News

24 Sep 2024 - Trend Following in Uncertain Markets

|

Trend Following in Uncertain Markets East Coast Capital Management September 2024 Trend Following: An Attractive Investment Strategy in Uncertain Markets In the ever-evolving landscape of financial markets, uncertainty is a constant companion. Economic fluctuations, geopolitical events, and market sentiment can create an environment where predicting outcomes becomes increasingly challenging. In our view, trend following is an attractive investment strategy and particularly so amid this unpredictability. Its appeal lies in its simplicity, adaptability, and effectiveness in capturing market movements, especially during turbulent times. 1. Simplicity and Objectivity in a Complex World One of the most significant advantages of trend following is its straightforward approach. The strategy is based on a simple premise: buy when prices are rising and sell when they are falling. This objectivity helps remove emotional biases from the investment process. In times of uncertainty, where emotional reactions can cloud judgment, trend following provides a systematic method to navigate the market. By relying on clear, predefined signals--such as moving averages or momentum indicators--investors can make decisions based on current market conditions rather than speculative predictions. See also our previous post "Remembering Daniel Kahneman". 2. Flexibility to Adapt to Changing Conditions Market conditions can shift rapidly, especially during periods of uncertainty. Trend following excels in this regard due to its adaptability. Whether in a bull market, bear market, or a phase of high volatility, trend-following strategies will dynamically adjust to the prevailing conditions. This flexibility allows investors to pivot and stay aligned with market trends, with the strategy remaining relevant as circumstances evolve. 3. Capitalising on Emerging Trends Amidst Volatility Volatility and uncertainty often lead to the emergence of strong trends. While other strategies might struggle with the noise of unpredictable markets, trend following focuses on capturing significant price movements that align with established trends. This ability to harness the power of volatile conditions enables trend followers to benefit from market inefficiencies and seize unexpected opportunities. 4. Built-In Risk Management for Uncertain Times Effective risk management becomes paramount when navigating uncertainty. Trend-following strategies incorporate rigorous risk management practices, such as setting stop-loss orders. These mechanisms help limit potential losses and preserve capital, providing a buffer against unpredictable market movements. In times of heightened uncertainty, these tools are essential so that one adverse outcome does not derail the entire strategy. 5. Robust Historical Performance in Uncertain Markets Historically, trend following strategies have demonstrated resilience in volatile and uncertain markets. The success of trend followers during periods of market upheaval underscores the strategy's effectiveness in navigating unpredictability. For instance, during financial crises or economic downturns, trend followers have often avoided significant losses and even capitalized on market declines. This empirical evidence highlights trend following's robustness and reliability, making it an attractive choice for investors facing uncertainty. At our website and our YouTube channel you can view our video "Academic Research Support For Trend Following", in which ECCM's founder and CIO, Adam Havryliv, and Strategy Ambassador, Richard Brennan, talk more about the academic research on the effectiveness of trend following. Conclusion In our view, trend following offers a compelling investment strategy due to its simplicity, adaptability, and potential for long-term gains, especially in uncertain market conditions. Its systematic approach reduces emotional bias, while built-in risk management ensures disciplined investing. Supported by historical success, in our view, trend following is an attractive strategy for navigating the complexities of financial markets - both seeking to capitalise on emerging trends and helping to protect against adverse movements. At ECCM, our educational foundations are in finance and psychology. With extensive trading experience and long-term dedication to quantitative trading systems, we seek to provide our clients with our carefully developed approach to navigating the complexities and vagaries of markets. Wholesale clients can find more information on ECCM and our flagship ECCM Systematic Trend Fund at our website and Australian Fund Monitors. Funds operated by this manager: |

23 Sep 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Dimensional Australian Core Imputation Trust | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Dimensional Australian Large Company Trust | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Dimensional Australian Small Company Trust | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Dimensional Australian Sustainability Trust | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Dimensional Australian Value Trust | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Artisan Credit Opportunities Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 850 others |

20 Sep 2024 - Global Webcast: Reflecting on a volatile month & 2Q24 results season

|

Global Webcast: Reflecting on a volatile month & 2Q24 results season Alphinity Investment Management August 2024 |

|

Elfreda Jonker and Jonas Palmqvist reflect on what has been happening in markets over the previous month and review key themes from the second quarter of 2024. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Global Sustainable Equity Fund, Alphinity Sustainable Share Fund |

19 Sep 2024 - Speed chess and skinning cats: Multiple ways to lose money

|

Speed chess and skinning cats: Multiple ways to lose money Redwheel September 2024 |

|

For anyone who enjoyed the Olympics this summer, I'd like you to take a moment and spare a thought for Ali Farag. The Egyptian is the highest ranked men's squash player in the world, according to the Professional Squash Association, and was the winner of the 2019, 2021, and 2023 World Championships. Alas, unlike skateboarders, Farag did not grace your screen at the 2024 Paris Olympics, as squash is still not part of the games, despite it being played by an estimated 20 million people around the world in over 185 countries. Squash is one of the most contentious of the sports not included in the Olympics, among a litany of others including cricket, bowling, netball, darts - and chess. Chess, unlike other 'sports', is regularly dismissed not because of its lack of popularity, but because it lacks the "physical exertion" that the International Olympic Committee demands. Despite the Olympic snub, watching competitive chess online and in person is popular - particularly in the short-form 'Blitz' (3-minute) or 'Bullet' (1-minute) formats - with international celebrity players commanding audiences of over 600,000 viewers[1]. Chief amongst these celebrities is Norwegian Grandmaster Magnus Carlsen. Regarded by many as the greatest chess player of all time, 33-year-old Carlsen is a five-time World Chess Champion, five-time World Rapid Chess Champion (1-hour games), and seven-time World Blitz Chess Champion. A particularly enjoyable and widely replayed game was a rare defeat that Carlsen suffered in a live-stream he played online; here, Carlsen was playing a Blitz game, and was beaten in 18 moves ending in a highly unusual checkmate. Blitz chess - apart from being enjoyable to play and watch - is an excellent framework for thinking about investment skill. In Blitz chess, you are not only required to make intelligent moves: you need to also avoid running out of time. It is no good being excellent at identifying the best move if it takes you twenty minutes to do so; you may not lose on skill, but you will lose on time. Having only one of those abilities is insufficient to assure success - and the same is true in investing. Keep your eyes on the price As we have noted in the past, investing is a practice that requires, in reasonably equal measure, the ability to (i) understand and quantify the economics of a business over time, and (ii) to fairly assess the value of that business today, what we term the "intrinsic value" of the company. It is only if you are confident in both the earnings stream of a business, and that the price today represents a material discount to the true intrinsic value of the business, that an investment is merited; having only one of those critical elements is insufficient.

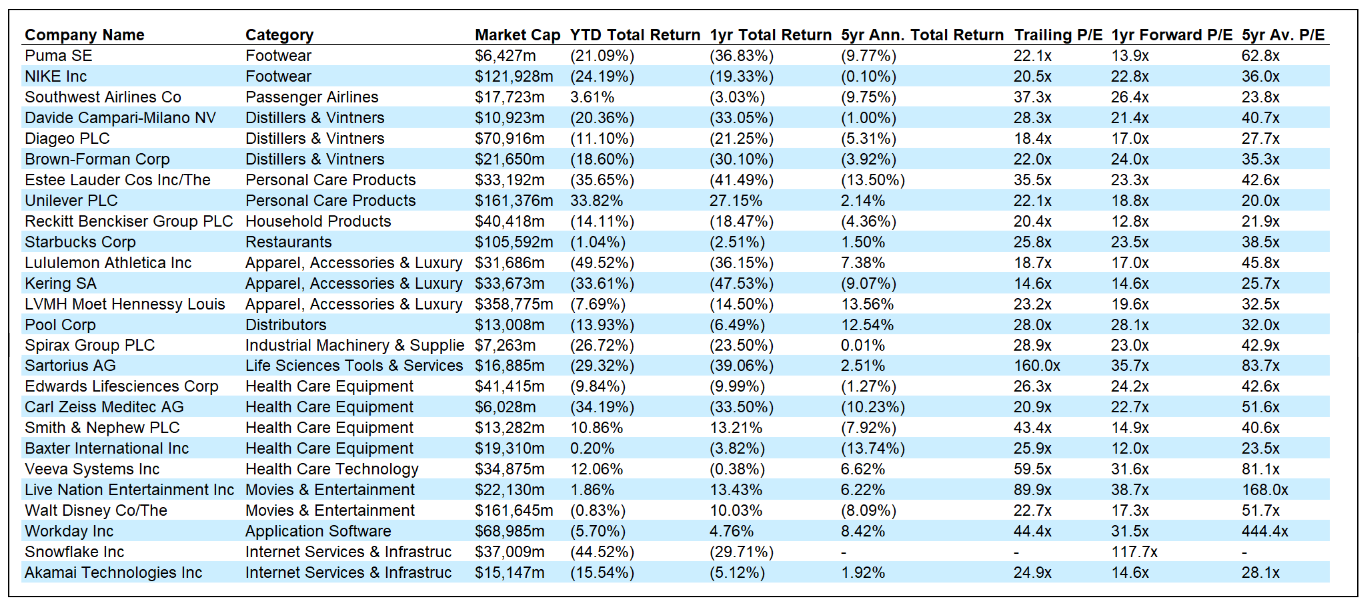

Yet, over the past decade, many investors have enjoyed the fruits of a benign economic environment, supported by accommodatingly low rates that made access to capital extremely cheap. This allowed some investors to focus only on the predictability of earnings - part of the assessed quality of the business - while forgetting the importance of considering what the company is worth. Whilst for many years this mistake was swept under the rug of ever-expanding valuation multiples, the landscape today is changing fast, and recent abrupt declines in value of some of the world's companies shine a spotlight on this error. Across industries, geographies, and sectors, many justifiably admired companies have seen their valuations collapse, often leaving investors with zero total returns over substantial timeframes (five years or more). Companies that are widely considered to be global leaders have lost shareholders substantial value in the past year, and many have done so to such a degree as to leave investors with flat or negative total returns over a full five-year period. This is not sector specific, but is a phenomenon found across high-quality industry-leading giants.

Source: Bloomberg as of August 26th 2024 Performance in brackets denotes negative total return. Past performance is not a guide to the future. Stocks selected are for illustrative purposes only and have been identified by the investment team to provide examples of large well-known names that have delivered either negative or below market returns over 1- or 5-year periods. The question that should arise, of course, is how it is possible that so many truly great companies - great as defined by the quality of their products, the strength of their market position, and the depth of their talent pools - have delivered such poor outcomes to investors? This question is amplified by the relative performance of global markets, which have been comparably strong, and by the simultaneous, very impressive performance of other public companies; again, across industries and geographies, there have been plenty of companies, even those of lower inherent quality, that have delivered fabulous returns to shareholders over the same period. What, then, is the problem? Quality growth vs value As with Blitz chess, the answer comes down to the inescapable fact that to win - beating either your opponent, or the market - investors need to be able to balance two skills at the same time. With the above companies, and others, the issue was unlikely to be the quality of the business: rather, it was going to be the quality of the business relative to the price paid, and relative to the expectations baked into those prices. Notably, the connection between the companies in the table above is not the line of business they are in, nor the country in which they operate: it is that they were all highly priced. For example, spirits manufacturer Davide Campari has delivered no net returns to investors over the past five years. This is largely because its valuation - expressed in shorthand by the multiple of its earnings paid by investors - has plummeted from over 50x in 2021 to 28x today, still by no means inexpensive (if you disagree, I have several banks to sell you). This valuation has also fallen in the context of growing earnings, and continued expectations - despite the share price fall - of future earnings growth. If buying a great business with growing earnings was the sole requirement for investment success, then Campari and the other companies above would have delivered much better outcomes for investors.

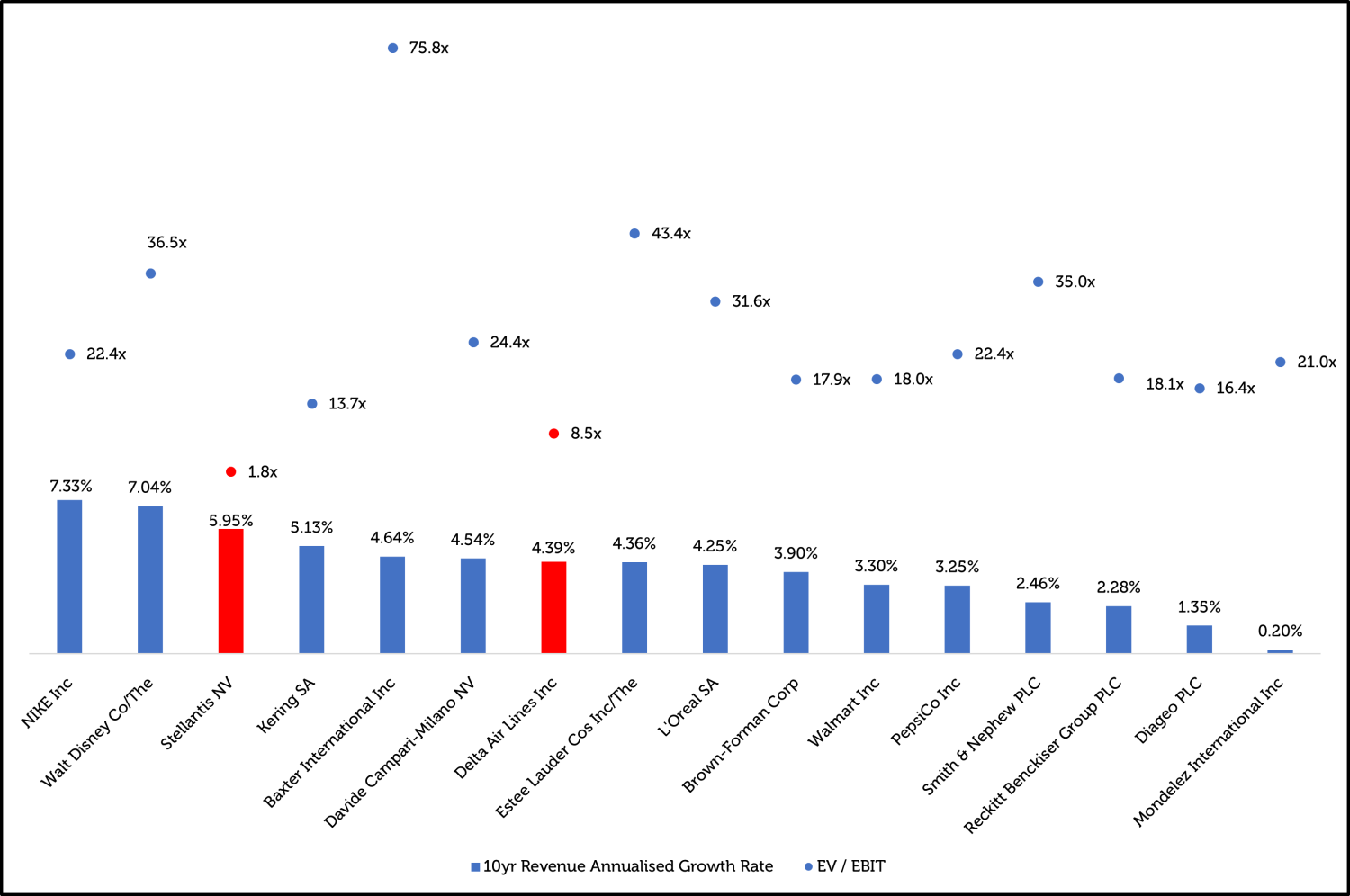

Instead, what has happened appears to be a growing dismissal of the importance of not overpaying, with many market participants having chosen to ignore valuation as irrelevant, relying on the market to constantly pay high multiples. Whilst this approach is all very well whilst the music is playing, it is hard to understand how it can deliver a favourable outcome when the party goes quiet. If you bought Campari at 50x earnings, and earnings grew 15% but the multiple fell to 28x, you would have lost 35.6% - even in the face of impressive fundamental performance. But we would press the question further: who can say that 28x will be the worst price you will get? Why wouldn't it be 20x (losing you 54%), 15x (losing you 66%) or 12x (losing you 72%)? There are plenty of comparably good businesses that are on similar multiples or lower - usually in unpopular industries - that are available for those prices, and it is very possible that your high-quality but higher valued business will join them. By way of example, look at the below chart, which compares annualised ten-year revenue growth with the enterprise value to operating earnings ratio, a useful shorthand for valuation. Here, it is evident that there are companies (which we own) holding their own against the adored quality growth crowd in terms of long-term revenue growth, but which carry far lower valuations, simply due to the distaste the market currently has for their industry.

Source: Bloomberg, Redwheel as of August 26th 2024. Past performance is not a guide to the future. Companies highlighted in red are securities that the Redwheel Value & Income team currently holds. If your investment case relies not on fundamental corporate performance - which is in the control of the company - but on a lofty sale price, then the force of economic gravity will do its best to help you lose. In our view, the main mistake being made by many investors today is not about the quality of the business, but the appropriateness of the price. Avoiding the double punch That is not to say, of course, that investors haven't also made mistakes in assessing the quality of a business; there are several companies - some in the list above - that have been lauded for years as perpetual growth machines, only to have recently stumbled, forced to issue profit warnings and temper the lofty expectations of their investor base. Take cosmetics giant Estée Lauder. Despite being priced for prime growth over the past five years - with an average price earnings multiple of 41.2x - the company has had to issue repeated profit warnings over the course of 2023 and 2024, with revenues for the full year 2024 expected to be only 4% higher than those delivered in 2019; net income, what truly matters to shareholders at the end of the day, is forecast to be less than half of that earned five years ago. Not only did investors overpay - they also misread the quality of the enterprise. This underscores the risk of paying high prices: you are not only relying on the market maintaining its willingness to keep paying up for quality, but you are also running the risk that you are fundamentally wrong about the quality of the business. By stark contrast, when you pay an unjustifiably low price for a company, you are investing on the basis that the core earnings stream of the company is being underestimated, and that things will evolve into a rosier, more normalised picture than is being priced in. If you are wrong, the chances of you losing money is lower; if the company is worse than you expected, it is still in line with what the market expected, and so the market price - right all along - is less likely to change. Buying into a darling company, where everyone expects greatness, can deliver a double punch should there be disappointment with the fundamental performance: not only are earnings lower than you and the market thought, but now the market is less willing to put a high price on those earnings. It has proven for many investors so far this year to be a bruising 1-2 combination. Valuation matters Like skinning a cat, there is more than one way to lose money as an investor. It is undoubtedly true that one of these ways is to buy poor quality businesses, whose operation and balance sheet deteriorates, permanently impairing your capital. However, post the Great Financial Crisis - a crisis in which this sort of risk did indeed materialise - investors have perhaps focussed too closely on that risk, forgetting, like the studious chess player who doesn't check the clock, that there is something else that they need to consider. Today, as interest rates rise and as highly priced quality companies fail to deliver, we would encourage investors to remember: valuation matters. |

|

Funds operated by this manager: Redwheel China Equity Fund, Redwheel Global Emerging Markets Fund |

|

Source: [1] https://kommunikasjon.ntb.no/announcement/1062?publisherId=16823864&lang=en Key Information |

18 Sep 2024 - Glenmore Asset Management - Market Commentary

|

Market Commentary - August Glenmore Asset Management September 2024 Globally, equity markets were positive in August. In the US, the S&P 500 rose +2.3%, the Nasdaq increased +0.7%, whilst in the UK, the FTSE was flat (+0.1%). In Australia, the All Ordinaries Accumulation Index increased +0.4%. The top performing sectors on the ASX were technology and gold, whilst energy was the worst performer. Reporting season on the ASX saw the vast majority of listed companies report their results for the six months to 30 June. Overall, we viewed it as a solid reporting season, albeit with less strong earnings "beats" than in previous reporting seasons. Large cap stocks materially outperformed small/mid cap stocks (which the fund has a strong exposure to), with the ASX Small Ordinaries index falling -2.0%. Resources and mining services stocks underperformed as sentiment towards to Chinese economy continues to be weak. On the positive side, central banks both globally and in Australia appear on the cusp of cutting interest rates, which should be beneficial for economic growth, company earnings, and general investor sentiment towards equities. In bond markets, the US 10-year bond rate fell -28 basis points (bp) to close at 3.86%, whilst its Australian counterpart fell -15 bp to 3.97%. The driver of lower bond rates was data showing economic growth in the US to be slowing. In currencies, the A$/US$ appreciated +2.2 cents to close at US$0.68. Funds operated by this manager: |

17 Sep 2024 - Investment Perspectives: Is the US headed for recession?

16 Sep 2024 - Manager Insights | Seed Funds Management

|

Paul Sanger, Head of Sequoia Direct, speaks to Nicholas Chaplin, Director and Portfolio Manager at Seed Funds Management. Nicholas Chaplin, Director & Portfolio Manager of Seed Funds Management, critiqued APRA's proposal to phase out Additional Tier 1 (AT1) bonds, highlighting concerns about the potential risks to banking stability and retail investors. He discussed the current challenges with AT1 instruments in the Australian market, the transition timeline, and the differing impacts on large and small banks. Nicholas also explored alternative solutions and gauged the market's reaction to the proposed changes. The Seed Funds Management Hybrid Income Fund has a track record of 8 years and 11 months and has outperformed the Solactive Australian Hybrid Securities (Net) benchmark since inception in October 2015, providing investors with an annualised return of 6.37% compared with the benchmark's return of 4.79% over the same period.

|

13 Sep 2024 - Government Bonds and High Yield Credit Compete for the Podium in a High Interest World

|

Government Bonds and High Yield Credit Compete for the Podium in a High Interest World JCB Jamieson Coote Bonds August 2024 When you're chasing those enticing yields, high yield credit funds can seem like a golden ticket. They promise strong returns compared to other asset classes, which might make them look like the smarter choice. But before diving in, it's crucial to understand that not all fixed income assets are created equal. High returns come with their own set of risks, and knowing what those are can help you make more informed investment decisions. The emergence of private credit fundsAs banks cut back on corporate lending, private credit funds have become more popular, offering more competition and financing options. These funds aim to generate returns through various strategies, which require careful consideration. Key factors include:

Understanding these aspects helps investors make informed decisions in this growing market. Credit funds, including those focused on more speculative private credit and property construction loans, often attract investors with the promise of higher returns. These funds offer elevated interest rates because they invest in debt issued by companies with lower credit ratings. While the potential for greater income is appealing, it's essential to understand that these higher yields come with substantial risks. Liquidity: The core concernA hallmark characteristic of genuinely defensive assets is liquidity. Private credit funds often have lower liquidity due to long lock-up periods, longer lead-times for redemptions and infrequent fund trading windows. Since these funds tend to involve direct lending to organisations, the loans do not trade on exchanges, therefore the secondary market to recall or trade capital is extremely low and difficult. For example, during the early days of Covid-19 in March 2020, many fixed income funds, both traditional and alternative, raised sell spreads to effectively gate investor capital, showing that what seemed like a safe investment could be problematic in times of crisis. Default Risk (Volatility): Compromising your hard earned capitalThe primary risk associated with credit funds is default risk. This refers to the possibility that the issuer of the bond or loan may be unable to meet its interest payments and/or repay the principal amount. This can become a real possibility during times of economic stress. The value of these investments can fluctuate dramatically based on a range of factors, including market sentiment, company-specific news, or broader economic deterioration. For example, if a company issuing high yield bonds reports poor earnings or faces operational challenges, the value of its bonds may drop. Similarly, changes in interest rates or economic downturns can lead to sharp declines in the value of high yield credit investments. This volatility means that while you might experience higher returns during periods of economic growth, there's a substantial risk of seeing your investment value decline during downturns or periods of market uncertainty. As with Olympic contenders, where unexpected outcomes can shift the podium positions, in the investment arena, a single default can have significant repercussions. The risk is magnified in high yield credit funds, where issuers are often less stable and more susceptible to economic fluctuations. Just as a single misstep in a crucial race can cost an athlete the gold, a default can lead to substantial losses for investors. Transparency Risk: The price of potential high returnsValuation is a key piece of private credit, affecting returns, risk, the cost and availability of capital. Since valuations are typically periodic with long lags, they may not reflect current market conditions or asset performance. This issue can be worsened where a fund may not fully account for borrower difficulties in its valuations. Inflated valuations can reduce loan liquidity, as there's less incentive to redeem at true values. Unfortunately, this trend is becoming more common across the private credit industry. Property Construction Loans: additional risksProperty construction loans, a subset of private credit funds, come with their own set of risks that can amplify the overall risk profile of high yield credit funds. These loans are typically provided to developers for building residential or commercial properties and are often characterised by high interest rates due to the inherent risks involved. Construction projects can face numerous challenges in tighter times, such as delays, cost overruns, and regulatory hurdles. If a project encounters significant problems or fails to complete on time, the borrower may struggle to repay the loan, increasing the risk of default. The financial health and track record of the developer is critical in assessing the risk of default. Such loans can also be less liquid compared to other investments. If you need to exit your investment before the construction project is completed or the loan matures, you might face difficulties in finding a buyer or could have to sell at a discount. Balancing Risks and RewardsInvesting in high yield credit funds and property construction loans can be a way to achieve higher returns, but it's important to weigh these rewards against the associated risks. Credit investments can offer attractive income opportunities, but they come with the potential for significant volatility and default risk. Property construction loans add another layer of risk. To navigate these risks, a diversified investment approach can help. Balancing high yield credit funds with more stable investments, such as government bonds or investment grade securities, can provide a buffer against the volatility and risk of high yield investments. Additionally, thorough due diligence on the underlying assets and careful consideration of the economic environment can aid in making informed investment decisions. Ultimately, the quality of private credit depends on the investment managers behind it. Their expertise in assessing and monitoring loans, managing risk, and protecting capital is key. Additionally, their experience, industry relationships and track record across various market cycles are essential factors. Government Bonds: A safe haven in a volatile environmentGovernment bonds typically perform well during periods of economic uncertainty and downturns. With sustained inflation and higher interest rates, the real return on existing bonds can become less attractive compared to new issues, which might offer higher yields. However, government bonds retain their appeal due to their stability and lower risk profile. And, within a government bond fund, portfolios are diversified with individual bonds maturing being steadily replaced by newer issues, which helps these funds keep pace with return needs. Government bonds inherent safety can attract investors looking for a refuge amid economic volatility. When interest rates eventually start to decline, the value of existing government bonds with higher coupon rates is likely to rise. Lower rates mean that newly issued bonds will offer lower yields, making existing bonds with higher rates more valuable. Additionally, as the economy begins to recover and inflation pressures ease, government bonds will likely benefit from renewed investor confidence and demand. Navigating Higher Risk in a Challenging EnvironmentCredit funds react differently to the economic landscape. In the current environment of high inflation and interest rates, the risk of default among companies with weaker credit ratings increases. As interest rates start to decline, the situation for high yield credit funds may improve, but not without complexities. Lower rates can reduce the cost of borrowing for companies, potentially easing some of the financial pressure and reducing default risk. However, the recovery in high yield credit markets might be uneven, depending on how quickly economic conditions improve and the specific financial health of the issuing companies. In light of these dynamics, it's crucial for investors to consider how shifts in economic conditions could impact their portfolios. Government bonds may offer increased value as interest rates decline, while high yield credit funds might see some relief if economic conditions improve. For a balanced investment approach, incorporating government bonds can provide stability and potential capital appreciation in a declining interest rate environment. Meanwhile, carefully selected high yield credit investments might still offer opportunities for higher returns, but should be approached with caution and a clear understanding of the associated risks. Which Investment Takes Gold?So, where does that leave investors? High yield credit funds and government bonds each play distinct roles in an investment portfolio, much like different events on the track. High yield funds are akin to the high-risk, high-reward sports, where taking on greater risk can lead to the potential for impressive returns, much like a daring pole vault or a thrilling sprint. These funds might suit investors prepared to handle the volatility and aim for those high yield medals. On the other hand, government bonds are like the marathon--steadily paced and reliable. For investors seeking stability and a steady income, government bonds are your marathon runners, providing a dependable performance over time. They are well-suited for investors who value consistency and want to avoid the unpredictability of higher risk investments. Ultimately, the choice should align with an investors financial goals, risk tolerance, and how they view the economic landscape unfolding. Funds operated by this manager: CC Jamieson Coote Bonds Active Bond Fund (Class A), CC Jamieson Coote Bonds Dynamic Alpha Fund, CC Jamieson Coote Bonds Global Bond Fund (Class A - Hedged) |

12 Sep 2024 - Can the Commonwealth Bank of Australia's share price rally continue into FY25?

|

Fast food profits Can the Commonwealth Bank of Australia's share price rally continue into FY25? Montgomery Investment Management August 2024 Our domestic large-cap funds have maintained an underweight position in the banks, and even though the Commonwealth Bank of Australia (ASX:CBA) was, for a time, our largest position, being underweight in the sector has cost relative performance thanks to the Commonwealth Bank of Australia's share price rallying as much as 23 per cent year-to-date and 35 per cent last financial year. Our reasoning is relatively straightforward; first, with each bank's position in Australia's banking oligopoly relatively stable - thanks in part to customer inertia and living on an island, and with each one constantly eyeing the others, we find their market shares and relative operating performances rarely vary much in absolute or relative terms. Therefore, trying to pick the short-term outperformance consistently successfully of one bank over the others has often proven to be a fool's errand. Secondly, and importantly, we have not identified a "change" trigger among the banks that justifies significant share price outperformance. Therefore, we do not believe the banks' outperformance can be repeated in 2025. For the major banks, competition remains intense, especially for home loans, and underlying demand for home and business loans is subdued, reflecting moribund economic activity. The Commonwealth Bank of Australia's FY24 cash earnings were higher than consensus analyst expectations, and pre-provisioning operating profit (PPOP) was in line with consensus estimates, driven by higher than anticipated net interest margin (NIM - more on that in a moment). Overall, the result was broadly in line with modest loan growth, expense growth of three per cent, and below-average bad debt expenses. The final ordinary dividend per share was 250 cents, 10 cents higher than analyst expectations and it takes the full-year dividend to $4.65, which is 3.3 per cent up on the previous year. Notably, the dividend reinvestment plan (DRP) will be done with no discount and will be offset by an on-market buyback. The Commonwealth Bank of Australia's FY24 Common Equity Tier 1 capital (CET1) ratio, was 12.3 per cent and 19.1 per cent on an internationally comparable basis. CET1 is a capital measure that was introduced in 2014 as a protective precaution to head off another financial crisis. In the event of a crisis, equity is taken first from Tier 1, which includes liquid bank holdings such as cash and stock. The Commonwealth Bank of Australia's resilience in maintaining its net interest margin (NIM) was a notable highlight in today's results. However, there were some early warning signs, including a potential decline in asset quality, driven by expected pressures on real household disposable income, and a resurgence in mortgage competition. For what it's worth, your author believes we will sidestep a recession this year and the reported slump in consumption will stabilise. From a valuation perspective, it's interesting to observe that while the Commonwealth Bank of Australia estimates its market-implied cost of equity to be around 8 per cent (I note many share market investors are using lower rates to justify stock market valuations for much riskier companies). However, the Commonwealth Bank of Australia maintains an internal cost of capital hurdle at 10 per cent. Investors are using lower rates to justify investing in the Commonwealth Bank of Australia at current prices. By lowering the discount rate, we can dream up a valuation for the Commonwealth Bank of Australia that is close to the price, but the company's prospects aren't as bright as many other companies also listed on the ASX. We view the Commonwealth Bank of Australia's valuation as reasonable but not cheap. Additionally, the price-to-earnings (P/E) ratio is much higher than has been historically evident, even taking into account its status as the premier bank with the best economic business performance. As an aside we think analysts fretting over substantially rising bad debts (credit losses) are misguided - there's plenty of room to cut rates quickly if animal spirits need to be stirred. Author: Roger Montgomery Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

11 Sep 2024 - The Evolution and Benefits of Equity Income Funds in Australia's Growing Retirement Market

|

The Evolution and Benefits of Equity Income Funds in Australia's Growing Retirement Market Merlon Capital Partners August 2024 Australia's growing retirement-age population has seen an increase in demand for and the availability of equity income funds over the last few decades. Australia's unique dividend imputation system means investors can successfully derive meaningful income as well as capital growth from holding Australian equities. Equity income strategies regularly make up a large component of the equity allocation for income-focused clients who seek a more defensive asset mix. Equity income funds have evolved significantly over time, beginning in the 1990s, with MLC and Colonial First State (now First Sentier Investors) launching equity income products. These initial products were not specifically focused on paying a regular, smoothed, tax-effective income but rather designed to grow capital before retirement to provide income once in retirement. The mid-2000s saw the equity income fund reimagined, designed specifically to meet retiree's key objectives - income generation, volatility management and capital growth over time. A number of managers developed products to meet these objectives at this time. The wake of the GFC saw growing recognition of the importance of total return generation from income, limiting the need to sell down holdings during market downturns. As a result, the equity income space continued to grow and through the 2010s, various managers launched new income funds, often with full market exposure. Additionally, with the rising popularity in passive investing through the 2010s, income-focused ETFs also emerged from leading ETF providers with the goal of generating income that exceeds the dividend yield offered by the broader market. With an aging population, the addressable market for equity income funds is only growing. Whilst not all equity income funds remain in existence today, there are a variety to choose from with over 15 Australian fund managers offering a product in this space. The need for regular income in retirement is well known and there are various ways to meet cashflow requirements. However, many of these tend to overlook the particularities of retirement. While fixed income products can help to meet an income objective, they fail to provide capital growth to protect against the impacts of inflation. A diminishing capital value on a real basis is inconsistent with the desire of many retirees for a growing capital base for both peace of mind and to leave an inheritance. Another option is to pursue an equity strategy centred solely on capital growth and simply selling down holdings when cashflow is required, rather than investing in income-generating investments. Yet, this ignores the fact that retirees are much more impacted by periods of drawdown than other investors, especially early in their retirement, amplified by their obligation to draw out from accounts when in pension phase. The GFC market crash and COVID-19 selloff in early 2020 demonstrated the serious consequences of needing to sell at an inopportune time and its long-term impact on total return. Skewing the components of equity total return to income removes the need to sell investments to raise cash when required. Proposed alternatives to equity income also ignore the value of franked dividends, which for retirees in pension phase present significantly more value than unfranked income or capital gains. Australian equity income strategies, when structured and executed appropriately, can provide strong total returns over time through attractive dividend yields and without sacrificing capital growth. The Merlon Australian Share Income Fund was launched in 2005 and led the innovation of contemporary equity income funds. It was the first product of its kind, aiming to provide above-market income with franking, grow capital over time with lower risk than the market. The non-benchmark portfolio has a high active share, blending well with both passive and direct share portfolios which are typically overweight large cap stocks. The Fund delivers above market income, the majority from franked dividends, paid monthly and has demonstrated strong risk-adjusted returns over multiple time periods. The strategy features a risk reduction overlay to insulate the Fund during periods of drawdown whilst retaining 100% of the franked dividend income generated from the underlying portfolio. Funds operated by this manager: Merlon Australian Share Income Fund, Merlon Concentrated Australian Share Fund Disclaimer |