News

5 Jun 2023 - Meta Platforms - AI Winner

|

Meta Platforms - AI Winner Insync Fund Managers May 2023 Excluding China (where US social media companies are generally excluded) Meta Platforms Family of Apps are used monthly by a staggering 90% of the world's connected population. Meta has a long history of investing into AI. For years, Meta has employed a world-class AI research team that has been publishing industry-changing research. Even though we can't see it, Meta has, for years, used AI to recommend posts in our feeds, moderate content, and target ads behind the scenes in Instagram and Facebook.

Source: Netbasesquid.com Meta is currently incorporating AI more visibly into his company's products. They are deploying AI technologies to assist advertisers optimise their spend across different mediums with the company saying it's improved its "monetization efficiency," or how much the company makes off of ads they sell on Reels, by 30-40 percent on Instagram and Facebook. Insync significantly increased the Fund's exposure to Meta when shares were trading below US$100 in November 2022, as investors were fretting over how much the company was spending on the Metaverse. What was not appreciated was that 80% of their investments was spent on their core business including AI. Meta shares are today trading in excess of US$200. Meta Platforms has 80% gross margin, over 19% net margins (which includes an expense/deduction of R&D spend of $35.4bn), and returns on invested capital in excess of 25%. It is an extremely profitable business which is in a strong position to benefit from the exponential deployment of artificial intelligence Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

2 Jun 2023 - Are we still catching cold when America sneezes?

|

Are we still catching cold when America sneezes? Pendal May 2023 |

|

Investors concerned about the banking crisis and recession fears in the US may be missing out on finding investment opportunities in other parts of the world, says Clive Beagles. MARKETS are watching the US closely as its banking system reels from the impact of higher interest rates on regional bank bond portfolios. Three US banks have been shuttered during the rolling crisis and regional bank shares have been volatile as markets weigh up the prospect of further failures. But the crisis has also swept up banks and markets outside the US, which may offer opportunities for investors who can keep calm amid the noise. Last week Pendal's Samir Mehta argued that the US regional bank turmoil shouldn't discourage investors from considering Asian bank stocks. Clive Beagles, a senior fund manager at Pendal's UK-based asset manager affiliate J O Hambro, has similar things to say about British bank stocks. "Many of the UK banks are posting returns on equity of close to 20 per cent in the first quarter," says Beagles. "But they all trade at a discount to book value -- some of them at 0.4 or 0.5. That includes big names like Natwest and Lloyds. "Discounts to book value for that kind of return on equity just look silly." Beagles says the US market is acting like a "rotating firing squad" that seems to be picking a different name every other day to sell off. But he believes the banks that are failing in the US are smaller players which are not globally significant. "The differential between how the US has been regulating their banks and how the UK and Europe are regulating banks is becoming ever clearer -- which is frustrating because they have been dragged down a bit by the noise. Is everyone else still catching cold when America sneezes? Beagles says the underlying concern many investors have is of a global recession triggered by a downturn in the US. "There's an old assumption that when the US sneezes everyone else catches a cold. But I do slightly wonder if it's going be different this time. "If this is a crisis, it's the first one we've had where the US dollar is going down rather than up. "Normally, you head to the dollar for safe haven status." Beagles believes the US dollar weakness indicates something different is going on from the usual global contagion. It could point to a period where the US is one of the slower-growing economies in the developed world rather than its traditional role as one of the fastest. "The banks are just a microcosm of that -- they will need more capital and need to be more tightly regulated in a slower US." Beagles also cautions against comparisons to previous banking crises. "In 2008, UK banks had tier-one capital ratios of 4 per cent. Today they have tier-one ratios of 14 per cent." Tier-one capital refers to bank's most reliable and highest-quality capital. A higher tier-one capital ratio generally suggests a bank is better equipped to absorb losses and maintain its financial stability. "In 2008, there were something like £400 billion more loans than there were deposits -- today it's the other way around. "The UK as an economy is under-geared rather than over-geared." Author: Clive Beagles, Senior Fund Manager |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

1 Jun 2023 - The maths of commercial real estate lending - April 2023

|

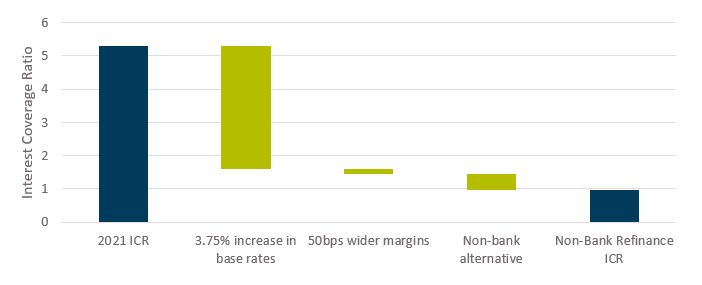

The maths of commercial real estate lending - April 2023 Challenger Investment Management May 2023 So much of financial analysis is comparative. We look for allegories; similar themes and narratives that could inform us about our current situation. In part due to the significant exposure of US regional banks to commercial real estate, risks in real estate lending markets have been front and centre of investors' minds. The obvious question is whether the stress in US commercial real estate markets could also emerge in Australia. And there is stress in the United States. As discussed in our recent quarterly review of markets the office sector is facing nationwide vacancy rates of 20%. In San Francisco, office vacancy rates are 30%, up from 3% in 2019. Average rents are almost 20% below the peak in 2019. In April, the Wall Street Journal reported on an office tower in San Francisco which was valued at US$300 million in 2019 is expected to be sold for US$60 million, an 80% decline in value over 4 years. Adding to this stress is higher interest rates and wider credit spreads. The drop in operating income and increase in cost of debt is resulting in much weaker debt serviceability. As shown below, a loan written in 2019 will struggle to cover its interest bill if current levels of interest rates and credit spreads are sustained. The maths doesn't work which is why rating agencies are downgrading deals and defaults are picking up. US Commercial Real Estate Serviceability (Office)

Here we have used the ICE BofA US Fixed Rate CMBS Index to estimate movements in interest rates and credit spreads. If interest rates increase another 100 basis points or the net operating income on the asset declines another 10% the interest coverage ratio on the loan will drop below 1 times. To get to a passing ICR for a bank loan (which we define as starting of 1.75x), new equity needs to be contributed to the deal. We estimate up to 50% of the original equity cheque would be required to right-size the bank loan. If the deal slips into the non-bank market where a passing ICR might be more like 1.15 times but the debt cost is significantly higher which reduces the required equity cheque to more like 20% with little in the way of post interest earnings available to equity. These findings tie into research from Deutsche Bank and Cohen and Steers which showed around one-third of 2023 maturities have a DSCR of less than 1.25 times[1]. Serviceability is very tight. Before we turn to Australia, it is worthwhile firstly to highlight some key differences with the U Australia Commercial Real Estate Serviceability (Office)

Again, for Australia, to get to a passing ICR for a bank (which we still define as starting of ICR 1.75x), new equity needs to be contributed to the deal. We estimate up to 20% of the original equity cheque for a bank deal. This is much better than the US in large part due to the fact that credit margins have to date held up in the bank market in Australia and rents have been stable as opposed to declining. However here if the deal slips into the non-bank market where funding margins are much wider (by >2%), Australia starts to look a lot like the US with significant equity contributions required to pass minimum ICR thresholds. So, what happens from here? It's abundantly clear there are serviceability issues in the United States and Australia. Absent equity contributions we think lenders will respond in the following ways:

The upshot of all of this is that equity valuations will likely need to come down. We all know this. The vast bulk of the market cannot be sustainably financed on existing capital structures at the current level of interest rates. But domestically we do not see a catalyst that will force a sharp revaluation across the market - as sales start to emerge through 2023 then valuations will start to adjust. This is not the not the case in the United States where the regional banking sector, a significant lender to US commercial real estate, is experiencing a meaningful tightening in financial conditions. The extend and pretend option is far less available as an option as regional banks clearly need to reduce the size of their portfolios. Nor is it available to the CMBS market which needs to be refinanced. Looking forward, we expect defaults to be heavily weighted towards deals originated during the low interest rates of 2021 and 2022 which will come due in the next couple of years. Not all the defaults will occur in the next couple of years; lenders and borrowers will extend for as long as they can see a path to recovery but the seeds for the losses have already been sown. New deals completed today will reflect the new reality of interest serviceability which at least in part will result in lower loan to value ratios and lower risk and a much improved risk return outcome. The next couple of years could well prove to be the best CRE lending opportunities since the post-GFC period. Author: Pete Robinson Head of Investment Strategy - Fixed Income Funds operated by this manager: Challenger IM Credit Income Fund, Challenger IM Multi-Sector Private Lending Fund [1] https://www.cohenandsteers.com/insights/the-commercial-real-estate-debt-market-separating-fact-from-fiction/ Disclaimer: The information contained in this publication has been prepared solely for solely for the addressee. The information has been prepared on the basis that the Client is a wholesale client within the meaning of the Corporations Act 2001 (Cth), is general in nature and is not intended to constitute advice or a securities recommendation. It should be regarded as general information only rather than advice. Because of that, the Client should, before acting on any such information, consider its appropriateness, having regard to the Client's objectives, financial situation and needs. Any information provided or conclusions made in this report, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of the Client. Past performance is not a guide to future performance. Neither Fidante Partners Limited ABN 94 002 895 592 AFSL 234 668 (Fidante Partners) nor any other person guarantees the repayment of capital or any particular rate of return of the Client portfolio. Except to the extent prohibited by statute, Fidante Partners or any director, officer, employee or agent of Fidante Partners, do not accept any liability (whether in negligence or otherwise) for any errors or omissions contained in this report. |

31 May 2023 - A fundamental change for AI?

|

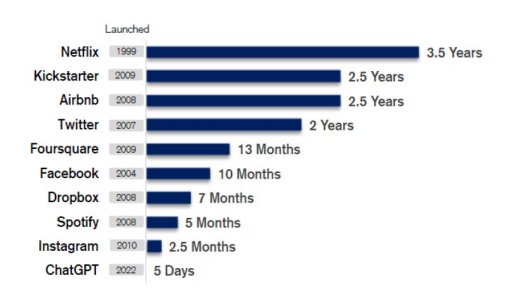

A fundamental change for AI? Nikko Asset Management May 2023 A new spark in AI It is said that artificial intelligence (AI) will revolutionise societies in a way fire transformed humanity in the prehistoric era. Akin to a spark that triggers a wildfire, the ushering in of ChatGPT in late 2022 has ignited an explosion of enthusiasm among the masses towards generative AI, potentially kickstarting a new era of rapid growth for machine learning. Amazingly, it took less than a week for ChatGPT—a free-to-use AI chatbot developed by Microsoft-backed OpenAI— to become the fastest-growing consumer application (app) in history when active users reached a million in just five days following its low-key launch in late November 2022 (see Chart 1). Chart 1: ChatGPT achieves 1 million users in record time

Source: Statista Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security.Nor should it be relied upon as financial advice in any way With the ability to create original jokes, write essays on any topic and even offer tips on relationships, ChatGPT has been on everyone's lips of late after becoming an overnight sensation. In a flash, ChatGPT has enlivened the consumer market for generative AI, which produces different types of content (including texts, images, sounds and other forms of data) on a prompt. Inadvertently, it has also triggered fresh competition among technology heavyweights in their AI offerings. Hot on the heels of OpenAI, some of the world's biggest technology platform companies have in recent months skurried to roll out their own version of AI tools to either take on ChatGPT or ride the popularity of this all-the-rage generative AI chatbot. In February 2023, software giant Microsoft rolled out a new version of its search engine Bing (with a new Bing AI chatbot), powered by GPT-4, an upgraded version of the same AI technology that ChatGPT uses. In March, searchengine behemoth Google launched its AI chatbot called Bard, after declaring a "competitive code red" in January, and Chinese search engine Baidu unveiled the Ernie Bot, which is powered by its own deep-learning model. Not to be outdone, Alibaba Cloud, the Chinese e-commerce giant's cloud computing arm, rolled out a similar AI chatbot called Tongyi Qianwen in April, and the list goes on. To be sure, the excitement about AI and the deep learning capability of machines are not new; we have been talking about these technology buzzwords for the past 20 years. But relative to five years ago, AI is at a point where it is becoming all-encompassing and moving rapidly up the s-curve (an s-shaped graph that represents a start, exponential growth and eventual plateauing over a period of time). Generative AI is already here, and rapid progressions are also taking place in other key areas of interest in next generation AI, such as self-supervised learning, decision intelligence, responsible AI and advance virtual assistants, as well as human-machine touchpoint augmentation—namely multimodal user interface, Internet of Things devices integration and voice biometrics. Exponential growth of AI kicks in In our view, AI is now near the exponential growth area of the s-curve, and it is surprising people in terms of the speed of its evolution. As investors whose investment philosophy is focused on fundamental change, we are excited about the opportunities that have emerged with the recent advancement of AI. As we see it, AI growth beneficiaries can be found not only in the developed world but also in Asia. Evidently, ChatGPT's meteoric rise to fame and its ability to draw millions of active users to its AI chatbot in a short span of time have hastened big tech companies (big techs) to offer and monetise their state-of-the-art AI tools to multiple platforms, including the enterprise-focused and consumer-centric ones. This intense competition is seen leading to more spending in the area of high-performance computing and the production of AI-focused microchips, such as graphics processing units (GPUs) and application-specific integrated circuits (ASICs), all of which are expected to benefit the high-end chipmakers. In a recent report, market intelligence firm IDC estimates that worldwide spending on AI, including hardware, software and services for AI-centric systems, will hit US dollar (USD) 154 billion in 2023, up 27% from 2022. According to IDC, the global AI spending will surpass USD 300 billion in 2026, and the current integration of AI into numerous products will result in a compound annual growth rate (CAGR) of 27.0% from 2022 to 2026.

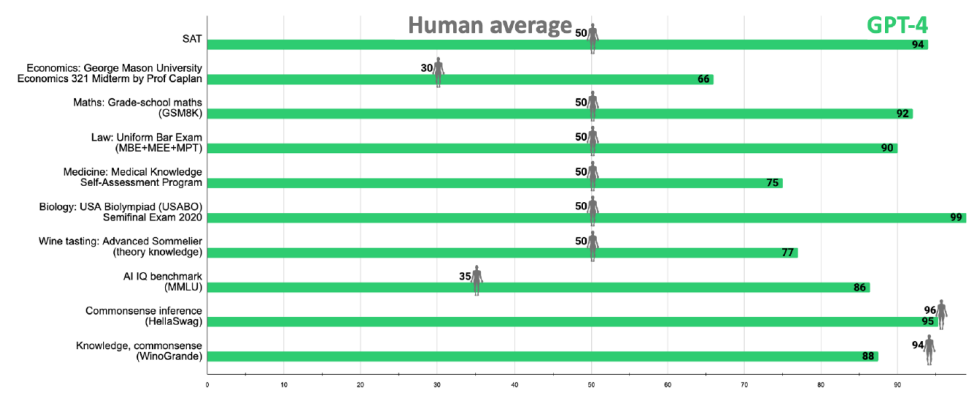

AI models getting better with higher efficiency and lower costs Many AI foundational models or neural networks, where huge amount of data is processed and unsupervised machine learning/trainings are carried out, have achieved significant progress and are becoming highly efficient in recent years. For example, OpenAI's newly-launched GPT-4, which is able to analyse and comment on graphics and images, has improved considerably from its previous version called ChatGPT-3.5 that is primarily text-focused. Research1 has shown that GPT-4 has 53% less hallucination (responses by AI that sound plausible but are either incorrect or nonsensical) and is 110% more truthful (degree of AI's ability not to produce untruthful content) as compared to

ChatGPT-3.5. Furthermore, this newest version of OpenAI's multimodal model has a pass rate of about 90%2 for the Uniform Bar exams (compared to 10%2 of GPT-3.5), amongst others (see Chart 2). Foundation models generally need to be at an optimisation level, without too many parameters and data points, to be efficient. By and large, the more specific the parameters are, the better outcomes a model will generate. As efficiency increases over time, the costs of training an AI model will come down. The training costs for ChatGPT-3 (an earlier version of OpenAI's AI model released in June 2020), for instance, were significantly lower than those of Google's DeepMind AI model, which was acquired by the tech giant in 2014. Chart 2: ChatGPT-4 versus human exams

Source: https://lifearchitect.ai/iq-testing-ai/, Dr Alan D. Thompson Monetising AI Among the big technology platform companies, Microsoft currently has a big advantage in AI due to its longstanding partnership with OpenAI, which has helped the US software heavyweight commercialise and monetise advanced AI technologies and tools as premium services on its platform. Microsoft was early to the party in terms of launching AI models on its platforms and getting these models embedded into its different suite of product offerings. The first was Microsoft's GitHub, a programmer's app used to set up new apps and businesses. In 2021, Copilot—a cloud-based AI tool developed by GitHub and OpenAI—was launched as a subscription-based service to support GitHub users via several additional assistive features. In February 2023, Microsoft also embedded more AI-powered capabilities—leveraging on the Azure OpenAI service and GPT—to its customer relationship management system called Viva Sales, which was launched in 2022. Microsoft is also offering premium services that give access to AI tools of OpenAI. Microsoft Teams (a communication platform), for example, is going into a premium structure, bundling existing features with access to OpenAI's models as well offering real time or immediate translation across 40 languages. The holy grail for Microsoft is to bundle AI tools with Office 365, and observers are expecting that to come through in the near future. Office 365 apps already have suggestive functionality but more of such features are expected to be added going forward, such as a possible virtual AI assistant, powered by OpenAI's models, for users willing to pay for such premium add-ons. On the whole, Microsoft, which is charging significant premiums on its platforms with AI functionality, is seen to have a competitive edge relative to other big technology platform companies when it comes to commercialising its AI capabilities.

Feeling the pressure after having invested a lot of money in AI, Google, which recently rolled out AI chatbot Bard, is trying hard to keep up in the AI race after having lost the first mover advantage to OpenAI and Microsoft. Facebook and Microsoft. In the Asia region, one big technology platform company that we believe is well positioned in terms of AI capabilities is Baidu, which has the most competitive AI product offerings among the Chinese competitors, in our view. Hardware producers and chipmakers riding the AI growth The rapid advancement of AI technology has brought about a surge in the production of AI-microprocessors, AI accelerators (or specialised hardware/computer systems designed to accelerate machine learning applications) and many other hardware that enables high performance computing, which is the ability to process data and perform complex calculations at high speed. This trend is likely to gather pace, benefiting many high-end chipmakers and AIfocused hardware manufacturers. For the high-end hardware and AI-centric microchip markets, American GPU manufacturer Nvidia Corporation and Taiwanese chip manufacturing giant Taiwan Semiconductor Manufacturing Company (TSMC) are best positioned to ride the AI boom, as the go-to suppliers for AI-focused tech companies, in our view. Among the AI processors, which commonly include GPU, ASIC and field programmable gate array (FPGA) chips, the relatively low-cost GPUs are currently most widely used for deep learning applications due to their high parallel computing power and ability to handle large amounts of data. Nvidia has dominated the global AI GPU market as the world's leading supplier with over 80% of market share.The most customised and resource-heavy ASIC and FPGA chips are more expensive to design and manufacture as compared to GPUs, which are considered a mass market, off-the-shelf type of processors. Producers of these two customised AI-centric chips are also not able to upscale the way Nvidia is doing for GPUs. The global GPU market, estimated at more than USD 40 billion in 2022, is expected to grow at a CAGR of 25% from 2023-2032, according to global market research firm Global Market Insights in its February 2023 report. In the high-end semiconductor market, TSMC, with a near monopoly on the production of three-nanometre cuttingedge chips, appears well poised for growth as AI takes off. To begin with, Nvidia uses TSMC as the main foundry for the production of GPUs and all of its high-end processors. The Taiwanese chipmaking titan also leads as the main foundry for ASIC chips for tech hyperscalers, such as Google, Intel/Havana, Amazon and others. Chips for highperformance computing (HPC) now accounts for over 40% of TSMC's sales and that trend will most likely continue in 2024 and 2025, in our view. Logic chips, which are generally considered the "brains" of tech equipment and devices, process information to complete tasks. Central processing units (CPUs), GPUs and neural processing units (designed for machine learning applications) are examples of logic chips. A decade ago, Intel was the dominant producer of logic chips. Since then, TSMC, which is the largest foundry company in the world with over 45% of market share in logic chip production, has taken the market away from Intel, and that trend is accelerating today, given the strong demand for high-end logic chips. Other key beneficiaries of the AI boom Alchip, which focuses mainly on the designs of ASIC microchips, benefits from the outsourcing trend of global big tech companies, many of which are pushing into chip production for their internal HPC, AI and machine learning needs. Likewise, Accton is expected to gain from the increasing demand for higher bandwidth and greater speed for networking connections as AI technology proliferates and low latency in computing networks takes off. As a large player in the white box server switch market, Accton will profit from an imminent switch to 400G cloud infrastructure, in our view. With four times the maximum data transfer speed over 100G, 400G is the next generation of cloud infrastructure, offering solutions to increasing bandwidth demands of network infrastructure providers. Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way Geopolitical risks In October 2022, the US barred its domestic firms—including major chipmakers—from supplying semiconductor chips and processor-making equipment to Chinese companies. In late 2022, the US government broadened its crackdown on Chinese technology companies by adding over 20 Chinese firms in the AI chip sector to the US Commerce Department's restricted entity list. The US has shown that it will continue to aggressively legislate in the AI and chip segments and may add more companies (particularly those from China) to the US Entity List, which adds another layer of risk for the Asian semiconductor and hardware sectors. At the moment, Chinese technology platform companies have limited access to high-end microchips manufactured by US chipmakers, and as chip upgrades continue to progress, the Chinese players could find themselves further behind the technology curve. Conclusions and ESG considerations We are just beginning to understand the impact of AI on other industries outside of technology and its implications on data ownership, utilisation of information and human rights. AI technology, for instance, is likely to have huge effects on labour forces, with the potential to displace many white-collar jobs. At the same time, widespread adoption of AI can have an impact on the environment as AI models and algorithms require substantial computing power, which in turn consumes considerable amounts of energy. All in all, there are AI-related ESG risks as well as legislation threats to consider when investing in AI companies, which could potentially be subject to increasing restrictions in the future. For now, we are selective on Chinese AI companies but remain constructive on South Korea's and Taiwan's technology leaders, especially the AI growth beneficiaries—which we believe represent a significant fundamental change to be harnessed for years to come. Author: Timothy Greaton, Senior Portfolio Manager Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information |

30 May 2023 - Glenmore Asset Management - Market Commentary

|

Market Commentary - April Glenmore Asset Management May 2023 Globally equity markets were mixed in April. In the US, the S&P 500 rose +1.5%, the Nasdaq was flat, whilst in the UK, the FTSE 100 rose +3.1%. In Australia, the ASX All Ordinaries Accumulation Index rose +1.8%. Top performing sectors were Real Estate, Technology and Industrials, whilst materials significantly underperformed, driven by fears around the Chinese economy and a sharp decline in the iron ore price. Of note, gold stocks continued their stellar performance in recent months. Bond yields in the US and Australia were broadly flat over the month. Commodities were weaker, with coal (thermal and coking), copper, iron ore and oil prices all declining. Regarding monetary policy in Australia, after 10 hikes in a row since May 2022, the RBA paused in April, stating a desire to see what impact the recent rate rises are having on the economy. To recap, the RBA has increased the official cash rate by 350 basis points or 3.5% in less than a year, the fastest tightening cycle on record. Inflation in Australia is currently ~7%, which continues to be well above the RBA's targeted range of 2%-3%, however there are some early signs that it may have peaked. At this point, it is difficult to forecast how the central banks will approach the current environment where inflation is still too high, albeit showing clear signs of moderating. Realistically we believe more rate hikes may be needed over the next 6-12 months, however we believe we are near the end of the rate hiking cycle. On a more positive note, and of more relevance for equity investors, we continue to see increasingly attractive valuations across a wide range of small to mid cap stocks on the ASX, where investor sentiment remains weak due to uncertainty around the earnings impact from the interest rates rises over the last 12-18 month. Funds operated by this manager: |

29 May 2023 - Investment Perspectives: The housing market's turning - and not just in Australia

26 May 2023 - The Rate Debate - Ep38 - Mixed signals from RBA creating market confusion

|

The Rate Debate - Ep38 Mixed signals from RBA creating market confusion Yarra Capital Management April 2023 Hitting the economy with surprise after surprise, the RBA takes another fresh assault to tackle inflation head-on by taking the cash rate to 3.85%. Continued mixed signals from Australia's central bank are causing havoc within the domestic economy. With the RBA not ruling out further rate hikes, Darren and Chris look into the impact on markets and discuss their thoughts on the future of the RBA in episode 38 of The Rate Debate. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

25 May 2023 - Changing of the Guard: Re-shoring to Drive a Manufacturing Resurgence

|

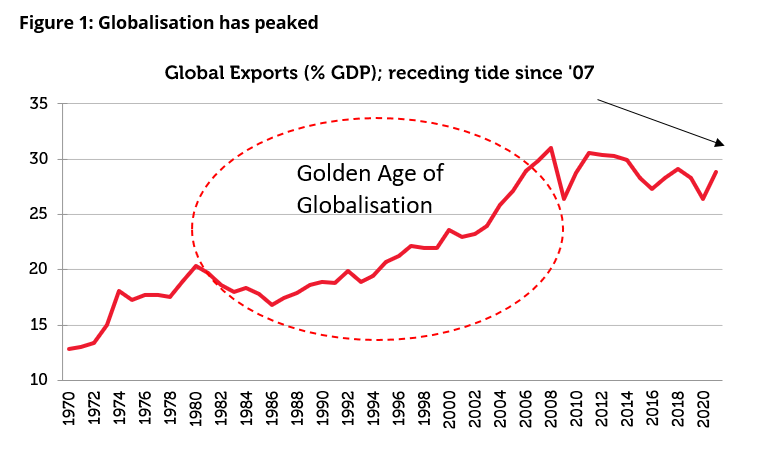

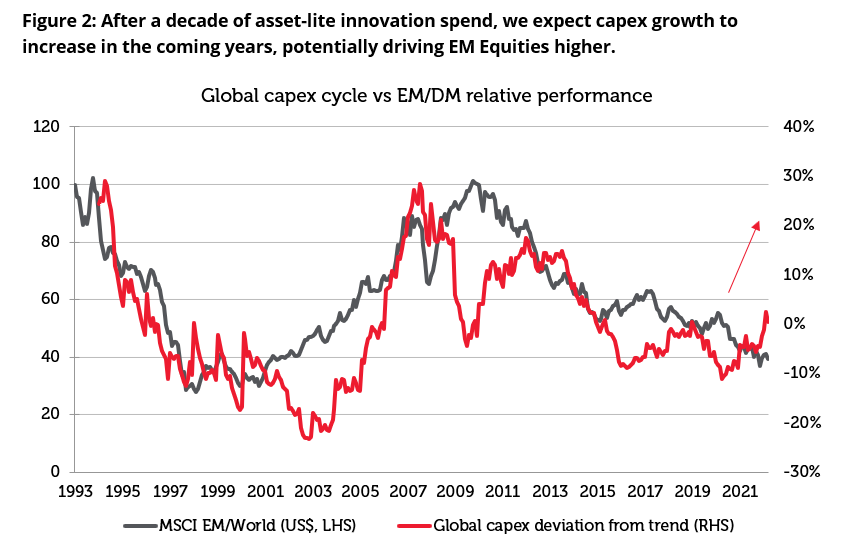

Changing of the Guard: Re-shoring to Drive a Manufacturing Resurgence Redwheel (Channel Capital) May 2023 Over the past decade we have seen more investment in asset-light innovation and technology than in any previous business cycle. The world is now awash with food delivery apps and online gaming and video streaming services. This investment has generally been driven by low inflation and a low cost of capital. However, we believe that the world is now entering a new asset-heavy economic cycle characterised by higher inflation, positive real interest rates and increased tangible capex as the world's priorities shift towards more spending on defence, renewable energy and localised manufacturing supply chains. As the macro environment is changing, we believe that the geopolitical environment is also evolving in a way that is very different to the one that shaped the secular bull market in trade of the 1990s and 2000s. In 1986, the pivotal Uruguay Round of the General Agreement on Tariffs and Trade (GATT) marked the start of a new era of globalisation. World trade expanded rapidly following the collapse of the Berlin Wall in 1989 and the signing of the North American Free Trade Agreement (NAFTA) in 1994. India joined the World Trade Organisation (WTO) in 1995 and China finally gained entry in 2001. Between 1995 and 2010, the pace of world trade grew at twice the rate of world GDP.[1] The outsourcing of manufacturing to cheap labour regions of the world along with the lower cost of importing capital goods back to the West dramatically boosted world trade. This benefitted countries such as Germany and the US.

Source: World Bank as at 06/03/2023. The information shown above is for illustrative purposes. Past performance is not a guide to future results. The peak of globalisation coincided with the financial crisis in 2008. Since then, world trade has slowed and trade as a share of GDP has moderated. We expect that this slower trend will continue after the Covid pandemic and the conflict in Ukraine revealed the fragility and over reliance on crucial supply chains in certain countries. The focus on de-carbonisation and increased geopolitical considerations are likely to result in a move towards greater regionalisation and onshoring which should drive capex growth. We believe that one of the more important aspects of de-globalisation relates to the security vulnerabilities created by potential economic dependence on strategic rivals such as Germany's reliance on Russia for the majority of its oil supply. As a result, supply chain security is being prioritised over the cost of production. With globalisation leading to deeper global trading relationships, we believe that unwinding these connections will create long-lasting effects on the global economy and financial markets. This will negatively impact developed markets as a more localised production base will likely raise the costs for most corporates in the developed world. On the other hand, Emerging markets (EM) should see a net benefit on the back of Foreign Direct Investment (FDI) inflows into various regions and increasing capex.

Source: Redwheel, CLSA, Datastream - Refinitiv as at 16 March 2023. Past performance is not a guide to future results. The information shown above is for illustrative purposes.

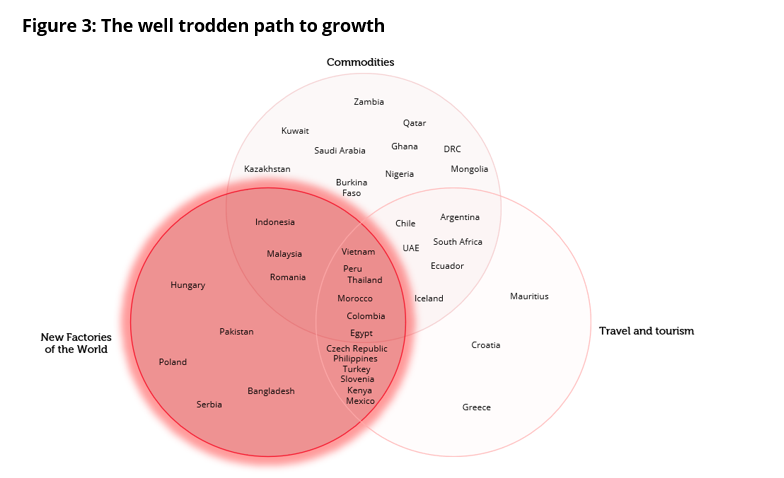

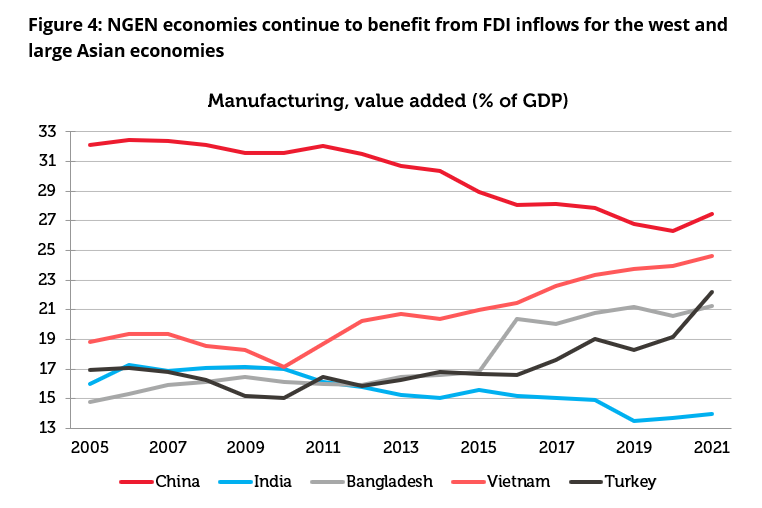

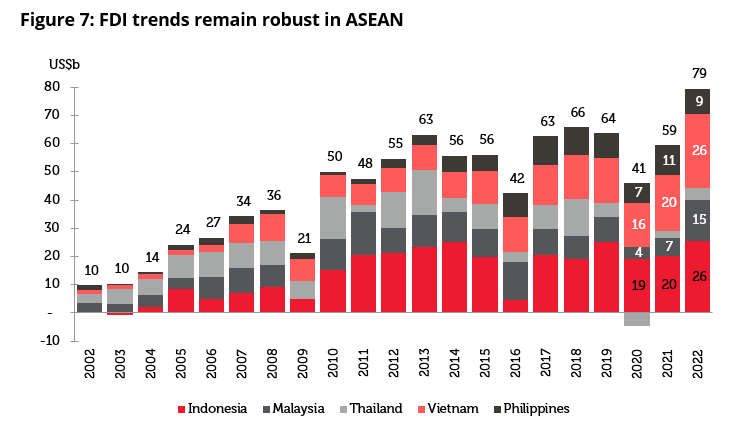

Source: Redwheel as at 28/02/2023. The information shown above is for illustrative purposes. The Beneficiaries: Next Generation Emerging (NGEN) MarketsOne of the most powerful ways that a country can develop its internal resources and realise its true longterm potential is by establishing an urbanised working population. This requires investment in manufacturing capabilities so that the workforce can shift from agrarian roots to a developed, salaried existence. Urbanisation drives consumption as local economies grow and consumers look to increase spending in property and durable goods, such as cars and appliances. China represents one of the most striking examples of this transformation. Its manufacturing capacity grew exponentially over the last twenty five years and created enough jobs to lift 750 million people out of poverty and into urban life.[2] Over the same time, its share of global manufacturing has risen from approx. 4% in 2000 to nearly 29% today.[3] As the US and Western Europe reduce their dependency on China, we expect this relocation of supply chains to benefit Latin America, Eastern Europe and the ASEAN region in the same way. The US has shifted its stance towards China and introduced policies that encourage re-shoring as illustrated by the Inflation Reduction Act and the CHIPS Act. Given the size of the Chinese export pie — almost ~US$600 billion p.a. is from the US alone — the emergence of new ecosystems represents a very significant opportunity for Next Generation Emerging Markets.[4] The US, Europe and Japan have remained important FDI sources for Next Generation Emerging Markets (NGEN), contributing significantly to the upswing since 2021. However, FDI from China, Taiwan and Korea has risen strongly with this bloc's contribution to ASEAN inflows rising the most over the past decade as North Asian markets move up the value chain.

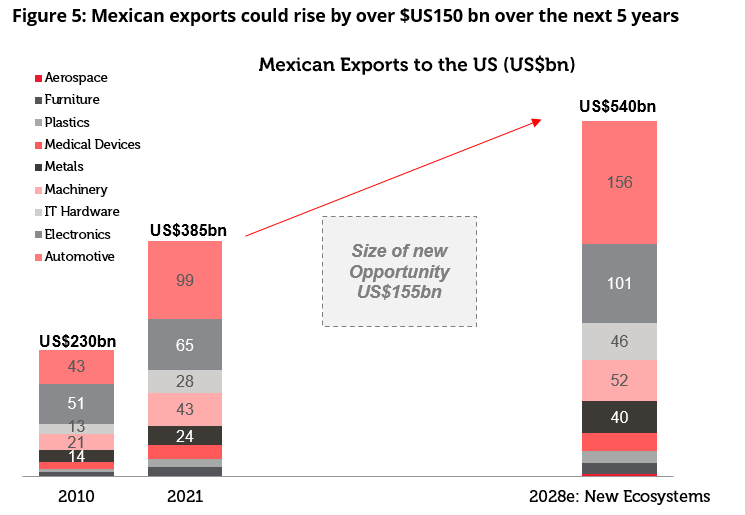

Source: World Bank as at 01/03/2023. Past performance is not a guide to future results. The information shown above is for illustrative purposes. MexicoGains from nearshoring could be transformational for Mexico's economy. Mexico's manufacturing exports (currently ~40% of GDP) could enter a new era of expansion on the back of accelerated growth in existing manufacturing clusters and the rise of new ecosystems.[5] We estimate that Mexican exports could rise by US$155bn (or more than 10% of GDP) over the next 5 years. This includes gains in well-established sectors, those associated with intra-United States, Mexico and Canada trends (US$38bn) and those specifically related to firming IT hardware and new clusters such as batteries, as well as electric vehicles and parts (US$22bn). Mexico is already taking export and manufacturing share from Asian economies to support the US and Canada, and as a result, macro and regional evidence show that we are well into the expansion of current ecosystems. There are a several key signposts ahead including progress on United States Mexico Canada Agreement (USMCA) disputes, the outcome of Mexico's 2024 presidential elections, the transition to Electric Vehicles (EVs) and the impact of the Inflation Reduction Act on the US auto industry. A great example of this ecosystem expansion is Tesla's recent announcement to build their new factory in Nuevo León which is one of the northern states of Mexico. The five billion dollar investment will aim to create 6,000 jobs and is the largest single investment in Mexico.[6] Beyond the numbers, this highlights Mexico's strategic role as the US diversifies away from China and moves away from fossil fuels. There are many direct and indirect beneficiaries from these types of inbound investments, ranging from banks such as Banorte to the industrial parks sector led by the Fibras and Vesta. Supply/demand dynamics in the Mexican industrial space are already tight due to the nearshoring structural shift that is driving a manufacturing boom. Looking forward, we estimate the $155 billion of incremental exports (over a 5Y period) would require at least 13 million square meters (sqm) of incremental industrial space — of which only 2 million sqm is under construction. Hence, Mexico is short at least ~11 million sqm of required Gross Leasable Area (GLA). More broadly, higher construction and manufacturing activity are all positive demand drivers for construction related companies in Mexico like cement stocks.

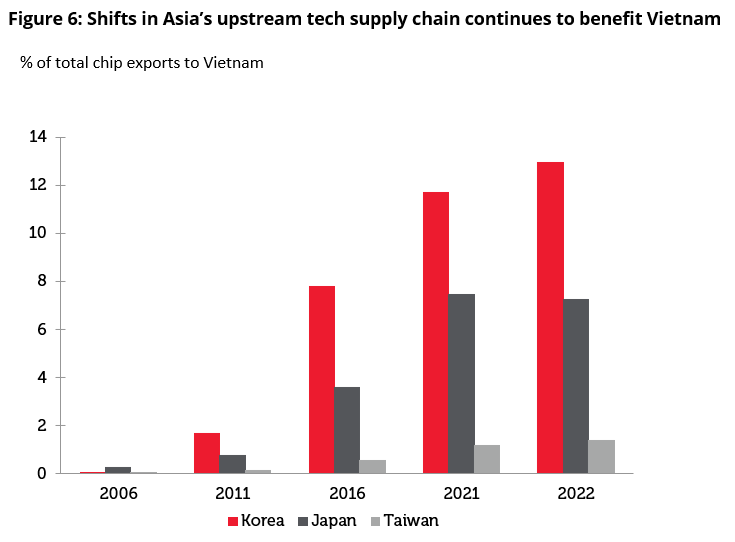

Source: US Census Bureau, Redwheel as at 28/02/2023. Past performance is not a guide to future results. The information shown above is for illustrative purposes. VietnamVietnam is now an established example of supply chain relocation. As a result of the sustained industrial development in Vietnam over the past decade, Vietnam's manufacturing output share of GDP has risen from 17% in 2010 to 24% in 2022.[7] Even though Vietnam's inbound FDI growth has slowed recently the absolute figure is still substantial and has increased as a share of the global aggregate, rising from 0.1% in 2000 to 1.6% in 2020. FDI disbursement in Vietnam also strengthened in 2022.[8] Of all the ASEAN nations Vietnam's ties to North Asia have deepened the most during the period. By 2018, China and Korea's value-added contributions to Vietnam's exports of manufactured goods were 30.7% and 11.7%, respectively.[9] There seems to be room for capacity growth in Vietnam as its manufacturing output share is still below that of Thailand's. Moreover, we think Vietnam should continue to gain in areas such as downstream lower-end manufacturing from China given the combination of China's industrial upgrading and declining working-age population as well as Vietnam's comparative advantages in these sectors. Longer term, Vietnam's strong pursuit of free trade agreements bode well for its ability to move up the value chain. In addition, Vietnam is supported by a relatively large workforce that is young and educated. Shifts in Asia's upstream tech supply chain also indicate some of Vietnam's increased electronic trade flows. As seen on the chart below Vietnam's share of chip exports from Korea, Taiwan and Japan continues to grow.

Source: Credit Suisse as at 28/02/2023. Past performance is not a guide to future results. The information shown above is for illustrative purposes. Over the last decade, Samsung has moved a large portion of its electronics manufacturing from South Korea and China to Vietnam. The company has invested almost $20bn in Vietnam and currently operates six factories along with a research and development centre based in the country. Today, Vietnam accounts for nearly half of Samsung's mobile phone production globally and in turn Samsung accounts for nearly one fifth of all Vietnam's exports.[10] Another example is Apple Macbooks moving production from China to Vietnam with the assistance of its top supplier, Foxconn. The company is moving forward with its plan to eventually end its reliance on China to manufacture many of its products including iPhones, AirPods, HomePods and MacBooks. Production of MacBooks in Vietnam is said to begin as early as May 2023. Once the assembly lines start operations in Vietnam Apple will have a second manufacturing base for its flagship products. A key beneficiary of this shift to Vietnam is Hoa Phat Group due to the increased demand for infrastructure needed to build out the manufacturing hubs. Hoa Phat Group is the largest steel manufacturer in Vietnam with a market share of around 32.5%.[11] We believe that the improvement in cash flow will reflect in the company's financials in 2023 and 2024. MalaysiaSince 2019, Malaysia has experienced the fastest rise in annual FDI inflows as a percentage of GDP in the ASEAN region.[12] The country's manufacturing output has increased more than that of neighbouring nations during the same period and has pushed up the trade surplus. Additionally, the increase in FDI likely reflects an expansion of distribution facilities and Malaysia's increasing role as a trans-shipment hub. Malaysia's position in the middle of semiconductor supply chains and a comparatively high export overlap with China versus the rest of ASEAN should allow it to gain from regional integration. Additionally, its geographical advantage and increased capacity in global distribution and processing activities lend structural support to boost its manufacturing activity. We believe that the recent pick-up in FDI can be sustained especially if the new coalition government can provide a more stable political environment than the period following the 2018 election and perceived reputational risks relating to forced labour issues improve. Going forward, Vietnam and Malaysia look well placed to remain the main ASEAN beneficiaries of supply chain shifts. Idiosyncratic improvement of IndonesiaIndonesia continues to make inroads in raw material processing. Recent gains reflect the offshoring of basic materials production from China, which could persist as it seeks to achieve carbon neutrality by 2060. Speaking of this trend, FDI inflows from China have jumped since 2016 and now represent the largest source of FDI for Indonesia after Singapore.[13] Indonesia will likely see continued FDI inflows as part of its venture into the supply chain for decarbonization metals and electric vehicle batteries. We are also optimistic with regarding the outlook for investment into the basic material industries more broadly, given the energy cost and drastic cost escalation of manufacturing in Europe. Additionally, the government have placed certain restrictions on some of Indonesia's mining exports, amid increased investment to expand capacity and move further downstream, also point to greater metals value added. Indonesia holds the world's largest nickel reserves and significant production of this metal and other metals, such as copper, is set to come on stream over the next three to five years. Hence, there is good scope for Indonesia to have an increased role in EV supply chains through providing key battery inputs and potentially production assembly.

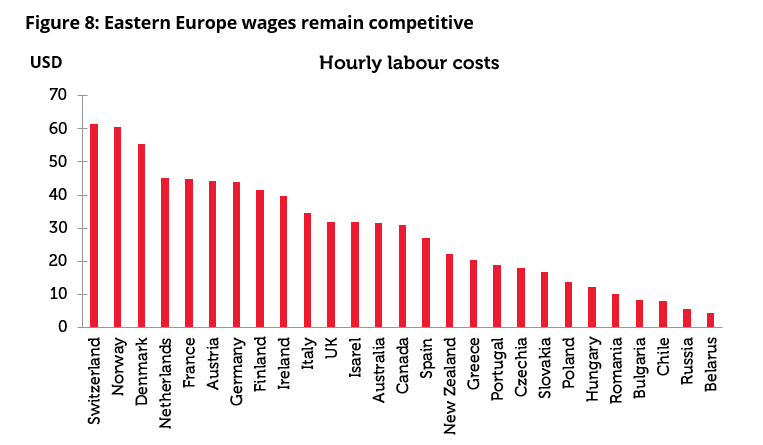

Source: Governments, World Bank, Macquarie Research 28/02/2023. Past performance is not a guide to future results. The information shown above is for illustrative purposes. Eastern Europe and North AfricaThe diversification of supply chains should also benefit countries in Eastern Europe and North Africa. Despite relatively higher labour costs compared to LATAM and ASEAN peers, its geographical proximity to Western Europe, higher quality of production and the shortened delivery times can compensate for the labour-cost gap among these countries. Despite increases in labour costs, labour costs in Central and Eastern Europe (CEE) countries remain around one third of those in Germany.[14]

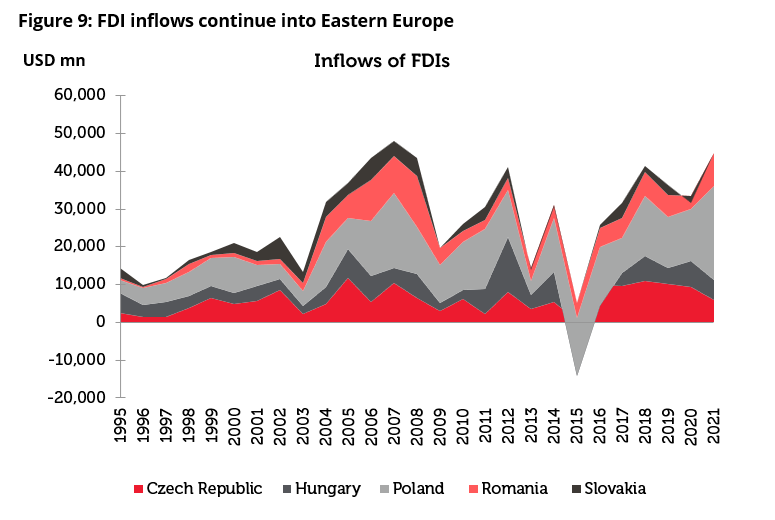

Source: Citi, International Labour Organisation as at 31/12/2022. The information shown above is for illustrative purposes. *Hourly labour costs in US dollars converted using 2017 purchasing power parities (PPP $) and exchange rates (US $), latest year In May 2020, the Polish Institute of Economy published a report indicating that the CEE countries could gain up to $22 billion annually following relocation of production from China. The CEE countries that are set to gain the most relatively from this trend are Slovakia, Poland, Czech Republic and Hungary. The chart below shows a substantial rise in FDI inflows in the CEE region over recent years. Poland stands out as the largest nominal recipient of FDI inflows (though mostly because of the size of its economy). CEE economies are certainly punching above their weight in terms of being an attractive FDI destination. For example, UNCTAD data allows us to estimate that the CEE region accounted for 6% of the value of all announced FDI projects globally in 2021, which is significantly more than the region's share of global GDP (1.6%) or total population (~1.1%).

Source: UNCTAD, FDI/MNE database (www.unctad.org/fdistatistics). Past performance is not a guide to future results. The information shown above is for illustrative purposes. An example of the on-going shift of manufacturing into the CEE region is found in automobile production. Romania, the Czech Republic and Morocco now produce more passenger vehicles than more developed economies, such as Italy. Companies such as Peugeot, Renault and Jaguar Land Rover have all shifted production to lower cost locations, and we expect this trend to continue. We see the banking sector as the biggest beneficiary in Eastern Europe. There is currently low leverage in the economy meaning that the banks have the capacity to outgrow GDP growth.[15] ConclusionThe development of a manufacturing economy and an urbanised workforce is a well-trodden path. We have seen it before, and we expect that we will see it again. The Asian "Tiger" economies of Hong Kong, Singapore, South Korea and Thailand enjoyed rapid growth as they developed manufacturing industries and grew employment in the 1980s and 1990s. In the early 2000s, China then took over the helm as the world's low-cost manufacturer and underwent a similar industrial transformation, growing its manufacturing capacity exponentially. With the world now looking to diversify its supply chains and to reduce its reliance on China, we believe it will be the next generation emerging market economies which will emerge as the greatest beneficiaries of this new shift in global manufacturing supply chains. Vietnam is currently among the front-runners of this new wave but other Asian economies such as Malaysia and Indonesia look well-positioned to attract continued inward investment as they develop strong manufacturing bases and expand employment opportunities. Elsewhere in the world, Mexico, the Czech Republic, Morocco and Hungary look similarly well placed to benefit from reshoring over the coming years. Over the last thirty years in emerging markets we have seen the positive effect which higher employment has on a country's economic development from Korea to China. We now look forward to the Next Generation of Emerging Markets to continue along this well-trodden path to prosperity and economic growth. |

|

Funds operated by this manager: CC Redwheel Global Emerging Markets Fund, CC Redwheel China Equity Fund Sources: [1] World Bank and Bloomberg, as at 30 April 2023 [2] World Bank & IMF, as at 30 April 2023 [3] Bloomberg, as at 30 April 2023 [4] Morgan Stanley, US Census Bureau, 30 April 2023 [5] Tellimer and WorldBank, 30 April 2023 [6] Tesla, 30 April 2023 [7] World Bank, 31 January 2023 [8] World Bank, 31 January 2023 [9] World Bank, April 2023 [10] Samsung Company Reports, 30 April 2023 [11] Hoa Phat Group Company Reports, 30 April 2023 [12] World Bank & IMF, 31 Jan 2023 [13] Credit Suisse, April 2023 [14] Governments, World Bank, Macquarie Research, April 2023 [15] Peugeot, Renault, JLR, Company Reports, April 2023 Key information: No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor's investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only. |

24 May 2023 - Momentum is Building in Aged Care

|

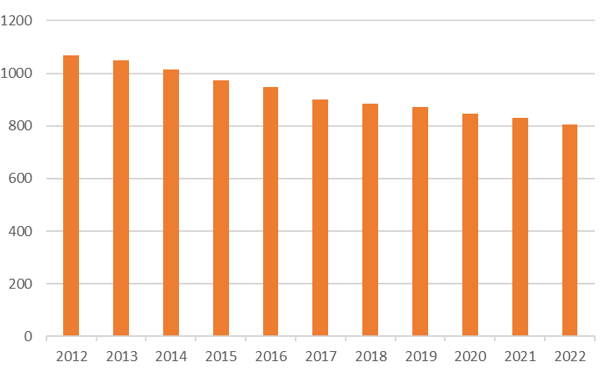

Momentum is Building in Aged Care Novaport Capital May 2023 With established investments in both of Australia's listed residential aged care providers, Estia Health and Regis Healthcare, our positive outlook for the sector is informed by three factors. Firstly, advanced age is associated with complex and ongoing care needs which Residential Aged Care is uniquely positioned to provide. Secondly, Aged Care operators with established processes to consistently deliver care (meeting ever more demanding standards) have a clear opportunity to consolidate what is currently a fragmented sector. Finally, the demographic tailwind provided by a growing and ageing population supports demand growth for the foreseeable future. Aged Care Industry Consolidation - Number of Providers

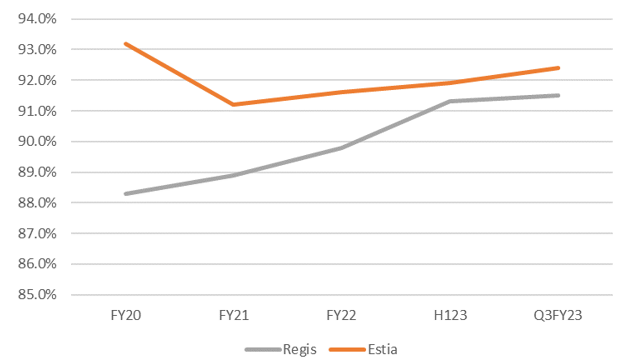

Source: Regis Healthcare In recent years the sector had to navigate challenges including a squeeze in funding, the Royal Commission and COVID-19; however recent operational updates from the listed providers as well as an announcement from the Federal Government, highlights how positive momentum is building in the sector. Funding ClarityOn 4th May 23, the Australian Government outlined how it will fund a 15% Aged Care workforce pay increase proposed by the Fair Work Commission. It is offering a meaningful increase in the AN ACC daily funding rate (rising to over $240 per resident) as well as a 'hotelling supplement' of $10.80 (per resident per day) to cover increased wages for aligned staff such as chefs. The funding increase is expected to pass through to workers in the form of higher wages, yet it reflects a positive outcome for the sector overall. It resolves a major uncertainty has dogged the sector since the Fair Work Commission first proposed wage increases for Aged Care employees. It also indicates the current government's commitment to sustainably reform the sector. Providing financial incentives for workers to commit to a career in Aged Care should support improved quality of care and customer satisfaction. In the past, low wages have repelled workers from Aged Care and operators became increasingly reliant on temporary employment agencies to fill rosters. The margins charged by these agencies are high, therefore the financial burden of using agency staff has been punitive for operators. Stabilising the workforce represents a meaningful opportunity for Aged Care operators to improve their financial performance. Operating Metrics ImprovingRecent updates from both the listed Aged Care operators shows they have made good progress on driving operational improvement. Occupancy is trending higher following several years disrupted by the Royal Commission and then Covid-19. Higher occupancy drives both revenue and margin.

Source: Regis Healthcare Ltd, Estia Health Ltd The sector has is also making progress adapting to the AN ACC funding reforms. Following substantial changes to the funding model, Aged Care operators can now refine their operations to ensure they are adequately funded to provide better quality care to residents. Resolving the uncertainty about the funding structure has enabled operators to develop platforms and models to deliver sustainable care. Author: Sinclair Currie, Principal and Co-Portfolio Manager Funds operated by this manager: NovaPort Microcap Fund, NovaPort Wholesale Smaller Companies Fund This material has been prepared by NovaPort Capital Pty Limited (ABN 88 140 833 656 AFSL 385 329) (NovaPort), the investment manager of the NovaPort Smaller Companies Fund and the NovaPort Microcap Fund (Funds). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante) is a member of the Challenger Limited group of companies (Challenger Group) and is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable to your circumstances. The Fund's Target Market Determination and Product Disclosure Statement (PDS) available at www.fidante.com should be considered before making a decision about whether to buy or hold units in the Funds. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. NovaPort and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, NovaPort and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties. Fidante is not an authorised deposit-taking institution (ADI) for the purpose of the Banking Act 1959 (Cth), and its obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante. Investments in the Fund(s) are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group. |

23 May 2023 - Australian Secure Capital Fund - Market Update April

|

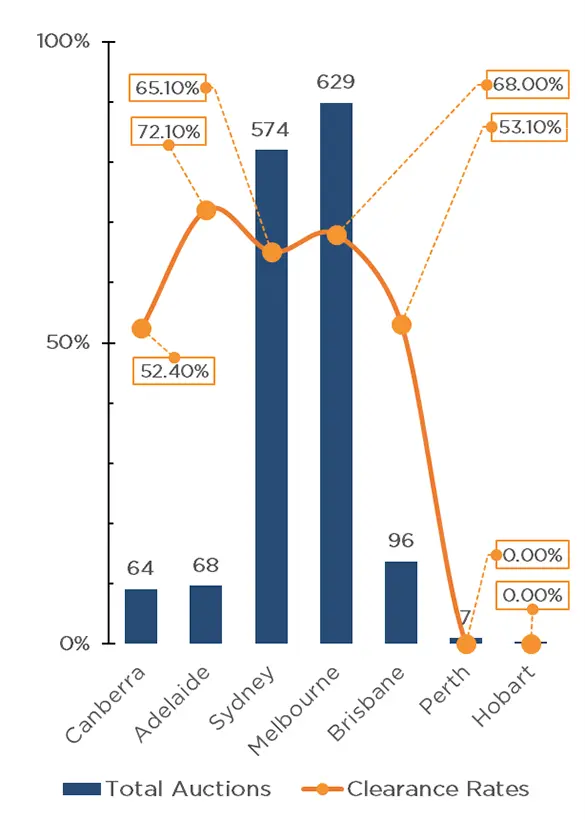

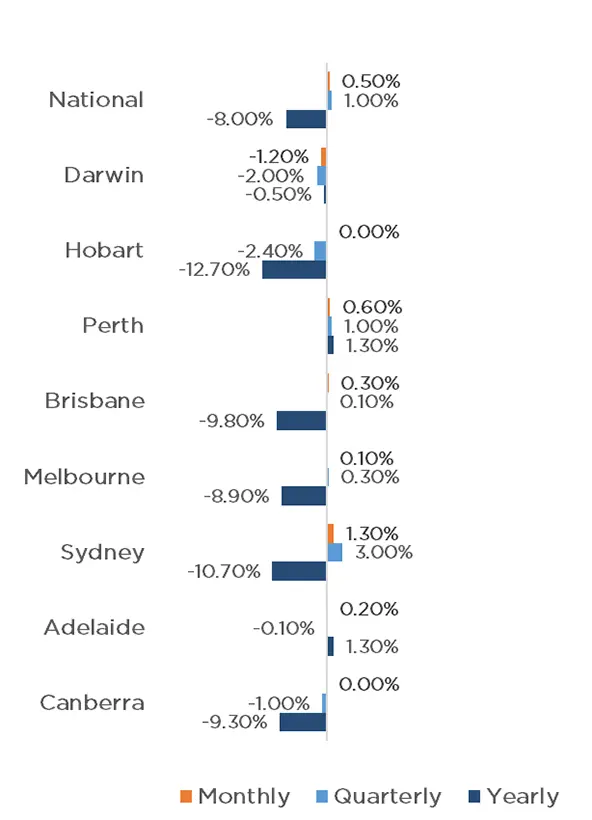

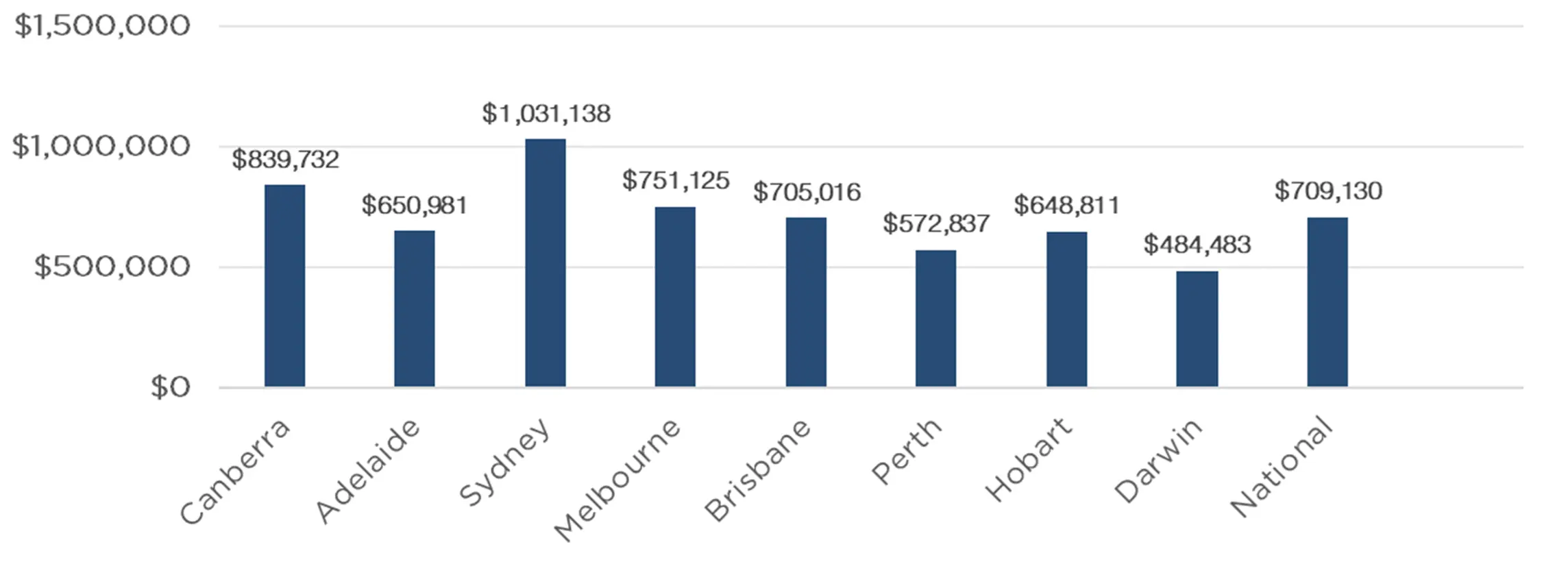

Australian Secure Capital Fund - Market Update April Australian Secure Capital Fund May 2023 Australian housing values appear to have stabilised, with a second consecutive monthly increase as CoreLogic's national Home Value Index rose by half a per cent. The capital cities performed strongly, with Sydney leading the way with a 1.30% increase for the month, followed by Perth (0.60%), Brisbane (0.30%), Adelaide (0.20%) and Melbourne (0.10%). Canberra and Tasmania remained stable, whilst only Darwin recorded a decrease in values, with a 1.20% reduction. Similarly, the regions have also performed quite well, with South Australia seeing a 0.90% increase, followed by Queensland (0.80%) and Western Australia and Tasmania, both increasing by 0.10%. Only regional Victoria and New South Wales experienced a reduction in values, of 0.40% and 0.30%, respectively. Auction activity remained low in April, with volumes down by approximately 25% when compared to last year. Persistently low levels of residential property coming to market remains a key factor in supporting housing values. The rolling four week trend during April was around 14% below the previous five year average in new listings for April. Whilst numbers were down, clearance rates remained robust. With the decision of the RBA to once again increase the cash rate by a further 0.25% following last month's pause, the outlook for the property market remains stable but with future growth potentially constrained. Whilst we are yet to see the full impact that the rate rise cycle has had on household cashflows, foreign buyers are returning and the labor market remains tight which should keep prices stable. Clearance Rates & Auctions 17th - 23rd of February 2023 |