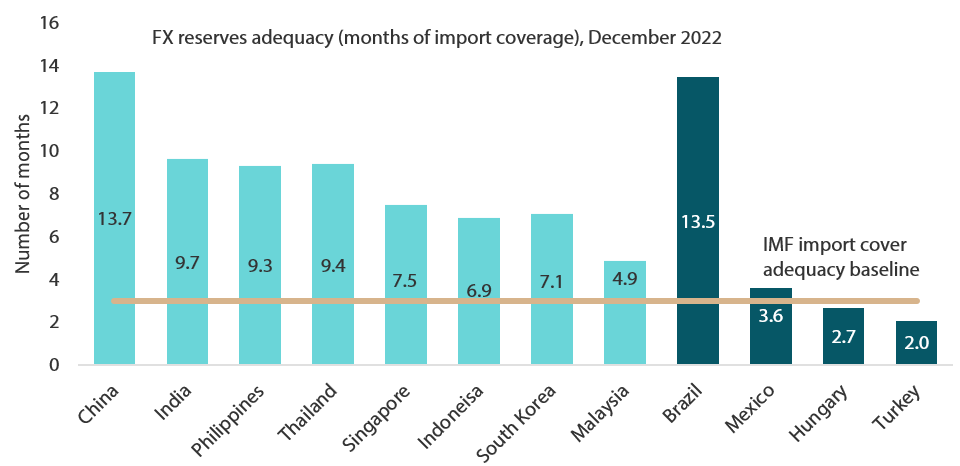

Source: Morgan Stanley, January 2023 Note: Asia includes China, Hong Kong, India, Indonesia, South Korea, Malaysia, Philippines, Taiwan, Australia and Japan. Singapore and Thailand are excluded due to a lack of data. Moreover, the purchasing managers' indexes of many Asian countries are falling in line with the global trend, whereas Asia's exports, which are still largely dependent on demand from the US and the EU, have also started to come off as growth in developed countries slows. That said, a potential recovery of exports to China may offset the slowdown. But given the overall weaker growth outlook, we expect most of Asia's central banks to pause hiking rates. In our view, Asian central banks—cognisant of the slower economic growth outlook—are likely to be less hawkish in their monetary policy stance and will be more inclined to keep interest rates accommodative, all of which should bode well for regional bonds. Asia's FX reserves remain adequate; regional currencies look cheap Asian foreign currency (FX) reserves have decreased over the past few months. They remain adequate, however, and are in accordance with the International Monetary Fund (IMF) rule of thumb from of having at least three months of imports being covered by FX reserves (see Chart 7). This underscores the sound fundamentals of Asian economies. Chart 7: Asia's FX reserves remain adequate

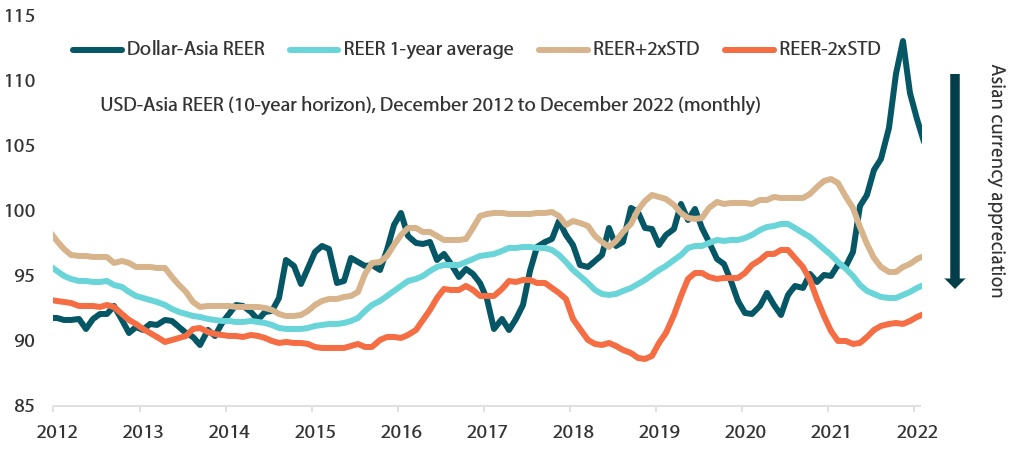

Source: Bloomberg, IMF, January 2023 In addition, Asian currencies, as measured by the real effective exchange rate (REER), currently look cheap relative to their historical long-term averages. As regional currencies weakened against the US dollar (USD) in 2021 and 2022, the USD-Asia REER had recently exceeded two standard deviations from its long-term averages, making Asian currencies cheap from a long-term perspective (see Chart 8). In our view, the environment surrounding regional currencies is improving. As mentioned, we think that dollar strength will start to fade as the Fed may be nearing the end its tightening cycle, and Asian currencies will have ample room to appreciate versus the greenback. In terms of regional currencies, we favour the Thai baht, which is seen benefiting from increased tourism inflows and current account improvement. We also like the renminbi. China's reopening and the imminent recovery in the world's second largest economy are likely to spur the renminbi to appreciate against the greenback, in our view. Chart 8: Asian currencies look cheap versus their long-term averages

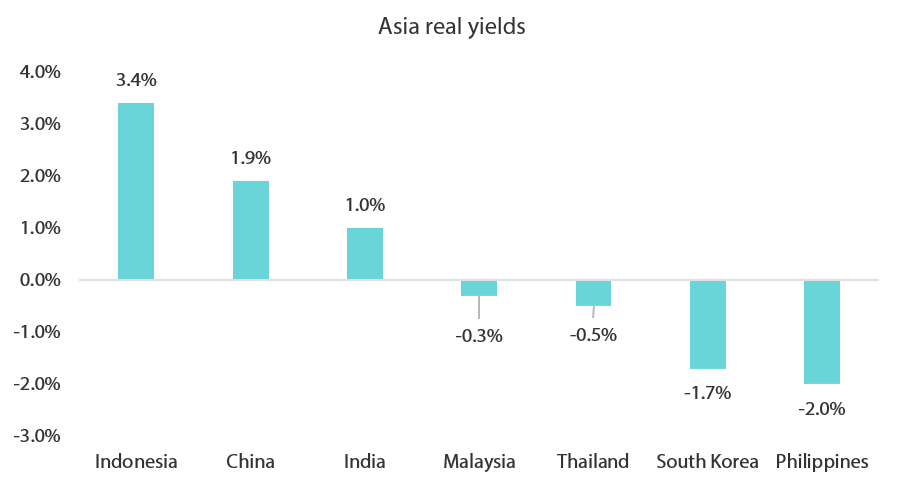

Source: Citibank, Bloomberg, January 2023 Positive on the local bonds of Indonesia, India and South Korea Within the region, we are most positive on the local currency bonds of Indonesia, India and South Korea. We expect Indonesian bonds to perform well on the back of strong foreign inflows—both portfolio fund flows and foreign direct investments (FDIs)—into the country. Indonesia is attracting considerable foreign investments on the back of its thriving electric vehicle supply chain ecosystem, which entails mining and the processing of metals all the way to the manufacturing of cathodes and battery cells. Strong FDIs into Indonesia are expected to support its economy and currency, as well as boost the appeal of its local currency government bonds, which also look attractive on a real yield (nominal yields minus core CPI) basis (see Chart 9). Chart 9: Asian local currency bonds offer attractive real yields

Source: Bloomberg, January 2023 Local currency Indian bonds also look attractive from a real yield perspective and offer a good carry. Furthermore, we expect Indian bonds to receive a fillip when the Reserve Bank of India (RBI) ends its rate hike cycle in the near future. The RBI raised its benchmark repo rate by 25 bps to 6.5% in February. Like many other Asian central banks, the RBI is waiting for inflation to make a sustained decline before it stops hiking rates and revert to a more accommodative stance as the Indian economy slows. Likewise, we expect South Korea's local currency bonds to perform well. The Bank of Korea (BOK) was one of the first central banks in the world to hike interest rates to address soaring inflation; it embarked on its tightening cycle back in August 2021 and raised benchmark interest rates seven consecutive times. In February 2023, however, the BOK paused its rate hike cycle by keeping benchmark rate steady at 3.5%. We think that South Korea could be the first country in Asia to cut interest rates. The possibility of steady or declining rates coupled with the potential inclusion in the FTSE WGBI in the future will be supportive of South Korean local currency government bonds, in our view. Summary on why Asian local bonds may outperform On the whole, we expect Asian local bonds, which have outperformed their global peers over the past several years, to thrive in the remaining quarters of 2023 and beyond, supported by a conducive global environment of lower inflation, lower growth and steady interest rates. At the same time, slower but still positive growth in Asian economies and a pause in regional central banks' policy rate adjustments will benefit the Asian local bond market, in our view. We believe that Asian central banks are nearing the end of their rate hike cycles as inflation eases and growth prospects weaken. The prospect of stable or even falling interest rates in Asia bodes well for regional bonds. Strong fundamentals, high-quality yields and low foreign ownership (and hence more room for fund flows recovery) are other factors that are supportive of Asian local bonds, which are also seen doing well as regional currencies strengthen versus the greenback. Within the region, we favour Indonesian local bonds, which could benefit from strong inflows (both FDI and foreign portfolio fund flows) and fiscal consolidation. Indian bonds continue to offer good carry as the RBI looks to end their rate hike cycle, while South Korean bonds are also favoured to outperform on rate cut expectations over the longer term and their potential inclusion into bond indices. There are risks that could alter our positive views on Asian local bonds, such as a resurgence in inflation, a big flare-up in global geopolitics and full-blown turmoil in the global banking sector, which undoubtedly will lead to widespread risk aversion in global financial markets. Those risks, while possible, are not likely to transpire in our base case scenarios, which by and large look conducive for Asian local bonds. Author: Edward Ng, Senior Portfolio Manager Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund, Nikko AM New Asia Fund, Important disclaimer information |

4 May 2023 - The twilight of China's population

|

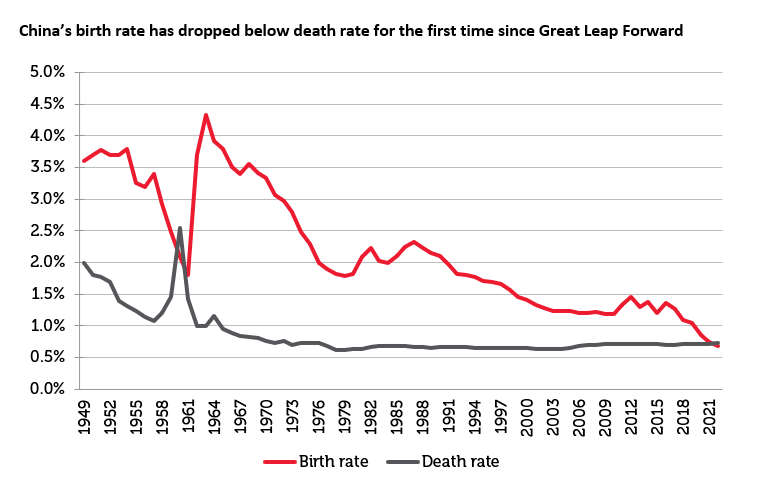

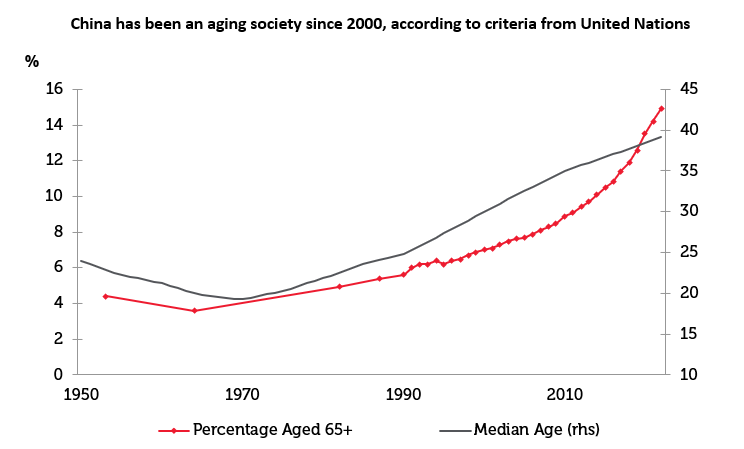

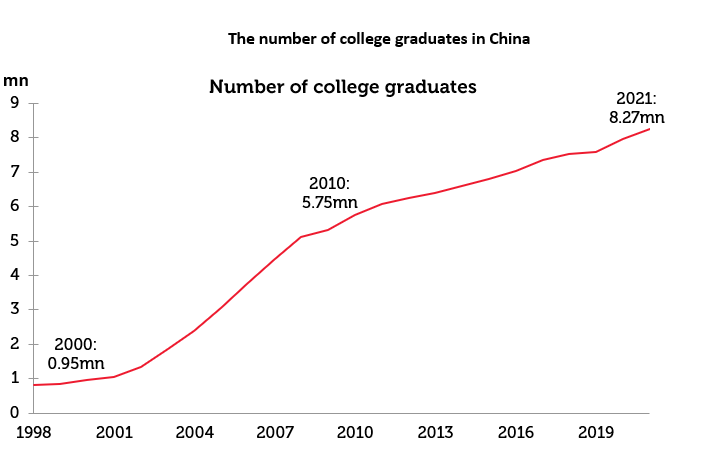

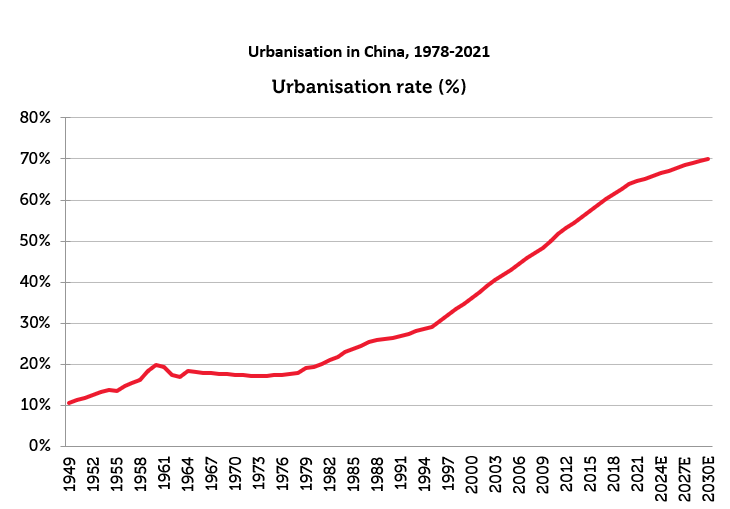

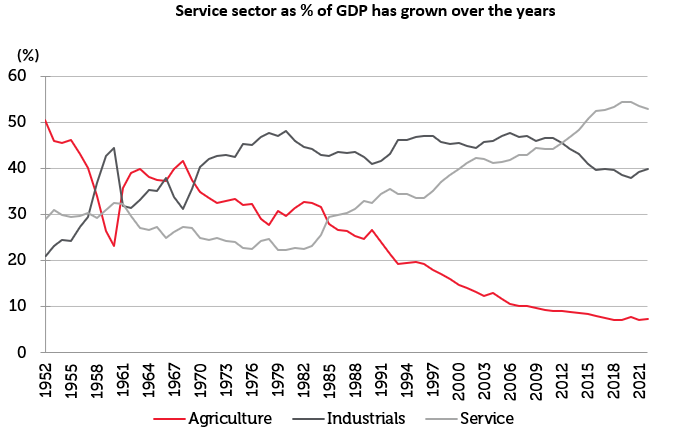

The twilight of China's population Redwheel (Channel Capital) April 2023 China's population declined last year, the first annual contraction since 1961, amid a Covid-induced sharp decrease in new births and long-term structural factors. China has followed a similar trajectory to many developing countries as having an aging population is a common demographic problem in developed countries, where birthrates have steadily declined with higher levels of income, healthcare and education. Countries such as Japan and Germany have had decades to adjust as their populations have aged gradually. China, on the other hand, has begun the aging process at an earlier stage of development and at a more accelerated pace than most countries have experienced. In 2022, official statistics revealed a decline in China's population with a fall of 850,000 from the previous year. However, for a country of more than 1.4 billion people, the difference is relatively small but shows the general trend. The central government has acknowledged the looming demographic problem with a policy package to boost births in August 2022, pledging to improve public services such as healthcare and childcare as well as to offer priorities on public housing to bigger families. Local governments have since followed suit, rolling out home purchase subsidies or allowances for families with multiple children. Despite China's population decline often presented as a crisis, we see a number of opportunities as we continue to believe China's economic growth will be driven by labour quality rather than labour quantity. We expect China's GDP to potentially grow around 5.5% to 6% in the medium term, within which service sectors should become more prominent.

Source: CEIC, Jefferies as at 31 January 2023. The information shown above is for illustrative purposes. Given the forecasted population contraction, many are concerned that the demographic crisis will turn into strong growth headwinds. In our view, the shrinking population may influence total demand, but the negative impact may not be as large or damaging as the headlines suggest. We examine the economic impact of this demographic trend on China's manufacturing and consumption.

Source: NBS, United Nations, Citi Research, as at 31 January 2023. The information shown above is for illustrative purposes. Manufacturing will see little impact

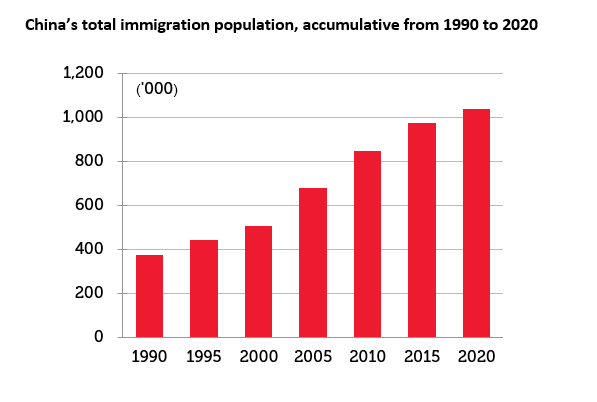

Source: CNBS/H, United Nations, Haver, as at 31 January 2023. Past performance is not a guide to future results. The information shown above is for illustrative purposes. Most developed countries actively increase immigration to mitigate population collapse. However, this is less applicable in China: from 1990 to 2020, China has seen total immigration of merely 1 million. This lack of immigration is due to both language barriers and the country's restrictive immigration policy. While we do not expect this to reverse in the foreseeable future, we do think that raising the retirement age could enable more workers to stay in the labour force for longer. China currently has the lowest retirement age among the OECD countries. China requires most men to retire at 60, white-collar women at 55 and blue-collar women at 50. That is well below the retirement age of 65 in Singapore, 67 in Germany, and 70 in Japan. The Chinese government has pledged to gradually increase the retirement age by 2025. We believe this could offset some of the impacts from the declining labor force.

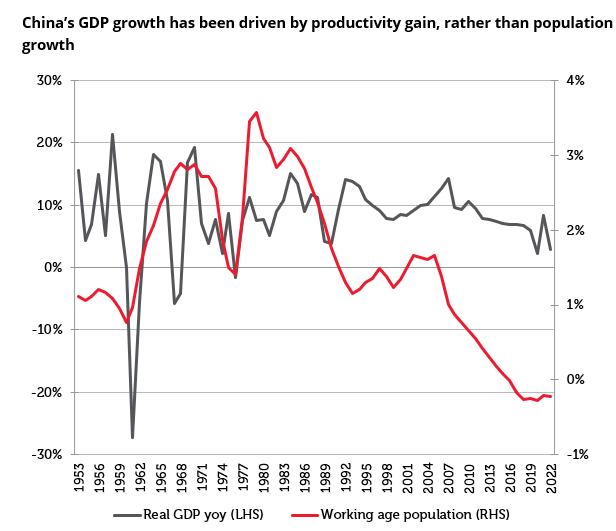

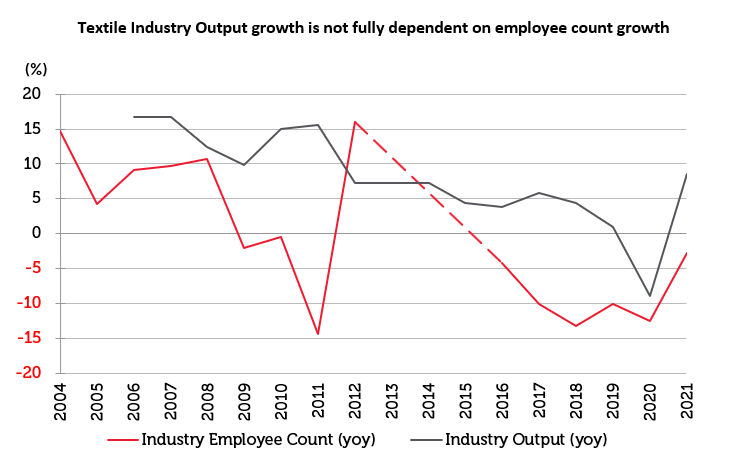

Source: United Nations, as at 31 January 2023. The information shown above is for illustrative purposes. Labour aside, productivity gain should continue to be the key contributing factor for growth. China's manufacturing sector has seen a strong productivity improvement in the past three decades. Since joining the World Trade Organisation (WTO), China has established massive production scale and expanded into several diverse industries. The economies of scale and comparatively integrated industrial chain have created impeccable production efficiency and cost effectiveness, which offers a significant advantage to other nations in comparison. Looking at the labour-intensive textile industry as an example, in addition to mass production, China's cost advantage in the textile industry stems from the fact that China leads the upstream production of polyester. China has about 80% of the world's polyester production capacity, which provides unparalleled cost advantages to local fabric manufacturers and subsequently the garment producers. China, therefore, has remained a production powerhouse in apparel, which might seem to be among the easiest to shift to lower-cost countries. However, China remains at the forefront of FDI inflows into neighbouring regions such as Vietnam as China aims to move up the value chain and give priority to projects which could generate high value products and operate using cutting edge technologies.

Source: National Bureau of Statistics, as at 31 January 2023. The information shown above is for illustrative purposes. Past performance is not a guide to future results. Going forward, we expect China's productivity to gradually improve. Its productivity gain could come from rising investment in human capital, further urbanisation and technology-driven efficiency improvement.

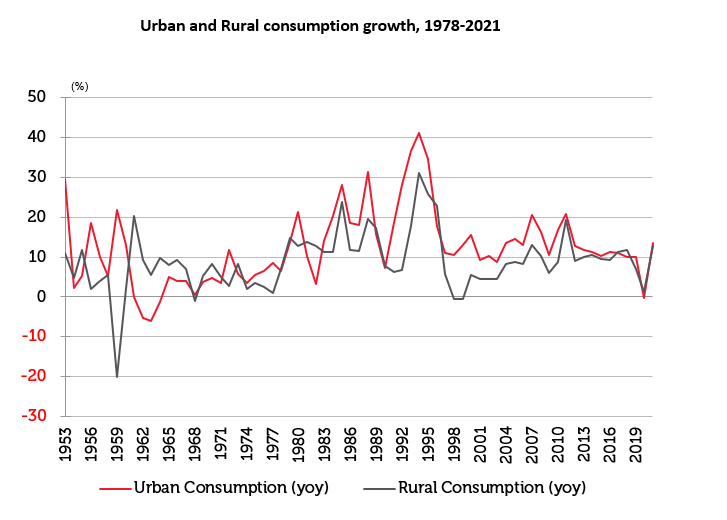

Source: United Nations, National Bureau of Statistics as at 31 January 2023. The information shown above is for illustrative purposes. Urban migration has been a major source of cheap labor in China. As people move from villages to cities, productivity tends to increase significantly due to the productivity differentials between agriculture and industry. Additionally, there is a change in consumption spending growth as consumers look to increase spending on property and durable goods, such as cars and appliances. China's urbanisation rate rose from 36% in 2000 to 65% in 2021, which remains low compared to developed countries such as Japan (92%) and the United States (83%). While facing higher costs, China's improved labour productivity should allow it to compete with quality in the next wave of industrial prosperity.

Source: National Bureau of Statistics as at 31 January 2023. The information shown above is for illustrative purposes.

Source: CEIC. The information shown above is for illustrative purposes. Forecasts and estimates are based upon subjective assumptions. Finally, new technology, such as automation and artificial intelligence, could reduce the demand for labour and extend the working lives of the labour force in general while maintaining output growth. China has been the world's largest industrial robot market since 2013. With the aid of government policy to push towards automation across industries, we expect China to keep leading in robot adoption and production in the next decade. More importantly, similar to Korea, China is making great strides in high-tech industries in which it still accounts for a relatively small share of global markets, such as renewables, machines, tools and pharmaceuticals. As a result of these factors, we believe China's productivity improvement will continue to outweigh the lack of population growth when it comes to manufacturing. We, therefore, see the impact from labour on growth to be minimal. Unlike manufacturing, consumption should see structural changes

Source: National Bureau of Statistics, CICC, as at 31 January 2023. Past performance is not a guide to future results. The information shown above is for illustrative purposes. Conversely, businesses in areas such as child-care and higher education will face a smaller market cohort should the number of newborns fail to stabilise. These sectors are at a natural disadvantage. We think that population and demographic changes will bring both rising and receding prospects to China's general consumption. We are selectively constructive in the service sector, where both the policy and market set-up are much more favourable. While the demographic shift is often presented as a crisis for China, we see immense opportunities in these challenges. We think that China's economic growth will be driven by labour quality rather than labour quantity, which will partly offset the impact of a declining population. We expect China's GDP to grow around 5.5% to 6% in the medium term, within which service sectors should become more prominent. Against this backdrop, we are well positioned for opportunities in these growth areas: new technologies, smart manufacturing, healthcare, insurance, and consumer services. |

|

Funds operated by this manager: CC Redwheel Global Emerging Markets Fund, CC Redwheel China Equity Fund Key information: No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor's investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only. |

3 May 2023 - ESG in 10 Podcast: Artificial Intelligence and Big Tech

|

ESG in 10 Podcast: Artificial Intelligence and Big Tech Alphinity Investment Management April 2023 Episode 4- Artificial Intelligence and Big Tech - What does this mean for responsible investors? Charlotte O' Meara is joined by Mary Manning and Jessica Cairns, Alphinity Investment Management. This information is for advisers & wholesale investors only. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |