News

4 Jul 2024 - Nothing Wrong With Big Super Funds

|

Nothing Wrong With Big Super Funds Marcus Today June 2024 |

|

For most Australians, picking individual stocks and maintaining stock market vigilance is a passionate hobby. But what if you don't have the time? What if you just want to look after money, not make money? What if you need something more passive? What if you don't want to step onto the stock market battlefield, get distracted from your metier, and take risk?Well I have some good news. There is nothing wrong with that Big Super or Industry Fund that you are already invested in.Almost everybody has Super and for those of you that want a peaceful life, undisturbed by share market volatility and requiring only marginal vigilance, you need do no more than stick with the structure that most of you already have. That is to say, leave your money tucked in one of the large superannuation or industry funds because there is nothing wrong with that, for a number of reasons:

Author: Marcus Padley |

|

Funds operated by this manager: |

3 Jul 2024 - When the equity markets are misjudging risk focus on what you can control

|

When the equity markets are misjudging risk focus on what you can control Redwheel June 2024 |

|

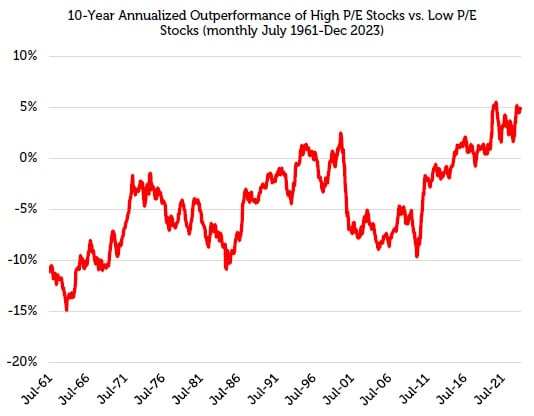

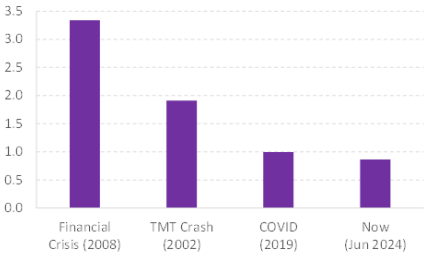

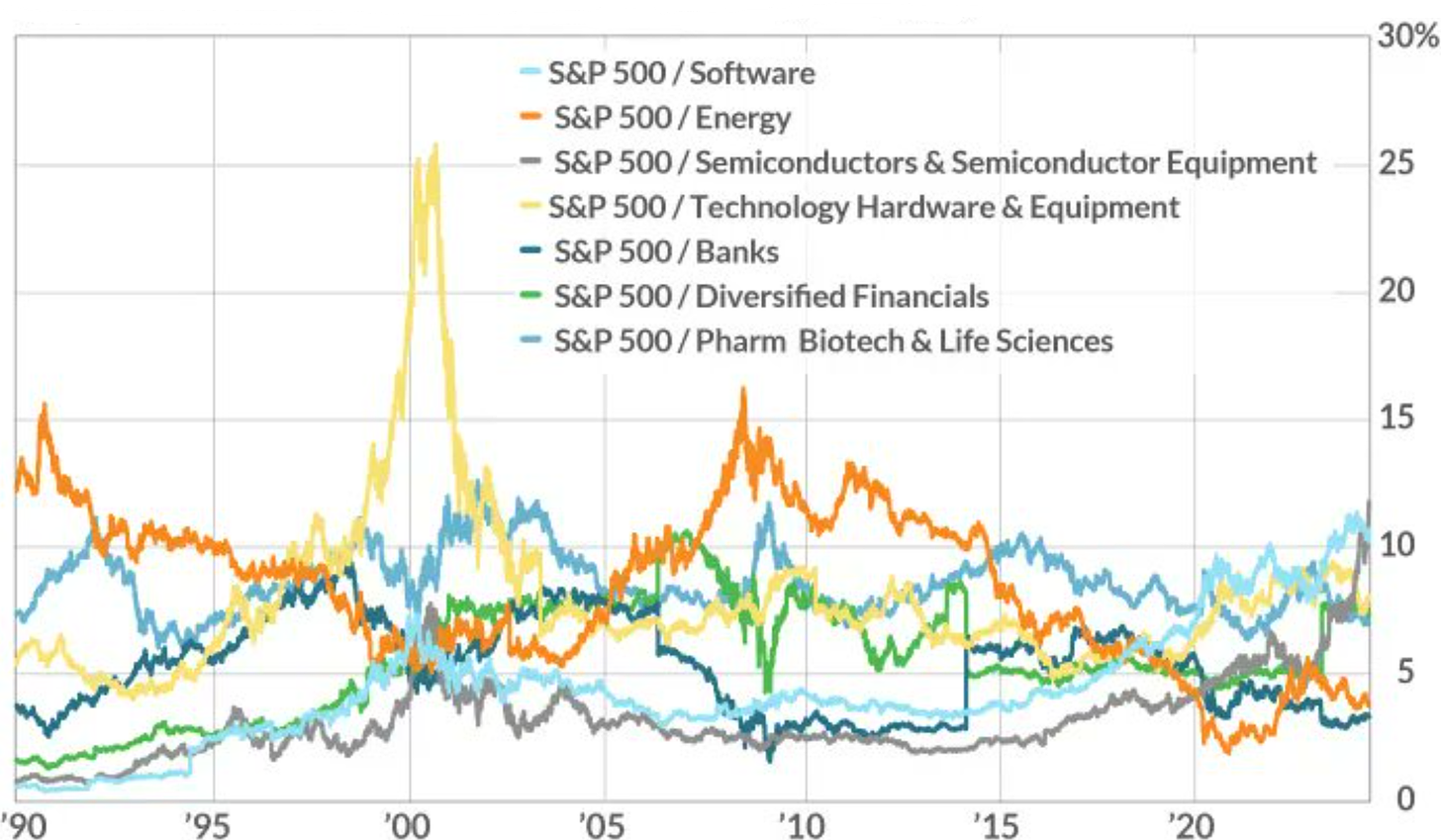

The concept of risk should be simple and straight forward, yet it repeatedly seems to get twisted upside down and back to front, causing bubbles and crashes. For investors, it is the coupling of human behaviour and risk systems that are the root cause of such outcomes. Today, when seven stocks account for 20% of global indices[1], risk seems to have been turned on its head yet again. As excessive valuations and concentration risk in global benchmark indices continue to increase, how can equity investors navigate this environment? We believe the answer lies in accepting what you can control and what you can't. Investors can't control valuations, but they can target income in market conditions where dividends have historically made outsized contributions to total returns. Three quotes that explain how risk can be turned on its head For investors, risk is inseparable from return; both are predicated on an unknowable future. Hence, the risk-free return is usually the lowest: the greater the certainty of future outcomes, the lower both the risk and return. In general, accepting the risk of an uncertain range of future outcomes is necessary to generate a return higher than the risk-free rate. However, it does not guarantee such a return - that's why it is called risk! Therefore, one should strive in an investment process to allocate capital for a range of future outcomes where the probability is skewed towards a favourable return. Naturally this won't always result in a positive outcome. We get things wrong and/or it can take longer to generate a return. The challenge obviously is to get it right more often than not. However, there can be times when, despite leaning the statistics in one's favour, performance can remain sub-par for a period. A coin toss is 50/50 but you can still get a run of heads. Howard Marks wrote, "...human nature makes it hard for many to accept the idea that the willingness to live with some losses is an essential ingredient in investment success". [2] Within active equity management, relative underperformance is "hard for many to accept" despite being "an essential ingredient in investment success". The reasons why are multi-faceted, yet at the kernel of it is a catch created by our own industry. Active managers assume risk in order to generate decent returns. Clients are then told to measure the success of this risk return approach by comparing the outcome to a benchmark. It is therefore assumed that active managers take risk while the benchmark is risk free. Most of the time this makes sense. Within equities, markets are typically rational and accurate at allocating capital, and the risk reward is skewed favourably. However, there are periods where irrationality can take a hold. Benjamin Graham, mentor to Warren Buffett, said: "In the short-run, the stock market is a voting machine, in the long-run, it is a weighing machine". The "weighing" of risk reward becomes replaced by emotion or "voting". It is usually at these times of excessive greed or fear that the benchmarking system turns on its head. In extreme conditions, underperformance becomes magnified and it becomes "hard for many to accept the idea .... to live with some losses". When the herd mentality creates a concentrated market, being different from such a majority feels increasingly wrong. It's at these times, when pressure on fund managers is greatest, that career risk is highest. It's also during these periods that risk systems are most likely to drive investors to move closer to the herd, to the benchmark, in order to reduce the risk of further relative "losses". Yet it is exactly at these times that the understanding of risk is turned on its head. Given the extreme valuations in the benchmark, it is there that the risk is greatest. Despite this, investors are encouraged by emotion and risk systems to invest in the benchmark in an attempt to reduce risk! In the words of Oscar-winning actress Geena Davis: "If you risk nothing, then you risk everything". By trying to reduce risk, you generally succeed only in increasing it. Global equity markets carry considerable risk Right now, equities are a prime example of this inverted appreciation of risk. Once again, the market has become concentrated. A narrow part of the market has created a highly concentrated market. US equities now account for c.70% of the MSCI World index, up from c.30% back in the late 1980's (when as an aside, Japan was c.45% of the MSCI World and is now c.6%!). [3] Within that US dominance, the Magnificent 7 account for c.20% of the MSCI World on their own. Of the S&P 500, the Mag 7 [4] account for c.30% of the index [5], yet only account for 18% of the index's earnings, evidencing the premium valuation applied to these stocks. [6] The chart below illustrates how the market has historically disregarded valuation at extremes (when "voting" takes over), increasing both concentration and risk in the benchmark.

Source: Ken French Data Library, CRSP database, 07/31/1961 - 12/30/2023. Stocks separated into Top Price/Earnings minus Bottom Price/Earnings. The information shown above is for illustrative purposes. Past performance is not a guide to future results. Whether it's the Nifty Fifty bubble in the 1970's or the Magnificent Seven bubble today, the market has repeatedly marched a narrow cohort of the market to excessive valuations, only to see them crash. Yet, it is at these highs and lows, when emotion is dominant, that the pressure is greatest to join the herd. During times of exuberance, when valuation is no longer a concern, investors that follow the benchmark are practically betting on rising valuations. The valuation multiple reflected by the benchmark moves significantly over time, as illustrated by the chart below.

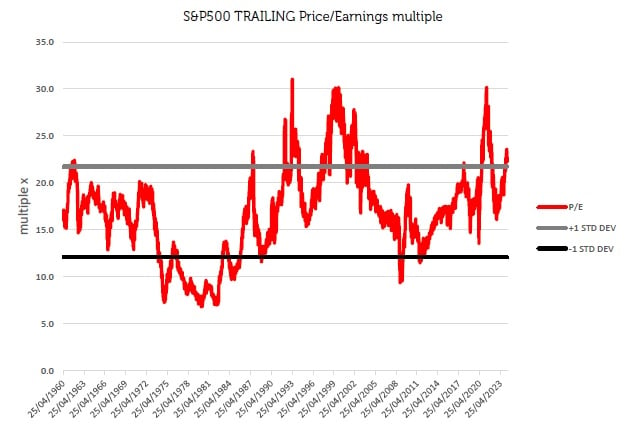

Source: Bloomberg, Redwheel 22 April 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results. The chart shows that the aggregate price to earnings (P/E) of the S&P 500 since 1960 has spanned a low of 8x to a high of 30x. Today the S&P 500 is above one standard deviation from the average over this period, driven primarily by just seven stocks. The valuation can be influenced by an almost inexhaustible list of things - sentiment, psychology, media, macro events, interest rates, politicians, wars and many more - but it can't be controlled. Despite this, at the extremes when the pressure is greatest to join the herd, investors are simply betting that the valuations will keep rising. Effectively, they are betting on something that is beyond their control, which continues to increase risk while they attempt to reduce it. The chart below demonstrates this well. It shows the maximum drawdowns and upswings in the Redwheel Global Equity Income Strategy (USD) since re-launch in December 2020, compared to the same for the MSCI World index (USD).

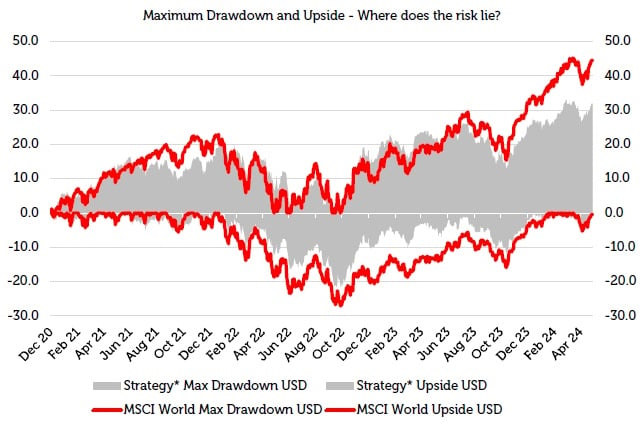

Source: Bloomberg, Redwheel 22 April 2024. The information shown above is for illustrative purposes. Past performance is not a guide to future results. *Please see the disclaimer at the end of this document for further information on the Representative Portfolio. It shows clearly that the moves have fluctuated more in the index than in the strategy. For the most part, the strategy lags during the upswings, but outperforms during the drawdowns. Yet, because the benchmark is seen as lower risk by risk management systems, and due to our own encouragement as an industry, adhering to the benchmark to reduce risk after a period of relative underperformance typically achieves the complete opposite. Focus on what you can control: durable dividends The chart below shows how the periods where emotions ("voting") dominate fundamentals ("weighing") can drive changes in the composition of total returns.

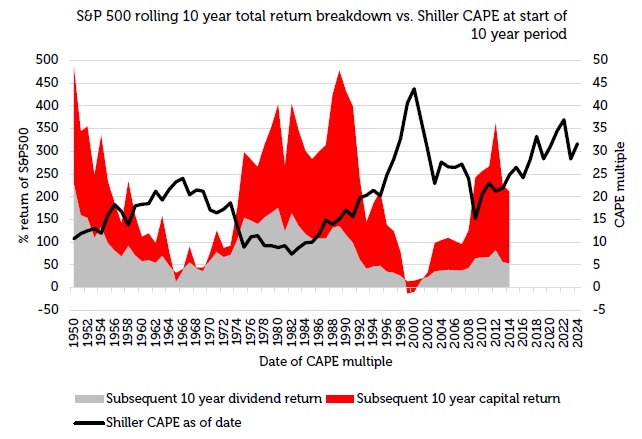

Source: Source: Bloomberg for S&P500 / Shiller Cyclically Adjusted Price to Earnings Ratio (CAPE) www.multpl.com/shiller-pe/table/by-month 31st December 2023. The information shown above is for illustrative purposes. Past performance is not a guide to future results. The chart shows the rolling 10-year returns (USD) for the S&P 500. One can see that the composition of the total return over the rolling 10-year periods changes meaningfully. Sometimes capital return dominates, sometimes the dividend return. The capital return is driven by earnings growth and the multiple applied to those earnings (valuation), which as discussed earlier, are beyond investors' control. However, the dividend return can be controlled. Active managers can invest in companies that aim to deliver durable dividends. Those dividends can then be reinvested to compound a return to drive the total return over time. Of note from the chart above, is that the cycle of the composition of total returns over rolling 10-year periods tends to correlate with the current valuation (Shiller Cyclically Adjusted P/E - CAPE) at the start of the period. The higher the starting valuation, the greater the probability that the next 10 years' total return will be driven by the dividend component, the lower the starting valuation and it is the capital that will likely dominate. Thus, in the current market, where valuations are high, where the last 10-year period has been driven by capital gains, where concentration has once again peaked, many investors are being encouraged by emotions and risk systems to herd into the most uncontrollable, more volatile aspect of total returns to reduce risk! Instead, we believe investors should be focusing upon what is achievable, what is within their control: durable dividends, compounded over time. The less volatile path over time. This is what the Redwheel Global Equity Income Strategy is focused on to deliver robust total returns over time. We focus on what we have a degree of control over: dividends and the yield we get on them.

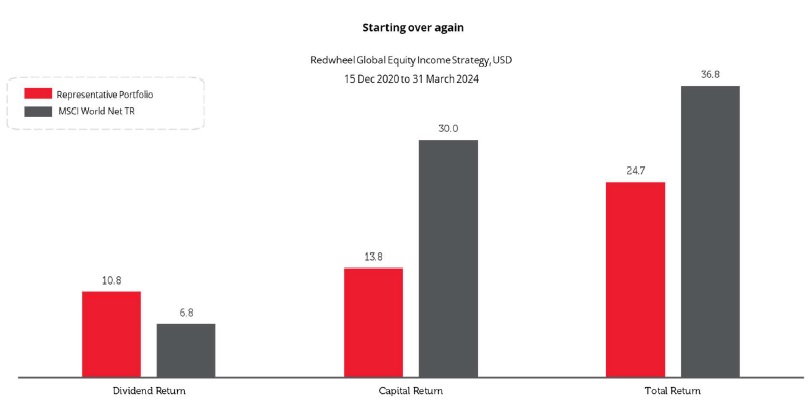

Source: Redwheel, Bloomberg, 31 March 2024 ,USD Dividend yields should drive total returns from here Since resuming the strategy at Redwheel, already the income contribution is greater than the market[1], despite compounding that income at a far lower rate than the market. [7] That is because of the higher starting yield. Given where risk really resides today, we believe that over time, the capital return element of the strategy will normalise in line with the market, allowing the compounding of dividends yields to drive long-term outperformance. Today's relative losses reflect our "willingness to live with some losses [as] an essential ingredient in investment success". However, it is precisely at times like today when it is most appropriate to invest in a strategy like ours that focuses on what can be controlled, rather than the benchmark, where risk has been turned on its head. |

|

Funds operated by this manager: Redwheel China Equity Fund, Redwheel Global Emerging Markets Fund |

|

[1] Source: Factset end of March 2024. [2] Howard Marks, Fewer Losers, or More Winners? Memo September 2023. [3] Source: Factset end of March 2024. [4] Microsoft, Amazon, Google (Alphabet), Tesla, Facebook (Meta), Nvidia and Apple [5] Source: Factset end of March 2024. [6] Source: Factset end of March 2024. [7] MSCI World Net TR index Key Information |

2 Jul 2024 - Bull and bear case for Australian shares in the New Financial Year

|

Bull and bear case for Australian shares in the New Financial Year Airlie Funds Management May 2024 |

|

It's coming to that time of year when equity market strategists and the financial media will start issuing their forecasts for the performance of the stock market in FY25. Airlie's view is to ignore them. Their predictions (like most predictions) are usually wrong.

Despite all these events, global equity markets have risen. The S&P/ASX 200 Accumulation index (which includes dividends) has delivered a total return of 47% or 8% per annum [1]. In Airlie's view, the past five years have shown that buying and selling stocks based on a view of the market's impending movements is a fool's game. In this article, Airlie avoids predicting where the market is going to be in 12 months and instead focuses on three reasons for investors to be bullish on Australian equities in FY25 and three reasons to be bearish. BULL CASE FOR AUSTRALIAN EQUITIES1. Corporate balance sheets in good shape Many Australian investors have lived in a period of declining and ultra-low interest rates. Before the RBA's first interest-rate hike in May 2022, the public had not experienced an increase in interest rates since November 2010, and that cycle only saw the cash rate increase from 3% to 4.75%. To find a rate-hiking cycle of equivalent magnitude today, investors would have to go back more According to Airlie, the rise in interest rates over the last two years could be seen as a reminder for investors of the opportunity cost of capital and the value of conservative capital structures. Airlie's view is that when rates were low, debt was considered 'free' and helped prop up risky companies as investors chased greater returns in speculative companies, while other companies were encouraged to take on large amounts of debt to fund acquisitions and growth with no consequence of increasing financial risk. This era of 'free money' is over and balance sheets now matter. Airlie's view is that corporate balance sheets across the ASX 200 in general look in good shape. The chart below shows the leverage ratio of the average industrial company in the ASX 200 today versus previous economic cycles. At less than 1.0x Net Debt/EBITDA, corporate balance sheets look healthy to Airlie. Airlie considers this suggests that Australia's largest companies could be well placed to handle any adverse bumps the economic cycle, competitors or internal issues may throw at them.

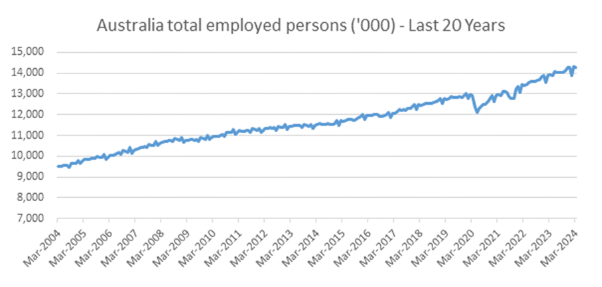

2. Domestic profit pools often supported by a handful of players The grocery sector, where two major supermarket chains account for about 65% of the market. Contrast this with the UK, where the top two grocers account for 43% of the market, and the US, where the four largest supermarket chains have a combined share of 34% [2]. The banking sector, where the four major banks account for over 70% of the home-loan market in Australia [4]. Airlie's view is that this concentration can potentially be a positive for investors in large-cap Australian equities in that they can put their money behind industry-leading companies that have a low risk of being disrupted by competition. Historically these businesses tend to have a track record of stable returns and market-share gains versus their smaller rivals. 3. Australia's place in the world only getting better When we look through a global lens, Australia has a lot going for it - a beautiful place to live, a safe, strong rule of law, and high-quality education. In Airlie's view, even the much-grumbled-about house prices still means some people can buy a house and not a shoebox apartment in capital cities. Australia continues to attract people and capital, both providing a long-term tailwind for the economy. This is best reflected in Australian Bureau of Statistics (ABS) data (see charts below) showing that compared to pre-COVID-19, an additional 1.35 million people are employed in the country (a 10% increase) [5]. This compares favourably to other developed economies like the UK, where the total labour force has increased by just 1% over the same period [6]. Airlie's view is that growth in employed persons translates directly into spending and this has provided a tailwind for Australia's consumer-facing sectors despite cost-of-living pressures. Total retail sales have increased by 30% over the last five years [7]. According to Airlie, the looming tax cuts for individual workers in Australia in FY25 are likely to bolster retail spending and support those companies relying on the domestic consumer.

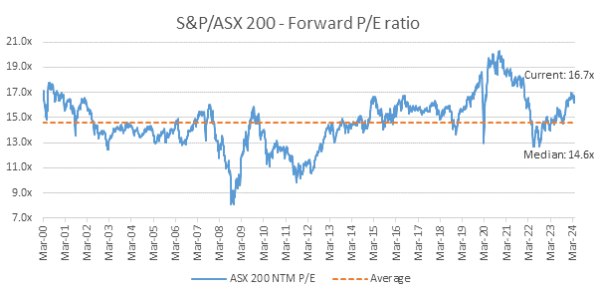

THE BEAR CASE FOR AUSTRALIAN EQUITIES1. Valuations for publicly listed companies have re-rated higher In Airlie's view, higher company valuations reduce the prospect of near-term upside for investors. The rally in equity markets over the past 12 months reflects a level of optimism about 'peak' interest rates and the need to see further evidence for the market to continue re-rating higher. The ASX 200 is currently trading above its long-term median Price Earnings multiple of 14.6 times [8]. This suggests to Airlie that companies in general are valued positively and it's clearly not the "cheap" market Within this aggregate, however, there may still be individual businesses that look attractive, and investors could have to dig for mispriced opportunities.

Source: Factset 2. High cost of living is gaining political attention In Airlie's opinion, concentrated domestic oligopolies can potentially be good for investors. But in an environment where consumers are under pressure, some oligopolies could come under threat from politicians. For example, there have been recent accusations of profiteering levelled at the domestic supermarkets. Airlie would not be surprised if the government turned its attention to other concentrated sectors, so as to be seen to be tackling the cost-of-living crisis. Even if there is no immediate change to regulation of these sectors, Airlie 3. Stick Inflation In Airlie's view, interest rates may well remain elevated, or worse - they may even increase in the coming year. The optimism embedded in sharemarket valuations is predicated on a narrative of peak rates. Any evidence of inflation persisting above the RBA's target range of 2-3% may lead investors to reprice securities lower to reflect a higher cost of capital. To date, the Australian economy has been strong with elevated migration and record-low unemployment supporting demand. And on the supply side, the cost of the energy transition and the restructuring of global trade (away from China) could continue to act as inflationary forces that may well be structural. ConclusionWhile Airlie doesn't have a crystal ball for what 2025 will have in store for the Australian sharemarket, we believe investing in companies with strong balance sheets, and that are market leaders with pricing power, may help drive returns over the long term. Author: Vinay Ranjan Funds operated by this manager: [1] FactSet - ASX 200 total return 5 years to 3 May 2024 Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks.. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

1 Jul 2024 - Glenmore Asset Management - Market Commentary

|

Market Commentary - May Glenmore Asset Management June 2024 Equity markets were stronger in May. In the US, the S&P 500 rose +4.8%, whilst the Nasdaq was also very strong, up +6.9%. In the UK, the FTSE rose +1.6%. Of note, more than half of the S&P 500's gain was due to four mega cap tech stocks (Nvidia +26%, Apple +13%, Microsoft +7%, and Alphabet +6%). On the ASX, the All-Ordinaries Accumulation Index materially lagged the US indices, rising +0.9%. Technology was the top performing sector (assisted by strong results from Xero and Technology One). Banks also performed well, due to a better than feared reporting season. Telecommunications was the worst performer, dragged down by the underperformance of Telstra. Economic data released from the US in May was generally softer than expected: GDP growth weakened to +1.3%, whilst the April jobs report was also lower than expected. Unemployment remained at 3.9% (almost a 50 year low). Fed Fund Futures are now pricing in a 60% chance of a rate cut at the September Federal Open Market Committee (FOMC) meeting. In bond markets, yields were relatively flat during the month. The US 10-year government bond rate declined - 6 basis points to close at 4.57%, whilst its Australian counterpart was stable, closing at 4.41%. Funds operated by this manager: |

28 Jun 2024 - It doesn't look like the RBA is planning to join the global rate-cuts club soon

|

It doesn't look like the RBA is planning to join the global rate-cuts club soon Pendal June 2024 |

|

AS expected, there was no rate change from the Reserve Bank today. We believe changes are more likely to happen at RBA meetings where updated forecasts are released in the form of their Statement on Monetary Policy. Those meetings are held in February, May, August and November. What did we get out of today's statement? There are a lot of known unknowns at the RBA at the moment:

The central bank rate-cut club has increased its membership in recent months. The Bank of Canada and the European Central Bank both joined the club this month, easing by 0.25% each. Existing club members include the Swiss National Bank and Sweden's Riksbank. Anyone looking for Australia to join the club soon would be disappointed, however. The final paragraph from today's RBA note said: "Inflation is easing but has been doing so more slowly than previously expected and it remains high. "The Board expects that it will be some time yet before inflation is sustainably in the target range." So the RBA is not ruling anything in or out. Rate hikes? We see this as highly unlikely. What the RBA is looking forThe RBA needs to see inflation moving sustainably towards its target before easing policy. Instead, right now it sees excess demand in the economy and a tight labour market. There is now a higher risk of an RBA policy mistake caused by holding policy too tight, for too long. The RBA is now reactive to past data. Gone are the days of relying on forecasts resulting in policy changes. That is a scenario they are more comfortable with, however. Easing policy too soon - without inflation properly contained - is the death knell for any central banker. Author: Steve Campbell head of cash strategies. |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

27 Jun 2024 - Transition trilemma: a reckoning for decarbonisation?

|

Transition trilemma: a reckoning for decarbonisation? abrdn June 2024 The transition in 2024 - reality bitesDecarbonisation, supply resilience, affordability: is it possible to solve all three? The old adage of the transition trilemma (balancing all three components of energy policy) has come starkly into focus again over the last 12 months. To some, the energy transition seemed unstoppable. But throw in some post-pandemic supply chain issues, stubborn inflation, cost-of-living pressures, a hefty dose of geopolitics, and the juggernaut is starting to stutter. It's going to be a bumpy ride and investors need to understand the implications. Decarbonisation in EuropeThe pace of decarbonisation in the European energy system has been impressive over the last decade. Around 70 gigawatts of renewable generation capacity was added in 2023 - a 17% increase on 2022 - and the bloc is well on the way to exceeding its target of 42.5% of energy consumption from renewables by 2030. The UK has also made substantial progress in some areas, such as reducing the emissions intensity of electricity by 64% since 2015. But since Russia's invasion of Ukraine there's been a noticeable rebalancing of attention towards energy security and affordability. This has become more pronounced over the last 12 months. Energy security and affordabilityIn the UK, the wind industry's cost problems were brought into sharp focus in 2023, when there were no bids for the fifth round of offshore auctions. In the transport sector, cost pressures also led to a slowing of electric-vehicle uptake across Europe, and policies to ban the sale of conventional passenger vehicles have been pushed out. The focus of policymakers, so far, has been firmly on decarbonising electricity generation, while other parts of the jigsaw have been neglected. This remains the case in the 'space and time' elements of the transition: getting renewable energy to where it is needed at the right time. This mismatch creates delays and adds costs for developers. The lack of storage, meanwhile, has led to periods of negative electricity prices and unused renewable energy. In order to retain system resilience, governments are forced to rely on gas-fired (or in some cases coal-fired) generation to do the hard work for longer. Facing the realityAll of these factors add up to a slower decarbonisation pathway. The UK's independent Climate Change Committee has major concerns about the country's progress against targets. Some analysts now consider it highly likely that the 2050 net-zero objective will be missed. In Scotland, the recent scrapping of the country's 2030 climate target was the catalyst for the collapse of the coalition government's power-sharing agreement. Similar patterns are playing out across the globe. Despite impressive progress, the energy transition is now facing some cold, hard economic and political realities. It's clear that the transition can't and won't happen without balancing energy security and the consumer's pocket. Case study - biomethane in ItalyFor infrastructure investors, we are used to navigating this complex situation to find opportunities to deliver long-term value for our clients. Our most recent investment in Italy provides an excellent example of combining the decarbonisation imperative with energy security and locking-in price certainty for the taxpayer. The country is looking to produce 30% of its energy needs from renewables by 2030 and, in line with overall EU ambitions, to fully decarbonise by 2050. With the support of the EU, the Italian government has decided to move away from using biogas for electricity generation. Instead, it's upgrading to biomethane to directly displace fossil gas in the grid. There's now a €4.5 billion incentive programme in place for biomethane in Italy. This is part of the EU's wider strategy to increase domestic production to 35 billion cubic metres by 2030. The strategy can support new biomethane plants, or the upgrading of existing biogas plants to produce biomethane, to reduce greenhouse gas emissions by at least 80% compared with conventional fossil gas. Importantly, the shift to incentivising more green molecules also reduces the country's reliance on imported fossil fuels. We established a partnership with Blu-H Energy, which has unrivalled knowledge of the market. It is helping us identify small-scale opportunities and build our platform. But not all sites are equal. There are several crucial criteria we consider when selecting appropriate sites. First and foremost is the control of feedstock. It's not like installing solar panels in a field and waiting for the sun to shine. These plants need large quantities of inputs like manure and other agricultural waste. Securing this at the right price and quality is a key determinant of success. We like rolling up our sleeves and getting involved in this type of investment. Taking our time, getting to know a sector, and building the right relationships on the ground is how we create the opportunities and risk-adjusted returns for our clients. Final thoughts...The energy transition is at a crucial point. There's a recognition that it won't happen at any cost and a rebalancing towards resilience and affordability is underway. This creates complexity for investors. But as exemplified by the case of our biomethane investment in Italy, sometimes it's possible to tackle all three of the trilemma's imperatives at once. Author: Ruairi Revell, Head of Sustainability, Infrastructure |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund |

26 Jun 2024 - 10k Words | June 2024

|

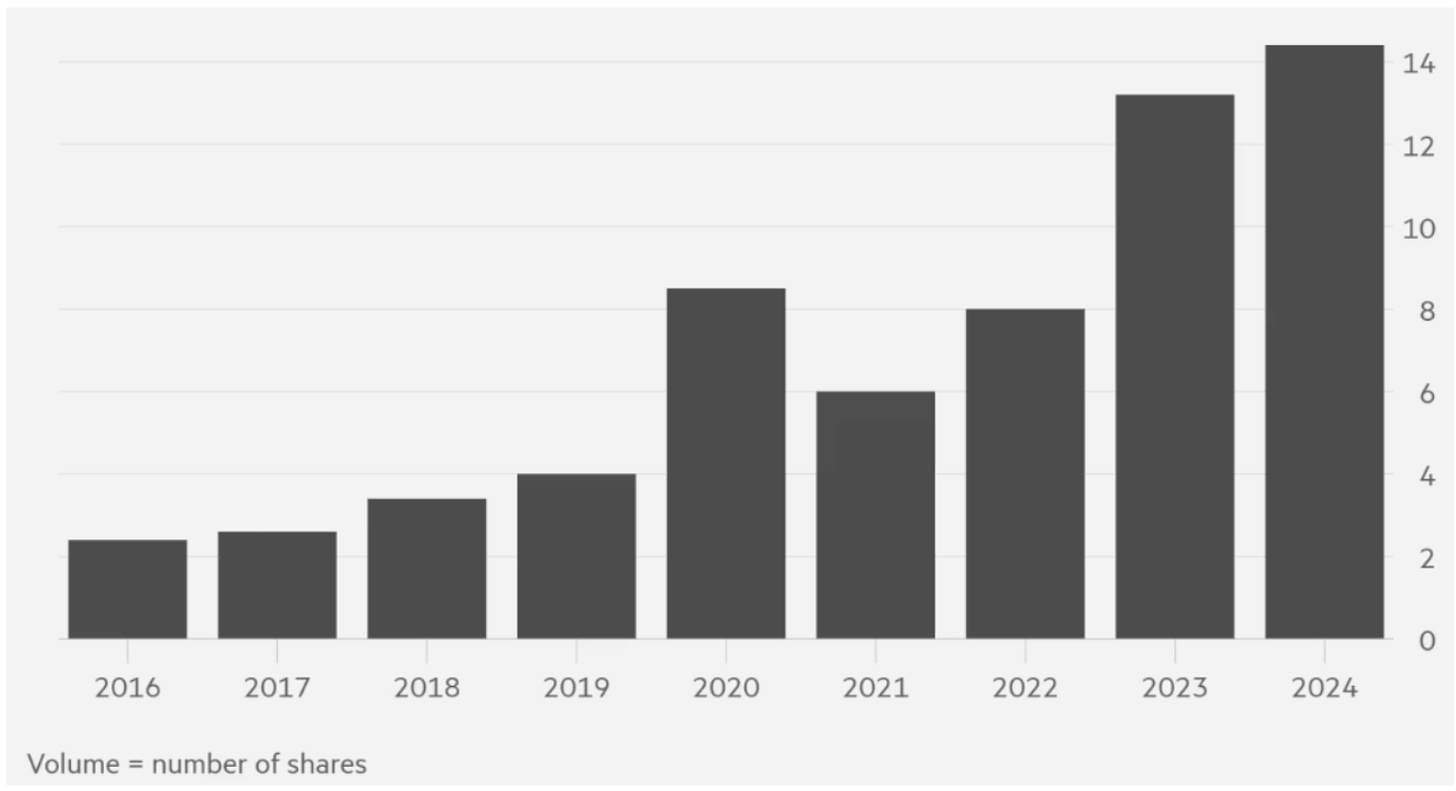

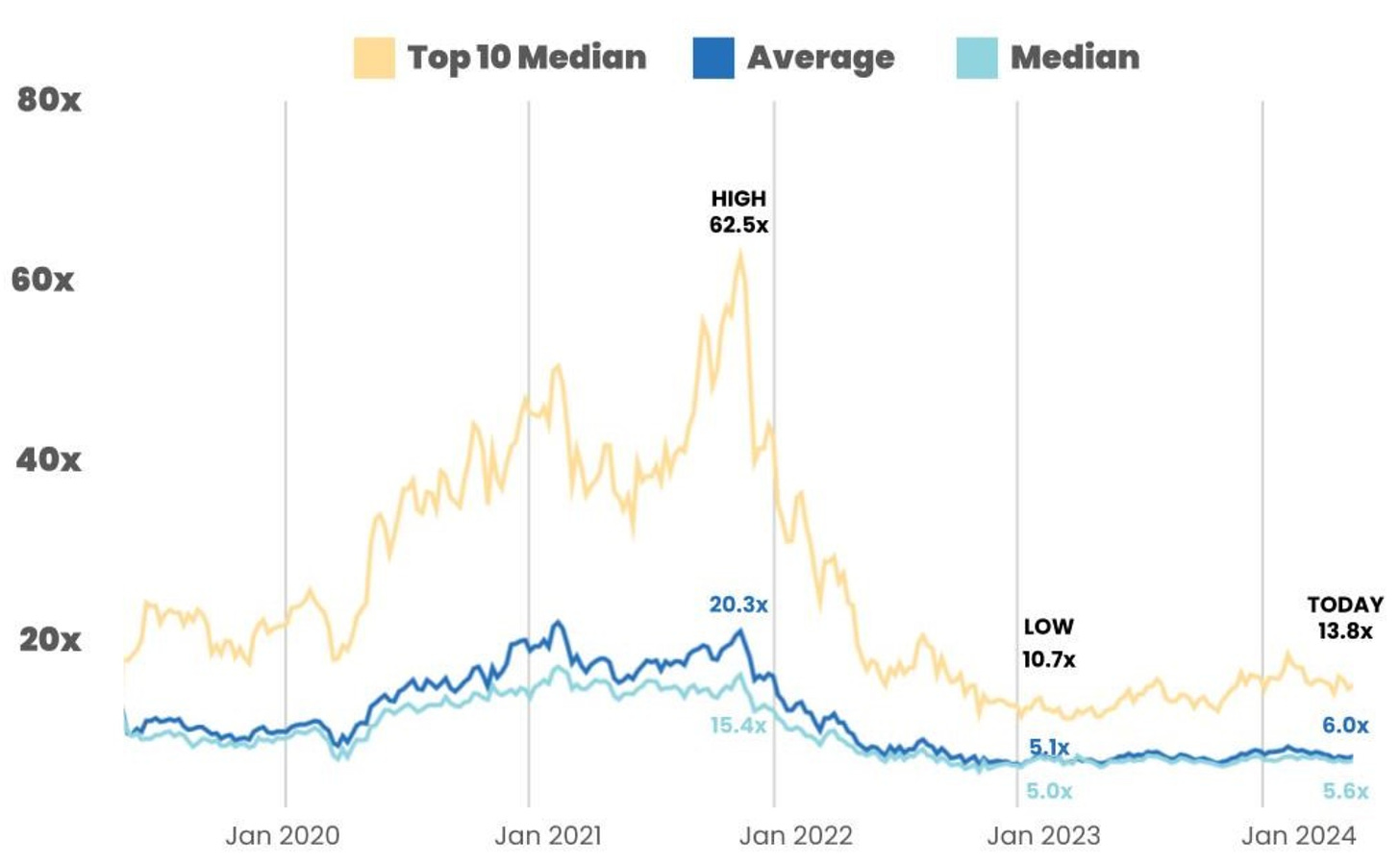

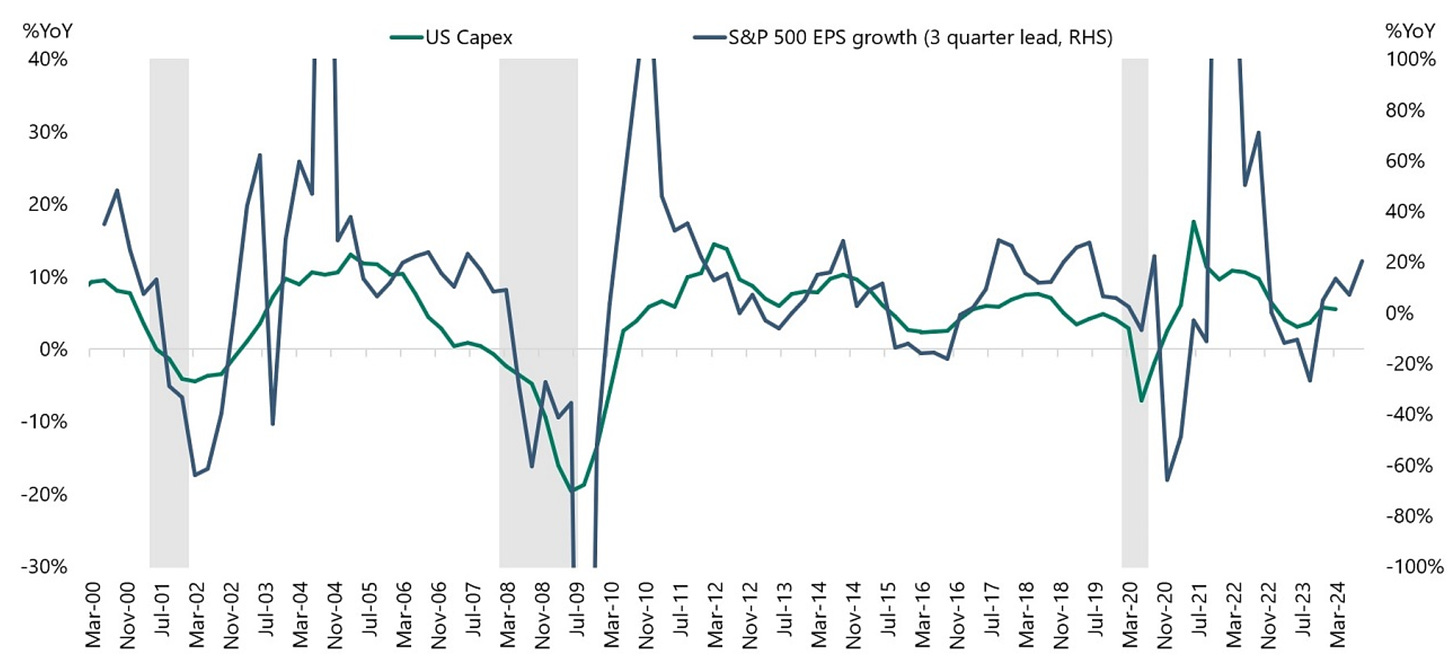

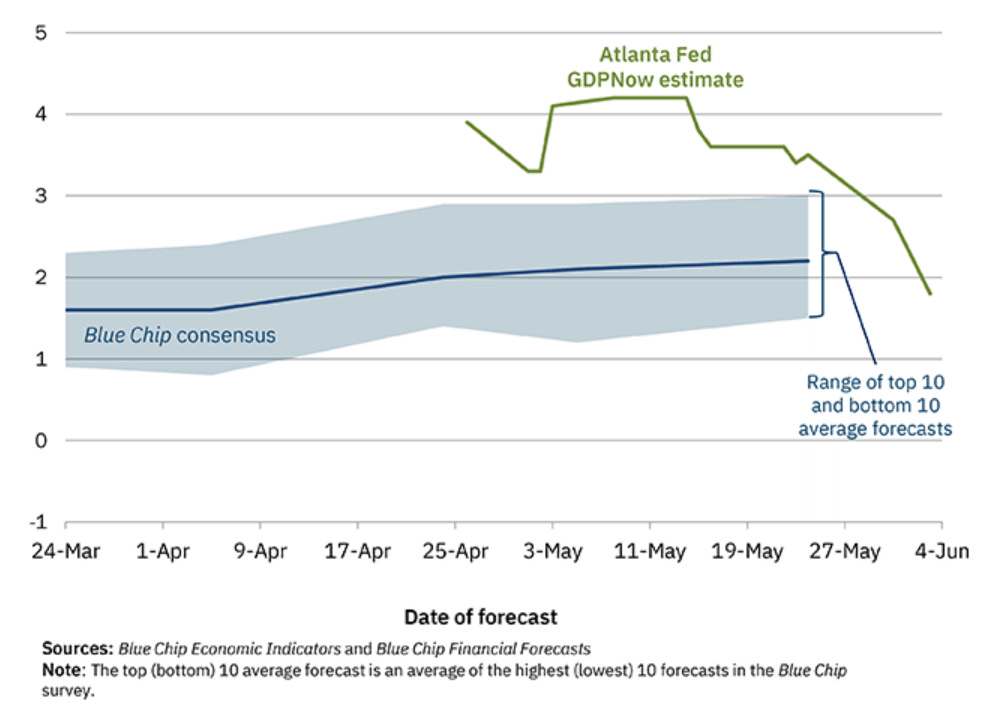

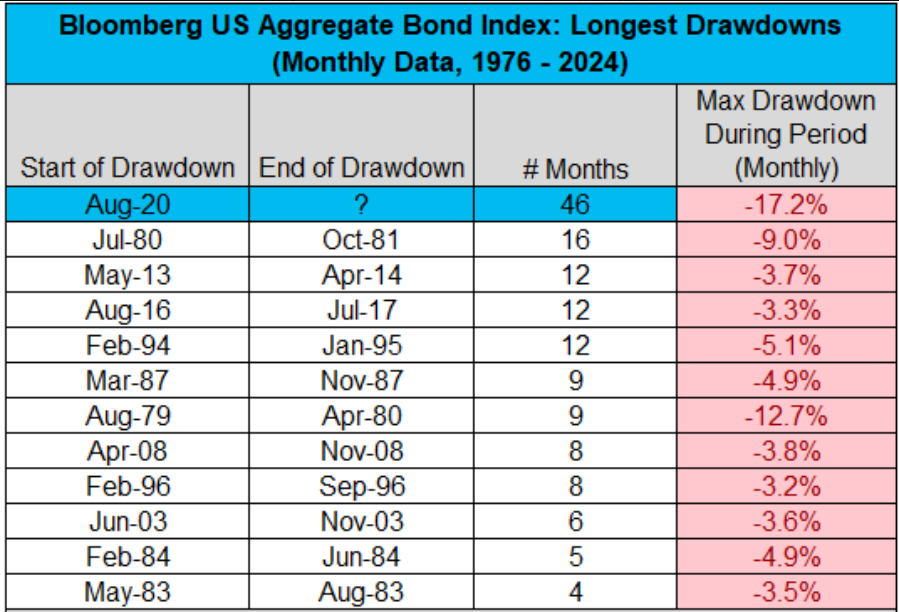

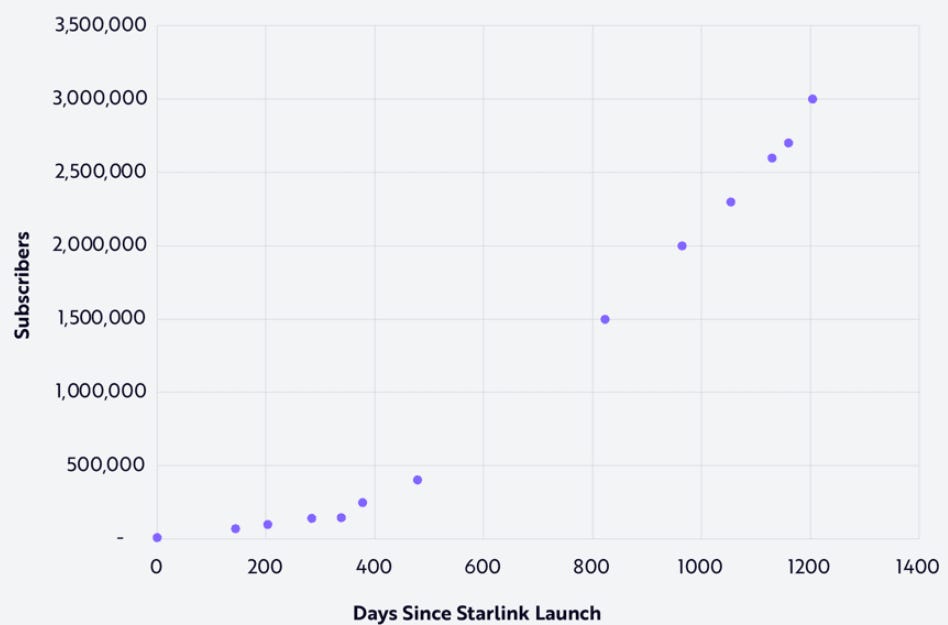

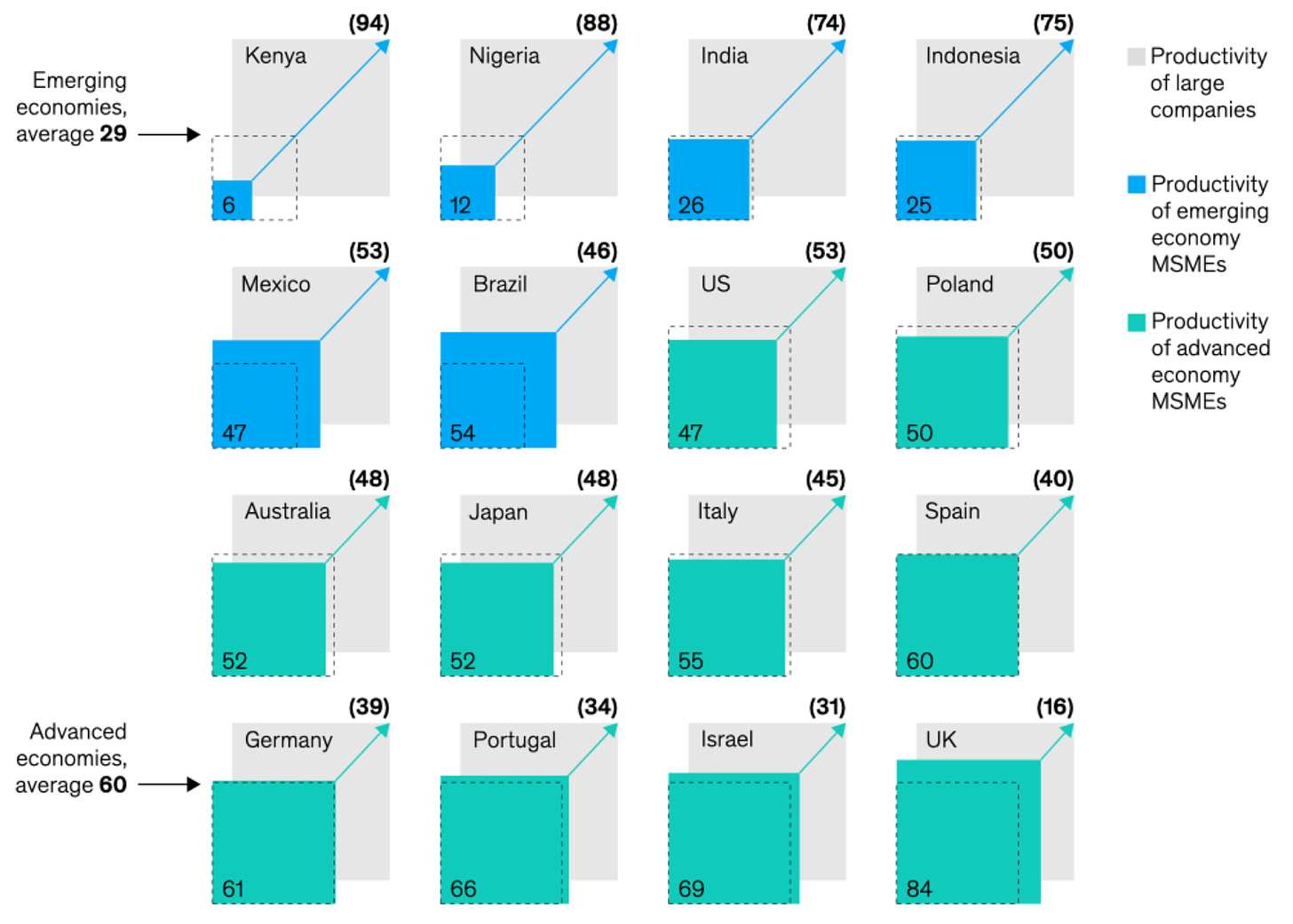

10k Words Equitable Investors June 2024 We have semiconductors snatching the sector title in equities as penny stock activity also rise in the US (not so much in Australia; and no mention of GameStop here, sorry). B2B SaaS growth moderates - as have tech EV/Revenue multiples - and strategists are now looking at strong US corporate earnings growth - will it drive capex or will it fall short itself as demand cools? The Atlanta Fed's GDP indicator has certainly dropped in recent days. Over in the US bond market, we are witnessing possibly the longest ever drawdown. Meanwhile, the Federal Reserve last held rates steady for over a year in the lead-up to the global financial crisis. Finally, we take a look at Starlink satellite customer numbers scaling up and the varying productivity chasm between small and large enterprises across nations. Semiconductors emerge with the heaviest weighting in the S&P 500 Source: FactSet (via @jessefelder) Share of US equities volume accounted for by "penny" stocks (trading at <$US1 a share) Source: Financial Times

Estimate of ex-S&P/ASX 300 volume relative to total ASX volume Source: Equitable Investors, Iress Net new sales for all "B2B" SaaS companies on ProfitWell Metrics since Jan 1, 2022 (seven-day growth rates, seasonally adjusted) Source: ProfitWell

Technology sector EV/NTM (next 12 months) revenue multiples Source: Mostly metrics Strong S&P 500 earnings growth as lead indicator for capex spending Source: Apollo Chief Economist (BEA, S&P. Haver Analytics)

Evolution of Atlanta FedNow GDPNow real GDP estimate for 2024 Q2 Source: Atlanta Fed US Bond Market in a drawdown for 46 months Source: Creative Planning, @CharlieBilello One precedent for the Federal Reserve undertaking a long hold Source: Bloomberg Source: ARK Productivity of "Micro-, small, and medium-size" enterprises relative to larger firms by country Source: McKinsey June 2024 Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Past performance is not a reliable indicator of future performance. Fund returns are quoted net of all fees, expenses and accrued performance fees. Delivery of this report to a recipient should not be relied on as a representation that there has been no change since the preparation date in the affairs or financial condition of the Fund or the Trustee; or that the information contained in this report remains accurate or complete at any time after the preparation date. Equitable Investors Pty Ltd (EI) does not guarantee or make any representation or warranty as to the accuracy or completeness of the information in this report. To the extent permitted by law, EI disclaims all liability that may otherwise arise due to any information in this report being inaccurate or information being omitted. This report does not take into account the particular investment objectives, financial situation and needs of potential investors. Before making a decision to invest in the Fund the recipient should obtain professional advice. This report does not purport to contain all the information that the recipient may require to evaluate a possible investment in the Fund. The recipient should conduct their own independent analysis of the Fund and refer to the current Information Memorandum, which is available from EI. |

25 Jun 2024 - Australian Secure Capital Fund - Market Update

|

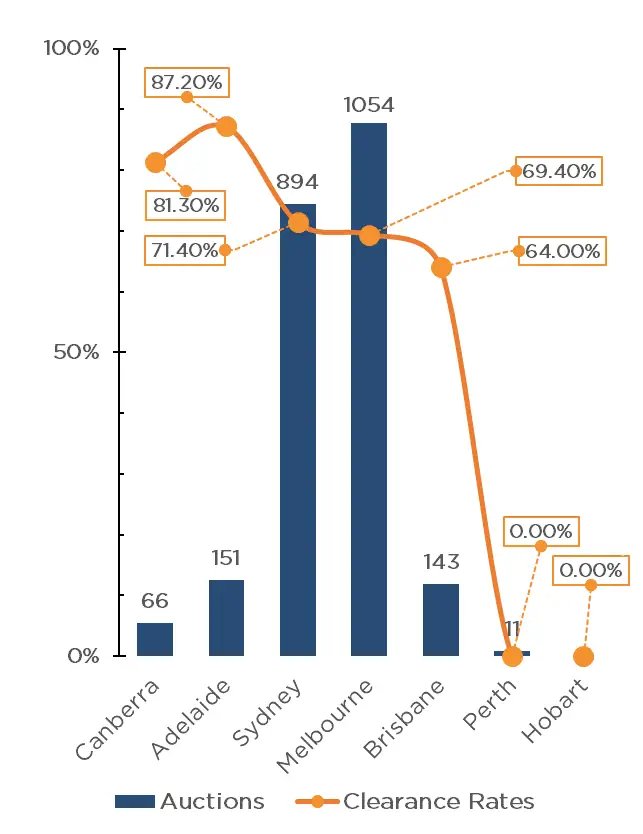

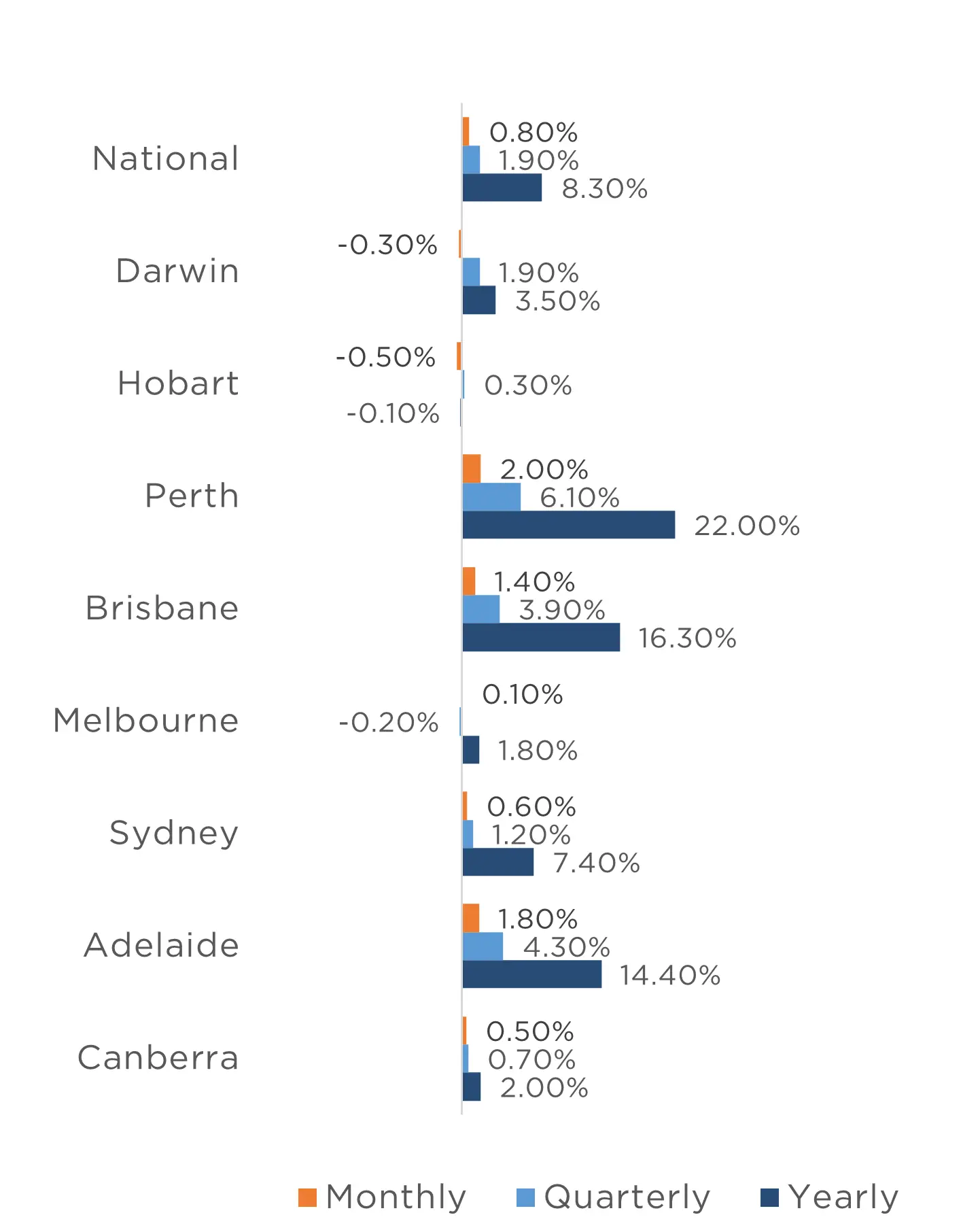

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund June 2024 For the 16th consecutive month, property prices across the capital cities have risen, with CoreLogic's Home Value Index reporting a 0.8% increase for the month of May, the largest monthly gain since October 2023. The regions also continue to experience growth, with a combined 0.6% increase. Perth continues to be the highest performing market, increasing by a whopping 2% for the month, with Adelaide and Brisbane also recording strong growth of 1.8% and 1.4% respectively. Sydney, Canberra and Melbourne also experienced growth for the month, increasing by 0.6%, 0.5% and 0.1% respectively, whilst only Hobart and Darwin recorded a reduction in dwelling values, of 0.5% and 0.3% respectively. The RBA is scheduled to next meet on the 18th of June. Whilst we believe a further increase to interest rates is unlikely, the undersupply of new housing and low tenancy vacancy rates should, in our view, ensure property prices remain strong regardless of the RBA decision. Clearance Rates & Auctions week of 2nd of June 2024

Property Values as at 1st of June 2024

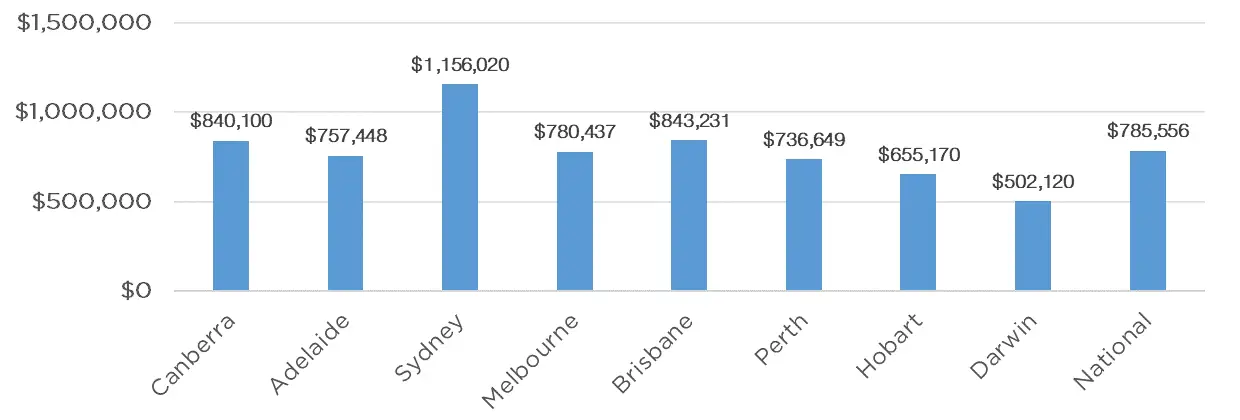

Median Dwelling Values as at 1st of June 2024

Quick InsightsInvestor's RushLoans in the investment property market spiked in April, new home loan commitments to investors jumped 5.60% from March, the fastest rate of gain since November 2021. Commonwealth Bank senior economist Belinda Allen said, "There's no end to price impacts from the lack of supply and strong demand. It's economics 101″. Source: Australian Financial Review Australian Apartments Up AgainThere has been a 26% national increase in apartment selling prices, primarily benefiting higher-end developments, this surge alone is driving the rise in new home completions to 28,000 this calendar year. This figure marks the highest in four years, compared to the previous total of 32,000. However, Urbis director Mark Dawson emphasized that without a corresponding decrease in borrowing or materials costs to make lower-priced unit projects financially feasible, the current spike in completions might taper off in the future. Source: Australian Financial Review Author: Filippo Sciacca, Director - Investor Relations, Asset Management and Compliance Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

24 Jun 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Maple-Brown Abbott Australian Small Companies Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Acorn Capital NextGen Resources Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Acorn Capital Micro Opportunities Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Impax Sustainable Leaders Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Invesco Global Real Estate Fund - Class A | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

21 Jun 2024 - India's election and implications for equities

|

India's election and implications for equities Nikko Asset Management June 2024 Despite the predictions of exit polls and contrary to market expectations, the 2024 Indian parliamentary elections saw Prime Minister Narendra Modi's Bhartiya Janta Party (BJP) secure only 239 seats, falling short of the 272 needed for a majority. This was a significant decline from the 303 seats the BJP won in the previous 2019 elections. The National Democratic Alliance (NDA), the political coalition led by Prime Minister Modi's BJP, still managed to secure 291 seats. With crucial support from pre-alliance partners in the states of Andhra Pradesh and Bihar, the NDA is set to lead the government. However, it will be a coalition government with a smaller margin. On the other hand, the opposition Indian National Developmental Inclusive Alliance (INDIA) has made unexpected gains, securing 234 seats, while the Indian National Congress (INC) nearly doubled its seat count to 100. The BJP's allies will now have greater bargaining power, which could extend to cabinet decisions and crucial reforms. This means the BJP will need to include its allies in important decision-making processes. Prime Minister Modi's government may now have a reduced majority but Indians have voted for his government for a third term, signalling a desire for policy continuity and continued reform momentum. Election outcome indicates rural distress, need for large-scale job creationThe post-result analysis suggests that voters are discontent with issues like unemployment and inflation, and a more populist manifesto may have carried greater appeal. India's growth story remains resilient, but there seems to be a disparity between household consumption growth and real GDP growth. In the post-pandemic period, India has been witnessing a K-shaped consumption recovery, with demand from the affluent or premium segment doing well and with demand for entry-level and mass-market goods remaining subdued. The lower end of the income pyramid has struggled following the pandemic and limited fiscal support has amplified the situation. To widen benefits from economic growth and reduce income disparities, India, in our view, will need a broad-based recovery in the capex cycle as construction is the largest generator of jobs outside of agriculture. We believe that the government will have to focus more on job creation and expanding the manufacturing sector while maintaining its focus on infrastructure development and digitalisation. Government spending may change, but fiscal situation unlikely to deteriorateThe Indian economy has seen growth led by investments, partially encouraged by government initiatives, while consumption has lagged. The election outcome could result in a partial reorientation of government spending. However, we still believe that the government will maintain its focus on macroeconomic prudence. There could be a shift towards subsidies at the expense of some capex, but we do not see a significant impact in the near term nor any deviation from the interim fiscal deficit target of 5.1% of GDP. If government reflationary policies are enacted as a result of political necessity, this could result in slower fiscal consolidation. Supply-side reforms are likely to continue, while factor market reforms may prove difficult to implement. India's fundamentals remain strongIndia's economic fundamentals remain robust. Reforms in India have generally survived political challenges, and we expect the government to maintain the pace of governance and administrative reforms. However, the more complex reforms involving land and labour need greater consensus building. Therefore, while near-term uncertainty is high and the political backdrop is slightly different, the broad direction of reforms and macroeconomic factors remains unchanged. We continue to remain very positive on the longer-term potential of the India equity markets. With Prime Minister Modi sworn in on 9 June, the immediate focus is on government formation and the political jostling between and among parties. The cabinet now has some new members from coalition partners. We will focus on the final budget, which is most likely to be put together early in July, to assess the policy direction. The first 125-day agenda of the new government will be a key event that will set the direction of economic reforms. We believe that the agenda will focus on digitalisation, infrastructure, industrialisation and governance-related reforms. Focus on companies with sustainable returns undergoing positive fundamental changeIn the short term, the Indian equity markets are likely to be volatile. However, now that the election uncertainty has been resolved, we believe that over the medium term, there will be a strong corporate capex and credit cycle. In addition, a multi-year buildup in domestic savings is expected to funnel into equities and potentially provide a further boost for consumption. From a longer-term perspective, this could be an opportune time to assess quality business franchises in India. We continue to focus on companies with high free cash flows, low balance sheet leverage and high return on capital. Currently, we have a favourable view on sectors such as financials via large private sector banks, consumer discretionary via the automobile sector and communication services. Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information |

.png)