News

11 Jun 2019 - Performance Report: Paragon Australian Long Short Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Paragon's unique investment style, comprising thematic led idea generation followed with an in depth research effort, results in a concentrated portfolio of high conviction stocks. Conviction in bottom up analysis drives the investment case and ultimate position sizing: * Both quantitative analysis - probability weighted high/low/base case valuations - and qualitative analysis - company meetings, assessing management, the business model, balance sheet strength and likely direction of returns - collectively form Paragon's overall view for each investment case. * Paragon will then allocate weighting to each investment opportunity based on a risk/reward profile, capped to defined investment parameters by market cap, which are continually monitored as part of Paragon's overall risk management framework. The objective of the Paragon Fund is to produce absolute returns in excess of 10% p.a. over a 3-5 year time horizon with a low correlation to the Australian equities market. |

| Manager Comments | Positive contributors included Kidman, iSignthis, Xero, Atrum and shorts in Bluescope and Sandfire. Kidman received a takeover offer from Wesfarmers on 2nd May which became binding later in the month. Paragon noted they anticipated this outcome for KDR, with its world class and undervalued offering. They added that Gina Reinhardt raised her bid yet again to secure Riverdale, illustrating considerable upside in neighbouring Atrum. In their latest report Paragon discuss Nearmap, a cloud-based software-as-a-service (Saas) company offering aerial imagery services in Australia, New Zealand and North America. Paragon see Nearmap to be a highly scalable SaaS-based business in a high growth phase, well placed to continue to deliver >30% organic sales growth over the medium to long-term. They also provide their view on Xero, a company which they believe boasts strong revenue momentum in its cloud-based accounting SaaS and a substantial growth runway. |

| More Information |

7 Jun 2019 - Fund Review: Bennelong Long Short Equity Fund May 2019

BENNELONG LONG SHORT EQUITY FUND

Attached is our most recently updated Fund Review on the Bennelong Long Short Equity Fund.

- The Fund is a research driven, market and sector neutral, "pairs" trading strategy investing primarily in large-caps from the ASX/S&P100 Index, with over 16-years' track record and an annualised returns of 14.69%.

- The consistent returns across the investment history highlight the Fund's ability to provide positive returns in volatile and negative markets and significantly outperform the broader market. The Fund's Sharpe Ratio and Sortino Ratio are 0.88 and 1.41 respectively.

For further details on the Fund, please do not hesitate to contact us.

31 May 2019 - Performance Report: Insync Global Quality Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Insync employs four simple screens to narrow the universe of over 40,000 listed companies globally to a focus group of high-quality companies that it believes have the potential to consistently grow their profits and dividends. These screens are: size of the company, balance sheet performance, valuation and dividend quality. Companies that pass this due diligence process are then valued using dividend discount models, free cash flow yield and proprietary implied growth and expected return models. The end result is a high conviction portfolio typically of 15-30 stocks. The principal investments will be in shares of companies listed on international stock exchanges (including the US, Europe and Asia). The Fund may also hold cash, derivatives (for example futures, options and swaps), currency contracts, American Depository Receipts and Global Depository Receipts. The Fund may also invest in various types of international pooled investment vehicles. |

| Manager Comments | Of the Fund's top 10 holdings, equating to about 60% of the portfolio, the strongest returns came from Walt Disney (+22.7%) and Facebook (+15), while the weakest performers were Intuit (-5%) and Amadeus IT (-1.1%). The Fund's top holdings as at the end of April included Visa, Intuit, Walt Disney, Accenture, Facebook, Tencent Holdings, Booking Holdings, Amadeus IT, Adobe and Zoetis. |

| More Information |

30 May 2019 - Performance Report: Bennelong Emerging Companies Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund may invest in securities expected to be listed on the ASX within 12 months. The Fund may also invest in securities listed, or expected to be listed, on other exchanged where such securities relate to ASX-listed securities |

| Manager Comments | The Fund's top five holding as at the end of April were Jumbo Interactive, Zip Co, Pinnacle Investment Management, Nearmap and Emerchants. Bennelong believe micro and small-cap stocks can offer more exciting growth prospects than larger companies despite presenting greater investment risks. The investment team aim to be disciplined in focusing on high quality stocks and seek to avoid the higher risk propositions such as minerals explorers, speculative stocks, fads and unproven business models. |

| More Information |

29 May 2019 - Performance Report: Touchstone Index Unaware Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The portfolio is constructed using Touchstone's Quality-At-a-Reasonable-Price ('QARP') investment process. QARP is a fundamental bottom-up process, however, it also incorporates a top-down risk management framework designed to successfully manage the portfolio during varying market conditions and economic cycles. The Touchstone Fund is concentrated, typically holding between 15-20 stocks. No individual stock will ever make up more than 10% of the portfolio at any one time. The Investment Manager may temporarily exceed the exposure limits of the Fund occasionally, particularly during periods of market volatility, to allow for holdings in excess of this 10% limit where the increase in value of the underlying security is due to market movement. The Fund may also hold between 0-50% of the portfolio in cash. The Fund has a high level of associated risk, therefore, the minimum suggested investment time-frame is 5 years. |

| Manager Comments | As at the end of April, the Fund held 21 stocks with a median position size of 4.9%. The portfolio's holdings had an average forward year price/earnings of 16.0, forward year EPS growth of 6.6%, forward year tangible ROE of 27.1% and forward year dividend yield of 4.5%. The Fund's cash weighting had decreased to 3.0% from 5.0% at the end of March. The Fund primarily seeks to select stocks from the ASX300 Index, typically holding between 10-30 stocks. The Fund seeks to invest in reasonably priced, good quality companies with a significant share of expected returns coming from sustainable dividends. |

| More Information |

28 May 2019 - Performance Report: KIS Asia Long Short Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Whilst the Fund's primary strategy is focused on long/short equities, the ability to retain discretionary powers to allocate across a number of other investment strategies is reserved. These strategies may include, but not be limited to: convertible bond investments, portfolio hedging, equity related arbitrage, special situations (e.g. merger arbitrage, rights offerings, participation in international public offerings and placements, etc.). The Fund's geographic focus is Asia excluding Japan, but including Australia). The Fund may invest outside of this region to the extent that: 1. The investment decision is driven from the Asian region or; 2. The exposure is intended to mitigate risk or enhance return from factors external to the Asian region. |

| Manager Comments | Using index options and futures to keep the portfolio hedged and express a small net short bias, over the month KIS averaged -8% of AUM short which cost the Fund 58bp. There were no other losses greater than 30bp. KIS noted they remain cautious on markets and are committed to a market neutral approach, protecting investors' capital against any sudden change in sentiment. They say the rally in equity markets from the December lows feels to have been initially a reaction to looser US monetary conditions and is now a bid for equities for fear of missing out on any further rally and a lack of other investment opportunities. On the winning side the Fund made 31bp on their long position in MedAdvisor Ltd (MDR.AX). |

| More Information |

28 May 2019 - Performance Report: Bennelong Concentrated Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The overriding objective of the Concentrated Australian Equities Fund is to seek investment opportunities which are under-appreciated and have the potential to deliver positive earnings, while satisfying our stringent quality criteria. Bennelong's investment process combines bottom-up fundamental analysis together with proprietary investment tools which are used to build and maintain high quality portfolios that are risk aware. The portfolio typically consists of 20-35 high-conviction stocks from the S&P/ASX 300 Index. The Fund may invest in securities listed on other exchanges where such securities relate to ASX-listed securities. Derivative instruments are mainly used to replicate underlying positions and hedge market and company specific risks. |

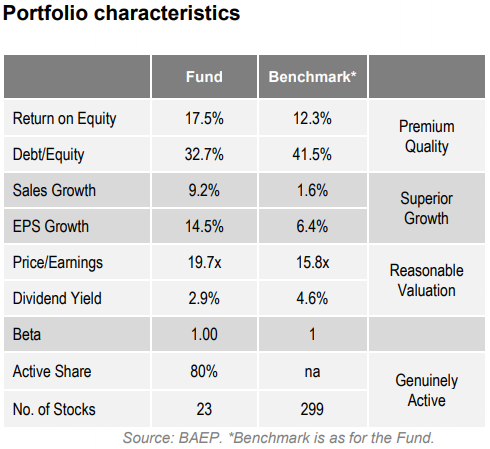

| Manager Comments | The Bennelong Concentrated Australian Equities Fund rose +3.40% in April, outperforming the ASX200 Accumulation Index by +1.03% and taking annualised performance since inception in February 2009 to +16.34% versus the Index's +10.65%. The Fund's up-capture and down-capture ratios since inception, +139% and 91% respectively, highlight the Fund's capacity to outperform over the long-term regardless of the market's direction. As at the end of April, the Fund's weightings had been increased in the Consumer Staples, Industrials, IT, Communication and Financials sectors, and decreased in the Discretionary, Health Care, Materials and REIT's sectors. The Fund's top holdings include CSL, BHP Billiton and Aristocrat Leisure. The Fund aims to invest in a concentrated portfolio of high quality companies with strong growth outlooks and underestimated earnings momentum and prospects. The data in the table below from the latest monthly report demonstrate that the Fund is in line with its investment objectives;

|

| More Information |

27 May 2019 - Performance Report: Insync Global Capital Aware Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Insync employs four simple screens to narrow the universe of over 40,000 listed companies globally to a focus group of high quality companies that it believes have the potential to consistently grow their profits and dividends. These screens are size of the company, balance sheet performance, valuation and dividend quality. Companies that pass this due diligence process are then valued using dividend discount models, free cash flow yield and proprietary implied growth and expected return models. The end result is a high conviction portfolio of typically 15-30 stocks. The principal investments will be in shares of companies listed on international stock exchanges (including the US, Europe and Asia). The Fund may also hold cash, derivatives (for example futures, options and swaps), currency contracts, American Depository Receipts and Global Depository Receipts. The Fund may also invest in various types of international pooled investment vehicles. At times, Insync may consider holding higher levels of cash if valuations are full and it is difficult to find attractive investment opportunities. When Insync believes markets to be overvalued, it may hold part of its resources in cash, or use derivatives as a way of reducing its equity exposure. Insync may use options, futures and other derivatives to reduce risk or gain exposure to underlying physical investments. The Fund may purchase put options on market indices or specific stocks to hedge against losses caused by declines in the prices of stocks in its portfolio. |

| Manager Comments | Of the Fund's top 10 holdings, equating to about 60% of the portfolio, the strongest returns came from Walt Disney (+22.7%) and Facebook (+15), while the weakest performers were Intuit (-5%) and Amadeus IT (-1.1%). The Fund's top holdings as at the end of April included Visa, Intuit, Walt Disney, Accenture, Facebook, Tencent Holdings, Booking Holdings, Amadeus IT, Adobe and Zoetis. |

| More Information |

24 May 2019 - Performance Report: Wheelhouse Global Equities Income Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | To pursue this objective, the Investment Manager is responsible for actively managing, monitoring and tailoring the integration of derivative contracts alongside the Morningstar Portfolio, while taking into account changing market and stock specific conditions. The Investment Manager is responsible for maximising the structural benefits of short option positions (lowered Volatility, improved capital preservation, higher income generation), whilst mitigating, minimising and monitoring the structural negatives (variable market exposure, option expiries, collateral management and asymmetric return profiles). In addition, long derivatives positions are also used to enhance the capital preservation characteristics of the Fund in more extreme market movements. As a consequence of the integration of Derivatives, returns of the strategy, intra-cycle, are expected to vary from the underlying Morningstar Portfolio due to these characteristics. For example in weak markets, or in extended sideways markets, the Fund is expected to outperform relative to the Morningstar Portfolio. Conversely in strong positive markets the Fund is expected to underperform. |

| Manager Comments | Top contributors included Disney, ServiceNow, Microsoft, United Technologies Corp and Guidewire Software. Detractors included Amgen, Intel, Pfizer, Zimmer Biomet and Roche. The Fund is designed to deliver equity returns with higher income generation and active downside protection. The strategy's high income generation and active tail risk program are designed to lower risk and deliver equity returns with a smoother, more retiree-friendly return profile. As a result, Wheelhouse intend for returns to add relative value in weak and low-growth markets and to drag in more positive markets. |

| More Information |

24 May 2019 - Performance Report: Quay Global Real Estate Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund will invest in a number of global listed real estate companies, groups or funds. The investment strategy is to make investments in real estate securities at a price that will deliver a real, after inflation, total return of 5% per annum (before costs and fees), inclusive of distributions over a longer-term period. The Investment Strategy is indifferent to the constraints of any index benchmarks and is relatively concentrated in its number of investments. The Fund is expected to own between 20 and 40 securities, and from time to time up to 20% of the portfolio maybe invested in cash. The Fund is $A un-hedged. |

| Manager Comments | The largest contributors were Safestore (US Storage), Hysan (HK Diversified) and Unite (UK Student Accommodation). Detractors were Scentre (Aust Malls), LEG Immobilien (German Apartments) and Ventas (US Healthcare). During April many of the Fund's US investees reported their 1Q19 results. Quay noted the results are pleasing for all of their investees and represent a continuing trend of robust operating fundamentals against the backdrop of a healthy US economy. |

| More Information |