News

28 Jan 2025 - Global Matters: 2025 outlook

24 Jan 2025 - Hedge Clippings | 24 January 2025

|

|

|

|

Hedge Clippings | 24 January 2025 Five days in from Trump's inauguration, and no one is left guessing on the question of whether he's as committed in office as his promises were on the campaign trail. With over 200 executive orders (which bypass Congress) reportedly signed since his first day in office, he's set a record and if he keeps going, he'll be approaching a record for his entire term. By comparison, the previous 10 US Presidents (including Trump's first term when he signed a modest 220) only signed an average of 266 executive orders in their entire terms. Maybe he's just trying to break his own record? It has certainly been a whirlwind start, possibly a reflection that this time he expected to win, whereas in 2016 he (and many others) believed that was unthinkable. One thing to remember about Trump, irrespective of whether you think he's the reincarnation of the Messiah, or the devil, is to expect both the expected, and the unexpected, often on the same day, and possibly the same conversation. Frequently the difficulty is sorting his thought bubbles from firm policy - think Greenland for instance. It was too cold in Washington to hold his inauguration out in the open, but maybe his climate change policies will fix that problem, and also turn Greenland... well green, instead of white? On a more serious note, the world is yet to really understand how his major policy initiatives will play out on the world stage, or who outside America will be the beneficiaries - if any. His unashamedly America First policy, particularly around tariffs and border protection, both trade and immigration, are both highly contentious and depending on one's views, or where you live, or your economic position, likely to result in magnificence, or mayhem. As the world's most powerful man, and as leader of the largest economy there doesn't appear to be any other leader or country, apart from Denmark who is miffed about his Greenland stance, or Panama who are prepared to call him out. The remainder, possibly with the exception of Canada's outgoing Prime Minister Justin Trudeau, seem to be holding their tongues, and possibly their collective breaths. From Australia's perspective, the same applies, with our ambassador Kevin Rudd, along with Penny Wong, no doubt working their diplomatic skills for all they're worth. Trump has a vindictive streak and won't forget Kevin 07's previous remarks, but to what extent we're friend or foe, winners or losers, remains to be seen. When push comes to shove, our military alliance and Pine Gap are, to the horror of the Greens, likely to help. Turning to fund performances, both December's results and those for the full 12 months of 2024, are summarised below. Performance data in the 12 months to December 2024 across all 900 funds in FundMonitors' database, which covers equities, fixed income, property, infrastructure, alternatives, and digital assets, highlights the mix of outcomes and the importance of careful research across both asset class and fund selection. In the short term - December - global and Asia-focused equity categories delivered mostly positive returns: Leading the way was Equity Long - Asia, up 3.32%, while Equity Long - Large Cap - Global gained 1.24% and Equity Long - Small/Mid Cap - Global added a modest 0.07%. Meanwhile, Australian equities struggled, with Equity Long - Small/Mid Cap - Australia falling 1.58% and Equity Long - Large Cap - Australia down 2.92%. Fixed income categories made slight gains, while property (-3.53%) and infrastructure (-2.57%) experienced declines. The table below shows the highest and lowest returns seen within each broad peer group and across the entire database, both during the month of December 2024 and across the full calendar year.

News & Insights Market Commentary - December | Glenmore Asset Management Long-term Investing | Airlie Funds Management December 2024 Performance News Argonaut Natural Resources Fund Bennelong Emerging Companies Fund Bennelong Twenty20 Australian Equities Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

24 Jan 2025 - Performance Report: Cyan C3G Fund

[Current Manager Report if available]

24 Jan 2025 - Performance Report: Argonaut Natural Resources Fund

[Current Manager Report if available]

24 Jan 2025 - The Advantages Of Being A Small Investor

|

The Advantages Of Being A Small Investor Marcus Today January 2025 |

|

I have never liked the expression "Smart money". It is demeaning to individual investors and used by the finance industry to imply they are smart and the rest of you are by implication "Dumb". But a lot of supposedly smart professionals do some very dumb things, and a lot of non-professional investors (you guys) do some very clever things. What Big Investors Can Do That You Can't There are a few "Smart Money" activities available to institutional investors that most individual investors can't access. These include: Access to IPOs and Placements Big institutions often get priority access to IPOs, share issues, and placements. They get it because the brokers controlling the issue want to suck up to them to get their secondary market business. Inside Information There's an old broker's saying--"If you're not on the inside, you're on the outside." Many private investors assume that institutional investors have access to inside information and that the market is rigged against them. But this isn't the case. I once stood in a lift with a very experienced professional trader who overheard two brokers discussing an inside tip. In his gravelly voice of experience, he said, "If I'd never been told any inside information, ever, I'd be a million dollars better off." While inside information might exist, it's neither legal nor common, even among professionals. The misconception that everyone else has it is simply not true. That's not the game. Writing Options for Incremental Gains Wealthy investors sometimes write out-of-the-money call options against existing holdings. While this strategy can generate small, incremental returns, it doesn't provide substantial gains. It's also not practical for most individual investors. Why Being a Small Investor Is an Advantage Despite the perks available to big investors, small investors enjoy significant advantages that professionals can only envy. Liquidity Isn't an Issue Institutional investors often face liquidity problems, struggling to enter or exit positions without affecting share prices. Small investors can buy and sell quickly without influencing the market. Despite the perks available to big investors, small investors enjoy significant advantages that professionals can only envy. Freedom to Adapt Unlike fund managers who must follow strict mandates, small investors can shift strategies whenever they like. You're free to act without needing approvals or explanations. The Ability to Hold Cash Fund managers often can't hold cash even when markets drop. Small investors can exit the market and wait for better opportunities, avoiding unnecessary losses. No Need for Over-Diversification Fund managers must diversify to meet benchmarks, even if it means including underperforming stocks. Small investors can focus on a few high-quality opportunities instead. No Reporting Requirements Professionals deal with compliance regulations, financial services guides, and audits. Small investors avoid these headaches, saving time and money. Minimal Costs Running a self-managed portfolio means avoiding the overheads that come with managing large funds. There are no compliance fees, licensing costs, or administrative burdens. Instant Decisions Small investors can react to market events in real-time. Fund managers, on the other hand, face internal approvals that delay decisions. The Downsides of Being a Small Investor Of course, small investors do miss out on some perks available to institutional players: No Broker Perks Big investors enjoy access to IPOs, discounted placements, and premium research. Brokers often court them with lunches and events. Limited Research Support Institutions have teams of analysts hunting for investment opportunities. Individual investors typically rely on their own research. No Excuses for Losses While fund managers can justify losses by pointing to market-wide downturns, small investors face personal accountability for their results. Why Flexibility Beats Big Money Sure, big investors get the perks--lunches, research, and IPOs but they're also stuck in a system full of rules, reports, and restrictions. Small investors, on the other hand, have the freedom to move quickly, cut costs, and make decisions without answering to anyone. And let's be honest when it comes to investing, freedom is worth more than a free lunch. Author: Marcus Padley |

|

Funds operated by this manager: |

23 Jan 2025 - Performance Report: Bennelong Twenty20 Australian Equities Fund

[Current Manager Report if available]

23 Jan 2025 - Trump nominated a vaccine sceptic for health secretary. What does that mean for investors?

|

Trump nominated a vaccine sceptic for health secretary. What does that mean for investors? Redwheel December 2024 |

|

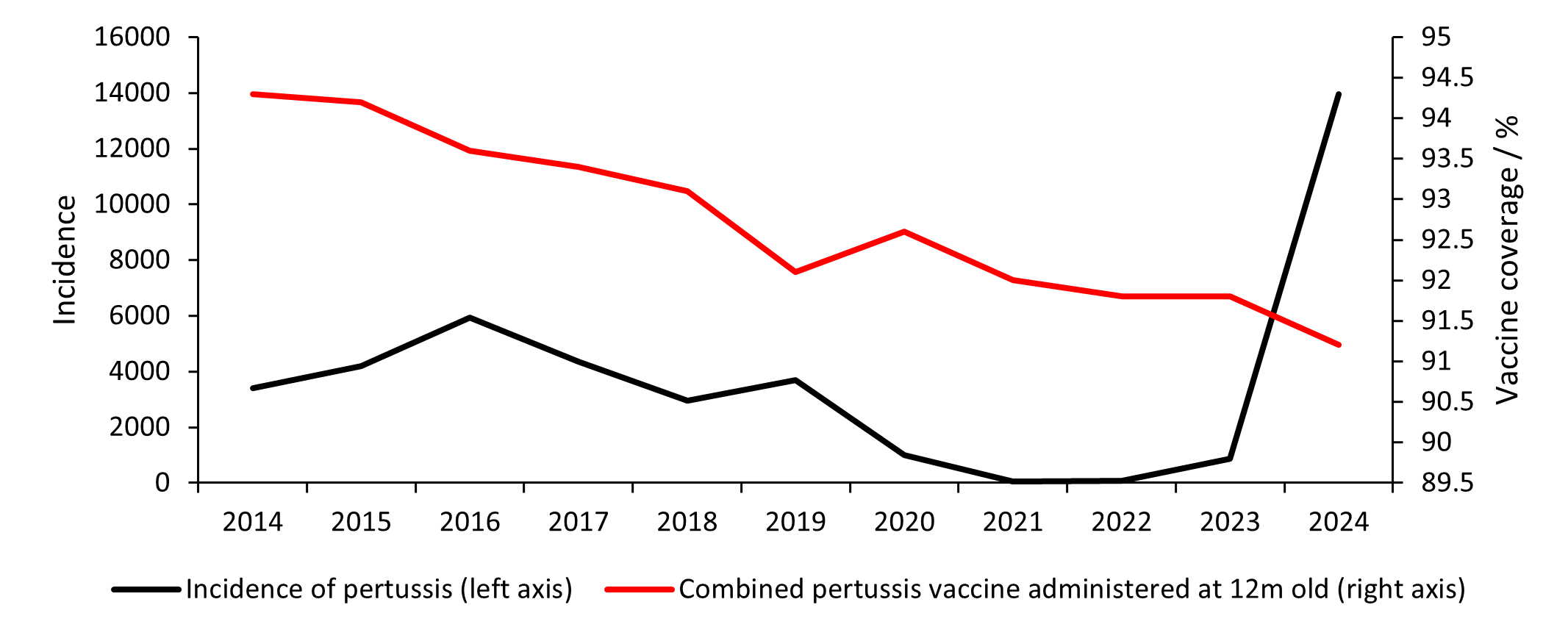

Vaccines are among the most impactful medical inventions in history.[i] Globally, vaccines exist to prevent more than 20 life-threatening diseases.[ii] New estimates suggest that global immunisation efforts over the past 50 years have prevented 154 million deaths from diseases like diphtheria, tetanus, pertussis, yellow fever, and measles.[iii] Despite worldwide immunisation success, the COVID-19 outbreak and resulting vaccination race brought into focus the global prevalence of vaccine hesitancy and appeared to trigger a further decline of trust in vaccinations.[iv] A US survey found that the proportion of surveyed adults who do not think approved vaccines are safe rose by 6% to 16% between 2021 and 2023.[v] Similarly, a survey in Germany shows that public vaccine scepticism increased from 21% in 2022 to 25% in 2024.[vi] As a result of decreasing vaccine uptake and concerns over the prevalence of preventable diseases, the World Health Organisation has declared vaccine hesitancy as one of the top global health challenges.[vii] Whooping cough (pertussis) in England shows the concerning effect of increasing vaccine scepticism, declining vaccination rates, and consequent rising incidence of the disease. Although historically associated with lower-income countries where there is greater mistrust of vaccines, Figure 1 demonstrates how growing scepticism can have a marked impact on disease prevalence in higher-income countries too[viii]. In 10 years, the infant pertussis vaccine coverage in England fell from 94% to 91%, meanwhile the maternal pertussis vaccine coverage fell from 75% to 59% from 2017 to 2024[ix]. Incidence of the disease has more than tripled over the same time-period.

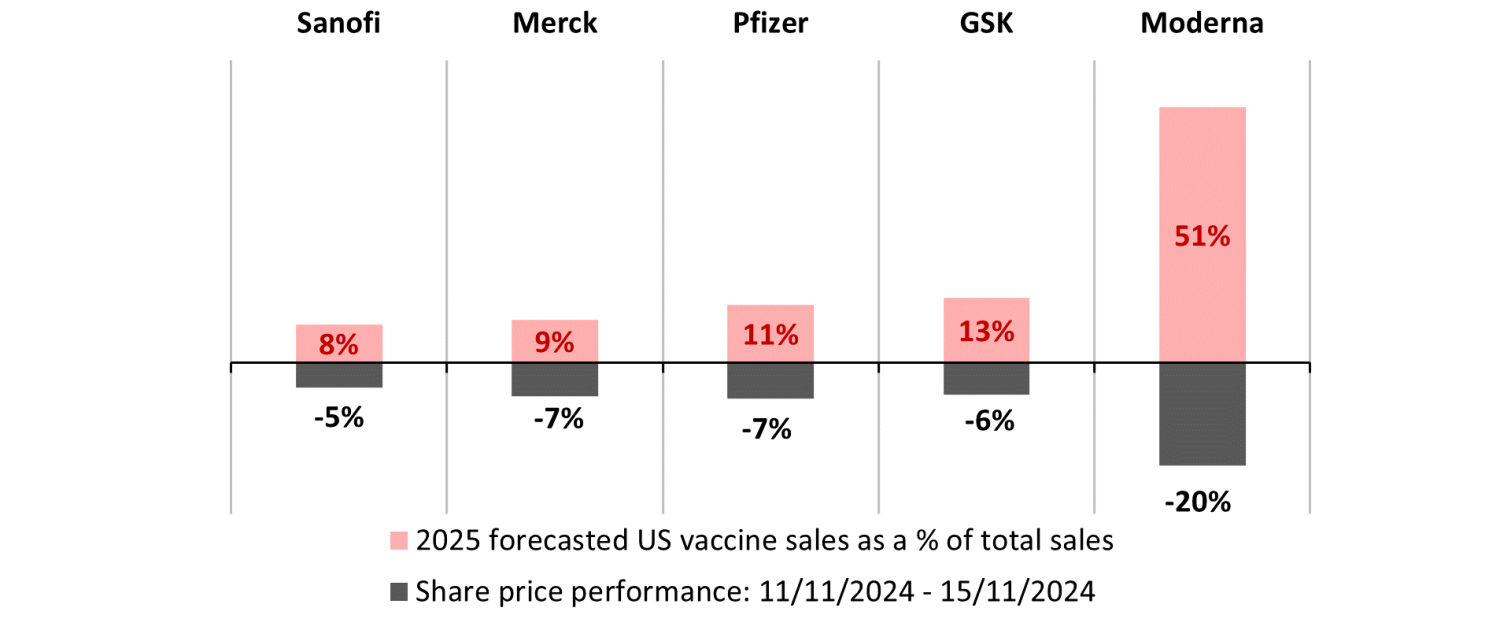

A similar trend can be detected with measles, where misguided concerns over a link with autism in children have led to declining vaccination rates[x]. 2023 saw a 20% rise in global cases compared to 2022[xi], while nearly 60 countries experienced outbreaks in the past year. Globally, only 83% of children received a first dose of the measles vaccine in 2023 and only 74% received the recommended second dose, despite national coverage of 95% or greater being necessary to prevent outbreaks of the contagious disease.[xii] During the COVID-19 pandemic it was found that antivaccine messages from authority figures were a common reason for vaccine hesitancy.[xiii] Now that President-elect Donald Trump has nominated Robert F Kennedy Jnr. (RFK Jnr.) - who has been skeptical of vaccines in the past - to head up the Health and Human Services Department, there are increasing concerns of an even greater erosion of people's willingness to get vaccinated in the US.[xiv] How does this impact investors? RFK Jnr.'s nomination as Head of Health and Human Services (HHS) precipitated a sharp sell-off in healthcare stocks. Sanofi, Merck, Pfizer, GSK, and Moderna have greater exposures to the US vaccine market and hence were punished most by the market in the week of his nomination.

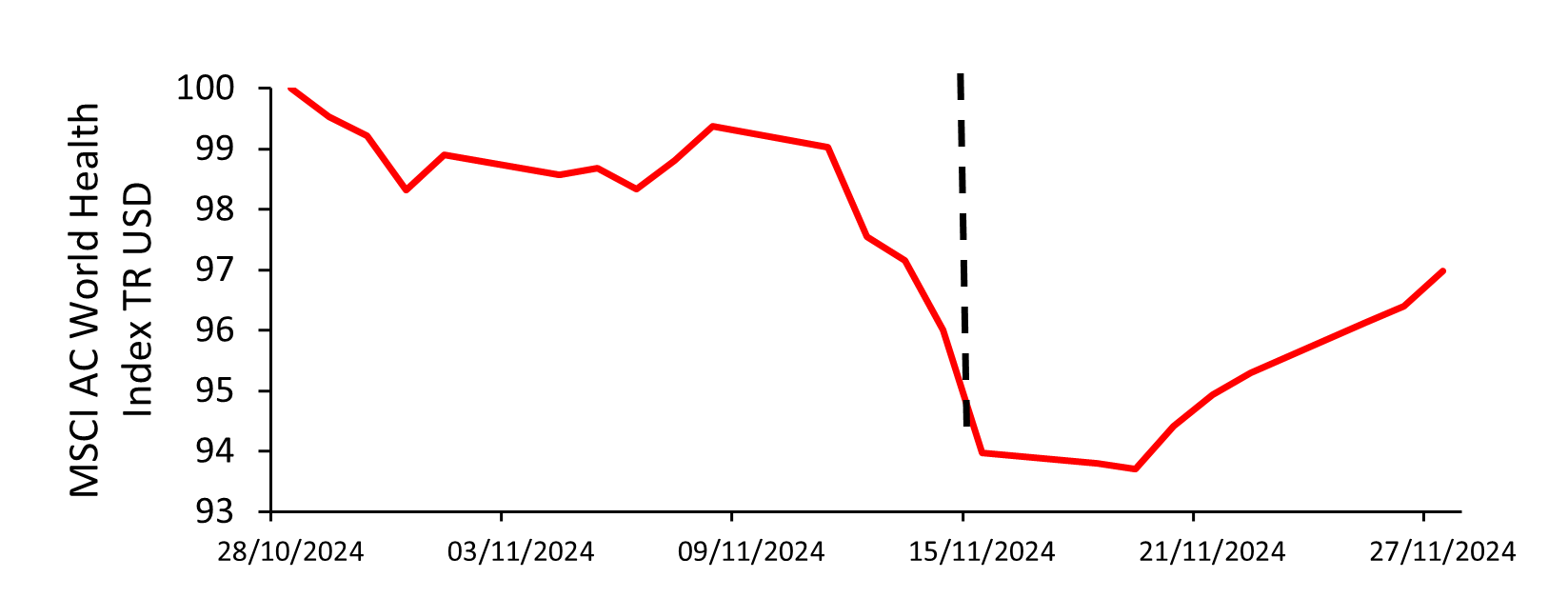

Although there is very little clarity over the shape of future US health policy, there is a presumption in the investment community that RFK Jnr.'s vaccine stance may lead to larger and longer clinical trials, stricter labels for approved products, lower vaccination rates, and therefore lower revenues for vaccine makers. Further, with Republican control of both chambers of Congress and the White House, a hawkish health department could seek to repeal the National Childhood Vaccine Injury Act of 1986 which protects vaccine makers from litigation due to injury. An increase in lawsuits - even if not successful - may increase costs for manufacturers. Ultimately, if significant legislative changes were to occur then investing in vaccine makers could be riskier. However, whilst commentators have focussed largely on RFK Jnr.'s more harmful rhetoric, not all news has been entirely negative. RFK Jnr. has stated that vaccines were 'not going to be taken away from anybody'[xv], while Vivek Ramaswamy - who will co-lead the newly created Department of Government Efficiency (DOGE) - confirmed that the new US healthcare leadership 'understand innovation is a key part of the solution.'[xvi] And it is interesting to note that Ramaswamy has made comments suggesting that he wants DOGE to reduce regulatory burden on pharma, biotech and medical device companies that require US Food and Drug Administration (FDA) approval. He recently posted on X, "My #1 issue with FDA is that it erects unnecessary barriers to innovation", so it could be argued that the FDA under the Trump administration may be supportive of getting treatments to patients more quickly, which would most likely be a net positive for manufacturers. Further, it is our view that despite potential disruption in US healthcare, many treatments will continue to have a life-changing impact on patients' lives, and hence, best-in-class businesses will keep their competitive advantage. In the week of RFK Jnr.'s nomination, the MSCI AC World Health Index declined by more than 5%[xvii], which included companies with no exposure to vaccines. With that discount, we believe there are significant opportunities for us to invest in these life-changing solutions at compelling valuations.

|

|

Funds operated by this manager: Redwheel China Equity Fund, Redwheel Global Emerging Markets Fund |

|

Sources: [i] UN, 2024 [ii] WHO, 2024 [iii] WHO, 2024 [iv] Larson et al., 2022 [v] Annenberg Public Policy Center, 2023 [vi] Statista, 2024 [vii] WHO, 2019 [viii] RACGP, 2024 [ix] GOV UK, 2024 [x] Hviid et al., 2019 [xi] Reuters, 2024 [xii] CDC, 2024 [xiii] Griffith et al., 2021 [xv] NPR interview, 06/11/2024. [xvi] Vivek Ramaswamy's push for FDA changes could boost his wealth - The Washington Post, accessed 27/11/2024. [xvii] Bloomberg, November 2024 Key Information |

22 Jan 2025 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

22 Jan 2025 - Long-term Investing

|

Long-term Investing Airlie Funds Management December 2024 |

|

Investing in Australian listed companies with a long-term outlook entails retaining investments for a minimum of five years or longer. While the exact time frame for long-term investing can differ, the core principle is dedication, regardless of market turbulence and fluctuations in asset prices. We delve into key strategies tailored for those investors keen on harnessing the potential of Australian listed companies for long-term wealth accumulation. Objectives, risk tolerance and investment horizonLong-term investing begins with a clear understanding of your financial objectives, risk appetite, and investment time frame. Whether your aim is to secure your retirement, finance education expenses or a dream property, clearly defining your goals is essential. Assessing your risk tolerance, which means finding out if your risk level is conservative, moderate or aggressive, helps you understand the level of risk you're willing to accept in pursuit of your investment objectives. Generally, investors with longer horizons can afford to embrace higher risks compared to those nearing retirement. It's important to consider your investment time horizon, as this is when you'll need access to money to achieve your financial objectives. Some of the factors that influence your time horizon include your financial goals, income, age and risk tolerance. Tailoring your investment strategy to align with your unique circumstances is foundational for long-term success in the Australian market. Diversify your portfolioThe Australian investment landscape, like any other, is prone to unpredictability and market fluctuations. Spreading your investments across different industry sectors can potentially help to mitigate risk. Diversification may help reduce the potential negative impact of any single asset's downturn on your overall portfolio. This approach helps in balancing out the performance, as when one asset or sector underperforms, another may outperform, stabilising the portfolio's returns. It's important to align diversification with your individual risk tolerance and investment goals, ensuring a well-rounded and resilient investment strategy. Stay committedEmotions often run high during market downturns, tempting investors to deviate from their chosen investment strategies. However, succumbing to fear-driven decisions can jeopardise long-term returns. Resist the urge to time the market, as consistently predicting market movements is exceedingly challenging. Long-term investing requires discipline and resilience, where investors are encouraged to adhere to their investment strategies even amidst turbulent market conditions. Avoid falling into the trap of chasing short-term profits, as maintaining investment during market cycles can be essential for realising the full potential of the market. It's easy to feel drawn to timing the markets, aiming to choose tomorrow's winners from yesterday's winners. However, evidence suggests that market timing is a tough game. Take the buy low, sell high approach, for instance; it hinges on predicting when a stock will rise or fall, a task fraught with complexity. Successful long-term investing, on the other hand, demands a commitment to staying invested, resisting the urge to constantly chase the next big thing. The chart below illustrates the risks of trying to time the market. Leverage expertise and regular reviewAchieving success in investing requires a thorough understanding of market dynamics and investment strategies. Consider investing in managed funds where investment experts are actively researching and managing a portfolio, aiming for optimal diversification with continued dedicated oversight. Review your investment strategy regularly to ensure it remains aligned with your long-term objectives. Rebalancing your portfolio and adjusting the weightings of your portfolio helps to ensure alignment with your intended long-term goals. Over time, some investments may perform better than others, causing your portfolio to shift from its original strategy. Rebalancing brings your portfolio back to its original plan, ensuring it continues to reflect your investment goals and risk tolerance. Long-term investing in Australian-listed companies entails a strategic approach tailored to your unique financial goals and risk tolerance. By embracing diversification, maintaining discipline, and leveraging expert guidance, investors may have greater confidence in navigating the dynamic Australian market landscape. Funds operated by this manager: Airlie Australian Share Fund, Airlie Small Companies Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Airlie will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

21 Jan 2025 - Performance Report: Skerryvore Global Emerging Markets All-Cap Equity Fund

[Current Manager Report if available]