News

27 Nov 2024 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

27 Nov 2024 - Performance Report: Bennelong Twenty20 Australian Equities Fund

[Current Manager Report if available]

27 Nov 2024 - A new era dawns for Hybrids?

|

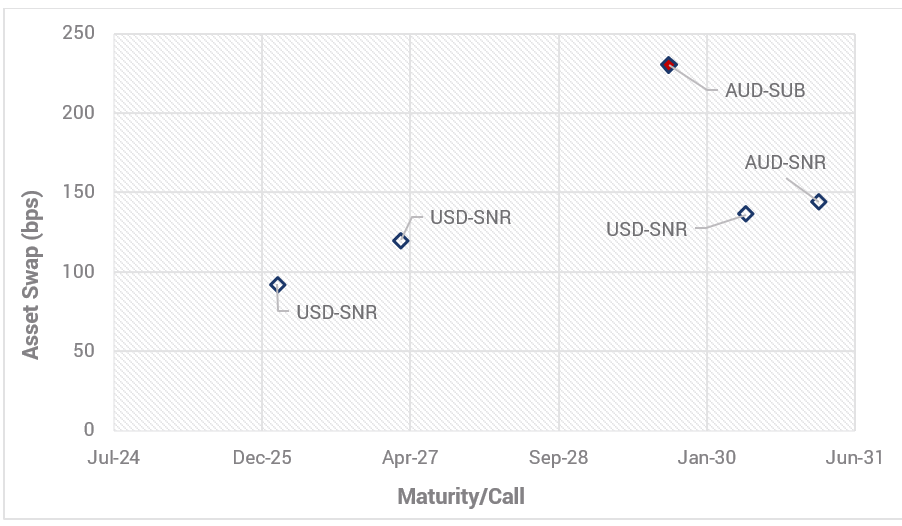

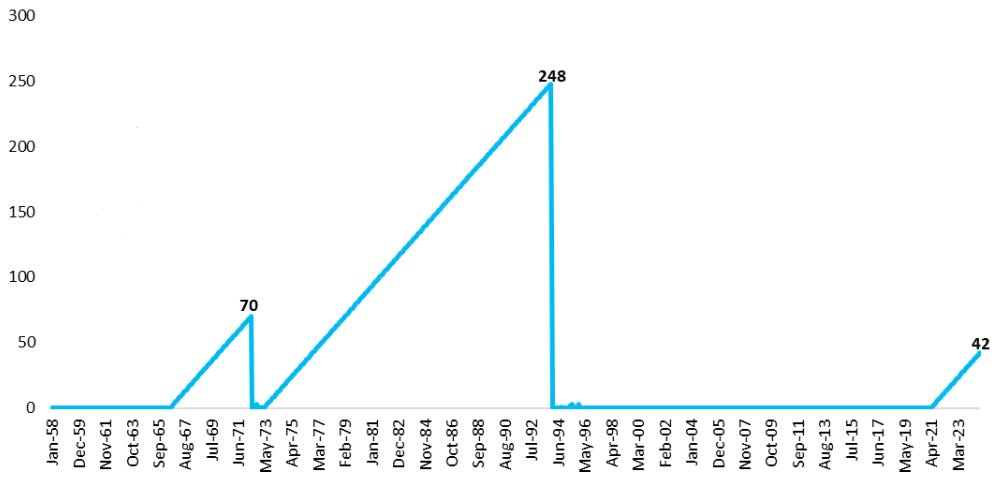

A new era dawns for Hybrids? Yarra Capital Management October 2024 As bank issuance shrinks, corporate hybrids are in the ascendent, with non-financial corporate hybrids potentially instrumental in powering Australia's energy transition. So what do they offer the fixed income investor? Australia's hybrid bond market rarely makes headlines, but in recent weeks it has been firmly back in the spotlight. The Australian Prudential Regulation Authority (APRA) recently revealed plans to phase out Australian banks' use of additional tier one (AT1) capital which APRA believes is riskier, thereby seeking to enhance the overall stability of the banking system. The announcement came on the heels of a surge in interest in corporate hybrids sparked by the successful raising for Australian Securities Exchange (ASX) listed mall operator Scentre Group. Yarra's outlook for Australia's hybrid bond market--of which bank AT1 hybrids make up around $41 billion--considers these latest proposed regulatory changes while focusing on the future potential for hybrids in funding corporate Australia's energy transition ambitions. Investors and issuers alike are now navigating a market partly in transition. More immediately it seems that in the wake of APRA's announcement, some are betting that a shrinking pool of Australian bank hybrids will drive up demand, pushing prices higher and yields lower across Australia's big four banks. Since last month's announcement, spreads for Tier 1 securities have contracted ~16bps--so retail investors are eager to bid up assets and get a larger slice of a shrinking pool. While uncertainty prevails in hybrid bank issuance for now, and short-term opportunities may arise, over the longer-term a broader set of dynamics is emerging for hybrids, particularly in sectors like energy and infrastructure. Expanding role in Australia's energy transitionThe potential scale of the energy transition in Australia offers an exciting growth opportunity for corporate hybrids. As energy transition projects such as new transmission lines and large-scale generation get underway, hybrids can and should play a role in funding the significant upfront capital costs and become a permanent feature of issuer capital structures. We estimate a total system investment of $400 billion is required by 2050 in order to decarbonise Australia's energy market with a focus on new energy generation including investment in wind farms, solar, batteries, and associated transmission assets. It is highly unlikely that equity alone will foot the bill for these expensive projects and that is why we see hybrids as an increasingly popular funding source in Australia's transition to a low-carbon economy, offering flexibility and capital efficiency. The sheer size of the capital requirement means that corporates will need to tap into multiple funding sources, and hybrids offer a lower-cost alternative to pure equity issuance. For large-scale energy transition projects, such as new transmission lines and renewable energy facilities, hybrids offer a way to fund significant upfront capital costs without putting undue strain on a company's balance sheet. For that reason, we expect large blue-chip generation companies like AGL, Origin, APA, and even Woodside and Santos along with transmission companies like Austnet and Transgrid, to tap into hybrid issuance as part of their funding strategies for energy transition plans. The recent success of Scentre's corporate hybrid raising demonstrates this growing interest from non-financial corporates looking to leverage a flexible funding tool, and we expect this interest to grow from here with further non-financial corporate issuance likely in FY2025. While APRA's move signals tighter regulatory scrutiny and a potential decline in AT1 hybrid issuance by banks, there is also the possibility that as major bank issuance retreats in APRA's suggested 2027-2032 transition period, corporate issuers may step in to fill the gap. Bringing it back to fundamentalsAs the APRA development demonstrates, assessing and pricing the inherent risks of hybrids becomes trickier with regulatory change in the mix. But these upheavals should be viewed as atypical events in a sector that is actually offering attractive returns akin to longer term equity market averages, with the 'higher for longer' rates, which are thematic for fixed income assets, here to stay. We are forecasting a new era for tactical fixed income, characterised by sustained, higher yields. In this environment, investors, particularly those focused on investment-grade assets, are increasingly comfortable holding instruments such as hybrids, viewing the attractive yields on offer as ample compensation for assumed risk. We see further opportunities for investors to access the higher yields and risk-adjusted returns that have made the hybrid instrument so popular recently. Further, with APRA's decision to phase out AT1 hybrids, there is an expected shift of a substantial pool of capital, estimated to be around $41 billion, that will be seeking new investment avenues. This development is likely to create significant opportunities for corporate hybrids to emerge as a viable alternative for retail investors who are in search of yield. Consequently, we anticipate that corporate hybrid instruments could play a crucial role in filling the gap left by the diminishing bank hybrid market. This shift could potentially lead to a resurgence of hybrid issuance on the ASX, ensuring that investors continue to have access to the attractive yields they have grown accustomed to with bank hybrids, but now through corporate issuance by larger, investment-grade companies. In addition to the rise of corporate hybrids, another area that warrants close attention as AT1 hybrids are phased out is the potential for Bank Tier 2 paper - that is, subordinated debt which provides an additional layer of protection for banks - to become more prominent on the ASX. It is conceivable that banks may opt for increased Tier 2 issuance as a strategic move to maintain access to retail capital pools and fulfill their capital requirements while they gradually wind down their AT1 hybrid instruments. This strategic shift towards Tier 2 issuance could provide banks with the necessary flexibility to navigate the changing regulatory landscape and continue to meet their capital needs effectively. Hybrids in portfolio constructionA key performance factor here is the issuer's credit strength--when dealing with investment-grade hybrids from strong issuers, the chance of conversion or extension is significantly diminished but investors still get rewarded for taking on what are essentially low-probability events. These features allow investors to effectively double the credit spread, significantly increasing returns without taking on a disproportionate increase in risk. For instance, investors in Scentre Group's recent hybrid issuance picked up a credit spread that was 1.8 to 1.9 times the spread on the company's senior debt, providing a return close to 6%. Chart 1: Scentre Group Bond Curve - 4 September 2024

|

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

26 Nov 2024 - Performance Report: PURE Income & Growth Fund

[Current Manager Report if available]

26 Nov 2024 - 10k Words | November 2024

|

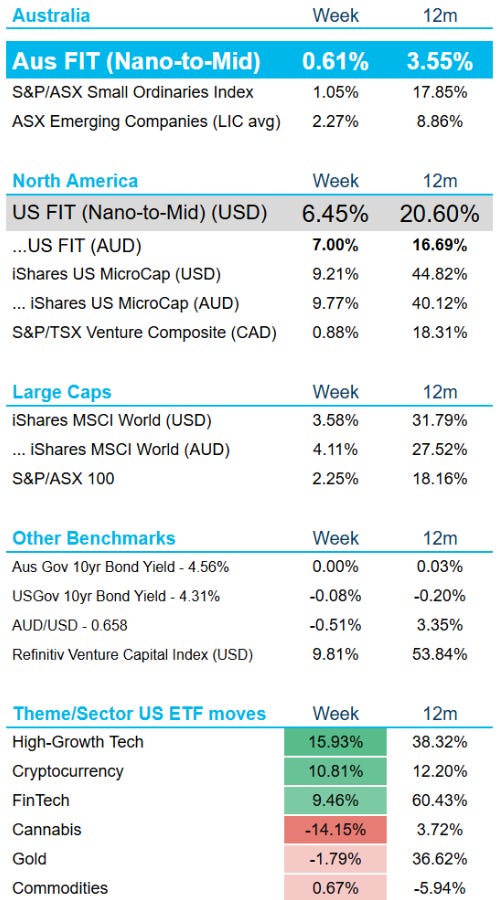

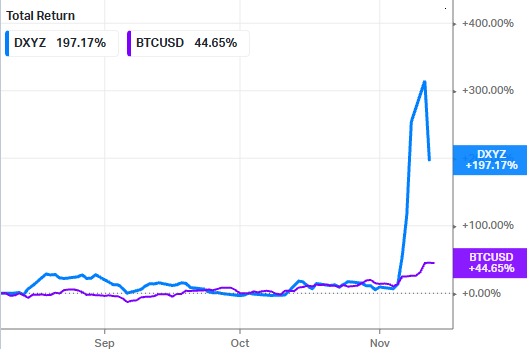

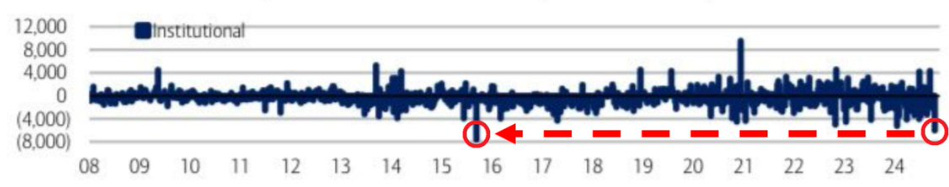

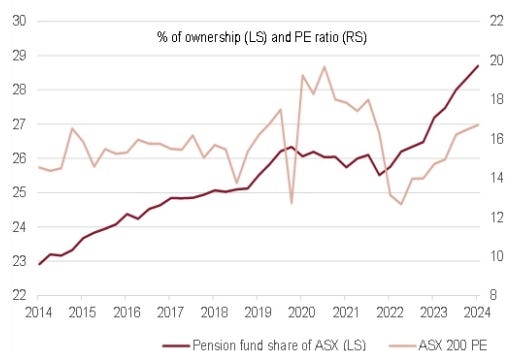

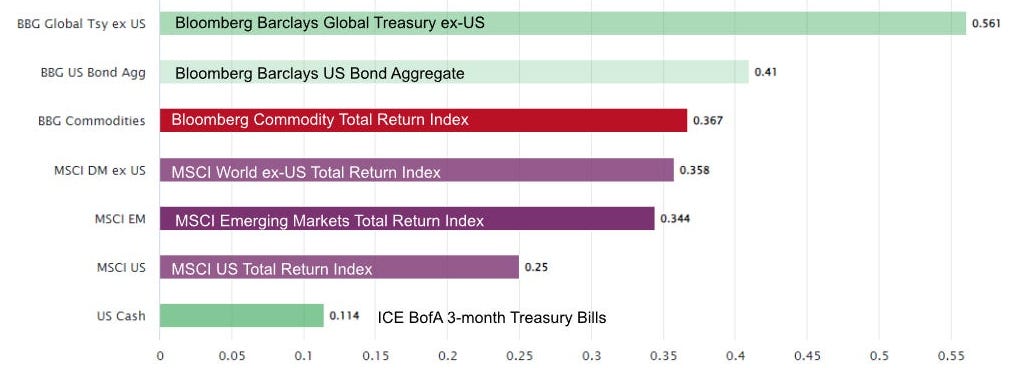

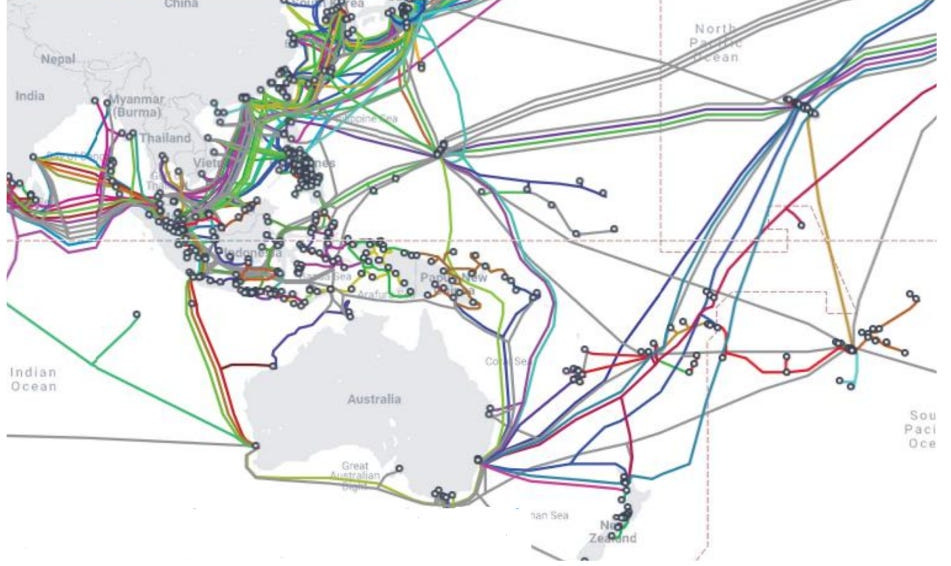

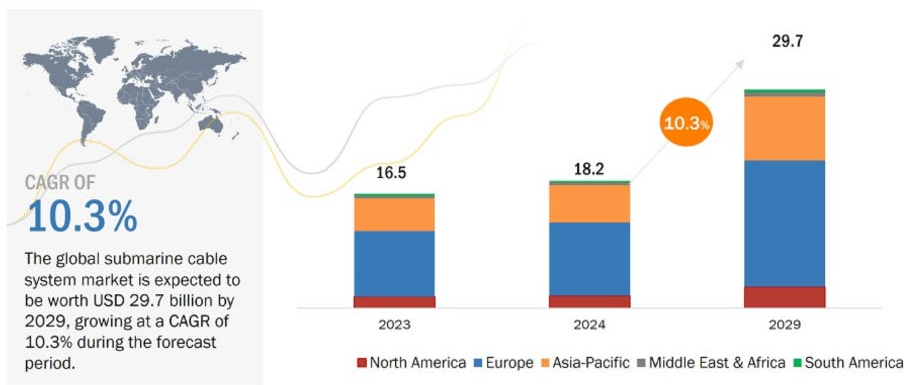

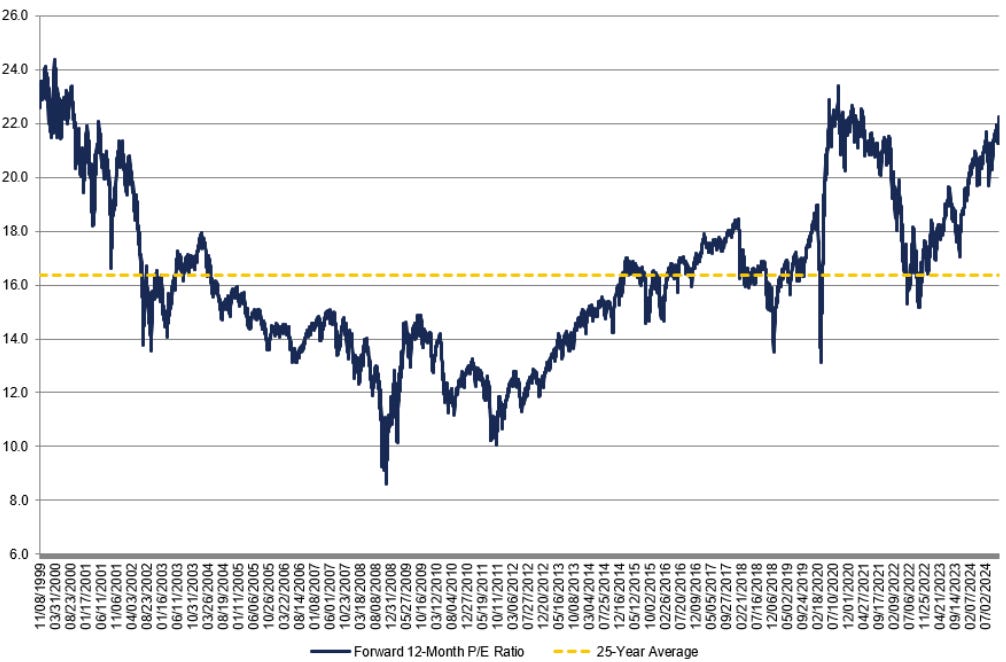

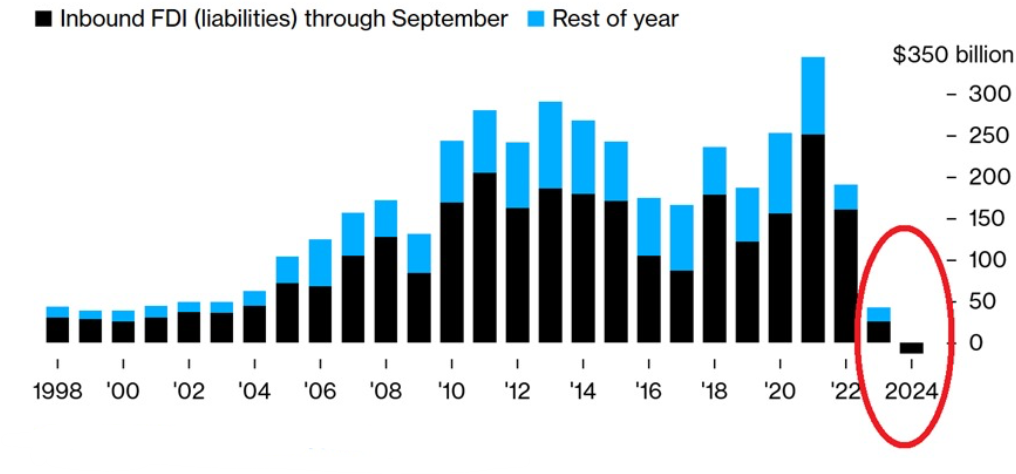

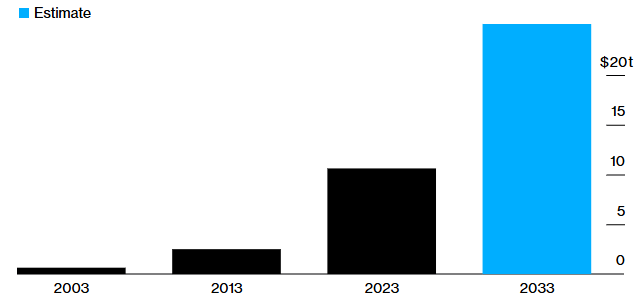

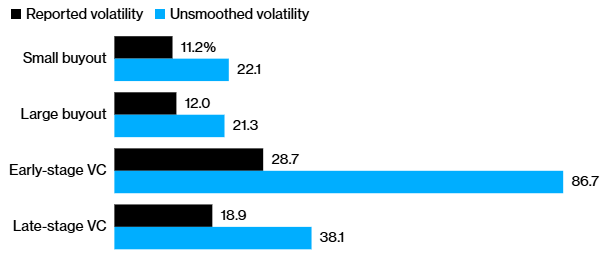

10k Words Equitable Investors November 2024 The "Trump Bump" in full effect, with bitcoin not the greatest benficiary and fund managers allocating away from equities beforehand; the "Super Bump" in Australian equities, as evident in the P/E multiple of CBA; gold's correlation; subsea cable spend creating opportunities; funds flowing out of Chinese investment markets; the boom in private equities and the truth about volatility; and finally the inflation story is not over yet in the US. Benchmark returns in the week of the US Presidential election (Nov 4 - 8, 2024) Source: Equitable Investors' SmallTalk "Trump Bump" for NYSE-listed "closed end" SpaceX investor Destiny Tech100 (DXYZ) outshines bitcoin Source: Koyfin Second largest net sale by institutional clients in Bank of America fund manager survey history Source: Bank of America "Super Bump" for Australian equities Source: Evans & Partners Forward P/E multiple of Commonwealth Bank (ASX: CBA) Source: TIKR Correlations between gold and other assets classes over past six years Source: World Gold Council Rolling 6 month correlation between gold and other asset classes Source: World Gold Council Regional subsea cables being built Source: DXN Limited Forecast spend on submarine cables Source: Research & Markets S&P 500 forward 12-month P/E ratio: 25 years Source: FactSet Foreign investment into China drops in 2024 Source: @Kobeissiletter, China's State Administration of Foreign Exchange Global private equity assets under management Source: Bloomberg, Bain & Co The reported volatility of private funds v "unsmoothed" volatility

Source: Bloomberg, "Amortizing Volatility across Private Capital Investments" (Mark Anson, The Journal of Portfolio Management, Vol 50, Issue 7) US Core CPI Inflation (year-on-year % change) - consecutive months above 3% (seasonally adjusted) Source: @CharlieBilello, Creative Planning November 2024 Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Past performance is not a reliable indicator of future performance. Fund returns are quoted net of all fees, expenses and accrued performance fees. Delivery of this report to a recipient should not be relied on as a representation that there has been no change since the preparation date in the affairs or financial condition of the Fund or the Trustee; or that the information contained in this report remains accurate or complete at any time after the preparation date. Equitable Investors Pty Ltd (EI) does not guarantee or make any representation or warranty as to the accuracy or completeness of the information in this report. To the extent permitted by law, EI disclaims all liability that may otherwise arise due to any information in this report being inaccurate or information being omitted. This report does not take into account the particular investment objectives, financial situation and needs of potential investors. Before making a decision to invest in the Fund the recipient should obtain professional advice. This report does not purport to contain all the information that the recipient may require to evaluate a possible investment in the Fund. The recipient should conduct their own independent analysis of the Fund and refer to the current Information Memorandum, which is available from EI. |

25 Nov 2024 - Global Matters: The data centre opportunity for infrastructure investors

22 Nov 2024 - Hedge Clippings | 22 November 2024

|

|

|

|

Hedge Clippings | 22 November 2024 Following the build up, media frenzy and speculation leading to the US election, and then the surprise at Donald Trump's resounding victory (except to The Donald himself), everything has gone quiet, relatively speaking. Maybe it's just the media in limbo, save for regular announcements regarding key appointments. Trump himself, rarely short of a word over the past 6 months, has also gone quiet. Either he's taking a break prior to taking over in January, or maybe he's back on the golf course? Maybe it's just the lull before the storm? There's plenty of speculation on policy implementation, but even more on the reaction from China on tariffs, or immigration, or ending wars "in a day". Back in Australia the government is softening us up prior to the election due by May next year, which according to the polls is going to be much closer than one would have imagined after the last election. Much will come down to the economy (as it did in the end in the US) with inflation and interest rates taking centre stage. Treasurer Chalmers is trying to put a good spin on inflation, but is unlikely to fool anyone, and certainly not the RBA or the market. A big test will come next Wednesday when monthly CPI numbers are due for October. While the headline rate for the September Quarter seemed to be on the right track at 2.8%, that was significantly affected thanks to electricity rebates and lower fuel prices. Underlying inflation remained high at 3.5% which the RBA Bulletin noted was falling more slowly, and was not expected to return to target until the end of 2026 - in fact, the RBA expects that it will pick up in the September quarter 2025 when the energy rebates are due to end. Added to this, as noted in PinPoint Macro Analytics' weekly macro research (see below), the latest inflation figures in four major economies (US, UK, Eurozone and Canada) which had been falling, have all picked up. If Australia's CPI follows suit next week, then the chance of the RBA helping the embattled Albanese government out with a rate cut pre-election slips further. As PinPoint's Richard Grace points out, "the overnight index swap (OIS) market is the purest form of the market's expectation for what the RBA may do, and it is finally starting to push out the timing of the next interest rate cut." PinPoint also warns that the RBA Board has also said it is not ruling anything in or out. That might mean no rate cuts until after the election, or as an outside option, maybe a rate rise. That would certainly cook Albo's goose! News & Insights Manager Insights | East Coast Capital Management Hedge Clippings - Macro Research | PinPoint Macro Analytics US Election 2024: How will markets and sectors respond? | Magellan Asset Management Market Commentary - October | Glenmore Asset Management October 2024 Performance News Argonaut Natural Resources Fund Skerryvore Global Emerging Markets All-Cap Equity Fund Bennelong Long Short Equity Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

22 Nov 2024 - Performance Report: Digital Income Fund (Digital Income Class)

[Current Manager Report if available]

22 Nov 2024 - Performance Report: ECCM Systematic Trend Fund

[Current Manager Report if available]