News

23 Mar 2018 - Hedge Clippings

Naughty bankers, Trump's trade tirade, Company tax, and Shorten's retiree tax grab.

The banking industry was in the headlines again this week for all the wrong reasons as the Banking Royal Commission continued to unearth totally unacceptable, and we would imagine, criminal lending behaviour. A report quoting UBS analyst Jonathan Mott estimated that one third of all mortgages ("Liar Loans") written in the past year were based to some degree on borrowers' false or misleading income or expenditure data. There's an eerie sense of déjà vu of pre GFC US housing lending here. If anyone's looking for a catalyst for a property crunch, imagine if those loan applications were re-submitted based on the real numbers?

Over in the US the Federal Reserve increased interest rates by 25 bps to 1.75%, taking rates above the RBA cash rate in the process. As pointed out by Jamieson Coote's Charlie Jamieson, the last time this occurred the A$ was at US$.50 cents! As this was possibly the most widely anticipated move we can remember, the market didn't seem to miss a beat, but that didn't last as Trump's latest tariff salvo against the Chinese took its toll overnight.

At the beginning of the year we warned that there were likely to be two big risks to markets this year - rising interest rates, and political "left of field" events.

Both seem to be playing out, although the interest rate theme has been well flagged and therefore there's no surprise in that - although there will come the time when the "Tipping Point" arrives - i.e. when the risk/return balance moves investors out of equities to other less volatile asset classes.

Politics is of course very left field in the Donald Trump/Vladimir Putin era, although it's fair to say that as both are becoming predictable, it's a case of expect the unexpected - or just more of the same. In both cases there's an old rule we recall from physics classes - "for every action there's an equal and opposite reaction". However in the political environment the reaction is not always rational, equal, or predicable. There's no way the Chinese are going to let Trump's tariff announcement simply slide by un-noticed, but what they'll do is yet to be seen.

From investors' perspective therefore volatility and risk come to the fore. Hedge and Absolute Return funds - depending on their strategy, style and the manager's skill - will help protect the downside to varying degrees, for instance those funds with high cash parameters, or the ability to protect against overall market risk using short index futures, or long put options.

Tax - one way or another - was also front and centre in the news this week. In the US The Donald is cutting company tax, while in Australia Malcolm Turnbull is hoping to. Overall, Hedge Clipping's view has always been that the Australian Taxation System - if not broken - is seriously in danger of breaking under the weight of complexity and legislation. As this link shows, Australia's tax act has increased over the past 100 years from just 22 pages to over 5,000 and rising, but that, as they say, is history.

Politicians of all persuasions like to have their say, but none have made any real effort to act to simplify the system. The Henry Tax Review, released in 2010, made 138 specific recommendations, almost none of which were adopted by the government of the day, or since - except the failed Resources Super Profit Tax. Henry's review was also hamstrung as that great political elephant in the room, the GST, was explicitly excluded from the terms of reference. As a result the great taxation debacle, and all its complexity, continues seemingly ad infinitum.

Memo to politicians of all persuasions: An increasing number of the electorate are desperate for a simplification and overhaul of the taxation system (including superannuation). The Country and the economy need it. Leadership is required!

Combining the topics of political leadership and taxation is never easy. However, last week, the opposition leader Bill Shorten got into a fiddling tax act mess, announcing a planned change to the treatment of franking credits - or more specifically a plan to ditch franking credit cash rebates for tax payers with low taxable incomes. He certainly hit a raw nerve on all sides of the electoral spectrum. In last week-end's Financial Review his proposal received no less than 8 full pages of comment or editorial, and in the days since it seems everyone has jumped on the bandwagon, with most of them jumping on Bill.

As such it would be remiss of Hedge Clippings not to join the throng, but we had difficulty in coming up with a new angle. As a result, and being a Friday, here's a different view (with hyperlinks for those of our overseas readers unfamiliar with the local vernacular):

Wee Willie Short-One was looking for a plan,

to soak the rich and famous and so help the common man;

With an election 'round the corner, it's a chance he couldn't miss,

He tried it with his Mediscare, it might just work with this:

"I know!" he says to Albo, (who's breathing down his neck),

"What about the pensioners, they're fair game - what the heck!

Best of all I'm sure they're Libs, so wouldn't vote for us,

We'll call it taxing millionaires, that'll not cause so much fuss."

No matter that they worked for years to put some funds away,

or started up a super fund just for that rainy day.

"Look at all the franking credits they're getting back in cash -

They'll whinge a bit, poor old folk, but few teeth left to gnash."

"But best of all OUR super's safe, indexed and inflation free,

Fifteen percent and guaranteed, it won't hurt you and me.

If it works I'll get a pension, gold pass, driver and a car,

But only if I make PM - if I can only get that far..."

But Willie's got his facts wrong, as pollies often do,

Didn't understand the people his franking tax will screw,

There's lots of labour voters who he forgot to note,

Have also put some shares away - and bloody hell! they'll vote!

For those amongst you who might not recognise the rhythm or the rhyme, check out (and apologies to) William Miller's Wee Willie Winkie. Or for a less politically correct musical connection, Benny Hill's all time number one classic from 1971, Ernie - the fastest milkman in the West.

16 Mar 2018 - Hedge Clippings, 16 March, 2018

Banking revelations surprise even the most cynical, but on reflection, no surprises.

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry hit the headlines this week with mis-deeds and malpractice in the banking sector front and centre. Even those who expected that Australia's banks would probably not emerge from Court Room 4A in Melbourne's William Street smelling like roses, might not have suspected the levels of graft, seriously poor practices, corporate governance and criminality that were revealed.

In particular lending for Australia's residential property market, which makes up such a large proportion of each bank's loan book, came under scrutiny, with executives from NAB and Commonwealth, and their respective distribution and mortgage broking arms, uncomfortably sharing the limelight.

It seems inevitable that if you hire a sales team, place them on significant commissions and incentives, (including both upfront and the trailing variety) and then set aggressive sales targets, selling into a market desperate to buy your product, you are going to end up with only one result - or more correctly one result, many thousands of times over.

To what extent part of this was either part cause, or effect, or a bit of both of the residential property boom is unknown. Maybe it's just a part of it, but given the record of the culture in the US mortgage broking and loan origination leading up to the GFC, surely Aussie banks' senior management must have seen it coming?

We suspect they did, but hey! Preventing, or stopping it would have been what is known in some parts of the industry as "commercially naive". Hence the old "sweep it under the carpet if possible" strategy.

That doesn't directly correlate with the fund management sector, but we'd be surprised if at some stage the Commission doesn't turn its attention to the banks' vertical integration in funds management and distribution, with banks wearing three hats (albeit frequently under different brands) as product issuers, (i.e. fund managers) gateways, (platforms) and distribution (financial planning groups).

While there are issues and potential for conflict abounding in the managed fund sector, they're likely to pale into insignificance compared with this week's revelations.

On a totally different note Stephen Hawking, one of the greatest minds of the last 100 years possibly longer, passed away this week, amazingly on March 14th, Albert Einstein's birthday, which also happens to be Pi Day (Pi = 3.14 ) and just one day before the Ides of March.

What was so impressive about Hawking was not only his ability under such difficulty, and his sheer determination to not let that inhibit him, but above all his sense of humour, as summed up by one of his better-known quotations, "Life would be tragic if it weren't funny".

9 Mar 2018 - Hedge Clippings 09 March, 2018

Trump's Tariffs obscures bond and equity market risks - for now.

Trump's trade restriction deal is still a work in progress, but in typical Donald style it's all part of a bigger negotiation play, and possibly directed as much at the rust belt which helped him into the White House in the first place than foreign nations dumping steel on the US market.

We're not sure his change in US tariff policy (now clearly aimed at China and Asian imports, although that's gone unsaid) will necessarily turn around that section of the US economy, which is also facing other significant structural and long term issues. However, whilst not agreeing with his economic logic, one has to give Donald the politician points for keeping to his electoral promises.

We also noted that when it comes to trade and tariffs, he's now saying the Mexican's are his good friends, along with Canada. How much steel and aluminium (or even aluminum) is required to build the WALL?

Meanwhile the bond/equity market two step has receded from the front pages* of all but the financial press, but it is still there. As per this report from HSBC's Steven Major this morning:

"Our view is that the correction in risky asset markets (equities) should be taken as a warning of what could follow," Major wrote in the report. "Historical correlations between asset classes are unlikely to be stable as the global economy adjusts for the normalisation of unconventional monetary policy."

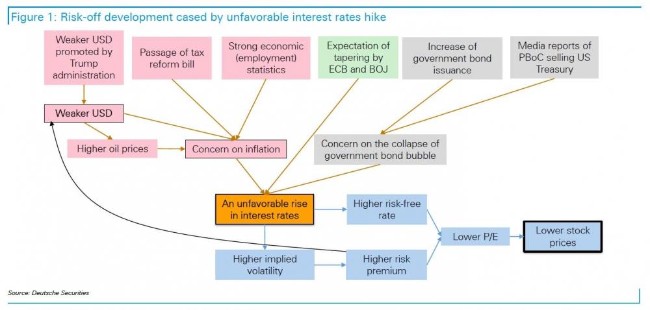

We've written about this for a while, but this chart from Deutsche puts it all in simple terms. As they say, a picture paints a thousand words...

This chart was produced before Trump's announcement on tariffs, but the key boxes are "An unfavourable rise in interest rates" and "Lower stock prices". Don't ignore the message!

In breaking news it has been announced that Donald Trump and North Korea's Kim Jong Un will meet in May - refer above to Trump's negotiating style rather than political skills. There will be plenty of claims to bringing this historic meeting about, firstly from Trump himself by ramping up both rhetoric and sanctions, but also China for the pressure they've brought to bear behind the scenes. If nothing else it will put two of the most distinctive global haircuts into the same space at the same time.

*So too, thankfully, has Barnaby's maybe baby and the PM's "bonk ban". The wider world must be wondering what life down under is all about.

2 Mar 2018 - Hedge Clippings, 2 March, 2018

Increasing turbulence as headwinds become tailwinds…

A combination of Jerome Powell's first major public appearance, and a typically Trumpesque announcement on steel tariffs, managed to further unsettle jittery markets overnight. As a result on the first day of March the US market declined for the third straight session,with the Dow falling 1.7%, and the S&P500 having declined 3.9% in February and when it moved more than 1% on 12 out of a total of 19 trading days, interestingly more often rising than falling when doing so.

Taking Powell's comments first - after all, they are likely to be somewhat more rational and considered than those of his Commander-In-Chief's. His comment that headwinds have become tailwinds set the tone, and as a result created headwinds for the market. Acknowledging that the FED's role was to create a balance between inflation ("expect to see it" increasing towards trend) and growth, Powell noted that while there was no evidence of overheating in the economy, US unemployment has fallen from 10% post GFC to its current level of 4.1%, with wages growth at only 2.5%, although he's also expecting that figure to increase.

What's always curious for those with grey (or no) hair amongst us, and those with memories of the '70's and 80's, is that the FED is actively trying to encourage inflation.

The market has little doubt that interest rates in the US will increase over the course of the year, with most analysts expecting at least three hikes, and possibly four, over the next 10 months. All eyes therefore will be on Powell's next major test, namely the FOMC meeting scheduled for 20th and 21st of March. Markets dislike uncertainty, and with the 10 year bond rate having climbed to within five basis points of the psychologically important 3% mark, the view remains that volatility will continue and the risk for both equities and bonds will remain on the downside. It is well worth remembering that for the last eight times when the FED has moved to a tightening cycle, lower P/E's have been the result.

Never one to be outdone, Trump (we'll resist any further "hair" comments as being a cheap shot) added fuel to the recent volatility by announcing a 25% tariff on steel imported into the US, and 10% on aluminium, each for "a long period of time". Even though steel and aluminium represent only a little more than 1% of overall US imports, the fear is probably greater than the fact. Trump is signalling, threatening or risking a trade war, or a response, particularly from China.

Watch this space.

23 Feb 2018 - Hedge Clippings, 23 February, 2018

Goldilocks' equity market - the beginning of the end?

Overnight the S&P500 closed at 2,703 - and after the recent volatility, posting a 52 week high of 2,872 and a 52 week low of 2,322 for a range of 550 points, and a rise over one year at one point of 24%.

Even though there's been some volatility over the past 3 weeks, the broader US market is less than 6% off its all-time highs, and is still much closer to its recent highs than lows. Volatility, which had been dragging along at less than 10% for much of last year, has doubled to around 18% after spiking to over 40% earlier in the month.

US company earnings and profitability have been underpinned by super low interest rates, low inflation, and low wages growth, (albeit that low wages growth is not that great for consumer spending or confidence) which we recently heard described as a "Goldilocks" environment - not too hot, and not too cold.

So the stronger economy is good for corporate health and earnings, which in turn is good for the economy. So what's the problem? The high equity multiples and valuations might be justifiable based on the above fundamentals, but higher bond yields are not good for equity prices if the result is a shift out of equities.

The US economy will continue to improve because the above "lows" are not going to reverse overnight even if they're on the move upwards. Goldilocks is still happy! But careful of bond rates. The US equity market is yielding dividends circa 2.4% - 10 year bonds are now yielding 2.9% and heading over 3% sooner rather than later.

The question is when? Next week sees Jerome Powell's first real outing as Fed chair - and markets will be watching that closely, even if another 3 rate rises are already expected before the end of the year. However, watch the bond market more closely. It is not that the US economy is not improving. Markets are driven by supply and demand, and if overall demand (asset allocation) is shifting from equities to bonds, maybe this signals the begining of the end of the Goldilocks era for equities?

On the local front one of Australia's most highly respected investors and fund managers, Platinum's Kerr Neilson, announced his intention to step down in June as MD and from day to day portfolio management duties. While some observers may fear "key person risks" may come into play given he has run the shop since inception in 1994, Hedge Clippings is not amongst them, partly as he'll remain a director and major shareholder.

Neilson has not only been a major contributor to the actively managed and absolute return sector, but he has created a business with $27 billion in FUM, and in doing so a culture and process which over the past 15 years has helped build Australia's global fund's management reputation. Modest, and lacking the ego often found elsewhere in the sector, we doubt much will change in style at Platinum as neither the culture, process nor people will change much at all. If that view is correct, neither will performance.

16 Feb 2018 - Hedge Clippings, 16 February, 2018

Markets stumble, then find their feet - for now…

The major story of the past week - or "non-story" depending on how you look at it - is that the sky has not quite fallen in (much like the member for New England) after the US market's sudden spike in volatility earlier in the month.

Inevitably there will be those who will be saying "what was that all about, it was just an over-reaction, and now there's a great buying opportunity!"

That may be, but as Hedge Clippings warned a couple of weeks ago, don't risk betting the house on it. The US market, having risen for 12 straight months, including over 5% in January, was approaching the "irrationally exuberant" stage, underpinned by low/zero/negative interest rates (depending on where in the world you are), the promise of US tax cuts and infrastructure spending, low inflation, and low wages growth, all of which are feeding into an improving economy and corporate earnings.

The canary in the mine is the 10 year bond yield at over 2.8% (and rising) vs the S&P500's 2017 yield of 2.4%, and an uptick in inflation. Perversely this is precisely what the FED has been trying to achieve. The renewed volatility (the VIX having traded around 10% for a large part of the last 6 months) was a useful warning shot across investors' bows, and luckily for them, the market seems to have stabilised - for now - rather than going into free fall.

While the economy and corporate earnings continue to improve, that won't fully insulate the market from an impending switch in asset allocation as the US10 year bond yield moves to 3% and above - which it will at some stage, and probably in the not too distant future.

Locally the damage to the Australian market was not as great, simply because in 2017 it had only risen half as much as the S&P500, but it still wasn't immune to the volatility. While it's only halfway through February, there'll be the usual wide range of fund results come the end of the month, but many absolute return funds had either short positions, or were carrying a high level of cash as at the end of January. As such their relatively low net market exposure will buffer them from the volatility, proving their worth in rocky markets.

2 Feb 2018 - Hedge Clippings, 2 February 2018

US fed signals the course for 2018 as Janet Yellen is set to hand over the reins...

Outgoing chair Janet Yellen presided over her last Fed meeting overnight with a unanimous decision to keep rates on hold, but sending a clear signal that they expect "inflation to pick up this year" albeit that they also indicated that it is likely to stabilise around their 2% target. From next week Jerome Powell takes over, and given there was no change to the central bank's December projection of three rate rises in 2018, and with US economic growth described as "solid", it would appear that there is every chance of a .25% rate rise in March.

With yields on the 10 year U.S. Treasury bonds having gradually risen this year to levels not seen since April 2014, the time is approaching for a seismic shift or tipping point in asset allocations, potentially destabilising the long-running equity bull market. Of course the phrase "the time is approaching" is deliberately vague, and covers every possibility from months to years, thereby giving Hedge Clippings the opportunity to claim to have forecast the move correctly, at the appropriate time, when it in fact was inevitable.

However as far as the immediate situation is concerned markets pretty much took things in their stride, no doubt in large part because investors are already pricing in a rate hike in March, and at least two, or possibly three, over the balance of the year if inflation fails to stabilise, but continues to rise. While it is been stubbornly low since the GFC on the back of economic weakness and low wages growth,Donald Trump's tax cuts and infrastructure spending plans provide the potential for it to overshoot the 2% target.

While it is inevitable that eventually the bull market in equities will come to an end at some future date, what has yet to play out is the investors' reaction and how this plays out. History tells us that bull markets rarely end in a whimper - as evidenced by the spectacular falls in 2008 and 1987 amongst others. The added known unknown this time around is the effect that the massive inflows of the past few years from passive investments (ETF's) will have on a falling market. Just as an incoming tide lifts all boats, so too does a falling tide, exposing hidden dangers on the way out.

Having said that there are those, possibly with more optimistic views, that next time round it will be different: That the steadying influences of solid economic growth, aided by tax cuts, with benign wages growth assisted by advances in technology, will balance supply and demand to allow central banks (and markets) to hold a steady course. There is no doubt this possibility exists, but it is not one to bet the house on.

25 Jan 2018 - Hedge Clippings, Thursday 25 January

Over the past couple of weeks Hedge Clippings has looked at the returns of Australian hedge funds over 2017 - particularly equity based funds which on average outperformed the market - returning +13.02% against the ASX 200 Accumulation Index 11.8%. However we also noted that averages were sometimes misleading, with many funds significantly outperforming the average.

Looking at similar figures from Eureka Hedge (based in Singapore and whose focus is global funds rather than Australian), the average global fund was only up 8.25% for the year, with 79% of fund managers in positive territory, compared with Australian funds with almost 93% in positive territory. Comparing apples with apples on a strategy basis, Australian equity long/short funds returned 14.23% vs their global peers performance of +12.39%, while in the long only strategy the locals again outperformed returning 17.05% vs. 16.85%.

These results are even more impressive considering the local market's underperformance compared to the return of 21.83% by the S&P500 where the bulk of global equity managers invest. So not only did the locals outperform their overseas peers and the local market, but the global industry underperformed the global market.

There could be reasons for this of course, one being that the majority of funds in the www.fundmonitors.com database investing in Australia have limited FUM, and rarely above $1 billion, compared to the many larger $5bn+ US funds, with high FUM historically leading to lower returns. However to a great degree it is down to the depth of quality managers in Australia, and a market which is under researched - particularly outside the top 100 or 200 stocks, providing significant opportunities for managers investing in companies that are travelling under the brokers' research radar.

However the bottom line reality is that there are some outstanding local fund managers, large and small, who consistently perform on a global scale.

Moving away from the subject of hedge funds for a moment, and given that it is the day before Australia Day, Hedge Clippings has been pondering whether as a nation we are making the most of our opportunities. Australia is often considered to be the "lucky country" with its abundance of resources, a great climate, and a multicultural and generally tolerant society which most countries would be proud of.

For instance, take the ridiculous and distracting argument about the date upon which we celebrate Australia Day, and even what it should be called. All Nations and civilisations have aspects of their past they might prefer had not occurred. However, instead of arguing about the date or trying to airbrush history, surely we should be using the day to not only celebrate our successes, but also redoubling our efforts to ensure that we have a fairer and more inclusive society for all - irrespective of past wrongs.

And at the end of the day what event has shaped this nation, warts and all, more than the arrival of the First Fleet, on January 26, 1788?

Australia may well be the lucky country, but I'm not sure we are very smart. When in the UK recently (hardly renowned as one of the sunniest places in the world) I was struck by the number of fields alongside motorways in which there were rows and rows of solar panels. At the same time the UK, along with many other nations, are looking forward by planning for the end of the internal combustion engine.

Solar and alternative power and electric vehicles on just two examples of where the average Australian seems keen to move, but is being restricted by political dogma and vested interests, not only of certain industries, but also of an unsafe seat in Canberra.

There's an old saying: "Unless you embrace change before it occurs, you will be decimated by it when it does!"

And on that note, we wish all readers a Happy Australia Day, however you wish to spend it.

19 Jan 2018 - Hedge Clippings, Friday 19 January, 2018

Hedge Clippings enjoyed catching up on Sky Business this morning with an old colleague, and frequently quoted market commentator, Macquarie Wealth Management's Martin Lakos, along with Ric Spooner from CMC Markets. Discussing actively managed funds with a couple of market professionals who come from a different section of the market provides one with a different perspective, which is always useful. Amongst other things we discussed the underperformance of the Australian equity market over the past 12 months (actually over the past 10 years) compared with other markets, particularly the S&P500, and how Australian managed funds have fared in this environment.

Inevitably these types conversations tend to quote averages, which remembering the old adage that if "one's head is in the freezer, and toes in the oven, than your average temperature is comfortable", means averages can be misleading. However we did quote both the average return of actively managed equity funds in 2017 (+13.10%) against the return of the ASX 200 accumulation index at +11.8% which suggested they performed marginally, but not dramatically better. However as per the freezer and oven analogy above, there's a dramatic range amongst the diverse nature of Australian actively managed funds.

For instance, taking all funds and all strategies, the best performing fund returned 75%, whilst the worst fell 21%. The median return was 13.34%, with 55% of all funds outperforming the ASX200, and with 95% of all funds in positive territory. With this extreme distribution spread of returns, inevitably questions were asked: Whilst there was certainly a focus on funds investing in small and micro cap stocks, plus those with Asian or global mandates amongst the top performers, this was by no means universal.

Equally it is difficult for a manager to consistently perform in the top quintile year in, year out, but undoubtedly the best ones manage to do so, if not every year, then at least regularly. Another aspect discussed was that top performance does not necessarily equate to the best returns: Frequently what investors are looking for, particularly in the absolute return space, is effective risk management thereby resulting in limited drawdowns.

Further discussions ensued regarding fund flows - whether positive or negative. We were happy to report that fund flows were broadly positive, albeit they obviously favour the better performing funds. However when looking behind the reasons for increased fund flows, anecdotal evidence would suggest that self-managed superannuation funds, or at least their trustees, are significantly made up of baby boomers, who as a natural result of their age, or financial security, are now more risk aware and less focused on trading individual stocks on the market than they were 10 or 20 years ago. At the same time they tend to have significantly more capital to invest, either on a personal basis or within their SMSF.

The other great benefit of a properly selected portfolio of managed funds, apart from hiring the expertise required, is the diversification obtained as a result. With most actively managed funds holding between say 25 to 75 individual stocks, with careful selection of even just five funds, an individual investor can have exposure to 100 to 300 stocks across multiple sectors and geographical markets, providing excellent diversification of risk. Certainly there is not the individual involvement of market trading that many investors enjoy, but sometimes leaving it to the experts is a safer and more relaxing option.

12 Jan 2018 - Hedge Clippings, 12 January, 2018

With a new year beginning it is no doubt time to consider what's in store? Whilst tempting to think there's more of the same, things rarely work that way, but before we start looking into the crystal ball, let's take a look at the year that was:

From an Australian equity market perspective it started and finished well, but sagged in the middle before finishing up 11.8% on a total return basis. That's a reasonable return vs. cash, but it was the exceptionally low interest rate environment which helped explain a significant proportion of the equity market's performance.

Overall (allowing that some funds are yet to report their December results) the average return of all funds in AFM's data base broadly matched the market at +11%, while local equity based funds fared better at +13.97%.

From a strategy perspective Long Only funds provided the best returns at +17.46%, followed by Long/Short and Equity 130/30 at +15.04 and 13.84% respectively.

Australian small caps with the big winners in 2017, particularly as the big banks and Telstra struggled. As a result those funds returning over 20% per annum tended to be focused on the small cap sector, or had a global or Asian geographic mandate.

On a global basis the Australian market significantly underperformed the S&P500's total return of almost 22%. One big difference between the two markets was that on average the ASX200 provided investors with a dividend return of 4.75%, compared with the S&P500 of 2.4%.

Looking forward: Undoubtedly on a global basis after 10 years of falling interest rates and central-bank support, equity markets have been, if not propped up, at least well supported. This environment however is coming to an end with interest rates in the US starting to rise in a (hopefully) measured fashion, whilst locally interest rate rises would seem to still be a few quarters away at least.

There's been much discussion in the media over the past couple of weeks with forecasts of more of the same for 2018, or alternatively the end of the dance party as interest rates increase. While there is certainly potential for that, provided the slow unsteady measured approach continues we would expect that equity markets, even though their valuations are stretched on a historical basis, will remain supported. However that won't go on forever, and at some stage there will be a switch in asset allocation. As ever, keep a watchful eye on the bond market, many times larger and more powerful than its attention seeking equity market cousin.

So if interest rates remain stable, or at least rise gradually, where do the risks lie looking forward? We would expect them to be political, both in Australia and overseas. Whilst Trump has reduced corporate tax rates to 21% in the US, he remains somewhat of a loose cannon - or should that be finger - either tweeting, or on the button. In the short term North Korea seems to have stepped back from the brink, but how long that may last is anyone's guess. In Europe Germany is not as stable as it was, and the whole Brexit fiasco is a distraction and has a long way yet to play out on both sides of the English Channel.

Closer to home, aside from political issues, it would seem that property prices will remain both a talking point and a significant risk, with household debt at record levels leaving the RBA with the challenge of a fine balancing act as and when the inevitable tightening cycle commences.