News

31 Jul 2023 - Will service stations be stranded assets?

|

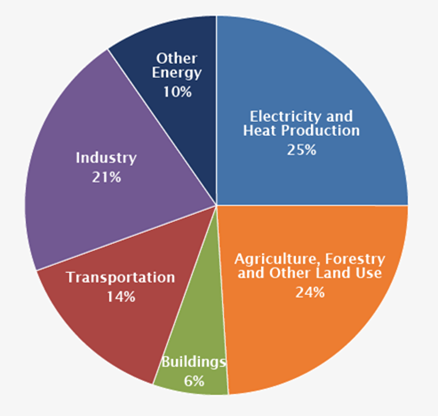

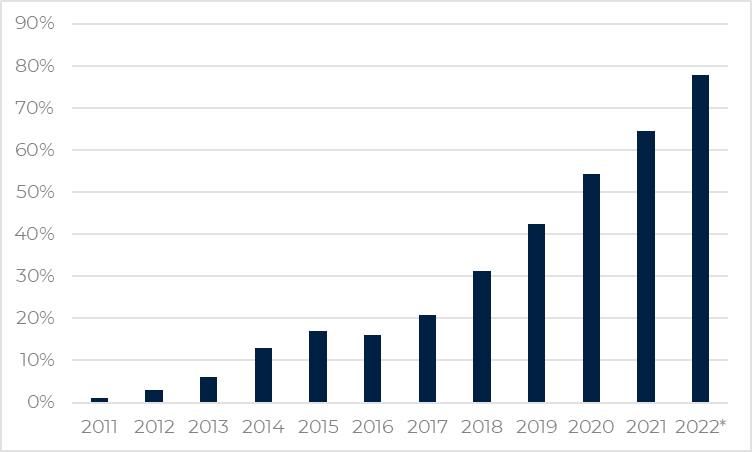

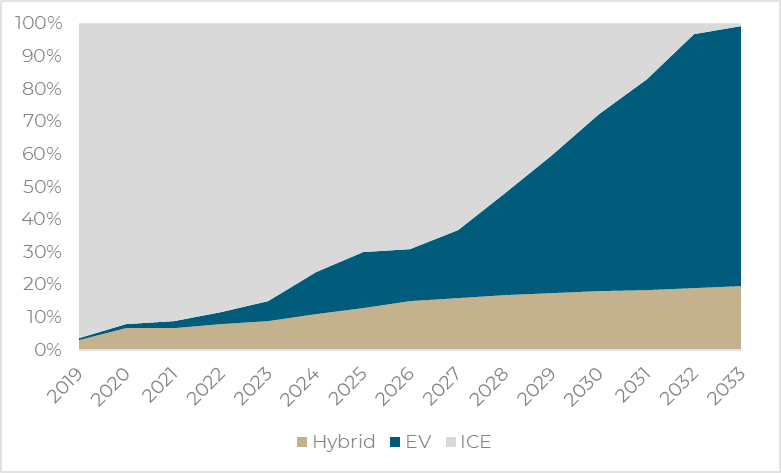

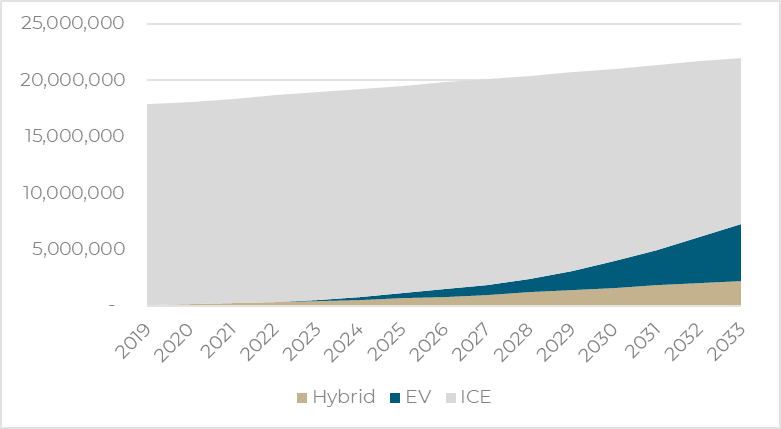

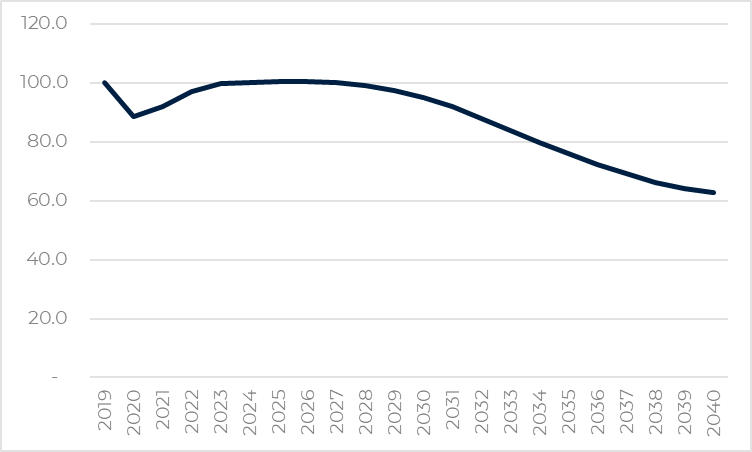

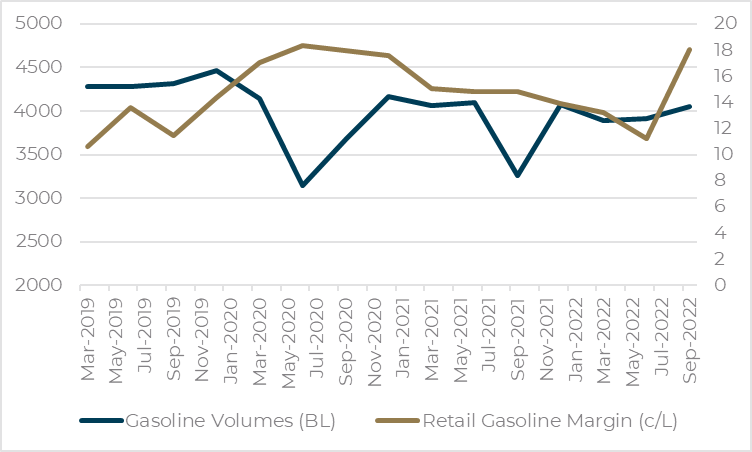

Will service stations be stranded assets? Tyndall Asset Management June 2022 At the same time as we are seeing global policy initiatives seeking to further accelerate the uptake of electric vehicles (EVs), corporate activity in the fuel and convenience retailing sector has stepped up. If the common belief that EVs will displace the need for Fuel Retailers, why are industry players increasing their capital allocation to the sector? We investigate the outlook for Fuel Retailers against the commonly held perception that they will ultimately be stranded assets. With the transport sector accounting for 14% of global carbon emissions (refer Figure 1), internal combustion engines (ICEs) are directly in the firing line of governments seeking to meet reductions targets. Further, the development of cost-competitive alternative technologies means that the transition to cleaner transport is not only achievable but now gathering significant momentum around the world. Figure 1: Global Greenhouse Gas Emissions by Economic Sector Source: US Environmental Protection Agency The consequence is that ICEs are likely to go the way of the steam engine over time. This begs the question - will service stations become stranded assets? What are the prospects for these sunset industries? Three years ago the answer to these questions was largely speculative. However, the COVID-19 period has created an ideal test environment in which the impact of a reduction in fuel volumes can be readily examined. This paper reviews the data and the risk that service stations become stranded assets. It is beyond debate that over the next two decades the vast majority of Australia's passenger vehicle fleet will transition to cleaner fuels. Car manufacturers are moving rapidly towards EVs, recognising the mega trend and the cost comparability. Governments around the world have varying incentives to assist in the transition, with adoption of EVs having increased rapidly as price-competitive and range issues have been overcome. Australia lags but won't foreverWhile adoption of EV's in Australia has been relatively slow to date, it would be naïve to consider that this will remain the case. Norway is the country most advanced in electric vehicle penetration of new car sales. This has come on the back of significant government incentives for the electric vehicles and support for infrastructure development. While EVs were only 1% of new car sales in 2011, the Norwegian Office of Vehicle Statistics reports that in the nine months to September 2022, EVs represented 77.8% of new car sales (refer Figure 2). Figure 2: Electric Vehicle Share of New Car Sales - Norway Source: Road Traffic Information Council (OFV); Electric Vehicle Association (Elbil). *Year to date September 2022. What would this adoption rate mean for Australian fuel volumes?We have modelled the implications of an adoption rate as rapid as Norway's for the Australian market, allowing us to map out the potential impact on retail fuel demand as the energy transition proceeds. We have also assumed that the uptake of hybrid vehicles accelerates from recent trend rates, as more models become available. Combined these assumptions indicate that ICE vehicles will be a rapidly declining proportion of new car sales, to the point that they are all but eliminated by 2033. Notably this is faster than the proposed legislated goal of ending ICE vehicle sales in the UK and EU by 2035 and close to the recent Biden Administration proposal to phase out ICE vehicles by 2032. Figure 3: Composition of New Car Sales (Australia) Source: VFACTS, Tyndall estimates While the composition of new car sales changes rapidly in a decade, the impact on the vehicle fleet (refer Figure 4) is a much slower process. Under this scenario, hybrids and electric vehicles will represent only one-third of the total fleet by 2033. Figure 4: Australia's Vehicle Fleet Mix Source: VFACTS, Tyndall estimates What is evident from this analysis is that the impact on volumes from the transition to electric vehicles is extraordinarily protracted (Refer Figure 5). Retail volumes are not forecast to decline from 2019 levels until 2029. And even then, the decline is only 1.3ppts. The impact does accelerate quite significantly during the following decade, with 2040 volumes forecast to be c33.5% lower than 2019 levels. Figure 5: Fuel Volumes (Indexed to 2019) Source: ABS, Tyndall estimates A longer-term volume contraction is only half the storyWhile significant and at face value perhaps alarming, a significant decline in fuel volume is only half the story. The other relevant variable of course is price, and the COVID-19 experience has demonstrated the ability of the fuel retailing industry to maintain dollar gross margin in the face of falling volumes. This rational industry response perhaps benefited from the recent memory of unprofitable discounting that occurred during calendar 2018. Chart 6 shows the trends in gasoline volumes and retail gasoline margins over the recent past - capturing the period of COVID disruption. As the chart shows, Fuel Retailers responded to lower volumes with price increases, such that dollar gross margins expanded. Figure 6: Retail Gasoline Margins and Volumes Source: Australian Petroleum Statistics, Department of Energy; Australia Institute of Petroleum; Tyndall In the June 2020 quarter, which includes the early part of the pandemic and national lockdowns, fuel volumes fell ~45%. Retail margins in that period averaged 18.3 cents/litre, ~46% above the 2019 average. Preparing for the futureAs highlighted above, the medium-term outlook for Fuel Retailers is sound, with the impacts of the fleet conversion to electric vehicles a very slow burn that will not materially impact volumes for a decade. That said, the longer-term outlook does point to significant erosion of fuel volumes. While pricing offsets to combat this have been proven possible through the COVID experience and at face value are not unaffordable, the very long-term scenario is that retail fuel volumes go to zero. We are watching this area closely and observing how the listed participants are progressing their strategies. Both Viva Energy and Ampol have de-risked their businesses by selling service station properties but with long-term options that provide ongoing control over the site. Author: Tim Johnston, Portfolio Manager Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund |

28 Jul 2023 - ChatCB - Artificial Intelligence and Convertible Bonds

|

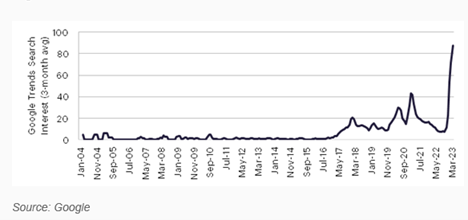

ChatCB - Artificial Intelligence and Convertible Bonds Redwheel (Channel Capital) July 2023 The concept of Artificial Intelligence (AI) has been around for a while, but is it finally ready to be the Next Big Thing? Over the last 12 months, the release of a large language model to the public (ChatGPT) and a material uplift in Q2 2023 guidance from chipmaker Nvidia based on demand from AI applications has spurred many stock prices higher. In the case of a few companies, dramatically so. The chart below shows the uptick in Google searches for the term "Artificial Intelligence" - clearly, there are many questions about the impact that AI might have on the economy and for workers, both good and bad. Could the rise of AI justify higher stock prices now, and could there be more to come - or is recent optimism unfounded?

Source: Google, as at March 31st 2023. The information shown above is for illustrative purposes. We will not claim to have all the answers to these questions, but we will explore the background of AI, some of its use cases, and how we think the convertible bond market and individual issuers have and will play a role in AI developments. What is AI?AI is a branch of computer science that uses digitised inputs (text, images, numbers) to generate outputs in a way that can simulate human intelligence, using relationships between data to program algorithms for decision-making or answers. For many, AI became familiar from the creation of structured solutions to a known application - for example, programming computers to play chess, but in the past, these efforts required a high degree of human involvement for fine-tuning. Historical advances in AI are due largely to the exponential increase in computing power with miniaturisation of chips, driven by Moore's Law and the parallel process capabilities of GPUs*. Along with gains in storage and software programming, faster computational speeds allow researchers to run statistical models on an enormous amount of data collected over the internet, including new data sets. In turn, AI programmers can now model tasks such as image recognition, natural language processing, and computer vision. More computing power also allows algorithms to automatically incorporate new data - a process referred to as 'machine learning' - for efficiency gains. The launch of Chat GPT, a natural language processing tool developed by OpenAI, which allows users to have human-like conversations, has captured worldwide imagination and the fastest ever consumer adoption, reaching 1 million users in only 5 days (source: OpenAI). ChatGPT does more than lift sections of text from a source, it creates new sentences as a response to a user's input question. While ChatGPT and other large language models are in their early stages, replication of language-based outputs using AI could have a significant effect on economic growth, especially if they can broaden task automation or enhance search capabilities. Including other use cases for AI - such as autonomous vehicles and facial or image recognition - this field could create a profound change in business models, potentially creating new winners and categories, while disrupting some existing models. For investors, being able to successfully navigate through this environment and picking the winners won't be an easy task - just ask those investing in internet stocks in the late 1990s. Most had successfully predicted the huge impact the internet would have in the future, but many companies that were market darlings and were seen as winners ultimately failed to live up to the early promise. Investing in AI - using convertiblesIn our analysis, we currently split AI beneficiaries in three broad categories. The first group includes companies directly making hardware or software ('Building Blocks') used for AI development. The second group are those companies using AI to enable change in an industry or for their customers ('Transformative Potential'). The third group consists of companies using AI to enhance customer experience and interactions ('Personalised Product Offerings'). The analysis is by no means exhaustive, but we see it as a good starting point for investors to look at the opportunity set. Our view included a look at some of the largest ETFs focused on AI and robotics, as well as reviews of individual companies and sectors. We have also included a glossary of some of the key terms needed to understand the businesses of these companies. Building Blocks

Transformative Potential

Personalised Product Offerings

Source: Redwheel, as at 31st May. No investment strategy or risk management technique can guarantee returns or eliminate risks. Of course, there is no reward without risk, and stock prices today may not reflect the reality of tomorrow. We think that convertible bonds can help by allowing for upside participation in the theme but with downside protection from volatility and uncertainty. The asset class has long been favoured by technology companies as the vehicle of choice to raise capital to make productive investments or re-investments. We also see that demands for investment in AI development can be well-suited for financing with a convertible bond, given a multi-year payoff period and the possibility of high future growth and cash flow from an investment today. Convertible bonds give these issuers flexibility with a financing tool that can be converted into equity, but at a premium to its stock price at issuance. Convertible investors accept lower coupons than if the bond were a straight corporate bond because they hold a valuable longer-term option to convert; in turn, these lower coupons provide flexibility to the issuer. In case the company's stock price does not rise during the life of the convertible bond, convertible investors still consider the credit of the issuer and its ability to repay or refinance its debt. Where these two groups meet in the middle is that convertible investors want issuers to reinvest profitably over the life of the convertible and drive value for their share price, rather than simply to repay this debt while earning a coupon. For each of the three categories, we present a review of one specific convertible bond issuer that we see as being a good representative of the potential impact of AI. We also note other convertible bond issuers within each of the categories. Building BlocksHynix is a DRAM* manufacturer, which along with peers Samsung and Micron, operates in an oligopolistic industry consisting of these three main suppliers, whom have significant scale benefits compared with smaller operators. Hynix should be a key beneficiary from AI because Hyperscalers* require DRAM; the company is also a key supplier of high bandwidth memory to Nvidia. DRAM is at the heart of AI servers, and we see the AI boom driving a large multi-year demand cycle for memory. Other notable issuers include: Lenovo (computers and peripheral devices), Microchip (microcontrollers and integrated circuits), STM Micro (semiconductors), SOITEC (semiconductors), Lumentum (opticals for semiconductor manufacturing). Transformative PotentialMicrosoft - the firm needs little introduction: under CEO Satya Nadella, the company has successfully transformed itself into a leader in AI across various parallel uses. Three of its largest segments stand to benefit from emergence of AI. Azure, Microsoft's data centre product, is playing a fundamental role as a building block with AI, as the percentage of cloud spend is expected to pick up meaningfully in the next three years. The company has started integrating AI into its productivity suite such as Office 365, allowing Microsoft to add a premium tier to its current offering. Finally, Microsoft's 50% stake in OpenAI offers transformative potential in the search business. Other notable issuers include: SaaS vendors, Kingsoft (AI in products), Tesla (Electric Vehicles and autonomous driving), and Ford (Electric Vehicles and autonomous driving). Personalised Product OfferingsAirbnb - one of the most popular platforms for offering and booking homestays worldwide.[1] In a recent interview, company founder and CEO Brian Chesky laid out his vision of AI integration becoming central to how the company's app works. The company envisions the app becoming almost like the ultimate host, the ultimate concierge. This means leveraging the power of AI to offer a personalised experience for its customers, driving recommendations based on their preferences, choices, and data. Customer services is another area where the company expects AI to drive large efficiency gains by augmenting traditional customer services with AI. For example, customer service agents will be assisted by AI to gain quick access to the relevant sections of one of the 72 user policies: each 100 pages long, helping them resolve queries faster and cutting down training times. Other notable issuers include: Booking.com, Expedia, Uber, Block, Etsy, Zillow. ConclusionWe believe that AI is here to stay and many of the companies at the forefront have used the convertibles market for financing, both in the past and now. Because there is no return without risk, convertibles can provide exposure to AI and relevant technologies, with structures which allow for upside capture but with protection on the downside from volatility and uncertainty. |

|

Funds operated by this manager: CC Redwheel Global Emerging Markets Fund, CC Redwheel China Equity Fund Sources: *See glossary for definitions [1] Skift, 3rd May 2023, https://skift.com/2023/05/03/interview-airbnb-ceo-on-how-its-service-will-radically-change-with-ai-by-next-year/ GlossaryCPU (Central Processing Unit) The key processor in a computer that runs most functions, such as logic and arithmetic. GPU (Graphics Processing Unit) Enables graphics, visual effects, and video in a computer to be run in parallel with other functions. Hyperscaler An extremely large-scale cloud-based data and service provider. Foundry Fabricates semiconductors using silicon wafers and integrated circuits. Some foundries are owned by semiconductor companies, others manufacture semiconductors to customised designs by semiconductor designers that are using a "fabless" operating model. SaaS (Software as a Service) Typically, a subscription-based business model where users connect to and use cloud-based applications via the Internet, often accessed through web browsers. DRAM (Dynamic Random Access Memory) Dynamic RAM is one of the most typical types of semiconductor memory. DRAM generally uses a capacitator to store electrical energy and a transistor to regulate voltage to store data in a memory cell. Using DRAM involves a trade-off between the low cost of units versus the need to recharge the capacitators, which also involves re-writing data to the memory cells ('memory refresh'). More DRAM available to a computer allows it to run a greater number of computations and processes; advances in power management help to reduce the electricity requires for operation and the memory refresh process. Key information: No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor's investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only. |

27 Jul 2023 - Forever Chemicals - PFAS

|

Forever Chemicals - PFAS PURE Asset Management July 2023 The jungle drums are beating louder as the calls for increased regulation of Per- and polyfluoroalkyl substances (PFAS) become clamorous, and class action lawyers gear-up for their next big opportunity. This comes more than two decades after internal documents revealed that DuPont had known of a link between PFAS and cancer in 1997, and was aware of the potential health risks as far back as the 1960s. Corporate settlements, regulatory changes and journalist investigations are proliferating, broadening public awareness of the risks associated with PFAS. Suggestions that these chemicals are the 'asbestos' of the current generation, are a clarion call for strengthened regulation, and the Environmental Protection Agency (EPA) in the US has responded aggressively. What are PFAS?PFAS are man-made chemicals that have been used extensively in industry and household products since the 1940's. Non-stick cookware, food packaging, cosmetics, water repellents and fire retardants illustrate the proliferation of these forever chemicals, which don't break down and can accumulate over time. Exposure is difficult to avoid, with ingestion the primary transmission mechanism. What are the risks of PFAS?While scientists continue to learn about the human impacts of PFAS, recent studies have suggested that exposures may lead to the following health effects:

What is being done about it? In short, plenty. Over the past five years, corporate America has been under attack for its historical negligent use of these chemicals. This ranges from products sold, to how waste has been disposed, and the downstream consequences presented to humans as a result. While the pun is ironic, the 'downstream' issue facing society today is the prevalence of PFAS in municipal drinking water. Corporate litigation has been building momentum, with Dupont the first to settle a class action in 2015, made infamous by the Dark Water movie - a must watch for anyone interested in the subject. Together with two other defendants, Dupont also recently settled another US$1.2bn claim with water utilities, and in recent weeks, US conglomerate 3M agreed to a US$10.3bn structured payout to water utilities. Analysts at Morningstar, a research firm, estimate that 3M's total liabilities could grow to as much as $30bn as state, foreign and personal injury claims are factored in. Source: https://news.bloomberglaw.com/pfas-project/companies-face-billions-in-damages-as-pfas-lawsuits-flood-courts The scale of the 3M settlement is likely to set a dangerous precedent for this US$28bn revenue industry, with the company just one of 12 major participants, including Merck, Bayer, BASF and Honeywell. Like Dupont, 3M appears to have known and covered up the risks for decades. Litigation cases have heightened awareness, and regulatory bodies are rapidly responding. Given its importance to society, initial focus has centred on municipal drinking water. Many US states, predominantly those on the east and west coasts, have independently moved to regulate acceptable levels of PFAS in drinking water. While a step in the right direction, the Environmental Protection Agency (EPA), with a Federal mandate, has now become engaged, embarking on a radical change to regulations. The EPA has proposed a revised US national drinking water standard. With formal implementation expected in late 2023, these stringent measures target six common PFAS, with tolerable limits all but eliminating any trace in drinking water. "The previous guideline, set in 2016, set a limit of 70 parts per trillion (ppt) for both PFOS and PFOA in drinking water. The new advisories decrease that by more than a thousandfold. The new limit for PFOS is 0.02 ppt; for PFOA, it's 0.004 ppt. Essentially, the EPA wants the limits to be as close as possible to zero as a growing body of research has shown how toxic these compounds are." Source: https://www.hsph.harvard.edu/news/features/stricter-federal-guidelines-on-forever-chemicals-in-drinking-water-pose-challenges/ Coupled with the availability of US$2bn in Bipartisan Infrastructure Law Funding, all municipal water utilities in the USA must now adopt measures which ensure compliance. The proposed rules require public water systems to:

In meeting the levels proposed, the EPA has previously provided guidance on how best to achieve compliance. This has focussed on three measures, namely:

The most commonly used method, and primary recommendation of the EPA as a solution to combat liquid-phase chemical removal, is through filtering using Granular Activated Carbon (GAC). Investment opportunity Unlike asbestos, where profits were derived from shorting companies selling asbestos products, activated carbon appears to offer a profitable long thesis. Pricing has moved aggressively in recent periods, with industry leader Calgon Carbon announcing price rises of 15-40% across its product range in December 2022. At PURE, we are investing in this thematic via an exposure to ASX listed company, Carbonxt (CG1.ASX). CG1 has historically focussed on air-phase solutions through powdered and pelletised products. A recent 50/50 joint venture agreement with Kentucky Carbon Processing (KCP) is facilitating the Company's entry into the liquid-phase market. Carbonxt's aim is to meet demand from water utilities via the production of GAC, or a superior pelletised product. The Company can produce GAC but also has aspirations to introduce a specialised pellet product that achieves the same results with less pressure drop. In simple terms, this decreases electricity consumption for water utilities, lowering their cost of production. Not only is market demand underpinned by regulatory change, but new supply is both long-dated and costly. Calgon Carbon announced a 25ktpa expansion at its Mississippi plant in 2020 at a cost of US$185m. We understand this came online in 2022. Carbonxt is expecting saleable product from the JV facility in 1H2024, with an initial 10ktpa delivered at a capital cost of just US$20m. The JV parties believe this can be doubled to 20ktpa for a modest additional outlay. Carbonxt's entry into the liquid-phase market appears well timed. The Company estimates that the current Activated Carbon market for the liquid phase is c.US$600m per annum, but the American Waterworks Association estimates the annual cost to comply with the regulations in its current form is US$3.8bn. Source: https://www.awwa.org/Portals/0/AWWA/Government/2023030756BVFinalTechnicalMemoradum.pdf?ver=2023-03-14-102450-257 Funds operated by this manager: |

S&P 500 rose +6.5%, the Nasdaq was up +6.6%, whilst in the

UK, the FTSE 100 appreciated +1.2%.

26 Jul 2023 - Glenmore Asset Management - Market Commentary

|

Market Commentary - June Glenmore Asset Management June 2023 Globally equity markets were positive in June. In the US, the S&P 500 rose +6.5%, the Nasdaq was up +6.6%, whilst in the UK, the FTSE 100 appreciated +1.2%. The strength in the US indices was again driven by mega cap technology stocks. In Australia, the All Ordinaries Accumulation Index rose +1.94%. Materials and Financials were the top performing sectors, whilst Healthcare underperformed (driven by a negative earnings update from index heavyweight CSL). On the ASX, large cap stocks outperformed small caps, continuing a trend that has been in place for the last 18 months. We believe this trend will reverse once there is more clarity over the number of interest rate hikes required by the RBA to reduce inflation to its targeted 2-3% range, which should see small/mid caps on the ASX perform strongly vs large caps. Bond yields in both Australia and the US increased, with the Australian 10 year bond rate rising +42bp to close at 4.02%, whilst its US counterpart rose +22bp to 3.88%. In both cases, increased investor expectations of "higher inflation for longer" was the driver, with inflation proving more difficult to reduce to targeted levels than central banks would like. Consumer spending in particular, continues to be more resilient than expected despite ongoing headwinds from cost of living pressures. Whilst investor sentiment remains very cautious towards small/mid cap stocks, we continue to see numerous examples of mis priced stocks, which are well positioned to outperform once the current interest rate hiking cycle is complete. At this stage, our view is that the RBA will increase rates 2-3 more times to bring inflation to acceptable levels. Given the lagged impact of monetary policy, we expect inflation to continue to fall over the next 6-12 months. Funds operated by this manager: |

25 Jul 2023 - Investment Perspectives: Why best-in-class mall rents are recession resilient

21 Jul 2023 - Why railroads are an attractive investment and how PSR is helping

|

Why railroads are an attractive investment and how PSR is helping Magellan Asset Management June 2023 |

|

Yathavan Suthaharan, Investment Analyst, discusses why railroads are an attractive infrastructure investment, recent events at Norfolk Southern and what the hype is around PSR. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

20 Jul 2023 - The Rate Debate - Ep 40: The winners and losers

|

The Rate Debate - Ep 40: The winners and losers Yarra Capital Management July 2023 The RBA has paused on hiking rates (for now) creating some big winners and losers. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

18 Jul 2023 - Global Economic Outlook: Recession, Interrupted

|

Global Economic Outlook: Recession, Interrupted abrdn June 2023 Resilient labour markets, strong service sectors, and sticky underlying inflation mean that central banks are not done raising interest rates. However, the size of these hiking cycles is still likely to cause eventual recessions in many developed markets and some emerging economies. While headline inflation will continue to drop sharply, only these downturns will be able to bring sticky underlying inflation down in a sustainable manner. In turn, we are forecasting central bank cutting cycles during 2024 that will ultimately take interest rates back into accommodative territory. Figure 1: Global forecast summary Source: abrdn, June 2023 Recession, interruptedThe US, and broader global consumer and services sectors, will remain robust for slightly longer than we'd previously anticipated, given households' ongoing willingness to draw down excess savings, the resilience of labour markets, and the boost consumers will soon get from lower headline inflation. Certainly, the weakness in manufacturing and housing activity in the US that started in the fourth quarter last year does not seem to have been the usual early-warning signal of a wider recession. Instead, it has remained largely consigned to those two sectors, and there are even signs that housing activity may be starting to recover. Against this, we expect ongoing stresses in the banking sector amid higher interest rates, although we don't anticipate a systemic financial crisis. Nonetheless, credit conditions will continue tightening - a headwind to growth that will build over time. Stubborn inflationHeadline inflation will continue to drop sharply over the next 12 months driven by energy base effects and lower food inflation, albeit with some volatility and cross-country differences. Indeed, by late-2024, headline inflation rates in many economies will be close to target. Core inflation will also decline from here, as it has already started doing in the US, Eurozone, and many emerging market (EM) economies. However, this will be mostly driven by global-goods disinflation in the first instance. We think core services inflation will remain sticky amid tight labour markets and strong wage growth. Indeed, a recession is ultimately necessary to bring core-services inflation back to target-consistent rates in the US, many other developed markets (DM), and parts of EMs. We think this is a price central banks are willing to pay to deliver on their mandates and maintain the credibility of inflation targets in the future. What now for monetary policy?This means that central banks still have a small amount of additional monetary policy tightening left to implement. We are forecasting a Federal Reserve (Fed) rate hike in July after skipping one in the June meeting. A final rate hike later in the year, as signalled by the Fed's latest forecasts, is possible although not our base case. We think the European Central Bank (ECB) will hike rates once more in July, and the Bank of England (BoE) at least twice more. But the risks around these forecasts are also clearly skewed to the upside. Ongoing inflation persistence could force both central banks to tighten further despite the clear desire of policy makers to draw the hiking cycle to a close for fear of triggering recessions. In Japan, we expect the Bank of Japan (BoJ) to deliver effective monetary policy tightening this northern hemisphere summer via changes to the yield curve control (YCC) framework, allowing the 10-year Japanese Government Bond yield to trade up to 75 basis points. Past tweaks to YCC reflected concerns about market functioning, which have since diminished. Instead, in a striking change to the Japanese macroeconomic environment, we think the BoJ will now be tightening policy directly in response to a pick-up in underlying inflation pressure. Recessions around the cornerWe continue to think this large monetary-tightening cycle will ultimately lead to recessions in the major DM economies and parts of EMs. The manufacturing sector in many economies is already in contraction. However, amid broader data resilience, we now think the timing of economy-wide recessions will be somewhat later than we had previously anticipated - mostly beginning around the turn of the year. There are cross-country differences in the timing of the respective recessions we are forecasting, with the UK downturn beginning as soon as the second quarter (albeit in part due to a technical quirk of the data), the Eurozone expected to be in recession by the fourth quarter this year, and the first negative quarterly gross domestic product (GDP) print in the US in the first quarter of next year. That said, our conviction around the precise timing of the US downturn is less strong than our conviction that this cycle will end with a policy-induced recession over a time horizon that is relevant for investment decision making. The US…We think policy only became contractionary in the US around the middle of last year when the real policy rate started to exceed our estimate of the equilibrium real rate. The 'long and variable' lags of monetary policy mean that the impact of that tightening is only now starting to be felt in earnest, with the effects set to build through the second half of this year. This is the same signal that our recession probability models are providing, with near-term risks having declined as data have been solid, but longer-horizon models remaining elevated due to the deep imbalances in the US economy. It is plausible that the economy could remain even stronger than we expect through the rest of this year, with a tight labour market supporting household spending. However, we think such a 'no landing' scenario is unsustainable as the Fed would be forced to take another 'bite of the cherry' - pushing up rates much further to squeeze out the inflationary excess in the economy. In this scenario, the recession is merely delayed rather than avoided. …and elsewhereIn our base case scenario, we think monetary policy cutting cycles will begin by early 2024 and continue throughout next year as headline inflation drops and growth is negative. We ultimately expect interest rates to fall below neutral and by more than markets have priced. This is consistent with how theory and history suggest central banks behave, with large and rapid easing cycles the norm once an economy has entered a recession and unemployment is increasing. The easy gains of China's re-opening recovery are over. However, we still forecast above-target GDP growth in 2023 given the room for consumption, travel, and services activity to return to pre-pandemic levels. But manufacturing, trade and real estate will continue to struggle, which mean much smaller global economy spill overs than during a typical Chinese recovery. With inflation rates very low, there is scope for modest policy easing. While many EMs were early to the rate-hiking cycle, they will have to wait until 2024 for underlying inflation to cool enough to allow rate cuts to begin. Latin America is best placed to cut given high real rates. Asia Pacific benefits from a less challenging inflationary environment, but lower policy rates there require a 'wait and see' approach. Central and Eastern Europe's lack of central bank credibility amplifies its still substantial inflation problem, implying the region will be the last to cut rates. The most likely alternative scenario is still a soft landing. One way of reading the US labour market data is that a benign loosening - that can reset wage growth and lower inflation expectations without a recession - is already underway. But we still think that historical precedent lends greater weight to a recessionary baseline. ABRDN RESEARCH INSTITUTE |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund |

17 Jul 2023 - Investing Essentials: Active vs passive

|

Investing Essentials: Active vs passive Bennelong Funds Management June 2023 |

|

Firstly, let's clarify the difference. A passively managed fund is designed to minimise decision-making and keep costs down. The most common types of passively managed funds are index funds, which replicate the movements (and therefore returns) of a particular benchmark index. These funds are set up so their performance will effectively mirror that of the index - meaning the fund won't outperform the index, but won't underperform it either. An actively managed fund aims to outperform a particular index or benchmark over a defined period of time, with a portfolio manager using research and expertise to select individual securities they believe will perform best. There is also, therefore, a risk of underperforming the benchmark. What sometimes gets lost in the argument of 'which is better' is a genuine understanding of the different approaches - and, importantly, how they can both benefit you as an investor at different times. In a constant effort by investors to reduce fees, the popularity of index funds is understandable. But in a world where performance is becoming harder to come by, an actively managed fund - where investment choices are based on analysis, research, and market knowledge and experience - might be a more attractive option. When deciding on an investment approach, there are three important things you should consider. 1. Your objectives If you're looking for a market level return and you're comfortable with the characteristics of a particular asset class and its benchmark (such as the ASX300 for Australian equities), an index fund could suit your requirements. In terms of performance, whatever the market does is what you'll get - there's no flexibility around this. If you want to try and outperform the market, need a particular style of return (such as income), or have a bias towards a particular characteristic or type of stock, then you could consider an actively managed fund. 2. Fees There are no active investment decisions involved in managing an index fund, so a comparatively smaller investment team is required. As a result, index funds usually have a lower management fee than actively managed funds. In an actively managed fund, the investment team will usually conduct assessment and analysis of individual shares as well as the broader economy and other relevant factors. Given the resources involved in this, and the fact that an active manager expects to outperform its benchmark, actively managed funds tend to have a higher cost than index funds. In the drive to reduce fees and get 'value for money', investors can sometimes become hung up on the investment's cost rather than its outcome. Make sure your investment strategy is aligned to your goals, and you understand the difference between price paid and value received. 3. Investment manager Because it only ever matches an index, an index fund will essentially always do what it says on the tin. If the index goes up, performance goes up, and vice versa. But when it comes to choosing an active manager, not all funds are created equal. This is also why it can be hard to compare the performance of active and passive funds: there are wild variances between active managers, styles, investment approaches, risk, etc. Do your research when it comes to a manager's style, process and philosophy. Do you understand how the fund is managed? Are you clear on what it's aiming to achieve? Above all, though, always remember that past performance is not an indicator of future performance - one of the most important rules of investing! There's no doubt that the debate around 'active versus passive' will continue. But, as with all investments, the key for investors is to be clear on what your own purpose or objective is, and then select the funds that best align to achieving your goals. It doesn't have to be either/or - adopting an investment strategy that combines active and passive elements may in fact deliver the best of both worlds |

|

For more insights visit www.bennelongfunds.com Disclaimer The content contained in this article represents the opinions of the author/s. The author/s may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the author/s to express their personal views on investing and for the entertainment of the reader. |

14 Jul 2023 - Australian Secure Capital Fund - Market Update June

|

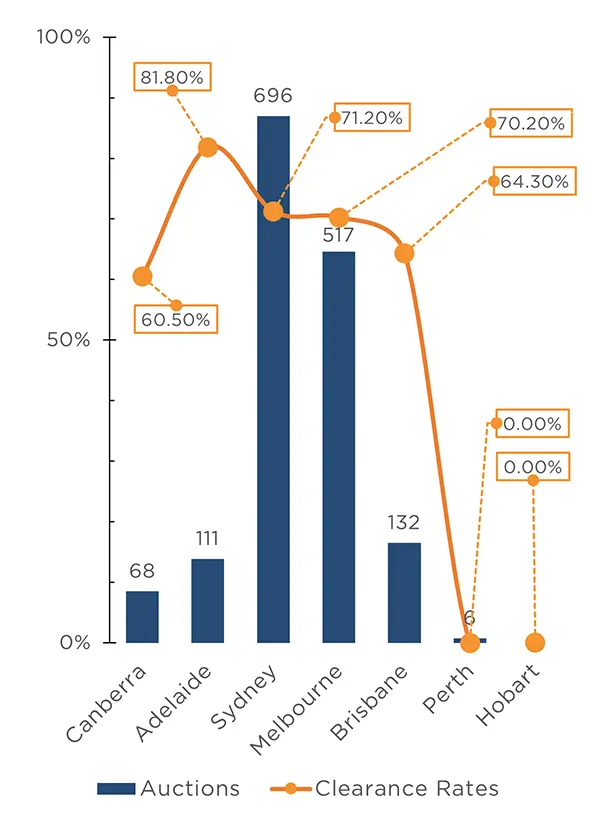

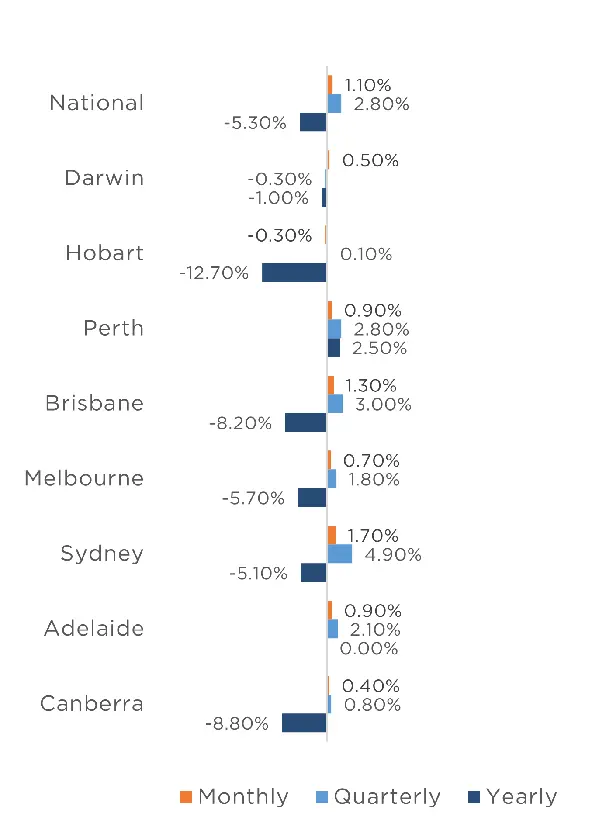

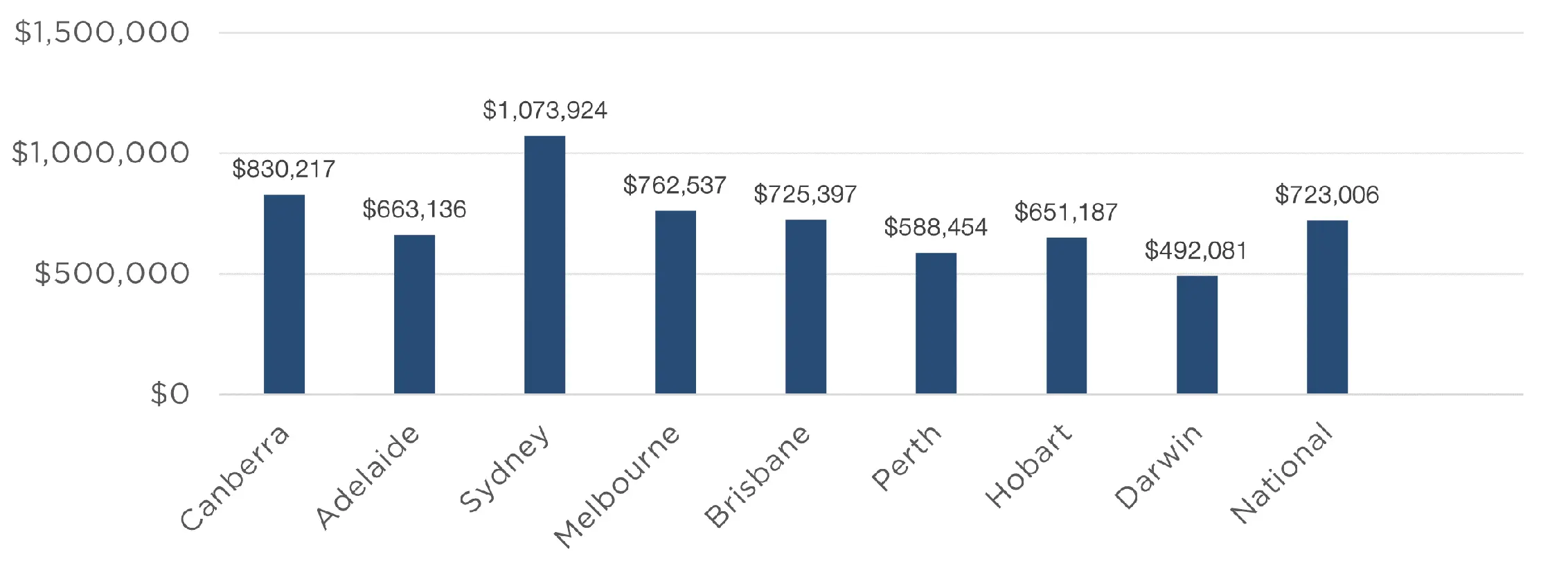

Australian Secure Capital Fund - Market Update June Australian Secure Capital Fund July 2023 The Australian housing market finished the financial year strongly, increasing by 1.1% in June according to CoreLogic's national Home Value index. All capitals except for Hobart (-0.3%) recorded growth for the month, with Sydney the standout with a 1.7% monthly increase. Brisbane was not far behind (1.3%) followed by Adelaide (0.9%), Perth (0.9%), Melbourne (0.7%), Darwin (0.5%) and Canberra (0.4%). The regions also performed strongly with only regional Victoria (-0.4%) and Tasmania (-0.3%) recording a reduction. Regional Queensland and South Australia performed best, with both recording a 1% increase. Regional New South Wales and Western Australia also saw a modest increase of 0.3%. The particularly strong performance over the past two months resulted in very favorable quarterly results, with all markets except for Darwin and regional Victoria experiencing growth. Auction numbers continue to be bellow that of last year, with 1,530 auctions taking place on the first weekend of July, down from 1,881 in the previous year. This further highlights the lack of supply in the housing market, with all capital cities recording fewer auctions than the same weekend of 2022. Sydney recorded the most auctions with 696 taking place with Melbourne not far behind with 517. Brisbane, Adelaide, Canberra and Perth recorded significantly fewer auctions with 132, 111, 68 and 6 respectively. There were no auctions held in Tasmania, however there was also only 1 auction on the same weekend last year. This lack of supply is resulting in higher than usual clearance rates, with the weighted average clearance rate of 70.3% for the weekend, up from 53.2% in the previous year. Once again, clearance rates are higher across all capital cities than last year, with Adelaide performing the strongest at 81.8% (up from 65.4% last year). Sydney (71.2%), Melbourne (70.2%), Brisbane (64.3%) and Canberra (60.5%) all performed strongly and well above previous years results of 49.9%, 55.8%, 45.2% and 52.9% respectively. Clearance Rates & Auctions 26th June - 2nd of July 2023

Property Values as at 30th of June 2023

|