The saying that all good things must come to an end is a bittersweet reflection of reality. Sadly, too many of us fail to appreciate those good times, often focusing on what could or might go wrong. Perhaps this is understandable given the potential for higher interest rates to stifle economic growth and an increasingly complex geopolitical environment.

However, financial markets have delivered investors a stellar twelve months of performance. The Dow Jones Industrial Average and S&P 500 have both reached record highs in the US, as did the Stoxx 600 in Europe and Japan's Nikkei 225. Corporate bonds have also performed well, with the spread over similarly dated government bonds approaching historically tight levels in both the investment grade and high yield markets.

Can the good times continue?

It is looking increasingly likely that forecast aggressive interest rate cuts are no longer on the way.

In fact, "higher for longer" appears to be the base case for a growing number of central banks with inflation remaining stubbornly above the average 2% target. US inflation, which has become a bellwether for market expectations unexpectedly rose from 3.1% to 3.2% in February, while core inflation which excludes volatile food and energy prices remained closer to 4%. A similar trend is evident in other developed market economies such as the United Kingdom, Australia, and the Eurozone where central banks are now forecast to begin trimming interest rates in May or June - far later than previously forecast.

Higher interest rates are already impacting the corporate sector, and this is where we could see the first cracks of a financial market correction. In many industries, the combination of higher input and financing costs mean that capital expenditure has been curtailed and cash stockpiles are low.

Debt finance which was readily available and cheap is now falling due with nearly $1.5 trillion of high-yield debt, including loans, maturing globally through the end of 2026, of which $882 billion is U.S. debt, according to S&P Global. Bonds account for some $338 billion of that total with $53.8 billion maturing this year, $125.5 billion next year, and $158.6 billion in 2026.

Refinancing that debt presents a challenge on two fronts, with the first being affordability. Interest rates have risen very significantly in recent years meaning the cost of refinancing these bonds will have also risen and for some corporates these higher rates will be unaffordable. The second challenge is one of demand. The spread over supposedly low risk government debt has narrowed, limiting the upside of corporate debt for investors, and shining a bright light on current valuations. Defaults have been surprisingly resilient, but that could change and the impact on demand will be immediate.

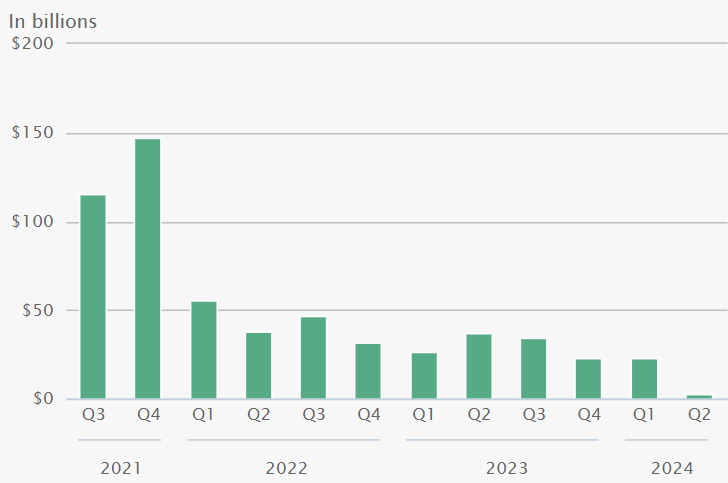

Furthermore, the process of quantitative tightening has sapped liquidity from the financial system. Inflows into the US Federal Reserve's overnight reverse repo facility, a proxy for excess cash in the financial system, have been falling sharply for over twelve months. Once cash drains from the reverse repo facility, bank reserves at the Fed are likely to fall, further tightening financial system liquidity, and potentially hitting demand for corporate debt as well as equities.

The high cost of debt finance, lofty valuations and a rapidly approaching wall of maturing bonds at a time where economic growth is forecast to slow are all reasons for investors, particularly those in the corporate bond market to be cautious. Yet, flows into the corporate sector remain strong and this we believe is purely a function of forecast interest rate cuts later in the year.

Should those interest rate cuts fail to materialise and concerns around corporate debt come to fruition, many investors could be over exposed to rapidly falling asset class.

Unlike traditional bond investment managers, our relative value approach is duration neutral and excludes credit. Investment performance is independent of the level of bond yields, the direction of interest rates and macro-economic variables. Consequently, relative value portfolios are excellent diversifiers of traditional fixed income and equity market risk, often appreciating when these asset classes are in retreat.

The economic outlook remains uncertain and as such, the outlook for financial markets is also uncertain. We believe now more than ever it is important for fixed income investors to look past the consensus view when structuring their portfolios, adding assets that are able to weather a wider variety of economic and financial market conditions.

(1).png)

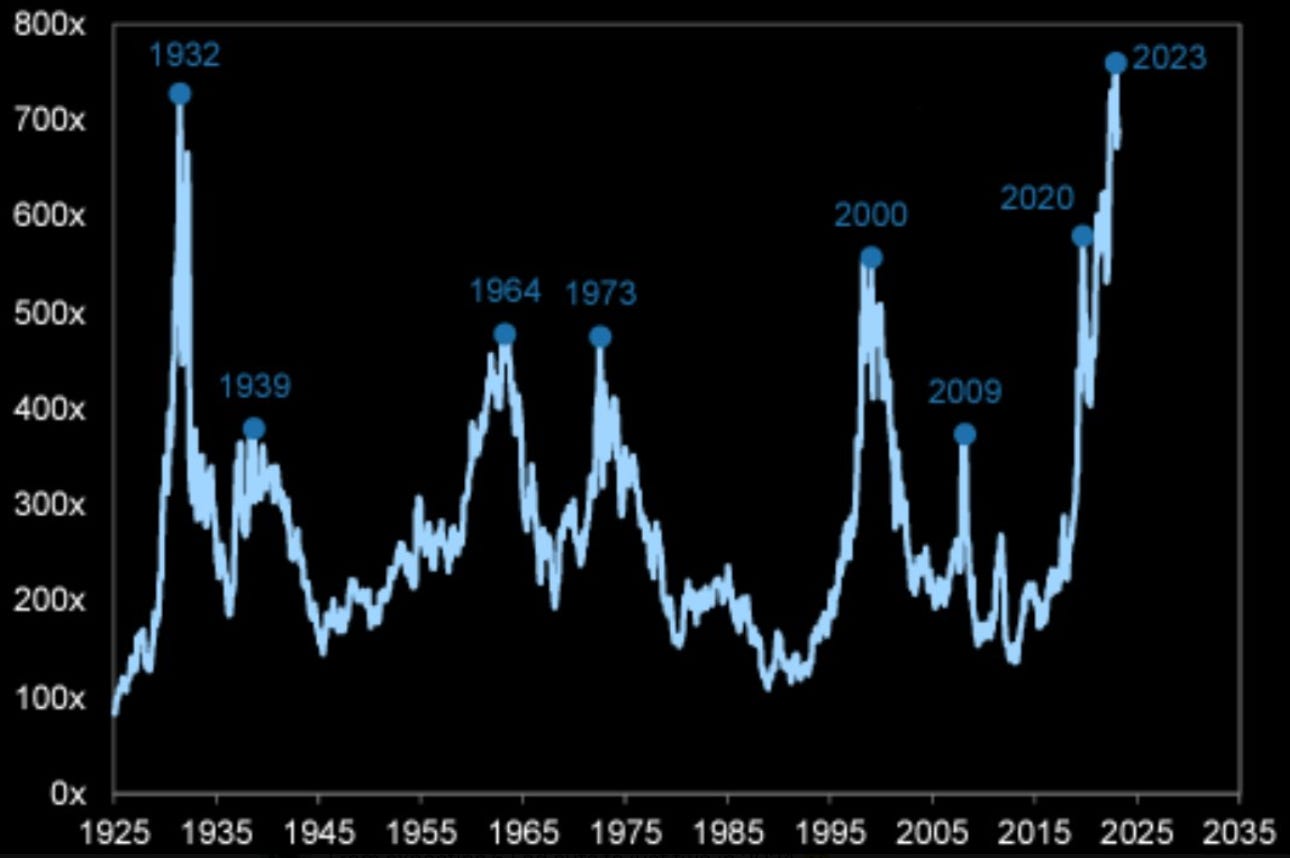

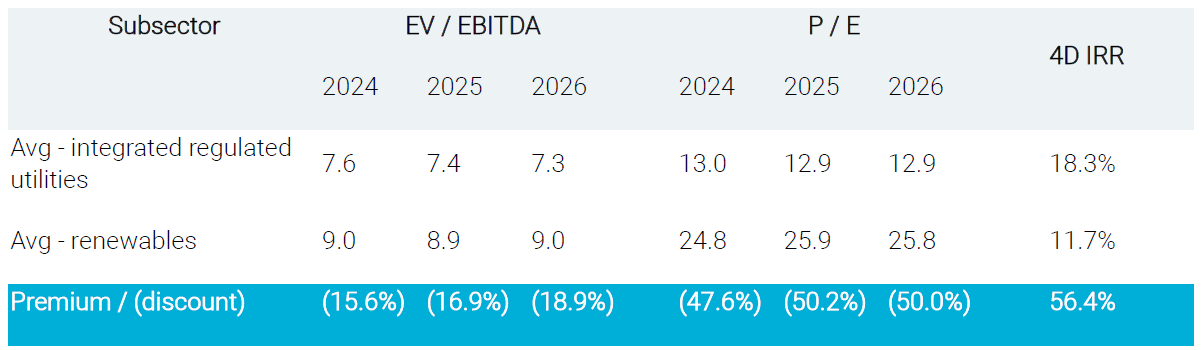

Now let's turn this on its head and see the opposite of a bubble. These are periods of high opportunity and always occur when the crowd has lost its head in pessimism. This is when watching the herd, rather than joining the herd really pays off. At the end of the GFC. At the end of the pandemic. At the end of the Tech Wreck. When the crowd has lost its objectivity. When everyone is undervaluing everything, when everyone is being too bearish.

Now let's turn this on its head and see the opposite of a bubble. These are periods of high opportunity and always occur when the crowd has lost its head in pessimism. This is when watching the herd, rather than joining the herd really pays off. At the end of the GFC. At the end of the pandemic. At the end of the Tech Wreck. When the crowd has lost its objectivity. When everyone is undervaluing everything, when everyone is being too bearish.:max_bytes(150000):strip_icc()/dotdash-five-largest-asset-bubbles-history-FINAL-7eb958a1ff6e49b7ab9c9f3afbaf9d85.jpg)