News

14 Aug 2024 - Performance Report: 4D Global Infrastructure Fund (Unhedged)

[Current Manager Report if available]

14 Aug 2024 - Performance Report: Emit Capital Climate Finance Equity Fund

[Current Manager Report if available]

14 Aug 2024 - Investment Perspectives: Thinking about (REIT) timing

13 Aug 2024 - Quarterly State of Trend report - Q2 2024

|

Quarterly State of Trend report - Q2 2024 East Coast Capital Management August 2024 In this update, we present the quarterly State of Trend report for Q2, 2024. As we publish this report, incredibly volatile market conditions have emerged. With global equity markets falling in recent days, we see value in alternative asset classes. Our report covers the performance of Trend Following systems compared with traditional investments such as the S&P/ASX 200 Total Return index, and the Australia "60/40" portfolio. Trend Following provides exposure to a diverse pool of underlying instruments, and implements trading strategies systematically and without emotional biases. Subdued quarter for trend following systems Trend following systems were down slightly for Q2 2024, with key trends from Q1 having moderated this period, including in equities. Diversified asset exposure across commodities and currencies helped to buffer performance in the context of what was a "whipsaw" quarter. Key market movements in Q1 2024

Featured chart - S&P500

Funds operated by this manager: |

12 Aug 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Regal Emerging Companies Opportunities Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Regal Investment Fund (ASX:RF1) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Regal Partners Private Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Microequities Global Value Microcap Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Schroder Sustainable Growth Fund (Wholesale Class) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Vantage Private Equity Secondary Opportunities Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 850 others |

9 Aug 2024 - Hedge Clippings | 09 August 2024

|

|

|

|

Hedge Clippings | 09 August 2024 The result of this week's RBA board meeting came as no surprise given the CPI number from the week before, and the board's previous insistence that they were - or are still - "resolute in their determination" to curb sticky inflation which is stubbornly close to 4% whichever number you look at. As the RBA's statement's headline noted, "Inflation remains above target and is proving persistent," and a trimmed mean figure of 3.9% is way off the board's target of 2.5%. Not only way off numerically, but way off in the future as well, with the RBA's forecast that it will be December 2026 before the target will be met. In addition, the statement added another headline that "The outlook remains highly uncertain," which had the market's soothsayers basically writing off any chance of a rate cut this year. However, it could have been worse - the board gave strong consideration at their meeting to raising rates, which would have upset home owners with a mortgage, as well as the treasurer Jim Chalmers. Why so? The RBA indicated that the government wasn't helping, with tax cuts, support for wage rises, and energy support all contributing to the problem. But the Treasurer was quick to refute that - as he would. However, simple logic and facts tell you that while the RBA is trying to curb consumption, the government, with an election not too far away, are tipping money into consumers' pockets as fast as they can. It seems to us that the RBA and the government are pulling on different ends of the same rope. When Chalmers announced the appointment of Michele Bullock as the new RBA Governor last year, it was all smiles, generally at the expense of departing Governor Philip Lowe. Less than 12 months into her tenure, and there may be some gritted teeth behind his smile, but if he really expected any change in her approach he must have been deluding himself. Bullock has been at the RBA since 1985 and was deputy governor since 2022 under Lowe. At the time of her appointment Albo was quoted as saying "Ms. Bullock is eminently qualified to lead this national institution," although he was also quick to claim credit this week for getting inflation under control - sort of. On the radio interview we heard Albo was quick to change the subject away from inflation, moving to safer ground, namely Australia's medal tally at the Paris Olympics. In particular he was quite excited about Aussie success in the skateboarding and break-dancing, obviously pitching for younger voters in the upcoming election. Before that occurs (maybe even later this year) we're sure he'll be basking in reflected Olympic glory, either at the potential ticker tape parade through the streets or the inevitable reception at the Lodge on the athletes' return. News & Insights New Funds on FundMonitors.com The RBA's August decision: Insights from Nick Chaplin of Seed Funds Management | Seed Funds Management Market Update | Australian Secure Capital Fund Market Commentary | Glenmore Asset Management |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

9 Aug 2024 - Fixed income: the likely impact of rates, inflation and a Trump presidency

|

Fixed income: the likely impact of rates, inflation and a Trump presidency Pendal July 2024 |

|

THE services side of the economy - particularly wages and rental inflation - have held up prices in recent times. But forward indicators monitored by Pendal's income and fixed interest team show the drivers of these two factors weakening. That means inflation in developed markets should continue to fall, allowing central banks globally to start cutting rates, argues Pendal's head of credit and sustainable strategies, George Bishay. "That means central banks globally can start cutting rates," he says. "My view is that central banks will cut rates because inflation is coming down -- not because we are going into recession." It's an important distinction, because when an economy goes into recession, bonds usually perform well, while credit and equity markets can underperform. "If inflation is falls, that's a bullish environment for bonds as central banks will cut cash rates and interest rates in general should come down. "This is also bullish for credit and equity markets." What a Trump White House meansThe key risks to this view is if oil prices rise or if Donald Trump beats presumptive Democratic nominee Kamala Harris in the US presidential election later in the year, Bishay says. "If Trump wins the election, will he have the ability to change policy? Will he have a majority in both houses of Congress? "If he does, then that's problematic for bonds because ultimately that's likely to be inflationary," Bishay says, nominating tax, immigration and trade as key areas of policy to watch. The impact of a Trump Presidency is more skewed towards longer-term bonds because his policies would likely have a medium-term impact on inflation, he says. "The short end continues to perform because central banks will be easing rates as current inflation comes down." Active management remains important for fixed incomeWith so much uncertainty in the market, active management of credit portfolios is critical. "Most credit managers in Australia are buy-and-hold managers. In periods such as Covid, performance of those strategies can get hammered before eventually recovering. "Volatility of their returns can be quite high. "We prefer to actively de-risk and re-risk our credit exposures, based on a top-down process. "If we have concerns about the macro environment, we will reduce risk across the board on credit exposures. That tends to support outperformance because it minimises downside risk. "When we have more confidence in the market, we re-risk and participate in the upside benefit." The three main pillars of Pendal's top-down process are a qualitative view, quantitative models and technical analysis. "When the three pillars line up, we de-risk or re-risk the portfolios and that's been incredibly powerful."

Author: George Bishay |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

8 Aug 2024 - The RBA's August decision: Insights from Nick Chaplin of Seed Funds Management

|

Chris Gosselin, CEO of Australian Fund Monitors, speaks to Nichols Chaplin, Director and Portfolio Manager at Seed Funds Management. Topics covered include: interest rates and inflation; US markets; volatility in equity markets; and bonds and hybrids.

|

||

7 Aug 2024 - Glenmore Asset Management - Market Commentary

|

Market Commentary - July Glenmore Asset Management July 2024 Equity markets were stronger in June. In the US, the S&P 500 rose +3.5%, the Nasdaq increased +6.0%, whilst in the UK the FTSE100 declined -1.3%. The US markets were boosted by growing confidence that inflation is slowing, and interest rate cuts are on the horizon. During the month, the Canadian central bank cut its key interest rate by 25 basis points to 4.75%, making it the first member of the G7 to lower rates. Domestically, the ASX All Ordinaries Accumulation Index rose +0.7%. Top performing sectors included financials and consumer staples, whilst materials were the worst performer, due to concerns about the Chinese economy and its demand for commodities. In Australia, inflation continues to track higher than targeted by the Reserve Bank (RBA). Given this high inflation and recent expansionary fiscal policy from the federal government, this potentially sees the need for the RBA to lift rates in August, however, to date it appears equity investors on the ASX are taking the view that the cycle of rate hikes is almost over. In addition, we would note valuations across a wide range of small to mid-cap stocks on the ASX are still very attractive, which should lead to investors being well rewarded over the next few years. Funds operated by this manager: |

6 Aug 2024 - Australian Secure Capital Fund - Market Update

|

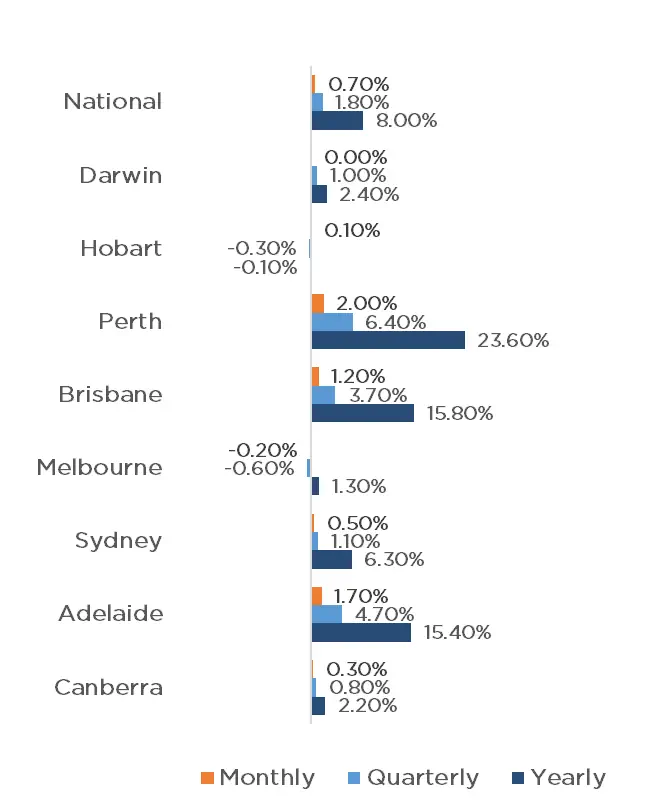

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund July 2024 Property prices across the capital cities have risen yet again, bringing the 17th consecutive month of price growth with June's 0.7% increase, taking growth to 8% across the nation for the 2023-24 Financial year. Yet again, Perth has experienced the largest growth with a further 2% increase, followed closely by Adelaide with 1.7% and Brisbane with a 1.2% increase. Sydney, Canberra and Hobart also experienced growth, albeit it to a lesser degree, with 0.5%, 0.3% and 0.1% respectively. Property prices in Darwin remained stable, whilst Melbourne saw a reduction of 0.2%. The financial year data is nearly all positive, with all capital cities experiencing growth, excluding Hobart which received a small reduction of 0.1% for the year. Perth, Brisbane and Adelaide all experienced growth well into the double digits, with Perth leading the way with a mammoth 23.6% increase, followed by Brisbane and Adelaide with 15.8% and 15.4% respectively. Sydney, Darwin, Canberra and Melbourne also finished the year in the positive, with 6.3%, 2.4%, 2.2% and 1.3% respectively. Growth wasn't just experienced in the capitals, with the regions also increasing by 7%. Property Values as at 30th of June 2024

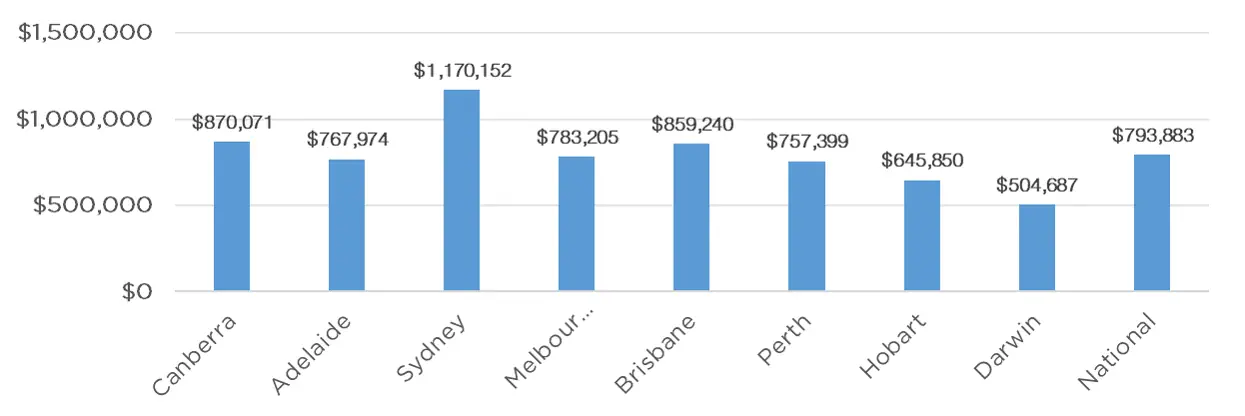

Median Dwelling Values as at 30th of June 2024

Quick InsightsLarger LoansThe average new owner-occupier home loan is at $626,055 nationally, hitting a record high, as the growth housing markets of Perth, Brisbane and Adelaide surge higher, according the latest official lending figures. "It's astounding to think owner-occupiers are, on average, taking out larger loans than ever before despite the fact the cash rate is sitting at a 12-year-high.", said Sally Tindall, research director at comparison website, RateCity.com.au. Source: Australian Financial Review

Construction Costs & Increasing Interest RatesHigh interest rates and construction costs are now choking off the supply of new housing. High construction costs in particular are being singled out amid a complex mix of factors that have pushed up the cost of building in most capital cities. "There has been some relief in access to inputs and labour, and in the prices of some early-stage inputs, but labour costs remain elevated and the regulatory burden high.", investment banking firm Barrenjoey's chief economist Jo Masters said. Source: Australian Financial Review Author: Filippo Sciacca, Director - Investor Relations, Asset Management and Compliance Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |