News

15 Jun 2018 - Hedge Clippings, 15 June, 2018

A short week - and an argument for being short the banks, or avoiding ETF's.

It's been a pretty busy week for one with only four working days - in most of Australia at least. Quite how we have a system where the same event - the Queen's Birthday - is celebrated on three different Mondays in either June, September or October depending on which state you're in, is bizarre. It's no wonder we have a complex tax system if the same bureaucrats and politicians came up with dates for public holidays…

Firstly Trump, who no one thought would make it to the White House in the first place, achieved what many thought was a diplomatic impossibility by shaking hands with Kim Jong-Un and inking the bones of an agreement that none of his more diplomatic predecessors had even dreamed of.

Then Jerome Powell and the US Fed upped US rates by 25 bps, and the markets … did nothing. The RBA, and then the ECB, kept rates on hold, with the latter announcing the end of QE will take place in December. More of the same…

Fresh from Singapore, Trump is tonight scheduled to announce tariffs on $50 billion of Chinese products, which will inevitably lead to an upping of the trade war with both retaliation and rhetoric from China's President Xi Jinping. Watch that space with care.

Meanwhile at home we gave some focus to the banking sector (again) but this time on the big 4 banks' share price declines over the past 12 months, which caused Hedge Clippings to reflect on one of the great flaws in the passive investing approach of ETF's.

Consider this: Over the past 12 months the share price of each of the big four banks has fallen around 20%, whilst Telstra has fallen almost double that. These five stocks make up just under 30% of the market cap of the ASX200, which in spite of this Famous Five's 12 month performance, has managed to rise approximately 5%.

Any investor in an ASX200 ETF, or even worse in an ASX Top20 ETF, hase, for better or worse (in fact for worse!) had their returns dramatically curtailed as a result. Simply accepting whatever the market as a whole throws at you and justifying the decision on the basis of low fees makes little sense to us.

While we accept that the opposite can occur as well, boutique or concentrated funds which can avoid - or select - individual stocks, sectors or markets by using their skill and experience on a discretionary basis are worth finding and if appropriate, investing in. Certainly some will perform better than others, and not all of them will perform in unison. Whilst possibly biased, we would argue that a diversified portfolio of well researched boutique managers will provide a better return, with lower volatility and risk than the overall market, and its ETF equivalent.

8 Jun 2018 - Hedge Clippings, 8 June, 2018

Towards the end of each week we seek inspiration (that's probably a slight exaggeration - maybe "ponder" describes it better) for the subject matter of the weekly Hedge Clippings email. It is a sad reflection on the current state of financial markets that for the past couple of months we have become somewhat predictable, as the antics of bankers and other sectors of the financial services industry have dominated the commentary.

The list has been extensive, headlined by AMP, plus NAB, CBA in multiple guises, and the overall vertical integration structure of product distribution and sales masquerading as independent advice. The boardroom ranks of AMP in particular have been thinned out significantly as reputations have fallen by the wayside, and the damage has either been reputational, or borne by shareholders.

This week has seen the significant extra bite of criminal charges being laid against senior banking executives, including one chairman, at the top end of town amongst Citi, Deutsche, and ANZ over an underwriting shortfall. The problem with financial penalties, even those as large as the $700 million levied on CBA by AUSTRAC's for breaching AML regulations, is that generally speaking it is the shareholders who pay the price. Even then, unless the dividend is cut as a result, there is little pain in investors' hip pockets at the end of the day. That's all changed and the message will have been sent loud and clear not only in this case but to all boardrooms.

Some readers may have noticed that Hedge Clippings has joined none other than the Treasurer, Scott Morrison, in previously suggesting that the potential for an enforced "holiday" would be the ultimate deterrent for serious corporate wrongdoing in the banking sector. Without wishing to prejudice the outcome of this particular case, it will be a serious wake-up call to all executives and directors who elect to sail close to the wind based on "normal practice".

Passing on a hefty fine to shareholders is one thing. Taking the risk of getting one's reputation pinged by the regulator even - but the thought of packing one's toothbrush and being introduced to a new diet (and room-mate) will undoubtedly sharpen some directors' sense of priority - and self-perseveration.

In 1756 at the start of the seven years' war the British executed Admiral Byng for "failure to do his utmost" to avoid defeat at the hands of the French fleet in the Mediterranean. When a French Admiral was asked why, and if this was not a little harsh, he responded it was "pour encourager les autres" - to encourage the others.

Whatever the outcome of the upcoming court case over ANZ Bank's underwriting shortfall, there's no doubt the message has been sent to "discourager les autres".

1 Jun 2018 - Hedge Clippings, 1 June, 2018

This week the Australian Government's Productivity Commission released its draft report assessing the "efficiency and competitiveness of Australia's superannuation system". Predictably the report found that the system was actually "not so super", and reading through the 571 pages of the full report, Hedge Clippings decided that (purely for expediency as you would understand) the overview, just 65 pages long, was likely to be more our speed.

Taking expediency even further, it was judged that the best way to look at even the draft report was to skip to page 56 under the heading "OVERALL ASSESSMENT". Expediency aside, we would have to say both versions were excellent, and it was almost impossible to fault either the logic, findings or recommendations contained therein.

First and foremost in the recommendations was the removal of "unintended multiple accounts (and the duplicate insurance that goes with them), which the commission estimated would save members collectively about $2.6 billion a year. In addition, if members in underperforming MySuper accounts had instead been moved to the median of the top 10 performing MySuper products, they would collectively have gained an additional $1.3 billion a year".

That's nearly $4 billion a year, probably on behalf of the lowest value accounts, and therefore on behalf of the neediest in the community, which could collectively be added to their retirement benefits. Multiplying that by a 40-year working life makes a mouth-watering $160 billion.

Not surprisingly the Productivity Commission came to the conclusion that "the superannuation system has not kept pace with the needs of members".

What was an outstanding and forward thinking concept introduced by Paul Keating way back in 1983, (allegedly with much input from Garry Weaven, the founding executive chair of industry fund services in the early nineties, and who still wields significant influence in the industry superannuation sector) not only has the system not kept pace with the needs of members, successive governments haven't been able to help themselves and have complicated it disastrously.

Without running through all the findings and recommendations, (again in the interest of expediency), the Productivity Commission's draft report also covered fees (higher than those in other OECD countries), transparency (poor), disclosure (sub-par), performance (mixed, with underperformers particularly prevalent in the retail sector), competition (inadequate), policy (changes required), default fund selections (unhealthy), erosion of member balances (no comment required), and governance (stronger rules needed).

We could go on, but that would prevent readers having the enjoyment of thumbing through either report themselves. However, one recommendation, which copped some flak from the industry fund sector, (unreasonably, but given self-interest, not surprisingly), was the call for 30% of each industry fund's board to be made up of independent directors.

The industry funds' position would seem undefendable, apart from the difficulty of finding sufficient appropriately qualified independent candidates. After all, if it is appropriate for the board of an ASX listed company, the majority of which are smaller and have fewer shareholders than industry funds have members, to have 30% independent directors, why not industry super funds?

What's good for the goose, should be good for the gander.

25 May 2018 - Hedge Clippings, 25 May 2018

Over the past couple of months Hedge Clippings has been overwhelmed by revelations of gross misconduct evident at a number of levels of banks and AMP in the areas of financial planning and advice. The Hayne Royal Commission became a cross between reality TV, a soap opera, and a big end of town version of Judge Judy.

This week's episode, focusing on banks lending to small businesses, and their subsequent treatment of the borrower and their unfortunate guarantors when the proverbial hits the fan, has been dull by comparison. It has been no less shocking, but dull, probably because there haven't been too many surprises. Banks only lend when the borrower can provide adequate security, and when it's time to pay the piper, it's the lender that calls the tune.

There's an inherent conflict here. Small business borrowers constantly complain that it's hard to get a business loan, even with the security of a home as collateral, often owned by some unfortunate relative. Banks argue that they aren't there for the benefit of the borrower, and have been driving hard bargains when things turn turtle since Shylock was a boy. Hence the term "getting their pound of flesh."

The issue is to what lengths should a bank go to in getting a guarantee, and how, or from whom in the first place. Once again it is in the area of what is "acceptable conduct" from a supposedly reputable business that the banks appear to have failed the test. No one disputes the banks' basic business obligation to take appropriate measures to protect the money they lend, but it comes down to what is considered appropriate.

Once again the pressure to perform, particularly to meet sales and lending targets, leads to unfortunate outcomes where the bank is rarely the loser at the end of the day. Until the government of the day announces a Royal Commission…

18 May 2018 - Hedge Clippings, 18 May 2018

The AMP saga continues.

The latest casualty was the resignation of AMP's Chief Risk Officer, which is probably understandable given the revelations of the past month or so, although his comments on LinkedIn were, let's say, "unconventional".

Geoff Wilson from Wilson Asset Management, one of the most experienced fund managers around, publicly questioned whether AMP was a buy at any price, given not only the internal and governance problems that the company is facing, but with a business model out of step with the times, and a business sector that is guaranteed to have unknown regulatory changes imposed on it in the future.

Added to anecdotal evidence of AMP advisors moving out, in line with an industry trend from "big end" to "boutique" this week Macquarie Bank is reportedly moving up the wealth management food chain to focus on HNW investors - a further indication that financial advice for "mums dad's" is not an attractive place to be going forward.

Given ASIC's hard line on advisor commissions, and particularly training commissions, that's probably as true for the adviser as it is for the recipient of the "advice". Whether it is the place to be or not, it is an issue for the retail investor who needs and deserves proper financial advice.

Hedge Clippings looks forward to the dismantling of the vertical integration, tied distribution, and producer heavy Approved Products List model to the day when investment products stand on their merits, not product sales dressed up as advice. However, in spite of the headlines, and the fundamentals behind them, it is worth remembering it is the minority of advisors who are the problem, aided and abetted by the industry structure and poor corporate governance that allowed them to operate that way.

The danger of the Hayne Royal Commission will come from the risk of an over-reaction from politicians, and subsequently regulators, and thus to corporate compliance departments, to the extent that the end consumer will go without the genuine advice that they need. Next week the Commission moves its focus to the small business sector - away from the small investor being delivered products they don't need or want, to small business that need the products, but all too often can't get them!

Meanwhile, APRA is starting to put pressure on industry superannuation funds and their selection of board members without the requisite financial acumen, or rather non-selection of board members from outside the industry with appropriate experience. We don't know whether this will come under the gaze of the Hayne Royal Commission, but if not it should do. With their control of so many trillions of dollars of small investors' retirement funds, the governance, skills and experience required should be no different to a public company board.

Finally onto global markets. So far the S&P500 seems to be defying the 10 year bond market yield, now trading at a tad under 3.1%.

So far ... but watch this space.

11 May 2018 - AMP's tale of woes not over by a long shot

In spite of the weakness in the financial and banking sector which dominates the ASX Top 20, and to a slightly lesser extent the ASX200, the Australian market has finally made up some ground over the past few days and is now in positive territory calendar YTD. To the end of April the ASX200 was still slightly in the red on a total return or accumulation basis (-0.11%) and only showing a return of 5.46% over 12 months.

Against this the FundMonitors.com index of actively managed investing in Australia and NZ have returned 12.08%. Across all strategies 89.97% of funds have provided positive returns, ranging from -17% to +73% with 57.58% of funds outperforming the ASX200.

We thought we'd throw that in before moving on to AMP...

Hedge Clippings remains sceptical about AMP on nearly every count. This is not only based on their past failings as revealed by the Royal Commission, but also on their response in the ensuing crisis, plus market and client perception, and evidence of investors' outflows as a result.

Last Friday AMP responded to the Royal Commission with what sounded suspiciously like a denial of wrongdoing, in spite of the fact that they had been found to have charged clients fees for services not performed, and then lied to ASIC (including at board level) on no less than 20 occasions.

In spite of losing the chief executive, chairman, three directors, and their chief legal counsel, (who we suspect was thrown under the proverbial bus) the tone of AMP's response was one of, if not denial, refusal to accept responsibility.

And yet to quote from the interim chairman's report to the AGM yesterday:

"I begin by reiterating and reaffirming our unreserved apology. We are truly sorry.

The issues highlighted in our advice business are unacceptable.

We let you down.

We have let our customers down.

And we have let the wider community down."

A little further on the blame was attributed to "a small number of individuals in our advice business who made the decision not to follow policy."

And "the situation was compounded through a series of communications that misrepresented the issue to - and therefore serve to mislead - our regulator on several occasions."

"On both counts the behaviour was absolutely unacceptable."

He then tried to claim that the board had accepted accountability, with some 50% of the board having left, or leaving.

The reality is that the previous chairman and CEO only departed when it became completely obvious that their positions were untenable, and the additional board members only resigned when it was clear they would not make it through the AGM. Hardly synonymous with "leaving of their own accord or willingly".

(The acting chairman also regretted having lost all female directors through the process, but the reality is that ALL directors should be appointed based on ability and experience, by what is between their ears, irrespective of gender. Hedge Clippings might be wise to keep out of that argument!)

But now they have the great white hope, David Murray, as the incoming Chairman.

David Murray is undoubtedly qualified and experienced in financial services. He was CEO of the Commonwealth Bank for 13 years from 1992 to 2005, and was the classic career banker having started as a teller, and rising through the ranks based on his undoubted ability.

However the problem is that Murray believes in the same vertically integrated structure which has not only caused such problems in the banking sector, but is also quite likely to come under pressure as the Royal Commission continues its hearings before making its findings and recommendations known early next year.

At CBA David Murray oversaw the acquisition and integration of Colonial, Count, and Aussie Home Loans, all of which have come under fire in various ways, as has the whole vertical integration structure where sales were repackaged as advice.

The danger for AMP will be that Murray still believes in that model and structure, and that his experience almost aligns itself to his DNA.

Murray has a couple of other problems apart from having to find quality directors with the experience and ability to take on the challenge, let alone instilling the change throughout the organisation.

One of them is his relationship with ASIC, where we would imagine that AMP needs to do some serious fence mending, having in 2016 likened ASIC's approach of trying to enforce corporate culture on boards to that of Adolf Hitler.

At least the 2014 Financial System Inquiry, chaired also by Murray, recommended significantly increased powers for ASIC, even though his later comments suggested that boards should not be held liable for a breach of culture.

The reality is that at AMP it has been that the culture, including at board level, as well as the structure of the business, that has been the problem, and it remains to be seen if Murray, in spite of his outstanding credentials and experience, will be able to, or is the best person to lead it into the future.

4 May 2018 - Hedge Clippings, 4 May, 2018

It's gone very quiet as the Financial Services Royal Commission took a well-earned breather from the excitement and revelations of the past couple of weeks, with Round 3 of the Public Hearings not due to begin again until 21 May. However, in the background the AMP machine (minus CEO, Chair and Legal Counsel) has been busy producing their response, mainly denying or refuting the allegations levelled against them.

For those not wanting to wade through the full 27 pages and 101 points in AMP's submission, here's a 4 page Fact Sheet summarising their response.

In the meantime of course the public fallout has been dramatic, and in spite of AMP's response and denial, necessary. However, the outcomes - both in the short, medium and long term remain to be seen. Here's Hedge Clippings' quick take:

Short Term:

- AMP's AGM next week will be a cracker!

- AMP's reputation has been irreparably damaged. How long, and what it will take to recover it, is anyone's guess.

Medium Term:

- Expect more divestment of Banks' wealth divisions (with the exception of "private wealth"). NAB has flagged the spin-off of MLC, ditto ANZ, with CBA examining disposal of Colonial. However, this will only separate the banks from the platforms. The Product Issuer, Platform and the Advisor network model will most likely remain in place but under new ownership.

- Expect an exodus of bank aligned (and AMP) advisors to truly independent groups to gain independence from their current restricted approved product lists.

- Expect Investors, faced with having to pay for advice, will avoid visiting a financial advisor even more than they do now, which while it will help some, will unfortunately not necessarily benefit their financial future.

Longer Term:

- Vertical Integration to come under pressure and possibly be abandoned. The big banks' and AMP's vertically aligned platforms are reportedly losing market share, while industry evidence suggests that only 20 to 25% of SMSF's and self-directed investors use them - either due to cost, or the fact they don't seek the services of a financial advisor.

- Bank culture itself may or may not change, but the headcount, and the pecking order, of their internal compliance departments almost certainly will.

Meanwhile it remains to be seen if the findings of the Royal Commission, when eventually handed down and pondered over by the authorities, and then argued over through the courts, will actually result in any successful prosecutions, particularly at senior or board level.

27 Apr 2018 - Hedge Clippings

The Hayne Royal Commission Part II: How did this happen, and where's it going?

The revelations from Hayne's Royal Commission continues to reinforce the need for… the Hayne Royal Commission.

We incorrectly thought that the spotlight from the Royal Commission's peek into banking and the home loan sector was bad, but the exposure of the Financial Advice sector has probably surpassed it for the level and depth of systematic failure at every level of the industry.

How did this happen, and what will the outcome be? There'll be books written on it in the not too distant future, but here's one view:

Firstly, How did this happen?

It happened by stealth when in the early 1990's the banks decided they needed a "larger share of the customer's wallet" - a term used by NAB, but no doubt others, and coined from Wells Fargo Bank in the US.

Back then banks started buying stockbrokers; NAB bought AC Goode, ANZ bought McCaughan Dyson, Westpac - which having narrowly avoided going to the wall - was a little slower buying Ord Minnett, while eventually the CBA, having been privatised, bought E*TRADE, introducing flat fee broking and spoiling the brokers' party of charging fees between .5 and 2.5% of each trade.

AMP and National Mutual, the two largest life insurance companies, each with a significant sales force paid on commission, decided to rename insurance salesmen and women as financial advisors. AMP became a listed company that had to compete for the consumer's wallet, and National Mutual became AXA, which from memory AMP consumed! Old habits die hard and the sales culture continued, with even greater spoils as reward.

Meanwhile in the mid '90's banks were also fighting Aussie Home Loans' "Aussie" John Symond and Wizard's Mark Bouris, each also with a strong sales culture. CBA bought out Aussie (if you can't beat them, don't join them, buy them!) while building societies which had competed with banks for the home loan and mortgage market, were by and large consumed in the wallet share exercise. NAB bought MLC, CBA - Colonial, Westpac - BT etc., etc.

Banking became a sales game, with trail commissions galore, and market share to play for.

And the practice of paying the big bonus! One senior executive in front of the Royal Commission had his bonus clipped for his division's poor operational practices, reducing it by $60,000 to a mere $960,000! That must have damaged his local bottle shop's sale of Penfolds Grange!

Next, Where's it going?

Who knows, but it will change.

For one, the vertical integration where a product issuer owns each of the product, the distribution channel, and the sales force, with scant transparency between the three, looks like it has been laid bare and will be dismantled one way or another - government regulation, consumer awareness, or a more competitive (probably online) model.

The structure of dealer groups, and blanket licensing of their employees - including the professional qualifications of those being able to use the term "advisor" will come into focus, as will having two organisations representing the industry while competing for members.

And today's revelations exposing the limitations under which ASIC operate and are able to prosecute wrongdoers will in due course provide the regulator with greater powers - either to investigate or prosecute.

And corporate ethics and responsibility? Someone, or some people, might be worried about taking a one way trip to the big house. They might have to rename the East Wing into something more representative. The Financial Services Wing maybe?

Meanwhile genuine and honest advisors - and there are many of them - will have to wear the reputational consequences of a system riddled by conflicts, and investors will need to understand that good advice is hard to find, and worth paying for.

13 Apr 2018 - Hedge Clippings

Macro risk and volatility remain front and centre

Macro issues seem to be centred on geopolitical risk, particularly where The Donald is involved. Mind you, his "my button is bigger than yours" policy approach seems to be moving things along on the Korean Peninsula more than those of his predecessor, so while his style may be more "hardball" than "diplomatic", it might just also turn out to be more effective.

Syria, and in particular with Russia and Iran's involvement, may be a harder nut to crack. From a market perspective investors are possibly becoming acclimatised to Trump's Twitter Diplomacy, which in itself may be a risk when, or if, the rhetoric results in an actual physical or military confrontation.

Meanwhile turning to the markets, in spite of the increased volatility of the past two months, the upcoming US earnings season is likely to see continuing growth in positive numbers. As the US economy picks up, and while wages/inflation remain reasonably benign, interest rates rises will remain firmly on the agenda as the market's number one economic risk.

What has recently changed in the US is the market's perception and realisation, particularly over the issue of privacy and personal data for tech stocks and the FANGS, which have had such a stellar run for the past few years. Suddenly people are realising that if you're not paying for a service or product, you are the service or product.

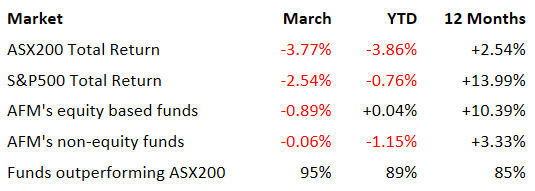

Meanwhile taking a look at the local market and funds' performance YTD and over the past 12 months, where apart from January in the US, there is a sea of red:

Hedge and absolute return funds risky? Hardly! Although choppy markets certainly make things more difficult in a general sense, equity based funds' average outperformance of almost 8% over 12 months, with 85% of all funds' returns beating the market, would seem to answer their critics.

Next week sees a recommencement of the Hayne Royal Commission, with the spotlight turning to the Financial Services sector and wealth advice (or more correctly in some cases, lack of it). Whilst unlikely to be quite as explosive as envelopes stuffed with cash passing across the desks of suburban bank managers' desks, it will still cause plenty of embarrassment to those in the spotlight, and others in the advice industry.

Expect particular attention not only on fees being charged with no advice given, but also over promotion of in house products on dealer groups' approved product lists (APL's), and vertical integration of the industry overall.

6 Apr 2018 - Hedge Clippings, 6 April, 2018

Bill Gates reportedly once gave this advice to an audience of school leavers he was asked to address. It might be equally apt for Robert Shand, the CEO of Blue Sky Alternative Investments, under extreme pressure this week from an activist short selling attack by US hedge fund Glaucus, who claim that Blue Sky's share price is (was is probably more correct now) significantly overpriced. Readers would understand that Hedge Clippings has no issue with short selling in itself, but can sympathise with Blue Sky, whom we have always found to be smart and professional, under attack from a concerted campaign online and in the media designed solely to drive the price down for a profit, rather than letting natural market price discovery take its course.

There's no doubt that Glaucus has involved itself in a case of market manipulation, as Shand claimed in his teleconference on Tuesday morning. There's also no doubt that some elements of the Glaucus report were based on assumptions and speculation, which Blue Sky has claimed are not based on fact, but opinion. The issue with activist short selling, and then heavy publication of the logic or otherwise behind it, is that it doesn't have to be based on fact, or accurate. Once the fear factor is in shareholders minds the buying will dry up, even if they don't hit the panic button and sell. That's how the activist model works.

Shand is facing a number of difficulties in responding, and is learning the hard way that running a fast-moving asset management company investing in alternative and unlisted assets as a public company has its own set of issues. Many, or most of the asset they have developed and manage are closed-ended funds investing in unlisted assets, so pricing is always going to be a question. The timing of exiting, or realising the full value of these mainly private equity, private real estate or infrastructure assets is critical. Most importantly the issue of market transparency doesn't necessarily sit comfortably with unlisted assets housed in wholesale funds.

As such Blue Sky are caught between a rock and a hard place, but like it or not Shand and his board have only two options - either open up the books to prove Glaucus is wrong, or secondly, putting their heads down and focus on delivering the performance of the various underlying assets in due course. The second option in itself will not be easy as "in due course" could be a number of years in the case of some of the underlying investments. Meanwhile, market perception will make it difficult to source new deal flow, and the negative publicity will also make it difficult to attract investors to those funds, while at the same time trying to keep the market happy.

Difficult does not mean impossible. Macquarie Bank came under a similar style attack a few years ago when a US based short seller accused it of being a Ponzi scheme. History shows that Macquarie's share price suffered (and no doubt the short seller profited) but over time the performance was such to re-build the bank's reputation - and share price. There have of course been other cases...