News

18 Apr 2024 - An upgrade to the financial system's plumbing

|

An upgrade to the financial system's plumbing Pendal April 2024 |

|

THE plumbing of Australia's financial system is a bit like the plumbing in your house - of little interest until something goes wrong. For those few who do take an interest in the RBA and our financial system's plumbing, the Assistant Governor Chris Kent gave a speech on Tuesday last week: "The Future of Monetary Policy Implementation". By the end of this year, he explained, Australia will have a new system called "Ample Reserves". In short, the central bank will set a price for "Open Market Operations" (repos) and offer unlimited quantity - instead of setting the quantity and letting the market determine the price, as was the previous system. Banks have been flush (so to speak) with liquidity since early 2020, courtesy of RBA quantitative easing and the term funding facility over the pandemic. These are now slowly rolling off, reducing excess reserves in the system. The RBA is worried that the pre-pandemic "corridor and low reserve" system may not work so well. That system relied on the RBA accurately forecasting government inflows and outflows into the system (think taxes and welfare payments) and offsetting them by adding or draining the cash back into the system through repos and reverse repos. You lend them securities and they give you cash that you then pay interest on or vice versa. The corridor meant banks could always borrow or lend unlimited funds with the RBA at 0.25% above or below target cash, but hardly ever did. With Ample Reserves, banks can go to the RBA and offer unlimited securities to repo in return for cash (OMOs) at a pre-set margin to the official cash rate. The price and frequency of these operations are yet to be determined but look like at least weekly and something like the target cash rate plus five basis points (currently 4.40%). The RBA will release more details later in the year after market consultations. So, what does this mean for investors?The good news for leveraged portfolios is that there is now an "ample" supply of central bank liquidity at a reasonable price. For investors, the good news is that overnight cash should eventually drift back towards target cash levels rather than sit at the ES level. This would mean closer to 4.35% than 4.25% at current cash targets. The bad news for investors, however, is that bank bills are less likely to drift too far above cash again. Also, for relative value funds, government bond baskets (where bonds trade to futures) are less likely to get too cheap again. Overall, it is a new era for the RBA. It is not only temporarily moving out of the asbestos-ridden 65 Martin Place while expensive and long overdue renovations are undertaken, but it now has a new way of ensuring system liquidity is always rock solid. Author: Tim Hext, Pendal portfolio manager and head of government bond strategies |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

17 Apr 2024 - Glenmore Asset Management - Market Commentary

|

Market Commentary - March Glenmore Asset Management April 2024 Equity markets were stronger in March. In the US, the S&P 500 rose +3.1%, the Nasdaq was up +1.8%, whilst in the UK, the FTSE 100 rose +4.2%. In Australia, the All Ordinaries Accumulation Index rose +3.1%. Gold and real estate were the top performing sectors, whilst communications was the worst performer. In terms of sector performance, there was no clear reason for the ~9% rise in the gold price in the month, whilst real estate stocks were boosted by falling bond rates. Broadly speaking, inflation continues to gradually track down towards the top end of central bank inflation targets, providing confidence we have seen the end of interest rate hikes. This has been the main driver of strength in equity markets in the last five months in our view. In bond markets, the US 10-year bond rate fell -7 basis points (bp) to close at4.20%, whilst its Australian counterpart fell +17 bp to finish at 3.97%. The Australian dollar was again flat for the month, ending at US$0.65. Funds operated by this manager: |

16 Apr 2024 - Investment Perspectives: Aussie interest rates are heading for zero (again)

15 Apr 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Fidelity Global Short Duration Income Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Fidelity Global Long Short Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Fidelity Global Future Leaders Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Fidelity Global Equities Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Fidelity Australian Opportunities Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

12 Apr 2024 - Why reframing fixed income is key to portfolio stability

|

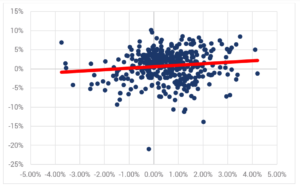

Why reframing fixed income is key to portfolio stability Yarra Capital Management March 2024 Conventional portfolio construction theory positions equities as the primary driver of returns, while fixed income typically takes a back seat as a low-return and low-risk asset class. However, this perspective often overlooks a crucial aspect of fixed income: its role in dampening portfolio volatility. Protecting portfolios through the stormContrary to the notion that fixed income should exhibit a negative correlation to equities, suggesting that when one goes up, the other goes down, in our view, it's more accurate to view fixed income as a stabilising force within a portfolio. Instead of focusing solely on returns, investors should also consider the invaluable function of fixed income can have in reducing overall portfolio volatility and improving risk-adjusted returns. Historically, equities have exhibited higher volatility, compared to bonds, reflecting the relatively stable income streams of bonds and their fixed coupon payments. While bonds can still experience price fluctuations, especially in response to changes in interest rates or credit risk, these movements are generally less pronounced compared to equities. Even small bond allocations in a portfolio can help dampen portfolio volatility for a small reduction in overall return and improving risk adjusted returns (Sharpe ratio). Chart 1: Historical risk adjusted return comparison of bonds and equities

|

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

9 Apr 2024 - Exchange Traded Funds

|

Exchange Traded Funds Airlie Funds Management March 2024 |

|

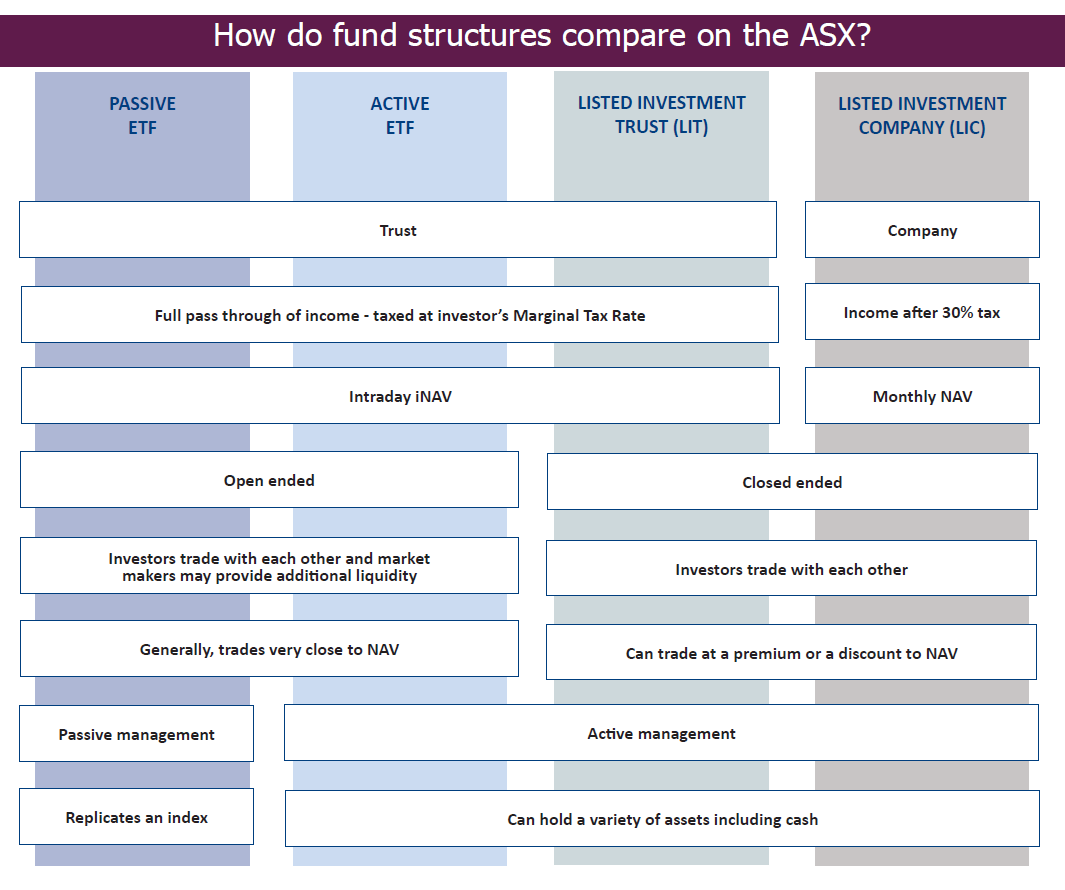

Exchange Traded Funds (ETFs) are a simple way for investors to gain access to a wide range of asset classes. They are open-ended funds whose units trade on a securities exchange (Exchange), just like an ordinary listed security. They enable investors to gain access to a portfolio of securities in one easy transaction - either online or through a stockbroker. Passive ETFs have existed since 1993 when State Street launched the SPDR S&P 500 ETF in the US. Passive ETFs typically track an index (such as the ASX200 index) and the portfolio is updated regularly (generally quarterly) to reflect changes in the reference index. Active ETFs, where an investment manager is actively managing a portfolio of securities, have existed globally for some time. However, there have been few choices available to investors as investment managers have been reluctant to publish their portfolios daily. In Australia, Active ETF issuance started to evolve in early 2015 when issuers and regulators agreed on a portfolio disclosure regime that balanced the needs of investors who want to know what they are investing in with the protection of the investment manager's intellectual property (its portfolio holdings and active portfolio decisions). What are the similarities?STRUCTURE In Australia, both Passive and Active ETFs are generally registered managed investment schemes, a type of 'unit trust', that trades on the Exchange in the same way that a share in a company trades on an Exchange. Like any share or unit traded on an Exchange, investors can buy or sell units in the ETF from each other through the Exchange. TRANSPARENCY Investors have transparency as to the value of the underlying fund and the composition of its portfolio through regular disclosure provided on the Exchange and the ETF issuer's website. The value of the ETF's underlying investments is generally provided in the form of the net asset value (NAV) per unit and an indicative intraday net asset value (iNAV) per unit, which generally updates throughout the ASX trading day. The level of portfolio disclosure will generally depend on whether the ETF is a Passive ETF or an Active ETF and, in the case of the latter, adhering to regulatory guidance on portfolio holding disclosure. Passive ETFs will either provide an iNAV per unit and/or full portfolio disclosure on a daily basis. Active ETFs that employ an internal market making model will generally provide daily net asset value and iNAV per unit, monthly fund updates and a full portfolio comprising names and weights of the investments on a quarterly basis. LIQUIDITY In seeking to ensure there is efficient trading in the secondary market of ETF units and with the objective of having the trading price track the underlying NAV, ETF issuers put in place additional liquidity arrangements. As ETFs are open-ended funds and can issue and redeem units, they are able to facilitate these liquidity arrangements. Passive ETF issuers largely outsource the provision of liquidity to third-party market makers or authorised participants such as institutional brokers. Market makers trade an inventory of units on the Exchange and are able to apply or redeem with the ETF issuer to settle their net trading position. These market makers form their own view of the NAV of the ETF and provide bids and offers in the market around that value, within the bounds of their own balance sheet risk appetite for providing this liquidity. Active ETF issuers either follow the same market making model as Passive ETFs or opt to be internal market makers where they seek to provide sufficient liquidity for the ETF. This means that the ETF might, at any time, be providing bids and offers in the market around the issuer's assessed value of the units at that time. TAXATION Being unit trusts, both Passive and Active ETFs allow a full passthrough of income on a pro-rata basis such as dividends, franking credits, capital gains and discounted capital gains income and net income is taxed in the hands of the end investor. What are the differences?TYPES OF INVESTMENTS With an Active ETF, a portfolio manager will undertake stock research to determine which underlying securities or stocks to hold and in what percentages. They will then actively manage weightings of the stocks depending on stock valuations, industry trends and views on macroeconomics. They can also hold cash to manage the overall risk of the portfolio and to take advantage of opportunities when markets move. A Passive ETF tracks an index. This can be over a broad-based stock market index, a sector index, custom-built indices or indices comprising fixed income, credit, commodities and currency. They can either fully replicate an index by buying all the securities that make up the index or they can be optimised by buying the securities in an index that provides the most representative sample of the index based on correlations, exposure and risk. Passive ETFs can either attempt to track their target indices by holding all, or a representative sample, of the underlying securities that make up the index or instead of physically holding each of the securities they can hold synthetic exposure to securities by using derivatives such as swaps to execute their investment strategy. How many ETFs are available on the ASX?As at the end of January 2024, there were 325 Active and Passive ETFs available on the ASX with over $178 billion* in market capitalisation.

|

8 Apr 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Schroder Multi-Asset Income Fund (Wholesale Class) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Schroder Global Emerging Markets Fund (Wholesale Class) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Schroder Global Sustainable Equity Fund (Wholesale Class) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Schroder Sustainable Global Core Fund (Wholesale Class) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Schroder Global Recovery Fund (Wholesale Class) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Schroder Equity Opportunities Fund (Wholesale) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

5 Apr 2024 - Assessing the impact of green bonds

|

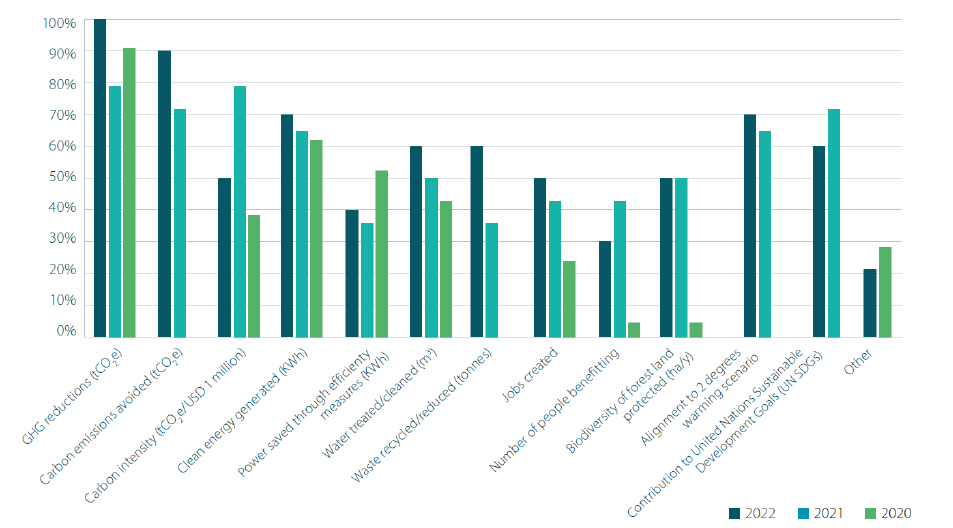

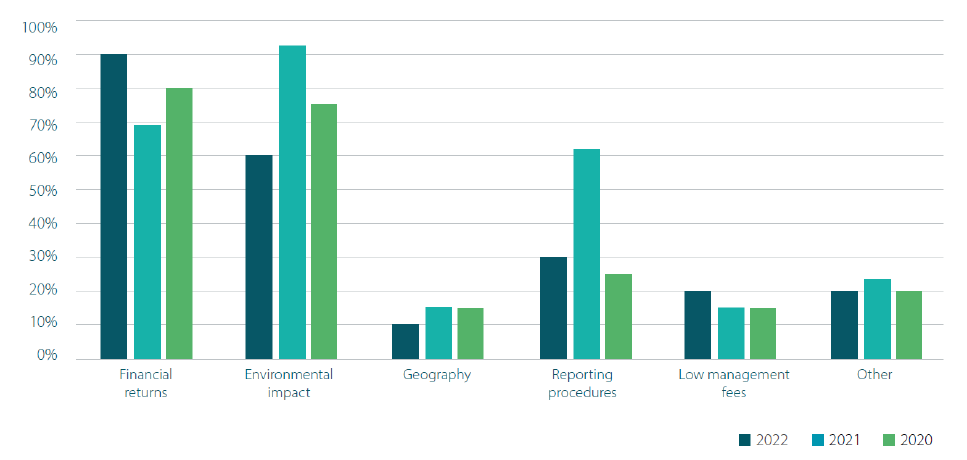

Assessing the impact of green bonds Nikko Asset Management March 2024 The green bond market has experienced tremendous growth since 2007, but despite its rapid success, there are still barriers to overcome. In particular, assessing the impact of green bonds continues to be a contentious topic. Due to a lack of standardisation among both issuers and regulators, gathering, grouping and communicating fund-level impact data is challenging, as are efforts to ensure green bonds continue to represent the interests and requirements of investors. Nonetheless, measuring the impact of green bonds is an essential component in ensuring their continued success. Which metrics matter most to green bond investors?As one would expect given the increasing appetite to understand the real impact of investments, most green bond investors track alignment with the United Nations Sustainable Development Goals (SDGs). SDGs are a great basis for mapping the use of proceeds to clear and understandable environmental and social outcomes. Indeed, many of the most common metrics required by investors - including greenhouse gas reductions, CO2 emissions avoided and carbon intensity--have become established components in impact reports from issuers. Please see an Environmental Finance survey from 2022 in Charts 1 and 2. Green, Social, Sustainability and Sustainability-Linked Bond Principles designed by the International Capital Market Association (ICMA) have been widely accepted as the common framework to provide transparency on the issuance of labelled bonds. All issuers aligned to ICMA Principles are committed to report on the allocation of proceeds, which is generally accompanied by impact metrics. While the IMCA Principles are a useful starting point to gather and compare how proceeds are being used by issuers, and the impact they have, the principles themselves are broad and not prescriptive. This means that the reporting quality and consistency between issuers can still vary widely. Some issuers will report their allocation on an aggregated portfolio basis, rather than on a bond-by-bond basis. Others may not specify what proportion of a specific project is financed by the green bond proceeds--making it almost impossible to measure bond-specific impact. In recognition of this, while adhering to IMCA Principles is a good starting point, investors seeking to meaningfully understand the impact of green bonds and want to be able to compare and contrast between different green bonds, continue to demand better quality impact reporting from bond issuers, and increasingly look to do so through issuer engagement. Chart 1: What environmental metrics are your firm most interested in?

Source: Environmental Finance survey (2022) Chart 2: What are your firm's main criteria when choosing a green bond fund to invest in?

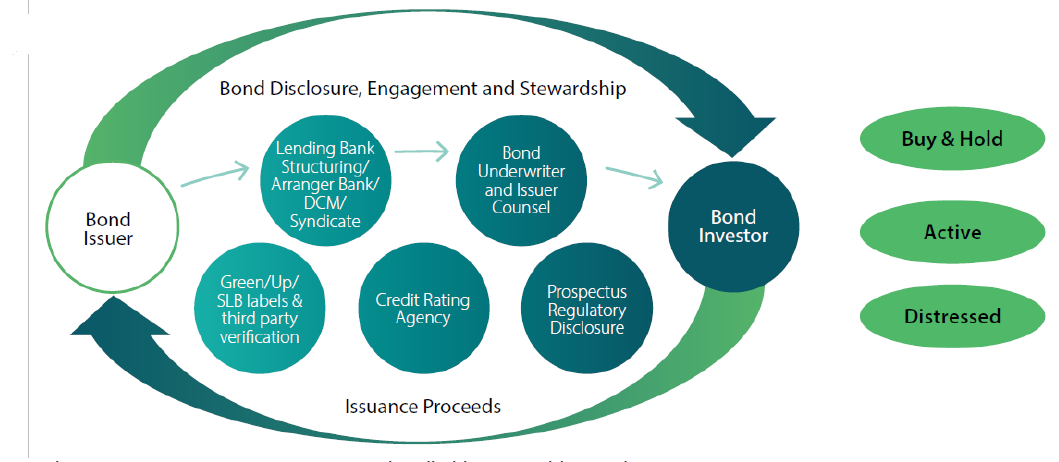

Source: Environmental Finance survey (2022) Engagement throughout the lifecycleThe IIGCC Net Zero Bondholder Stewardship Guidance advocates a long-term financing lifecycle-based approach. This presents a useful illustration on how engagement can support better impact measurement and reporting. The lifecycle includes the following steps:

Chart 3: Bond market ecosystem

Source: https://www.iigcc.org/resources/net-zero-bondholder-stewardship-guidance Regulatory challengesNew 2023 requirements surrounding the introduction of the EU Taxonomy have imposed additional regulatory responsibilities on fund managers. While initially focusing on climate environmental objectives, 2023 revisions have included a wider set of sustainably-orientated economic activities, namely:

Nikko AM's perspective is that although the EU Taxonomy is helpful for determining whether an economic activity can be considered environmentally sustainable, it is not the only approach and is less well adapted to companies beyond the EU. The EU Taxonomy could be considered as sometimes too stringent in its quantitative demands, given the availability and quality of data. Currently we do not use the EU Taxonomy to measure impact in our own funds. That said, we do recognise it has value in terms of monitoring, as well as highlighting certain key elements that any sustainable investment process should possess. What next for green bond fund impact reporting?Although impact reporting among green bond issuers is improving, the quality and consistency of impact reporting can still vary significantly. Without being properly addressed, this lack of standardisation on reporting could have deeper consequences for the industry as a whole. The lack of consistent data is not only an issue for our own analysis but also for our client's reporting expectations. The less transparent an issuer is, the less likely the bond will be included in a sustainable fund. However, progress is being made, and the global significance of green bonds means that specialist data providers are increasingly looking to provide comparable impact data for analysis and reporting, using assumptions and methodology to understand impact. Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information |

4 Apr 2024 - When Private Equity Would Be Laughed Out of The Boardroom

|

When Private Equity Would Be Laughed Out of The Boardroom Redwheel March 2024 |

|

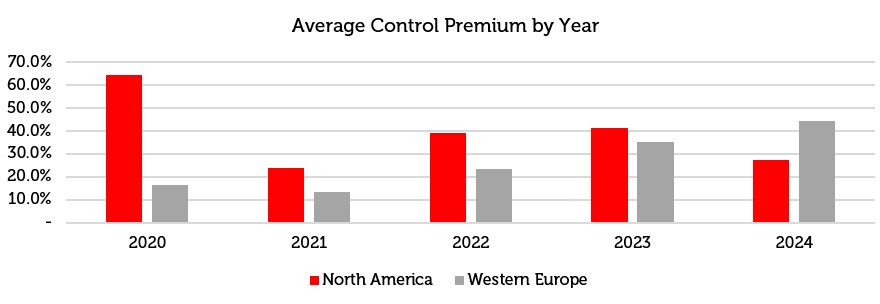

In recent decades, fuelled by lower and lower interest rates, we observe many large investors across the world have been re-allocating funds away from public markets, and into private assets - be those private equity or private credit vehicles. The theory behind this approach is that there is an 'illiquidity premium' to be earned by owning assets that are locked up for longer, boosting the returns of the investors relative to those who own assets that are freely traded on the open market. Leaving aside the veracity of that conjecture - with some who have argued plausibly that, in fact, investors pay not to see the mark-to-market volatility of their portfolios [1] - one curious aspect of the private markets, as compared to public markets, is worth noting. When buying companies outright, private investors necessarily need to negotiate over a single price for the entire company, a process involving numerous Board members, bankers, lawyers and accountants on all fronts, not to mention the shareholders who will be the ultimate beneficiaries of the sale proceeds. In that process, it is common for bidders to offer a "control premium", an excess of the current market price of the company that convinces shareholders to sell, and ostensibly represents the value to the buyer of having control of the company. These premiums can range anywhere between 10% and 100% in excess of the current market value of the company, with average premiums in the ~40% range, a figure we would view as not insubstantial.[2]

Source: Bloomberg, at 11 March 2024. 2024 control premium is year-to-date. The information show above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice. By contrast, when public market investors like us want to invest in a company, we don't consult the Board or its advisors on what price they'd like us to pay - we just go into the market and buy shares from whomever is willing to sell them to us, at the prevailing price, even if that price is so low that a Board of Directors would never dream of accepting it for the entire enterprise. By its nature, then, buying the same previously-listed company in a private equity fund or structure will cost more than simply buying shares on the open market - increasing the hurdle of corporate performance that will be required to earn investors a good return. In this sense, we believe us public market investors have a huge advantage, with the ability to make purchases at prices which we consider often so ludicrously low that any private equity firm - when trying to pay the same price for the entire company - will be quite literally laughed out of the Boardroom. This is more than simple conjecture: in the past two weeks, two companies held in our portfolios - Curry's and Direct Line Group - have received unsolicited buyout offers from parties seeking to take them private, and both have (we think quite rightly) firmly rejected those offers as materially too low. Of course, no one made any such objections or consternations to us when we bought our shares on the London Stock Exchange for those same companies at similar prices (or, dare we admit, even lower prices). It is intriguing, then, that many large institutional investors - principally large pension funds - continue to eschew public markets in favour of private markets [3], especially in markets such as the UK, where public market valuations are undemanding in our view. Yet, as the Curry's and Direct Line example shows, this discount is not available to private bidders at prevailing prices: Boards are well aware of the despondency embedded in their market valuation, and are not going to let their shareholders be wrestled out of their companies for unfair prices. If you are the Trustee of a pension fund investing in private markets, then, you may wish to ask your CIO if they allocate to investors paying a premium to own the same assets that we get to buy without one. As value investors, we aim to earn a superior investment return over the long-term by paying material discounts to intrinsic business value. This opportunity, however, is effectively available only in public markets, where we can buy small pieces of companies - which is, after all, what shares truly are - from sellers on the open market, and to do so at prices that we consider as so eye watering that any self-respecting private bidder would not dare to suggest. As Curry's and Direct Line bidders Elliot and Ageas have learned recently, there are some potentially fantastic opportunities available in the public markets - but that these are often available only to public equity investors, and are perhaps simply too good for private bidders to access. Author: Shaul Rosten |

|

Funds operated by this manager: Redwheel China Equity Fund, Redwheel Global Emerging Markets Fund |

|

Sources: [1] Richardson, S. and Palhares, D., 2018. (Il) liquidity premium in credit markets: A myth?. The Journal of Fixed Income, 28(3), pp.5-23; Cliff Asness, AQR, (https://www.aqr.com/Insights/Perspectives/The-Illiquidity-Discount) [2] Eaton, G.W., Liu, T. and Officer, M.S., 2021. Rethinking measures of mergers & acquisitions deal premiums. Journal of Financial and Quantitative Analysis, 56(3), pp.1097-1126 [3] E.g. https://www.bloomberg.com/news/articles/2023-12-11/investors-to-increase-allocation-to-private-credit-survey-shows, https://www.pionline.com/pension-funds/calpers-mulls-boosting-private-assets-allocation, https://www.ftadviser.com/investments/2024/02/15/half-of-advisers-to-increase-allocation-to-private-assets/, https://www.funds-europe.com/investors-bullish-about-private-capital-allocation/ Key Information |

3 Apr 2024 - 10 cognitive biases that can lead to investment mistakes

|

10 cognitive biases that can lead to investment mistakes Magellan Asset Management April 2024 |

|

To be a successful investor over the long term, we believe it is critical to understand, and hopefully overcome, common human cognitive or psychological biases that can often lead to poor decisions and investment mistakes. Cognitive biases are 'hard wired', and we are all liable to take shortcuts, oversimplify complex decisions and be overconfident in our decision-making process. Understanding our cognitive biases can lead to better decision making, which is fundamental, in our view, to lowering risk and improving investment returns over time. Below we outline key cognitive biases to be aware of that can lead to poor investment decisions. 1. Confirmation biasConfirmation bias is the natural human tendency to seek information that confirms an existing conclusion or hypothesis. In our view, confirmation bias can be a significant contributor to investment mistakes. Investors often become overly confident when they repeatedly receive data that validates their decisions. This overconfidence can result in a false sense that nothing is likely to go wrong, which increases the risk of being blindsided when something does go wrong. To minimise the risk of confirmation bias when investing, we attempt to challenge the status quo and seek information that causes us to question our investment thesis. We are always seeking to 'invert' the investment case to analyse why we might be wrong. We continually revisit our investment case especially considering new information and challenge our assumptions. Conducting thorough research is at the foundation of what we do. 2. Information biasInformation bias is the tendency to make decisions based on useless or irrelevant information. The key in investing is to see the 'forest for the trees' and to carefully evaluate information that is relevant to making a more informed investment decision and to discard (and hopefully ignore) irrelevant information. Investors are bombarded with useless information every day and it is difficult to filter through it to focus on information that is relevant. In our view, daily share price or market movements usually contain no information that is relevant to an investor who is concerned about the medium-term prospects for an investment, yet there are entire news shows and financial columns dedicated to evaluating movements in share prices on a moment-by- moment basis. 3. Loss aversion/endowment effectLoss aversion is when people strongly prefer to avoid a loss than make a gain. Closely related to loss aversion is the endowment effect, which occurs when people place a higher value on a good that they own than on an identical good that they do not own. The loss aversion/endowment effect can lead to poor and irrational investment decisions whereby investors hold onto losing investments for too long in the hope that they will eventually recover or sell winning investments too quickly to lock in gains. The loss-aversion tendency breaks one of the cardinal rules of economics, the measurement of opportunity cost. To be a successful investor over time you must be able to accurately measure opportunity cost and not be anchored to past investment decisions due to the inbuilt human tendency to avoid losses. It's important to evaluate the opportunity cost associated with retaining an existing investment versus making a new investment in a portfolio. For example, when investors consider selling an existing investment, they may hesitate due to the fear of losing money, even if a new opportunity could bring better returns. So, understanding this balance may help investors make rational decisions to grow their portfolios while managing risk effectively. We believe investors would make better investment decisions if they understood their risk tolerance (the amount of risk they are willing to accept in order to achieve their investment goals) and took a disciplined approach to weighing up the opportunity cost between keeping an existing investment or not. 4. Incentive-caused biasIncentive-caused bias, a concept introduced by renowned investor Charlie Munger, is the tendency for people to act in ways that align with their incentives, rewards, or self-interest, even if those actions are not in their best interest or the best interest of others. The sub-prime housing crisis in the US is a classic case study in incentive-caused bias. Financiers were lending money to borrowers even though they knew the borrowers had appalling credit histories, and in many cases no income or jobs and limited assets. How did this happen on such a massive scale? We believe the answer can be found in the effect of incentives. At virtually every level of the value chain, there were incentives in place to encourage people to participate. The developers had strong incentive to construct new houses. The mortgage brokers had strong incentive to find people to take out mortgages. The investment banks had a big incentive to pay mortgage brokers to originate loans so that they could package and securitise these loans to sell to investors. The ratings agencies had strong incentive to give AAA ratings to mortgage securities to generate fees, and banks had a big incentive to buy these AAA-rated mortgage securities as they required little capital and produced enormous, leveraged profits. One of the key factors we focus on when making investment decisions is our evaluation of agency risk. We evaluate the incentives and rewards systems in place at a company, to assess whether they are likely to encourage management to make rational long-term decisions. We prefer companies that have incentive schemes that focus management on the downside as well as the upside and encourage management to return excess cash to shareholders. For example, executive compensation that is overly skewed towards share-option schemes can encourage behaviour that is contrary to the long-term interests of shareholders, such as retention of earnings above those that can be usefully reinvested into the business. 5. Oversimplification tendencyIn seeking to understand complex matters people tend to want clear and simple explanations. Unfortunately, some matters are inherently complex or uncertain and do not lend themselves to simple explanations. In our view, investment mistakes can be made when people oversimplify uncertain or complex matters. Oversimplification bias can lead to poor decisions based on overly simplistic or incomplete analyses of complex investment situations. Underestimating risk or misinterpreting data can have negative impacts on investment strategies. We consider that investors should conduct thorough and comprehensive analyses of investment opportunities, consider multiple perspectives, and seek out diverse sources of information. A key to successful investing is to stay within your 'circle of competence'. At Magellan part of our 'circle of competence' is to concentrate our investments in areas we consider exhibit a high degree of predictability and to be wary of areas that are highly complex and/or highly uncertain. Our extensive bottom-up stock analysis and industry research is a critical tool in understanding the underlying fundamentals of individual companies, enabling us to make well-informed investment decisions and build portfolios we believe are positioned for long-term success. 6. Hindsight biasHindsight bias is the tendency for people to believe that they could have predicted a past outcome accurately, even though they were unable to do so in real-time. As an example, many people claimed "I knew it" when the dot.com bubble burst hit in 1998, however very few predicted it. Hindsight bias has the potential to lead to overconfidence in investment knowledge and skills. Investors may start to make irrational and risky decisions as they only remember the instances when they were right and overlook the times when they were wrong. Investors may look for expected outcomes in investment decisions rather than looking at all the possible outcomes. In our view, hindsight bias is a dangerous state of mind as it clouds your objectivity when assessing past investment decisions and inhibits your ability to learn from past mistakes. To reduce hindsight bias, we spend considerable time upfront setting out the detailed investment case for each stock, including our estimated return. This enables us to accurately assess our investment history with the benefit of hindsight. We do this for individual stock investments and macroeconomic calls. 7. Bandwagon effect (or herd mentality)The bandwagon effect, or herd mentality, describes gaining comfort in something because many other people do (or believe) the same. In recent times, we have seen the bandwagon effect or herd mentality with the events that surrounded the GameStop stock event. Where many people saw the rise in stock prices and without proper research jumped on the bandwagon and invested. This impacted a lot of investors who bought the stock due to the fear of missing out and the hype it created. We believe, to be a successful investor, you must be able to analyse and think independently. Speculative bubbles are typically the result of herd mentality. Herd mentality in investing can overshadow rational decision-making and could increase the risk of financial losses. Investors need to recognise the feeling of pressure to conform to popular opinion or follow the crowd and instead consider conducting research and analysis before making decisions, as well as seeking alternative views to challenge the consensus. Our investment process is focussed on deep fundamental research and analysis, backed by an investment team with many years of experience. At the end of the day, we will be right or wrong because our analysis and judgement is either right or wrong. While we don't seek to be contrarian, we have no hesitation in taking 'the road less travelled' if that is what our analysis concludes. 8. Restraint biasRestraint bias is the tendency to overestimate one's ability to show restraint in the face of temptation. The issue for many investors is how to properly size an investment when they believe they have identified a 'sure winner.' We believe, 'sure thing' investments are exceptionally rare, and many investments are sensitive to changes in assumptions, particularly macroeconomic assumptions. Investors need to have in place a well-thought-out investment plan that aligns with their financial goals, risk tolerance, and time horizon. Having a clear plan in place can help to maintain focus on long-term objectives and avoid making impulsive decisions based on short-term market movements. At Magellan, we hardwire restraints or risk controls into our process, which may include placing maximum limitations on stocks and combinations of stocks that we consider carry aggregation risk. 9. Neglect of probabilityHumans often overlook or misjudge probabilities when making decisions, including investment decisions. Instead of considering a range of possible outcomes, many people tend to simplify and focus on a single estimate. However, the reality is that any outcome an investor anticipates may just be their best guess or most likely scenario. Around this expected outcome, there's a range of potential results, represented by a distribution curve. This curve can vary widely depending on the specific characteristics of the business involved. For instance, companies which are well-established and have strong competitive positions, tend to have a narrower range of potential outcomes compared to less mature or more volatile companies, which are more susceptible to economic cycles or competitive pressures. In our portfolio construction process, we carefully consider the differences in businesses to account for the various risks and probabilities associated with different outcomes. This approach helps us construct portfolios that we believe are better suited to navigate the uncertainties of the market. Another error investors may make is to overestimate or misprice the risk of very low probability events. That does not mean that 'black swan' events cannot happen, but that overcompensating for very low probability events can be costly for investors. To seek to mitigate the risk of 'black swan' events, we include businesses in our investment portfolios that we consider are high- quality and long-lasting, purchased at appropriate prices. We believe these companies have a tight range of potential outcomes, reducing the risk of major losses from unexpected events. If we have real insight that the probability of a 'black swan' event is materially increasing and the pricing is attractive enough to reduce this risk, we will have no hesitation in making a material change to our investment portfolios. However, spotting these events isn't easy and doesn't necessarily depend on how much attention they're getting in the media or the markets. As Warren Buffett famously said, "The biggest mistake in stocks is to buy or sell based on current headlines." 10. Anchoring biasAnchoring bias is the tendency to rely too heavily on, or anchor to, a past reference or one piece of information when making a decision. There have been many academic studies undertaken on the power of anchoring on decision making. Studies typically get people to focus on a totally random number, like their year of birth or age, before being asked to assign a value to something. The studies show that people are influenced in their answer by, or anchored to, the random number that they have focused on prior to being asked the question. Looking at the recent share price is a common way investors anchor their decisions. Some people even use a method called technical analysis, which looks at past price movements to predict future ones. However, just because a stock's price was high or low in the past doesn't tell us if it's a good deal now. Instead of focusing on past prices, we look at whether the current price is lower than what we think the stock is really worth. We don't let past prices influence our decisions. We also don't rely solely on the current price when deciding whether to research a new investment. We want to be ready with well-researched options so we can make smart decisions when prices drop below what we believe is their true value. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund 1 Generative AI refers to algorithms that can be used to create new content based on the data they were trained on. This can include audio, images, code, text and more. Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |