After many years of limited activity on green bonds in Australia, we have seen a number of developments in this space recently, with the announcement of the Australian Government issuing a green bond. This reflects the substantial increase in activity in green bond development globally.

Joining the latest episode of the ESG in 10 podcast, is Tamar Hamlyn, portfolio manager at Ardea Investment Management, to take us through the developments in the green bond space in Australia and what this means for sovereign bond investors.

News

11 Aug 2023 - ESG in 10: Episode 9- The Australian Green Bond Program, with Ardea

|

ESG in 10: Episode 9 - The Australian Green Bond Program, with Ardea Fidante Partners July 2023 |

|

Funds operated by this manager: Bentham Asset Backed Securities Fund, Bentham Global Income Fund, Bentham Global Income Fund (NZD), Bentham High Yield Fund, Bentham Syndicated Loan Fund, Bentham Syndicated Loan Fund (NZD) |

10 Aug 2023 - Are You a Trader, an Investor, or a Hybrid of Both?

|

Are You a Trader, an Investor, or a Hybrid of Both? Marcus Today July 2023 |

|

Ask the average investor how they invest and you will get one of two answers. 'Fundamental Analysis' or 'Technical Analysis', and never the two shall meet. It all goes back to Benjamin Graham, who wrote 'The Intelligent Investor' in 1949, the Bible of Fundamental Analysis. In there was the line: "We do not hesitate to declare that (Technical Analysis) is as fallacious as it is popular". In that one sentence he erected a wall between Fundamental and Technical Analysis, or to put it another way, between investors and traders, and it has stood for 62 years, with the proponents of both seemingly hell bent on putting each other down, and they both have their points.

The Bad BitsTraders will tell you that investors:

But the truth is that they both have a lot to learn from each other, and if we look at the positives instead of the negatives, you'll see why. The Good BitsTraders:

The Bottom LineAs any experienced trader will tell you, there is no Holy Grail for success, no one approach that works. Amidst so much grey and so little black and white, the game is simply about trying to get an edge on random outcomes and to do that you would be a fool not to use every tool in the shed, and that's the point, every tool. Not one or the other, but every. You dismiss nothing and learn everything, and this is where so many people go wrong. They decide they are in one camp or the other when it would be far more effective to be in both. The bottom line is that you make a big mistake writing off traders as an investor, or investors as a trader. They both have some good bits and some great bits. You would do well to explore both. Author: Marcus Padley, Founder of Marcus Today |

|

Funds operated by this manager: |

9 Aug 2023 - Political lobbying risks in the US

|

Political lobbying risks in the US 4D Infrastructure July 2023

In recent years, political controversies involving US utility companies have caused significant concern for investors. There have been instances where lobbying activities have contravened the law and resulted in companies and individuals being criminally investigated and punished. Other instances, though not necessarily criminal, have also resulted in negative market reactions. In both scenarios, political lobbying controversies have been difficult for investors to foresee and, therefore, difficult to avoid. Utilities' role in US politicsUtilities are responsible for the delivery of power and gas from source to end-customers, and are considered key players in the energy supply chain. As a result of the importance of both energy prices and reliability to businesses and consumers alike, utilities are central to economic growth, efficiency and quality of life in their operating jurisdictions. For these reasons, utility operators believe their corporate responsibility dictates that they should have a voice in the development of energy legislation. With energy legislation and regulation established at both federal and state levels in the US, lobbying is considered important in ensuring that legislation is in the best interest of all stakeholders, including shareholders. Risk to investors of inappropriate lobbyingLobbying undertaken by utilities in an open and ethical manner supports a more thorough understanding of energy markets for legislators and a better outcome for both customers and shareholders. The obvious concern is that utilities and/or management teams lobby for their own self-interest or solely that of their shareholders, with little consideration to other stakeholders such as customers. Problems eventuate when lobbying contravenes the law and/or ethical expectations. Companies should have ethical charters outlining the values that guide how they operate, including how they interact in the political sphere. The old saying, "would you feel comfortable with your behaviour being published on the front page of the newspaper" is also a good guide for what constitutes ethical political lobbying. Potential violations of the law are often difficult to identify until it's too late and enforcement agencies are involved. Regardless of guilt, once a review is underway, the utility in question will feel pressure as the process evolves. This potentially includes:

Utilities across the world are bound by a social license to operate. Regardless of strict legality, that social license may be tarnished based on the public's perception that the company has received special treatment from legislators/regulators based on aggressive/unethical lobbying activities. This scenario could result in public backlash, and regulators/legislators taking detrimental action against the utility to reinforce their independence. This can take the form of fines, difficult regulatory decisions, out-of-cycle regulatory reviews and irrational oversight. Negative financial ramifications and poor market sentiment are the result, and re-establishing customer faith in regulators and utilities takes a long time. 4D's approach to political lobbying riskDue to the high legal, financial and reputational risk associated with lobbying activities, 4D undertakes significant due diligence to identify utilities that are at higher risk and steps being taken to mitigate this risk. Internal controlsPolitical lobbying should be guided by a political engagement policy or a similar document recognised by the company board. It should be easily publicly available and outline a set of criteria guiding lobbying efforts and political contributions, and provide authority for contributions and oversight. Best practice for authority of contributions is for the annual political contributions budget to be developed by the corporate affairs team (or equivalent). The individual contributions should be reviewed by a legal professional and signed off by the most senior executive in the team. It's often a good idea to include an executive or leadership committee review it to ensure widespread knowledge and acceptance of contributions. In our view, large contributions should be reviewed and signed off by the CEO (~>$1 million). The board audit subcommittee should also review contributions on behalf of the board. A recommendation should then be provided to the board as part of that oversight. Any newly planned contributions should also be reviewed by an audit committee. This ensures that senior leadership approve all contributions, approvals involve multiple parties, and the board has ultimate oversight. TransparencyEnsure public transparency of all contributions to individual political figures and parties, political action committees (PAC), other tax-exempt structures (such as 501(c)4 structures), trade associations and political consultancy/advisory groups. Stakeholders should have access to all internal control and governance documents relating to political engagement. Appropriate size of contributionsThe size of political contributions should be moderated so that they don't give the impression that a political favour is expected in exchange for the contribution. Many utilities have outlined that any individual contribution over $1 million requires CEO sign-off, suggesting that this size of contribution is rare. Overall contributions need to be moderated as no financial return should be expected on these funds - it should be perceived more as a cost, rather than an investment with the expectation of receiving something in return. Focus on the utilisation of structures for contributionsSome tax-exempt structures provide anonymity to contributors. Companies should seriously question why they need/prefer anonymity when making a contribution. Generally speaking, such structures have attracted scepticism from the media and stakeholders, and should be avoided unless there is a specific reason for their use. Some utilities in the past have engaged political consultancy groups. These groups have historically provided anonymity in political lobbying. Interactions with these groups should be transparent internally and externally, including taking meeting minutes for all interactions. Companies should be very clear on their motivations for engaging such groups, and they shouldn't be considered as vehicles to undertake clandestine political manoeuvres. US federal election laws prohibit corporations and labour unions from making political contributions to federal candidates and national political parties. As a result, companies often use their own, or third party, PACs to make contributions to individuals and parties. 'Pay for play' legislationSome utility management teams suggest that when a company makes significant contributions to support or oppose a particular ballot measure, it can be interpreted as a 'pay for play' situation. Rightfully or wrongfully, this could be perceived as bribery or a quid-pro-quo arrangement. Best practice would be to lobby through trade associations or PACs with correct governance practices in place to avoid any direct link between the company and an individual ballot measure or proposal. Third party verification of lobbying controls and practicesThird party verification of companies' political disclosures and practices can support investors' due diligence efforts. One of the more well-known verification groups is the Center for Political Accountability (CPA), which releases the CPA-Zicklin Index annually. Using 24 metrics, or "indicators", the CPA-Zicklin Index assesses companies' disclosure practices, spending and accountability policies for utilisation of corporate funds to influence elections. It does not address company spending on lobbying or PACs. 4D's actions post lobbying controversiesRecent lobbying controversies have influenced our decision to divest companies from our funds. We have exited positions based on the likelihood that a controversy violated the law, disrupted relationships with regulators and stakeholders, and/or there was a lack of definitive action from boards in identifying and rectifying flaws in lobbying controls, processes and disclosures. By contrast, we have also retained positions where our due diligence suggested the above negative thresholds were not violated. Every situation is considered on a case-by-case basis involving internal due diligence as well as engagement with the company in question. As part of our research into political lobbying best practice, we reached out to companies who rate highly on the CPA-Zicklin Index for comment on this paper and their approach to lobbying. Two such companies in Southern Company and CMS Energy provided their feedback below.

|

|

Funds operated by this manager: 4D Global Infrastructure Fund (Unhedged), 4D Global Infrastructure Fund (AUD Hedged), 4D Emerging Markets Infrastructure Fund For more information about 4D Infrastructure, visit https://www.4dinfra.com/ The content contained in this article represents the opinions of the authors. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. |

8 Aug 2023 - Webinar Podcast 01 Aug 2023 | Infrastructure Funds - Analysing the Opportunities and Risks

|

Webinar Podcast | Infrastructure Funds - Analysing the Opportunities and Risks FundMonitors.com 01 August 2023 |

|

Listen to the podcast to discover the key insights and opportunities in this dynamic investment landscape. In this informative 45-minute session, we explored the potential benefits and risks of investing in infrastructure funds and uncovered the various types of infrastructure assets, including transportation, energy, and social infrastructure. Our panel consisting of Sarah Shaw from 4D Infrastructure, Ben McVicar from Magellan, and Matt Lorback from Atlas Infrastructure also delved into the regulatory and policy considerations impacting infrastructure investments. |

7 Aug 2023 - The three factors driving stock returns

4 Aug 2023 - A site visit with a difference

3 Aug 2023 - In Conversation with Airlie's Analysts

|

In Conversation with Airlie's Analysts Airlie Funds Management July 2023 |

|

Airlie Australian Share Fund Portfolio Manager, Emma Fisher, engages in a conversation with Airlie's senior analysts, Vinay Ranjan and Joe Wright. Emma discusses the performance of the Australian market during the past 12 months and asks Joe and Vinay to share insights on how some of their stocks have performed during the year within the Fund. This includes Mineral Resources, QBE Insurance and James Hardie. Funds operated by this manager: Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks.. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

2 Aug 2023 - Do they have your back or just your back pocket? The fun, games, and fees of equity investing

|

Do they have your back or just your back pocket? The fun, games, and fees of equity investing Collins St Asset Management July 2023 FY23 recap: ASX 200 defies the bears to end up +10% over last financial year It is often said that: When someone with money meets someone with experience, the person with the experience gets the money and the person with the money gets an experience. For equity investors, regardless of whether or not they choose their own investments or outsource some or all of that responsibility to an external manager/adviser, this remains a very real and important risk to be on top of. Many Directors and Management teams do not run companies for the benefit of shareholders despite all of the claims and promises of future gold and glory laid out in glossy annual reports. Fat salaries for start up company Directors, gifted equity to management in large established businesses and all manner of perks and parties along the way are, all too sadly, par for course. To that end, its important to understand the governance structure of a company and the way in which senior decision makers are remunerated before deciding whether or not to invest. Some key questions we at Collins St Asset Management seek to understand before deploying capital include:

Sadly, a rolling stone gathers no moss in much the same way as an upwardly mobile executive can suffer no financial pain by moving from one company to the next just before the next crisis is uncovered. Of course, Directors and senior Management are not alone in their pursuit of cushy rent-seeking corporate opportunities. Whilst many intermediaries in the funds management space are often no better, there are a variety of fee models on offer which invariably incentivise different behaviours. The table below provides an overview of some of the different ways professional fund managers may seek to charge their clients: Overview of fee structures Author: Rob Hay, Head of Distribution & Investor Relations For wholesale investors only |

|

Funds operated by this manager: |

1 Aug 2023 - Stage two of the downturn - earnings downgrades

31 Jul 2023 - Will service stations be stranded assets?

|

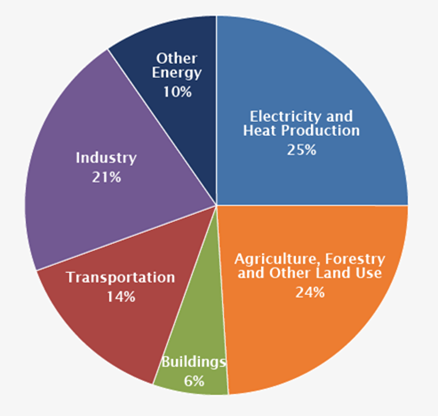

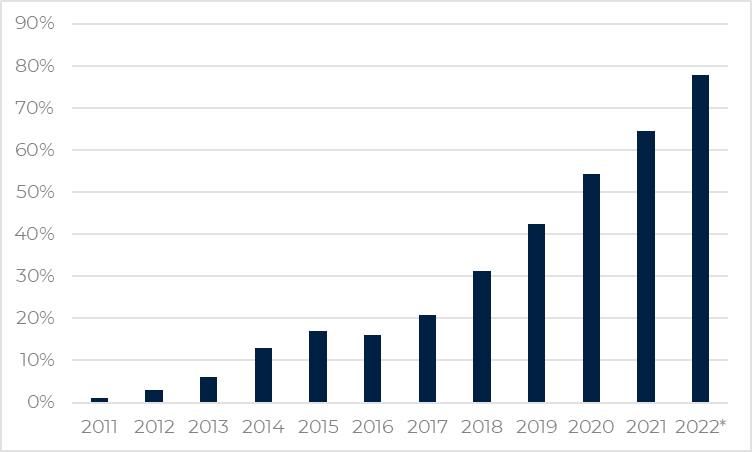

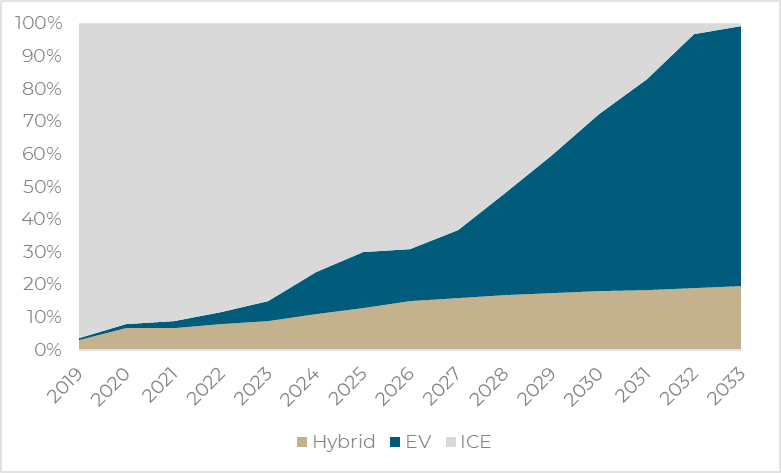

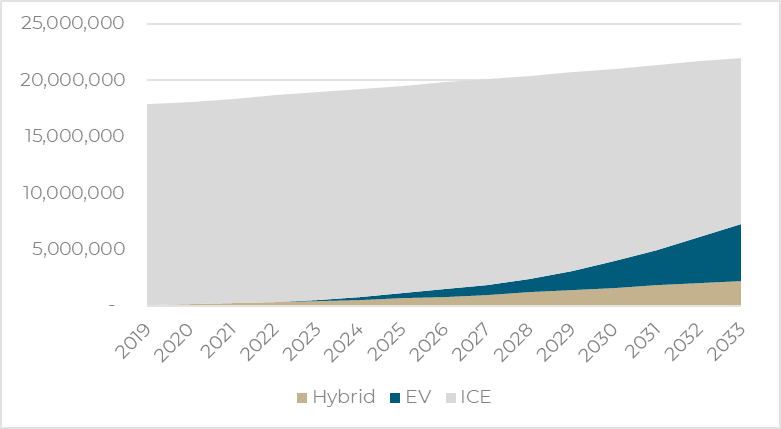

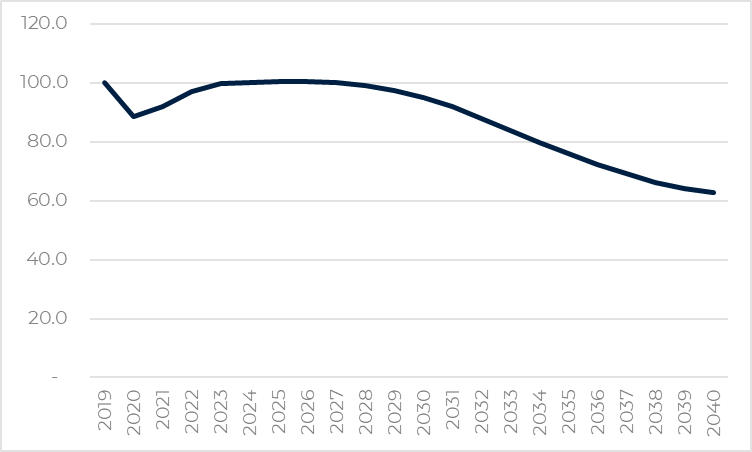

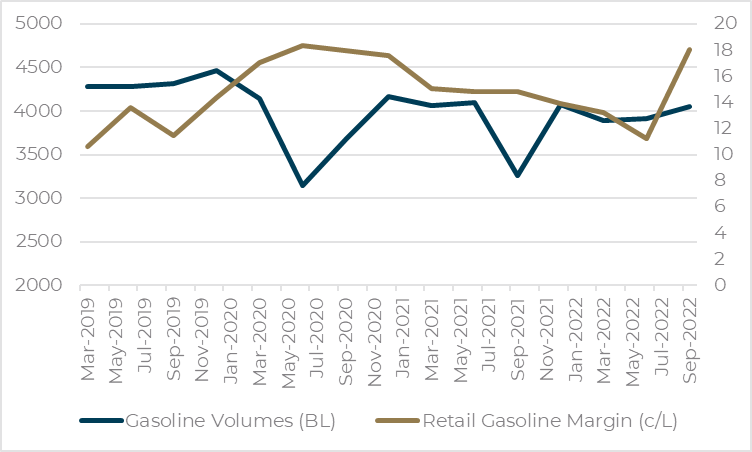

Will service stations be stranded assets? Tyndall Asset Management June 2022 At the same time as we are seeing global policy initiatives seeking to further accelerate the uptake of electric vehicles (EVs), corporate activity in the fuel and convenience retailing sector has stepped up. If the common belief that EVs will displace the need for Fuel Retailers, why are industry players increasing their capital allocation to the sector? We investigate the outlook for Fuel Retailers against the commonly held perception that they will ultimately be stranded assets. With the transport sector accounting for 14% of global carbon emissions (refer Figure 1), internal combustion engines (ICEs) are directly in the firing line of governments seeking to meet reductions targets. Further, the development of cost-competitive alternative technologies means that the transition to cleaner transport is not only achievable but now gathering significant momentum around the world. Figure 1: Global Greenhouse Gas Emissions by Economic Sector Source: US Environmental Protection Agency The consequence is that ICEs are likely to go the way of the steam engine over time. This begs the question - will service stations become stranded assets? What are the prospects for these sunset industries? Three years ago the answer to these questions was largely speculative. However, the COVID-19 period has created an ideal test environment in which the impact of a reduction in fuel volumes can be readily examined. This paper reviews the data and the risk that service stations become stranded assets. It is beyond debate that over the next two decades the vast majority of Australia's passenger vehicle fleet will transition to cleaner fuels. Car manufacturers are moving rapidly towards EVs, recognising the mega trend and the cost comparability. Governments around the world have varying incentives to assist in the transition, with adoption of EVs having increased rapidly as price-competitive and range issues have been overcome. Australia lags but won't foreverWhile adoption of EV's in Australia has been relatively slow to date, it would be naïve to consider that this will remain the case. Norway is the country most advanced in electric vehicle penetration of new car sales. This has come on the back of significant government incentives for the electric vehicles and support for infrastructure development. While EVs were only 1% of new car sales in 2011, the Norwegian Office of Vehicle Statistics reports that in the nine months to September 2022, EVs represented 77.8% of new car sales (refer Figure 2). Figure 2: Electric Vehicle Share of New Car Sales - Norway Source: Road Traffic Information Council (OFV); Electric Vehicle Association (Elbil). *Year to date September 2022. What would this adoption rate mean for Australian fuel volumes?We have modelled the implications of an adoption rate as rapid as Norway's for the Australian market, allowing us to map out the potential impact on retail fuel demand as the energy transition proceeds. We have also assumed that the uptake of hybrid vehicles accelerates from recent trend rates, as more models become available. Combined these assumptions indicate that ICE vehicles will be a rapidly declining proportion of new car sales, to the point that they are all but eliminated by 2033. Notably this is faster than the proposed legislated goal of ending ICE vehicle sales in the UK and EU by 2035 and close to the recent Biden Administration proposal to phase out ICE vehicles by 2032. Figure 3: Composition of New Car Sales (Australia) Source: VFACTS, Tyndall estimates While the composition of new car sales changes rapidly in a decade, the impact on the vehicle fleet (refer Figure 4) is a much slower process. Under this scenario, hybrids and electric vehicles will represent only one-third of the total fleet by 2033. Figure 4: Australia's Vehicle Fleet Mix Source: VFACTS, Tyndall estimates What is evident from this analysis is that the impact on volumes from the transition to electric vehicles is extraordinarily protracted (Refer Figure 5). Retail volumes are not forecast to decline from 2019 levels until 2029. And even then, the decline is only 1.3ppts. The impact does accelerate quite significantly during the following decade, with 2040 volumes forecast to be c33.5% lower than 2019 levels. Figure 5: Fuel Volumes (Indexed to 2019) Source: ABS, Tyndall estimates A longer-term volume contraction is only half the storyWhile significant and at face value perhaps alarming, a significant decline in fuel volume is only half the story. The other relevant variable of course is price, and the COVID-19 experience has demonstrated the ability of the fuel retailing industry to maintain dollar gross margin in the face of falling volumes. This rational industry response perhaps benefited from the recent memory of unprofitable discounting that occurred during calendar 2018. Chart 6 shows the trends in gasoline volumes and retail gasoline margins over the recent past - capturing the period of COVID disruption. As the chart shows, Fuel Retailers responded to lower volumes with price increases, such that dollar gross margins expanded. Figure 6: Retail Gasoline Margins and Volumes Source: Australian Petroleum Statistics, Department of Energy; Australia Institute of Petroleum; Tyndall In the June 2020 quarter, which includes the early part of the pandemic and national lockdowns, fuel volumes fell ~45%. Retail margins in that period averaged 18.3 cents/litre, ~46% above the 2019 average. Preparing for the futureAs highlighted above, the medium-term outlook for Fuel Retailers is sound, with the impacts of the fleet conversion to electric vehicles a very slow burn that will not materially impact volumes for a decade. That said, the longer-term outlook does point to significant erosion of fuel volumes. While pricing offsets to combat this have been proven possible through the COVID experience and at face value are not unaffordable, the very long-term scenario is that retail fuel volumes go to zero. We are watching this area closely and observing how the listed participants are progressing their strategies. Both Viva Energy and Ampol have de-risked their businesses by selling service station properties but with long-term options that provide ongoing control over the site. Author: Tim Johnston, Portfolio Manager Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund |

.jpg)