News

8 Apr 2025 - Performance Report: 4D Global Infrastructure Fund (Unhedged)

[Current Manager Report if available]

8 Apr 2025 - Performance Report: Bennelong Emerging Companies Fund

[Current Manager Report if available]

8 Apr 2025 - Australian Secure Capital Fund - Market Update

|

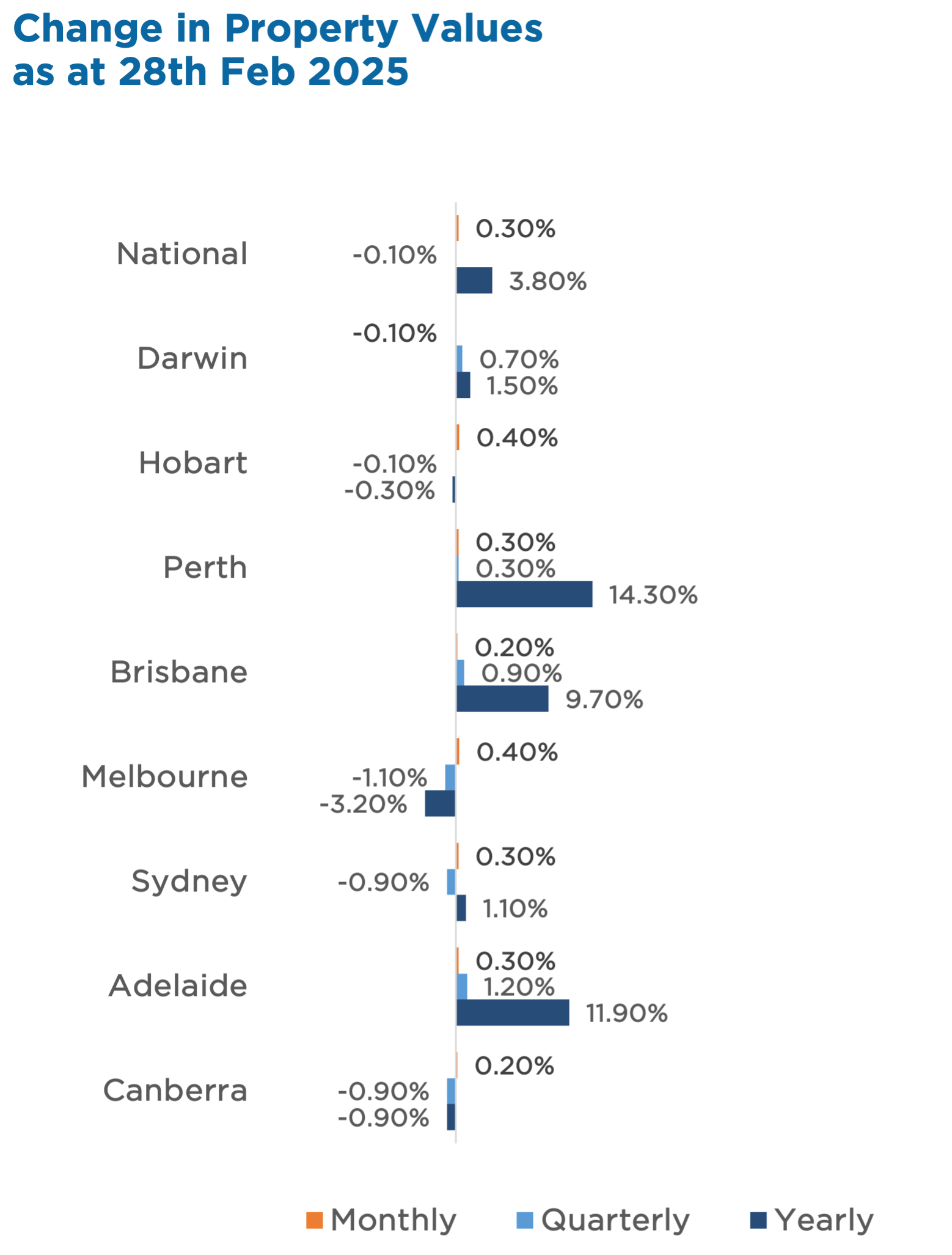

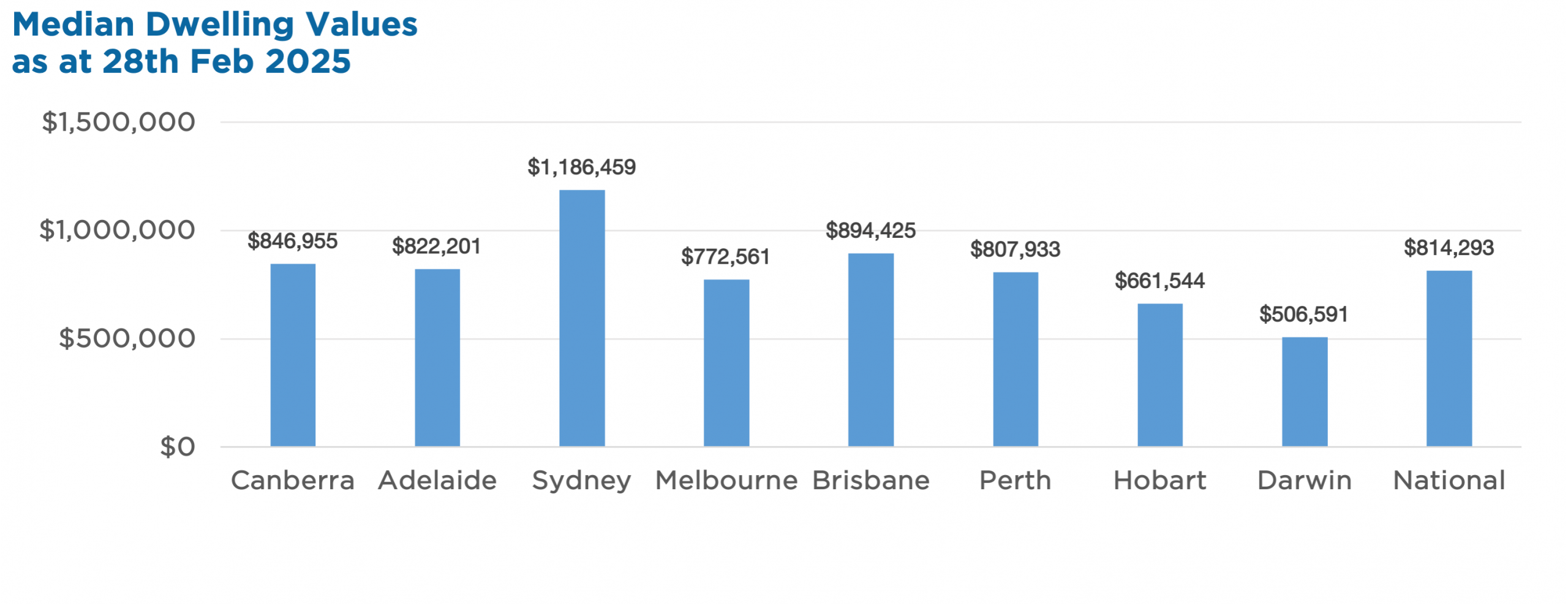

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund March 2025 February marked a shift in Australia's housing market, with national home values rising 0.3%, ending a three-month downturn. Gains were widespread, with Melbourne and Hobart leading at +0.4%, while regional markets continued to outperform, rising 0.4% for the month and 1.0% over the quarter. This renewed momentum aligns with improving buyer sentiment, supported by tighter housing supply and a slowdown in new listings, which remain 4.7% lower year-on-year. Auction clearance rates have also strengthened, reflecting growing confidence in the market. While affordability remains a challenge, supply constraints and positive sentiment could support continued price growth in the coming months. Investors monitoring market trends should note the shifting dynamics, particularly in premium housing markets, which have historically been the first to respond to changing economic conditions. Property Values

|

7 Apr 2025 - Manager Insights | Euree Asset Management

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Winston Sammut, Property Director at Euree Asset Management. They discuss the global market reaction to Donald Trump's tariff announcements, as investors shift to safer assets amid rising uncertainty, falling interest rates, and fears of a trade war, with flow-on effects for REIT valuations and broader market sentiment.

|

4 Apr 2025 - Hedge Clippings | 04 April 2025

|

|

|

|

Hedge Clippings | 04 April 2025 It's difficult to add anything new to the commentary about Donald Trump's "Liberation Day" that hasn't already been said or written. Outside his immediate circle of acolytes, seemingly led by Commerce Secretary Howard Lutnick, we have struggled to find any positive commentary from any corner of the world, (including the economic powerhouse of Norfolk Island) or in any language that supports Trump's upending of the world's economy. Except two: Russia and North Korea. Go figure? Ronald Reagan and every other US president since WWII would be turning in their grave. To be fair, although Norfolk Island was singled out in Trump's Rose Garden ramble, by the time the official list was released, someone had realised there's stupid, and then there's plain dumb, and thus Fletcher Christian's descendants were spared - yet again. One assumes that in due course the results of Trump's "genius" (his words, not ours nor it seems anyone else's) will come back to bite him where it hurts most - his ego and the ballot box. Unfortunately his self esteem/adoration is such that he probably won't notice when it does, and in spite of his best efforts, a third term seems out of reach. Not that the US constitution will stop him from trying. So Australia, and the rest of the world, (except as above, Russia and North Korea) are left to try to decide how to respond to the US directly, and, at the same time, try to fathom how every other country's response will change the overall global economic landscape. One factor to consider is that Trump is obsessed with the trade of goods, where the US operates a deficit. In today's technological and service orientated world, the US has a services trade surplus - admittedly not sufficient to even the score, but he's quiet on that front. Trump will try to pick off individual targets. Maybe the world's best reaction is to coordinate their responses? It worked in 1939 (just, after a shaky start) when dealing with another predictably self-obsessed adversary, even if it did take the US a couple of years to join the fray, and only then when they had no other option, or possibly saw the tide turning. In the meantime, everyone else - along with the RBA - is left to ponder their reaction in uncertain times. For the record, if you can remember as far back as last Tuesday, the newly formulated board left rates on hold on April Fool's Day, just before Trump's Liberation Day. However, they did mention "uncertain" no less than five times, as well as devoting more than 50% of their media release to a section on the "Uncertain Outlook", before returning to the more familiar ground of "returning inflation to target" being the priority. Markets, and as a result, many fund performances, were negative in February and March, and April is certainly heading that way. We spoke with Euree Asset Management's Winston Sammut just before going to press, (see video below) and it is fair to say that with all his experience, he views the immediate outcome as "uncertain" (that word again) but not overly positive. News & Insights Manager Insights | Euree Asset Management Making sense of the banking sector | Airlie Funds Management |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

4 Apr 2025 - Spurious Correlations

|

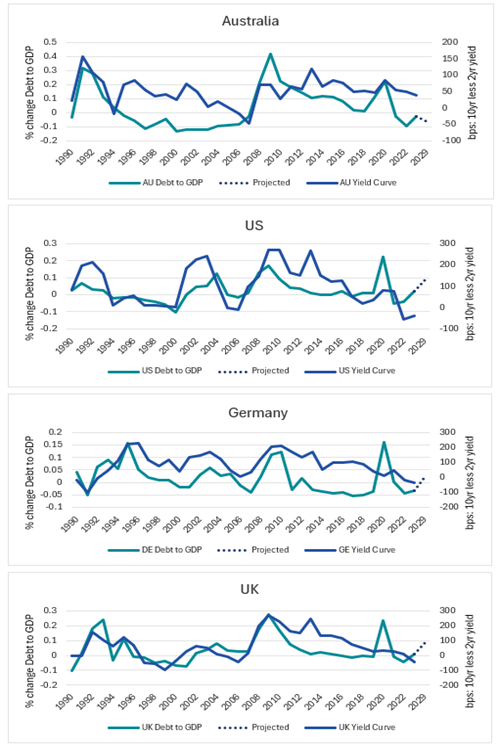

Spurious Correlations Yarra Capital Management March 2025 Debt size doesn't seem to matter!Major government borrowing events have typically been triggered by one-off crisis like the Global Financial Crisis (GFC) and COVID-19, not by interest rates. Before 2008, debt-to-GDP ratios were stable or even declining in many economies, suggesting governments borrow based on necessity, not borrowing costs. Looking at the US, Australia, Germany, and the UK (refer Chart 1), debt levels have risen, yet interest rates haven't followed suit. Germany, for instance, has kept debt-to-GDP in check, yet its bond yields have moved in line with other developed economies. Chart 1 - Debt-to-GDP vs. 10-year yields

|

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

3 Apr 2025 - Trumponomics: What tariffs could mean for small caps

|

Trumponomics: What tariffs could mean for small caps abrdn March 2025 The recent wave of tariffs imposed by President Trump, along with retaliatory measures from affected nations, has created a complex environment for businesses worldwide. While these trade disputes pose risks, they also present unique opportunities for certain US small-cap companies. At the core of Trump's tariff policies is the goal of protecting American industries and reducing trade deficits. Measures that will undoubtedly disrupt global supply chains, drive up the cost of imported goods, and create challenges for businesses reliant on foreign materials. They are expected to, however, incentivize domestic production, potentially benefitting small-cap companies that can step in to replace diminished imports. While not all firms will benefit, we believe companies with resilient business models, pricing power, and strong balance sheets will be best positioned to navigate these economic shifts. Reshoring and supply chain reconsiderationsOne of the primary ways tariffs could benefit small-cap companies is through the reshoring of manufacturing capacity. As tariffs make foreign goods more expensive, many US firms are adapting supply chain strategies to increase domestic sourcing and production. This shift presents new opportunities for smaller companies across a variety of sectors. For instance, reshoring projects will drive demand for local construction crews, concrete suppliers, and equipment rental firms. Regional banks will play a key role in financing these initiatives. Meanwhile, new semiconductor facilities will require specialised HVAC systems with nearby maintenance and repair services. By positioning themselves within these expanding domestic supply chains, small-cap companies stand to benefit from stronger revenue and earnings growth. Tariff-driven innovation and efficiencyAdditionally, tariffs have spurred innovation and efficiency improvements among small-cap companies. Many businesses are investing in automation, advanced manufacturing techniques, and other innovations to offset rising material costs to enhance productivity. These efforts help maintain margins and better position small-cap companies for long-term success. This is especially relevant for technology and industrial companies leveraging innovation to reduce dependence on foreign inputs and strengthen their competitive position. Reshaping the competitive landscapeCounter-tariffs imposed by other nations in response to Trump's policies have also played a role in shaping the competitive landscape. Countries like China have targeted US exports, impacting industries such as agriculture and automotive. While some small-cap exporters face headwinds, others have successfully pivoted to alternative markets. We believe companies that can adapt to shifting trade dynamics and diversify their customer base will be best positioned to thrive. The economic environment remains supportiveWhile we are mindful of the risks associated with recent policy actions, the broader economic environment remains supportive of high-quality small-cap stocks. Despite geopolitical uncertainty, GDP growth is expected to remain in positive territory. Also, many companies have already strengthened operations in response to past disruptions, such as the pandemic and volatility during Trump's first term. These efforts, such as diversifying supply chains and implementing efficiency initiatives, have better-positioned businesses to navigate potential tariffs and raw material inflation. Overall, the US economy is expected to continue expanding, albeit at a more modest pace. This environment allows resilient small-cap companies to capitalise on the new administration's 'America First' agenda while leveraging recent operational enhancements to mitigate near-term risks. ... Along with earnings growthAs we move through 2025, small-cap stocks are gaining attention for several reasons. Investors are increasingly looking to diversify, given the growing concentration of "Big Tech" in large-cap indices. The shift is timely, as small-cap companies are expected to deliver stronger earnings growth relative to their large-cap counterparts (Chart 1). This is an important development as small-cap growth rates have lagged large-caps for several years. Chart 1. Russell 2000 Index (RTY) vs. S&P 500 Index (SPX) positive EPS growth ... And attractive valuationsFurthermore, small-cap stocks are trading at attractive valuations, with their discount to large-caps near historic lows (Chart 2). Chart 2. Small cap relative to large cap forward price/earnings (PE) ratio While multiple factors have contributed to this valuation gap, earnings growth differentials have been key drivers. As small-cap earnings accelerate, this discount should begin to narrow, presenting a compelling opportunity for investors. Final thoughts...Trump's latest tariffs and the retaliatory measures from affected nations are reshaping the competitive landscape for US small-cap companies. While risks remain, the push towards domestic production, supply chain diversification, and innovation can drive earnings growth for many firms over the long term. Coupled with resilient economic conditions and historically attractive valuations, high-quality small-cap stocks present a strong investment opportunity for those looking to capitalise on evolving trade dynamics. |

|

Funds operated by this manager: abrdn Sustainable Asian Opportunities Fund, abrdn Emerging Opportunities Fund, abrdn Global Corporate Bond Fund (Class A), abrdn International Equity Fund, abrdn Multi-Asset Income Fund, abrdn Multi-Asset Real Return Fund, abrdn Sustainable International Equities Fund |

2 Apr 2025 - Making sense of the banking sector

|

Making sense of the banking sector Airlie Funds Management March 2025 |

|

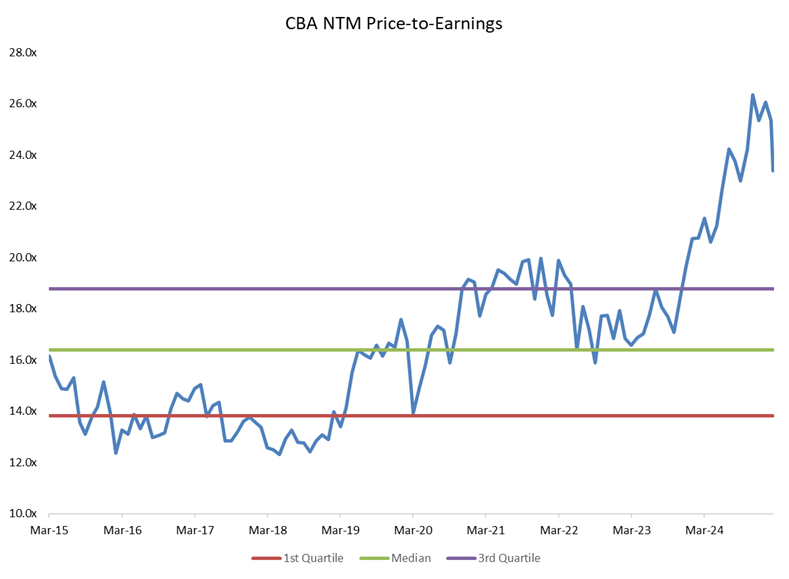

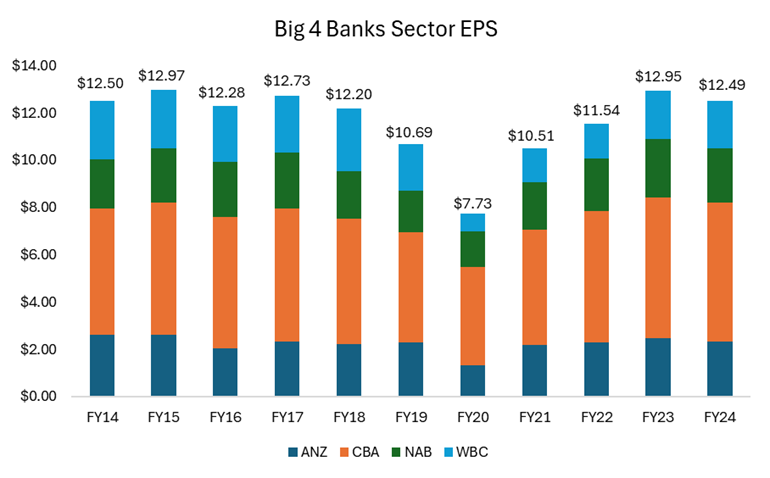

How long will the extraordinary rally continue? The banking sector enjoyed an extraordinary rally in 2024, with the Big Four Banks delivering an average TSR of 33%. As recently as February, Commonwealth Bank (CBA), for instance, enjoyed a price to earnings multiple of 26x- a 60% premium to its historical average. This raises an important question: are these valuations justified for a sector that has not grown its overall earnings per share over the last 10 years?

To look at this in another way, you can see in the chart below that the collective earnings of the Big Four are only today back to where they were in 2018. Yet if we add up the cumulative share prices of the banks, you're paying $233 in total for all four banks versus $157 in 2018 for the same level of earnings. And this is after the recent share price rout; at the banks' peak in February, you would have paid a cumulative $276 for these earnings.

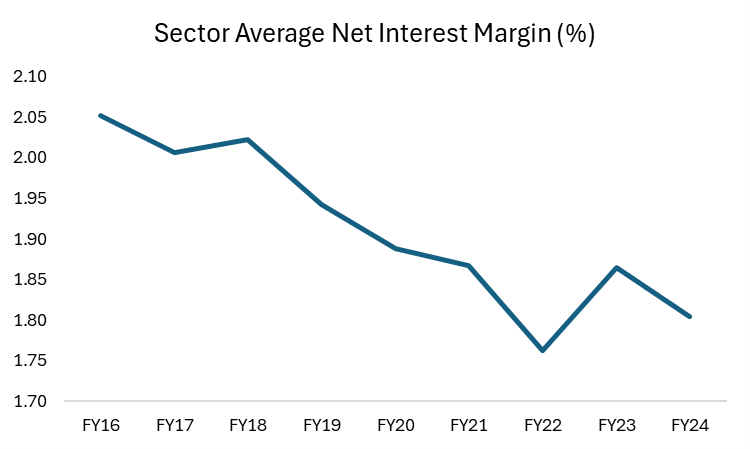

Are banks really making more money? The net interest margin storyAt its core, banking profitability hinges largely on a single key metric: Net Interest Margin (NIM). This is the difference between what a bank earns on loans and what it pays on deposits. The higher the margin, the more profitable the bank. However, over the past few decades, this margin has been steadily shrinking. This decline has been driven by three key structural changes in the industry:

Over the past decade, the share of mortgage broker-originated loans has surged from ~50% to 75%, significantly squeezing bank margins. Banks pay the broker a large upfront commission of ~0.65% of the loan value ($6.5k for every $1m lent) and a trailing commission of 0.15% per year. Moreover, because brokers focus on securing the lowest possible rate for customers, mortgages have become increasingly price-driven, reducing banks' ability to charge more favourable rates. Since brokers earn their largest commission when writing a new loan, they have an incentive to refinance customers regularly, which further erodes bank margins. The Commonwealth Bank estimates that the broker channel is 20-30% less profitable than a loan originated through a bank's proprietary channel.

Over the last decade, Macquarie Group has entered the banking sector, employing a digital, broker-led model where it can operate a lean model without the tech debt and branch costs of its traditional competitors. The company has successfully grown its share to ~5% and its ease of use has made it popular with brokers. Unlike the major banks, Macquarie doesn't need to maintain a constant presence in the mortgage market. It has entered when risk and pricing are attractive and exited when margins tighten, making it a highly agile competitor. This dynamic prevents periods of excess profitability for the Big Four, as Macquarie re-enters the market whenever rates become too favourable for banks.

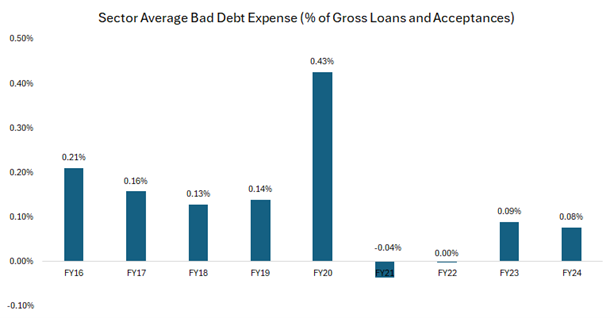

In the past, banks operated in higher-margin businesses such as wealth management and insurance. While these divisions may have distracted them from mortgage competition, they also provided additional profitability. With banks now exiting these areas, mortgage lending has become their primary battleground, intensifying competition and further pressuring margins. Bad debts are low but can this last?One of the biggest risks for any bank is loan defaults, which result in bad debt expenses; that is, the losses banks take when borrowers can't repay their loans. Historically, Australian banks have averaged bad debt expenses of ~0.15% to 0.20% of gross loans and acceptances. In FY24, this figure was just 0.08% - about half the long-term average. While this looks like a positive for bank earnings, the key question is: is this sustainable? Why are bad debts so low right now? There are three key reasons bad debt expenses remain unusually low:

The real risk: Are banks underestimating future loan losses? While bad debts are currently low, history suggests this won't last forever. Since current bank earnings are inflated by unusually low bad debt expenses, it's reasonable to assume:

Bottom line? The current low levels of bad debts make bank earnings look better than they likely are in the long run, suggesting investors should be cautious about assuming today's profits are sustainable. To pick on ANZ as an example - and we chose ANZ because it has the lowest level of provisioning for bad debts - if the bad debts expense were to normalise to ~0.20% of gross loans and acceptances (the pre-covid FY16-19 average) from 0.05% in FY24, its EPS would have been ~13% lower.

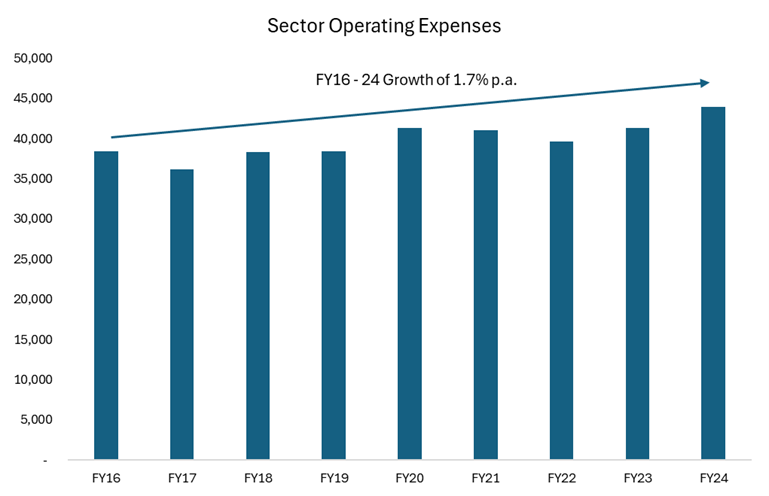

ExpensesOne area where banks could justify a higher valuation is through improved efficiency. However, the track record here is mixed. While banks have closed physical branches and pushed digital banking, these savings have been offset by rising IT spending, cybersecurity costs and regulatory compliance. Additionally, employee expenses account for ~70% of a bank's cost base and wage pressures remain high. The net result? Banking cost bases have proven resilient, making it difficult for them to structurally improve profitability through expense reduction. Since FY16, bank expenses have grown at ~1.7% p.a. compared to income growth of just 0.9% p.a.

This means that despite cost-cutting efforts, banks struggle to convert these savings into higher profits because any efficiency gains are competed away in lower prices for customers. As a result, cost-cutting alone is unlikely to drive meaningful margin expansion at the sector level.

|

1 Apr 2025 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Ophir Global High Conviction Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Datt Capital Small Companies Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Atlas Australian Equity Income Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Ziller Asset Management Founders Global Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 900 others |

31 Mar 2025 - Manager Insights | Altor Capital on the Business of Sport

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Benjamin Harrison, Chief Investment Officer at Altor Capital. Ben discussed the growing investment opportunities within the global sports industry, highlighting its diverse revenue streams and Altor's strategic focus on both team ownership and related support sectors. The conversation underscored the potential for meaningful investor involvement beyond just elite-level teams, particularly within Australia's mid-market sports landscape.

Disclaimer This video presentation (the "Content") has been prepared by Australian Fund Monitors Pty Ltd, "AFM" (AFSL 324476) and has been prepared without taking into account the investment objectives of the viewer or recipient. The Content is intended for information purposes only, and recipients should conduct full research and take appropriate advice prior to making any investment decisions. The Content is believed to be accurate at the time of publication, but past performance is not guaranteed. Copyright, Australian Fund Monitors Pty Ltd. October 2024. |