News

16 Nov 2023 - China and India's contrasting inflation front

|

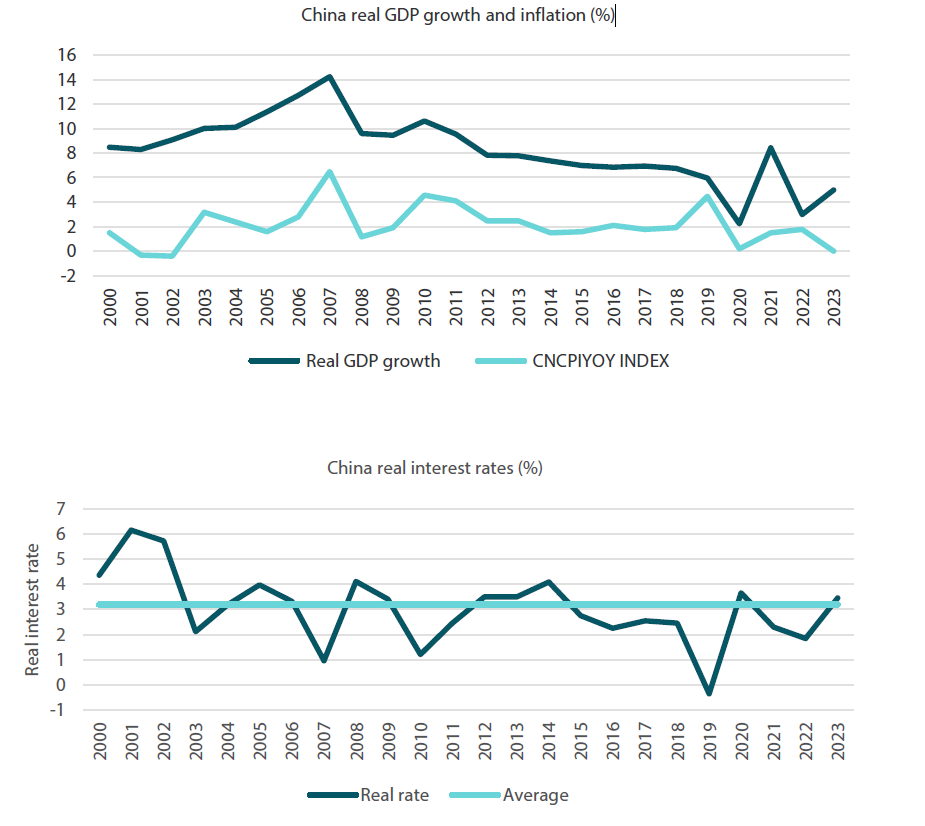

China and India's contrasting inflation front Nikko Asset Management October 2023 The implications of inflation Inflation--the increase in the general price level of goods and services in an economy over a timeframe--has become one of the most closely watched economic gauges in recent years as consumer prices hit record highs. Besides bearing significant influence on standards of living, economic growth and the direction of interest rates, inflation also has significant implications on the top-down development of countries as well as the bottom-up fundamentals of companies. On a top-down basis, inflation signals the strengths and weaknesses in the overall economy and drives the policies and responses of governments and central banks, either being supportive or restrictive. From a bottom-up perspective, inflation signals whether certain industries have the pricing power to pass on the changes in costs and to generate sustainable returns from future investments. In other words, inflation encapsulates changes in both the overall economy and the operating metrics of a company. Moreover, inflation can have political implications, particularly in the developing world, as it is often a key issue in elections and can impact the popularity of elected politicians. That is why investors in the emerging markets often pay close attention to the general development of consumer prices, plus the outlook of inflation. Indeed, how a government navigates inflation often affects future investment returns. In this article, we compare and contrast two of emerging Asia's largest economies, China and India, through the lens of inflation. Today, China and India face opposite inflationary pressures, which could alter the outlook for these two large emerging economies. Inflation in China is close to zero, while that of India is above 6% (as of August 2023). Year-to-date (YTD), as at end-September 2023, the renminbi has depreciated more than 5% against the US dollar (USD), whereas the India rupee is flat versus the greenback. Equity markets also seem to be rewarding one and punishing the other; Indian equities (as measured by the MSCI India Index) were up 8.0%, in USD terms, on a YTD basis (as at end-September 2023), while China stocks (as measured by the MSCI China Index) were down 7.3% YTD. China faces deflationary pressures Let us begin with a close look at China. Concerns that China could be facing a deflationary spiral arose when the country reported that consumer inflation dropped by 0.3% YoY in July, the first decrease since February 2021. Since then, consumer prices in the world's second largest economy have moved higher, rising by 0.1% YoY in August, allaying fears a persistent deflationary trend in the nation. Headwinds from falling property prices and the decline in construction activity due to its ailing real estate sector are likely to cause more lingering deflationary pressures, in our view. Very low inflation or deflation can directly impact consumer behaviour. First, it can lead to a decrease in consumer spending as consumers may delay purchases in anticipation of lower prices in the future. This can lead to decreased economic growth and job creation. Second, low inflation can compound the debt burden. As the real value of debt increases due to the lack of inflation, this could lead to increased financial stress for households and businesses. At the same time, low inflation can discourage investments as investors may seek higher returns in other countries with higher inflation rates. And if subdued inflation persists for an extended period, it can lead to a deflationary spiral where prices continue to fall, potentially leading to a long-term economic stagnation. The big picture is that Chinese economic growth has been on a declining trajectory since the 2008 Global Financial Crisis (GFC). Having said that, if China were to achieve its government's targeted GDP growth of 5% for 2023, that would still be a decent result for a maturing economy (see Chart 1 for China's real GDP growth, inflation and real interest rates). Chart 1: China's real GDP, inflation and real interest rates

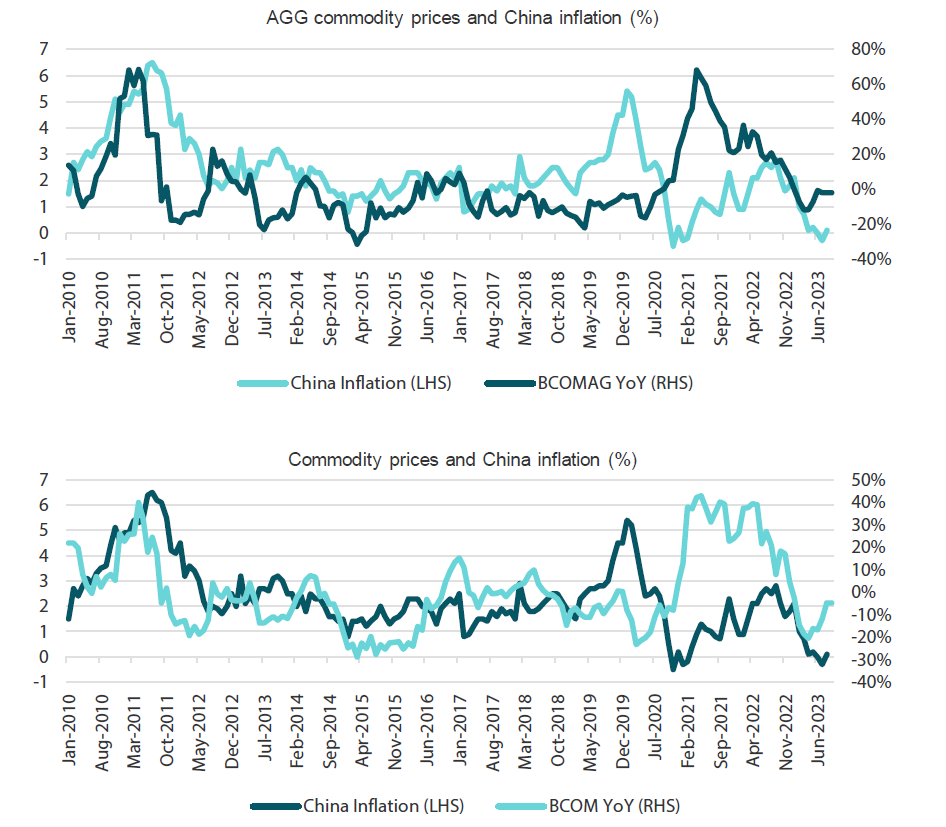

Source: Bloomberg, August 2023 More broadly, China currently faces several structural issues. It has negative population growth, a heavy debt burden in certain areas (namely property), an oversupply of goods, weak export markets and tight monetary policy. China's monetary policy has historically been on the tighter side, averaging 3% in real interest rates. Despite its recently flagging economy, China's current real interest rates still stand at 3%. There have been times when real rates in the country were lower, such as during the GFC and around the period of global economic weakness of 2015. This time around, the People's Bank of China (PBOC) is using alternative measures, like cutting mortgage rates incrementally and reducing banks' reserve requirements to boost overall liquidity. In our view, the Chinese government and the PBOC need to do more to stimulate the economy. Monetary policy loosening at a drip-feed speed is not creating a positive environment for the Chinese markets. Indeed, consumer and investor confidence in China is fading. Portfolio flows are negative and foreign investors are net sellers of Chinese equities. Nonetheless, it is not all bad for the world's second largest economy on the inflation front. One of the positives is that China is still seeing some inflation on the services side, which accounts for 40% of the inflation basket. Services-related inflation is rising at 1.3% on average, compared to overall consumer inflation at 0.1% YoY (as at August 2023). Historically, China's services-related inflation had hovered between 2-3%. During the COVID-19 lockdowns, it fell below zero. A rise in services consumer price index (CPI) is good for the overall inflation picture in China, which is growing more slowly in recent years and whose growth is largely due to government spending. All in all, China needs inflation to move higher. Higher commodity and agriculture prices could lead spur Chinese inflation Going a step deeper into the drivers of inflation in China will show that agriculture prices (namely those of soybean and pork) and commodity prices (including hydrocarbons, which are the main components of oil and natural gas) are closely related to the direction of inflation in the country (see Chart 2). As such, rising commodity prices and higher agricultural prices could pose an upside risk to inflation in China. A surge in China's inflation in 2019, for instance, was partially attributed to the outbreak of swine flu in 2018, which caused an increase in pork prices amid a drop in supply. Chart 2: China's inflation and commodity prices move in tandem

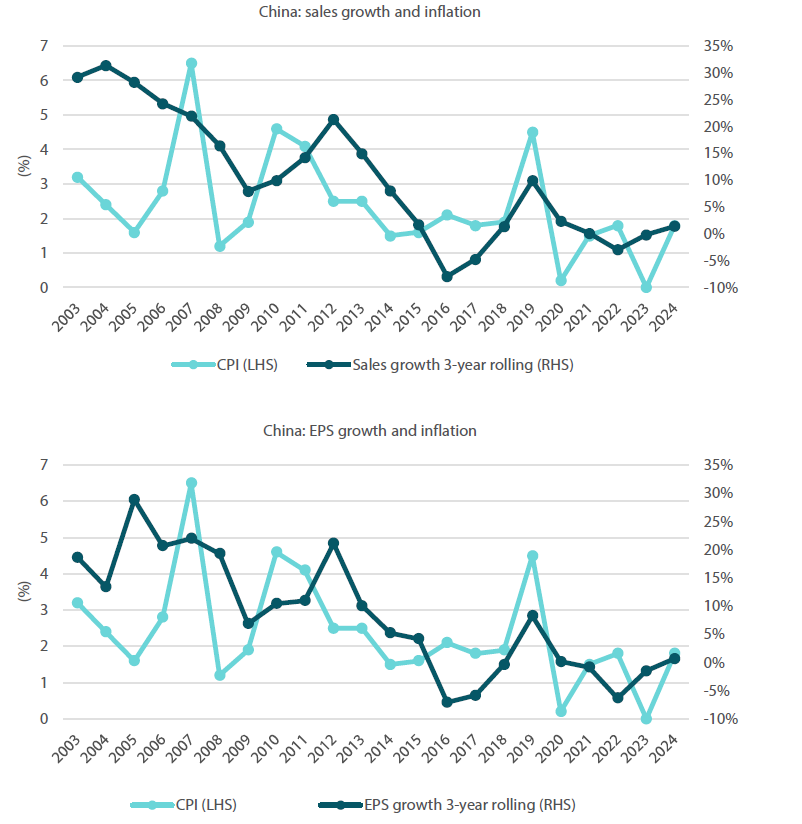

Source: Bloomberg, August 2023 COVID-19 further distorted the time series of inflation in China. Since the country's re-opening earlier in 2023 (and the absence of disease or other disruptions to supply), agriculture consumer prices look to have bottomed. Agriculture inflation in China is trending around 2% and could lift overall Chinese CPI. The same is true of rising commodity prices. Oil prices have recently risen above USD 90 per barrel. China imports around 59% of its oil needs, making it the largest oil importer globally, and higher oil prices will support inflation in the country. There is, however, a risk of stagflation if rising commodity-driven inflation is accompanied by low growth. Indeed, without productivity gains or other spending increases, inflation without growth for China may be problematic for the world's second largest economy. Chinese inflation and its impact on equity markets The Chinese equity market, as measured by the MSCI China Index, is trading close to the lowest price earnings (PE) multiples in 20 years, with very low growth priced in by the market. During the 2010-2015 period, equity valuations in China fell with declining inflation. Over that period, the market return in China averaged 1.5% on an annualised basis. Without dividends, it was negative. Today, China is once again experiencing a period of low and declining inflation, which coincides with the downturn of its equity market. However, if Chinese inflation starts to rise due to higher agriculture and commodity prices and looser monetary policy, we do expect a better showing for China stocks. This is because corporate sales and earnings per share (EPS) growth rates tend to have a positive correlation with inflation (see Chart 3). Chart 3: China's corporate sales and EPS growth are positively correlated with inflation

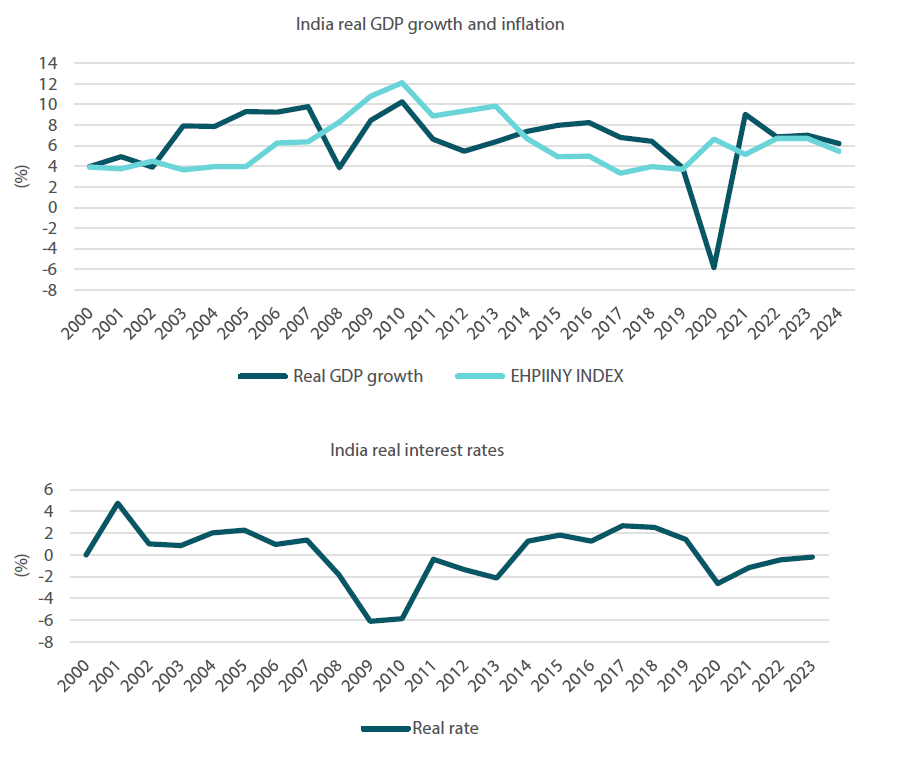

Source: Bloomberg, August 2023 Earnings growth in China has been decelerating since 2005 and hit bottom in 2016, when China implemented a massive monetary stimulus that lifted global equity markets and Chinese earnings. The effects of that stimulus have worn off, and the Chinese equity markets are now back to the lows of 2016. Chinese earnings growth is in a difficult position; it needs a forthcoming and large stimulus, which, in turn, will help lift inflation in the country. After China's last set of quarterly results, earnings revisions for 2023 and 2024 were negative; growth expectations, though positive, are also falling. We have looked at the annualised three-year sales growth of corporate China, working under the assumption that it takes time for inflationary pressures to work through a company's operations. Our expectations are for Chinese inflation to rise to 2% in 2024 and sales growth to follow suit. If that materialises, it would be a good result for Chinese earnings growth. All things considered, the Chinese equity market needs a source of higher profitability, and rising inflation, amongst other factors, could be key to invigorate profit levels. India at a sweet spot Viewed through the lens of Inflation, India is at the opposite end of where China is. India's Inflation, while above the Reserve Bank of India (RBI)'s target of 4%, isn't looking too elevated, as compared to its historical averages. Inflation in India has slightly eased to 6.83% YoY in August (from 7.44% in July) and is currently in line with the country's average annual inflation rate, which over the past few decades has been around 6-7%. As we see it, the Indian central bank remains accommodative, keeping real rates close to zero. The country's political climate is pro-business. The government of Indian Prime Minister Narendra Modi is in its third year of running large budget deficits, and with the coming general elections in 2024, the administration is unlikely to tighten its budget strings in the foreseeable future. At the same time, high oil prices have yet to hit the Indian economy, which is still relying on cheap Russian oil. India's annual GDP growth has hovered steadily in recent years, generally between 6% and 10%, while inflation has moved around the same levels as GDP growth (see Chart 4). India is in a sweet spot at the moment as inflation is trending lower, yet it is at a faster rate than GDP growth. Chart 4: India's real GDP, inflation and real interest rates

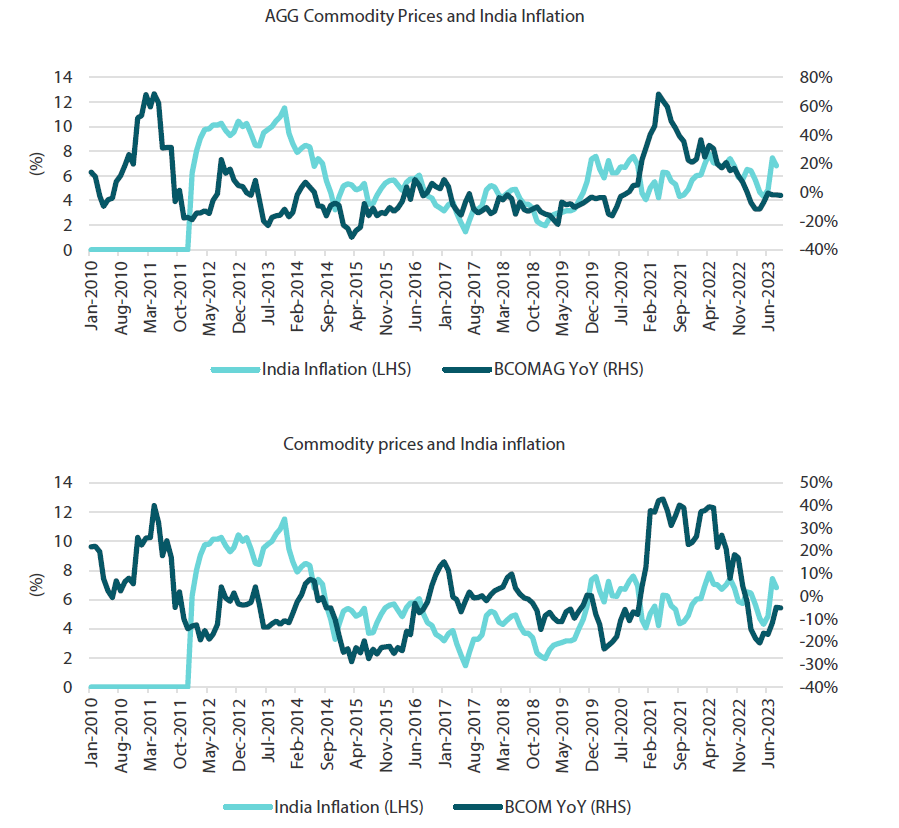

Source: Bloomberg, August 2023 The RBI tends to keep a closer eye on real GDP growth than inflation. In times of rising real GDP growth, the central bank has tightened monetary policy and loosened policy during periods of declining GDP growth. Expectations are for the RBI to continue to be accommodative, given that there are elections in 2024. Future agriculture prices key to India's inflation India's inflation basket is heavily weighted towards food, which makes up almost 37% of the CPI basket, while fuel comprises 5-6% of the total. Agriculture prices, on a YoY basis, have flattened, giving respite to inflationary pressures in India (see Chart 5). If there are any shocks to the global food supply, from either an escalation of the Ukraine-Russia war or from weather-related events, that could be a potential risk to inflation in India. Overall commodities, though rising largely because of higher oil prices, do not have that much of an impact on inflation in India. Chart 5: India's intertwined Inflation and commodity prices

Source: Bloomberg, August 2023 The Indian equity market and its link with inflation In India, the earnings yield, which is the inverse of the PE multiple, tends to move in tandem with inflation. During the commodities super cycle at the turn of the century, the Indian stock market did very well as inflation trended higher and valuations rose. Today, the environment looks similar. Inflation is high, growth expectations are rising and the market is starting to perform well. India's earnings growth, which is reaching historic highs, could mean persistently higher inflation. However, stand-alone valuations in the country are not excessive and rising rates haven't dampened investor sentiment. Relative to cash, equity valuations look fair, our view. Likewise, sales and earnings growth in India, historically, have had a fairly good relationship with inflation. In the post pandemic period, we have seen a divergence, however. Inflation has flattened and is expected to decline over 2024, while both sales and earnings are expected to continue to rise. Still, we reckon that if the country's sales and earnings were to remain strong in 2024, that would be supportive of higher rather than lower inflation. All in all, the Indian equity market looks well-placed with inflation under control, supportive monetary and fiscal policies. And with investors looking for alternatives to China, the uptrend in the India equity market could last for a while. Overall, the Indian equity market is pricing in a longer growth cycle; earnings growth expectations remain high, while strong macro tailwinds should continue to support the corporate sales and earnings rebound. Key takeout

Author: Mohammed Zaidi, Investment Director Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information |

15 Nov 2023 - Investing in communication towers

14 Nov 2023 - Glenmore Asset Management - Market Commentary

|

Market Commentary - October Glenmore Asset Management November 2023 Globally equity markets declined in October. In the US, the S&P 500 fell -2.2%, the Nasdaq declined -2.8%, whilst in the UK, the FTSE 100 fell -3.8%. The main drivers of the declines were ongoing high inflation, rising bond yields, and the conflict in the middle east. In Australia, the All Ordinaries Accumulation Index fell -3.9% in October. Gold was the top performing sector, whilst technology and healthcare were the worst performers, both of which were impacted by higher bond yields. Small caps again underperformed as investor risk aversion increased, with the Small Ordinaries Acc. Index declining -5.5%, whilst the Small Industrials Acc. Index fell -7.0%. Bond yields rose in October, in the US the 10-year bond yield rose +30 basis points to close at 4.84%, whilst its Australian counterpart climbed +44bp to 4.92%. Investor sentiment continues to be impacted by the issue of high inflation and rising interest rates. We believe equity markets (being very forward looking) will respond positively to signs that central banks (particularly the RBA in Australia) are being more aggressive in their commitment to reduce inflation to targeted levels. Currently we expect one to two more interest rate rises in Australia in this current cycle, but this will be dependent on the path of inflation in the next 6- 12 months. Despite the current negativity impacting the ASX and in particular small/mid caps stocks, we do believe the bulk of the interest rate rises have been implemented in this cycle and hence once there is more clarity on the number of rate hikes remaining, equity markets are well placed to perform strongly. Funds operated by this manager: |

13 Nov 2023 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|||||||||||||||||||

| EQT Eight Bays Global Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

| EQT Flagship Australian Share Fund (Retail) | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

| EQT Flagship Australian Share Fund (Wholesale) | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

| EQT Responsible Investment Australian Share Fund | |||||||||||||||||||

|

|||||||||||||||||||

| EQT Responsible Investment Global Share Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| Paradice Equity Alpha Plus Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||||

|

Subscribe for full access to these funds and over 750 others |

10 Nov 2023 - Global Matters: Extreme weather risks and their impact on investors

9 Nov 2023 - Inflation is higher. But is it 'materially' higher? That's the big question

|

Inflation is higher. But is it 'materially' higher? That's the big question Pendal October 2023 |

|

AUSTRALIA'S latest inflation data was higher than expected. The September quarter inflation number came out at 1.2% for both headline and underlying (trimmed mean) measures. This was above expectations of 1.1% and 1% respectively. In terms of headline inflation, it's now fair to say the current pace is about 4% annually. Last quarter it was 0.8%, dragged 0.2% lower by fuel prices. This quarter was 1.2%, dragged 0.2% higher by fuel. The increase in underlying inflation would be of greater concern for the Reserve Bank. A quarterly rate of 1.2% would not have been welcomed. Under the hoodLooking under the hood would add to the RBA's concerns. Market services remain stubbornly high. Housing inflation remains at over 2% a quarter, driven in part by utilities. At least rents have now caught up with leading indicators at 8% annually. Anyone who recently received their council rates will not be surprised by the 4.4% increase there. At least it only happens annually. Government subsidies once again had an impact. The government is already suppressing utility prices and now also childcare prices - though the childcare changes are permanent. Childcare costs were down 13%, subtracting 0.1% from this quarter's CPI. Here you can see a breakdown of the ABS's latest inflation data:

What's material? Focus now turns to the RBA's November 7 board meeting. We have two communications recent communications to consider. The RBA's latest minutes mentioned a "low tolerance" to upside inflation surprises. And in her maiden governor speech, Michelle Bullock mentioned "the board will not hesitate to raise the cash rate further if there is a material revision to the outlook for inflation". The question is - what is material? In August the RBA forecast year-end inflation to be 4.1% and 3.9% underlying. It's early days, but Q4 is expected to be around 0.9%. This would leave headline at 4.3% and underlying at 4.1%. The RBA will release updated forecasts in its next monetary policy statement on Friday November 10 (though it will reference them in their rate decision beforehand). Is 0.2% higher "material" or a breach of the "low tolerance"? That will be the big question come November 7. Markets have 60% chance of a hike in November and a cash rate 0.35% higher by early next year. At these levels there is no clear trade, since it will be line ball. If pushed, I think Michelle Bullock will be keen to show her inflation fighting credentials by putting in one hike, even though she was probably hoping today's number would let her off the hook. If the market gets close to pricing two hikes in the next few weeks we will go long duration. But until then today's reaction seems sensible and fair. Long bond yields largely ignored Wednesday's moves. Ten-year bonds remain around 4.75%. As always, they will rightly or wrongly be more captive to US bond moves and the latest iteration of oil prices. Author: Tim Hext, Portfolio Manager and Head of Government Bond Strategies |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

8 Nov 2023 - Future Quality Insights: Focus on the knowns in an era of unknowns

|

Future Quality Insights: Focus on the knowns in an era of unknowns Yarra Capital Management October 2023 The Future Quality approach to navigating uncertainty

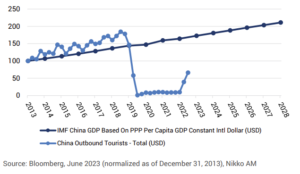

The great quantitative easing experiment of the last decade set global markets on a course into unknown territory. The repercussions of this are only just starting to play out and are proving near-impossible to predict. Central banks contended a rise in inflation would be temporary until it proved to be persistent and sticky. At the start of this year, markets were collectively expecting the US Federal Reserve to start tapering monetary policy, but we cannot yet be certain that interest rate rises have peaked. Earlier in the year, America's banking sector was unexpectedly impaired by the impact of rapid monetary tightening, but could other sectors also be vulnerable to unforeseen shocks? And we are yet to truly see the impact that central bank actions will have on growth. The major economies have so far avoided falling into recession, but for how long? Market dynamics reflect this sense of uncertainty. US equity returns have largely been driven by a cohort of seven mega-cap stocks during the first half of the year, a narrow leadership anomaly that is crowding out good performance in other parts of the market. And anyone on the wrong side of this trade has felt the impact of underperformance. So how should investors be navigating this sea of uncertainty? Known knowns At a time when investors are facing many unknowns, it is almost impossible to accurately predict the future. Yet, despite this ambiguity, there are still knowable knowns to be found. Previous market cycles have taught us that major shifts in the economic landscape generally lead to changes in leadership. So, we must focus on what we know to help identify those sectors and industries capable of taking up the position of market leaders in the forthcoming cycle. Fortunately, there are several clear and indisputable trends. The path to clean energy An energy transition will be key to solving the major social and environmental problems caused by climate change. We know there is a need to reduce humankind's reliance on fossil fuels and create better alternatives through renewable sources of energy. Despite this knowledge, the journey is not straightforward. Paradoxically, given the time it will take to develop the necessary scale of new clean energy sources, we remain reliant on fossil fuel supplies; yet supply constraints have driven up prices, making the transition process even more costly. So, while the general sentiment is that we need to invest in renewable energy sources, continued investment in fossil fuels can be vital to enabling the energy transition. This creates a fruitful pool of investment opportunities where individual companies offer solutions to both sides of this equation. On the one hand, some services and providers can help sustain fossil fuel production more efficiently, while still considering lower carbon outputs. On the other, technology is emerging to deliver more renewable solutions, and innovations in both hardware and software are helping reduce energy usage, waste, and the scale of emissions. Market leaders in all these areas are likely to surprise in terms of margins and profitability, and therefore present classic future growth opportunities. Growing healthcare requirements Healthcare presents a second long-term, structural trend. An ageing global population will only result in greater demand for healthcare while, at the same time, the sector faces increasing challenges in terms of its affordability. In our view, this demographic test will present a great hunting ground for investment ideas as healthcare companies are forced to innovate to ensure more efficient delivery of healthcare services, both in the hospital environment and through consumer-led healthcare solutions. In the post-pandemic era, the healthcare sector has faced further volatility amid the disrupted labour market for staff, while inventories have needed to be replenished from the high demand necessitated by Covid-19. These challenges are starting to stabilise, and we are optimistic about the sector's ongoing potential due to the 3 • yarracm.com clear need for innovation in the provision of new and more efficient healthcare solutions. The resumption of travel Finally, travel is perhaps a less obvious trend, but it's one we believe is worth exploring. The pandemic was a huge challenge for the sector, with many people under-consuming travel services simply because they were not allowed to travel. In terms of supply, the lack of demand meant the availability of flights and the development of hotels completely dried up for a period. While many consumer activities have completely normalised, travel is very much still in the process of recovery. When you look at the core consumers of travel, demand remains robust. This is particularly true for younger generations, who are placing even greater value on 'experiences' during life after lockdown. Further, a new travel cohort is emerging from developing countries where rising gross domestic product (GDP) per capita means more people will be able to afford to travel in the future. This reflects the same growth trajectory that developed nations have already experienced in recent decades. In our view, there will be many direct beneficiaries of this significant return to global travel, from booking companies to manufacturers of luggage and travel accessories. Chart 1: Is there a China travel boom pending?

Addressing the known unknowns While the investment case for established trends is relatively straightforward, it can often be harder to assess when or if an emerging trend will become a longterm investible opportunity. AI presents an interesting example of this conundrum. While research in this area can be traced back to the 1950s, it has only recently become a commercial opportunity in the eyes of many investors. The market has quickly latched on to this development, and excitement over its potential has seen the limited number of direct AI players re-rate significantly - hence the dominance of the technology mega-caps so far this year. Although we have few doubts that the AI theme is both real and profound, there are still many unanswerable questions. The profits and cashflows from AI are yet to materialise, so it's hard to be certain that they will be strong enough to justify current valuations. The adoption of AI is likely to have a meaningful impact across multiple industries - just as the internet did in the early 2000s - but it is difficult to identify who the eventual winners and losers of this disruption will be. There will also be geopolitical implications - the need for specific policy and regulation is already being widely debated. While we can see the investment potential of having exposure to AI, it needs to be done in a way that's consistent with our Future Quality philosophy of focusing on the knowns rather than blindly following the hype. A raft of companies are benefitting from the rising tide of AI, but only hardware companies are currently seeing any tangible uplift in cash flow and profitability - which is what we are looking for. As more companies look to harness AI's potential, we expect to see strong long-term demand for the complex high-end semiconductors that underpin this technology. For example, Synopsys - a leader in design technology and services for the semiconductor market - could benefit strongly as companies' demand for exceptionally complicated design services grows. Similarly, Hoya is a leading supplier and manufacturer of high-tech components used by semiconductor manufacturers and should be a beneficiary of increased demand. Future Quality in the Year of AIWhile it's impossible to know the ultimate direction of travel, we do know that we are in the midst of a regime change to a world of slower growth that will endure bouts of persistently higher inflation. It is also a time of significant technological transformation that not only encompasses AI but will drive the energy transition and provide new healthcare solutions. History tells us that during such inflection points, companies delivering high growth and sustained high returns of basic capital - classic Future Quality companies - earn the right to be market leaders and that these companies may come from different areas of the market to the leaders of the previous cycle. As investors, we believe it's essential to stick to what we know, particularly during times of unpredictable change. Our investment approach is focused on identifying and investing solely in Future Quality companies, those with superior long-term returns on investment that have been shown to deliver better performance over time. In our view, it is these Future Quality companies, especially in sectors aligned with secure, long-term trends, that will be the market leaders of tomorrow. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

7 Nov 2023 - The Rise of Meta: AI, Innovation, and Sustainable Growth

|

The Rise of Meta: AI, Innovation, and Sustainable Growth Insync Fund Managers October 2023

Meta's resurgence can be attributed to its focus on cost optimization and a robust rebound in advertising revenues. Profiting from the burgeoning wave of AI, Meta also ventured into the development of its 'expansive language model', bolstering its ability to drive innovative applications. Notably, its AI prowess paved the way for novel advertising solutions tailored to the needs of businesses which we believe will deliver sustainable earnings growth for many years. The potential of an even more profound transformation from the deployment of AI-powered agents within WhatsApp, Messenger, and Instagram looms large. Their capacity to substantially enhance the search and shopping functionalities of these massive platforms promises a paradigm shift in both user experiences and business interactions. Meta's journey from hardship to revival imparts valuable insights into dispelling the 'crowded trade' theory. Firstly, adaptability is paramount in our now dynamic world. Companies that can pivot and innovate fast, thrive. Secondly, an enduring long-term vision is a potent asset. Founder-led firms driven by unique insight often excel beyond their peers. Moreover, investors must remember that markets are not always efficient and so deliver exploitable opportunities. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

6 Nov 2023 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|||||||||||||||||||

| Plato Global Alpha Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| Regal Resources Royalties Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| Riparian Water Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|

|||||||||||||||||||

| Perpetual ESG Australian Share Fund | |||||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

| Munro Climate Change Leaders Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| IML Sustainable Future Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| Betashares Active Australian Hybrids Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||||

|

Subscribe for full access to these funds and over 750 others |

2 Nov 2023 - Airlie Quarterly Update

|

Airlie Quarterly Update Airlie Funds Management October 2023 |

|

Emma Fisher, Portfolio Manager, chats to Airlie's Analysts Joe Wright and Jack McNally about their recent US trip and findings from their discussions with companies, Aristocrat, QBE and SANTOS which are holdings in the Airlie Australian Share Fund. Funds operated by this manager: Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks.. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |