News

3 May 2019 - Hedge Clippings | 03 May, 2019

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

26 Apr 2019 - Hedge Clippings | 26 April, 2019

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

12 Apr 2019 - Hedge Clippings | All eyes on the Federal Election. It's the economy, stupid!

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

5 Apr 2019 - Hedge Clippings | Impending election, RBA uncertainty and ASIC's sharpened teeth

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

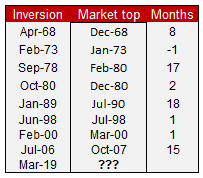

29 Mar 2019 - Hedge Clippings | Yield inversion and the "R" word

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

22 Mar 2019 - Hedge Clippings | 22 March 2019

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

15 Mar 2019 - Hedge Clippings | Talking, talking, talking. Sooner or later you've got to walk the walk.

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

8 Mar 2019 - Hedge Clippings | 08 March 2019

The see-saw equity market has been making things difficult for fund managers over the past 6 months - they found the last quarter of 2018 tough enough as the market tanked under the pressure of US investors' reaction to 10-year bond rates at 3.25%, and locally the side effects Hayne Royal Commission. Subsequently the ASX rebounded 6% in February as 10-year US bond returns retreated to yield 2.75%, just as many fund managers reset their portfolios to be more defensive and risk averse.

Of course not helping markets are the multiple geopolitical and associated economic issues they're facing: Brexit is getting closer and closer to the wire without a solution; Europe's economy is slowing partly as a result of Brexit, and partly due to China's slowdown; Trump's mega arm wrestle with Xi isn't going as well as he'd like to tweet, with evidence that it is hurting the US economy as well and possibly as much as China's; and finally the Donald might be realising that negotiating with Korea is not as easy as simply comparing and bragging about the size of his button.

While on the subject of China, an article today on Bloomberg's "Five Things To Start Your Day" (well recommended if you don't already receive it) citing the exodus of Chinese property buyers as the main cause of the property downturn in Australia (having bid it up in the first place), and elsewhere around the globe. Whilst that may be a major reason, so is the banks' tightening of loan eligibility (or possibly just applying what was there in the first place) along with the impending end of 5-year fixed-term interest-only mortgages being switched to principal and interest loans; low wages growth, in turn leading to poor retail sales figures as consumers' confidence is eroded and they pull their collective heads in.

For the property market it is somewhat of a perfect storm, and coming at the end of an extended period of double digit annual growth, bound to fall further. Whilst not property experts, Hedge Clippings would suggest the worst for the property market is not over yet, particularly with the imminent potential of a change in government, and with it the introduction of restrictive negative gearing rules amongst other goodies.

1 Mar 2019 - Hedge Clippings | 01 March 2019

It's been a mixed week of general news, with the Australian equity market recovering some of last year's late sell off by rising over 5% in February, courtesy in particular of the banking sector which rallied (in relief?) over 8%. It's worth remembering, however, that CBA for instance is still a long way from regaining sight of $100.

The Trump/Kim show is set for round 3 at least, but it was never going to be a straightforward negotiation. Kim's not easy, and Trump's well… Trump. Maybe he wanted to get back to Washington as quickly as possible to speak to his ex-solicitor, Steve Cohen. Markets will stay nervous, but understanding that a war starting in 1949 and which has yet to have a truce signed is not going to be fixed by a couple of high profile summit meetings. There'll be a resolution…. in due course.

Unlike Brexit, which is heading for goodness knows what? A hard exit? Disaster, although some look forward to it. A negotiated exit? Looking increasingly unlikely as the EU has the whip hand, or acceptable to many in Westminster or the UK at large. A second referendum? The first was an error of judgement, the second if held would probably result in a reversal, and a lot of unhappy Brexiteers.

In China, factory output hit a three-year low dipping below the all-important 50 level. That's a problem for Australian companies dependent on China, and not only in the resources sector such as BHP and RIO. Think Blackmores, who didn't see China's buyers coming and, by their own admission, didn't see them going either. Irrespective of the ongoing trade talks, factory output is down because consumer spending is down or slowing, particularly at the luxury or discretionary level.

And finally, on to funds management and financial services: We read with interest that Advisor Ratings are to publish Financial "Advisor" rankings. Great idea, but it will be difficult to accurately focus on their quality of advice, rather than only providing an orange or red flag for those surveyed (assuming they take part) who fall short. However, it will hopefully weed out some who shouldn't be in the industry. Along with the HRC's call for all advisors to have to declare their affiliations with, or ownership by, a financial institution or product issuer, this will at least provide consumers with some warning.

The dictionary lists synonyms for "advisor" as "counsellor, mentor, guide, consultant, confident, guide, aide, helper" etc. The bottom line is that an "advisor" must be able to declare they're independent, or not be permitted to use the term. If not, they risk being classified as being in product distribution, business development or sales. Such advisors should also be required to declare which products they have affiliations with and justify each product's inclusion on any recommendation or recommended product list.

22 Feb 2019 - Hedge Clippings | Graham Rich's Portfolio Construction Forum (PCF)

This week Hedge Clippings attended the 500+ advisor/fund manager annual info-fest run by Graham Rich's Portfolio Construction Forum (PCF). Run is probably an understatement, as is managed - the event is a superb example of organisational efficiency, or should we say control.

PCF is a longstanding annual event and thus has the benefit of years of experience, some serious theatrics, audio volumes to rival a Bruce Springsteen concert and, led by Rich himself, with an excellent line up of speakers, plus the obligatory "pay to perform" fund managers. In case you're wondering, this is not a paid endorsement or return favour for a freebie or contra ticket - Hedge Clippings coughed up the $795 entrance fee and will happily do so again next time around.

Why? Simply the professionalism of the production and the quality of the speakers - in spite of the geographically impossible location in deepest Redfern, which it seems, as we wandered hopelessly lost* (as Google Maps doesn't call it Redfern do they, probably preferring the more fashionable Eveleigh) around the streets. It seems Redfern has been transformed from "no go" to "inner city chic" in the blink of Sydney's property boom.

But we digress - back to the speakers, the main morning attraction being a global economic review from the likes of Jonathan Pain who is seriously bearish on property. Another, Longview Economics' Chris Watling from London, who held an equally bearish view based on his concern over the expansion of global debt at record low rates (in some cases, zero) which now exceeds GFC levels.

Watling's theme was that "bubbles always burst", having always started with cheap money, and always ending when it gets more expensive. He particularly singled out BBB corporate bonds issued by companies he described as "Zombies" who, after paying their bond holders, had nothing left to invest in R&D or production, and who in a normal interest rate environment would not be able to survive. He was equally critical of valuations, citing We Work currently priced at 20 times revenue!

Watling was unable to predict the timing of the bubble's burst, but one got the impression that, even though he might have been singing from the same song sheet for a while, time was running out.

Watling was followed by Ron Temple from Lazard Asset Management who was more sanguine, but cautioned that global growth was slowing, was surprised by the Fed's recent "pivot" but believed Euro growth will rebound.

Forecasters are notoriously good at predicting the future, but equally bad at calling the timing. We're reminded of the old adage that "the right trade, but with the wrong timing frequently results in a bad outcome."

*OK, our fault. A little prior preparation the day before would have averted the long walk, but at least Redfern was a pleasant revelation, and who would have thought we'd say that twenty, or even ten years ago.