News

12 Sep 2024 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

12 Sep 2024 - Performance Report: Bennelong Australian Equities Fund

[Current Manager Report if available]

12 Sep 2024 - Can the Commonwealth Bank of Australia's share price rally continue into FY25?

|

Fast food profits Can the Commonwealth Bank of Australia's share price rally continue into FY25? Montgomery Investment Management August 2024 Our domestic large-cap funds have maintained an underweight position in the banks, and even though the Commonwealth Bank of Australia (ASX:CBA) was, for a time, our largest position, being underweight in the sector has cost relative performance thanks to the Commonwealth Bank of Australia's share price rallying as much as 23 per cent year-to-date and 35 per cent last financial year. Our reasoning is relatively straightforward; first, with each bank's position in Australia's banking oligopoly relatively stable - thanks in part to customer inertia and living on an island, and with each one constantly eyeing the others, we find their market shares and relative operating performances rarely vary much in absolute or relative terms. Therefore, trying to pick the short-term outperformance consistently successfully of one bank over the others has often proven to be a fool's errand. Secondly, and importantly, we have not identified a "change" trigger among the banks that justifies significant share price outperformance. Therefore, we do not believe the banks' outperformance can be repeated in 2025. For the major banks, competition remains intense, especially for home loans, and underlying demand for home and business loans is subdued, reflecting moribund economic activity. The Commonwealth Bank of Australia's FY24 cash earnings were higher than consensus analyst expectations, and pre-provisioning operating profit (PPOP) was in line with consensus estimates, driven by higher than anticipated net interest margin (NIM - more on that in a moment). Overall, the result was broadly in line with modest loan growth, expense growth of three per cent, and below-average bad debt expenses. The final ordinary dividend per share was 250 cents, 10 cents higher than analyst expectations and it takes the full-year dividend to $4.65, which is 3.3 per cent up on the previous year. Notably, the dividend reinvestment plan (DRP) will be done with no discount and will be offset by an on-market buyback. The Commonwealth Bank of Australia's FY24 Common Equity Tier 1 capital (CET1) ratio, was 12.3 per cent and 19.1 per cent on an internationally comparable basis. CET1 is a capital measure that was introduced in 2014 as a protective precaution to head off another financial crisis. In the event of a crisis, equity is taken first from Tier 1, which includes liquid bank holdings such as cash and stock. The Commonwealth Bank of Australia's resilience in maintaining its net interest margin (NIM) was a notable highlight in today's results. However, there were some early warning signs, including a potential decline in asset quality, driven by expected pressures on real household disposable income, and a resurgence in mortgage competition. For what it's worth, your author believes we will sidestep a recession this year and the reported slump in consumption will stabilise. From a valuation perspective, it's interesting to observe that while the Commonwealth Bank of Australia estimates its market-implied cost of equity to be around 8 per cent (I note many share market investors are using lower rates to justify stock market valuations for much riskier companies). However, the Commonwealth Bank of Australia maintains an internal cost of capital hurdle at 10 per cent. Investors are using lower rates to justify investing in the Commonwealth Bank of Australia at current prices. By lowering the discount rate, we can dream up a valuation for the Commonwealth Bank of Australia that is close to the price, but the company's prospects aren't as bright as many other companies also listed on the ASX. We view the Commonwealth Bank of Australia's valuation as reasonable but not cheap. Additionally, the price-to-earnings (P/E) ratio is much higher than has been historically evident, even taking into account its status as the premier bank with the best economic business performance. As an aside we think analysts fretting over substantially rising bad debts (credit losses) are misguided - there's plenty of room to cut rates quickly if animal spirits need to be stirred. Author: Roger Montgomery Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

11 Sep 2024 - The Evolution and Benefits of Equity Income Funds in Australia's Growing Retirement Market

|

The Evolution and Benefits of Equity Income Funds in Australia's Growing Retirement Market Merlon Capital Partners August 2024 Australia's growing retirement-age population has seen an increase in demand for and the availability of equity income funds over the last few decades. Australia's unique dividend imputation system means investors can successfully derive meaningful income as well as capital growth from holding Australian equities. Equity income strategies regularly make up a large component of the equity allocation for income-focused clients who seek a more defensive asset mix. Equity income funds have evolved significantly over time, beginning in the 1990s, with MLC and Colonial First State (now First Sentier Investors) launching equity income products. These initial products were not specifically focused on paying a regular, smoothed, tax-effective income but rather designed to grow capital before retirement to provide income once in retirement. The mid-2000s saw the equity income fund reimagined, designed specifically to meet retiree's key objectives - income generation, volatility management and capital growth over time. A number of managers developed products to meet these objectives at this time. The wake of the GFC saw growing recognition of the importance of total return generation from income, limiting the need to sell down holdings during market downturns. As a result, the equity income space continued to grow and through the 2010s, various managers launched new income funds, often with full market exposure. Additionally, with the rising popularity in passive investing through the 2010s, income-focused ETFs also emerged from leading ETF providers with the goal of generating income that exceeds the dividend yield offered by the broader market. With an aging population, the addressable market for equity income funds is only growing. Whilst not all equity income funds remain in existence today, there are a variety to choose from with over 15 Australian fund managers offering a product in this space. The need for regular income in retirement is well known and there are various ways to meet cashflow requirements. However, many of these tend to overlook the particularities of retirement. While fixed income products can help to meet an income objective, they fail to provide capital growth to protect against the impacts of inflation. A diminishing capital value on a real basis is inconsistent with the desire of many retirees for a growing capital base for both peace of mind and to leave an inheritance. Another option is to pursue an equity strategy centred solely on capital growth and simply selling down holdings when cashflow is required, rather than investing in income-generating investments. Yet, this ignores the fact that retirees are much more impacted by periods of drawdown than other investors, especially early in their retirement, amplified by their obligation to draw out from accounts when in pension phase. The GFC market crash and COVID-19 selloff in early 2020 demonstrated the serious consequences of needing to sell at an inopportune time and its long-term impact on total return. Skewing the components of equity total return to income removes the need to sell investments to raise cash when required. Proposed alternatives to equity income also ignore the value of franked dividends, which for retirees in pension phase present significantly more value than unfranked income or capital gains. Australian equity income strategies, when structured and executed appropriately, can provide strong total returns over time through attractive dividend yields and without sacrificing capital growth. The Merlon Australian Share Income Fund was launched in 2005 and led the innovation of contemporary equity income funds. It was the first product of its kind, aiming to provide above-market income with franking, grow capital over time with lower risk than the market. The non-benchmark portfolio has a high active share, blending well with both passive and direct share portfolios which are typically overweight large cap stocks. The Fund delivers above market income, the majority from franked dividends, paid monthly and has demonstrated strong risk-adjusted returns over multiple time periods. The strategy features a risk reduction overlay to insulate the Fund during periods of drawdown whilst retaining 100% of the franked dividend income generated from the underlying portfolio. Funds operated by this manager: Merlon Australian Share Income Fund, Merlon Concentrated Australian Share Fund Disclaimer |

10 Sep 2024 - Emerging Middle Class Megatrend

|

Emerging Middle Class Megatrend Insync Fund Managers August 2024 The era of blindly betting on Western brands to tap into China's burgeoning consumer market is over. Once considered no-brainers, global titans like L'Oreal, Nike and Starbucks are finding their footing increasingly precarious. Despite the allure of its growing middle class the dynamics at play are more nuanced than ever. New generation of Chinese consumers are flexing their economic muscle. No longer in favour of the imported brands that once dominated their preferences they have rotated towards domestic brands that speak to their cultural identity and nationalist pride. LVMH, a beacon of luxury with its Sephora chain, has had to slim down operations in China--a stark indicator of this shifting landscape. Domestic players, such as Anta Sports, are not only catching up but surpassing Western rivals like Adidas in market share. Meanwhile, coffee giant Starbucks, a symbol of Western lifestyle, is ceding ground to local competitors like Luckin Coffee, which captivates the market with aggressive pricing and expansive growth recently surpassing 20,000 stores. The same story echoes across most industries: global brands are no longer the default choice for Chinese consumers. Companies must now navigate a complex web of local preferences, cultural trends, and rising nationalism inside China. Simply assuming that Chinese spending power will translate to Western profits is dangerous. When investing in such global brands, understanding how these nuanced drivers impact stock values and acknowledging that what worked yesterday may not hold sway tomorrow, is now crucial. Founded only in 2017, Luckin Coffee quickly challenged Starbucks in China with lower prices, discounts, and drinks tailored to Chinese tastes, like the coconut latte and collaborations with local brands. By aligning with the "Guochao" trend, Luckin appeals to younger, cost-conscious consumers and benefits from the preference for local brands. With 20,000 stores versus Starbucks' 7,000+, Luckin dominates China's coffee market. Meanwhile, Starbucks reported an 8% revenue decline in its most recent results. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

9 Sep 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Resolution Capital Global Property Securities Fund - Series II | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Resolution Capital Core Plus Property Securities Fund - Series II | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Resolution Capital Global Listed Infrastructure Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Blackwattle Small Cap Long-Short Quality Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Langdon Global Smaller Companies Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

|

||||||||||||||||||||||

| Aikya Emerging Markets Opportunities Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 850 others |

6 Sep 2024 - Hedge Clippings | 06 September 2024

|

|

|

|

Hedge Clippings | 06 September 2024 In last week's Hedge Clippings we "expected that the phone lines would be running hot between Jim Chalmers and the RBA to encourage a rate fall" following the July CPI figure. While we're pretty sure the phone lines did in fact run hot, what we didn't expect from the Treasurer was a broadside delivered via multiple media appearances, including his now infamous claim that the RBA was smashing the economy with high interest rates. The government is obviously keen not to be seen as responsible for any household financial pain, but such a direct and openly critical comment - although he subsequently denied that it was meant as criticism - made the issue very public, which it was no doubt intended to do. As we've previously commented, the government and the RBA are each pulling on the opposite ends of the same rope. The RBA is trying to curb inflation by keeping rates elevated and reducing demand, while the government is trying to offset the effects of inflation by increased spending, supporting above CPI wage increases, and handouts, subsidies, and tax cuts for all. Having dispensed with the former governor, Philip Lowe, and replaced him with his deputy, Chalmers finds there's been no change in policy, or message - only the messenger. Meanwhile the message was reinforced again on Thursday by Michele Bullock with a speech given at the annual Anika Foundation lunch entitled "The Cost of High Inflation" which not only suggested there would be no easing before Christmas, but that it would be 2026 before the bank's inflation target was met. She was careful to emphasise that conditions, or the numbers, may change between now and then, in which case the RBA would adjust policy settings accordingly. While that might suggest an earlier timeline for easing if conditions allow, it could also mean the opposite. Meanwhile, we expect Jim Chalmers to continue with his line that the government is doing all that it can to help stretched household budgets - which it is - but it is certainly not helping the RBA fight the costs of high inflation. Of course he also has one eye (or maybe both) on the upcoming election. Rather than continue the public spat he started, it seems Dr. Chalmers called for some back-up in the form of ex (Labor of course) treasurer Wayne Swan, who maintained the pugilistic tone by accusing the RBA of "punching itself in the face" and so continuing the issue. Chalmers and Swan may be trying to shift the blame for household mortgage pain, but borrowers don't seem to be pulling their collective heads in based on housing finance statistics released today by the RBA. Investors led the charge, with new investor loans up by 35% over July, 2023, new owner occupied loans increased by 21%, and owner occupied first home buyer loans were up 19.7%. As the ABS noted, these numbers were only partially driven by higher property prices. So in between accusations of "smashing the economy", and "punching itself in the face", the RBA is steadfast in its fight against inflation, the government is pouring more fuel into the economy, while the property market - or at least the financiers of it and real estate agents - aren't taking any notice. Finally on the political front, Bill "Wee Willy" Shorten announced his exit this week, having tried, but never made it to the lodge, in large part due to his policy to cancel franking credits in the lead up to the 2019 election, when he and shadow treasurer Bowen "misread" the level of investor anxiety about the move. Yet another case of politicians being totally out of touch with both the electorate, and common sense. Even so, maybe Shorten can see the writing on the wall for the next election? News & Insights New Funds on FundMonitors.com What not being born and not dying is doing to investments | Insync Fund Managers Stock Story: Stryker | Magellan Asset Management |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

6 Sep 2024 - August Reporting Season - Week Three Update

|

August Reporting Season - Week Three Update Tyndall Asset Management August 2024 The third week of reporting season is always busy, with some 110 companies reporting that represent $716bn of market capitalisation. A similar number of companies are expected to report over the final week. The 2024 earning season has been marked by a mix of optimism and caution, with distortions caused by the COVID-19 pandemic largely now dissipated. However, this normalisation has not been without its challenges, particularly as earnings expectations have generally trended downward. Some of the trends emerging include:

Earnings Performance and Market ReactionsReporting season has so far revealed a mixed performance across the ASX 300, with companies reporting a balanced mix of beats and misses. In aggregate across those ASX 300 companies that have reported (61%), profit before tax beats sit at 25% vs misses at 23%. It is worth reflecting that the final week tends to be more skewed to the downside (48% of results missed by >5% over the past two reporting seasons). Market reactions have been varied, with share prices responding accordingly to the earnings outcomes.

Sector Highlights

Where to next?The final two weeks of reporting season are always brutal, with the sheer number of companies reporting making it difficult to separate the noise from the underlying fundamentals. It is important to determine quickly whether the share price reaction is reflecting the long term, short term or simply how the market is positioned in the stock. As long-term fundamental value investors, excessive moves during earnings season typically bring opportunities. As Benjamin Graham, the father of value investing opined: "In the short run, the market is a voting machine but in the long run, it is a weighing machine." Fear and greed are some of the most powerful long-term alpha generators and thus it is important to have a patient and disciplined process that can find opportunities amongst the dislocations. Author: Brad Potter, Head of Australian Equities Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund |

5 Sep 2024 - Can utilities solve the renewable energy storage problem?

|

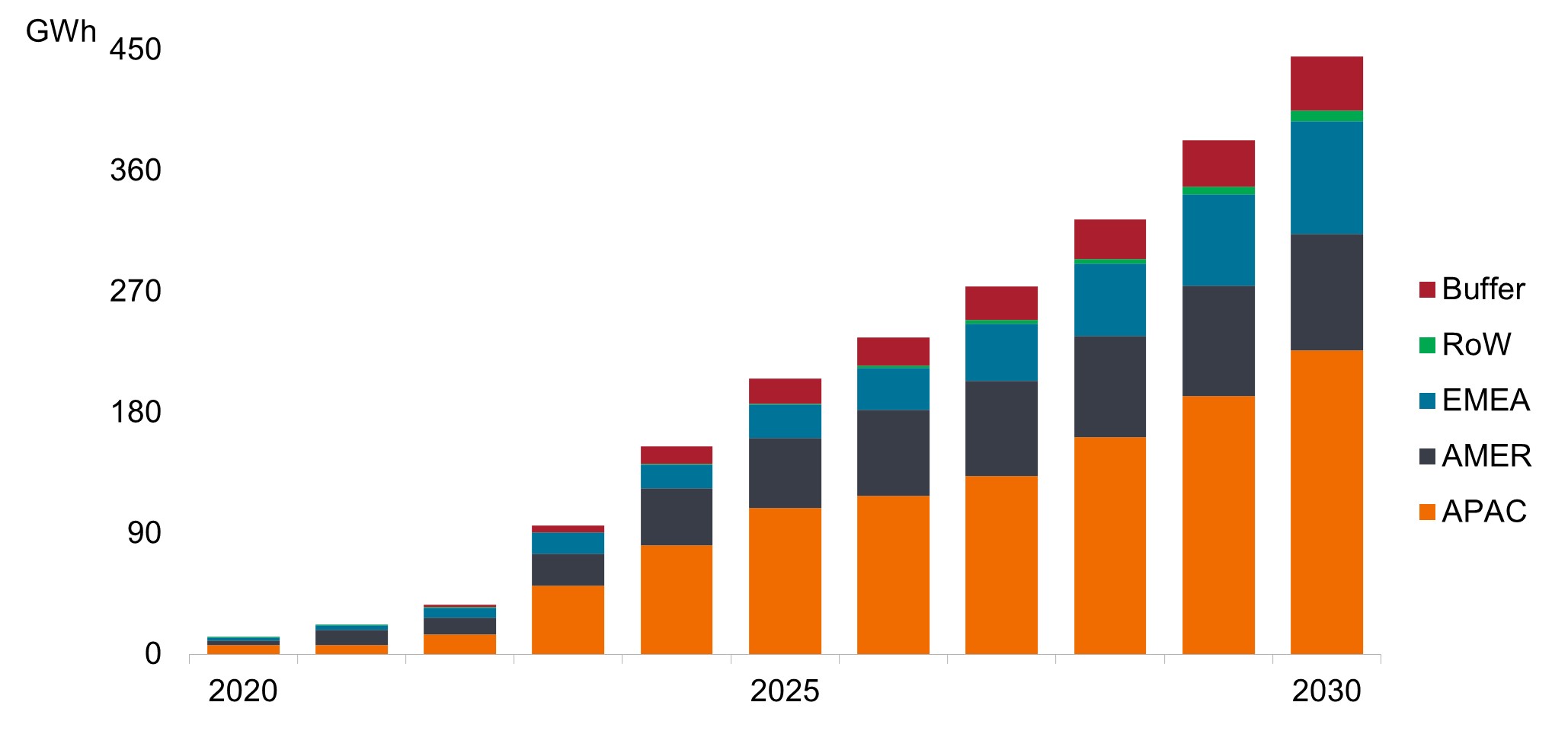

Can utilities solve the renewable energy storage problem? Janus Henderson Investors August 2024 The rapid growth of renewable energy sources like wind and solar power has brought a critical challenge to the forefront: how to effectively store and distribute this intermittent energy. As utilities grapple with increasing load growth and work toward net-zero decarbonization goals, they face a pressing question: How much renewable energy can they integrate before hitting practical limitations? The renewable integration ceilingBased on our discussions with utilities in various locations, the upper limit for renewable penetration in their energy mix without significant storage solutions or major interconnection improvements is somewhere between 30%-40%. Beyond this threshold, the intermittency of wind and solar power begins to pose challenges. While plans vary, many utilities aim for 70%-80% renewables by the early 2030s. While renewables penetration is already high in certain areas, like Texas and California, states in the mid-Atlantic, Northeast, and Pacific Northwest face bigger hurdles in achieving these goals due to less intense wind and solar power generation given weather conditions in those regions. The elusive long-duration storage solutionFor over a decade, utility-scale, long-duration battery storage has been the holy grail for increasing renewable energy penetration. Ideally, this solution would store power for more than 24 hours, and preferably up to a week. However, despite ongoing research, an economically viable option that works at the scale needed to power entire cities or regions has yet to emerge. Current storage solutions often work well on a small scale but struggle when scaled up. The physics may not work, or costs become prohibitive. While breakthroughs in technologies like solid-state batteries, sodium batteries, or hydrogen solutions occasionally make headlines, they often fall short of being able to power a major city during extended outages or prolonged periods of low renewable generation. The need for better storage is twofold: to prepare for multi-day renewable energy shortfalls and to reduce waste. In some regions, like California, excess renewable energy generated during peak times goes unused due to lack of storage capacity. Short-term solutions and alternative technologiesDespite these challenges, utilities are investing heavily in energy storage. The global market nearly tripled last year and is on track to surpass 100 gigawatt-hours of capacity for the first time in 2024 (Exhibit 1). Large regulated utilities like NextEra, Xcel, and AES are leading the charge in building out grid-scale storage. Exhibit 1: Annual global storage installations outlook by region

Current models typically use lithium-ion batteries that can hold only two to four hours of power. These short-duration solutions help manage daily fluctuations - storing electricity during peak renewable generation periods and discharging it back to the grid when electricity demand is high - but don't address longer-term power mismatches or resilience planning. As utilities recognize that lithium-ion batteries probably aren't the ultimate solution for their long-duration, large-scale storage needs, alternative technologies are gaining attention. Flow batteries and sodium ion batteries, for example, use cheap, abundant materials, potentially solving the sourcing and availability issues associated with lithium. While their weight and size make them impractical for electric vehicles, they could work well for stationary storage. Hydrogen is another frequently discussed option, though its promise has remained "10 years out" for some time. The main barriers to widespread adoption of these technologies are cost and efficiency. For instance, green hydrogen production needs consistent, high-uptime operation to be economically viable, which is challenging when relying on intermittent renewable energy sources. Implications and potential scenariosThe lack of a viable long-duration energy storage solution has far-reaching implications: 1. Utilities may need to delay fossil fuel plant retirements and rely more heavily on natural gas as a short-term solution, potentially building new gas-fired facilities. While this could slow progress toward decarbonization goals, it would help ensure grid reliability as electricity demands from AI data center growth and the move to a more electrified economy increase over the next decade. If regulated public utilities prioritize achieving net-zero goals over building new gas-fired facilities, power could potentially be generated by the private sector. Alternatively, electricity prices could increase, potentially slowing data center growth and bringing electricity demand back to a more manageable level. 2. The expansion of wind and solar installations may face limitations as grid operators struggle to balance intermittent supply and demand. This could potentially slow the pace of renewable energy adoption in some regions. Furthermore, installations could slow in regions with an abundance of renewable energy and negative power pricing. Adding more renewables could compound the oversaturation problem in these regions without favorable economics for developers. 3. Data centers, which need constant electricity and have Big Tech clients with ambitious sustainability goals, may explore alternative options like small-scale nuclear reactors to meet their energy needs while maintaining sustainability commitments. 4. Grid stability becomes more challenging without adequate storage capacity, potentially leading to increased volatility in power markets and reliability issues during extended periods of low renewable generation. Incentives could stoke further innovationThe road ahead for renewable energy storage remains uncertain, but incentives for developing and implementing large-scale, long-duration storage solutions are likely to grow. As utilities and tech companies push for solutions, and as the frequency and duration of power outages potentially increase with greater incidence of extreme weather, innovation in this space will be crucial. For investors, the energy storage market presents a complex landscape with very few pureplay public equity investment opportunities. Many companies are still in the early stages of development and face profitability challenges, particularly cash-intensive businesses in a high interest rate environment. The industry can also be volatile and dependent on government support, making it potentially better suited for diversified portfolios. We expect larger utility companies leading in renewable development such as NextEra, AES, and Iberdrola to drive long-term progress in energy storage. While regulated, they are at the forefront of current storage buildouts and are investing in next-generation storage technologies like hydrogen. We believe utilities can eventually solve the renewable energy storage problem. For now, however, despite their progress, the holy grail of energy storage remains just out of reach. Author: Noah Barrett, CFA |

|

Funds operated by this manager: Janus Henderson Australian Fixed Interest Fund, Janus Henderson Australian Fixed Interest Fund - Institutional, Janus Henderson Cash Fund - Institutional, Janus Henderson Conservative Fixed Interest Fund, Janus Henderson Conservative Fixed Interest Fund - Institutional, Janus Henderson Diversified Credit Fund, Janus Henderson Global Equity Income Fund, Janus Henderson Global Multi-Strategy Fund, Janus Henderson Global Natural Resources Fund, Janus Henderson Tactical Income Fund IMPORTANT INFORMATION Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned. Volatility measures risk using the dispersion of returns for a given investment. This information is issued by Janus Henderson Investors (Australia) Institutional Funds Management Limited (AFSL 444266, ABN 16 165 119 531). The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Whilst Janus Henderson Investors (Australia) Institutional Funds Management Limited believe that the information is correct at the date of this document, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson Investors (Australia) Institutional Funds Management Limited to any end users for any action taken on the basis of this information. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson Investors (Australia) Institutional Funds Management Limited is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. |

4 Sep 2024 - RBA minutes - inside a meeting of two-handed economists

|

RBA minutes - inside a meeting of two-handed economists Pendal August 2024 |

|

IF anyone complains about RBA transparency, they are not paying attention. The minutes from the central bank's early August meeting were released today, though I am not sure minutes is the correct word - at 3,667 words, transcript might be a better term. Together, with the post-meeting press conference, the RBA is putting its best foot forward in communicating with the public, as encouraged by the RBA review. There was so much to say but so little confidence in anything. Even the new Deputy Governor Andrew Hauser chose a recent speech to warn of false prophets and said we should have little confidence in any forecasts. In the minutes we were treated to such gems as:

However, the one thing the RBA was keen to say is that if the Board was to do anything near term it is hiking - not cutting. It believes there is less spare capacity in the economy than previously thought. If that does not improve, then inflation will be too slow to fall. Very little spare capacity when GDP is barely growing? Sounds like the Board still believes we have a supply problem. Otherwise, its message could be summarised as "we need a recession to beat inflation", which is a variation of Paul Keating's "recession we had to have". I am not sure it would want that headline. We disagree with the RBA's current concerns, finding more agreement with the ex-RBA chief economist - now Westpac Chief economist - Luci Ellis. She describes the RBA as "skating to where the puck used to be" due to the fact that the RBA is focused on where the labour market was, not is. Recent data showing increasing participation and supply, falling hours worked per person, and improving real incomes means the puck has moved. In the months ahead, the RBA should be increasingly comfortable with labour market dynamics helping lower inflation. This should change its narrative and see it follow other central banks by cutting rates early next year. Remember, the RBA stated in February 2022 that "while inflation has picked up, it is too early to conclude it is sustainably within the target range" and that "there are uncertainties about how persistent the pick-up in inflation will be as supply side problems are resolved". In May 2022, it hiked. OutlookMarkets for now are largely ignoring the RBA anyway. Three-year bonds remain near 3.5% and ten-year bonds finally seem to be holding just below 4%. At these levels, bond markets are no longer super cheap but, at the risk of becoming a two-handed fund manager, they are also not expensive. It is important to remember the cycle has turned and, when that happens, yields will trend lower for an extended period. Author: Tim Hext |

|

Funds operated by this manager: Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Multi-Asset Target Return Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Pendal Sustainable Australian Share Fund, Regnan Credit Impact Trust Fund, Regnan Global Equity Impact Solutions Fund - Class R |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

Source: BloombergNEF, 1H 2024 Energy Storage Market Outlook, April 25, 2024. Note: RoW = Rest of the World; EMEA = Europe, Middle East, and Africa; AMER = US, Canada, Latin America; APAC = Asia-Pacific; Buffer = headroom not explicitly allocated to an application.

Source: BloombergNEF, 1H 2024 Energy Storage Market Outlook, April 25, 2024. Note: RoW = Rest of the World; EMEA = Europe, Middle East, and Africa; AMER = US, Canada, Latin America; APAC = Asia-Pacific; Buffer = headroom not explicitly allocated to an application.